Global Fruit Fillings Market Size, Share, And Business Benefits By Filling Type (Fruit Fillings without Pieces, (Ambient Fillings, Frozen Fillings) Fruit Fillings with Pieces, Candied or Semi-candied Fruit Fillings, Others), By Fruit Type (Berries, Citrus Fruits, Tropical Fruits, Others), By Application (Bakery, Confectionery, Dairy, Ice Cream, Beverages, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153214

- Number of Pages: 205

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

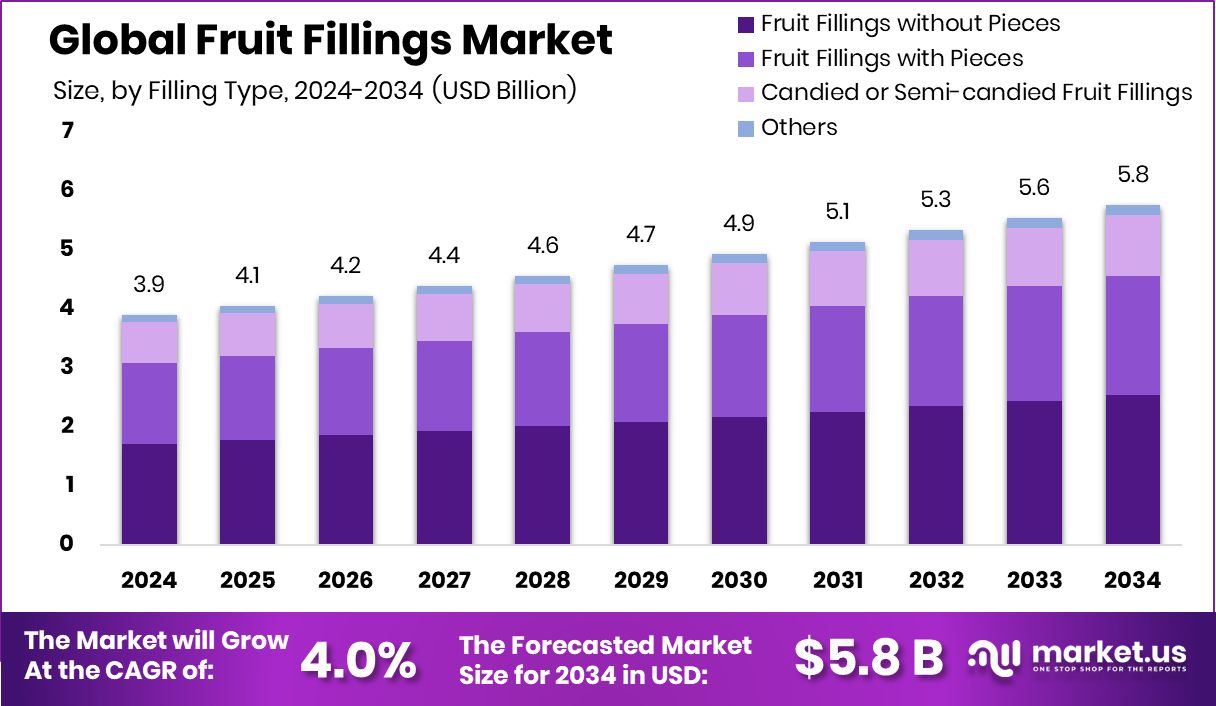

Global Fruit Fillings Market is expected to be worth around USD 5.8 billion by 2034, up from USD 3.9 billion in 2024, and grow at a CAGR of 4.0% from 2025 to 2034. Strong demand for bakery products drove Fruit Fillings’ growth across North America by 39.50% in 2024.

Fruit fillings are sweet or semi-sweet preparations made from fresh or processed fruits, combined with sugar, pectin, and sometimes starch or other stabilizers. They are commonly used in bakery products, confectionery, dairy items, and desserts such as pies, cakes, pastries, yogurts, and donuts. The texture can range from smooth purees to chunky pieces, depending on the application. Tesco commits £4 million to supply fruits and vegetables to 400 schools.

The fruit fillings market refers to the production, distribution, and consumption of processed fruit-based fillings across various food and beverage sectors. It includes both shelf-stable and refrigerated variants tailored for industrial, commercial, and retail uses. The market serves bakeries, foodservice, and ready-to-eat product manufacturers looking for convenient and flavorful fruit additions in their offerings.

