Global High Performance Fluoropolymer Market Size, Share Analysis Report By Type (Polytetrafluoroethylene (PTFE), Fluorinated Ethylene Propylene (FEP), Perfluoroalkoxy (PFA)/Methyl Fluoroacetate(MFA), Ethylene Tetrafluoroethylene (ETFE), Others), By Application (Transportation, Electrical And Electronics, Medical, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 161768

- Number of Pages: 216

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

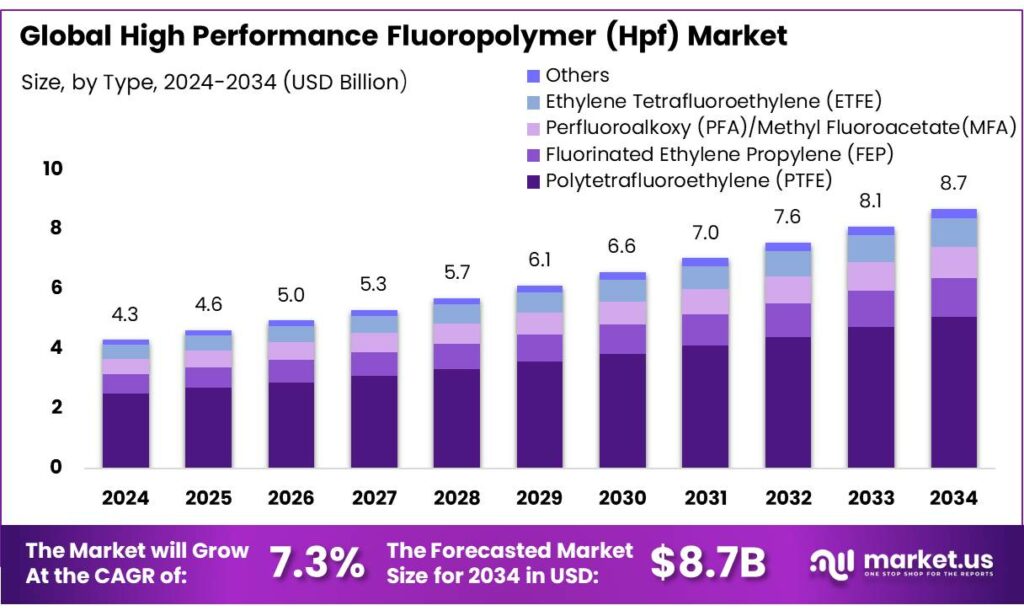

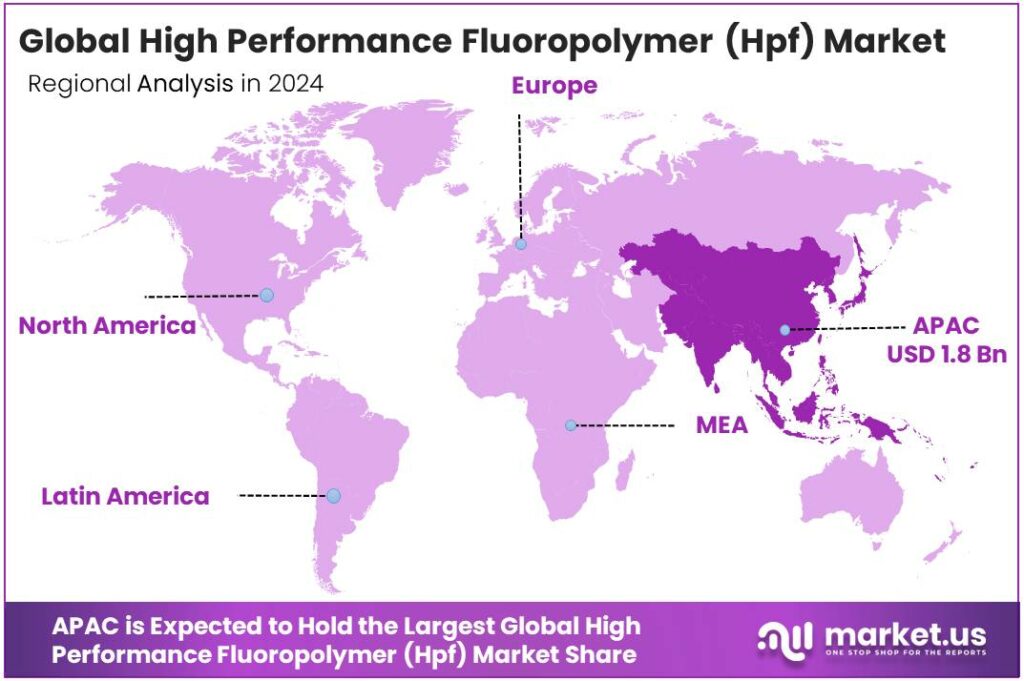

The Global High Performance Fluoropolymer Market size is expected to be worth around USD 8.7 Billion by 2034, from USD 4.3 Billion in 2024, growing at a CAGR of 7.3% during the forecast period from 2025 to 2034. In 2024 Asia Pacific held a dominant market position, capturing more than a 43.8% share, holding USD 1.8 Billion in revenue.

High-performance fluoropolymers (HPFPs)—notably PTFE, PVDF, FEP, and PFA—enable harsh-duty sealing, ultra-pure fluid handling, dielectric insulation, corrosion-proof linings, and battery binders/back-sheets where temperatures, solvents, or voltages defeat conventional polymers. Their role is expanding across energy, semiconductors, EV batteries, hydrogen, and advanced electrification—segments now posting record build-outs.

- In 2024 alone, global renewable power capacity rose by 585 GW, the fastest annual increase on record, underscoring multi-year demand for weather-resistant cables, modules, membranes, and balance-of-plant parts in which HPFPs are entrenched.

