Global Glyoxal Market Size, Share, And Business Benefits By Type (Industrial Grade, Pharmaceutical Grade), By Application (Cross-linking, Intermediate), By End-Use (Textile, Leather, Resin and Polymers, Cosmetics and Personal Care, Paper Packaging, Oil and Gas), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: October 2025

- Report ID: 162323

- Number of Pages: 225

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

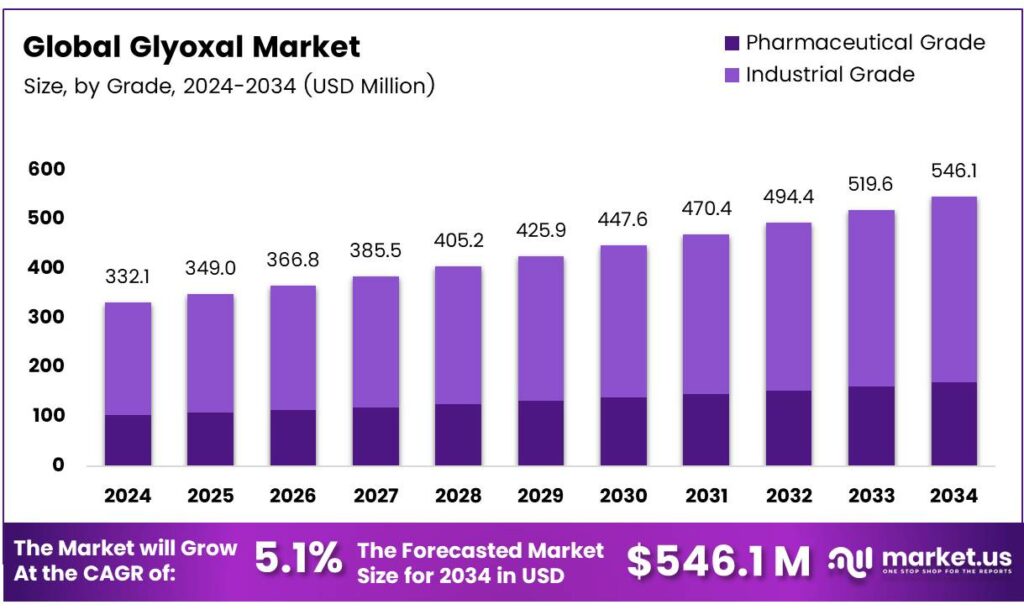

The Global Glyoxal Market size is expected to be worth around USD 546.1 Million by 2034, from USD 332.1 Million in 2024, growing at a CAGR of 5.1% during the forecast period from 2025 to 2034.

Glyoxal (OHC–CHO) is a highly abundant dialdehyde in the atmosphere, formed through anthropogenic and biogenic processes. It is the smallest dialdehyde, derived from lipid oxidation or biological by-products. With strong hydration ability, it enhances water uptake in aerosol particles. Its low vapor tension and low toxicity make it a safer alternative to formaldehyde. Glyoxal is widely used in various industrial and biological applications.

Glyoxal appears as yellow crystals that melt at 15°C, often presenting as a light yellow liquid. It has a weak sour odor, and its vapor is green, burning with a violet flame. As a dialdehyde, it consists of ethane with oxo groups on both carbons. It serves as a pesticide, agrochemical, allergen, and plant growth regulator. The Cosmetic Ingredient Review (CIR) Panel deems it safe for nail products at concentrations ≤ 1.25%.

Glyoxal oxidase shares similarities with galactose oxidase, including a 28% sequence identity. It lacks the 150-residue N-terminal domain present in galactose oxidase. Both enzymes conserve critical active site residues typical of radical copper oxidases. Spectroscopic studies confirm structural similarities in their active sites. Glyoxal oxidase catalyzes a distinct reaction despite these shared properties.

Glyoxal resins are increasingly used in denim finishing as a foundational process. They crosslink fibers, altering fabric structure and strength. Controlled strength loss allows fibers to break and be removed via dry mechanical action. Dry pumice stones abrade the surface, creating high-low contrasts without water. This enhances the visual appeal of seams and fabric panels. Its low toxicity is advantageous compared to formaldehyde. Careful control is needed in industrial applications to manage fabric strength loss.

