Global Fructose Market Size, Share, And Business Benefits By Source (Sugarcane, Sugar Beet, Corn, Others), By Product (High Fructose Corn Syrup (HFCS), Fructose Syrups, Fructose Solids), By Application (Beverages, Processed Foods, Dairy Products, Bakery and Confectionery, Pharmaceuticals, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 154241

- Number of Pages: 220

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

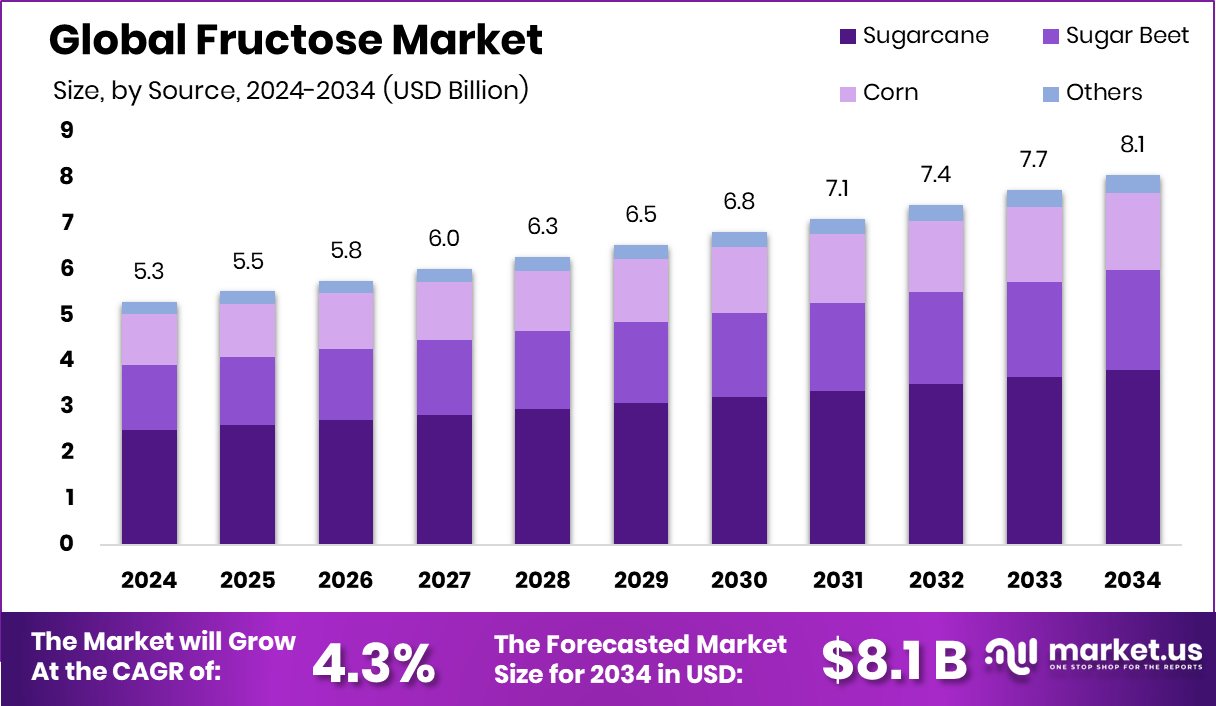

The Global Fructose Market is expected to be worth around USD 8.1 billion by 2034, up from USD 5.3 billion in 2024, and is projected to grow at a CAGR of 4.3% from 2025 to 2034. Strong demand for sweeteners supported North America’s 47.4% market leadership in 2024.

Fructose is a naturally occurring simple sugar found in fruits, vegetables, and honey. It is a type of monosaccharide that is also known as “fruit sugar.” Fructose is often used as a sweetening agent in processed foods and beverages due to its high sweetness intensity compared to glucose and sucrose. It is commonly consumed in the form of high-fructose corn syrup or as a component of table sugar (sucrose), which is made up of equal parts glucose and fructose.

The fructose market refers to the global trade and utilization of fructose in food, beverage, pharmaceutical, and personal care products. It includes both naturally sourced fructose and industrially produced variants like crystalline fructose and high-fructose corn syrup. The market caters to several industries where sweetness, moisture retention, and low-cost formulation are essential.

