Global Forskolin Market Size, Share Analysis Report By Purity (Low, Medium, High), By Product Type (Root Extract, Leaf Extract, Seed Extract), By Form (Capsules, Tablets, Powder, Liquid Extract), By Application (Allergy Treatment, Weight Management, Respiratory Problems, Cardiovascular Disorders, Glaucoma, Hypothyroidism, Psoriasis, Others), By End-use (Dietary Supplements, Food And Beverages, Cosmetics, Pharmaceuticals, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 159052

- Number of Pages: 251

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

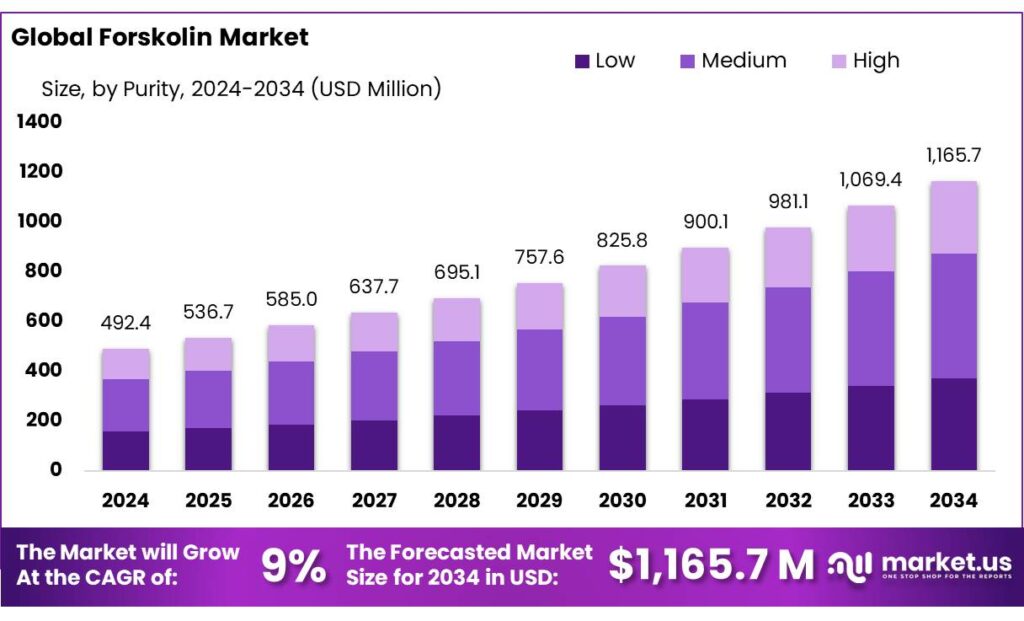

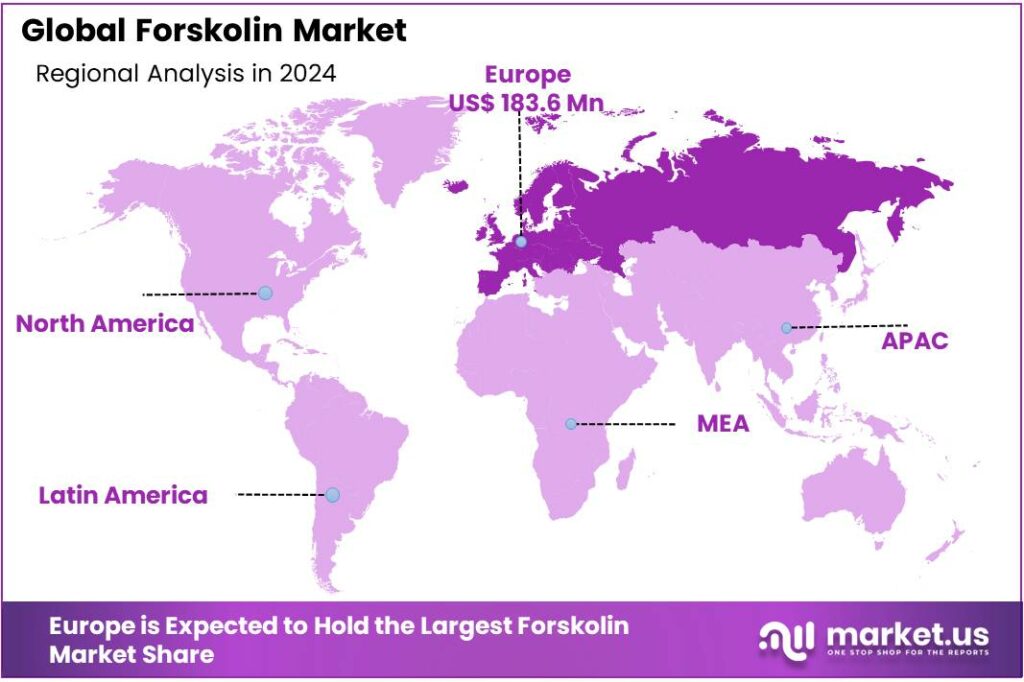

The Global Forskolin Market size is expected to be worth around USD 1165.7 Million by 2034, from USD 492.4 Million in 2024, growing at a CAGR of 9.0% during the forecast period from 2025 to 2034. In 2024 Europe held a dominant market position, capturing more than a 37.30% share, holding USD 183.6 Million in revenue.

Forskolin, a bioactive compound extracted from the roots of the medicinal plant Coleus forskohlii, is gaining prominence in the global market due to its therapeutic applications in weight management, cardiovascular health, and respiratory disorders. India, being the native origin of Coleus forskohlii, plays a pivotal role in its cultivation and production. The plant thrives in regions with well-drained, fertile soils, such as Tamil Nadu, Karnataka, Gujarat, Maharashtra, and Rajasthan, where its cultivation has seen significant growth in recent years.

