Global Glycerol Monostearate Market By Purity (Less-than 90%, Greater-than 90%), By Form (Powder, Flake, Tablets), By Application (Emulsifier, Thickener, Preservative, Others), By End-use (Food And Beverages, Personal Care And Cosmetics, Pharmaceuticals, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 158926

- Number of Pages: 322

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

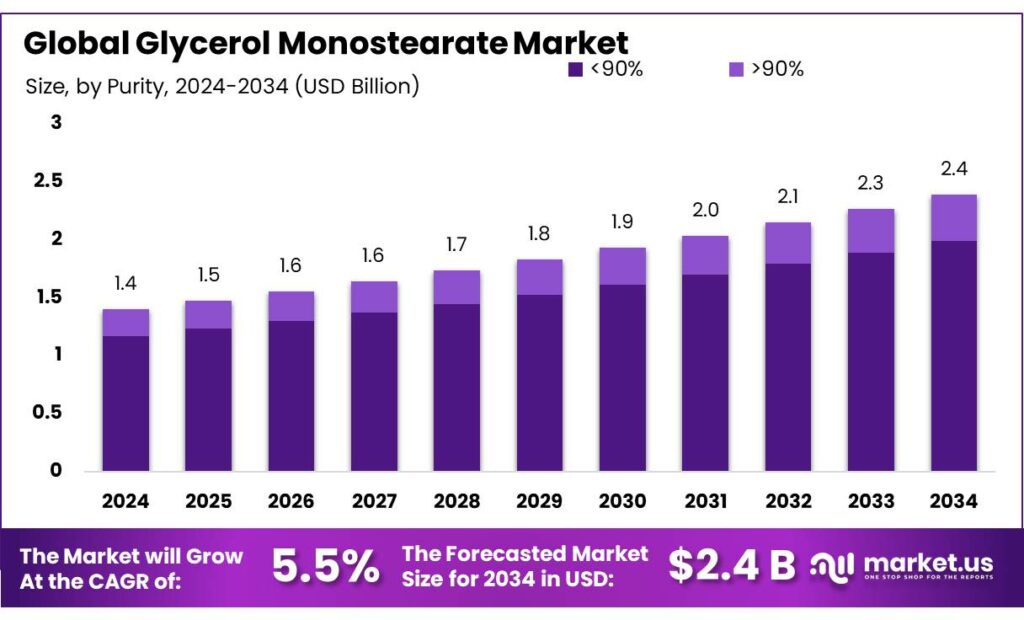

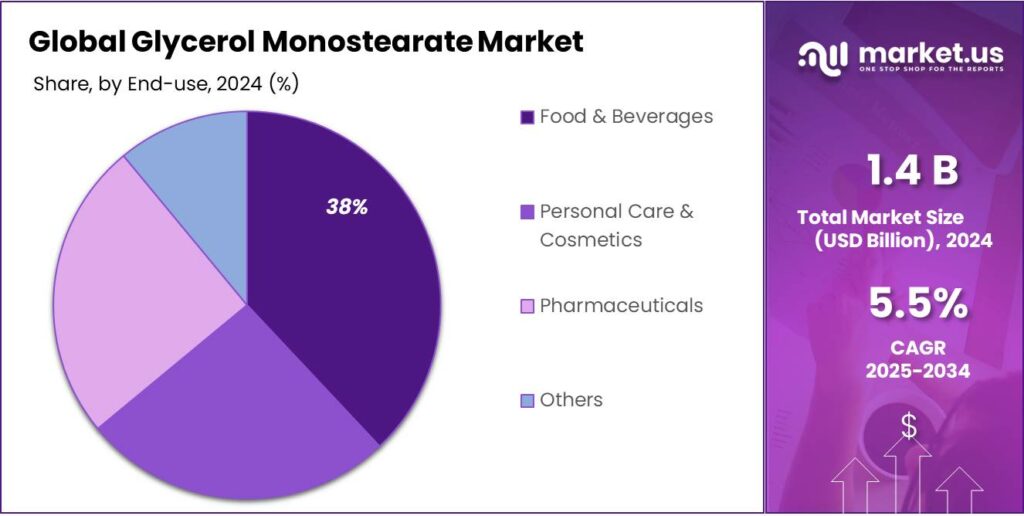

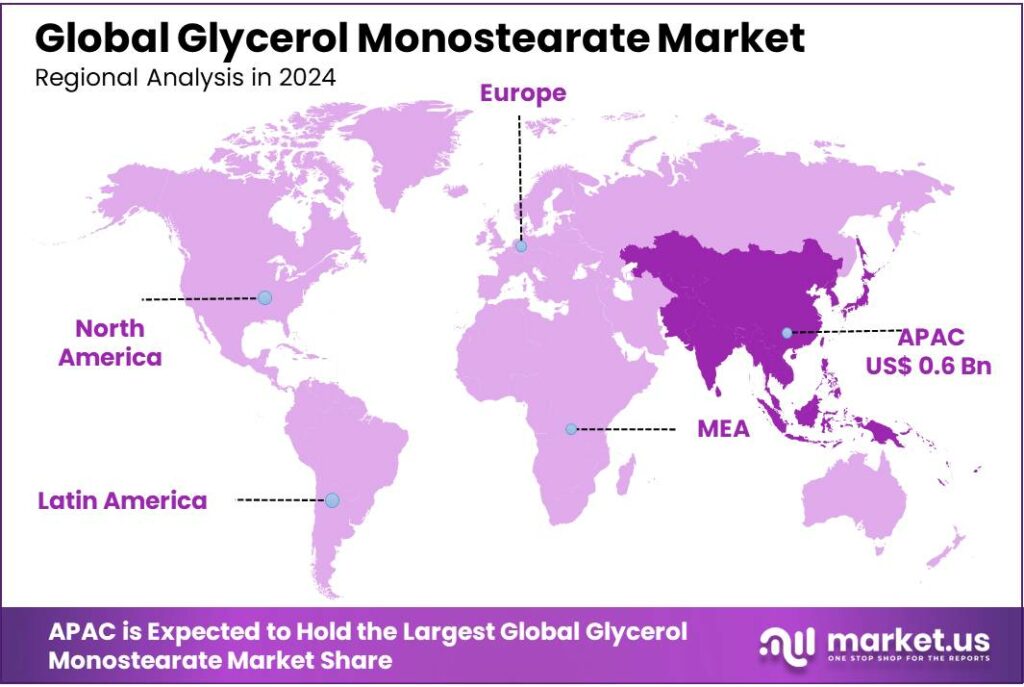

The Global Glycerol Monostearate Market size is expected to be worth around USD 2.4 Billion by 2034, from USD 1.4 Billion in 2024, growing at a CAGR of 5.5% during the forecast period from 2025 to 2034. In 2024 Asia Pacific held a dominant market position, capturing more than a 43.20% share, holding USD 0.6 Billion in revenue.

Glycerol Monostearate (GMS) is a versatile chemical compound widely used as an emulsifier, stabilizer, and surfactant in various industries, particularly in food, cosmetics, pharmaceuticals, and personal care products. It is a derivative of glycerol and stearic acid, commonly derived from renewable vegetable oils. Due to its ability to improve texture, enhance stability, and extend shelf life, GMS plays a critical role in the production of processed foods, creams, lotions, and oral hygiene products. With its broad application spectrum, the demand for GMS has witnessed significant growth, driven by expanding end-user industries.

According to the U.S. Department of Agriculture (USDA), the global food processing industry is expected to continue its upward growth, with packaged food sales in the U.S. alone estimated to reach $420 billion by 2025. This growth is directly influencing the demand for emulsifiers like GMS in food applications. Furthermore, the rising consumer demand for personal care and cosmetic products has created substantial market opportunities for GMS, as it is widely used to improve the texture and stability of lotions, creams, and makeup products.

Third, regulatory support from governments worldwide is fostering growth. For instance, the European Union (EU) has established regulations ensuring the safety and quality of food additives like GMS. The EU’s Regulation (EC) No 1333/2008 on food additives provides a clear legal framework for GMS use, encouraging its application across the food industry.

Several key factors are driving the growth of the GMS industry. First, there is increasing consumer demand for processed foods, especially in emerging markets. The demand for convenience foods, including ready-to-eat meals and packaged snacks, is expanding rapidly, driving the need for emulsifiers like GMS. According to the International Food Information Council (IFIC), over 80% of American consumers now regularly consume packaged foods, which rely heavily on additives and emulsifiers for texture and preservation.

