Global GNSS Chip Market By Device Type (Smartphones, Tablets and Wearables, Personal Tracking Devices, Low-power Asset Trackers, In-vehicle Systems, Drones, Other Device Types), By Frequency Band (Single-frequency L1, Dual-frequency L1/L5, Dual-frequency L1/L2, Multi-frequency (Tri-band and above)), By End-user Industry (Automotive, Consumer Electronics, Aviation, Agriculture, Construction and Mining, Defense and Public Safety, Other End-users), By Application (Navigation, Positioning and Mapping, Timing and Synchronization, Remote Sensing, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Nov. 2025

- Report ID: 165705

- Number of Pages: 259

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

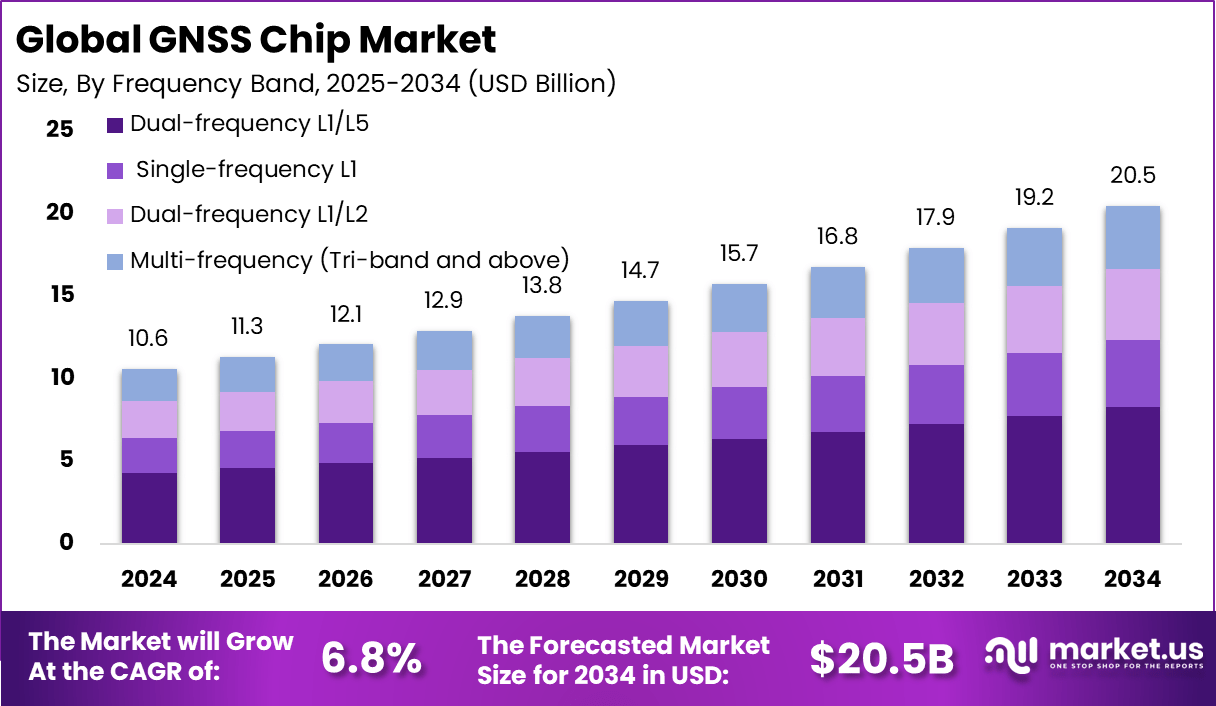

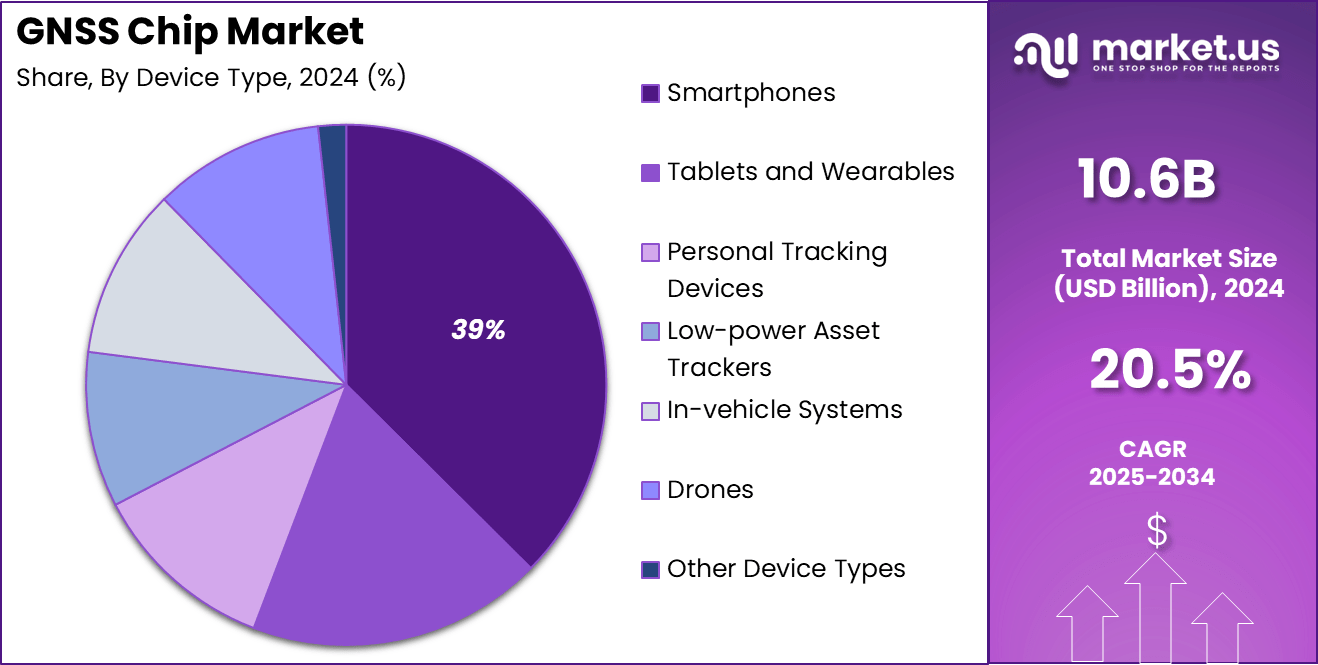

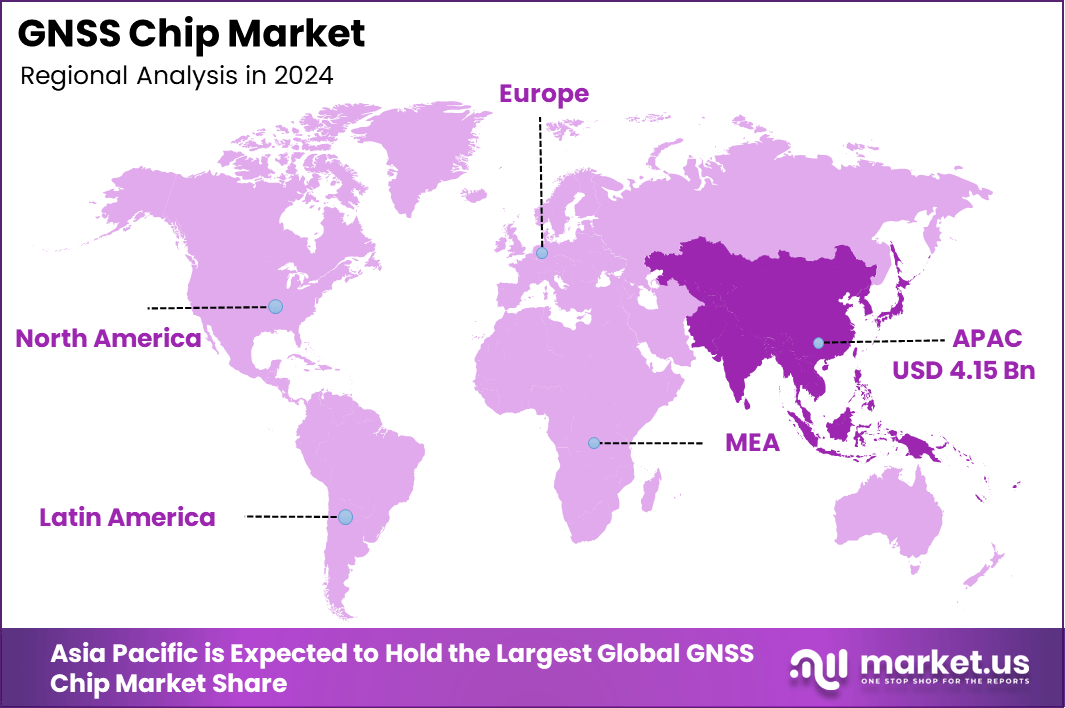

The Global GNSS Chip Market generated USD 10.6 billion in 2024 and is predicted to register growth from USD 11.3 billion in 2025 to about USD 20.5 billion by 2034, recording a CAGR of 6.80% throughout the forecast span. In 2024, Asia Pacific held a dominan market position, capturing more than a 39.2% share, holding USD 4.15 Billion revenue.

The GNSS Chip market is expanding as these chips become essential components in a wide range of applications requiring precise positioning, navigation, and timing. GNSS (Global Navigation Satellite System) chips are increasingly integrated into smartphones, autonomous vehicles, drones, wearables, and agricultural equipment to enable accurate location-based services.

