Global Geothermal Power Generation Market Size, Share Analysis Report By Component (Generator, Heat Exchanger, Heat Pump, Separator, Turbine), By Type (Binary Cycle, Dry Steam, Flash Steam), By Power Plant Size ( Large-scale Plants, Medium-scale Plants, Small-scale Plants), By Site (Offshore, Onshore), By Deployment Type (New Deployments, Retrofit And Modernization), By Industry Verticals (Commercial, Industrial, Residential) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 168880

- Number of Pages: 387

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Component Analysis

- By Type Analysis

- By Power Plant Size Analysis

- By Site Analysis

- By Deployment Type Analysis

- By Industry Verticals Analysis

- Key Market Segments

- Emerging Trends

- Drivers

- Restraints

- Opportunity

- Regional Insights

- Key Players Analysis

- Recent Industry Developments

- Report Scope

Report Overview

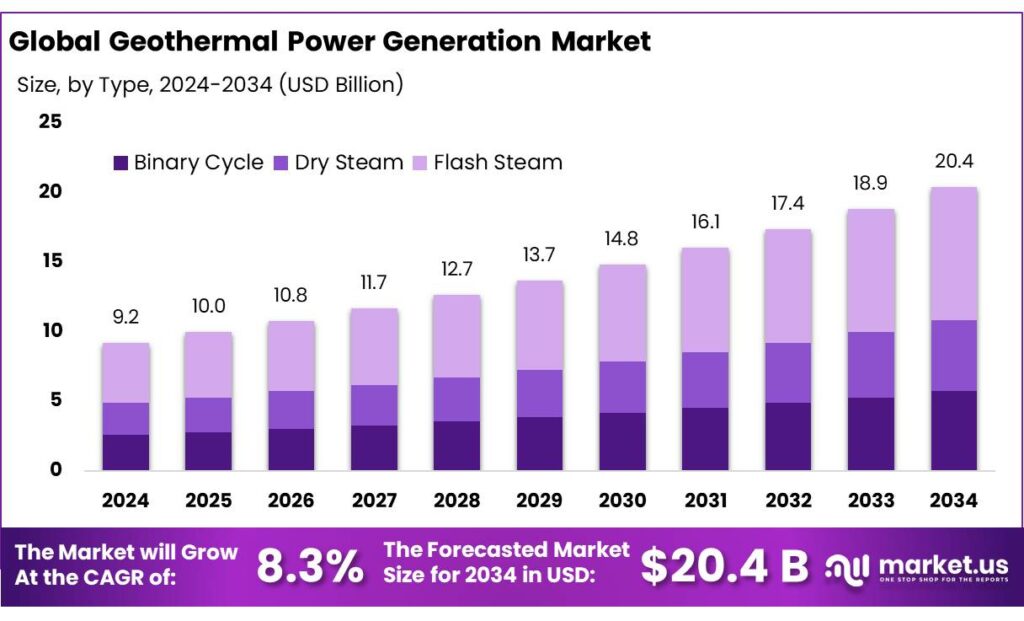

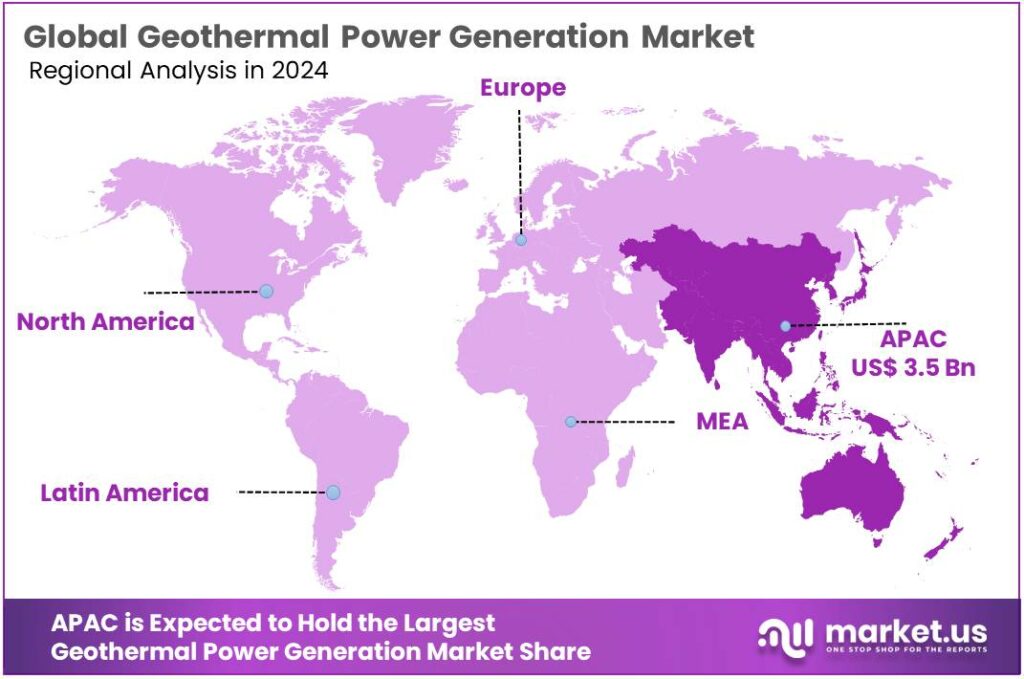

The Global Geothermal Power Generation Market size is expected to be worth around USD 20.4 Billion by 2034, from USD 9.2 Billion in 2024, growing at a CAGR of 8.3% during the forecast period from 2025 to 2034. In 2024, Asia-Pacific held a dominant market position, capturing more than a 38.6% share, holding USD 3.5 Billion revenue.

Geothermal power generation refers to producing electricity from heat stored beneath the earth’s surface, typically via dry steam, flash steam or binary-cycle plants. It offers firm, low-carbon baseload power with a very small land footprint, so it plays a strategic role alongside variable renewables like wind and solar in long-term decarbonisation plans. However, it remains a niche technology in today’s power mix, concentrated in a limited number of countries with high-quality resources.

- On the supply side, global geothermal power capacity is still modest. REN21 estimates that only about 14.8 GW of geothermal power capacity was operating worldwide in 2023, after just 0.1 GW of new additions that year. IRENA likewise reports that geothermal electricity capacity has grown at around 3.5% per year since 2000 to roughly 16 GW in 2021, yet this represents only about 0.5% of total installed renewable electricity capacity. In terms of output, the U.S. EIA notes that 24 countries generated about 92 billion kWh of geothermal electricity in 2022.

