Global Frozen Meat Market Size, Share, And Business Benefits By Product (Chicken, Beef, Pork, Others), By Nature (Organic, Conventional), By Distribution Channel (Supermarket/ Hypermarkets, Convenience Stores, Online, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152234

- Number of Pages: 314

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

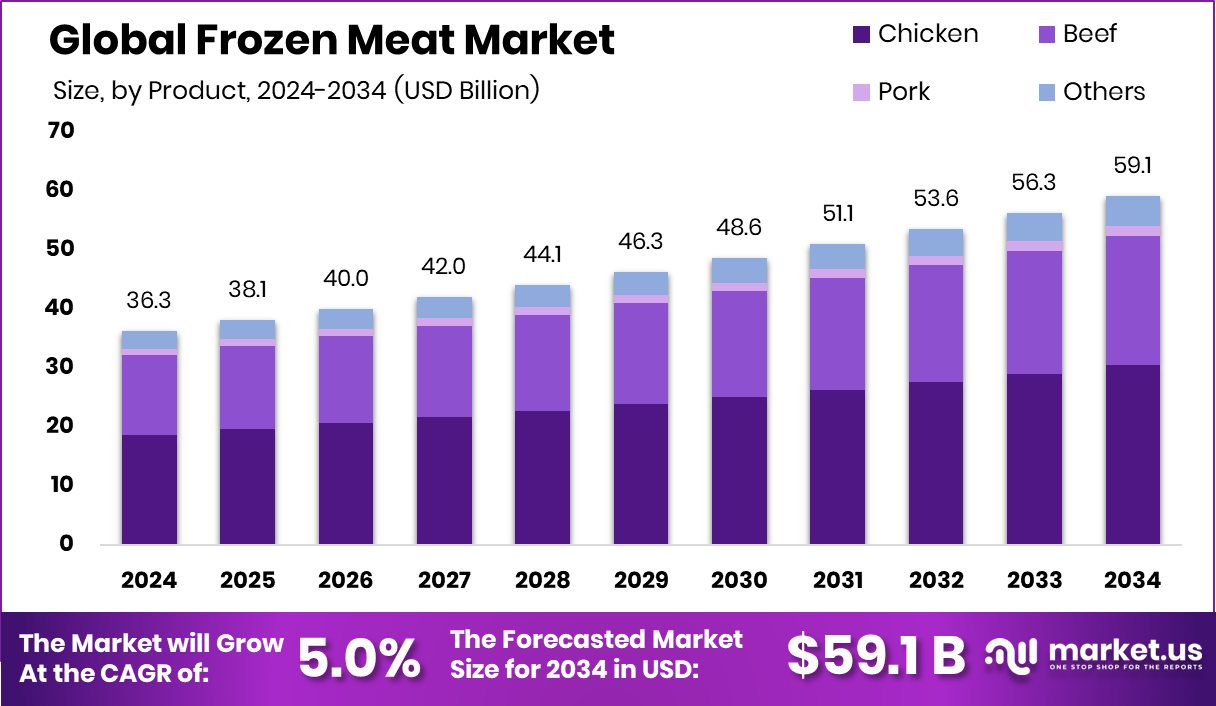

Global Frozen Meat Market is expected to be worth around USD 59.1 billion by 2034, up from USD 36.3 billion in 2024, and grow at a CAGR of 5.0% from 2025 to 2034. Asia-Pacific’s 35.9% share shows strong growth potential in frozen meat consumption.

Frozen meat refers to animal meat products that are preserved by lowering their temperature below freezing point, typically at or below -18°C. This process halts the growth of bacteria and other microorganisms, thereby extending the shelf life of the product without the use of preservatives. Common types of frozen meat include beef, poultry, pork, and lamb, which are available in various cuts or processed forms.

The frozen meat market refers to the global trade and distribution of meat products that are preserved through freezing. This includes the supply chain from slaughterhouses to cold storage and from retail outlets to end consumers. The market caters to the growing demand for convenience foods, longer shelf life, and improved logistics. The expansion of cold chain infrastructure, increasing urbanization, and rising income levels have further propelled the market’s growth across developed and developing nations.

