Global Gum Arabic Market Size, Share, And Business Benefits By Sources (Acacia Senegal, Acacia Seyal), By Functionality (Emulsifier, Viscosity, Solubility, Film Forming, Fat Substitute, Fiber, Stabilizer), By Nature (Organic, Conventional), By Application (Food and Beverages, Pharmaceutical, Printing and Painting, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: September 2025

- Report ID: 158440

- Number of Pages: 207

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

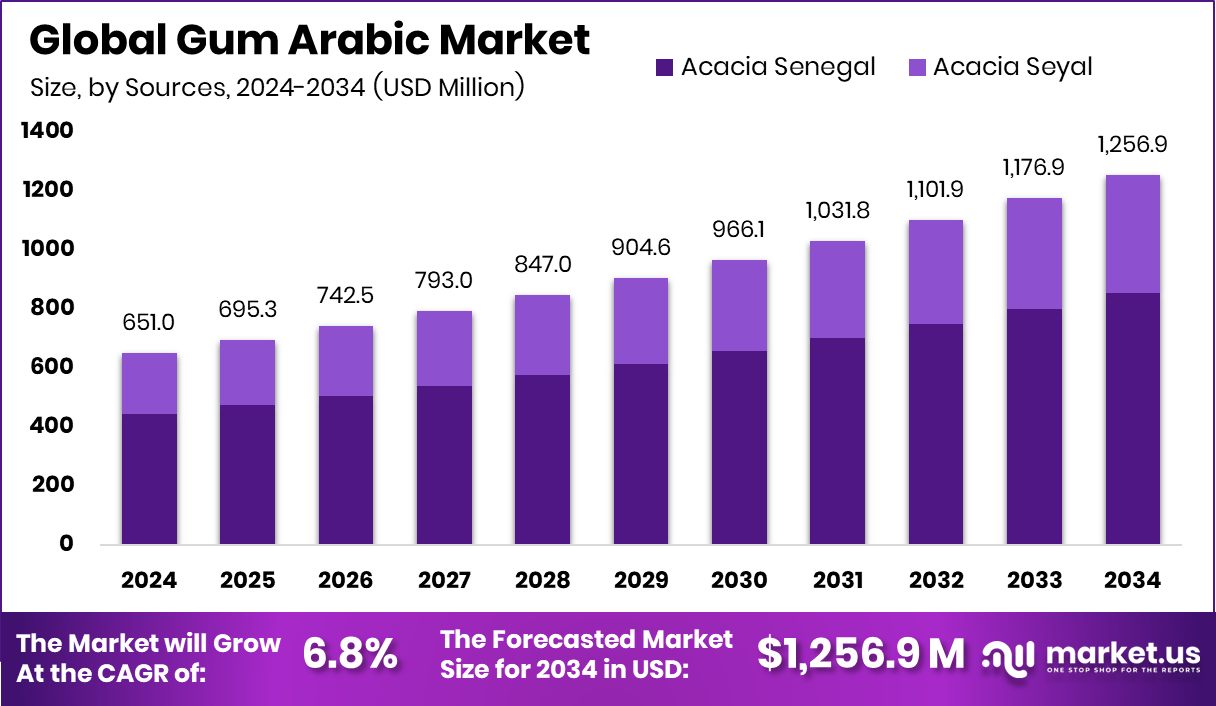

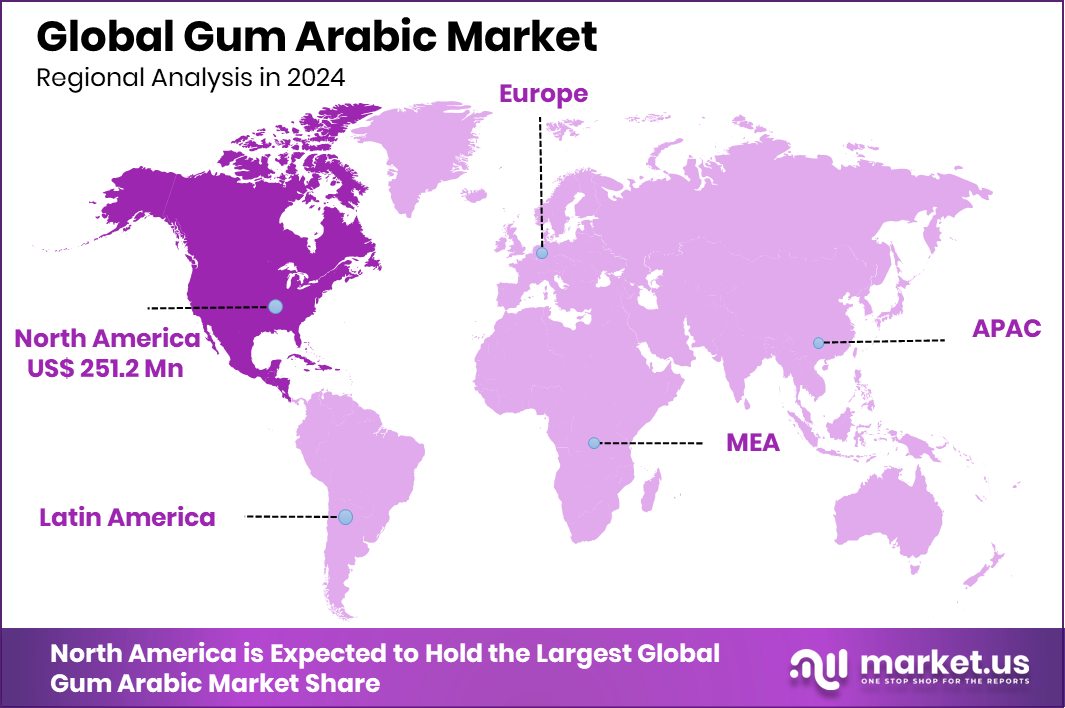

The Global Gum Arabic Market is expected to be worth around USD 1,256.9 million by 2034, up from USD 651.0 million in 2024, and is projected to grow at a CAGR of 6.8% from 2025 to 2034. Rising demand for natural stabilizers pushed the North America Gum Arabic Market to USD 251.2 Mn, 38.6% share.

Gum Arabic, also called acacia gum, is a natural edible gum obtained from Acacia senegal and Vachellia seyal. It is a water-soluble mixture of polysaccharides and glycoproteins, widely used as a stabilizer, emulsifier, and thickener in foods, beverages, pharmaceuticals, and cosmetics. The gum arabic market covers harvesting, processing, and supplying this ingredient to industries, with demand growing as consumers prefer natural and clean-label additives.