Key Takeaways

- Glycerol Monostearate Market size is expected to be worth around USD 2.4 Billion by 2034, from USD 1.4 Billion in 2024, growing at a CAGR of 5.5%.

- Glycerol Monostearate with purity levels of less than 90% held a dominant market position, capturing more than 83.4% of the total market share.

- Powdered Glycerol Monostearate held a dominant market position, capturing more than 67.3% of the total market share.

- Emulsifier applications held a dominant market position, capturing more than 47.2% of the total market share.

- Food & Beverages sector held a dominant market position, capturing more than 38.9% of the total market share.

- Asia Pacific is the leading region in the global glycerol monostearate (GMS) market, accounting for 43.20% of the total market share, valued at approximately USD 0.6 billion.

By Purity Analysis

Glycerol Monostearate with Purity <90% Dominates with 83.4% Share in 2024

In 2024, Glycerol Monostearate with purity levels of less than 90% held a dominant market position, capturing more than 83.4% of the total market share. This segment’s significant share is driven by its widespread use in food products, pharmaceuticals, and cosmetics. The lower purity grades of GMS are cost-effective and suitable for applications where ultra-high purity is not required, making it a preferred choice in industries such as food processing and personal care. These applications leverage GMS for its emulsifying properties, stabilizing various formulations and extending shelf life.

The demand for <90% purity GMS is especially strong in emerging markets, where the cost-efficiency of products is a crucial factor. In 2025, this segment is expected to maintain its leading position, continuing to dominate due to increasing consumption of processed foods, dairy substitutes, and affordable personal care products. Additionally, the economic conditions in regions like Asia-Pacific, where consumer preference is shifting toward more affordable yet functional ingredients, further boost the demand for this segment.

By Form Analysis

Powdered Glycerol Monostearate Dominates with 67.3% Share in 2024

In 2024, Powdered Glycerol Monostearate held a dominant market position, capturing more than 67.3% of the total market share. This form of GMS is highly favored across various industries due to its easy handling, storage, and incorporation into different formulations. The powder form is particularly useful in food processing, where it is added to dry mixes for products like baked goods, snack foods, and powdered beverages. Its stability and convenience in blending make it a go-to choice for manufacturers.

The trend of using powdered GMS is expected to continue growing in 2025 as well, driven by its increasing application in the convenience food industry, where quick and efficient processing is critical. Additionally, powdered GMS is also gaining traction in the pharmaceutical and cosmetic sectors, where precise dosages and easy incorporation into formulations are key. The form’s ability to easily disperse in both oil and water-based systems positions it as a preferred choice for many manufacturers.

By Application Analysis

Emulsifier Applications Lead with 47.2% Share in 2024

In 2024, Emulsifier applications held a dominant market position, capturing more than 47.2% of the total market share. Glycerol Monostearate (GMS) is widely used as an emulsifier across various industries, particularly in food and beverages. It plays a crucial role in ensuring smooth textures and preventing separation in products like margarine, ice cream, and salad dressings. The growing demand for processed and convenience foods, which require stable emulsions, is a key driver for this segment’s dominance.

Looking ahead to 2025, the emulsifier application segment is expected to maintain its strong market share. The rise in demand for plant-based foods and dairy alternatives is also contributing to the growth, as GMS helps achieve desirable textures and consistency in non-dairy beverages and vegan products. With its multifunctional benefits and increasing need for product stability in various industries, the emulsifier segment is poised for continued growth in the coming years.

By End-use Analysis

Food & Beverages Lead with 38.9% Share in 2024

In 2024, the Food & Beverages sector held a dominant market position, capturing more than 38.9% of the total market share for Glycerol Monostearate. GMS is widely used in the food industry as an emulsifier, stabilizer, and texturizing agent. It is particularly important in the production of margarine, ice cream, bakery products, and ready-to-eat meals, where it helps improve texture, consistency, and shelf life. The growth in the processed food industry, driven by increasing consumer demand for convenience and ready-to-consume products, is a key factor behind the strong performance of this segment.

As we look towards 2025, the Food & Beverages segment is expected to maintain its dominant position. The rising preference for plant-based and dairy-free alternatives is boosting the demand for GMS, as it helps these products maintain their texture and stability. The increasing use of functional and clean-label ingredients in food products is also expected to drive growth in this segment, ensuring GMS continues to play a crucial role in food formulation.