Key Takeaways

- The Global Glyoxal Market is projected to reach USD 546.1 million by 2034 from USD 332.1 million in 2024, with a CAGR of 5.1%.

- Industrial-grade glyoxal held a 68.3% market share, driven by its use in textiles, paper, leather, and oil & gas.

- Cross-linking accounted for a 49.7% market share in 2024, widely used in the textile, paper, and leather industries for enhanced durability.

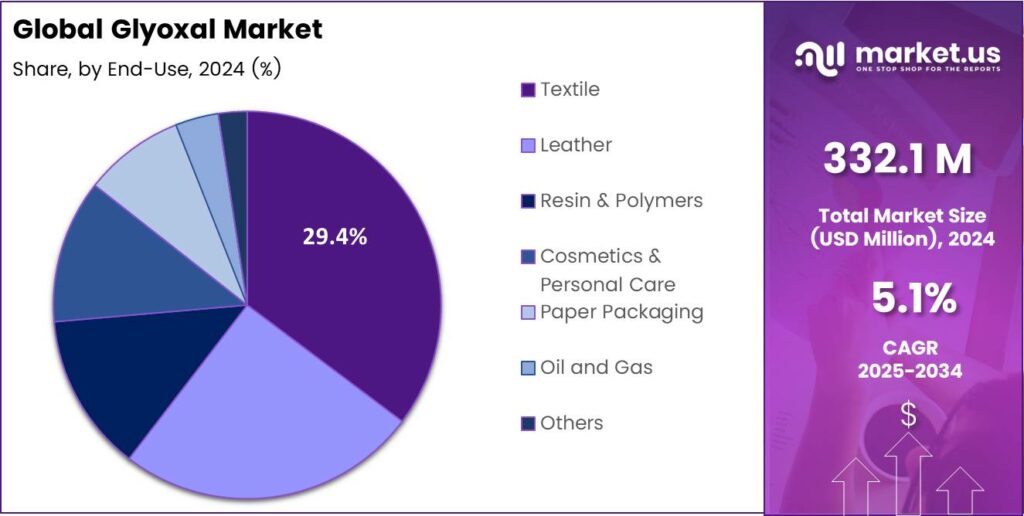

- The textile industry captured a 29.4% market share in 2024, fueled by demand for wrinkle-resistant and durable fabrics.