Growth is fueled by rising awareness of natural over synthetic ingredients, strong demand in confectionery, bakery, and beverages, and the clean-label and dietary fiber trend. Improved harvesting and logistics have also enhanced quality and availability. Demand is broad, encompassing food and beverages such as soft drinks, sweets, jams, and bakery items, as well as pharmaceuticals for capsules and coatings, cosmetics, and industrial uses like inks and adhesives.

Opportunities lie in refining and certifying sustainable agroforestry cultivation in arid zones, as well as developing innovative uses in nutraceuticals and functional foods. India provides a supportive backdrop with government funding: the National Mission on Natural Farming, approved in November 2024, has a budget of ₹2,481 crore (center share ₹1,584 crore, state share ₹897 crore). Additionally, ICAR’s National Institute of Secondary Agriculture supports R&D and technology for gums and resins.

Key Takeaways

- The Global Gum Arabic Market is expected to be worth around USD 1,256.9 million by 2034, up from USD 651.0 million in 2024, and is projected to grow at a CAGR of 6.8% from 2025 to 2034.

- In 2024, Acacia Senegal dominated the gum arabic market with a strong 67.2% share globally.

- By functionality, Emulsifiers led the Gum Arabic Market in 2024, securing a 27.4% share worldwide.

- In terms of nature, conventional gum arabic captured a commanding 62.5% share in the global market.

