Global Glycerine Market Size, Share, And Business Benefit By Grade (USP Grade, Technical Grade), By Application (Personal Care, Food and Beverages, Pharmaceuticals, Polyether Polyols, Chemical Intermediate, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: October 2025

- Report ID: 161800

- Number of Pages: 358

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

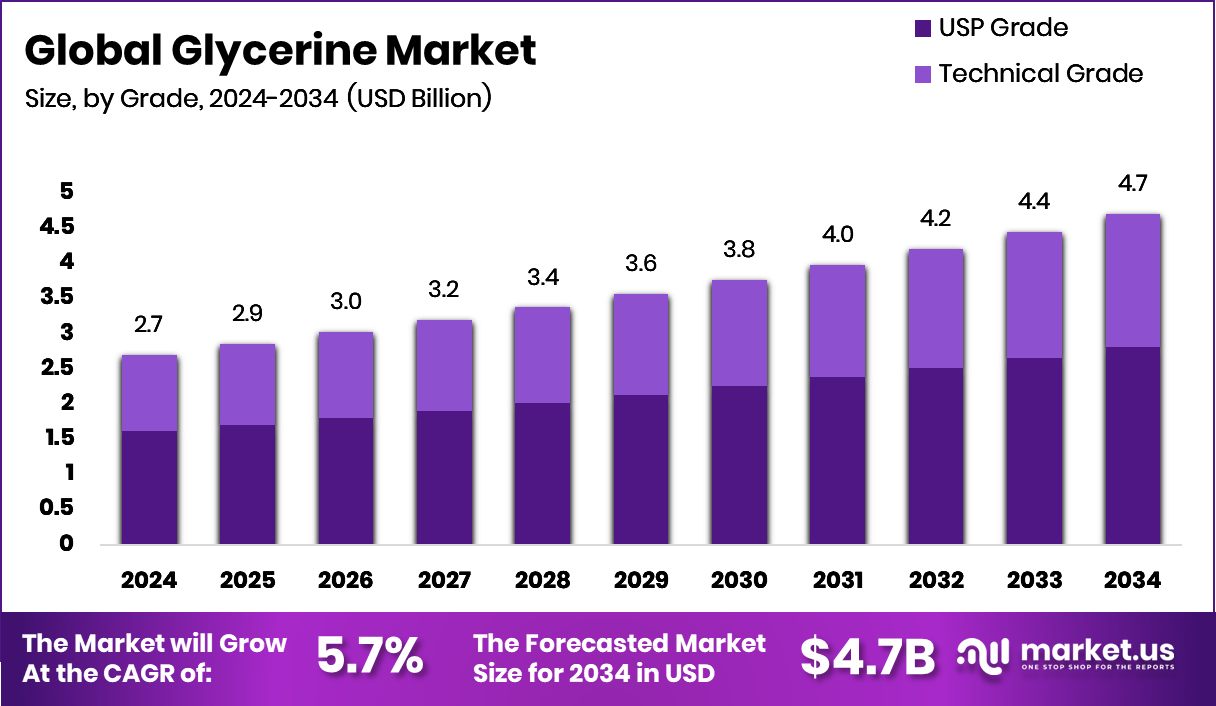

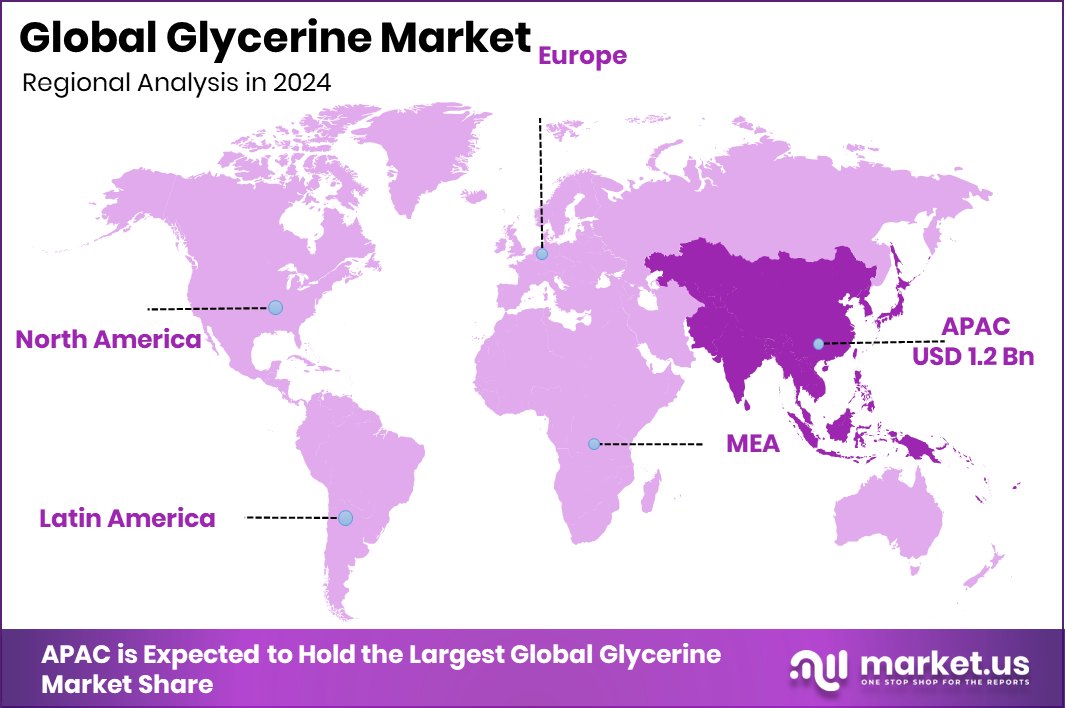

The Global Glycerine Market is expected to be worth around USD 4.7 billion by 2034, up from USD 2.7 billion in 2024, and is projected to grow at a CAGR of 5.7% from 2025 to 2034. Asia-Pacific’s expanding personal care and pharmaceutical sectors supported its 45.30% market dominance.

Glycerine (or glycerol) is a simple, colorless, viscous liquid with a sweet taste. It is a tri-hydric alcohol (three hydroxyl groups) commonly found as a byproduct of fat and oil processing. Owing to its hygroscopic nature and compatibility with many substances, it’s widely used in cosmetics, pharmaceuticals, food, and industrial formulations.

In the glycerine market, growth is fueled by rising demand in personal care and pharmaceutical sectors (because glycerine retains moisture, acts as a solvent or sweetener), and by the expansion of the biodiesel industry, which produces crude glycerine as a byproduct. The greater availability of glycerine from renewable sources also supports wider adoption.

Demand is particularly strong in skin & hair care, as glycerine helps with hydration and skin barrier function, and in medicinal formulations (creams, syrups). In industrial uses, it finds roles in chemicals, plastics, and resins, broadening the applications beyond consumer products.

Opportunities lie in innovation—derivatives of glycerine can become sustainable feedstocks for new chemicals, and improvements in purification can unlock higher-value markets. Also, coupling glycerine supply with waste streams and green processes (e.g., using waste glycerine) adds circular economy appeal.

Interestingly, AmphiStar recently secured €6 million in funding to launch a waste-based biosurfactant range. This points to a trend of integrating glycerine and related compounds into more sustainable, bio-derived products, creating further downstream applications and value.

Key Takeaways

- The Global Glycerine Market is expected to be worth around USD 4.7 billion by 2034, up from USD 2.7 billion in 2024, and is projected to grow at a CAGR of 5.7% from 2025 to 2034.

- In 2024, USP Grade Glycerine held a 59.7% share, driven by its purity in pharmaceutical formulations.