Key Market Segments

By Purity

- <90%

- >90%

By Form

- Powder

- Flake

- Tablets

By Application

- Emulsifier

- Thickener

- Preservative

- Others

By End-use

- Food & Beverages

- Personal Care & Cosmetics

- Pharmaceuticals

- Others

Emerging Trends

Shift Towards Clean Label and Plant-Based Emulsifiers

In recent years, the food industry has witnessed a significant shift towards clean label and plant-based emulsifiers, including glycerol monostearate (GMS). Consumers are increasingly seeking transparency in food ingredients, favoring products with simple, recognizable components. This trend is driven by growing health consciousness and environmental concerns, prompting manufacturers to adapt by incorporating natural and plant-derived emulsifiers into their formulations.

A notable development in this area is the rising demand for plant-based emulsifiers. As plant-based diets gain popularity, there is a corresponding increase in the use of emulsifiers sourced from plant ingredients. For instance, sunflower lecithin, soy lecithin, and various gums have become prominent choices, catering to the needs of vegan and vegetarian consumers. These natural emulsifiers not only align with dietary preferences but also contribute to sustainability efforts, as they often have a lower environmental footprint compared to their animal-derived counterparts.

Manufacturers are responding to this demand by investing in research and development to create emulsifiers that meet clean label criteria. This includes developing products that are free from artificial additives and preservatives, thereby appealing to consumers who prioritize natural ingredients. Such innovations not only enhance product appeal but also align with regulatory trends favoring transparency and simplicity in food labeling.

Drivers

Rising Demand for Processed Foods

One of the primary drivers behind the growing use of glycerol monostearate (GMS) in the food industry is the increasing consumer preference for processed and convenience foods. As lifestyles become busier, many consumers are opting for ready-to-eat meals, snacks, and packaged products that offer convenience without compromising on taste or quality. This shift in consumer behavior has led to a surge in demand for food additives like GMS, which play a crucial role in enhancing the texture, stability, and shelf life of these products.

GMS is widely used as an emulsifier, stabilizer, and thickener in various food products such as bakery items, dairy products, margarine, ice cream, and processed meats. Its ability to prevent the separation of oil and water phases in food formulations ensures a consistent texture and improves the overall quality of the product. Additionally, GMS contributes to the prevention of staling in bread and enhances the creaminess of products like whipped cream and ice cream.

- Governments and regulatory bodies play a vital role in ensuring the safety and efficacy of food additives like GMS. In many countries, GMS is approved for use as a food additive and is assigned an E number (E471) under the International Numbering System for Food Additives. This classification indicates that GMS has been evaluated for safety and is permitted for use in food products within specified limits.

Restraints

Health Concerns and Regulatory Scrutiny

While glycerol monostearate (GMS), also known as E471, is widely used in the food industry for its emulsifying and stabilizing properties, emerging health concerns have led to increased scrutiny and regulatory caution.

Recent studies have raised potential health risks associated with the consumption of GMS. A 2016 study indicated that chronic intake of food emulsifiers like GMS might increase safety risks due to contaminants such as phthalate monoesters (PAEs). The study found that internal exposure levels of PAEs increased by 30%–49% in the presence of GMS, and exposure to PAEs led to a reduction in testosterone levels by 23.4%–42.1% in rats, with GMS exacerbating these effects

Furthermore, a 2024 French observational study identified concerning correlations between E471 consumption and cancer risk. Researchers found that higher intake of mono and diglycerides of fatty acids E471 in highly processed foods was associated with a 15% increased overall cancer risk, with specific increases of 24% in breast cancer risk and 46% in prostate cancer risk among high consumers

In response to growing health concerns, some governments and regulatory bodies are taking proactive measures. For instance, the U.S. Food and Drug Administration (FDA) has implemented regulations under 21 CFR Parts 170-186, which include provisions for the safe use of GMS in food products. These regulations require manufacturers to adhere to good manufacturing practices and ensure that the levels of GMS in food products do not exceed established safety thresholds

Opportunity

Growth Opportunities in Emerging Markets

Glycerol monostearate (GMS), a widely used emulsifier and stabilizer in the food industry, is experiencing significant growth opportunities, particularly in emerging markets. As urbanization accelerates and disposable incomes rise in regions such as Asia-Pacific, Latin America, and parts of Africa, the demand for processed and convenience foods is increasing, thereby driving the need for effective food additives like GMS.