Despite its small scale, geothermal is important in several national systems. In 2022, Indonesia produced around 17 billion kWh of geothermal power, equal to roughly 5% of its total electricity, while Kenya generated about 5 billion kWh, meeting approximately 45% of its annual electricity demand from geothermal plants. Governments are pushing to expand this role: Indonesia’s power development plan targets roughly 5.2 GW of geothermal capacity by 2034, implying a near-doubling from current levels, alongside a specific goal to add 3.3 GW of new geothermal capacity by 2030.

Several structural drivers underpin the industry. Geothermal plants provide 24/7 low-emission power with very low direct CO₂ emissions, and global net-zero scenarios assume a much larger contribution from such firm clean sources. The IEA’s Net Zero pathway projects that clean energy investment overall must rise to about USD 4 trillion per year by 2030, more than triple today’s levels, with geothermal among the technologies expected to scale in suitable regions. In parallel, geothermal already accounts for less than 1% of global electricity, highlighting a large untapped technical resource.

- Cost trends are becoming more favorable. IRENA’s latest cost assessment finds that the global weighted average levelised cost of electricity (LCOE) for geothermal fell by about 16% in 2024, from roughly USD 0.072/kWh to USD 0.060/kWh, narrowing the gap with other mature renewables and remaining within a relatively stable range over the last five years.

Key Takeaways

- Geothermal Power Generation Market size is expected to be worth around USD 20.4 Billion by 2034, from USD 9.2 Billion in 2024, growing at a CAGR of 8.3%.

- Turbine held a dominant market position, capturing more than a 34.8% share.

- Flash Steam held a dominant market position, capturing more than a 47.6% share.

- Large-scale Plants held a dominant market position, capturing more than a 59.2% share.

- Onshore held a dominant market position, capturing more than a 92.4% share.

- New Deployments held a dominant market position, capturing more than a 67.3% share.