A key driver is the widespread adoption of 5G networks, which complements GNSS chips by facilitating faster, more reliable real-time data sharing and location tracking. These chips improve navigation accuracy and support emerging technologies like autonomous vehicles and smart mobility solutions, fueling steady market growth.

Top driving factors include rising smartphone penetration and the expansion of location-based services (LBS) used in ride-hailing, delivery, and mapping applications. The automotive sector’s push towards autonomous driving and advanced driver assistance systems (ADAS) demands high-precision GNSS chips capable of lane-level accuracy.

Precision agriculture benefits from GNSS-enabled autonomous machinery and yield mapping, which help boost productivity and sustainability. Continuous technical advancement, including multi-constellation support (GPS, GLONASS, Galileo, BeiDou) and multi-frequency receivers, significantly enhances reliability and positioning performance even in challenging environments like urban canyons or dense forests.

Demand analysis points to consumer electronics accounting for a large portion of adoption, as GNSS chips underpin devices like smartphones and wearables that require constant and accurate positioning data. The automotive sector is closely following, driven by electric vehicles and telematics systems integrating these chips for navigation and fleet management.

The aviation and defense sectors increasingly rely on GNSS chips for mission-critical operations, while industrial uses include asset tracking, logistics, and unmanned systems. Regions such as Asia-Pacific are emerging as fast-growing markets due to rapid urbanization, smartphone adoption, and investments in regional satellite constellations like BeiDou and NavIC.

Top Market Takeaways

- By device type, smartphones hold 38.8% of the market, driven by the widespread use of GNSS chips in consumer mobile devices for location-based services such as navigation, tracking, and mapping.

- By frequency band, dual-frequency L1/L5 GNSS chips account for 40.5% of the market. These chips offer enhanced positioning accuracy by reducing multipath and atmospheric errors, increasingly required in automotive and high-precision applications.

- By end-user industry, automotive leads with 34.7% share, driven by the integration of GNSS chips in advanced driver-assistance systems (ADAS), autonomous driving, and in-vehicle navigation systems.

- By application, navigation dominates at 35.7%, encompassing consumer electronics navigation, automotive positioning, surveying, and mapping uses.

