Global Glass Filled Polypropylene Compound Market Size, Share, And Business Benefit By Type (Short-Glass Fiber, Long-Glass Fiber), By Processing Method (Injection Molding, Extrusion, Blow Molding, Others), By Application (Air Vent Control, Door Panels, Bed Frames, Engine and Transmission, EV Charging Systems, Others), By End-Use (Automotive, (Passenger Vehicle, Commercial Vehicle), Electrical and Electronics, Furniture, Construction, Other), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: October 2025

- Report ID: 161096

- Number of Pages: 210

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

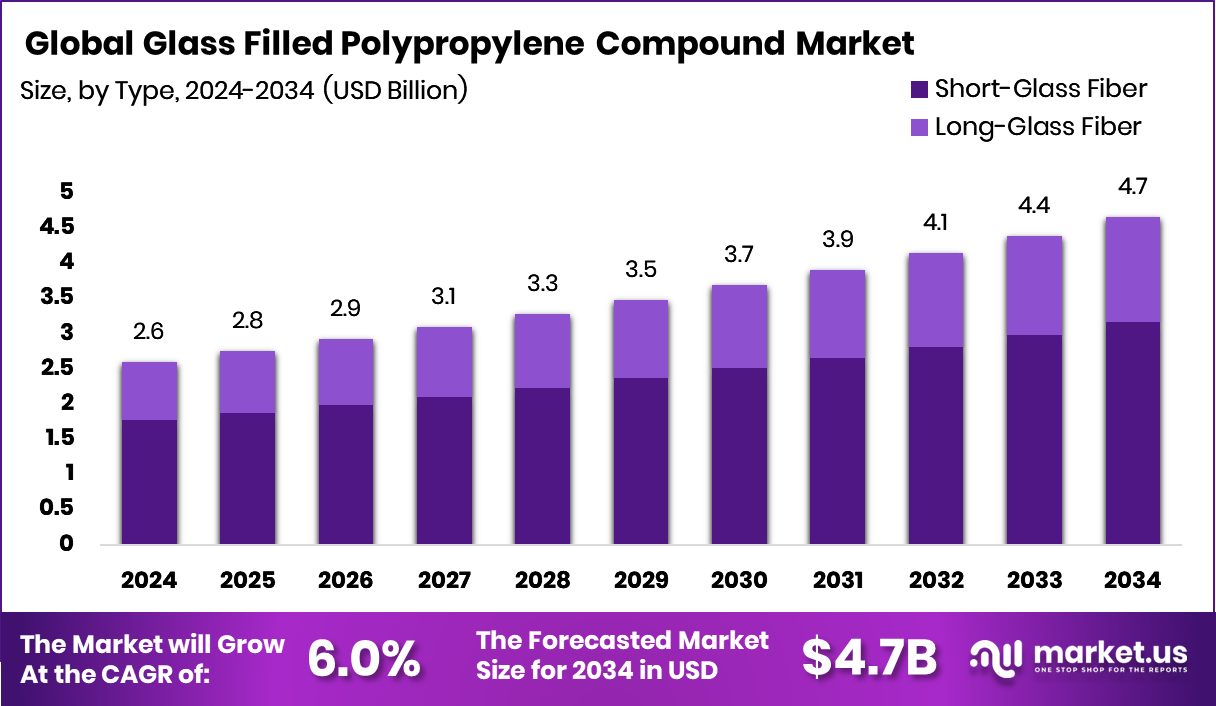

The Global Glass Filled Polypropylene Compound Market is expected to be worth around USD 4.7 billion by 2034, up from USD 2.6 billion in 2024, and is projected to grow at a CAGR of 6.0% from 2025 to 2034. Strong industrial growth and manufacturing expansion supported Asia-Pacific’s 43.90% share, leading market performance.