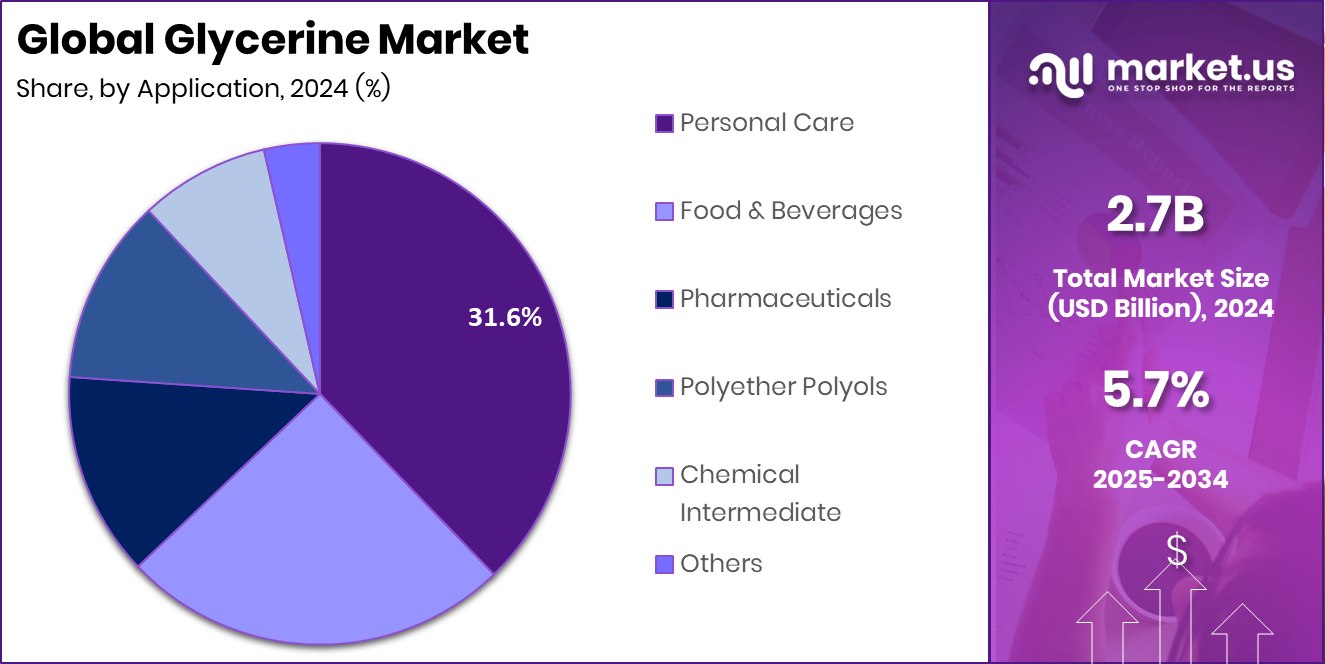

- Personal care applications captured a 31.6% share of the glycerine market, supported by rising demand for moisturizing and skincare products.

- The Asia-Pacific market reached a strong valuation of around USD 1.2 billion.

By Grade Analysis

In 2024, USP Grade dominated the Glycerine Market with a 59.7% share.

In 2024, USP Grade held a dominant market position in the By Grade segment of the Glycerine Market, capturing a 59.7% share. This dominance is mainly attributed to its high purity level and extensive use across pharmaceutical, cosmetic, and food applications. USP Grade glycerine meets stringent quality standards, making it suitable for sensitive formulations like medicines, skincare products, and food additives.

Its excellent moisture retention, smooth texture, and non-toxic nature make it a preferred choice for end-users seeking safe and reliable ingredients. The growing focus on health, hygiene, and product quality has further strengthened the demand for USP Grade glycerine, reinforcing its leading position within the market during 2024.

By Application Analysis

Personal Care applications led the Glycerine Market, capturing around 31.6% share.

In 2024, Personal Care held a dominant market position in the By Application segment of the Glycerine Market, capturing a 31.6% share. The segment’s leadership is driven by the extensive use of glycerine in skincare, haircare, and cosmetic formulations due to its excellent humectant and moisturizing properties.

It helps maintain skin hydration, softness, and smoothness, making it a vital ingredient in lotions, creams, soaps, and shampoos. The growing consumer inclination toward natural and safe ingredients in personal care products has further boosted the use of glycerine. Its compatibility with other cosmetic components and its ability to enhance product texture and shelf life have reinforced its strong presence in this segment during 2024.

Key Market Segments

By Grade

- USP Grade

- Technical Grade

By Application

- Personal Care

- Food and Beverages

- Pharmaceuticals

- Polyether Polyols

- Chemical Intermediate

- Others

Driving Factors

Rising Use in Personal Care and Cosmetics

One of the major driving factors for the glycerine market is its increasing use in personal care and cosmetic products. Glycerine is known for its ability to attract and retain moisture, making it ideal for skincare and haircare applications. It is widely used in lotions, creams, soaps, and shampoos to keep skin soft and hydrated.

The growing demand for natural and safe ingredients has encouraged manufacturers to use glycerine as a key component in their formulations. With consumers becoming more aware of product quality and skin-friendly ingredients, the use of glycerine in cosmetics continues to expand, supporting steady market growth across both developed and emerging regions.

Restraining Factors

Price Fluctuations Due to Raw Material Supply

A major restraining factor for the glycerine market is the fluctuation in raw material prices, especially those derived from natural oils and fats. Since glycerine is mainly produced as a byproduct of biodiesel and soap manufacturing, its supply depends heavily on these industries. When biodiesel production declines or feedstock prices rise, glycerine availability becomes inconsistent, leading to unstable market prices. These variations affect producers and end-users, making long-term planning difficult.

Smaller manufacturers often struggle to maintain profitability under such uncertain conditions. Additionally, any disruption in global trade or raw material sourcing can further impact the glycerine market, creating challenges for maintaining a stable and cost-effective supply chain.

Growth Opportunity

Growing Potential in the Pharmaceutical and Healthcare Sector

A key growth opportunity for the glycerine market lies in its expanding use within the pharmaceutical and healthcare industries. Glycerine is an essential ingredient in cough syrups, capsules, ointments, and creams because of its non-toxic, soothing, and moisturizing properties. It also serves as a stabilizer and solvent in many medicinal formulations.