One of the key growth factors driving the market is the rising demand for premium and clean-label bakery and dessert products. Consumers are increasingly drawn to natural ingredients, prompting manufacturers to use high fruit content and minimal additives in fillings. This trend is particularly strong in urban areas where food transparency and health awareness are gaining momentum. Oishii secures an additional $16 million to expand its premium strawberries globally.

The growing demand for convenience foods has further fueled the use of ready-to-use fruit fillings. With the expansion of modern retail formats and quick-service food chains, the need for time-saving ingredients that offer consistent taste and texture has increased. This has created a strong demand from industrial bakers and food processors.

Key Takeaways

- Global Fruit Fillings Market is expected to be worth around USD 5.8 billion by 2034, up from USD 3.9 billion in 2024, and grow at a CAGR of 4.0% from 2025 to 2034.

- Fruit Fillings Market is led by “without pieces” type, accounting for 44.2% due to smooth texture preference.

- Berries dominate the Fruit Fillings Market by fruit type, capturing a 48.4% share owing to their versatility.

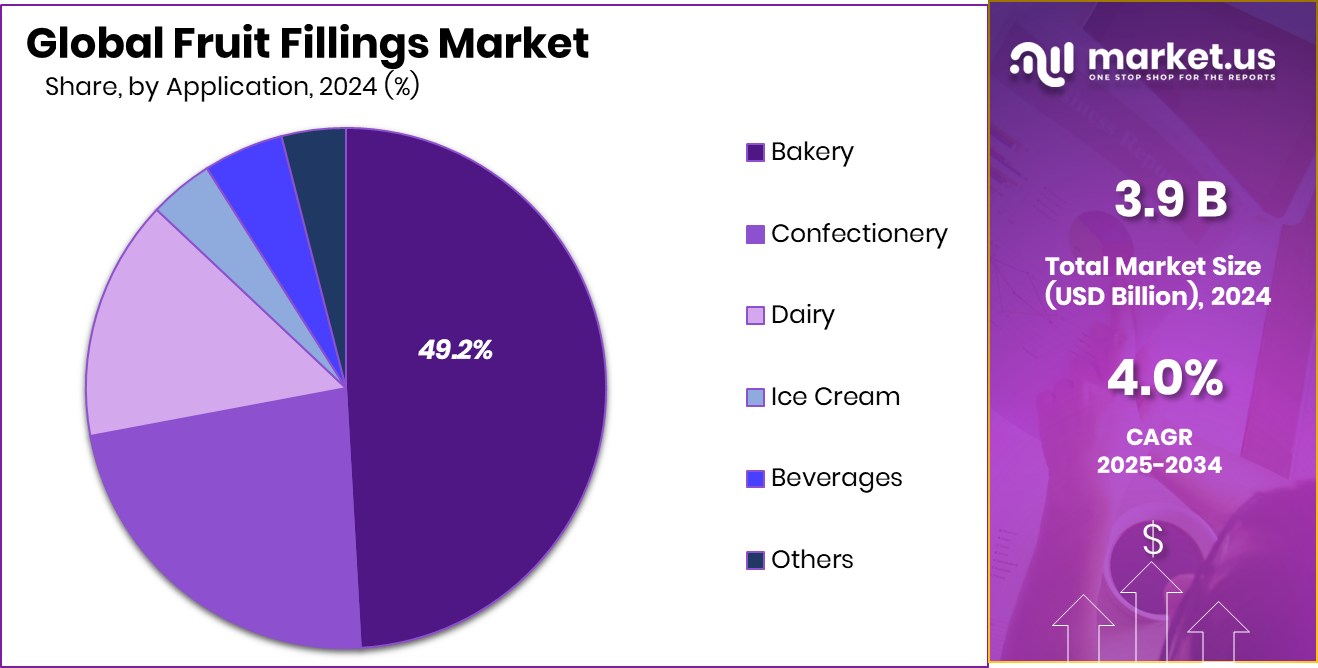

- Bakery sector drives the Fruit Fillings Market, holding 49.2% share due to widespread use in pastries.