Industrial momentum is strongest in solar, where oversupplied but massive manufacturing footprints translate into high equipment throughput and component consumption. The IEA estimates solar manufacturing capacity surpassed 1,100 GW in 2024, reinforcing multi-gigawatt flows of backsheets, wire & cable, encapsulation, and plant-level gaskets that frequently specify PVDF/FEP/ETFE. Electric mobility adds a second growth engine: nearly 14 million electric cars were sold in 2023, scaling PVDF binder use in Li-ion cathodes and fluoropolymer coatings in high-voltage harnesses and power electronics.

Policy and standards also shape the operating envelope. In April 2024, the U.S. EPA finalised national drinking-water PFAS standards, setting enforceable MCLs, accelerating transition away from legacy processing aids and pushing producers toward low-residual and alternative-emulsifier grades without sacrificing performance. This regulatory context raises compliance costs yet ultimately advantages qualified HPFP supply in medical, food, and water-contact uses.

Policy is reinforcing these fundamentals. In the United States, the Department of Energy’s GRIP program announced ~$4.2 billion for 46 projects to harden and expand the grid—explicitly to meet load growth from manufacturing, data centers and electrification—supporting long-life, high-reliability wire-and-cable and substation components where HPFs excel. Additional targeted DOE actions include >$600 million to bolster resilience after 2024 hurricanes, accelerating rebuilds that favor materials with proven durability in high-humidity and corrosive coastal environments.

Key Takeaways

- High Performance Fluoropolymer Market size is expected to be worth around USD 8.7 Billion by 2034, from USD 4.3 Billion in 2024, growing at a CAGR of 7.3%.

- Polytetrafluoroethylene (PTFE) held a dominant market position, capturing more than a 58.3% share of the global high-performance fluoropolymer market.