The growth of the frozen meat market can be attributed to rising urban populations and their preference for time-saving food options. With busy lifestyles, consumers are leaning toward ready-to-cook and easy-to-store meat products. Additionally, improved refrigeration technology and better cold chain logistics have made it easier for frozen meat to reach remote areas, boosting its consumption even in developing regions. According to an industry report, Bengaluru-based chicken quick-service chain BIGGUYS raises $2 million in funding.

The demand for frozen meat is strongly driven by its longer shelf life and minimal food waste. Consumers are increasingly opting for frozen products due to their flexibility in meal planning and storage. Furthermore, the growing number of working individuals and dual-income households has created a strong demand for quick meal solutions, where frozen meat serves as a core component due to its convenience and nutritional consistency. According to an industry report, Rebellious Foods’ plant-based chicken patty was added to the Great State Burger menu following a $2.4 million funding round.

Key Takeaways

- Global Frozen Meat Market is expected to be worth around USD 59.1 billion by 2034, up from USD 36.3 billion in 2024, and grow at a CAGR of 5.0% from 2025 to 2034.

- In the frozen meat market, chicken dominates with a 51.5% share due to its affordability and versatility.

- Conventional frozen meat holds 82.1% of the market share, driven by large-scale production and widespread consumer preference.

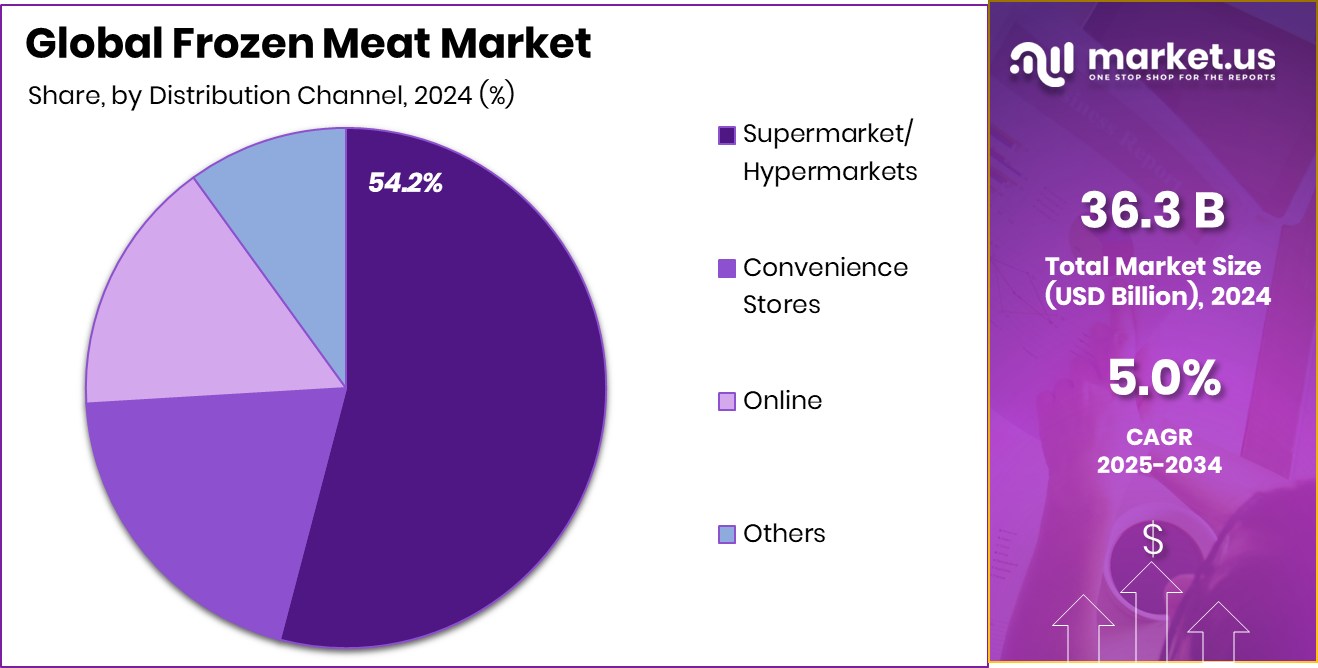

- Supermarkets and hypermarkets lead distribution with a 54.2% share, offering convenience, variety, and trusted quality assurance.