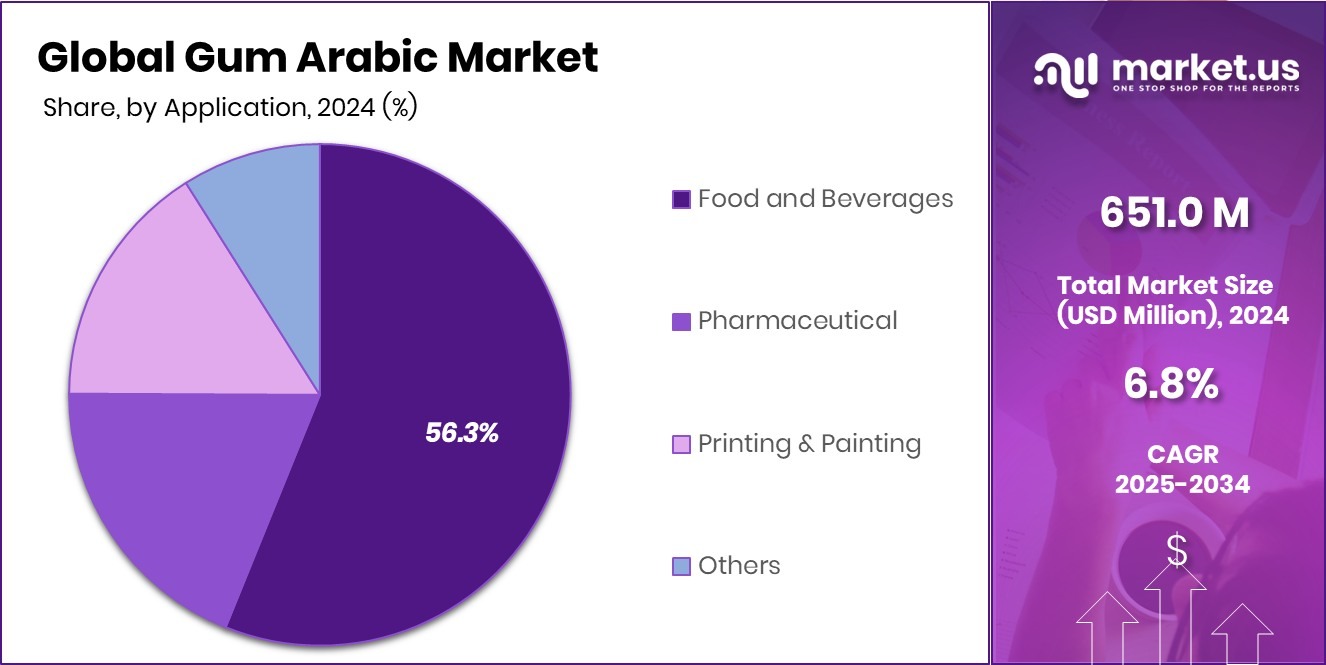

- By application, the Food and beverages segment accounted for the largest 56.3% share of the Gum Arabic Market.

- The strong growth in North America at 38.6% share reflects expanding food and beverage applications.

By Sources Analysis

In the Gum Arabic Market, Acacia Senegal leads with a 67.2% share.

In 2024, Acacia Senegal held a dominant market position in the By Sources segment of the Gum Arabic Market, with a 67.2% share. This strong presence is largely due to the superior quality of gum derived from Acacia Senegal, which is widely recognized for its high solubility, excellent emulsifying properties, and consistent performance across food, beverage, and pharmaceutical applications.

Its ability to meet international quality standards has made it the preferred choice for manufacturers seeking natural stabilizers and dietary fiber ingredients. The segment’s dominance is also supported by increasing global demand for clean-label products and natural additives, ensuring that Acacia Senegal gum continues to capture the confidence of industries and maintain its leading role in the gum arabic supply chain.

By Functionality Analysis

Emulsifiers dominate functionality in the Gum Arabic Market at 27.4%.

In 2024, Emulsifier held a dominant market position in the By Functionality segment of the Gum Arabic Market, with a 27.4% share. This dominance is driven by the rising use of gum arabic as a natural emulsifying agent in beverages, confectionery, and bakery items, where stable blending of ingredients is essential. Its unique ability to create uniform mixtures without altering taste or texture has made it highly valuable for food and drink formulations.

The clean-label movement further boosts its acceptance, as manufacturers look for natural alternatives to synthetic emulsifiers. With expanding applications in both traditional foods and modern health-focused products, the emulsifier functionality of gum arabic is expected to remain a key growth contributor within the market.

By Nature Analysis

Conventional sources hold a strong 62.5% share in the Gum Arabic Market.