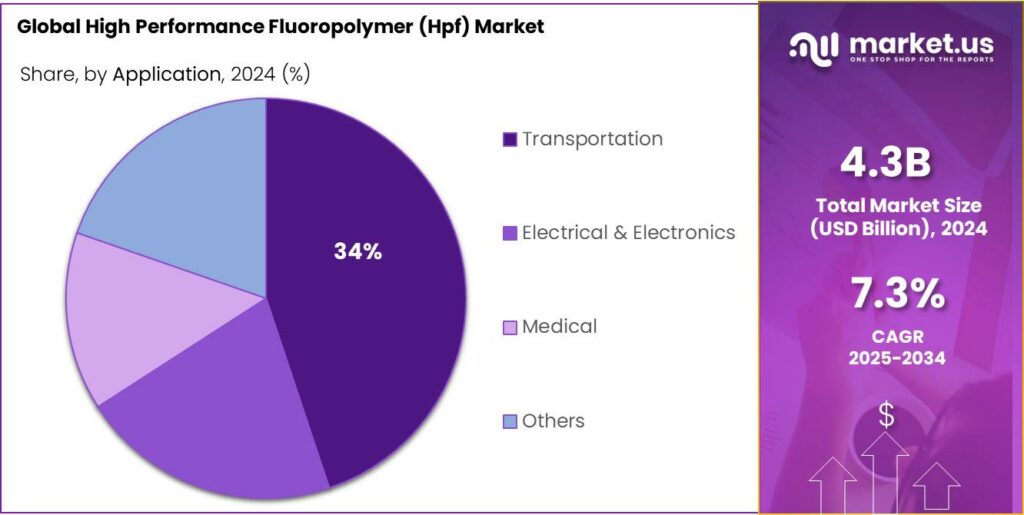

- Transportation held a dominant market position, capturing more than a 34.2% share of the global high-performance fluoropolymer market.

- Asia-Pacific (APAC) held a dominant position in the global high-performance fluoropolymer market, accounting for over 43.8% of the total revenue, valued at approximately USD 1.8 billion.

By Type Analysis

Polytetrafluoroethylene (PTFE) leads the market with 58.3% share due to its versatile industrial applications

In 2024, Polytetrafluoroethylene (PTFE) held a dominant market position, capturing more than a 58.3% share of the global high-performance fluoropolymer market. This strong presence can be attributed to its exceptional chemical resistance, low friction coefficient, and thermal stability, which make it highly suitable for demanding environments across industries such as chemical processing, electrical and electronics, automotive, and medical devices. PTFE continues to be widely used in coatings, gaskets, seals, linings, and non-stick applications where resistance to heat and corrosion is essential.

Demand for PTFE has shown steady growth, supported by the expansion of manufacturing and processing industries in Asia-Pacific and the increasing use of advanced materials in the electronics and automotive sectors. The rise in electric vehicle production has further boosted the use of PTFE-based insulation and wire coatings. Its broad applicability and performance reliability in both industrial and consumer products continue to reinforce PTFE’s market dominance, positioning it as a cornerstone material in the high-performance fluoropolymer segment.

By Application Analysis

Transportation sector dominates with 34.2% share driven by rising demand for lightweight and durable materials

In 2024, Transportation held a dominant market position, capturing more than a 34.2% share of the global high-performance fluoropolymer market. The segment’s leadership was supported by the growing need for advanced materials in automotive, aerospace, and rail applications where high temperature resistance, chemical stability, and lightweight characteristics are critical. PTFE, PVDF, and FEP are increasingly being used in fuel hoses, wire coatings, gaskets, and seals to enhance efficiency, durability, and safety in vehicles.

The transportation sector has witnessed notable material upgrades as manufacturers continue to focus on reducing emissions and improving fuel efficiency. The expansion of electric mobility and hybrid vehicles has further boosted the demand for high-performance fluoropolymers in battery insulation, wiring, and cooling systems. The combination of regulatory pressure on emission control and technological advancement in vehicle design has strengthened the adoption of fluoropolymer-based components, securing transportation’s position as the largest and most influential application segment in the high-performance fluoropolymer market.