Glass-filled polypropylene compound is a composite material in which short glass fibers (typically 10–40 wt% %) are mixed into a polypropylene (PP) matrix. The added glass increases stiffness, dimensional stability, and heat resistance and reduces creep, while preserving many of PP’s advantages, such as low density, chemical resistance, and ease of molding. This compound is widely used in automotive parts, electrical housings, consumer goods, and industrial components where enhanced mechanical and thermal properties are required, but cost and weight constraints still matter.

The market for glass-filled polypropylene compound refers to the global trade, production capacity, demand, applications, supply chains, and growth dynamics for PP resins reinforced with glass fibers. This market covers manufacturers of raw compounding, downstream converters making components, distributors, and end-users across sectors like automotive, electronics, appliances, construction, etc. The market is shaped by resin prices, feedstock availability, regulatory pressures (e.g., lightweighting, recycling), and industrial investments in capacity.

One of the key growth drivers is the push for light weighting in the automotive and transport sectors: substituting metals with glass-filled PP compounds helps reduce vehicle weight and improve fuel efficiency (or range in electric vehicles). Another factor is the growing demand for durable, stiff polymeric parts in appliances, electronics, and structural components. Further, increasing investments in local compounding plants and expansions (for example, in emerging economies) help scale supply and reduce costs.

Demand is being fueled by widespread adoption of PP composites in sectors such as automotive (dashboards, interior panels, structural parts), electrical and electronics (connectors, housings), infrastructure (piping, fittings), and consumer appliances. As manufacturers push for higher performance in durability, dimensional stability, and heat resistance, glass-filled PP becomes a preferred material choice. Also, the trend toward more electrified and compact devices creates pressure for materials with superior strength-to-weight ratios.

There is an opportunity in developing higher-performance glass-filled PP grades (e.g., better adhesion, reduced warpage, improved UV resistance) and in recycling/ circular approaches to composite materials. Also, growth is possible in developing markets with rising industrialization and automotive penetration. In recent funding news: woven polypropylene bag maker Knack Packaging filed for a ₹ 475 crore IPO to fund capex; a PP Recycling Coalition has set a 5 % recycling growth goal; a Houston company secured USD 12 million Series A to build a decarbonization plant; and BPCL plans to invest ₹ 5,044 crore in a polypropylene plant at its Kochi refinery. These developments indicate capital flows and strategic focus in the broader PP/polymer ecosystem, which can positively impact capacity, raw material sourcing, recycling, and innovation in glass-filled PP compounds.

Key Takeaways

- The Global Glass Filled Polypropylene Compound Market is expected to be worth around USD 4.7 billion by 2034, up from USD 2.6 billion in 2024, and is projected to grow at a CAGR of 6.0% from 2025 to 2034.

- In 2024, short-glass fiber dominated the Glass Filled Polypropylene Compound Market with a 67.9% share.

- Injection molding held a 49.7% share in the Glass Filled Polypropylene Compound Market in 2024.

- Engine and transmission parts captured a 31.4% share in the Glass Filled Polypropylene Compound Market in 2024.

