Global Gate Valve Market Size, Share, And Enhanced Productivity By Disc Type (Wedge Gate Valve, Parallel Slide Gate Valve, Knife Gate Valve, Slab Gate Valve), By Valve Material (Cast Iron, Steel (Carbon Steel, Stainless Steel, Alloy Steel, Cast Steel), Brass, Bronze, Plastic (PVC, CPVC, PP, Others)), By Size (0.25 inch to 2 inch, 3 to 12 inch, 14 to 30 inch, More Than 30 inch), By End Use (Oil and Gas, Water and Wastewater Treatment, Chemical and Petrochemical, Power Generation, Mining and Minerals, HVAC, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 167290

- Number of Pages: 199

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

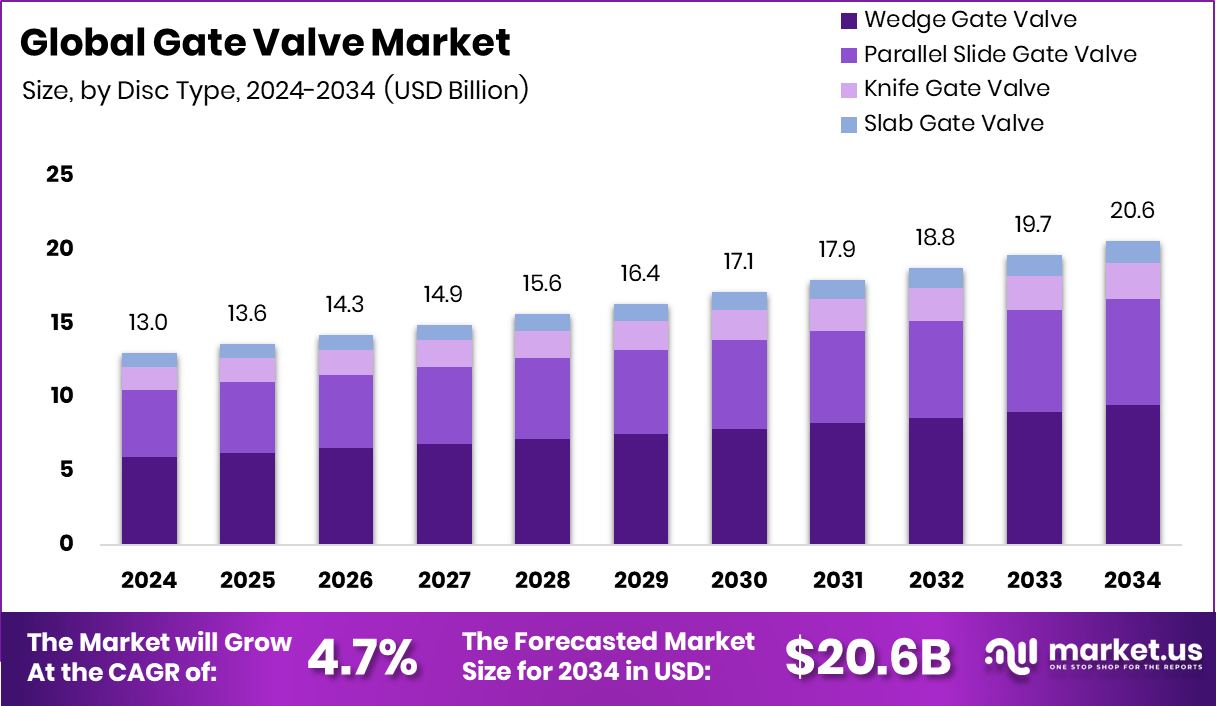

The Global Gate Valve Market is expected to be worth around USD 20.6 billion by 2034, up from USD 13.0 billion in 2024, and is projected to grow at a CAGR of 4.7% from 2025 to 2034. With 43.90% leadership, North America strengthens reliability, safety, and long-term pipeline systems performance.

A gate valve is a mechanical device used to control the flow of liquids, gases, or steam in pipelines. It operates by lifting or lowering a solid gate inside the valve body to either allow flow or completely stop it. Because it provides minimal flow restriction when fully open, the gate valve is widely used in water supply networks, oil and gas pipelines, chemical processing, and manufacturing environments where shut-off control is essential.

The gate valve market is shaped by rising industrial expansion, infrastructure upgrades, and increased investment in energy and water systems. Demand grows as more industries modernise pipelines and upgrade to durable stainless steel and alloy valves capable of handling high temperature and corrosive environments.

