Global Fruit Concentrate Market Size, Share, Growth Analysis By Source (Apple, Citrus Fruits, Pineapple, Grapes, Pear, Berries, Others), By Application (Food and Beverages, Nutraceuticals and Supplements, Pet Food, Others), By Distribution Channel (Hypermarkets/Supermarkets, Online Sales, Wholesale Stores, Others) - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 157231

- Number of Pages: 213

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

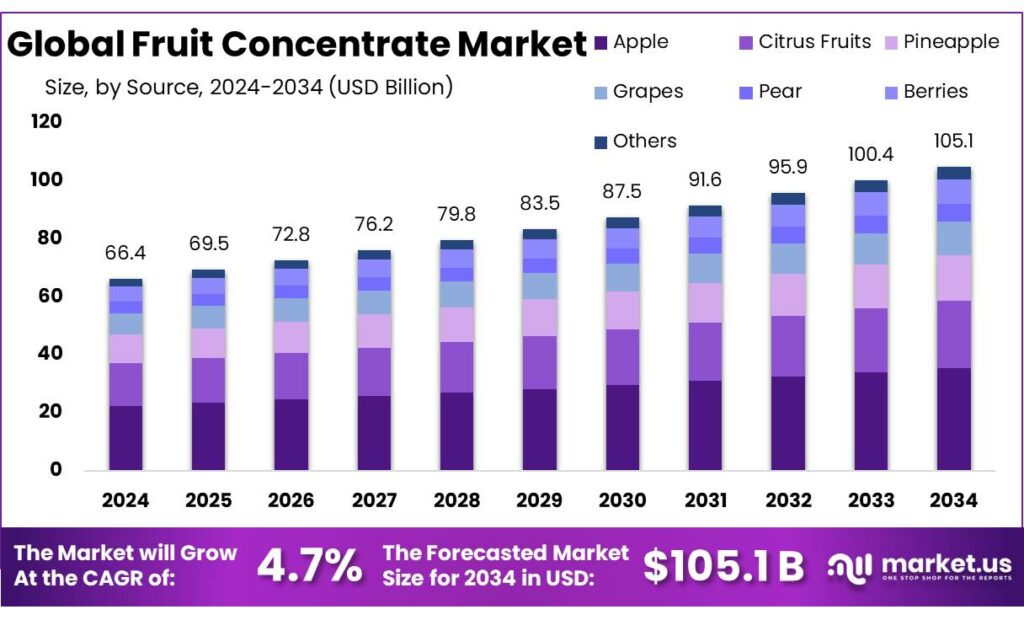

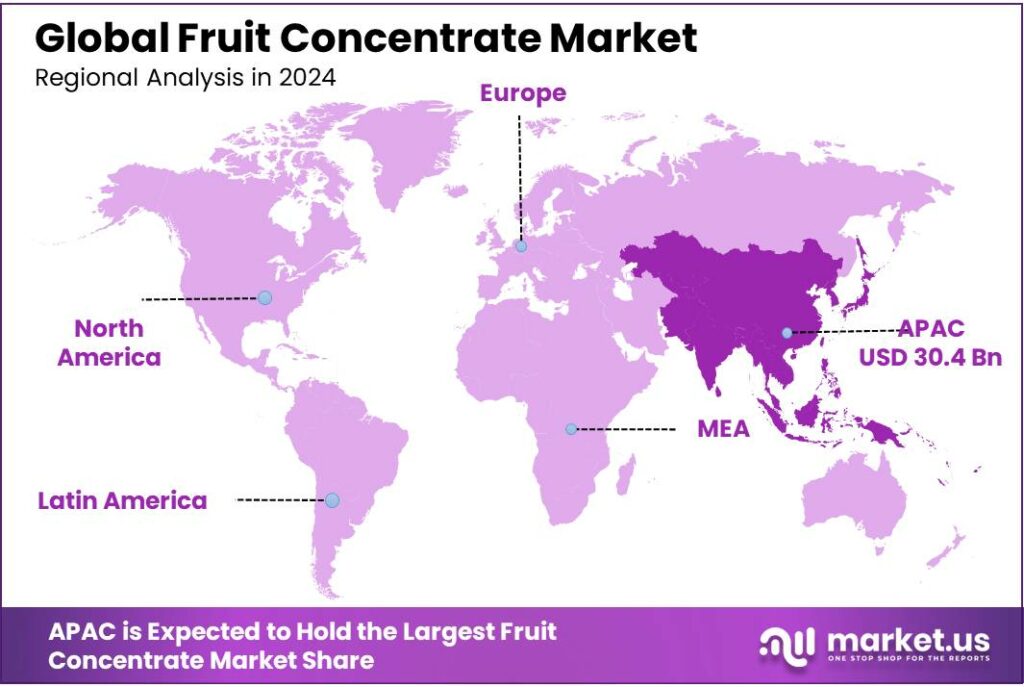

The Global Fruit Concentrate Market size is expected to be worth around USD 105.1 Billion by 2034, from USD 66.4 Billion in 2024, growing at a CAGR of 4.7% during the forecast period from 2025 to 2034. In 2024 Asia Pacific held a dominant market position, capturing more than a 45.8% share, holding USD 30.4 Billion in revenue.

The global fruit concentrate industry is experiencing steady expansion as a key segment within food processing and value-added agriculture. According to government-linked data, India’s food processing levels for fruits remain quite low at just 4.5% as of 2020–21, compared to global benchmarks. The Central Institute of Post-Harvest Engineering and Technology (CIPHET) targets raising this to 35% by 2025, aiming to significantly increase value addition in fruit processing. In parallel, the government’s “Make in India” and “Aatmanirbhar Bharat” campaigns are driving development in processing infrastructure and self-reliance in agro-industries.