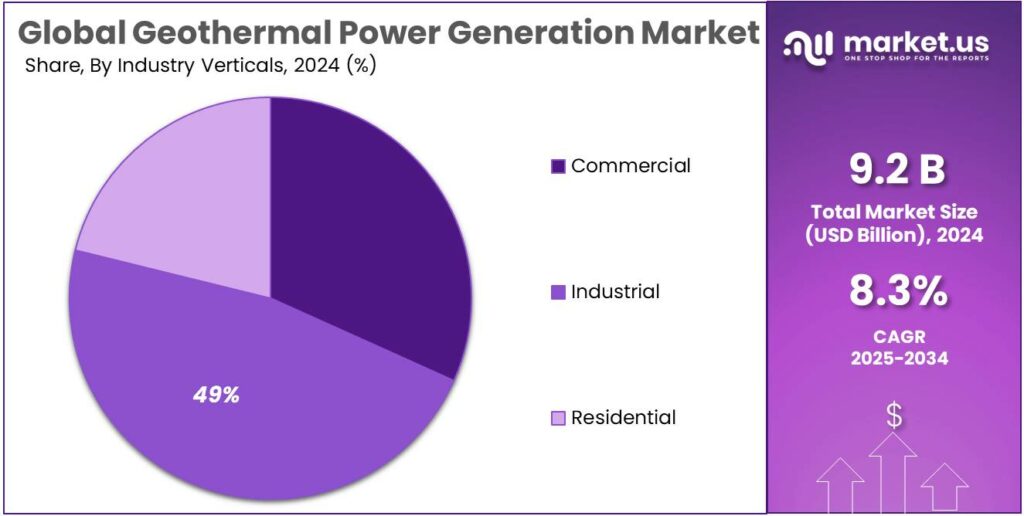

- Industrial held a dominant market position, capturing more than a 49.1% share.

- Asia-Pacific region accounted for 38.6% of the global geothermal power market, representing approximately USD 3.5 billion.

By Component Analysis

Turbine leads with 34.8% — driven by its central role in energy conversion and operational reliability.

In 2024, Turbine held a dominant market position, capturing more than a 34.8% share, as turbines continued to be recognised as the principal component converting geothermal steam and fluid enthalpy into usable electrical power. Investment and maintenance emphasis was placed on turbine efficiency and materials that withstand corrosive geothermal fluids, and incremental design improvements were implemented to raise thermal-to-electric conversion rates while lowering downtime.

Suppliers and plant operators prioritised turbomachinery upgrades and balance-of-plant integration to secure predictable output and extend operating life, which reinforced the turbine segment’s market lead. In 2025, the turbine component remained a focal point for capital expenditure and performance optimisation, with engineered upgrades and retrofits being pursued to improve reliability and reduce levelised cost of electricity — actions that are expected to sustain the turbine’s influential position within geothermal power systems.

By Type Analysis

Flash Steam leads with 47.6% — favoured for high-energy output from deep, high-temperature reservoirs.

In 2024, Flash Steam held a dominant market position, capturing more than a 47.6% share, as developers and utilities continued to select this type for reservoirs with high enthalpy and abundant steam supply. The technology’s ability to convert high-temperature, high-pressure fluid into steam for direct turbine driving delivers strong power density per well and predictable baseload output, which reduces the number of wells required for a given capacity and improves project economics.

Plant designers and operators have prioritised flash systems where reservoir conditions permit, because installation and commissioning timelines are well understood and retrofit paths exist for many legacy fields. Into 2025, flash steam is expected to retain its lead as new high-enthalpy projects and targeted retrofits proceed, supported by ongoing improvements in corrosion-resistant materials, turbine efficiency and balance-of-plant integration that together lower operational risk and enhance long-term asset value.

By Power Plant Size Analysis

Large-scale plants lead with 59.2% — driven by economies of scale and stronger grid integration.

In 2024, Large-scale Plants held a dominant market position, capturing more than a 59.2% share, as utility-grade geothermal installations continued to be preferred for bulk power delivery and long-term capacity planning. Project developers and system owners favoured large plants because they allow cost dilution across higher output, enable more attractive financing through predictable revenue streams, and simplify grid interconnection compared with many small, distributed units.

Investment was concentrated in steam-dominant and high-enthalpy fields where a single large plant can deliver baseload power with lower levelised cost of electricity; engineering effort was therefore directed toward optimized wellfield layouts, turbine selection and corrosion-resistant materials to secure long plant life and steady availability. Policy support and utility procurement practices that prioritise firm, dispatchable renewable capacity further reinforced large-plant economics in 2024. Into 2025, deployment activity was expected to remain skewed toward large-scale projects where resource quality and transmission access permit, while modular and small-scale solutions continued to be used selectively for remote or constrained sites.

By Site Analysis

Onshore dominates with 92.4% due to easier resource access and lower project risk.