- Regionally, Asia Pacific holds around 39.2% of the market, with China as a key contributor.

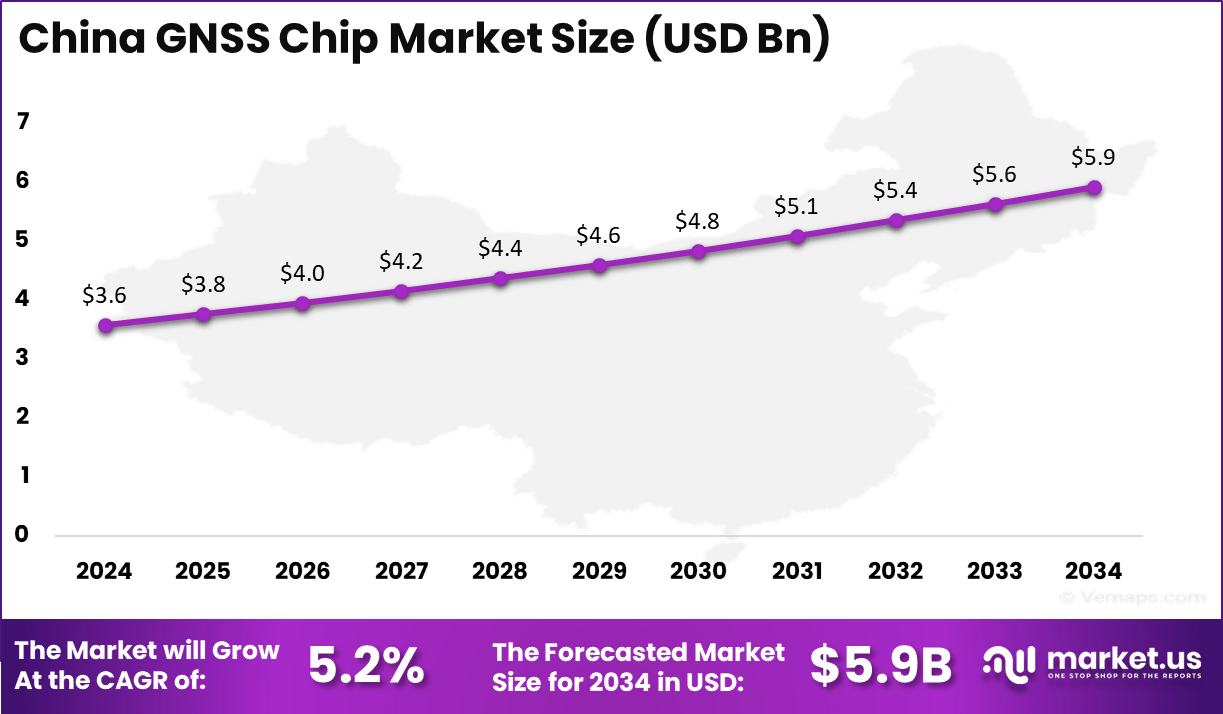

- The China GNSS chip market is valued at approximately USD 3.57 billion in 2025, supported by strong government initiatives like BeiDou satellite navigation, rapid smartphone penetration, and growing automotive industry demand.

- The market is growing at a CAGR of about 5.2%, supported by technological advancements, government satellite programs (including BeiDou, NavIC, and QZSS), and increased adoption in consumer electronics, automotive, and industrial sectors.

- Growth drivers include increasing demand for high-accuracy positioning, expansion of IoT applications, growth in smart transportation, and rising smartphone penetration in emerging markets.

By Device Type

Smartphones lead the GNSS chip market segment with a share of 38.8%. The widespread integration of GNSS chips in smartphones supports various applications such as navigation, location-based services, gaming, and geo-marketing.

As smartphones evolve technologically, with enhanced connectivity and processing power, their reliance on sophisticated GNSS chips increases to provide accurate and real-time positioning data.The rising consumer demand for efficient navigation features and location-based services continues to drive the penetration of advanced GNSS chips in smartphones, making them a key growth area in the market.