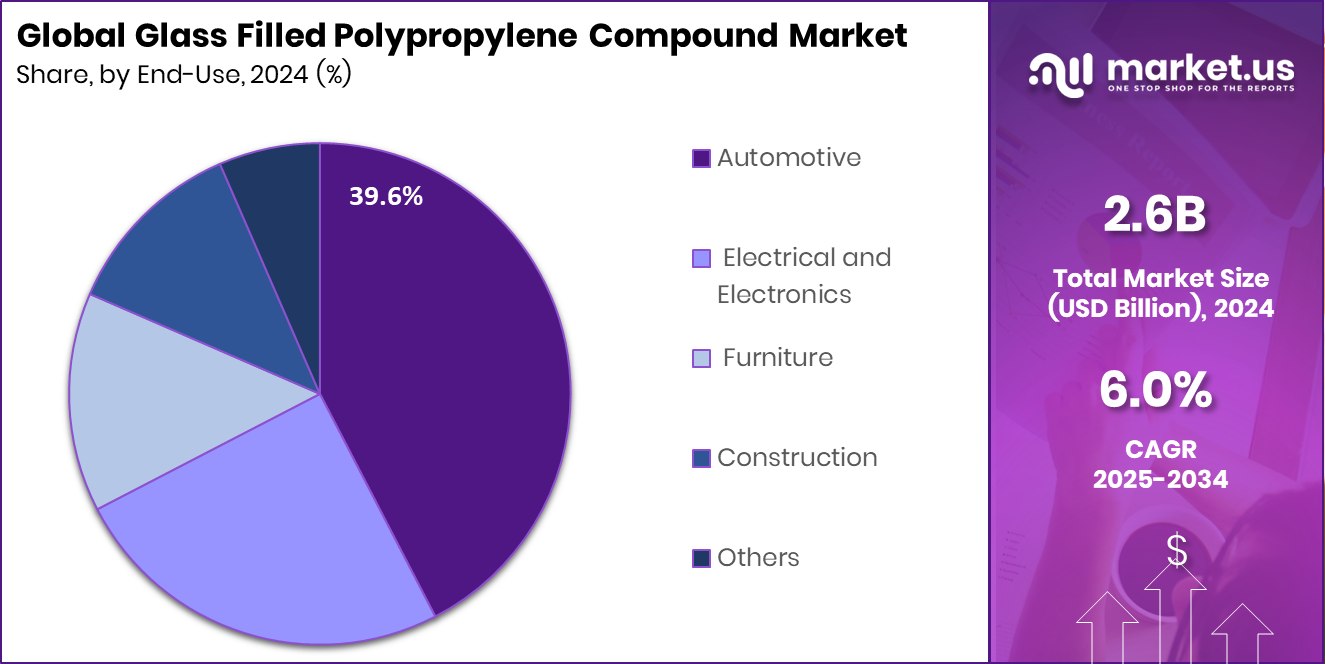

- The automotive sector led the Glass Filled Polypropylene Compound Market with a 39.6% share in 2024.

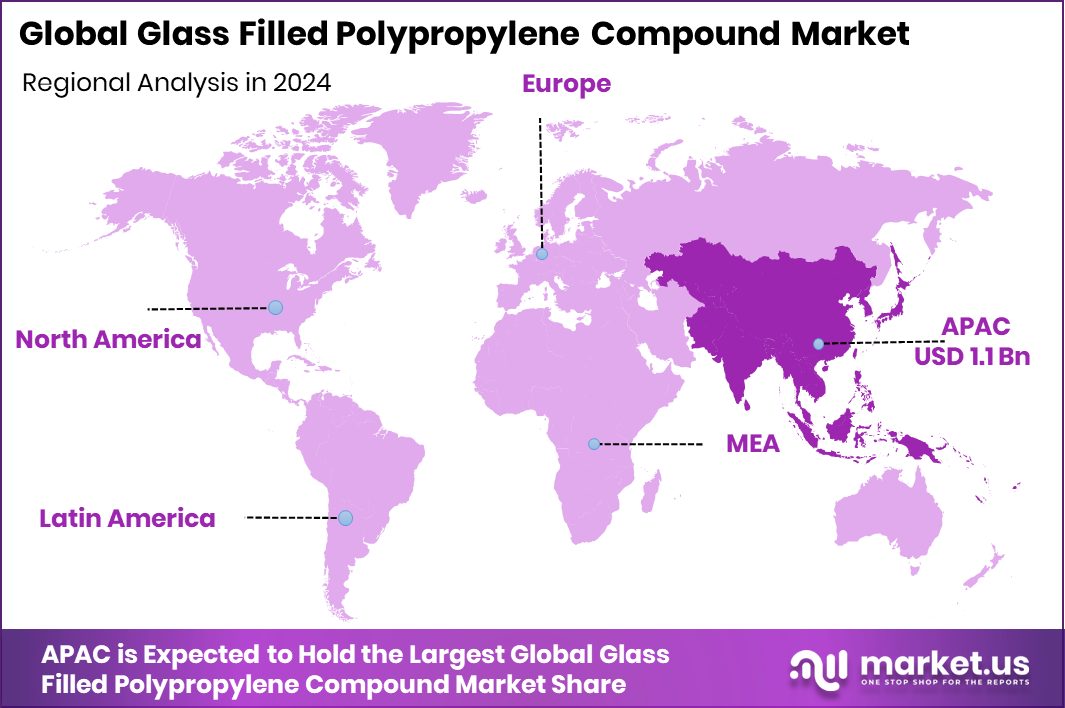

- The Asia-Pacific market value reached approximately USD 1.1 billion during the year.