- Government initiatives have further bolstered the sector’s growth. The Production Linked Incentive (PLI) schemes, with an allocation of ₹1.97 lakh crore (approximately $28 billion) across 13 sectors, aim to enhance domestic manufacturing and reduce import dependency. Additionally, the ‘Make in India’ program encourages companies to develop, manufacture, and assemble products domestically, fostering a conducive environment for investments.

The demand for forskolin is driven by its purported health benefits, such as weight management, respiratory support, and cardiovascular health. The increasing consumer preference for natural and plant-based products has further fueled this demand. In India, the pharmaceutical industry, valued at an estimated USD 50 billion in FY 2023-24, is a significant contributor to the growth of the forskolin market

In terms of export, Gujarat leads India’s chemical exports, contributing 46.16% of the total in FY 2024-25, amounting to $12,885 million out of $28,699 million. This dominance is attributed to the state’s well-established chemical manufacturing infrastructure and export ecosystem, providing a robust platform for the international trade of herbal products like forskolin.

Key Takeaways

- Forskolin Market size is expected to be worth around USD 1165.7 Million by 2034, from USD 492.4 Million in 2024, growing at a CAGR of 9.0%.

- Medium purity Forskolin held a dominant market position, capturing more than a 43.2% share of the market.

- Root Extract held a dominant market position, capturing more than 64.4% of the Forskolin market.

- Capsules held a dominant market position, capturing more than 43.9% of the Forskolin market.

- Weight Management held a dominant market position, capturing more than 34.5% of the Forskolin market.