In 2024, Onshore held a dominant market position, capturing more than a 92.4% share, as most geothermal power generation continued to rely on well-mapped, land-based reservoirs that offer predictable drilling conditions and lower development costs. Onshore sites were preferred because they provide stable geological profiles, faster permitting timelines, and easier integration with existing transmission networks, which collectively reduce overall project risk. Most global capacity additions in 2024 were directed toward high-potential volcanic belts and sedimentary basins where drilling depths remain manageable and well productivity supports long-term baseload output.

In 2025, the onshore segment is expected to maintain its lead as governments and utilities continue prioritising firm renewable power, and as ongoing investment focuses on resource expansion, wellfield optimization, and improved drilling efficiency. While offshore geothermal exploration is gradually advancing, its share remains minimal due to uncertainties related to seabed geology, high capital intensity, and complex environmental approvals. The overall market structure therefore remains firmly anchored in onshore development, which continues to provide the most reliable, economically feasible, and technically mature pathway for geothermal power generation.

By Deployment Type Analysis

New deployments dominate with 67.3% due to active project pipelines and policy backing.

In 2024, New Deployments held a dominant market position, capturing more than a 67.3% share, as capital was primarily allocated to greenfield geothermal projects and new wellfield development rather than to retrofits or expansions of existing plants. This preference was driven by pipeline economics, where fresh resource development offered clearer capacity additions per well and more attractive long-term returns for investors; permitting and financing frameworks in several markets were aligned to support new builds, and developers were incentivised to secure first-mover sites with high enthalpy potential.

Project delivery was focused on front-end engineering, drilling campaigns and turbine procurement, while risk-mitigation efforts such as detailed reservoir characterisation and staged drilling strategies were implemented to protect investment. In 2025, new-build activity was expected to remain the primary growth driver, with continued allocation of industry capex toward site development and early-stage project execution.

By Industry Verticals Analysis

Industrial leads with 49.1% — driven by steady on-site energy needs and process heat demand.

In 2024, Industrial held a dominant market position, capturing more than a 49.1% share, as geothermal power solutions were primarily adopted by industrial operators requiring reliable baseload power and low-cost heat for processes such as manufacturing, food processing, and mineral treatment. Large consumers favoured geothermal because it provided consistent output, reduced exposure to fuel price volatility, and delivered combined heat-and-power benefits that improved overall site economics; as a result, capital was directed toward integrated plant solutions and long-term offtake arrangements that lowered levelised energy costs and supported financing.

During 2024–2025, deployment activity for industrial applications was sustained by policy incentives for decarbonisation, increased corporate commitments to lower scope-2 emissions, and technology improvements that reduced drilling and balance-of-plant risk. Consequently, interest from heavy energy users and cluster developments was reinforced, with system designs increasingly tailored to deliver both electricity and process heat at required temperature ranges. Overall, the industrial vertical remained the principal demand centre for geothermal power, driven by operational stability, fuel-cost savings and the capacity to substitute fossil-fuel heat with low-emission geothermal energy.

Key Market Segments

By Component

- Generator

- Heat Exchanger

- Heat Pump

- Separator

- Turbine

By Type

- Binary Cycle

- Dry Steam

- Flash Steam

By Power Plant Size

- Large-scale Plants

- Medium-scale Plants

- Small-scale Plants

By Site

- Offshore

- Onshore

By Deployment Type

- New Deployments

- Retrofit & Modernization

By Industry Verticals

- Commercial

- Industrial

- Residential

Emerging Trends

Rising Capacity Additions and Broader Use

One of the most noteworthy recent trends in geothermal power generation is the uptick in global capacity additions and the growing ambition to use geothermal for both electricity and heat. According to the IEA’s “The Future of Geothermal Energy” report, by the end of 2024 global geothermal capacity reached roughly 15.1 GW, helped by a surge in new installations — at least 400 MW was added in 2024 alone.

This trend reflects a shift: geothermal is no longer just a niche source for a few active volcanic regions — it’s emerging as a cleaner, stable option for more countries. Because geothermal plants deliver steady, around-the-clock output, they offer what other renewables struggle with: firm, dispatchable power. The IEA notes that geothermal capacity utilization rates have exceeded 75% in 2023, much higher than typical wind or solar installations.

What makes this trend heartening is that improving technology and policy support are helping overcome past limitations. The IEA highlights advances in “next-generation geothermal” — for example, engineered deep systems that can tap heat from deep rock layers rather than naturally hot aquifers — opening geothermal’s reach to many areas previously considered unsuitable.