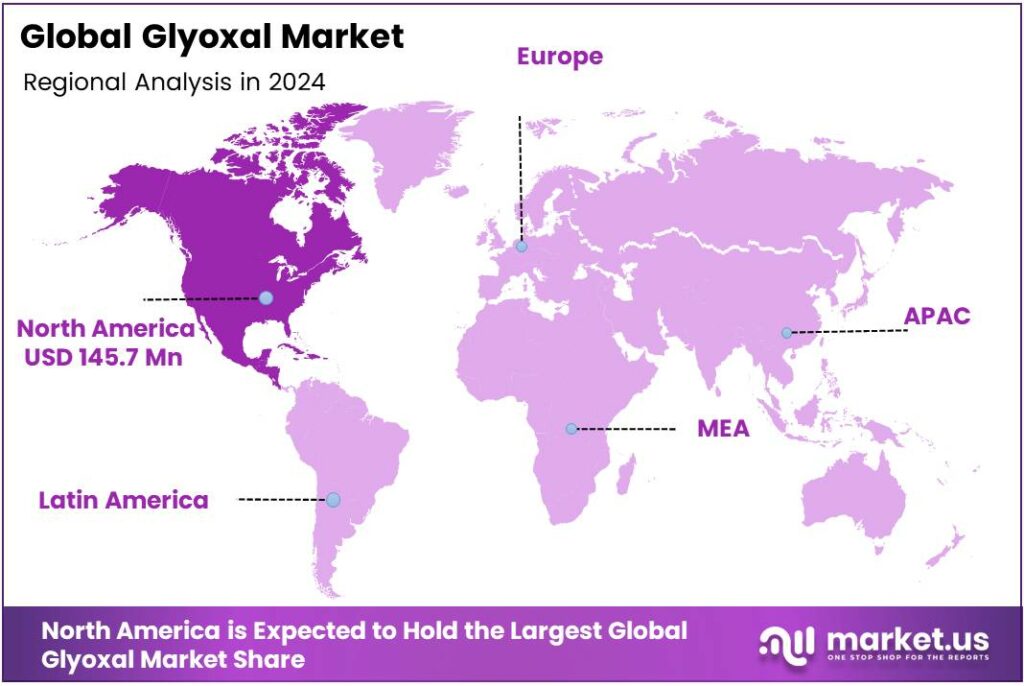

- North America held a 43.9% share in 2024, valued at USD 145.7 million, due to its strong industrial base in paper, textiles, and oilfield chemicals.

By Type

Industrial Grade Leads with 68.3% Market Share

In 2024, Industrial Grade held a dominant market position, capturing more than a 68.3% share in the global glyoxal market. Its strong presence was mainly driven by wide applications across textiles, paper, leather processing, and oil & gas industries. Industrial-grade glyoxal is primarily used as a crosslinking agent to improve product durability, water resistance, and finish quality.

The growing adoption of textile finishing and paper coatings enhanced its demand during the year. Additionally, the chemical’s stable performance under industrial processing conditions made it the preferred choice over other grades. The demand for industrial-grade glyoxal is expected to grow further, supported by the rising need for high-performance industrial chemicals.

The paper and packaging sectors continue to expand due to the global shift toward sustainable and recyclable materials, indirectly boosting glyoxal consumption. Growth in construction and oilfield operations has increased the requirement for glyoxal-based formulations used in adhesives and drilling fluids. The dominance of industrial grade reflects its versatility and consistent role in manufacturing and processing sectors worldwide.

By Application

Cross-linking Dominates with 49.7% Market Share

In 2024, Cross-linking held a dominant market position, capturing more than a 49.7% share in the global glyoxal market. Its wide use across the textile, paper, and leather industries made it the most preferred application segment. Glyoxal acts as an efficient cross-linking agent that enhances fiber strength, wrinkle resistance, and dimensional stability in textiles.

The chemical’s ability to bond with natural polymers like cellulose has made it essential in finishing treatments and coating applications. Additionally, in the paper industry, glyoxal improves wet strength and surface properties, supporting the demand from packaging and specialty paper segments. The cross-linking segment is expected to continue its strong growth.

Rising global textile exports, especially from the Asia-Pacific region, are likely to sustain glyoxal consumption in cross-linking processes. Furthermore, increasing use in polymer modification and adhesive formulations enhances its importance in modern manufacturing. The segment’s dominance reflects its essential role in providing mechanical and chemical stability to end products.

By End-Use

Textile Sector Leads with 29.4% Market Share

In 2024, Textile held a dominant market position, capturing more than a 29.4% share in the global glyoxal market. The dominance of this segment was mainly supported by the increasing demand for wrinkle-resistant, durable, and easy-care fabrics across both the apparel and home furnishing industries. Glyoxal plays a key role as a cross-linking agent in textile finishing, improving fiber strength, color fastness, and smoothness.

Its use helps in maintaining fabric structure under high stress and repeated washing, making it vital for modern textile production. Growing global textile exports, particularly from countries such as China, India, and Bangladesh, have further strengthened market consumption. The textile segment is expected to maintain steady growth, supported by the global shift toward high-performance and sustainable fabrics.

Rising investments in textile processing technologies and finishing agents are likely to boost glyoxal usage for better surface and mechanical properties. Increasing consumer preference for premium and low-maintenance clothing continues to drive industrial demand. The segment’s leadership reflects the chemical’s strong compatibility with cellulosic fibers and its proven ability to enhance product quality.

