Global Hemp Fiber Market Size, Share and Report Analysis By Source (Organic, Conventional, By Product (Seeds, Fiber, Shivs), By Application (Food, Beverages, Personal Care Products, Textiles, Pharmaceuticals, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2026

- Report ID: 178581

- Number of Pages: 296

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

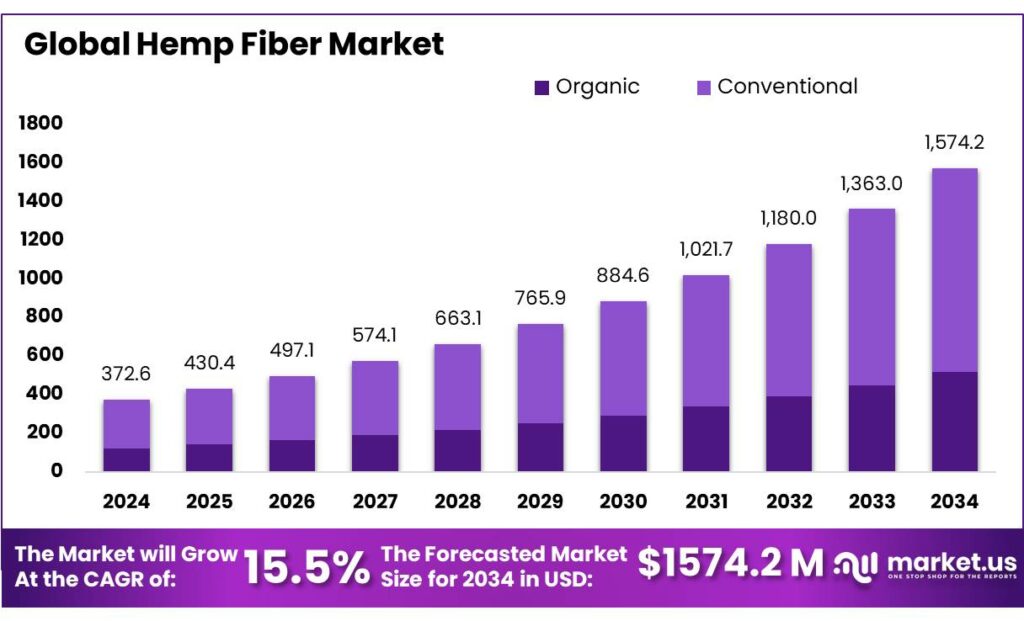

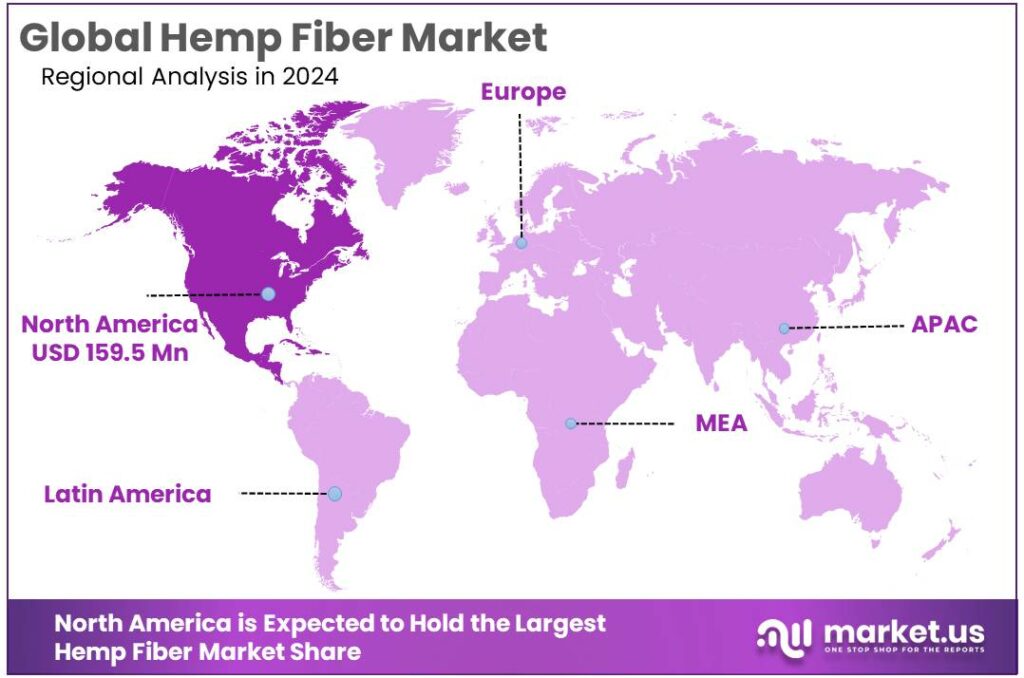

Global Hemp Fiber Market size is expected to be worth around USD 1574.2 Million by 2034, from USD 372.6 Million in 2024, growing at a CAGR of 15.5% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 42.9% share, holding USD 159.5 Million in revenue.