Key Market Segments

By Type

- Polytetrafluoroethylene (PTFE)

- Fluorinated Ethylene Propylene (FEP)

- Perfluoroalkoxy (PFA)/Methyl Fluoroacetate(MFA)

- Ethylene Tetrafluoroethylene (ETFE)

- Others

By Application

- Transportation

- Electrical & Electronics

- Medical

- Others

Emerging Trends

HPF surfaces to cut food waste and speed clean-in-place

A powerful trend in high-performance fluoropolymers (HPFs—PTFE, PFA, FEP) is their use as low-adhesion, easy-to-clean contact surfaces to reduce food waste and shorten cleaning cycles across processing lines. The driver is not only plant efficiency; it’s the growing moral and regulatory push to stop throwing away edible product.

- The UN’s Food Waste Index shows the world wasted 1.05 billion tonnes of food in 2022—about 19% of food available to consumers, with households at 60%, food service 28%, and retail 12%. When processors can keep batter, chocolate, dough, sauces, meat slurries, and sticky fillings from clinging to metal or conventional plastics, yields rise and fewer kilos are washed down the drain. HPF-lined chutes, hoppers, mixers, and conveyors are becoming a quiet, material-level way to chip at that waste mountain.

This waste-reduction logic sits alongside food-safety realities. The World Health Organization estimates 600 million people fall ill from unsafe food every year, with 420,000 deaths. That burden keeps plants focused on hygienic design, rapid clean-in-place (CIP), and surfaces that do not harbor soils or biofilms. HPFs—chemically inert, non-stick, and temperature-tolerant—help residues release in seconds and let CIP solutions work faster at lower mechanical force.

Regulatory acceptance is another reason this trend has legs. HPF families used in repeated-use food contact are covered in FDA 21 CFR 177.1550 (perfluorocarbon resins), giving processors and OEMs a clear compliance pathway for gaskets, bushings, tubing, liners, and coatings that touch food—so long as the grade and use conditions match the regulation. That clarity reduces approval friction when plants standardize on low-adhesion surfaces to address waste and cleaning goals.

Drivers

Rising food-safety stringency in processing plants

One big engine behind demand for high-performance fluoropolymers (HPFs like PTFE, PFA and FEP) is the relentless tightening of food-safety expectations across the world’s processing lines. The public-health stakes are high: the World Health Organization estimates 600 million people fall ill from unsafe food each year, with 420,000 deaths and US$110 billion lost annually in low- and middle-income countries. Those headline numbers keep regulators, brands, and plant managers laser-focused on hygienic design, cleanability, and chemical resistance in every surface that touches food—sweet spot qualities for HPFs.

- Governments and standard-setters have built a dense compliance web that explicitly governs materials used in food contact. In the United States, the Food and Drug Administration’s 21 CFR 177.1550 allows specific perfluorocarbon resins for repeated-use food-contact applications, anchoring their legitimacy in gaskets, seals, conveyor belting, bushings, and linings that must survive aggressive CIP/SIP regimes without leaching or degrading.

In the European Union, Regulation (EU) No 10/2011 on plastic food-contact materials continues to be updated and consolidated, with the latest official text (consolidated March 16, 2025) reaffirming migration-testing rules and verification procedures. For equipment builders and packagers, that means ongoing proof that contact surfaces meet specific and overall migration limits—again reinforcing the pull for inert, high-purity polymers such as HPFs in critical points of the process.

This regulatory drumbeat is global. The Codex Alimentarius Commission—the joint FAO/WHO body—now counts 189 members (188 countries plus the EU). When nearly the entire food-trading world aligns around Codex hygiene and contact-material expectations, multinational processors and OEMs converge on materials that clear compliance in multiple jurisdictions. HPFs have decades of dossier support and application precedent, which reduces approval friction when plants upgrade equipment or expand into new markets.