Furthermore, the growing trend of on-the-go lifestyles, especially among urban populations in emerging markets, is contributing to the rise in consumption of ready-to-eat meals and snacks. These products often require the incorporation of GMS to maintain texture, consistency, and stability, thereby driving its demand.

Governments in these regions are also playing a pivotal role in fostering the growth of the food industry by implementing policies that encourage food processing and manufacturing. For instance, initiatives aimed at improving food safety standards and promoting the use of food additives are creating a conducive environment for the adoption of GMS in food products.

Regional Insights

Glycerol Monostearate Market in Asia Pacific

Asia Pacific is the leading region in the global glycerol monostearate (GMS) market, accounting for 43.20% of the total market share, valued at approximately USD 0.6 billion in 2024. This dominance is primarily driven by the high demand for GMS in the food and beverage, pharmaceuticals, and cosmetics industries across the region. As one of the world’s largest producers and consumers of food products, particularly in countries like China, India, Japan, and South Korea, Asia Pacific has witnessed significant growth in the use of GMS as an emulsifier, stabilizer, and surfactant in various consumer goods.

In the food and beverage sector, Asia Pacific’s rapidly expanding processed food industry is a major driver for the GMS market. The rise in demand for ready-to-eat, convenience foods, dairy products, and bakery items, especially in India and China, has created an increasing need for emulsifying agents like GMS.

- According to the Food and Agriculture Organization (FAO), Asia Pacific is home to over 60% of the world’s population, and as disposable incomes rise, the demand for processed food products continues to surge, driving the adoption of GMS.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Croda International Plc offers Cithrol™ GMS 40, a non-ionic glyceryl ester derived from stearic acid. This low HLB surfactant functions as an efficient co-emulsifier in oil-in-water and water-in-oil emulsions, providing excellent lubrication and stability in various formulations.

Evonik Industries AG provides TEGIN® 90, a glycerol monostearate used as an antistatic agent in polyethylene and polypropylene films and injection-molded parts. It offers resistivity control and enhances the processing of polyolefin-based materials.

Stepan Company produces DREWMULSE® 200K FLAKE, a glyceryl monostearate made from fully hardened stearic acid. It serves as an emulsifier in food products, as well as in suppositories and ointments, contributing to improved texture and stability.

Top Key Players Outlook

- Lonza Group AG

- Stepan Company

- Croda International Plc

- Evonik Industries AG

- BASF SE

- Wilmar International Limited

- Kao Corporation

- Cargill, Incorporated

- Godraj

- Fengchen Group Co.,Ltd

Recent Industry Developments

In 2024, BASF’s Materials segment, which encompasses high-performance plastics and their precursors, reported sales of €9.798 billion, slightly below the previous year’s figures due to currency effects and pricing pressures.

In 2024 Lonza Group AG, reported a total comprehensive income of CHF 834 million, reflecting its strong financial performance and strategic investments. Lonza’s acquisition of Synaffix B.V. in 2023, with a contingent consideration of up to EUR 60 million, underscores its commitment to expanding its capabilities in the pharmaceutical sector.

Report Scope

Report Features Description Market Value (2024) USD 1.4 Bn Forecast Revenue (2034) USD 2.4 Bn CAGR (2025-2034) 5.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Purity (Less-than 90%, Greater-than 90%), By Form (Powder, Flake, Tablets), By Application (Emulsifier, Thickener, Preservative, Others), By End-use (Food And Beverages, Personal Care And Cosmetics, Pharmaceuticals, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Lonza Group AG, Stepan Company, Croda International Plc, Evonik Industries AG, BASF SE, Wilmar International Limited, Kao Corporation, Cargill, Incorporated, Godraj, Fengchen Group Co.,Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Glycerol Monostearate MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample

Glycerol Monostearate MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Lonza Group AG

- Stepan Company

- Croda International Plc

- Evonik Industries AG

- BASF SE

- Wilmar International Limited

- Kao Corporation

- Cargill, Incorporated

- Godraj

- Fengchen Group Co.,Ltd