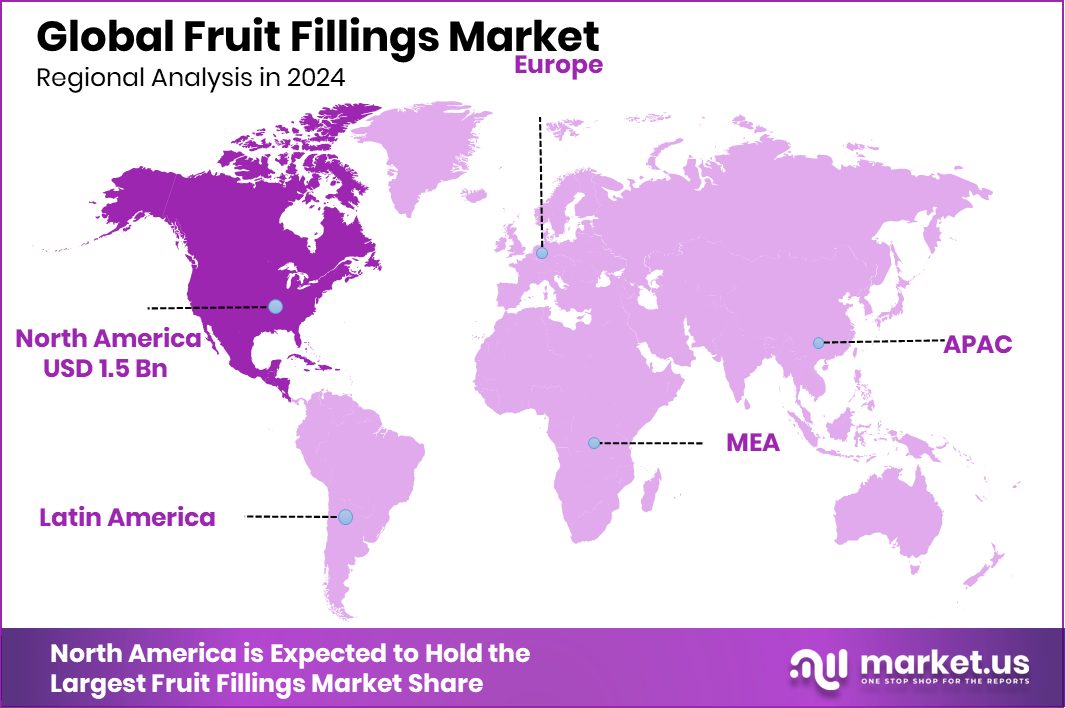

- The market in North America was valued at approximately USD 1.5 billion.

By Filling Type Analysis

Fruit fillings without pieces dominate at 44.2%.

In 2024, Fruit Fillings without Pieces held a dominant market position in the By Filling Type segment of the Fruit Fillings Market, with a 44.2% share. This segment’s strong performance can be attributed to its versatility and wide acceptance across various food applications, especially in products where a smooth and uniform texture is preferred.

These fillings are extensively used in baked goods, dairy desserts, and pastries where consistency, ease of application, and aesthetic finish are key requirements. Their ability to blend seamlessly into products without altering mouthfeel or structure has made them particularly popular among commercial bakers and food manufacturers.

The dominance of this segment also reflects changing consumer preferences toward refined textures and convenient food formats. With growing demand for visually appealing and easy-to-consume food products, fillings without fruit pieces are favored for offering a clean and consistent fruit flavor without the variation that comes from chunky inclusions.

By Fruit Type Analysis

Berries lead the segment with 48.4% market share.

In 2024, Berries held a dominant market position in the By Fruit Type segment of the Fruit Fillings Market, with a 48.4% share. This leading position is primarily due to the widespread popularity of berries in both traditional and modern culinary applications.

Berries such as strawberries, blueberries, raspberries, and blackberries are highly favored for their vibrant color, rich taste, and perceived health benefits, making them a top choice for fruit filling formulations. Their natural sweetness and tartness create a well-balanced flavor profile that complements a wide range of products, including bakery items, dairy desserts, and breakfast foods.

The high share of 48.4% also reflects strong consumer demand for berry-based products, driven by their association with antioxidant properties and a wholesome image. Manufacturers continue to utilize berries in their fillings due to their ability to enhance both the visual appeal and nutritional value of finished goods.

Furthermore, berries are seen as premium ingredients, often associated with indulgence and freshness, which adds value in high-end product offerings. The dominance of the berry segment highlights its central role in driving innovation and flavor trends across the fruit fillings market, supporting its strong position in 2024 and reinforcing its relevance in both retail and foodservice channels.

By Application Analysis

Bakery sector holds the highest share at 49.2%.

In 2024, Bakery held a dominant market position in the By Application segment of the Fruit Fillings Market, with a 49.2% share. This substantial lead is driven by the widespread use of fruit fillings in a variety of bakery products, including pies, cakes, tarts, turnovers, and pastries.

The bakery industry relies heavily on fruit fillings to add flavor, texture, and visual appeal to its offerings, making them an integral component of product formulation. The appeal of fruit-filled baked goods lies in their ability to combine indulgence with a perceived touch of natural goodness, a factor that continues to attract consumers across age groups.