For countries thinking long-term about clean and reliable power, this renewed interest in geothermal means opportunities: not just in new build-outs, but also in integrating geothermal heat for industry and buildings, improving energy security, and reducing carbon emissions. If the momentum continues, geothermal may increasingly become part of the backbone of stable, renewable-heavy power systems worldwide — not just a small add-on.a

Drivers

Rising Need for 24/7 Clean Electricity Drives Geothermal Power Growth

One of the strongest driving factors for geothermal power generation is the global push for reliable, round-the-clock clean electricity. Unlike solar or wind, geothermal plants operate continuously, making them highly valuable for stabilizing power grids while cutting emissions. According to the U.S. Energy Information Administration (EIA), geothermal plants typically operate at capacity factors above 70%, compared with about 25% for solar and 35% for wind, highlighting their baseload advantage.

Governments are increasingly recognizing this value as electricity demand rises from electrification of transport, heating, and industry. The International Energy Agency (IEA) states that global electricity demand grew by about 2.4% in 2023 and is expected to accelerate further as electric vehicles and heat pumps expand. This growth creates pressure on grids to add clean power sources that are not dependent on weather, directly supporting geothermal deployment in suitable regions.

- National energy strategies clearly reflect this shift. The U.S. Department of Energy announced in 2023 a funding program of USD 60 million specifically for enhanced geothermal systems (EGS), aiming to unlock geothermal resources beyond traditional volcanic areas. The DOE estimates that EGS alone could support up to 90 GW of U.S. geothermal capacity by 2050, enough to power tens of millions of homes while maintaining grid reliability.

Developing economies also view geothermal as an energy-security solution. Kenya’s Energy and Petroleum Regulatory Authority reports that geothermal already supplies about 45% of the country’s electricity, reducing dependence on hydropower that is vulnerable to drought. This reliability has helped Kenya avoid power shortages during dry seasons and stabilize household electricity prices.

Restraints

High Upfront Drilling Risk and Capital Cost Limit Large-Scale Adoption

The biggest restraining factor for geothermal power generation is the high upfront cost and financial risk linked to exploration and drilling. Unlike solar or wind projects, geothermal plants must confirm underground heat resources before power generation begins. This requires deep drilling, which is expensive and uncertain. The International Renewable Energy Agency (IRENA) states that exploration and drilling alone can account for 30% to 50% of total project capital costs, even before a single unit of electricity is produced.

- According to the International Energy Agency (IEA), around 20–25% of exploratory geothermal wells globally fail to deliver commercially usable heat or flow rates. These failed wells generate no return, yet their full drilling cost must still be absorbed, making financiers cautious about funding early-stage geothermal projects.

Capital intensity further slows projects in emerging economies. The World Bank estimates that developing a single geothermal well can cost between USD 3 million and USD 10 million, depending on depth and location. For a typical commercial plant requiring multiple wells, upfront investment quickly rises above USD 100 million, which is challenging for countries with limited access to low-cost financing.

Governments are trying to reduce this barrier, but progress is gradual. The U.S. Department of Energy notes that drilling costs have declined only about 10–15% over the past decade, far slower than the rapid cost reductions seen in solar or wind technologies. This slower learning curve limits geothermal’s competitiveness in energy auctions focused mainly on lowest upfront price.

In developing regions, public risk-sharing mechanisms are essential but still limited. The World Bank’s Global Geothermal Development Plan has mobilized about USD 200 million for risk‐mitigation funding since launch, yet this covers only a fraction of global project pipelines.

Opportunity

Scaling with Next-Generation Geothermal Technologies

One of the most promising growth opportunities for geothermal power generation lies in next-generation technologies that could massively expand where geothermal plants can be built. According to the International Energy Agency (IEA), if technological improvements continue and costs are brought down, geothermal could supply as much as 800 GW of global capacity by 2050 — a huge jump from today’s roughly 15–16 GW.

That kind of capacity could meet up to 15% of global electricity demand growth between now and 2050. Such growth would transform geothermal from a niche, regional energy source into a central backbone of clean energy systems worldwide — offering stable, low-emission baseload power alongside solar and wind.

This opportunity is especially significant for regions with limited surface-level geothermal resources today. With “enhanced geothermal systems” (EGS) and advanced drilling, even areas without classic volcanic or high-enthalpy geology could tap deep heat reservoirs. The IEA notes that harnessing only a small fraction of global geothermal potential — including these unconventional resources — could transform energy access in many developing regions.