In 2024, Conventional held a dominant market position in the By Nature segment of the Gum Arabic Market, with a 62.5% share. This leading position is primarily due to the widespread cultivation and availability of conventionally sourced gum arabic, which continues to meet the bulk demand of food, beverage, pharmaceutical, and cosmetic industries.

Conventional gum arabic is valued for its cost-effectiveness, consistent supply, and established trade networks, making it the preferred choice for manufacturers seeking large-scale raw material sourcing. Its extensive use in soft drinks, candies, and bakery products further strengthens its dominance. With reliable harvesting practices and broad acceptance across global markets, the conventional segment remains the backbone of gum arabic’s commercial success.

By Application Analysis

The food and Beverages application drives the Gum Arabic Market with a 56.3% share.

In 2024, Food and Beverages held a dominant market position in the By Application segment of the Gum Arabic Market, with a 56.3% share. This leadership is mainly driven by the extensive use of gum arabic in soft drinks, confectionery, bakery, and flavored beverages, where it acts as a natural stabilizer, emulsifier, and thickening agent.

Its ability to improve texture, enhance mouthfeel, and maintain product stability has made it a vital ingredient for manufacturers catering to rising consumer demand for clean-label and natural products. The segment also benefits from the growing popularity of functional foods and dietary fiber-enriched products, ensuring that gum arabic continues to play a central role in food and beverage formulations worldwide.

Key Market Segments

By Sources

- Acacia Senegal

- Acacia Seyal

By Functionality

- Emulsifier

- Viscosity

- Solubility

- Film Forming

- Fat Substitute

- Fiber

- Stabilizer

By Nature

- Organic

- Conventional

By Application

- Food and Beverages

- Pharmaceutical

- Printing and Painting

- Others

Driving Factors

Natural Ingredients, Clean-Label Demand, and Government Support

Consumers around the world are increasingly choosing products made with natural, recognizable ingredients. They are wary of artificial additives and want food, beverages, cosmetics, and pharmaceuticals to list ingredients they understand. This “clean-label” trend pushes manufacturers to substitute synthetic stabilizers, emulsifiers, or binders with natural ones like gum arabic, boosting its demand.

At the same time, governments and international agencies are stepping in with funding and programs to support gum arabic sectors, especially in major producing countries, to improve quality, increase production, and help small farmers benefit more. For example, Sudan received a US$10 million grant from the Green Climate Fund (GCF) to restore the gum arabic belt and support communities in Kordofan with climate adaptation and better management of natural resources.

Government funding helps in several ways: it supports infrastructure (roads, processing facilities), improves grading and quality control, organizes producers into cooperatives, provides technical training, and sometimes reforms export rules so more value stays in the producing countries. Without such support, even strong consumer demand might not translate into higher incomes or sustainable growth.

Restraining Factors

Climate Change Risks Reduce Gum Arabic Yield

The gum arabic market faces a serious challenge because of climate change. Gum arabic trees grow mainly in the “gum belt” across Sudan, Chad, and Nigeria, and they need stable weather to thrive. However, rising temperatures, irregular rainfall, and frequent droughts are making it harder for trees to survive. Long dry spells reduce sap production, while sudden floods damage land and weaken tree roots. This leads to lower yields and unstable supply for industries that depend on gum arabic.

Farmers in rural areas are most affected, as they rely on these trees for their income. Without strong environmental management and adaptation support, climate risks will continue to limit the steady growth of the gum arabic sector.

Growth Opportunity

Rising Demand for Global Natural Beverages

A big growth opportunity for the gum arabic market comes from the rapid rise of natural and functional beverages. More people now want healthy drinks, clean-label, and plant-based. Gum arabic is widely used as a stabilizer in juices, flavored water, and energy drinks because it keeps ingredients mixed without changing the taste. With beverage companies moving away from artificial additives, gum arabic is becoming a preferred choice.

The global push toward low-sugar and natural drinks is opening new markets in Asia, Europe, and North America. If producers improve supply chains and ensure consistent quality, gum arabic could see higher demand as beverage makers expand product ranges to meet consumer health preferences.