The Fruit Concentrate is shaped by tight agricultural supply cycles and shifting consumer demand for lower-sugar beverages. On the supply side, Brazil—critical for frozen concentrated orange juice—was forecast by USDA to harvest 320 million 40.8-kg boxes in MY 2024/25, down 15% versus the prior season, highlighting weather and disease sensitivity that cascades into concentrate pricing and availability. On the demand side, U.S. per-capita orange juice intake fell 54% between 2005 and 2021, while grapefruit juice fell 74%, a long-run shift that has pushed processors toward blends, purées, and reduced-sugar formulations.

The Government of India has stepped up measures to strengthen the fruit processing value chain. Under the Production Linked Incentive Scheme (PLIS) for the food processing industry, the government provides incentives to enterprises engaged in processed fruits and vegetables. Further, the Agriculture Infrastructure Fund (AIF), launched in July 2020 with a corpus of ₹1,00,000 crore (~USD 12 billion), supports agri‑entrepreneurs and farmer groups in building processing and cold-chain infrastructure; for instance, Punjab alone received an increased allocation up to ₹7,050 crore by February 2025.

- In July 2025, the Government of India launched the Prime Minister Dhan‑Dhaanya Krishi Yojana, a six‑year program with an annual budget of ₹24,000 crore, targeting yield improvement, sustainable agriculture, storage infrastructure, and credit access for around 1.7 crore farmers.

Key Takeaways

- Fruit Concentrate Market size is expected to be worth around USD 105.1 Billion by 2034, from USD 66.4 Billion in 2024, growing at a CAGR of 4.7%.

- Apple held a dominant market position, capturing more than a 29.7% share in the global fruit concentrate market.