Key Market Segments

By Type

- Industrial Grade

- Pharmaceutical Grade

By Application

- Cross-linking

- Intermediate

- Others

By End-Use

- Textile

- Leather

- Resin and Polymers

- Cosmetics and Personal Care

- Paper Packaging

- Oil and Gas

- Others

Emerging Trends

Safer, bio-lean crosslinking in textiles and paper

A clear trend in glyoxal use is the shift toward safer, bio-lean crosslinking, especially in textiles and paper, driven by regulation and circularity goals. In Europe, the Chemicals Strategy for Sustainability pushes industry to substitute hazardous substances and innovate safe and sustainable by design chemistries, nudging formulators toward lower-emission glyoxal systems and water-borne finishes.

- This regulatory pull matters because textiles are a huge flow market: the WTO notes textiles and clothing accounted for 3.7% of world exports, with Asia at 70.6% of exports, so small formulation changes scale quickly through supply chains. At the same time, policymakers are targeting waste and toxicity across the textile lifecycle.

The EU’s Textiles Strategy estimates 5 million tonnes of clothing are discarded annually in the EU (about 12 kg per person), underscoring pressure for longer-lasting, low-impact finishes, an area where glyoxal crosslinking contributes to durability. Safety profiles also guide this shift. ECHA’s harmonised classification for glyoxal keeps attention on worker protection and exposure control.

Drivers

Growth in Packaging and Tissue Paper Demand

A significant driver fueling the consumption of glyoxal is the rising demand for packaging, tissue, and specialty papers, which in turn increases the need for cross-linkers and wet-strength chemicals. According to the Food and Agriculture Organization (FAO), its Yearbook of Forest Products shows that global production of pulp and paper remains substantial across many regions, even as markets mature.

The demand comes from several underlying shifts: e-commerce growth, which has increased corrugated packaging volumes; the shift toward single-use hygiene tissue in many emerging markets; and regulatory pressures for recyclable and sustainable substrates.

Government initiatives amplify this effect. Recovering and recycling targets in regions like the EU, as part of its Circular Economy Action Plan, encourage paper producers to use formulations that support reuse and recyclability. The need for durable, low-chemical-impact finishes aligns with such regulations, and glyoxal-based systems often meet those criteria when optimized.

Restraints

Regulatory and Safety Burdens Hinder Glyoxal Growth

One major restraint facing the Glyoxal market is increasing regulatory and safety scrutiny, which raises costs and slows adoption. Under the European Chemicals Agency (ECHA), glyoxal is classified as a skin irritant and a serious eye irritant under the CLP Regulation. Additionally, workplaces in the U.S. must adhere to strict exposure limits.

- The Occupational Safety and Health Administration (OSHA) stipulates an 8-hour time-weighted average (TWA) of 0.1 mg/m³ (inhalable fraction and vapor) for glyoxal. These classifications signal to manufacturers, processors, and downstream users that handling glyoxal requires heightened controls such as personal protective equipment (PPE).

Ventilation systems, monitoring of exposure levels, and tighter waste management protocols. All of this drives up the operational cost of using glyoxal compared with less-regulated alternatives. For smaller chemical formulators and textile treatment plants. On the regulatory side, glyoxal is also listed under the EU’s Cosmetic Products Regulation with a maximum threshold of 100 mg/kg in finished cosmetic products.

Opportunity

Expanding textiles and paper packaging demand

A major growth engine for glyoxal is the steady expansion of performance-demanding end uses in textiles and paper-based packaging. Textile production keeps concentrating in Asia, where finishing chemicals like glyoxal are widely used for wrinkle resistance and durability. The WTO reports Asia’s share of world textile-and-clothing exports rose to 70.6%, showing how finishing choices in this region quickly scale through global supply chains.

- Packaging and tissue papers are another strong pull. In Europe, industry data show paper and board output at 74.3 million tonnes in 2023, underlining the sheer base where wet-strength and cross-linking chemistries are applied in coatings, tissues, and specialty packaging. The EU’s updated packaging framework aims for all packaging to be recyclable and to cut virgin material use.

Consumer and regulatory pressure to replace difficult-to-recycle plastics also channels investment toward fibre-based packaging. The OECD projects global plastic waste will nearly triple, keeping policy attention on alternatives and on stronger, longer-lasting paper solutions where glyoxal helps balance strength with recyclability. Glyoxal fits this need well.

Regional Analysis

North America leads with a 43.9% share and a USD 145.7 Million market value.