By Type Analysis

In 2024, Short-Glass Fiber held a 67.9% share in the Glass-Filled Polypropylene Compound Market.

In 2024, Short-Glass Fiber held a dominant market position in the By Type segment of the Glass-Filled Polypropylene Compound Market, accounting for a 67.9% share. This dominance reflects its excellent balance between strength, stiffness, and processability, making it ideal for high-performance molded components. Short-glass fiber compounds offer superior dimensional stability, heat resistance, and mechanical reinforcement while maintaining cost-efficiency and lightweight properties.

Their widespread use in automotive parts, consumer appliances, and electrical components supports continued growth in this category. The ease of molding and compatibility with existing injection and compression molding technologies further strengthen its preference among manufacturers seeking durable, versatile, and cost-effective materials for mass production.

By Processing Method Analysis

By processing method, Injection Molding accounted for a 49.7% share in the Glass-filled polypropylene Compound Market.

In 2024, Injection Molding held a dominant market position in the By Processing Method segment of the Glass-Filled Polypropylene Compound Market, accounting for a 49.7% share. This leadership is driven by the process’s ability to produce complex, high-precision components with excellent repeatability and surface finish. Injection molding ensures even dispersion of glass fibers in the polypropylene matrix, resulting in parts with superior mechanical strength, dimensional stability, and thermal resistance.

The method’s high production efficiency and suitability for large-scale manufacturing make it a preferred choice for producing automotive components, appliance housings, and electrical fittings. Its compatibility with automated systems and low material wastage further enhances its adoption across performance-oriented industrial applications.

By Application Analysis

By application, Engine and Transmission captured a 31.4% share in the Glass Filled Polypropylene Compound Market.

In 2024, Engine and Transmission held a dominant market position in the By Application segment of the Glass-Filled Polypropylene Compound Market, accounting for a 31.4% share. This leadership stems from the compound’s ability to deliver excellent heat resistance, rigidity, and dimensional stability under demanding automotive conditions.

Glass-filled polypropylene is widely used in engine covers, air intake manifolds, and transmission components, replacing heavier metal parts to reduce overall vehicle weight and improve fuel efficiency. Its resistance to oil, grease, and thermal stress ensures long-term performance and reliability. The combination of cost-effectiveness, design flexibility, and mechanical strength continues to make it a preferred material for under-the-hood applications in modern automotive manufacturing.

By End-Use Analysis

By end-use, the Automotive sector dominated with a 39.6% share in the Glass Filled Polypropylene Compound Market.

In 2024, Automotive held a dominant market position in the By End-Use segment of the Glass-Filled Polypropylene Compound Market, capturing a 39.6% share. This dominance is driven by the increasing use of lightweight and durable materials to enhance vehicle efficiency and performance. Glass-filled polypropylene offers high stiffness, thermal stability, and chemical resistance, making it ideal for manufacturing components such as interior panels, bumpers, engine covers, and under-the-hood parts.

Its ability to replace metal components without compromising strength supports automakers’ sustainability and cost-reduction goals. The compound’s versatility in molding complex shapes and its compatibility with mass-production techniques further strengthen its role as a preferred material across automotive design and engineering applications.