Growth is supported by strong financing activities and industrial capacity expansion. Recent capital movements include a £26 million export finance package for a stainless-steel manufacturer, €2.25 million in funding for AM solutions, and a ¥450 million seed investment for modular pod systems. These investments indirectly strengthen valve adoption across fabrication and engineered equipment supply chains.

Opportunities also arise from large-scale material and infrastructure projects, including India’s ₹34,000-crore PVC project backed by an SBI-led consortium financing, EUR 3 million aid for PVC manufacturing, and EUR 60 million for green steel development in Spain. Even though Spain saw a 24.4% decline in rolled steel exports, domestic industrial investments continue to stimulate future valve demand in energy, construction, and water distribution.

Key Takeaways

- The Global Gate Valve Market is expected to be worth around USD 20.6 billion by 2034, up from USD 13.0 billion in 2024, and is projected to grow at a CAGR of 4.7% from 2025 to 2034.

- In 2024, the Gate Valve Market saw Wedge Gate Valve hold 45.9%, driven by durability and sealing reliability.

- Steel remained the preferred choice in the Gate Valve Market, holding a 41.2% share for strength and corrosion resistance.

- Gate Valve Market demand was highest in the 3 to 12-inch category at 47.1%, supporting pipelines and infrastructure.

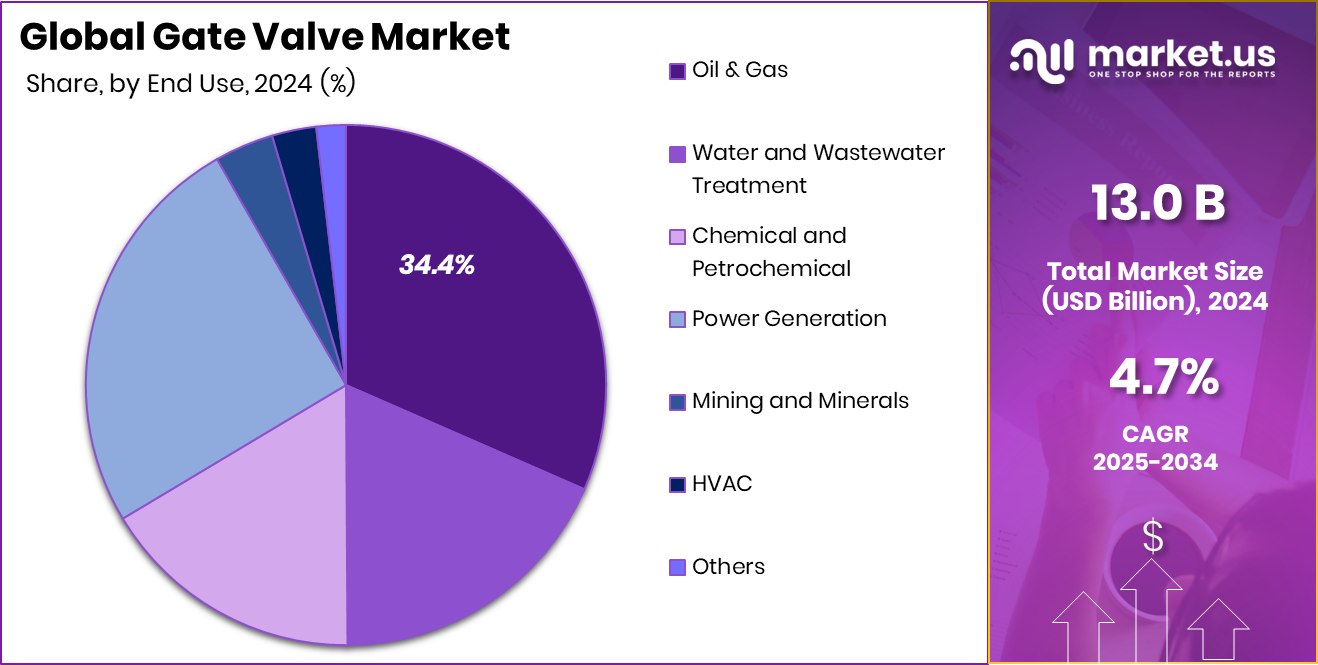

- The Oil and Gas sector led the Gate Valve Market with 34.4%, supported by expanding drilling and refining.