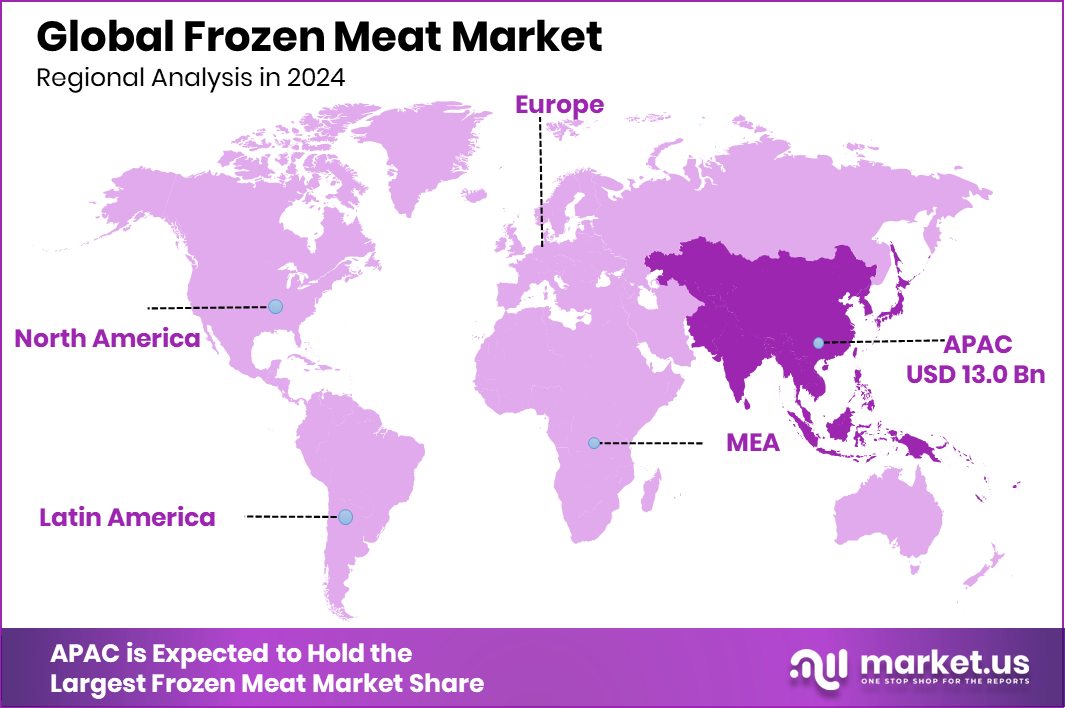

- The Asia-Pacific led due to urbanization and convenience-driven demand, worth USD 13.0 billion.

By Product Analysis

Chicken dominates the frozen meat market with a 51.5% share.

In 2024, Chicken held a dominant market position in the byproduct segment of the frozen meat market, with a 51.5% share. This significant market presence reflects the widespread consumer preference for chicken due to its affordability, versatility, and lower fat content compared to other meat types.

The ease of freezing and longer shelf life of chicken further support its leading role, especially in urban households and food service sectors where demand for quick and nutritious protein sources remains high. The popularity of frozen chicken is also supported by its suitability for a wide range of culinary uses, from ready-to-cook formats to processed food products.

Additionally, the consistent availability of chicken through both modern retail and online distribution channels has played a crucial role in reinforcing its market share. As global dietary habits continue to shift toward leaner protein options, frozen chicken maintains a strong advantage by offering both convenience and health appeal.

Its dominance in the frozen meat category also aligns with rising consumer awareness regarding food safety and hygiene, where frozen chicken is often perceived as a cleaner and safer option.

By Nature Analysis

Conventional meat leads the frozen market, holding an 82.1% share.

In 2024, Conventional held a dominant market position in the By Nature segment of the Frozen Meat Market, with an 82.1% share. This leading position is largely driven by its widespread availability, lower cost of production, and established distribution infrastructure.

Conventional frozen meat continues to be the preferred choice among a broad consumer base, particularly in price-sensitive markets where affordability plays a key role in purchasing decisions. Its dominance also stems from strong demand across institutional buyers such as restaurants, hotels, and catering services, where cost efficiency and bulk availability are critical factors.