The hemp fiber industry is evolving from a niche segment into a strategic bio-materials value chain. Industrial hemp, defined by very low tetrahydrocannabinol (THC) content, is now cultivated for fiber, seed and cannabinoids in at least 40 countries, with China and France among the largest producers. A United Nations industrial hemp review estimated the overall global industrial hemp economy at roughly USD 5 billion in 2020, highlighting how under-reported trade data masks the true scale of fiber and seed uses. Food- and agriculture-oriented analyses also note that at least 47 countries grow hemp for commercial or research purposes, and that the top 10 producing nations alone had about 864,000 acres under industrial hemp in 2019.

- The European Commission reports that EU area dedicated to hemp for fiber expanded from 20,540 hectares in 2015 to 33,020 hectares in 2022, a 60% increase, while hemp production rose from 97,130 tonnes to 179,020 tonnes over the same period. France accounts for more than 60% of EU output, followed by Germany at 17 % and the Netherlands at 5%. In the United States, USDA’s National Agricultural Statistics Service valued total industrial hemp production at USD 291 million in 2023, up 18 % year-on-year, with 27,680 acres planted and 21,079 acres harvested across all uses.

Key driving factors for hemp fiber include sustainability, circular economy goals and diversification of farm incomes. FAO-linked analysis notes that hemp raw materials feed more than 25,000 products spanning agriculture, textiles, recycling, automotive, furniture, food and beverages, paper, construction and personal care, reinforcing its multi-sector pull.

Environmentally, the European Commission estimates that one hectare of hemp can sequester roughly 9–15 tonnes of CO₂ in a single five-month growing cycle, comparable to a young forest, while typically requiring little or no pesticide use. In construction, policies targeting buildings—which account for around 40% of EU energy consumption and 36% of greenhouse-gas emissions—are pushing interest in hempcrete, hemp insulation and fiberboard as carbon-storing alternatives to conventional materials.

Government policy is a central pillar of the industrial scenario. In the United States, the Agriculture Improvement Act of 2018 removed hemp from the Controlled Substances Act and authorized commercial production of hemp, directing USDA to create a Domestic Hemp Production Program. Under this framework, USDA’s National Hemp Report shows 21.0 million pounds (≈9,545 tonnes) of hemp grown in the open for fiber in 2022 on 6,850 acres, valued at US$28.3 million. In the EU, hemp qualifies for area-based direct payments under the Common Agricultural Policy, provided certified varieties remain below 0.3% THC, and can receive coupled income support in countries such as France, Poland and Romania.

Environmental and performance attributes are the main driving forces. The European Commission highlights that one hectare of hemp can sequester 9–15 tonnes of CO₂ in a five-month growing cycle, comparable to a young forest but on much shorter rotation. Industry synthesis of agronomic studies suggests hemp uses about 50% less water per season than cotton and can yield 600–1,000 kg of fiber per hectare, with China supplying roughly 50% of global hemp fiber production.

Key Takeaways

- Hemp Fiber Market size is expected to be worth around USD 1574.2 Million by 2034, from USD 372.6 Million in 2024, growing at a CAGR of 15.5%.

- Conventional held a dominant market position, capturing more than a 67.2% share.

- Fiber held a dominant market position, capturing more than a 47.7% share.