The 49.2% share also reflects the bakery sector’s consistent demand for versatile and ready-to-use ingredients that streamline production without compromising on quality. Fruit fillings used in this category are often selected for their stability during baking, consistent taste, and smooth texture, allowing manufacturers to maintain uniformity across batches.

The growth in artisanal and premium bakery trends has further fueled the preference for fruit-based ingredients that offer authenticity and freshness. This strong performance underscores the vital role of the bakery segment in shaping demand dynamics within the fruit fillings market and sustaining its leadership position through widespread commercial adoption.

Key Market Segments

By Filling Type

- Fruit Fillings without Pieces

- Ambient Fillings

- Frozen Fillings

- Fruit Fillings with Pieces

- Candied or Semi-candied Fruit Fillings

- Others

By Fruit Type

- Berries

- Citrus Fruits

- Tropical Fruits

- Others

By Application

- Bakery

- Confectionery

- Dairy

- Ice Cream

- Beverages

- Others

Driving Factors

Rising Demand for Clean-Label and Natural Ingredients

One of the main driving factors for the fruit fillings market is the growing demand for clean-label and natural ingredients. Consumers are becoming more health-conscious and prefer food products that are made with real fruit, without artificial flavors, colors, or preservatives. This trend is especially strong among urban populations and younger demographics who actively read labels and choose products they believe are healthier and more natural.

As a result, food manufacturers are reformulating their fillings to include higher fruit content and fewer synthetic additives. This shift not only meets consumer expectations but also helps brands position their products as premium and trustworthy. The push toward transparency and wholesome ingredients continues to drive steady market growth.

Restraining Factors

Limited Shelf Life of Natural Fruit Fillings

A key restraining factor in the fruit fillings market is the limited shelf life of products made with natural ingredients. While consumers are asking for clean-label and preservative-free options, removing artificial preservatives often shortens the product’s stability over time. Natural fruit fillings are more prone to spoilage, discoloration, and flavor changes, especially when not stored under proper conditions.

This becomes a major challenge for manufacturers and distributors, particularly in regions with limited cold chain infrastructure. It can also lead to increased food waste and higher production costs due to shorter inventory cycles. As demand for fresh and natural products grows, ensuring safety and extending shelf life without compromising on quality remains a complex issue for the industry.

Growth Opportunity

Expansion into Exotic and Functional Fruit Fillings

An important growth opportunity in the fruit fillings market lies in expanding into exotic and functional fruit varieties. Consumers are increasingly interested in unique taste experiences and ingredients that offer additional health benefits, such as antioxidants, fiber, or low sugar options.

By introducing fillings made from tropical fruits like passion fruit, mango, or dragon fruit, as well as blends with functional additives like chia or probiotics, manufacturers can differentiate their products and cater to this demand.

Such innovation appeals to health-conscious consumers and premium product seekers. These new variants also provide opportunities for storytelling around indulgence, wellness, and global flavors, helping brands connect more deeply with modern shopper preferences and enhance their market presence.

Latest Trends

Rise of Reduced-Sugar and Keto-Friendly Fruit Fillings

Consumers are increasingly seeking healthier dessert and bakery options, which has led to a growing trend toward reduced-sugar and keto-friendly fruit fillings. Traditional fillings, high in sugar, are being reformulated to use natural low-calorie sweeteners such as stevia, erythritol, and monk fruit. This trend is aiding individuals who follow low-carb, keto, or sugar-conscious diets, without compromising on taste or texture.

Manufacturers are adapting by creating formulations that maintain fruit flavor and spreadability while significantly lowering sugar content. These products cater to the health-focused consumer who seeks indulgence without excess sugar intake.

As demand for clean-label and functional products increases, reduced-sugar fruit fillings are gaining traction—particularly among those looking for guilt-free treats that still deliver on flavor and satisfaction.

Regional Analysis

In 2024, North America held 39.50% share of the Fruit Fillings Market.

In 2024, North America emerged as the dominant region in the global Fruit Fillings Market, capturing a significant 39.50% share, which translates to a market value of approximately USD 1.5 billion. This strong regional presence is primarily driven by high consumption of bakery and confectionery products, coupled with increasing demand for convenient and ready-to-use ingredients across the foodservice and retail sectors.

The region’s well-established food processing industry and advanced cold chain infrastructure further support the widespread adoption of fruit fillings in various applications. Europe also represents a substantial market due to the popularity of fruit-based pastries and desserts, although exact figures remain unspecified.