By Frequency Band

Dual-frequency L1/L5 GNSS chips currently hold 39% of the market share. These chips operate by receiving signals on two different frequency bands, allowing them to deliver higher accuracy and better resistance to signal interference.

Dual-frequency technology is critical for applications requiring precise positioning, such as autonomous vehicles, surveying, and agriculture.Advancements in dual-frequency GNSS technology contribute significantly to improved positioning performance, reducing errors and enhancing reliability across diverse end-use cases.

By End-User Industry

The automotive industry accounts for 34.7% of GNSS chip adoption. These chips are integral in automotive navigation, telematics, advanced driver-assistance systems (ADAS), and autonomous driving applications.

With the automotive sector’s shift towards connected vehicles and smart navigation, reliable GNSS chip adoption is increasingly vital for safety, route optimization, and vehicle tracking.Growing investments in autonomous vehicle technology and connected infrastructure amplify the automotive segment’s prominence in the GNSS chip market.

By Application

Navigation is the primary application segment with a market share of 35.7%. GNSS chips enable precise location tracking and route guidance in consumer devices, automotive systems, and various industrial sectors.

Their role is central to everyday convenience – from mapping apps to logistics – and critical services like emergency response and fleet management.Continued innovation in chip technology enhances navigation accuracy, reduces latency, and supports complex use cases, cementing navigation’s importance in GNSS utilization.

Emerging Trends

Trend Description Increasing Multi-Constellation Support GNSS chips now commonly support multiple satellite systems such as GPS, GLONASS, Galileo, and BeiDou. This improves positioning accuracy and reliability in diverse environments. AI and Edge Computing Integration GNSS chips are incorporating AI and edge computing to enhance real-time positioning precision and robustness, especially in challenging urban or dense forest areas. Low-Power Consumption Designs Advances are being made in reducing the power consumption of GNSS chips, benefiting wearable devices and IoT applications where battery life is critical. Hybrid Positioning Solutions Combining GNSS with complementary technologies such as 5G and inertial sensors is becoming common, improving navigation performance indoors and in difficult signal areas. Focus on Automotive and Autonomous Systems Growth in autonomous vehicles and advanced driver-assistance systems (ADAS) is driving demand for high-precision GNSS chips with real-time kinematic (RTK) capabilities. Growth Factors

Factor Description Growing Demand for Precise Location Services Increased need for accurate positioning across industries including automotive, consumer electronics, agriculture, and defense is fueling growth. Expansion of IoT and Smart Devices The proliferation of connected devices such as smartphones, wearables, and industrial IoT equipment is driving widespread integration of GNSS chips. Investments in Autonomous Vehicles Investment in self-driving cars and drone technology relies heavily on GNSS chip capabilities, especially for real-time, high-precision location tracking. Advances in Satellite Navigation Systems Modernization of satellite constellations and support for multi-frequency signals increase GNSS performance and market appeal. Regulatory Support and Industry Standards Growing support from governments and standardization bodies helps facilitate wider adoption and system interoperability globally. Key Market Segments

By Device Type

- Smartphones

- Tablets and Wearables

- Personal Tracking Devices

- Low-power Asset Trackers

- In-vehicle Systems

- Drones

- Other Device Types

By Frequency Band

- Single-frequency L1

- Dual-frequency L1/L5

- Dual-frequency L1/L2

- Multi-frequency (Tri-band and above)

By End-user Industry

- Automotive

- Consumer Electronics

- Aviation

- Agriculture

- Construction and Mining

- Defense and Public Safety

- Other End-users

By Application

- Navigation

- Positioning and Mapping

- Timing and Synchronization

- Remote Sensing

- Others

Regional Analysis

In 2024, Asia Pacific led the GNSS chip market with a dominant share of 39.2%, driven primarily by strong demand from China, valued at approximately USD 3.57 billion. This growth is underpinned by China’s expanding BeiDou satellite constellation, which bolsters regional GNSS chip adoption across consumer electronics, automotive, agriculture, and defense sectors.