Restraints

Regulatory & Health Concerns Around PFAS Residues

One major brake on the expansion of high-performance fluoropolymers in food processing and packaging is the increasing regulatory and public concern about PFAS (per- and polyfluoroalkyl substances) and possible leachables or residues from fluorinated coatings. Though fluoropolymers (like PTFE, FEP, PFA) are broadly considered inert, scrutiny is rising on trace “non-polymeric fluorinated compounds” and contaminants connected to health risks.

In recent years, regulatory bodies and scientific studies have flagged that even when fluoropolymer coatings are used, small quantities of PFAS or oligomeric by-products may migrate under extreme conditions (high heat, strong solvent, abrasion). A review in a scientific journal notes that “if not properly pre-treated,” fluoropolymer coated food contact materials could lead to leaching of non-polymeric PFAS compounds.

- Regulators in multiple jurisdictions are tightening rules or proposing bans on certain PFAS-related substances. In the European Union, PFOA and PFOS and their derivatives are regulated under Regulation (EU) 2019/1021 as persistent organic pollutants (POPs). They face prohibitions or restrictive conditions. This means manufacturers of fluoropolymer materials must rigorously certify that no such restricted PFAS remain in their formulations or residuals, adding compliance complexity and cost.

Food contact material regulations already require proving that all monomers, starting substances, and additives are listed in authorized substance lists (e.g. under Regulation (EC) No 10/2011 in the EU). For fluoropolymers this means stringent documentation and testing for trace migration—even in aggressive conditions. Some grades of fluoropolymers, or the polymerization aids or residual catalysts, may face additional regulatory hurdles, making R&D and certification costs steep.

Opportunity

Expansion of Clean-label & Nonstick Food Processing

One major growth opportunity for high-performance fluoropolymers (HPFs) lies in their ability to meet the rising demand for clean-label, nonstick, and low-residue processing lines in food manufacturing. As consumers increasingly demand minimally processed food and more transparency, manufacturers are under pressure to reduce additives, coatings, and chemical treatments—while still keeping equipment surfaces hygienic, easy to clean, and safe for contact. That is exactly the niche where HPFs shine.

Unsafe food remains a significant global burden. The World Health Organization estimates that 600 million people—nearly one in ten globally—fall ill annually from contaminated food, causing 420,000 deaths. This heightens regulatory and consumer scrutiny of every interface in food processing. If processing lines can reliably resist sticking, fouling, corrosion, and microbial buildup—while avoiding additional coatings or release agents—then HPFs become attractive.

Furthermore, the sheer scale of food processing offers a rich addressable market. In the United States alone, there were 42,708 food and beverage processing establishments in 2022, according to U.S. Department of Commerce data. Imagine even a modest penetration—if 10% of those plants adopt or retrofit HPF-coated conveyance, mixing, or packaging surfaces, that’s thousands of plants. Many operate 24/7, so even small improvements in cleaning downtime or contamination control translate into strong value.

- Government and industry initiatives further support this growth. For example, widely adopted standards like ISO 22000 (a food safety management system) operate at over 51,500 certified sites globally as of 2022. Many of these sites seek process technologies that reduce cross-contamination risks and simplify cleaning. HPFs, with their chemical resistance and low friction, align well with those goals.

Regional Insights

Asia-Pacific leads the high-performance fluoropolymer market with 43.8% share valued at USD 1.8 billion

In 2024, Asia-Pacific (APAC) held a dominant position in the global high-performance fluoropolymer market, accounting for over 43.8% of the total revenue, valued at approximately USD 1.8 billion. The region’s strong industrial base, expanding automotive production, and rapid growth in electronics manufacturing have been the primary factors driving demand. Countries such as China, Japan, South Korea, and India have emerged as major consumers due to their increasing investment in advanced materials and high-performance engineering polymers.