The Asia Pacific region, while not leading in share, continues to witness steady growth, supported by urbanization and evolving dietary preferences that favor Western-style baked goods. In the Middle East & Africa, and Latin America, market activity is gradually expanding, driven by growing interest in processed and packaged food products.

However, these regions remain relatively smaller in terms of overall contribution. Among all, North America stands out as the leading regional market in 2024, reflecting its mature food industry, strong consumer preference for fruit-infused products, and continuous innovation in bakery and dessert formulations using fruit fillings.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Puratos has leveraged its strong R&D infrastructure and global presence to maintain a leading position in fruit fillings. Its focus on product innovation—especially clean-label and customized fruit blends—has allowed the firm to cater effectively to both artisan bakers and large-scale manufacturers. With a robust network across Europe and North America, Puratos has consistently demonstrated an ability to support regional preferences and regulatory requirements, reinforcing its market influence.

Dawn Food Products has capitalized on its extensive distribution channels and strong relationships with retail and foodservice operators. The company’s strategy of offering easy-to-use, high-quality fruit fillings has enabled it to become a preferred supplier for numerous bakery chains. Dawn’s emphasis on customer support, including formulation assistance and training, reinforces its value proposition.

Based in Europe, Agrana has made significant strides in broadening its fruit processing capabilities. Its specialization in sourcing high-quality fruit and leveraging efficient supply chains lends it a competitive advantage in product consistency and freshness. In 2024, Agrana’s focus on sustainability and traceability has further strengthened its brand appeal, particularly among health- and environment-conscious buyers, thus enabling steady growth in both retail and industrial segments.

CSM Ingredients has stood out through its capability to integrate fruit fillings into broader ingredient systems, particularly within industrial bakery lines. The company’s technical support and collaborative development initiatives have helped food manufacturers streamline operations while maintaining consistency in taste and texture. With a solid reputation in delivering customized ingredient solutions, CSM remains a key partner for large-scale producers aiming to innovate within fruit-filled applications.

Top Key Players in the Market

- puratos Group

- Dawn Food Products Inc.

- Agrana Beteiligungs-AG

- CSM Ingredients

- Barry Callebaut

- Zentis Gmbh & Co. KG

- Bakels Worldwide

- Andros Group

- Fruit Filling Inc.

- Rice & Company Inc.

- EFCO Products Inc.

- Baldwin Richardson Foods

- Barker Fruit Processors Ltd.

- Fruit Crown Products Corporation

- Wawona Frozen Foods

Recent Developments

- In March 2025, Puratos received two prestigious Pépites de la Boulangerie 2024 awards at Sirha Lyon for its fruit filling products: Topfil Forest Berries Pieces 60% and PatisFrance Praliné Collection Noisette France 64%. These accolades highlight the company’s innovation and commitment to clean-label, high-quality fruit-based ingredients for professional bakery applications.

- In March 2025, Dawn introduced the Blueberry Compound Coating under its Royal Steensma brand in the U.S. market. This fruit-flavored, easy-to-use coating is designed for enrobing and decorating pastries, offering artisanal bakers a flexible and freezer-thaw stable solution.

Report Scope

Report Features Description Market Value (2024) USD 3.9 Billion Forecast Revenue (2034) USD 5.8 Billion CAGR (2025-2034) 4.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Filling Type (Fruit Fillings without Pieces, (Ambient Fillings, Frozen Fillings) Fruit Fillings with Pieces, Candied or Semi-candied Fruit Fillings, Others), By Fruit Type (Berries, Citrus Fruits, Tropical Fruits, Others), By Application (Bakery, Confectionery, Dairy, Ice Cream, Beverages, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Puratos Group, Dawn Food Products Inc., Agrana Beteiligungs-AG, CSM Ingredients, Barry Callebaut, Zentis Gmbh & Co. KG, Bakels Worldwide, Andros Group, Fruit Filling Inc., Rice & Company Inc., EFCO Products Inc., Baldwin Richardson Foods, Barker Fruit Processors Ltd., Fruit Crown Products Corporation, Wawona Frozen Foods Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- puratos Group

- Dawn Food Products Inc.

- Agrana Beteiligungs-AG

- CSM Ingredients

- Barry Callebaut

- Zentis Gmbh & Co. KG

- Bakels Worldwide

- Andros Group

- Fruit Filling Inc.

- Rice & Company Inc.

- EFCO Products Inc.

- Baldwin Richardson Foods

- Barker Fruit Processors Ltd.

- Fruit Crown Products Corporation

- Wawona Frozen Foods