The increasing consumption of packaged and ready-to-drink beverages is one of the major growth drivers. Fructose, being highly soluble and sweeter than other sugars, is widely used in liquid formulations. The shift towards low-cost sweetening solutions in food manufacturing has also contributed to its growth.

Demand for fructose is being pushed by changing dietary habits, especially in urban areas where the preference for sweetened products is on the rise. Growth in processed food, bakery, and confectionery consumption has boosted the usage of fructose as a key ingredient.

An emerging opportunity lies in the growing demand for natural and low-glycemic sweeteners. As consumers become more health-conscious, the market is witnessing a slow shift toward fructose derived from fruits and natural sources instead of synthetic alternatives. This trend is expected to open new avenues in clean-label and organic product categories.

Key Takeaways

- The Global Fructose Market is expected to be worth around USD 8.1 billion by 2034, up from USD 5.3 billion in 2024, and is projected to grow at a CAGR of 4.3% from 2025 to 2034.

- In the fructose market, sugarcane is the leading source, holding a 47.2% share in 2024.

- High Fructose Corn Syrup dominated by product type, capturing a 67.3% share in the market.

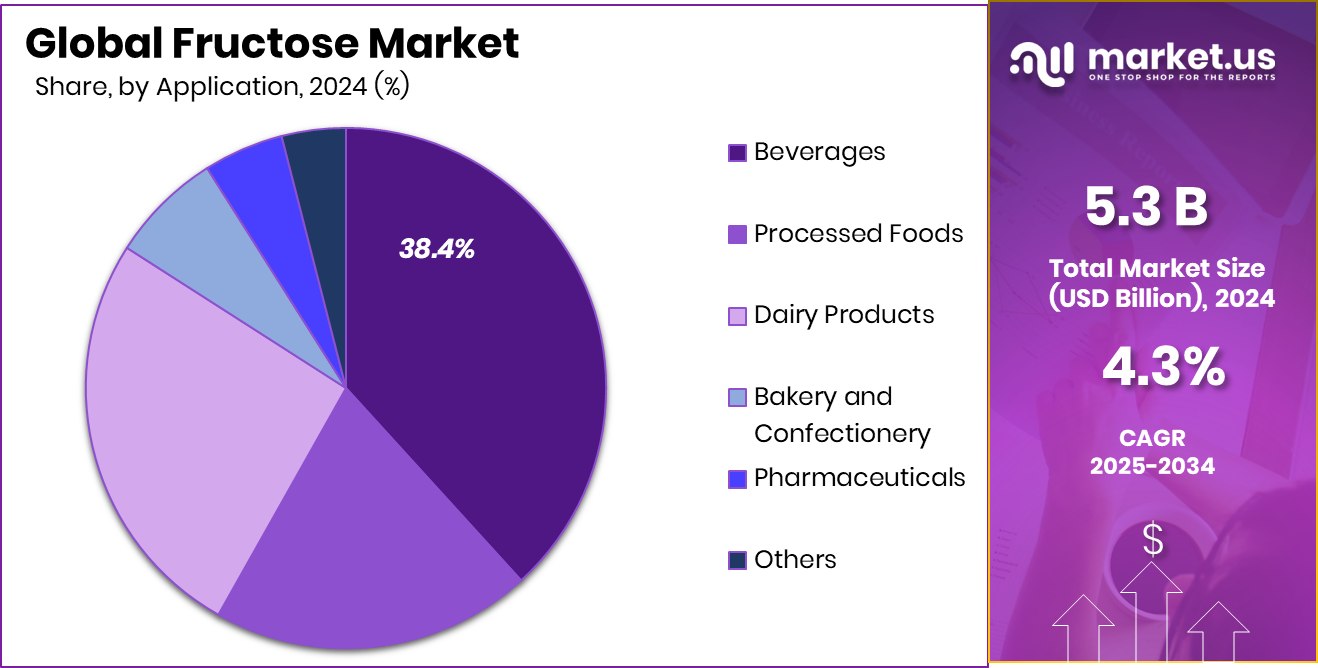

- Beverages emerged as the top application segment in the fructose market, accounting for 38.4% share.