In 2024, North America held a dominant position in the global glyoxal market, capturing more than a 43.9% share valued at around USD 145.7 million. The region’s strength lies in its mature industrial base—particularly in paper manufacturing, textiles, and oilfield chemicals, where glyoxal is widely used as a cross-linking and wet-strength agent.

The U.S. and Canada have seen consistent paper and packaging output growth, driven by e-commerce and sustainable packaging demand. According to the American Forest & Paper Association, total paper and packaging shipments in the U.S. reached over, supporting a steady pull for glyoxal-based additives.

North America’s growing emphasis on bio-based and low-emission chemical formulations has encouraged producers to develop cleaner glyoxal variants aligned with EPA and REACH standards. In the textile sector, the U.S. remains a significant importer and finisher of fabrics, where glyoxal is used to enhance durability and wrinkle resistance. The regional oil and gas industry also contributes to consumption.

The region is expected to maintain its leadership, supported by robust industrial infrastructure, ongoing investment in sustainable chemistry, and increasing replacement of formaldehyde-based agents. Strong regulatory frameworks promoting greener chemical use and continuous technological upgrades in chemical processing reinforce North America’s position as the key contributor to global glyoxal demand.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

WeylChem is a major force in the glyoxal market. Its strength lies in large-scale, integrated production and a robust global distribution network, serving primarily industrial clients. The company leverages advanced manufacturing technologies and stringent quality control, positioning itself as a reliable supplier for high-volume applications. Its strategic focus on chemical intermediates allows it to offer competitive pricing and consistent supply.

Haihang Industry operates as a prominent chemical supplier and distributor based in China. It excels in providing a diverse portfolio of chemicals, including glyoxal, to a vast global customer base. The company’s key strengths are its competitive pricing, flexibility in order volume, and strong export logistics. By effectively connecting Chinese manufacturing with international demand.

Otto Chemie Pvt. Ltd is a leading Indian supplier specializing in laboratory and fine chemicals, including glyoxal. Its market position is defined by serving research institutions, pharmaceutical labs, and specialty chemical manufacturers. The company distinguishes itself through high-purity product grades, reliable customer service, and a focus on the specific needs of the South Asian market. Otto Chemie’s strength lies in providing smaller.

Top Key Players in the Market

- WeylChem International GmbH

- Haihang Industry

- Otto Chemie Pvt. Ltd

- BASF SE

- Amzole India Pvt. Ltd

- Silver Fern Chemical LLC

- Eastman Chemical Company

- Dow

- Huntsman International LLC

- Formosa Plastics Corporation

Recent Developments

- In 2024, WeylChem launched a new glyoxal-based product line targeted at the personal care sector, emphasizing eco-friendly formulations for cosmetics and personal hygiene products. This initiative aligns with rising regulatory pressures for sustainable ingredients in the EU and aims to capitalize on glyoxal’s role as a biodegradable cross-linking agent.

- In 2024, Haihang Industry, a Chinese manufacturer of glyoxal and related chemicals, has seen limited public disclosures on specific developments, but it remains a prominent supplier in the Asia-Pacific region, where glyoxal demand is driven by expanding textile and oil & gas sectors.

Report Scope

Report Features Description Market Value (2024) USD 332.1 Million Forecast Revenue (2034) USD 546.1 Million CAGR (2025-2034) 5.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Industrial Grade, Pharmaceutical Grade), By Application (Cross-linking, Intermediate, Others), By End-Use (Textile, Leather, Resin and Polymers, Cosmetics and Personal Care, Paper Packaging, Oil and Gas, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape WeylChem International GmbH, Haihang Industry, Otto Chemie Pvt. Ltd, BASF SE, Amzole India Pvt. Ltd, Silver Fern Chemical LLC, Eastman Chemical Company, Dow, Huntsman International LLC, Formosa Plastics Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- WeylChem International GmbH

- Haihang Industry

- Otto Chemie Pvt. Ltd

- BASF SE

- Amzole India Pvt. Ltd

- Silver Fern Chemical LLC

- Eastman Chemical Company

- Dow

- Huntsman International LLC

- Formosa Plastics Corporation