Key Market Segments

By Type

- Short-Glass Fiber

- Long-Glass Fiber

By Processing Method

- Injection Molding

- Extrusion

- Blow Molding

- Others

By Application

- Air Vent Control

- Door Panels

- Bed Frames

- Engine and Transmission

- EV Charging Systems

- Others

By End-Use

- Automotive

- Passenger Vehicle

- Commercial Vehicle

- Electrical and Electronics

- Furniture

- Construction

- Other

Driving Factors

Lightweight Material Demand Driving Market Expansion

One of the main driving factors for the Glass-Filled Polypropylene Compound Market is the rising demand for lightweight yet strong materials across industrial and automotive applications. Manufacturers are replacing traditional metals with glass-filled polypropylene to reduce weight without sacrificing performance. This shift helps improve fuel efficiency, lower emissions, and enhance design flexibility.

The material’s balance of strength, heat resistance, and cost-effectiveness makes it ideal for producing durable components in vehicles, electrical devices, and appliances. Supporting this trend, plastic resin makers have launched a $25 million recycling fund for PP and PE plastics, aimed at boosting recycling infrastructure and promoting sustainable compound production, thereby reinforcing the long-term growth of the glass-filled polypropylene sector.

Restraining Factors

Recycling Challenges Limit Market Growth Potential

A major restraining factor for the Glass-Filled Polypropylene Compound Market is the difficulty in recycling these composite materials. When glass fibers are combined with polypropylene, the separation process becomes complex and costly, making it harder to reuse or reprocess the material efficiently. This limitation reduces the overall sustainability appeal of glass-filled polypropylene, especially as industries and governments move toward circular economy goals.

Additionally, improper recycling can degrade the material’s strength and quality, discouraging recyclers and manufacturers from large-scale recovery. Environmental regulations and waste management challenges further add pressure, making it essential for producers to develop innovative recycling solutions that can handle reinforced polymer composites without compromising performance or cost-effectiveness.

Growth Opportunity

Rising Use in Electric Vehicles Creates Opportunity

A key growth opportunity for the Glass-Filled Polypropylene Compound Market lies in the rapid expansion of the electric vehicle (EV) industry. As automakers focus on improving energy efficiency and reducing vehicle weight, glass-filled polypropylene offers an ideal solution due to its high strength-to-weight ratio and thermal stability. It is increasingly used in battery housings, under-the-hood parts, and structural interior components.

The compound’s ability to replace metal components without compromising durability or safety aligns well with EV design needs. Additionally, its compatibility with precision molding processes supports large-scale production of lightweight parts. As EV manufacturing grows globally, the demand for such advanced composite materials is expected to rise steadily, driving future market expansion.

Latest Trends

Shift Toward Circular and Sustainable Polypropylene Compounds

A major trend in the Glass-Filled Polypropylene Compound Market is the growing move toward circular and sustainable material solutions. Manufacturers are focusing on integrating recycled polypropylene and eco-friendly additives to reduce carbon emissions and enhance material reusability. This shift is driven by stricter environmental regulations and rising customer demand for greener products across the automotive, electronics, and consumer goods industries.

Companies are also investing in cleaner production technologies and advanced compounding methods to improve recyclability while maintaining strength and performance. Supporting this transition, Sumitomo Mitsui Banking invested $10 million in Closed Loop’s Circular Plastics Fund, encouraging large-scale recycling initiatives and circular polymer development, which are expected to accelerate sustainable growth in the polypropylene compound sector.

Regional Analysis

In 2024, Asia-Pacific dominated the market, capturing a 43.90% share.

In 2024, Asia-Pacific emerged as the dominant region in the Glass-Filled Polypropylene Compound Market, capturing a significant 43.90% share, valued at around USD 1.1 billion. This leadership is driven by rapid industrialization, strong automotive production, and expanding electrical and electronics manufacturing across major economies such as China, Japan, India, and South Korea. The region’s growing focus on lightweight materials for automotive and appliance applications continues to accelerate demand for glass-filled polypropylene compounds.

North America follows with steady growth supported by advanced manufacturing and rising demand for durable plastic components in transportation and industrial applications. Europe maintains a strong position due to stringent environmental regulations promoting recyclable and high-performance materials.