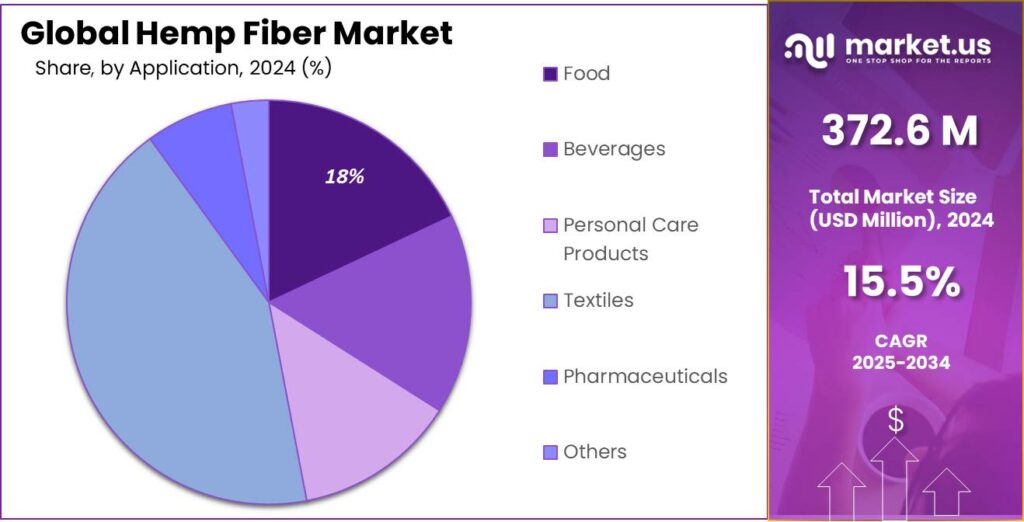

- Textiles held a dominant market position, capturing more than a 43.6% share.

- North America stands out as the dominating region, with a 42.9% market share valued at US$159.5 Mn.

By Source Analysis

Conventional hemp fiber leads the market with a strong 67.2% share

In 2024, Conventional held a dominant market position, capturing more than a 67.2% share, reflecting the continued reliance of processors, textile manufacturers and composite producers on traditional hemp cultivation systems. This segment remains preferred mainly because growers already have established farming practices, existing supply chains and accessible seed varieties that fit current regulatory norms. By 2025, the conventional category continues to maintain its leadership, supported by steady demand from paper mills, packaging converters and fiber-reinforced material manufacturers that depend on consistent, large-scale raw-material availability.

By Product Analysis

Fiber segment leads the market with a solid 47.7% share

In 2024, Fiber held a dominant market position, capturing more than a 47.7% share, reflecting its central role in the commercial use of hemp across textiles, biocomposites and construction-grade materials. The segment benefits from the steady demand of industries that rely on strong, lightweight and renewable fibers, especially as manufacturers continue shifting toward natural material alternatives. Throughout 2024, fiber-based applications experienced higher procurement activity as producers aimed to integrate hemp into clothing lines, automotive interior components and insulation materials.

By Application Analysis

Textiles segment dominates with a strong 43.6% share

In 2024, Textiles held a dominant market position, capturing more than a 43.6% share, reflecting the continued importance of hemp fiber in the global textile supply chain. Even though the segment name refers to textiles, the strong share highlights how widely hemp fiber is used in apparel, home fabrics and industrial textiles where durability and natural breathability matter. In 2024, textile manufacturers increased their demand for hemp fiber as fashion brands and home furnishing companies pushed for more sustainable raw materials that offer good strength yet remain lightweight and biodegradable.

Key Market Segments

By Source

- Organic

- Conventional

By Product

- Seeds

- Fiber

- Shivs

By Application

- Food

- Beverages

- Personal Care Products

- Textiles

- Pharmaceuticals

- Others

Emerging Trends

Hemp fiber is trending into “circular textiles” and low-carbon construction

A clear latest trend in hemp fiber is how quickly it is being pulled into two fast-moving sustainability tracks at the same time: circular textiles and carbon-aware construction. In Europe, this is no longer just a brand story—it is being reflected in policy language and sector planning. The European Commission openly frames hemp cultivation as supporting the European Green Deal and highlights that one hectare of hemp can sequester 9 to 15 tonnes of CO₂ in about five months, a pace it compares to a young forest.

In textiles, the direction is moving toward replacing a small share of fossil-based fibers with natural fibers that fit circular economy rules. This matters because the overall textile materials system is still expanding: Textile Exchange reported global fiber production reached 124 million tonnes in 2023. Against that huge number, hemp is still a small slice, but it is gaining attention because it has an industrial supply chain, can be blended into familiar yarn systems, and is increasingly treated as a “next step” material for companies trying to reduce footprint without switching to expensive, experimental inputs. Textile Exchange’s Materials Market Report notes hemp production at about 0.2 million tonnes in 2023.

The European Commission points out the construction sector is responsible for 40% of energy consumption and 36% of greenhouse gas emissions, and that 75% of that energy goes to waste—which is why builders are searching for materials and methods that improve efficiency and reduce carbon impact.