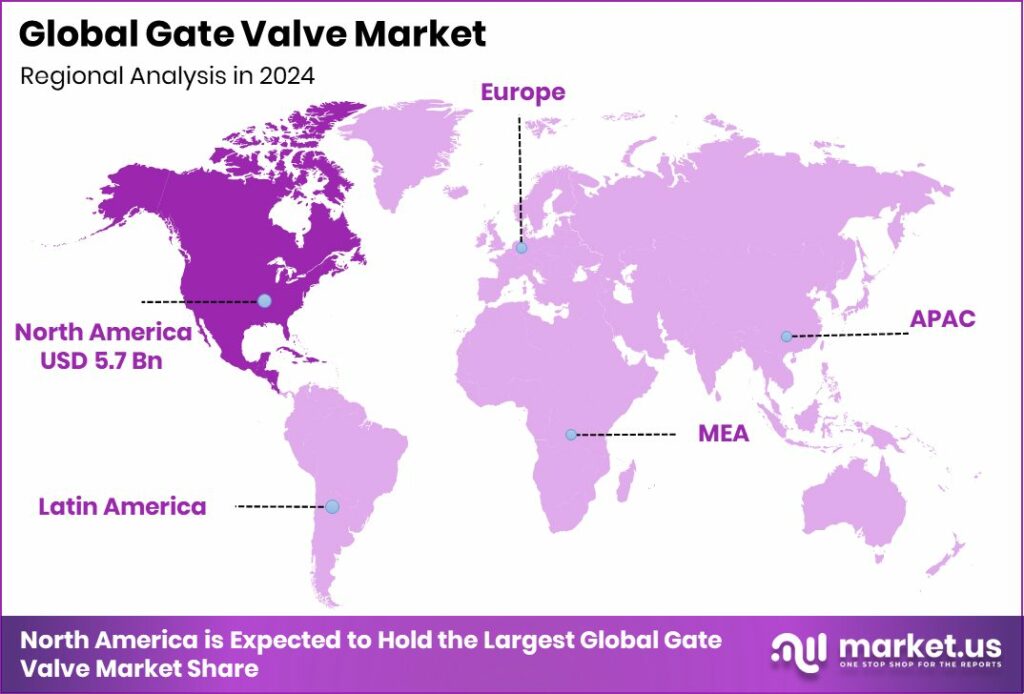

- Growing infrastructure upgrades push North America demand toward USD 5.7 Bn valuation.

By Disc Type Analysis

The Gate Valve Market sees the Wedge Gate Valve at 45.9%, driving higher installations.

In 2024, Wedge Gate Valve held a dominant market position in the By Disc Type segment of the Gate Valve Market, with a 45.9% share, driven by its reliability, tight sealing performance, and suitability for high-pressure and high-temperature applications. Industries such as water treatment, chemical processing, and oil transmission increasingly prefer wedge configurations because they maintain sealing efficiency even under fluctuating pressure and flow conditions.

The rising investments in steel manufacturing, PVC infrastructure, and modular system development further supported adoption, as these operations rely on durable shut-off systems to ensure operational safety and regulatory compliance. With ongoing industrial expansion and pipeline modernisation projects worldwide, wedge gate valves continued to be the preferred choice for long-term operational stability and reduced leakage risk.

By Valve Material Analysis

Steel dominates the Gate Valve Market with a strong 41.2% material preference.

In 2024, Steel held a dominant market position in the By Valve Material segment of the Gate Valve Market, with a 41.2% share, mainly due to its strength, temperature tolerance, and suitability for harsh industrial environments. The material became more relevant as large-scale investments continued across steel, PVC, modular manufacturing, and export-oriented industries.

Developments such as green steel funding, export finance support, and major PVC capacity expansion encouraged the use of durable valve materials capable of handling corrosive and high-pressure flow systems.

With the ongoing push toward stronger and long-lasting infrastructure, steel gate valves remained the preferred choice where reliability, long lifecycle performance, and safety are essential in both new installations and modernisation projects.

By Size Analysis

The Gate Valve Market demand is highest in the 3 to 12-inch size at 47.1%.

In 2024, 3 to 12 inches held a dominant market position in the By Size segment of the Gate Valve Market, with a 47.1% share, mainly because this size range is widely used across water supply networks, industrial pipelines, and construction systems. These valves offer a practical balance between flow capacity and installation flexibility, making them suitable for both medium-scale distribution lines and facility-level operations.