Meanwhile, the Middle East & Africa and Latin America show gradual growth, backed by expanding construction and packaging sectors. Collectively, these regions are witnessing increased investments in polymer compounding facilities and sustainable material innovations.

However, Asia-Pacific’s combination of large-scale production capacity, growing domestic consumption, and export strength firmly establishes it as the global hub for glass-filled polypropylene compound manufacturing and demand, shaping overall market direction.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Mitsui Chemicals, Inc. strengthened its position in the Glass-Filled Polypropylene Compound Market through continuous innovation in advanced polymer technologies. The company’s focus on high-performance polypropylene compounds for automotive and industrial applications supports global demand for lightweight materials. Mitsui’s development of eco-efficient compounding methods and enhanced glass fiber integration has improved the material’s rigidity and heat resistance, making it suitable for next-generation electric vehicle components and sustainable manufacturing systems.

Japan Polypropylene Corporation remains a prominent producer of polypropylene-based materials, with a focus on process optimization and quality consistency in glass-filled compounds. Its strategic collaborations with regional processors have improved production efficiency and product customization for end-use industries. The company’s focus on cost competitiveness and performance balance reinforces its reliability among automotive and appliance manufacturers.

Saudi Basic Industries Corporation (SABIC) remains a key global supplier with strong expertise in polymer innovation and large-scale production capacity. Its glass-filled polypropylene solutions cater to the growing industrial and automotive segments, driven by lightweighting and sustainability goals. SABIC’s integrated value chain and R&D advancements enhance product strength, recyclability, and thermal performance, aligning with global environmental objectives.

Top Key Players in the Market

- Mitsui Chemicals, Inc.

- Japan Polypropylene Corporation

- Saudi Basic Industries Corporation

- POLYONE Corporation

- LyondellBasell Industries Holdings B.V.

- Kingfa Sci. & Tech. Co., Limited

- Washington Penn Plastic Co., Inc.

- Borealis AG

- Sparsh Polychem Private Limited

- Ravago S.A.

Recent Developments

- In May 2025, Japan Polypropylene’s Novaorbis-MR (25% post-consumer recycled content PP) was used by KG Motors in the interior of its “mibot” mini-mobility vehicle.

- In March 2024, Mitsui Chemicals announced a collaborative project with Kao Corporation to launch recycled chemical products made using pyrolysis oil derived from plastic waste. They feed that recycled oil into a cracker at their Osaka Works to produce derivatives usable as plastics and chemicals.

Report Scope

Report Features Description Market Value (2024) USD 2.6 Billion Forecast Revenue (2034) USD 4.7 Billion CAGR (2025-2034) 6.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Short-Glass Fiber, Long-Glass Fiber), By Processing Method (Injection Molding, Extrusion, Blow Molding, Others), By Application (Air Vent Control, Door Panels, Bed Frames, Engine and Transmission, EV Charging Systems, Others), By End-Use (Automotive, (Passenger Vehicle, Commercial Vehicle), Electrical and Electronics, Furniture, Construction, Other) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Mitsui Chemicals, Inc., Japan Polypropylene Corporation, Saudi Basic Industries Corporation, POLYONE Corporation, LyondellBasell Industries Holdings B.V., Kingfa Sci. & Tech. Co., Limited, Washington Penn Plastic Co., Inc., Borealis AG, Sparsh Polychem Private Limited, Ravago S.A. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Glass Filled Polypropylene Compound MarketPublished date: October 2025add_shopping_cartBuy Now get_appDownload Sample

Glass Filled Polypropylene Compound MarketPublished date: October 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Mitsui Chemicals, Inc.

- Japan Polypropylene Corporation

- Saudi Basic Industries Corporation

- POLYONE Corporation

- LyondellBasell Industries Holdings B.V.

- Kingfa Sci. & Tech. Co., Limited

- Washington Penn Plastic Co., Inc.

- Borealis AG

- Sparsh Polychem Private Limited

- Ravago S.A.