- In the EU, hemp cultivation for fibre increased from 20,540 hectares in 2015 to 33,020 hectares in 2022 (a 60% rise), while production grew from 97,130 tonnes to 179,020 tonnes. In 2024, 116 hemp varieties are listed in the EU common catalogue, which signals a more formal, regulated seed and farming ecosystem.

Drivers

Sustainability push is a key driving force for hemp fiber

A major driving factor for the hemp fiber market is the strong global push toward sustainable, low-carbon materials. Industrial hemp is seen as a “nature-based solution” crop: FAO notes that hemp raw materials are used in more than 25,000 products across food, textiles, paper, construction and bioplastics, which makes it easy for brands to replace more resource-intensive inputs without redesigning entire product lines.

- The European Commission reports that one hectare of hemp can sequester 9 to 15 tonnes of CO₂ in a growing cycle of about five months, roughly comparable to a young forest but on a much faster rotation. At the same time, EU hemp area for fiber rose from 20,540 hectares in 2015 to 33,020 hectares in 2022, a 60% increase, while production grew from 97,130 tonnes to 179,020 tonnes (+84.3%) over the same period.

This environmental story is tightly linked with market growth. UNCTAD estimates that the overall industrial hemp sector had a production value of about US$5 billion in 2020, and notes that the global hemp market could reach around US$18.6 billion by 2027, almost four times the 2020 level. Much of that expansion is expected to come from fibers and materials where buyers are under pressure to cut carbon and move away from fossil-based or chemically intensive inputs.

Public policy adds another layer to this driving force. In the European Union, hemp is explicitly framed as supporting Green Deal goals such as climate neutrality and biodiversity. It is eligible for Common Agricultural Policy support, and official documents highlight benefits like low pesticide needs, erosion control and biodiversity gains alongside carbon storage.

- In the United States, USDA’s National Hemp Report shows that hemp grown in the open for fiber reached 21.0 million pounds on 6,850 acres in 2022, with a value of US$28.3 million, while total hemp production across uses was valued at US$824 million in 2021.

Restraints

Regulatory complexity remains a major restraint for the hemp fiber industry

One of the biggest restraining factors for the hemp fiber sector is the continuing regulatory complexity surrounding hemp cultivation, transport and processing. Even though hemp is a non-psychoactive crop, many countries still regulate it under strict frameworks that slow down investment and discourage farmers from expanding acreage. A clear example comes from the United States, where the USDA’s Domestic Hemp Production Program requires all commercial hemp to contain no more than 0.3% delta-9 THC, and crops testing above this threshold must be destroyed.

- The challenge becomes more visible when looking at actual cultivation patterns. USDA’s National Hemp Report shows that hemp grown in the open for fiber in 2022 covered only 6,850 acres, producing 21.0 million pounds of fiber worth US$28.3 million. These numbers are very small compared to common field crops, not because demand is weak but because many farmers find the regulatory burden too unpredictable to justify switching acreage. The total U.S. hemp production value across all uses fell to US$238 million in 2022, far below the US$824 million recorded in 2021, reflecting how policy uncertainty and compliance pressures have slowed the sector’s momentum.

This regulatory restraint is also seen in Europe. The European Union allows hemp cultivation only when certified seed varieties remain under 0.3% THC, and farmers must maintain documentation proving the seed origin and compliance. Several EU member states additionally require location registration, pre-approval of cultivation areas, and periodic field inspections, all of which increase the administrative load. While the EU has seen hemp cultivation grow from 20,540 hectares in 2015 to 33,020 hectares in 2022, the expansion is still far slower than what many sustainability-focused industries—especially textiles and construction—are calling for.

Opportunity

Rising demand for low-carbon materials is a big growth opening for hemp fiber

A major growth opportunity for hemp fiber lies in the global shift toward low-carbon, bio-based materials in construction and textiles. Policymakers, food and agriculture bodies, and climate agencies are all pushing for materials that store carbon instead of adding more emissions. The European Commission notes that one hectare of hemp can absorb 9–15 tonnes of CO₂ during a roughly five-month growth cycle, making it comparable to a young forest but on a much faster rotation

This climate angle fits well with wider food and farming trends. FAO describes industrial hemp as a multi-purpose crop used in more than 25,000 products, ranging from food and feed to textiles, paper, biocomposites and construction materials.

Government targets around buildings and climate add another layer to this opportunity. The EU’s Green Deal aims for climate neutrality by 2050, and the building stock is a big part of that effort. Policies promoting renovation, energy-efficient homes and circular construction indirectly help hemp. Natural fiber insulation and hemp-lime walls are attractive because they combine thermal performance with carbon storage.