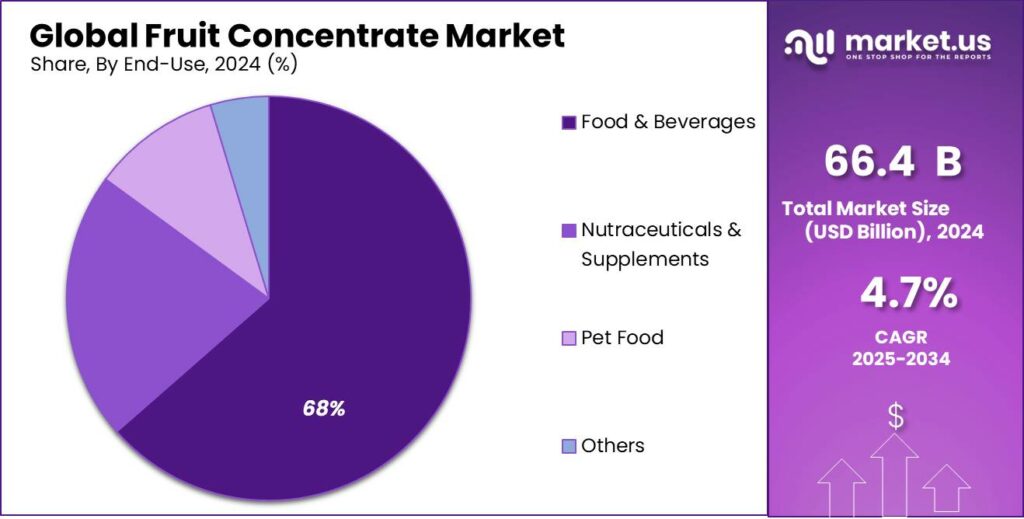

- Food & Beverages held a dominant market position, capturing more than a 68.8% share of the global fruit concentrate market.

- Hypermarkets/Supermarkets held a dominant market position, capturing more than a 36.3% share in the global fruit concentrate market.

- Asia Pacific region stood out as the dominant force in the global fruit concentrate market—holding a commanding 45.8% share, which translates to about USD 30.4 billion.

By Source Analysis

Apple Leads with 29.7% Share Thanks to Its Versatile Use and Global Demand

In 2024, Apple held a dominant market position, capturing more than a 29.7% share in the global fruit concentrate market. This strong performance is largely driven by the wide use of apple concentrate across a variety of food and beverage applications, including juices, bakery fillings, sauces, and dairy products. Apple concentrate is favored not only for its naturally sweet flavor and extended shelf life but also for its compatibility with clean-label trends, making it a popular choice among both manufacturers and health-conscious consumers. In addition, the availability of apples in large quantities across key producing countries such as China, Poland, and the United States has ensured a stable supply chain, contributing to the segment’s consistent growth.

By Application Analysis

Food & Beverages dominate with 68.8% share due to rising demand for natural ingredients in daily diets

In 2024, Food & Beverages held a dominant market position, capturing more than a 68.8% share of the global fruit concentrate market. This commanding lead reflects how deeply fruit concentrates have become embedded in everyday food and drink products—ranging from juices, smoothies, and soft drinks to yogurts, bakery items, and frozen desserts. Their natural sweetness, extended shelf life, and ease of blending make them ideal for large-scale production, especially as consumer demand rises for healthier, fruit-based alternatives over artificial additives.

By Distribution Channel Analysis

Hypermarkets/Supermarkets lead with 36.3% share due to strong visibility and consumer trust

In 2024, Hypermarkets/Supermarkets held a dominant market position, capturing more than a 36.3% share in the global fruit concentrate market. This segment’s strength lies in its ability to offer a wide variety of brands and product types under one roof, giving consumers the convenience of choice and instant access. Shoppers prefer these large retail formats because they can physically check product labels, compare prices, and often benefit from promotional discounts—especially on bulk or family-sized fruit concentrate packs.

The dominance of this channel is also backed by the steady expansion of organized retail networks in both developed and emerging economies. In countries like the U.S., Germany, China, and India, supermarket chains have become the go-to source for food essentials, including ready-to-use concentrates used in households for juices, smoothies, or cooking. Heading into 2025, the Hypermarkets/Supermarkets channel is expected to maintain its strong footing as more consumers continue to prefer in-person shopping for food products, despite the growth of e-commerce.

Key Market Segments

By Source

- Apple

- Citrus Fruits

- Pineapple

- Grapes

- Pear

- Berries

- Others

By Application

- Food & Beverages

- Dairy Based Beverages

- Non-Dairy Beverages

- Confectionery

- Bakery

- Snacks

- Desserts & Condiments

- Others

- Nutraceuticals & Supplements

- Pet Food

- Others

By Distribution Channel

- Hypermarkets/Supermarkets

- Online Sales

- Wholesale Stores

- Others

Emerging Trends

Turning Citrus Waste into Value with Functional Ingredients

There’s something quietly inspiring about how what was once wasted is now becoming a precious resource. Take India’s citrus sector, for instance. Only about 5% of India’s citrus crop is processed, a stark contrast to the 70–80% typical of developed countries. That means so much of those fragrant oranges, lemons, and mandarins were simply going to waste. But now, thanks to work at the ICAR‑Central Citrus Research Institute (ICAR‑CCRI) in Nagpur, that’s beginning to change—and in a deeply human and hopeful way.