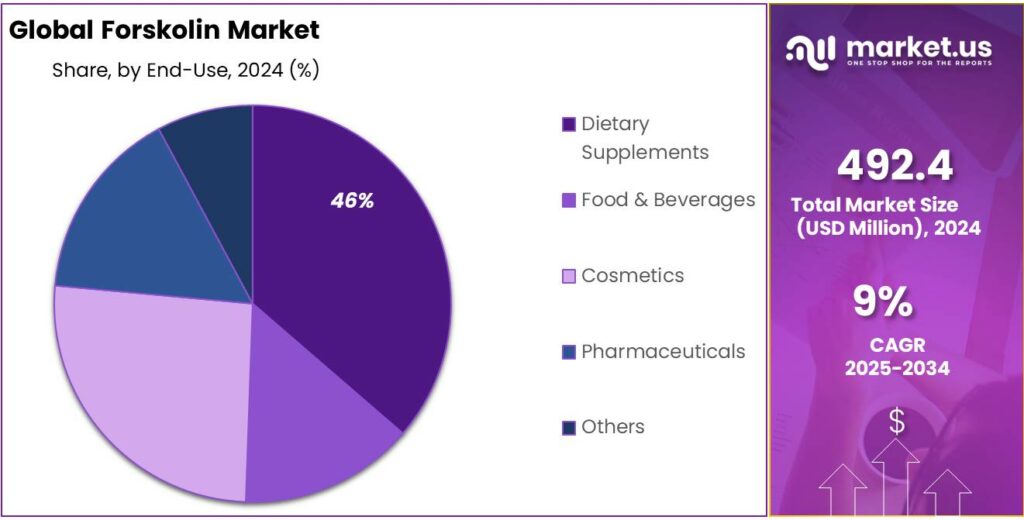

- Dietary Supplements held a dominant market position, capturing more than 46.3% of the Forskolin market.

- Europe is poised for steady growth, holding a dominant share of 37.30%, valued at USD 183.6 million in 2024.

By Purity Analysis

Medium Purity Forskolin Dominates with 43.2% Market Share in 2024

In 2024, Medium purity Forskolin held a dominant market position, capturing more than a 43.2% share of the market. This segment continues to lead the Forskolin market due to its balance between cost and effectiveness, making it a popular choice among both manufacturers and consumers. Medium purity Forskolin is widely used in dietary supplements and weight management products, providing a more affordable yet effective option compared to higher-purity variants.

The medium purity segment’s strong market presence can be attributed to the growing demand for natural and affordable weight-loss supplements, where medium purity Forskolin offers a viable option without compromising on potency. Its widespread use in both traditional and online retail channels further supports its market dominance. As more consumers look for cost-effective health supplements, this segment is expected to maintain its leading position in 2025, continuing to capture significant market share.

By Product Type Analysis

Root Extract Dominates Forskolin Market with 64.4% Share in 2024

In 2024, Root Extract held a dominant market position, capturing more than 64.4% of the Forskolin market. This segment continues to lead due to the natural, highly concentrated form of Forskolin derived from the roots of the Coleus forskohlii plant. Root Extract is widely preferred in dietary supplements and weight management products, as it offers the most potent and effective source of Forskolin.

The demand for Root Extract has grown steadily, driven by consumer preference for natural and plant-based ingredients in health supplements. As more people turn to holistic and natural wellness solutions, the root extract segment is expected to maintain its stronghold in the market through 2025. The high efficacy of root extract in promoting weight loss and improving metabolic functions makes it a top choice for product formulations in the health and wellness industry.

By Form Analysis

Capsules Lead Forskolin Market with 43.9% Share in 2024

In 2024, Capsules held a dominant market position, capturing more than 43.9% of the Forskolin market. The capsule form remains the preferred choice for consumers due to its convenience, precise dosage, and easy incorporation into daily health routines. Capsules are widely used in weight management and general wellness products, offering a simple and effective way for users to consume Forskolin.

The strong performance of capsules in 2024 is driven by the growing consumer demand for easy-to-use supplement formats. Capsules offer consistency in dosage, which enhances their appeal for those seeking reliable and straightforward weight-loss solutions. With more health-conscious consumers turning to supplements, the capsule segment is expected to continue leading the market through 2025, maintaining a significant share as new formulations and product innovations emerge.

By Application Analysis

Weight Management Leads Forskolin Market with 34.5% Share in 2024

In 2024, Weight Management held a dominant market position, capturing more than 34.5% of the Forskolin market. This application segment continues to be the largest due to the increasing demand for natural supplements that support weight loss and metabolism. Forskolin, known for its potential to stimulate fat breakdown and increase fat burning, is a popular ingredient in weight management products.

The rise in health consciousness and the growing focus on natural, plant-based solutions have further boosted the weight management segment. Consumers are increasingly turning to Forskolin supplements as part of their weight loss regimen, attracted by its natural properties and effectiveness. This trend is expected to continue in 2025, with weight management products incorporating Forskolin maintaining a strong market share as demand for weight loss solutions remains high.