The surge in electric vehicle manufacturing across the region has notably increased the use of fluoropolymers in wire coatings, battery components, and sealing systems, as these materials ensure high insulation and thermal stability. Japan and South Korea’s focus on electronic innovation and miniaturized components further strengthens fluoropolymer consumption in the electrical and electronics sector.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Chemours is among the leaders in fluoropolymers. Its Advanced Performance Materials business offers a broad array of fluoropolymers under brands like Teflon™, Viton™, Krytox™, Nafion™, among others. Their product range includes PTFE, PFA, FEP resins & coatings, non-stick coatings, membranes (for fuel cells, etc.), and high-performance elastomers. Recently, they entered a strategic agreement with SRF Limited (India) to increase supply capacity for fluoropolymers & fluoroelastomers by 2026, improving global supply chain resilience.

Celanese operates a diversified chemicals portfolio; its fluoropolymer activity is less prominent in public disclosures compared to PTFE specialists. However, Celanese is active in specialty polymers and materials that serve automotive, electronics, medical, and industrial markets. There is limited specific branded fluoropolymer work disclosed, indicating that fluoropolymers are a component rather than core branding for Celanese.

3M’s fluoropolymer offering is anchored in its Dyneon™ and Dynamar™ brands, which include PTFE, PFA, FEP, and related fluorothermoplastics and fluoroelastomers. The company supplies critical components to industries such as automotive, aerospace, electrical & electronics, and chemical processing, particularly where chemical resistance, wear reduction, and thermal stability are needed. Its PTFE film tapes and skived film products illustrate its capability in thin film and coating applications.

Top Key Players Outlook

- 3M Company

- AGC Inc.

- Arkema Group

- Asahi Glass Co., Ltd. (AGC)

- Celanese Corporation

- Chemours Company

- Daikin Industries, Ltd.

- Dongyue Group Ltd.

- Gujarat Fluorochemicals Limited (GFL)

- Honeywell International Inc.

- Kuraray Co., Ltd.

- Saint-Gobain S.A

- Solvay S.A.

- The Dow Chemical Company

Recent Industry Developments

In 2024, Chemours’ Advanced Performance Materials (APM) segment generated USD 1,326 million in net sales, down by 9% from USD 1,462 million in 2023, mainly because of lower prices (−5%), lower volumes (−3%), and adverse currency effects.

In 2024 Celanese Corporation, it posted net sales of USD 2.4 billion, down 10 % sequentially, and reported an operating loss of USD 1.4 billion, while adjusted EBIT was USD 333 million and EBITDA stood at USD 517 million.

Report Scope

Report Features Description Market Value (2024) USD 4.3 Bn Forecast Revenue (2034) USD 8.7 Bn CAGR (2025-2034) 7.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Polytetrafluoroethylene (PTFE), Fluorinated Ethylene Propylene (FEP), Perfluoroalkoxy (PFA)/Methyl Fluoroacetate(MFA), Ethylene Tetrafluoroethylene (ETFE), Others), By Application (Transportation, Electrical And Electronics, Medical, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape 3M Company, AGC Inc., Arkema Group, Asahi Glass Co., Ltd. (AGC), Celanese Corporation, Chemours Company, Daikin Industries, Ltd., Dongyue Group Ltd., Gujarat Fluorochemicals Limited (GFL), Honeywell International Inc., Kuraray Co., Ltd., Saint-Gobain S.A, Solvay S.A., The Dow Chemical Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  High Performance Fluoropolymer MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample

High Performance Fluoropolymer MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- 3M Company

- AGC Inc.

- Arkema Group

- Asahi Glass Co., Ltd. (AGC)

- Celanese Corporation

- Chemours Company

- Daikin Industries, Ltd.

- Dongyue Group Ltd.

- Gujarat Fluorochemicals Limited (GFL)

- Honeywell International Inc.

- Kuraray Co., Ltd.

- Saint-Gobain S.A

- Solvay S.A.

- The Dow Chemical Company