The region benefits from government initiatives promoting indigenization in semiconductor manufacturing and technology integration, alongside rising smartphone penetration and growing demand for real-time location-based services.

Additionally, rapid urbanization, advancement in IoT, and smart city projects in countries like India and Japan including NavIC and QZSS systems add to the momentum. With continuous innovation and expanding use cases, Asia Pacific is set to sustain steady growth in this sector.

China, as the largest and most influential market in Asia Pacific, continues to dominate GNSS chip consumption and production. The country’s comprehensive satellite navigation infrastructure, led by BeiDou, supports extensive adoption in mobile devices, precision agriculture equipment, automotive telematics, and defense applications.

Chinese manufacturers actively develop GNSS chipsets meeting international standards, capturing significant market share domestically and globally. The government’s focus on self-reliance in semiconductor technology and integration with AI capabilities further accelerates development. China’s thriving tech ecosystem coupled with large market size ensures its leadership in driving the GNSS chip market in Asia Pacific and on the world stage.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Rising Demand for Precision Positioning and Navigation

The GNSS chip market is driven by the ever-increasing demand for high-precision positioning and navigation services across diverse industries. From smartphones and automotive applications to agriculture and defense, GNSS chips provide accurate location data essential for navigation, tracking, and timing synchronization.

The rapid growth of connected devices and IoT ecosystems further fuels the need for reliable GNSS integration, enhancing functionalities such as fleet management, autonomous driving, and location-based services. Advancements in multi-frequency GNSS chips and satellite constellations enhance signal accuracy and resilience, encouraging adoption.

Restraint

Signal Interference and High Power Consumption

A significant restraint to the GNSS chip market is vulnerability to signal interference and jamming, which can reduce reliability and accuracy in dense urban or remote environments. External factors, including atmospheric disturbances and intentional signal blocking, pose ongoing challenges for consistent GNSS performance. Such disturbances create risks in critical applications like autonomous vehicles, aviation, and defense.

Additionally, GNSS chips traditionally consume considerable power, affecting battery life in portable and wearable devices. The need for balancing accuracy with energy efficiency drives up design complexity and costs. These factors hinder broader adoption, especially in low-power IoT devices.

Opportunity

Integration with AI, IoT, and 5G Technologies

The integration of GNSS chips with artificial intelligence, Internet of Things (IoT), and 5G networks represents a major growth opportunity. AI-powered GNSS processing improves accuracy by filtering noisy signals and enabling real-time positioning corrections even in challenging environments such as urban canyons.

Coupling GNSS with 5G enhances location services for smart cities, autonomous vehicles, and precision agriculture by providing enriched data streams and low latency. Additionally, the expansion of wearable devices and indoor navigation systems broadens application areas. These technological convergences offer new revenue streams and competitive advantages for market players.

Challenge

Cost and Supply Chain Disruptions

Manufacturers in the GNSS chip market face the challenge of managing high development costs while maintaining affordability, particularly for high-precision multi-frequency chips. Continuous innovation to improve chip functionality, size, and power efficiency demands significant R&D investments.

Furthermore, the market experiences disruptions due to semiconductor shortages and complex supply chains. Geopolitical tensions and reliance on foreign suppliers create risks of delays and increased production costs. Companies are adopting diversified sourcing strategies and local manufacturing to mitigate these risks and ensure steady market supply.

Competitive Analysis

The GNSS chip market is moderately consolidated with Qualcomm, MediaTek, and Broadcom leading consumer-grade volumes, while specialized players like u-blox, STMicroelectronics, and Trimble dominate precision and industrial segments. Qualcomm holds a significant share due to its advanced multi-constellation GNSS support, AI-based positioning, and integration in smartphones and automotive applications.

Increasing adoption of autonomous vehicles, IoT devices, and smart city initiatives propels market growth, supported by technological advancements including multi-frequency GNSS chips, AI-powered positioning algorithms, and integration with 5G networks.