By End-use Analysis

Dietary Supplements Lead Forskolin Market with 46.3% Share in 2024

In 2024, Dietary Supplements held a dominant market position, capturing more than 46.3% of the Forskolin market. This segment is the largest due to the growing consumer interest in natural health products aimed at improving overall wellness, weight management, and metabolic function. Forskolin is widely used in dietary supplements, particularly those targeted for fat loss and energy enhancement.

The increasing shift towards preventive healthcare, coupled with the popularity of fitness and weight management routines, has significantly driven the demand for Forskolin-based dietary supplements. As more consumers opt for plant-derived supplements, the dietary supplement segment is expected to retain its dominant share in 2025. This trend is expected to continue as health-conscious consumers seek effective, natural alternatives for their wellness needs.

Key Market Segments

By Purity

- Low

- Medium

- High

By Product Type

- Root Extract

- Leaf Extract

- Seed Extract

By Form

- Capsules

- Tablets

- Powder

- Liquid Extract

By Application

- Allergy Treatment

- Weight Management

- Respiratory Problems

- Cardiovascular Disorders

- Glaucoma

- Hypothyroidism

- Psoriasis

- Others

By End-use

- Dietary Supplements

- Food & Beverages

- Cosmetics

- Pharmaceuticals

- Others

Emerging Trends

Growing Popularity in Weight Loss and Fitness Supplements

One of the major trends for Forskolin, a natural plant-derived compound, is its growing use in weight loss and fitness supplements. Forskolin, which is extracted from the root of the Coleus forskohlii plant, has gained significant attention due to its purported ability to support fat burning, boost metabolism, and improve overall body composition. In recent years, as more consumers seek natural and plant-based alternatives to aid in weight loss, Forskolin has increasingly been included in dietary supplements aimed at fitness enthusiasts and those looking to manage their weight.

Forskolin’s rise in popularity can also be attributed to its growing presence in the fitness industry. Many fitness influencers and health coaches promote Forskolin supplements, citing their ability to help reduce body fat and improve muscle tone.

According to ConsumerLab.com, which provides independent testing of health products, Forskolin has become one of the more widely used ingredients in fat-burning supplements, especially among individuals seeking to improve physical performance or lose weight. As consumers become more health-conscious and informed about the ingredients in their supplements, the demand for plant-based and natural weight loss products like Forskolin is expected to increase.

Government initiatives and regulatory bodies are also playing a role in the promotion of natural supplements like Forskolin. In the United States, the Food and Drug Administration (FDA) allows the sale of Forskolin as a dietary supplement, but with certain guidelines to ensure safety and efficacy. The FDA monitors the quality of Forskolin products to ensure they are free from harmful contaminants and are labeled with clear dosage information.

Additionally, the European Food Safety Authority (EFSA) has issued scientific opinions on the use of natural ingredients in food supplements, which have paved the way for wider acceptance of plant-based supplements like Forskolin in the European market.

Drivers

Government Support for Medicinal Plant Cultivation

One of the most significant factors driving the growth of forskolin production in India is the robust support from the government aimed at promoting the cultivation of medicinal plants. Recognizing the economic and health benefits, the Indian government has implemented various initiatives to encourage farmers to engage in the cultivation of medicinal plants like Coleus forskohlii.

A notable initiative is the Revised Central Sector Scheme for the Promotion of Medicinal Plants, administered by the National Medicinal Plants Board (NMPB) under the Ministry of AYUSH. This scheme offers subsidies ranging from 30% to 75% of the cost of cultivation for 140 prioritized medicinal plants, including Coleus forskohlii. The support extends to activities such as establishing nurseries, post-harvest management, and setting up primary processing units, thereby ensuring a comprehensive approach to medicinal plant cultivation.

Furthermore, the National Medicinal Plants Board (NMPB) plays a pivotal role in coordinating efforts related to medicinal plants. Established by the Government of India, the NMPB focuses on promoting the cultivation, conservation, and sustainable use of medicinal plants across the country. Through its initiatives, the NMPB provides technical support, quality planting material, and facilitates market linkages for farmers.

- For instance, in Uttarakhand, a project was launched in the Hawalbagh block of Almora district to cultivate high-value medicinal plants like rosemary, chamomile, and kapoor kachri. With a budget of ₹43.22 lakh, the initiative aims to benefit 400 rural families and generate approximately 15,500 person-days of employment. This project not only promotes sustainable agriculture but also addresses issues like rural migration by providing stable income sources to farmers.