Latest Trends

Ethical Sourcing And Conflict-Free Supply Chains Growing

A strong recent trend in the gum arabic market is rising attention to ethical sourcing and ensuring that the supply chain is conflict-free. Because Sudan produces about 80% of the world’s gum arabic, instability in harvesting areas (for example, from armed forces or smuggling) creates risks for buyers who want to maintain ethical and legal standards.

Companies and consumers now demand proofs of origin, certifications, and traceability (that the gum was harvested under safe, fair, and lawful conditions). This trend pushes producers to improve documentation, reduce corruption, provide worker safety, and comply with regulations. In turn, sourcing from other producing countries or diversifying supply helps reduce dependency on any one unstable region. This makes ethical sourcing a key factor in trust, pricing, and long-term market relationships.

Regional Analysis

In 2024, North America dominated the Gum Arabic Market with a 38.6% share, reaching USD 251.2 Mn.

The Gum Arabic market shows varied regional dynamics across North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America, each contributing differently to global demand. In 2024, North America emerged as the leading region, capturing 38.6% of the market share, valued at USD 251.2 million. This dominance is strongly supported by the widespread use of gum arabic in the food and beverage sector, particularly in soft drinks, confectionery, and bakery products, where it serves as a natural emulsifier and stabilizer.Growing consumer preference for clean-label and plant-based ingredients further fuels its uptake in health-oriented and functional food categories. Additionally, the region benefits from advanced processing technologies and well-structured supply chains that ensure consistent product quality and availability, boosting its competitive edge.

While other regions such as Europe and the Asia Pacific also display steady adoption due to expanding applications in pharmaceuticals, cosmetics, and dietary fiber products, North America maintains its leadership position due to higher consumer awareness, stronger demand for natural additives, and favorable regulatory standards supporting clean-label formulations.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Nexira, with its long history in natural ingredients, reinforced its leadership by focusing on high-quality gum arabic sourcing and advancing its use in clean-label formulations. The company’s emphasis on sustainable supply chains and innovation in dietary fiber applications positioned it as a trusted partner for food and beverage producers seeking natural emulsifiers and stabilizers.

Kerry Group plc continued to integrate gum arabic into its extensive portfolio of taste and nutrition solutions, reflecting its commitment to meeting consumer demand for healthier, plant-based, and functional ingredients. By leveraging gum arabic’s versatility, Kerry enhanced product performance in beverages, confectionery, and wellness-focused foods, further cementing its role as a global leader in natural food systems. The company’s strong global presence ensured that gum arabic remained a core element in its growth strategy.

Meanwhile, Ingredion advanced its position by focusing on ingredient innovation, incorporating gum arabic as part of its specialty offerings tailored to meet rising demand for clean-label and natural additives. The company’s research-driven approach enabled it to improve application efficiency in both food and industrial uses, enhancing value for its customers.

Top Key Players in the Market

- Nexira

- Kerry Group plc

- Ingredion

- Agrigum International Limited

- Farbest Brands

- ADM

- Ashland

- Hawkins Watts Limited

- Gum Arabic Company

Recent Developments

- In November 2024, Kerry agreed to divest (i.e., sell off) its Kerry Dairy Ireland business in a phased deal worth about €500 million, to focus more on its taste & nutrition business.

- In November 2024, Agrigum expanded its capacity in the U.S. market by forming a collaboration with AMPAK Company, Inc. This partnership is meant to boost the distribution of its Acacia (gum arabic) products in the United States.

Report Scope

Report Features Description Market Value (2024) USD 651.0 Million Forecast Revenue (2034) USD 1,256.9 Million CAGR (2025-2034) 6.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Sources (Acacia Senegal, Acacia Seyal), By Functionality (Emulsifier, Viscosity, Solubility, Film Forming, Fat Substitute, Fiber, Stabilizer), By Nature (Organic, Conventional), By Application (Food and Beverages, Pharmaceutical, Printing and Painting, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Nexira, Kerry Group plc, Ingredion, Agrigum International Limited, Farbest Brands, ADM, Ashland, Hawkins Watts Limited, Gum Arabic Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Nexira

- Kerry Group plc

- Ingredion

- Agrigum International Limited

- Farbest Brands

- ADM

- Ashland

- Hawkins Watts Limited

- Gum Arabic Company