Moreover, the scalability of conventional meat production allows for a steady supply, making it easier to meet large-scale consumer demand without seasonal constraints. The established supply chains and processing standards associated with conventional meat further reinforce its trust among both retailers and end-users.

As frozen meat consumption continues to grow, particularly in urban and semi-urban settings, conventional products remain the backbone of this demand due to their familiarity, convenience, and compatibility with a variety of cooking formats.

By Distribution Channel Analysis

Supermarkets drive sales, capturing 54.2% of the frozen meat share.

In 2024, Supermarkets/Hypermarkets held a dominant market position in the By Distribution Channel segment of the Frozen Meat Market, with a 54.2% share. This leading share is primarily attributed to the extensive reach, wide product assortment, and convenience offered by these retail formats.

Consumers prefer supermarkets and hypermarkets for purchasing frozen meat due to the availability of multiple brands, packaging options, and promotional offers under one roof. These stores also maintain robust cold chain infrastructure, ensuring product freshness and safety, which enhances consumer trust in frozen meat products.

The organized retail environment provided by supermarkets and hypermarkets supports better product visibility and quality assurance, both of which play a crucial role in influencing buyer decisions. Their strategic locations in urban and semi-urban centers further support foot traffic, making them a preferred choice for routine grocery shopping.

Additionally, consumers often associate these outlets with better hygiene standards and reliability, especially when it comes to perishable goods like frozen meat. The 54.2% market share achieved by supermarkets and hypermarkets in 2024 reflects their continued dominance and vital role in bridging the gap between producers and end-users in the frozen meat value chain.

Key Market Segments

By Product

- Chicken

- Beef

- Pork

- Others

By Nature

- Organic

- Conventional

By Distribution Channel

- Supermarket/ Hypermarkets

- Convenience Stores

- Online

- Others

Driving Factors

Rising Demand for Convenient Protein-Rich Foods

One of the key driving factors of the frozen meat market is the increasing demand for convenient, protein-rich food options. As modern lifestyles become more fast-paced, especially in urban areas, consumers are looking for foods that are easy to store, quick to prepare, and nutritious. Frozen meat fits this demand perfectly by offering a long shelf life without compromising on quality or nutritional value.

It allows consumers to plan meals flexibly and reduce frequent visits to grocery stores. In addition, frozen meat eliminates concerns over spoilage, making it a practical choice for working individuals and families. This shift toward convenience and health-conscious eating habits is significantly boosting the demand for frozen meat across both developed and emerging markets.

Restraining Factors

Lack of Cold Storage Infrastructure in Regions

A major restraining factor for the frozen meat market is the lack of cold storage and refrigeration infrastructure, especially in developing and rural areas. Frozen meat requires consistently low temperatures to maintain its quality and safety during storage and transport. However, many regions still face challenges like limited electricity supply, outdated logistics systems, and insufficient investment in cold chain facilities.

These issues lead to spoilage, contamination, and reduced shelf life of products, discouraging retailers and consumers from opting for frozen meat. Without proper cold chain management, it becomes difficult to maintain the product’s integrity, affecting market growth.

Growth Opportunity

Expansion of Online Grocery and Delivery Platforms

The rapid growth of online grocery shopping and home delivery services presents a significant opportunity for the frozen meat market. As more consumers embrace e-commerce for their groceries, the convenience of ordering meat online and receiving it at their doorstep is increasingly appealing.

Retailers and meat suppliers can leverage this trend by offering frozen meat products directly through apps and websites, often accompanied by targeted promotions, variety packs, and subscription bundles.

Additionally, the development of specialized cold packaging and last-mile delivery systems ensures that meat stays fresh during transit. This approach not only enhances consumer satisfaction but also opens up new geographical markets, including urban and remote areas.

Latest Trends

Rise in Demand for Premium Frozen Meat Products

Consumers are increasingly seeking high-quality frozen meat options, marking a clear shift toward premium offerings. These products often include grass-fed, organic, and antibiotic-free choices that appeal to health- and quality-conscious buyers. As awareness around nutrition and sourcing grows, consumers are prepared to pay more for meat perceived as safer or ethically produced; this trend is particularly noticeable in regions where disposable incomes have risen.