The scientists at ICAR‑CCRI have brought real change. They’ve developed a suite of citrus value‑added products—from vitamin‑C fortified energy drinks, marmalades, and gummies to citrus powders and even biodegradable packaging made from peels. What’s beautiful isn’t just that these are novel products—it’s how they breathe new life into skin, pulp, and seeds that previously would have been tossed away.

For small entrepreneurs—many of whom are humble citrus growers or local processors—this trend opens a door that leads straight to entrepreneurship, income, and dignity. Several of these technologies have already been transferred to small and medium enterprises, paving the way for what ICAR‑CCRI lovingly calls “citripreneurs.” That term captures the personal side of progress: people, often from rural areas, finding value in what was once considered waste.

This trend also reflects a broader, global appetite for functional foods—products that nourish and do good. And that’s happening just as consumer awareness is rising around nutrition, sustainability, and clean-label products. What makes this trend feel warm isn’t just the numbers—though the shift from 5 percent to potentially much higher processed share is powerful—but the way it reconnects communities to value, purpose, and innovation.

Drivers

Government Support Strengthening Infrastructure & Processing Capacity

One of the most important forces pushing the fruit concentrate industry forward is the government’s investment in infrastructure and processing capacity, especially through schemes that connect farms directly to markets. India’s Mega Food Parks initiative under the Ministry of Food Processing Industries aims to create smooth linkages from farm collection centers to processing units and then to consumers. Each park receives grants up to ₹50 crore, is expected to host 30–35 processing units, mobilize ₹250 crore in private investment, generate turnover of ₹400–500 crore, and create at least 30,000 jobs. These parks help ensure farmers get better value, reduce spoilage, and deliver higher quality raw material for concentrate production.

Another key support mechanism is the Production-Linked Incentive (PLI) Scheme for the Food Processing Industry, which provides financial incentives for players who build efficient and high‑quality processing lines. The Ministry’s data shows that in June 2024, 92,549 micro food processing enterprises had been approved for assistance under the PMFME scheme, and the budget allocation for PMFME was ₹2,000 crore. This scheme empowers small and local concentrate producers to scale operations, access finance, and meet safety standards—and ultimately increases the supply of fruit concentrate made in hygienic conditions.

- As of 2023, the industry was valued at USD 336.4 billion, ranking sixth largest globally. It contributes around 12 percent to India’s manufacturing GDP, and supports over 7 million jobs across the value chain. A substantial share of this growth ripples directly into the fruit concentrate segment.

Restraints

The Human Cost of Post‑Harvest Losses in the Fruit Stream

- In India alone, between 6.02 % and 15.05% of fruits are lost between harvest and the market, according to a government‑commissioned study by NABARD (NABCONS) covering 2020–22. That’s more than a rounding error—it’s enough produce to power small rural economies.

Globally, the picture isn’t much brighter. The Food and Agriculture Organization (FAO) estimates that around 13.2 percent of food is lost between harvest and retail—including during storage and processing—in 2021. It’s a fraction that may sound modest in millennia of global food systems—but in a sector as delicate and yield-sensitive as fruit concentrate production, it’s a major leak in the chain.

Yet for all this government effort, the human toll of post‑harvest losses remains significant. Take guava: one recent study found up to 15.05% of guavas don’t reach the market—11.59% perishes on‑farm and another 3.46% gets lost in handling or transit. That’s nearly one in six fruits wasted before they even reach a processor’s doorstep.

Opportunity

Scaling Processing Through Government-Backed Capacity Building

To give this room to grow, India’s leaders have set a clear and ambitious path. Today, only about 2 percent of India’s fruits and vegetables are processed into value-added products—but by 2025, that figure is meant to leap to 35 percent. That kind of change isn’t just dramatic—it’s life-changing for farmers, entrepreneurs, and the economy.

This goal has real backing. The government’s Production-Linked Incentive Scheme for Food Processing Industries (PLISFPI) has a budget of ₹10,900 crore and has already helped add 35 lakh tonnes of food processing capacity across the country, while creating around 3.39 lakh jobs—both direct and indirect. That’s not theoretical—it’s bricks, vats, and real livelihoods rising up.

Then there’s the PM Formalisation of Micro Food Processing Enterprises (PMFME) scheme. Running from 2020–21 to 2025–26 with a budget of ₹10,000 crore, it supports micro-scale processors to clean up their operations, expand, and reach new markets. For a small village entrepreneur in, say, mango pulp or litchi concentrate, that level of support can mean the difference between staying local or reaching national—and even global—customers.