North America leads in market share due to strong government investments and early adoption, while Asia-Pacific is the fastest-growing region driven by smartphone penetration and satellite navigation initiatives like BeiDou and NavIC. The competitive landscape is shaped by innovations focused on chip miniaturization, power efficiency, and enhanced accuracy in challenging environments.

Top Key Players in the Market

- Qualcomm Technologies, Inc.

- Broadcom Inc.

- MediaTek Inc.

- STMicroelectronics N.V.

- u-blox Holding AG

- Samsung Electronics Co., Ltd. (System LSI)

- Skyworks Solutions, Inc.

- Quectel Wireless Solutions Co., Ltd.

- Sony Semiconductor Solutions Corporation

- Intel Corporation

- Thales Group

- Trimble Inc.

- Hemisphere GNSS, Inc.

- Septentrio N.V.

- Furuno Electric Co., Ltd.

- Allystar Technology Co., Ltd.

- Hexagon AB (NovAtel Inc.)

- Orolia (Safran Electronics & Defense)

- HiSilicon (Shanghai) Technologies Co., Ltd.

- Topcon Positioning Systems, Inc.

- Other Major Players

Recent Developments

- July, 2025, Qualcomm disclosed a critical GPS vulnerability (CVE-2025-21450) affecting many Snapdragon chipsets used in GNSS. The company promptly released a security patch to address this man-in-the-middle attack risk on GNSS data, improving device reliability and safety.

- August, 2025, Broadcom launched the BCM47748, a GNSS chip designed specifically for IoT and wearable devices. This chip offers low power consumption and edge signal processing to extend battery life while maintaining high positioning accuracy in fitness bands and other wearables.

Report Scope

Report Features Description Market Value (2024) USD 10.6 Bn Forecast Revenue (2034) USD 20.5 Bn CAGR(2025-2034) 6.80% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Device Type (Smartphones, Tablets and Wearables, Personal Tracking Devices, Low-power Asset Trackers, In-vehicle Systems, Drones, Other Device Types), By Frequency Band (Single-frequency L1, Dual-frequency L1/L5, Dual-frequency L1/L2, Multi-frequency (Tri-band and above)), By End-user Industry (Automotive, Consumer Electronics, Aviation, Agriculture, Construction and Mining, Defense and Public Safety, Other End-users), By Application (Navigation, Positioning and Mapping, Timing and Synchronization, Remote Sensing, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Qualcomm Technologies, Inc., Broadcom Inc., MediaTek Inc., STMicroelectronics N.V., u-blox Holding AG, Samsung Electronics Co., Ltd. (System LSI), Skyworks Solutions, Inc., Quectel Wireless Solutions Co., Ltd., Sony Semiconductor Solutions Corporation, Intel Corporation, Thales Group, Trimble Inc., Hemisphere GNSS, Inc., Septentrio N.V., Furuno Electric Co., Ltd., Allystar Technology Co., Ltd., Hexagon AB (NovAtel Inc.), Orolia (Safran Electronics & Defense), HiSilicon (Shanghai) Technologies Co., Ltd., Topcon Positioning Systems, Inc., and other major players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Qualcomm Technologies, Inc.

- Broadcom Inc.

- MediaTek Inc.

- STMicroelectronics N.V.

- u-blox Holding AG

- Samsung Electronics Co., Ltd. (System LSI)

- Skyworks Solutions, Inc.

- Quectel Wireless Solutions Co., Ltd.

- Sony Semiconductor Solutions Corporation

- Intel Corporation

- Thales Group

- Trimble Inc.

- Hemisphere GNSS, Inc.

- Septentrio N.V.

- Furuno Electric Co., Ltd.

- Allystar Technology Co., Ltd.

- Hexagon AB (NovAtel Inc.)

- Orolia (Safran Electronics & Defense)

- HiSilicon (Shanghai) Technologies Co., Ltd.

- Topcon Positioning Systems, Inc.

- Other Major Players