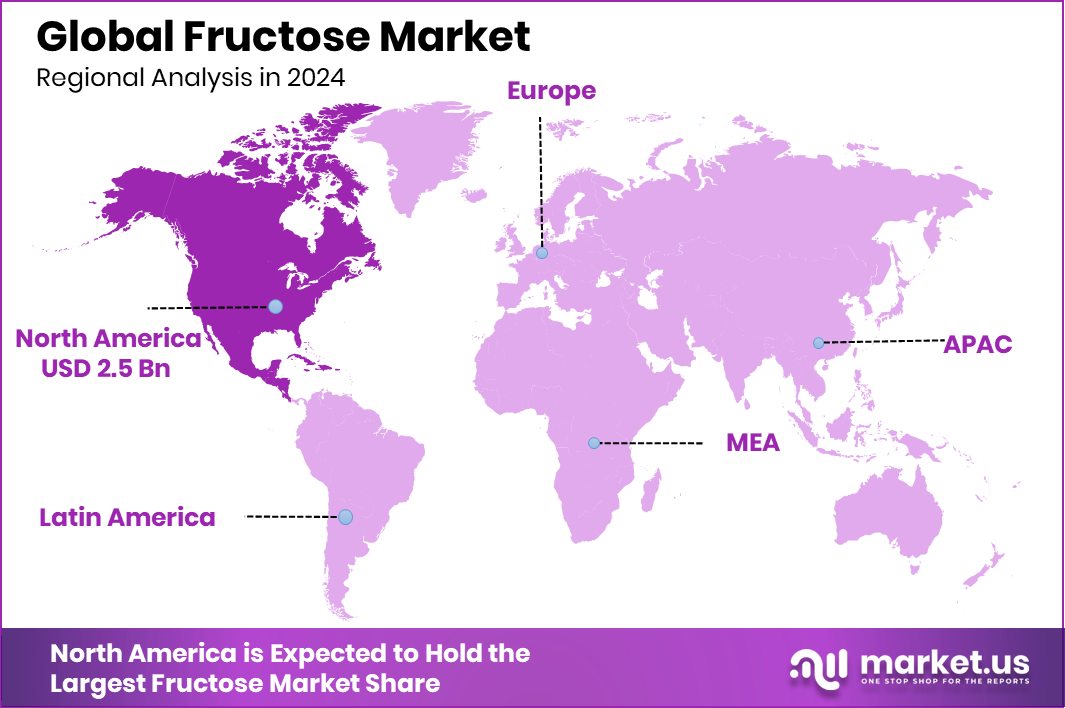

- The fructose market in North America reached a value of USD 2.5 billion.

By Source Analysis

Sugarcane leads the fructose market with a 47.2% share globally.

In 2024, Sugarcane held a dominant market position in the By Source segment of the Fructose Market, with a 47.2% share. This leadership can be attributed to the widespread cultivation and abundant availability of sugarcane, particularly in countries with favorable agro-climatic conditions. Sugarcane continues to be a preferred raw material for fructose extraction due to its high sucrose content, which simplifies the conversion process into fructose through enzymatic hydrolysis.

Moreover, the cost-effectiveness of sugarcane as a feedstock makes it a reliable option for large-scale fructose production, supporting its usage across various food and beverage applications. Its well-established supply chain further strengthens its presence in the global fructose market. In addition, sugarcane-derived fructose is increasingly utilized in processed foods and sweetened beverages owing to its consistent quality and high sweetness level.

The demand for fructose from sugarcane has also benefited from the rising consumption of ready-to-eat products and flavored drinks, particularly in developing economies. As manufacturers continue to seek efficient and scalable sources of natural sweeteners, sugarcane remains a dominant contributor to the fructose industry.

By Product Analysis

High fructose corn syrup dominates with 67.3% market share.

In 2024, High Fructose Corn Syrup (HFCS) held a dominant market position in the By Product segment of the Fructose Market, with a 67.3% share. This dominance is largely due to its widespread use as a cost-effective sweetener in the food and beverage industry. HFCS offers a high level of sweetness and is especially valued for its stability in acidic beverages and long shelf life, making it a preferred choice for soft drinks, flavored juices, and processed foods.

The large-scale adoption of HFCS in industrial food production is also supported by its easy blending with other ingredients and efficient handling in liquid form. Its consistency and functionality in enhancing flavor, texture, and moisture retention in bakery and confectionery products contribute to its strong market presence.