Their relevance increased as industries continued upgrading pipelines to improve efficiency and system safety. This size category also fits the operational requirements of many municipal and utility applications, where reliability, ease of maintenance, and compatibility with existing pipeline standards are essential, supporting steady demand through 2024.

By End Use Analysis

Oil and Gas remains the leading application in the Gate Valve Market with 34.4%.

In 2024, Oil and Gas held a dominant market position in the By End Use segment of the Gate Valve Market, with a 34.4% share, as gate valves remained essential for controlling high-pressure crude, gas flow, and refinery processes. The segment continued to rely on durable shut-off systems to manage transportation, storage, and processing environments where reliability and safety are critical.

Rising pipeline upgrades and maintenance activities also supported steady usage, particularly in upstream and midstream operations where flow isolation is required. With oil and gas infrastructure designed for long-term operation cycles and stringent safety standards, demand for gate valves in this sector continued to hold strong through 2024.

Key Market Segments

By Disc Type

- Wedge Gate Valve

- Parallel Slide Gate Valve

- Knife Gate Valve

- Slab Gate Valve

By Valve Material

- Cast Iron

- Steel

- Carbon Steel

- Stainless Steel

- Alloy Steel

- Cast Steel

- Brass

- Bronze

- Plastic

- PVC

- CPVC

- PP

- Others

By Size

- 0.25 inch to 2 inch

- 3 to 12 inch

- 14 to 30 inch

- More Than 30 inch

By End Use

- Oil and Gas

- Water and Wastewater Treatment

- Chemical and Petrochemical

- Power Generation

- Mining and Minerals

- HVAC

- Others

Driving Factors

Industrial Expansion Strengthens Global Valve Demand

One of the key driving factors for the Gate Valve Market is the growing expansion of industrial and energy infrastructure worldwide. As oil and gas networks, chemical plants, and large processing facilities grow, the need for reliable shut-off equipment increases. Recent capital decisions reflect this momentum.

For example, SCG Chemicals reported a loss of $87 million from its Vietnam-based Long Son Petrochemicals project in Q1, yet the project continues progressing, signalling long-term infrastructure commitments rather than short-term withdrawal.

Similarly, Indonesian state funds announced plans to invest in billionaire Prajogo Pangestu-backed Chandra Asri’s $800 million chemical plant project, highlighting continued confidence in large-scale industrial development. These expansions create consistent, ongoing demand for durable gate valves used in high-pressure operations, pipeline safety, and fluid control systems.

Restraining Factors

High Project Costs Slow Market Expansion

A major restraining factor for the Gate Valve Market is the high cost associated with large industrial projects, maintenance activities, and long installation cycles. Gate valves are mostly used in oil, gas, chemical, and large utility networks where system shutdowns, testing, and certification requirements increase overall project budgets.

Recent financial developments show how industries are under pressure. YNCC avoided default only after securing a $220 million lifeline from DL Chemical and Hanwha, reflecting how tight financial conditions can delay procurement.

At the same time, Uzbekneftegaz received €1.1 billion in funding to expand the Shurtan gas chemical complex, showing that only well-capitalised projects can move forward smoothly. When financing becomes limited or delayed, procurement of non-urgent components like gate valves is often postponed, slowing short-term demand growth.

Growth Opportunity

Cleaner Manufacturing Creates New Market Openings

A major growth opportunity for the Gate Valve Market comes from the rise of cleaner and next-generation chemical production facilities. As industries shift toward low-carbon and bio-based operations, new plants, pipelines, and processing systems require reliable flow control solutions. This transition is supported by significant funding activity. Solugen raised $357 million to produce chemicals from sugar instead of petroleum, signalling a clear shift toward sustainable manufacturing.

At the same time, Copenhagen-based Again secured €39 million to help decarbonise the petrochemical industry, reinforcing the growing movement toward cleaner technology. New infrastructure, such as biorefineries, carbon-neutral plants, and recycling-based chemical facilities, will continue driving demand for durable and corrosion-resistant gate valves designed to operate in evolving production environments.

Latest Trends

Shift Toward Advanced Automated Valve Systems

One of the latest trends in the Gate Valve Market is the move toward more automated and digitally monitored valve systems. Industries are now giving priority to valves that support remote monitoring, predictive maintenance, and improved safety control, especially in large and hazardous processing environments. This shift is strengthened as new petrochemical and energy facilities continue to expand globally.