The major growth opportunity for the fruit concentrate industry stems from scaling up processing infrastructure, catalyzed by bold government schemes like PLISFPI and PMFME, which together inject ₹20,900 crore in assistance, create 35 lakh tonnes of capacity, and generate 3.39 lakh jobs. When fruit processors—whether in towns or villages—have better facilities, they deliver better outcomes for everyone: from farmers to consumers. That’s not just business growth; it’s compassionate progress rooted in human potential.

Regional Insights

Asia Pacific leads with 45.8% share, contributing approximately USD 30.4 billion to the global fruit concentrate market

In 2024, the Asia Pacific region stood out as the dominant force in the global fruit concentrate market—holding a commanding 45.8% share, which translates to about USD 30.4 billion in revenue. This leadership is anchored in several strengths: the region’s robust agricultural base, variety in fruit production, and growing middle-class demand for processed foods that still feel fresh and natural. Countries like China, India, and Southeast Asian nations benefit from both supply and demand advantages—locally grown fruits supply concentrate manufacturers cost-effectively, and an expanding consumer base increasingly values fruit-forward, convenience-focused ingredients.

Additionally, government support in countries like India for food processing infrastructure and exports strengthens supplier readiness to serve both domestic and international markets. Retail and foodservice channels have also amplified distribution—modern trade formats and e-commerce platforms are delivering these products rapidly to both urban and semi-urban consumers.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Royal Cosun is a Dutch agricultural cooperative rooted in providing plant-based solutions since the late 19th century. It unites approximately 9,000 sugar beet growers and about 3,900 employees, generating an annual turnover near €1.9 billion. Through its business groups—such as Suiker Unie, Aviko, Sensus, and Duynie—it transforms crops like sugar beet, potatoes, and chicory into food ingredients, animal feed, green energy, and bio-based products.

Kerr Concentrates, Inc., a part of Ingredion, has over 90 years of heritage crafting fruit and vegetable ingredient systems from simple natural sources. It offers juice concentrates—like apple concentrate processed under vacuum—that deliver vibrant flavor and color while balancing sweetness and acidity for various food and beverage applications.

Dohler GmbH began as a spice mill in Germany back in 1838 and has grown into a global supplier of technology-driven natural ingredients, ingredient systems, and integrated solutions for food and beverages. With over 9,500 employees, plus 23 production sites and 24 application centers serving over 130 countries, Döhler excels in fruit and vegetable ingredients such as concentrates, purees, cells, and pieces—focused on preserving taste, mouthfeel, and freshness.

Top Key Players Outlook

- Royal Cosun

- Kerr Concentrates, Inc.

- Dohler GmBH

- Archer Daniels Midland

- Agrana Beteiligungs Ag

- Lemon Concentrate, S.L.

- Rudolf Wild GmBH & Co. Kg

- Sunopata Inc.

- Tree Top Inc.

- FruitSmart Inc.

Recent Industry Developments

In 2024, ADM reported a net income of USD 1.8 billion, with assets worth USD 53.3 billion and equity at USD 22.2 billion.

In 2024, Döhler’s revenues reached approximately BRL 627.57 million, marking a modest year-over-year rise of 1.53 percent from BRL 618.11 million in 2023.

Report Scope

Report Features Description Market Value (2024) USD 66.4 Bn Forecast Revenue (2034) USD 105.1 Bn CAGR (2025-2034) 4.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Apple, Citrus Fruits, Pineapple, Grapes, Pear, Berries, Others), By Application (Food and Beverages, Nutraceuticals and Supplements, Pet Food, Others), By Distribution Channel (Hypermarkets/Supermarkets, Online Sales, Wholesale Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Royal Cosun, Kerr Concentrates, Inc., Dohler GmBH, Archer Daniels Midland, Agrana Beteiligungs Ag, Lemon Concentrate, S.L., Rudolf Wild GmBH & Co. Kg, Sunopata Inc., Tree Top Inc., FruitSmart Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Royal Cosun

- Kerr Concentrates, Inc.

- Dohler GmBH

- Archer Daniels Midland

- Agrana Beteiligungs Ag

- Lemon Concentrate, S.L.

- Rudolf Wild GmBH & Co. Kg

- Sunopata Inc.

- Tree Top Inc.

- FruitSmart Inc.