Supermarkets and online grocers have responded by adding premium frozen lines, featuring enhanced packaging and certifications. The premium segment benefits from improved trust and perceived value, which helps justify its higher price point.

Regional Analysis

In Asia-Pacific, the frozen meat market captured a 35.9% share, reaching USD 13.0 billion.

In 2024, the Asia-Pacific region held the dominant position in the global frozen meat market, accounting for 35.9% of the total market share and valued at USD 13.0 billion. The region’s leadership is primarily supported by rising urban populations, changing dietary preferences, and increasing demand for convenient, ready-to-cook protein sources. Growth in retail infrastructure and cold chain development across countries like China, India, and Southeast Asian nations further supported the widespread availability of frozen meat products.

In North America, the market showed stable consumption patterns, largely influenced by a mature food service sector and consistent demand for frozen meat in both retail and institutional channels. Europe also exhibited strong performance, supported by consumer inclination toward hygienic, pre-packaged meat products and well-established distribution networks.

Meanwhile, the Middle East & Africa region demonstrated emerging demand, driven by urban expansion and shifting food habits. Latin America experienced moderate growth, supported by regional trade and increasing penetration of frozen food products in urban retail. Among all, Asia-Pacific stood out as the leading contributor, both in volume and value, reflecting the region’s growing role in shaping global demand dynamics for frozen meat products.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Associated British Foods plc (ABF) leveraged its extensive global food portfolio to enhance its frozen meat capabilities. By integrating its retail and food service channels, ABF improved distribution efficiency and expanded its reach into new markets. The company’s focus on streamlined operations, including optimized logistics and processing facilities, has supported consistent supply and enhanced quality control.

BRF Global, with its Brazilian origins, capitalized on strong upstream integration—ranging from livestock management to processing—to maintain cost competitiveness and ensure traceability. In 2024, BRF’s emphasis on vertical integration translated into better margin control, improved regulatory compliance, and heightened food safety credibility. These practices have fortified BRF’s presence in export-heavy regions, helping balance geographic risk and strengthen its footprint in markets that value transparency and origin assurance.

Cargill, a diversified agribusiness entity, continued to benefit from its global grain-meat supply chain synergies. Its integrated model allowed for better feedstock sourcing, flexible production scaling, and comprehensive risk management. In 2024, Cargill’s cross-sector coordination—spanning protein, feed, and logistics—provided cost efficiencies and enabled the company to offer frozen meat products with consistent quality globally.

Top Key Players in the Market

- Allana

- AL-Shah Enterprises

- Associated British Foods plc

- BRF Global

- Cargill

- International Agro Foods

- JBS S.A.

- Kerry Group plc

- Marfrig Group.

- Pilgrim’s

- Tyson Foods, Inc.

- V H Group

Recent Developments

- In June 2025, Allana agreed to acquire Minerva’s Colonia plant in Uruguay for approximately USD 48 million. This move expands Allana’s international footprint in meat processing and supports its global supply capacity.

- In August 2024, AB Mauri, the bakery-ingredients arm of ABF, acquired Romix Foods—a specialist blending business in the UK. While Romix primarily operates in a bakery, the deal enhances the company’s ingredient and processing expertise. This strengthens ABF’s capabilities in the frozen baked goods segment, which often intersects with frozen meat products in food service operations.

Report Scope

Report Features Description Market Value (2024) USD 36.3 Billion Forecast Revenue (2034) USD 59.1 Billion CAGR (2025-2034) 5.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Chicken, Beef, Pork, Others), By Nature (Organic, Conventional), By Distribution Channel (Supermarket/ Hypermarkets, Convenience Stores, Online, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Allana, AL-Shah Enterprises, Associated British Foods plc, BRF Global, Cargill, International Agro Foods, JBS S.A., Kerry Group plc, Marfrig Group., Pilgrim’s, Tyson Foods, Inc., V H Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Allana

- AL-Shah Enterprises

- Associated British Foods plc

- BRF Global

- Cargill

- International Agro Foods

- JBS S.A.

- Kerry Group plc

- Marfrig Group.

- Pilgrim’s

- Tyson Foods, Inc.

- V H Group