The global rise in health awareness, along with increasing demand for over-the-counter and skincare medicines, is boosting the need for high-purity glycerine. Furthermore, its use in drug delivery systems and wound care products adds to its importance in medical applications. As healthcare spending continues to grow worldwide, glycerine’s role in this sector is expected to create strong and lasting market opportunities.

Latest Trends

Shift Toward Bio-Based and Sustainable Glycerine Production

One of the latest trends in the glycerine market is the growing shift toward bio-based and sustainable production methods. With increasing environmental awareness, manufacturers are focusing on producing glycerine from renewable and waste-based sources instead of relying solely on synthetic or petroleum-based processes. This trend supports the global move toward greener and circular manufacturing systems.

Bio-based glycerine is preferred by industries such as cosmetics, pharmaceuticals, and food due to its safer and eco-friendly profile. Moreover, advancements in purification and refining technologies are improving the quality of bio-glycerine, making it suitable for high-end applications. As sustainability becomes a core business priority, the adoption of bio-based glycerine continues to rise globally.

Regional Analysis

In 2024, the Asia-Pacific dominated the glycerine market with a 45.30% share.

In 2024, Asia-Pacific held a dominant position in the global Glycerine Market, accounting for 45.30% share and valued at around USD 1.2 billion. The region’s leadership is driven by strong demand from the personal care, pharmaceutical, and food industries, particularly in countries such as China, India, Japan, and South Korea. Rapid industrialization and the growing adoption of bio-based chemicals have strengthened regional production and consumption levels.

North America showed steady growth due to the rising use of glycerine in cosmetics and pharmaceutical formulations, supported by a well-established healthcare infrastructure. Europe continued to focus on sustainable and refined glycerine applications, especially in the food and personal care sectors.

Meanwhile, Latin America and the Middle East & Africa regions are emerging markets, benefiting from expanding manufacturing capacity and growing consumer awareness toward natural and safe ingredients.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Wilmar International Ltd leveraged its strong integration across the palm oil and oleochemical value chain to maintain leadership in refined and USP-grade glycerine production. The company’s focus on eco-friendly refining processes and renewable feedstocks further enhanced its global footprint.

Cargill Inc. continued to expand its influence in the glycerine market through advanced processing capabilities and a growing portfolio of plant-based ingredients. The company’s emphasis on sustainable sourcing and quality assurance supported its strong customer relationships across the personal care and pharmaceutical sectors.

Meanwhile, Emery Oleochemicals focused on specialty oleochemical solutions, including high-purity glycerine for industrial and healthcare applications. Its technological expertise in bio-based chemical production positioned it as a reliable supplier of sustainable glycerine solutions. Together, these companies have contributed to the global market’s shift toward renewable and high-quality products. Their combined efforts in expanding production capacities, improving purity levels, and promoting circular utilization of byproducts have reinforced the growth momentum of the glycerine industry in 2024.

Top Key Players in the Market

- Wilmar International Ltd

- Cargill Inc.

- Emery Oleochemicals

- IOI Corporation Berhad

- Kao Corporation

- Godrej Industries Limited

- Croda International Plc

- P&G Chemicals

- KLK OLEO

- CREMER OLEO GmbH & Co. KG

- Others

Recent Developments

- In June 2025, Wilmar announced its plan to acquire the remaining 50% stake in PZ Wilmar (a joint venture previously with PZ Cussons) for about US $70 million. After completion (expected in late 2025), Wilmar will hold full equity in the Nigerian palm oil and related downstream business.

- In September 2023, P&G Chemicals began offering glycerin and heavy cut alcohol raw materials with registered Cosmetic Ingredient Codes from China’s NMPA (National Medical Products Administration). This adjustment enables their customers to register finished cosmetic products more easily for the Chinese market.

Report Scope

Report Features Description Market Value (2024) USD 2.7 Billion Forecast Revenue (2034) USD 4.7 Billion CAGR (2025-2034) 5.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Grade (USP Grade, Technical Grade), By Application (Personal Care, Food and Beverages, Pharmaceuticals, Polyether Polyols, Chemical Intermediate, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Wilmar International Ltd, Cargill Inc., Emery Oleochemicals, IOI Corporation Berhad, Kao Corporation, Godrej Industries Limited, Croda International Plc, P&G Chemicals, KLK OLEO, CREMER OLEO GmbH & Co. KG, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Wilmar International Ltd

- Cargill Inc.

- Emery Oleochemicals

- IOI Corporation Berhad

- Kao Corporation

- Godrej Industries Limited

- Croda International Plc

- P&G Chemicals

- KLK OLEO

- CREMER OLEO GmbH & Co. KG

- Others