On the policy side, several governments are beginning to support geothermal through incentive programmes, funding for demonstration projects, and streamlined regulation — making the economics more favourable for new entrants. As policy and technology align, geothermal could emerge as a core component of clean-energy transformation across many parts of the world.

Regional Insights

Asia Pacific leads with 38.6% — valued at USD 3.5 billion, driven by rich geothermal resources and rapid project development.

In 2024, the Asia-Pacific region accounted for 38.6% of the global geothermal power market, representing approximately USD 3.5 billion, a position supported by large resource endowments in Indonesia, the Philippines and emerging projects in Southeast Asia and East Asia. The region’s share reflects both sizeable installed capacity and an active pipeline: global geothermal capacity approached ~15 GW by 2023, with Asia-Pacific nations contributing a material portion of recent additions and pipeline projects.

Technology improvements—better corrosion-resistant materials, modern turbines and enhanced geothermal system (EGS) pilots—have raised plant load factors and lowered levelised costs, improving the economics of both flash and binary plants across varied reservoir types in the region.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Alterra Power’s geothermal, hydro and wind assets were integrated into Innergex following a C$1.1 billion acquisition; the combined group increased renewable capacity materially and preserved Alterra’s geothermal project pipeline. Alterra’s project portfolio historically spanned multiple countries and included utility-scale geothermal sites and development rights. Post-acquisition, the legacy Alterra geothermal assets have been managed within Innergex’s broader renewable platform, supporting ongoing operations, project development and cross-technology optimisation across hydro, wind and geothermal resources.

Turboden designs and supplies Organic Rankine Cycle (ORC) systems for geothermal and waste-heat recovery, focusing on medium-to-low enthalpy resources and modular plant solutions. Its portfolio includes multi-megawatt ORC units and numerous global installations, supporting power outputs up to ~40 MWe per generator and several hundred megawatts of installed capacity. In 2024 the firm continued to expand project deliveries and partnerships to deploy binary and ORC units for geothermal and industrial sites, reinforcing its role as an ORC specialist.

Atlas Copco supplies compressors, vacuum solutions and rotating equipment used across geothermal drilling, binary turbine balance-of-plant and plant maintenance activities. The group’s wide service footprint and rotating-equipment expertise support reliability and uptime for geothermal operators. In 2024 the Group reported revenues of BSEK 177, reflecting its broad industrial scale and capacity to support large equipment and aftermarket services for energy infrastructure.

Top Key Players Outlook

- Turboden S.p.A.

- Alterra Power Corporation

- TAS Energy

- Atlas Copco Group

- Exergy

- Toshiba Corporation

- Mitsubishi Heavy Industries

- General Electric

- Ansaldo Energia

- Ormat Technologies

Recent Industry Developments

In 2024 Turboden commissioned a 28.9 MWe binary geothermal plant in the Philippines, and secured several industrial and geothermal contracts including a 19 MW ORC system for a Canadian oil-and-gas waste-heat recovery project and a 10 MW unit for a gas-turbine waste-heat application, illustrating the flexibility of its product range.

In 2024, Alterra’s former asset base remained managed as part of Innergex’s portfolio after the earlier transaction that added 485 MW of operational and under-construction renewable capacity to Innergex; the acquisition consideration was USD 1.1 billion.

In 2024 TAS won a major TES + Turbine Inlet Chilling contract for a 1,300 MW combined-cycle project, underlining its ability to serve very large power applications and integrate thermal-storage with inlet-cooling to boost net output.

Report Scope

Report Features Description Market Value (2024) USD 9.2 Bn Forecast Revenue (2034) USD 20.4 Bn CAGR (2025-2034) 8.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Component (Generator, Heat Exchanger, Heat Pump, Separator, Turbine), By Type (Binary Cycle, Dry Steam, Flash Steam), By Power Plant Size ( Large-scale Plants, Medium-scale Plants, Small-scale Plants), By Site (Offshore, Onshore), By Deployment Type (New Deployments, Retrofit And Modernization), By Industry Verticals (Commercial, Industrial, Residential) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Turboden S.p.A., Alterra Power Corporation, TAS Energy, Atlas Copco Group, Exergy, Toshiba Corporation, Mitsubishi Heavy Industries, General Electric, Ansaldo Energia, Ormat Technologies Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Geothermal Power Generation MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Geothermal Power Generation MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Turboden S.p.A.

- Alterra Power Corporation

- TAS Energy

- Atlas Copco Group

- Exergy

- Toshiba Corporation

- Mitsubishi Heavy Industries

- General Electric

- Ansaldo Energia

- Ormat Technologies