- The European hemp area already expanded from 20,540 hectares in 2015 to 33,020 hectares in 2022, while production climbed from 97,130 tonnes to 179,020 tonnes. Those hectares are still small in global terms, but they show that farmers are responding when there is a clear policy signal and stable demand.

Trade and development agencies also see a window for rural economies. UNCTAD estimates that industrial hemp had a production value of around US$5 billion in 2020, and highlights its potential for developing countries that want to diversify agriculture and add processing jobs. For hemp fiber, this means new chances to set up regional decortication plants, spinning units and panel factories close to where the crop is grown. If governments align hemp rules with their food, climate and rural-development plans, they can turn a regulatory challenge into a growth lever.

Regional Insights

North America leads hemp fiber demand with 42.9% share and US$159.5 Mn

North America stands out as the dominating region, with a 42.9% market share valued at US$159.5 Mn, supported by a clearer commercialization pathway and a steadily organizing supply chain. In the United States, federal oversight has helped formalize hemp production under USDA rules, including the legal definition of hemp at 0.3% delta-9 THC, which brings consistency for interstate movement and contracting.

Europe remains a strong secondary hub, with the European Commission reporting EU hemp area growth from 20,540 ha (2015) to 33,020 ha (2022) and production rising from 97,130 tonnes to 179,020 tonnes; France contributes over 60% of EU output, followed by Germany (17%) and the Netherlands (5%), showing concentration around established fiber infrastructure.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

GenCanna, based in Kentucky, grew rapidly as a vertically integrated producer of hemp-derived ingredients before encountering financial distress. In 2019, the company secured about US$75 million in financing but, by February 2020, had filed for Chapter 11 reorganization in the U.S. Bankruptcy Court. Court filings show GenCanna sought an additional US$10 million debtor-in-possession loan to maintain operations during restructuring, and later wind-down documents detailed clawback actions of around US$1.4 million tied to prior payments.

Dun Agro Hemp Group, headquartered in the Netherlands, brings more than 30 years of industrial hemp experience, managing activities from cultivation to end products such as building materials and food ingredients. The group cultivates over 1,300 hectares of industrial hemp fiber annually, achieving yields up to 12 tonnes of dry material per hectare on open ground. U.S. and EU sources describe Dun Agro as one of two major hemp processors in the Dutch province of Groningen, with future plans to coordinate roughly 15,000–25,000 acres of hemp and to operate a facility capable of processing about 11–13 tons per hour of stalks for fiber and hempcrete markets.

Cavac Biomatériaux is the bio-based materials arm of the French agricultural cooperative CAVAC, which counts around 10,000 farmers, about 1,650 employees and annual turnover near €1 billion, across roughly 130 sites in western France.Within this structure, Cavac Biomatériaux manages a complete hemp chain “from field to site,” decorticating hemp and flax straw and manufacturing insulation panels. It typically draws from about 1,500 hectares of hemp delivering around 10,000 tonnes of straw per year, and in 2024 inaugurated a new Biofib Isolation plant to expand hemp-based insulation capacity and support France’s low-carbon building goals.

Top Key Players Outlook

- HempFlax

- Ecofibre

- Hemp Inc.

- GenCanna

- Dun Agro Hemp Group

- Cavac Biomateriaux

- BaFa

- American Hemp, LLC

Recent Industry Developments

In 2024, Dun Agro was growing more than 1,300 hectares of industrial hemp fibre each year in the Netherlands, with yields reaching up to 12 tonnes of dry material per hectare, and more than 30 years of experience in hemp cultivation and harvesting technology.

Cavac Biomateriaux sits inside the CAVAC cooperative, which brings together around 10,000 farmers, employs about 1,650 people and generates close to €1 billion in yearly turnover across roughly 130 sites in western France, giving the hemp unit a strong and stable supply base.

Report Scope

Report Features Description Market Value (2024) USD 372.6 Mn Forecast Revenue (2034) USD 1574.2 Mn CAGR (2025-2034) 15.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Organic, Conventional, By Product (Seeds, Fiber, Shivs), By Application (Food, Beverages, Personal Care Products, Textiles, Pharmaceuticals, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape HempFlax, Ecofibre, Hemp Inc., GenCanna, Dun Agro Hemp Group, Cavac Biomateriaux, BaFa, American Hemp, LLC Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- HempFlax

- Ecofibre

- Hemp Inc.

- GenCanna

- Dun Agro Hemp Group

- Cavac Biomateriaux

- BaFa

- American Hemp, LLC