Additionally, the availability of corn as a raw material and well-established production infrastructure have ensured steady supply chains for HFCS manufacturers. Its 67.3% market share in 2024 reflects its entrenched role in meeting the global demand for sweetening agents, particularly in mass-produced goods.

By Application Analysis

Beverages account for 38.4% of fructose application demand.

In 2024, Beverages held a dominant market position in the By Application segment of the Fructose Market, with a 38.4% share. This leadership is primarily driven by the extensive use of fructose, especially in the form of high fructose corn syrup, in soft drinks, fruit juices, energy drinks, and flavored water. Fructose is widely favored in beverage formulations due to its high sweetness intensity, which allows manufacturers to use smaller quantities while maintaining desired flavor profiles.

The beverage industry has increasingly relied on fructose for its ability to enhance taste, improve mouthfeel, and extend shelf life. Its excellent solubility in liquid products makes it particularly suitable for large-scale drink production. Moreover, consumer demand for sweetened, ready-to-drink beverages has remained strong across both developed and developing markets, reinforcing the segment’s growth.

The 38.4% market share held by the beverage segment in 2024 highlights its central role in fructose consumption. As beverage companies continue to expand their product lines to cater to diverse taste preferences, fructose remains an essential ingredient for achieving consistent sweetness and product stability.

Key Market Segments

By Source

- Sugarcane

- Sugar Beet

- Corn

- Others

By Product

- High Fructose Corn Syrup (HFCS)

- Fructose Syrups

- Fructose Solids

By Application

- Beverages

- Processed Foods

- Dairy Products

- Bakery and Confectionery

- Pharmaceuticals

- Others

Driving Factors

Rising Demand for Sweetened Beverages and Foods

One of the key driving factors for the fructose market is the rising consumption of sweetened beverages and processed foods across the world. Fructose, especially in the form of high fructose corn syrup, is widely used in soft drinks, fruit juices, energy drinks, baked goods, and packaged snacks due to its strong sweetness and cost-effectiveness.

As urban lifestyles become more fast-paced, consumers are increasingly turning to convenient, ready-to-eat food and drink options. This shift in dietary habits is creating a consistent demand for fructose as a preferred sweetener. The global increase in fast food chains, beverage outlets, and packaged food consumption continues to support the expansion of the fructose market across both developed and emerging economies.

Restraining Factors

Health Concerns Linked to Excessive Fructose Intake

A major restraining factor for the fructose market is the growing health concerns related to high fructose consumption. Studies have shown that excessive intake of fructose, especially from processed foods and sugary drinks, may contribute to obesity, type 2 diabetes, fatty liver, and other metabolic disorders. As a result, many health-conscious consumers are reducing their sugar intake and avoiding products with added sweeteners like high fructose corn syrup.

Governments and health organizations are also promoting sugar reduction through awareness campaigns and labeling regulations. These actions are pressuring food and beverage manufacturers to reformulate their products with lower sugar content or natural alternatives, which in turn is limiting the growth potential of fructose-based ingredients in certain markets.

Growth Opportunity

Growing Use of Fructose in Packaged Beverages

One of the main driving factors of the fructose market is the growing use of fructose in packaged and ready-to-drink beverages. Fructose is widely used as a sweetener in soft drinks, energy drinks, flavored water, and fruit-based beverages due to its high sweetness and easy mixing ability in liquids. As consumer lifestyles become busier, the demand for quick and convenient drink options has increased, especially among urban populations.

Beverage manufacturers prefer fructose for its cost-effectiveness and long shelf stability, which helps improve product taste and quality. This rising demand for sweetened beverages is expected to remain a strong growth driver for the fructose market, especially in developing countries where packaged drink consumption is expanding rapidly.

Latest Trends

Increasing Preference for Natural and Clean‑Label Sweeteners

Consumers are showing a rising preference for sweeteners labeled as natural or “clean‑label”. In response, manufacturers are increasingly sourcing fructose from fruit extracts or labeling it clearly on product packaging. This trend is visible across beverages, snacks, and even dietary goods. The clean‑label movement emphasizes minimal ingredients and transparency, prompting brands to replace ambiguous terms like “sugar syrup” with recognizably natural ingredients.