Recently, the UK government provided £600 million in backing to Jim Ratcliffe’s petrochemical plant, a project often labelled a carbon-intensive development, yet it highlights how major industrial complexes are still being built at scale. New plants like this require modern valve technologies that can integrate with digital control systems, improving efficiency, minimising downtime, and supporting long-term operational reliability.

Regional Analysis

North America holds a 43.90% share, driving the Gate Valve Market to USD 5.7 Bn.

In 2024, North America remained the dominating region in the Gate Valve Market, holding a 43.90% share valued at USD 5.7 Bn. The region continued benefiting from strong investment in pipeline maintenance, refinery upgrades, water systems, and industrial infrastructure. Steady project spending in the United States and Canada supported demand, especially in oil and natural gas networks where gate valves remain essential for high-pressure transport and shut-off control.

Europe showed stable demand driven by ongoing industrialised operations, energy networks, and chemical plant modernisation. Although growth remained measured, the region continued replacing ageing pipeline assets, which supported valve procurement.

Asia Pacific maintained a developing outlook, supported by large-scale industrial construction and expansion in petrochemicals, refining, and water infrastructure. While no values are specified for Asia Pacific, ongoing regional manufacturing and energy development kept requirements consistent.

The Middle East & Africa reflected a steady need due to refinery operations and long-distance oil and gas transport routes. Latin America also showed selective procurement tied to new and refurbished industrial facilities.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Emerson Electric Co. remained focused on integrating smarter control and monitoring capabilities into valve systems, aligning with increasing facility automation across oil, gas, water networks, and chemical plants. Its positioning highlighted a growing shift toward valves that improve efficiency, reduce downtime, and support long-term operational reliability.

Flowserve Corporation maintained relevance through its strong engineering approach and specialisation in valves designed for high-pressure and demanding applications. Its product positioning aligned with sectors like refining, pipelines, and heavy industry, where durability and long lifecycle performance play an important role in investment decisions. The company’s technical depth helped it remain visible in projects requiring safety-critical flow control.

Meanwhile, AVK Holding A/S continued strengthening its footprint in water infrastructure, wastewater systems, and distribution networks. The company’s focus on reliability and ease of installation supported growth as municipalities and utilities modernised existing systems. Together, these players shaped the technological direction of the market, emphasising durable construction, automation compatibility, and long-term system value in 2024.

Top Key Players in the Market

- Emerson Electric Co.

- Flowserve Corporation

- AVK Holding A/S

- Velan Inc.

- DeZURIK Inc.

- Zhejiang Zhongcheng Valve Co. Ltd.

- Crane Co. Ltd

- Tecofi

- Weir Group PLC

- Bray International

Recent Developments

- In January 2025, Emerson announced it would acquire the remaining outstanding shares of AspenTech for US $7.2 billion, making AspenTech a wholly-owned subsidiary. Though the acquisition is software-/automation-centric, this shows Emerson’s strategy to offer more integrated valve + automation solutions.

- In August 2024, Flowserve signed a definitive agreement to acquire MOGAS Industries, a Houston-based manufacturer of “mission-critical severe service valves and associated aftermarket services”, for approximately US $290 million with a potential earn-out of $15 million.

Report Scope

Report Features Description Market Value (2024) USD 13.0 Billion Forecast Revenue (2034) USD 20.6 Billion CAGR (2025-2034) 4.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Disc Type (Wedge Gate Valve, Parallel Slide Gate Valve, Knife Gate Valve, Slab Gate Valve), By Valve Material (Cast Iron, Steel (Carbon Steel, Stainless Steel, Alloy Steel, Cast Steel), Brass, Bronze, Plastic (PVC, CPVC, PP, Others)), By Size (0.25 inch to 2 inch, 3 to 12 inch, 14 to 30 inch, More Than 30 inch), By End Use (Oil and Gas, Water and Wastewater Treatment, Chemical and Petrochemical, Power Generation, Mining and Minerals, HVAC, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Emerson Electric Co., Flowserve Corporation, AVK Holding A/S, Velan Inc., DeZURIK Inc., Zhejiang Zhongcheng Valve Co. Ltd., Crane Co. Ltd, Tecofi, Weir Group PLC, Bray International Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Emerson Electric Co.

- Flowserve Corporation

- AVK Holding A/S

- Velan Inc.

- DeZURIK Inc.

- Zhejiang Zhongcheng Valve Co. Ltd.

- Crane Co. Ltd

- Tecofi

- Weir Group PLC

- Bray International