As a result, fructose derived directly from fruits or presented with simple, honest labeling is gaining favor. This shift reflects broader consumer interest in healthier, more natural food choices. Over time, it is expected that brands will continue to highlight the fruit origin of fructose, reinforcing trust and aligning with modern ingredient preferences.

Regional Analysis

North America accounted for 47.4% market share in the global fructose industry.

In 2024, North America held a dominant position in the global fructose market, capturing 47.4% of the total share with a market value of USD 2.5 billion. This leadership can be attributed to the region’s high consumption of processed foods and sweetened beverages, where fructose is widely used as a key ingredient. The strong presence of food and beverage manufacturing infrastructure and a well-established supply chain has further supported market expansion across the United States and Canada.

Europe followed with steady demand, driven by the continued use of fructose in bakery, dairy, and flavored beverages. Regulatory focus on sugar reduction has led to careful formulation strategies, keeping the market stable.

Asia Pacific also emerged as a significant regional contributor, supported by a growing population and changing food consumption patterns, particularly in emerging economies. Rising urbanization and increasing demand for packaged foods are influencing fructose adoption.

Meanwhile, Latin America and the Middle East & Africa represent developing markets with a moderate share. Their growth is supported by expanding food industries and rising consumer inclination toward sweetened products.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Ajinomoto Co. Inc. maintained its position as a diversified food and biotechnology firm with involvement in sweetener production, including fructose-related compounds for both food and pharmaceutical applications. Operating in over 30 countries and generating annual revenues around USD 10.6 billion, Ajinomoto benefits from global reach and technological expertise in amino acid and sweetener innovation.

Cargill Incorporated remained a core supplier of fructose and glucose‑fructose syrups, embedded within its starches and sweeteners business. Extensive industry experience and integration across the supply chain enable Cargill to support custom sweetener formulations and scale global production. The company continues to invest in production and R&D to enhance process efficiency and meet industrial demand.

DuPont de Nemours Inc., through its food and beverage technologies division, provided critical membrane and ion‑exchange solutions used in fructose purification. DuPont’s AmberLite™ resins and membrane technologies serve as essential processing tools for refining high‑purity fructose and glucose syrups, enabling cost‑effective, high‑performance production lines for sweetener manufacturers.

Top Key Players in the Market

- ADM

- Ajinomoto Co. Inc

- Cargill Incorporated

- DuPont de Nemours Inc.

- Galam Ltd.

- HSWT

- Ingredion Incorporated

- Ingredion

- Roquette Frères

- Shijiazhuang Huaxu Pharmaceutical Co. Ltd.

- Südzucker AG

- Tate & Lyle Plc

- Zhucheng Haotian Pharm Co., Ltd.

Recent Developments

- In July 2025, shares of ADM fell by approximately 2%, after public remarks suggested that a leading beverage company would switch from high fructose corn syrup to cane sugar in its U.S. products. Since ADM is a major supplier of HFCS, the news triggered immediate market concern about future fructose demand.

- In August 2024, Cargill announced the opening of a new corn syrup production facility in North America, with initial shipments expected by that time. This facility was designed to expand the company’s supply of corn-based sweeteners—including high fructose corn syrup—used extensively in food and beverages.

Report Scope

Report Features Description Market Value (2024) USD 5.3 Billion Forecast Revenue (2034) USD 8.1 Billion CAGR (2025-2034) 4.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Sugarcane, Sugar Beet, Corn, Others), By Product (High Fructose Corn Syrup (HFCS), Fructose Syrups, Fructose Solids), By Application (Beverages, Processed Foods, Dairy Products, Bakery and Confectionery, Pharmaceuticals, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ADM, Ajinomoto Co. Inc, Cargill Incorporated, DuPont de Nemours Inc., Galam Ltd., HSWT, Ingredion Incorporated, Ingredion, Roquette Frères, Shijiazhuang Huaxu Pharmaceutical Co. Ltd., Südzucker AG, Tate & Lyle Plc, Zhucheng Haotian Pharm Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- ADM

- Ajinomoto Co. Inc

- Cargill Incorporated

- DuPont de Nemours Inc.

- Galam Ltd.

- HSWT

- Ingredion Incorporated

- Ingredion

- Roquette Frères

- Shijiazhuang Huaxu Pharmaceutical Co. Ltd.

- Südzucker AG

- Tate & Lyle Plc

- Zhucheng Haotian Pharm Co., Ltd.