Restraints

Regulatory Oversight and Safety Concerns

Forskolin, derived from the root of Coleus forskohlii, has been promoted for various health benefits, including weight loss and improved cardiovascular health. However, its use is not without significant concerns, primarily due to inadequate regulatory oversight and potential safety risks.

In the United States, dietary supplements like forskolin are regulated under the Dietary Supplement Health and Education Act of 1994 (DSHEA). This legislation allows supplements to be marketed without prior approval from the Food and Drug Administration (FDA), provided they do not claim to treat or prevent diseases.

Consequently, manufacturers are responsible for ensuring the safety and labeling accuracy of their products. The FDA’s role is reactive; it can only intervene after a product has been marketed and adverse effects have been reported. This framework has led to concerns about the safety of supplements, as the FDA’s capacity to monitor and regulate the vast number of products on the market is limited.

Specific to forskolin, there have been instances where products containing this compound were marketed with unsubstantiated health claims. For example, the FDA issued warning letters to companies like Chambers’ Apothecary and Absonutrix for promoting forskolin-containing products with claims suggesting they could treat conditions such as high blood pressure and glaucoma without the necessary scientific evidence or FDA approval. These actions highlight the challenges in ensuring that consumers are not misled by unsupported health claims.

Moreover, forskolin is associated with several potential side effects. According to the National Institutes of Health, common adverse reactions include gastrointestinal issues like diarrhea, as well as cardiovascular effects such as low blood pressure and rapid heart rate. Individuals with certain health conditions, such as polycystic kidney disease, are advised to avoid forskolin due to the risk of exacerbating their condition. Additionally, forskolin may interact with medications like blood thinners and blood pressure drugs, leading to increased risks of bleeding or other complications.

Opportunity

Expanding Applications in Health and Wellness

Forskolin, a natural compound derived from the root of the Coleus forskohlii plant, is gaining attention for its potential health benefits. Traditionally used in Ayurvedic medicine, recent research and consumer trends are driving its integration into various health and wellness products.

In the realm of weight management, forskolin has been studied for its potential to promote fat loss and increase lean body mass. A study published in the journal Obesity found that overweight and obese men who took forskolin experienced a reduction in body fat percentage and an increase in lean body mass. These findings have led to the incorporation of forskolin into dietary supplements aimed at supporting healthy weight management.

Government initiatives and regulatory bodies are playing a crucial role in ensuring the safety and efficacy of forskolin-containing products. In the United States, the Food and Drug Administration (FDA) monitors dietary supplements to ensure they are safe and accurately labeled. While the FDA does not approve supplements before they reach the market, it can take action against products that are found to be unsafe or misbranded.

The skincare industry is also witnessing the incorporation of forskolin due to its potential anti-inflammatory and antioxidant properties. Forskolin is being used in formulations aimed at reducing cellulite and promoting smoother skin. The growing consumer preference for natural and plant-based ingredients in skincare products is driving this trend.

Regional Insights

The Forskolin market in Europe is poised for steady growth, holding a dominant share of 37.30%, valued at USD 183.6 million in 2024. This dominance is driven by increasing consumer demand for natural health supplements, particularly those targeting weight management, metabolic health, and overall wellness. European consumers are increasingly turning to plant-based solutions, with forskolin being recognized for its potential fat-burning and health benefits.

Countries such as Germany, the UK, and France are the key contributors to the region’s forskolin market. The UK, in particular, has seen a surge in the popularity of dietary supplements, and forskolin is being widely marketed for its effectiveness in weight management. Germany, with its robust pharmaceutical and nutraceutical industries, has contributed significantly to forskolin’s demand, especially in the context of fitness and wellness products. Additionally, France’s growing focus on natural and organic ingredients has boosted the acceptance of forskolin in the region.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Alchem International Ltd. is a leading manufacturer specializing in natural and synthetic active ingredients, including forskolin. They offer forskolin with varying concentrations, such as 10%, 20%, and 97%, catering to diverse applications in pharmaceuticals, nutraceuticals, and cosmetics. Their products are known for high purity levels, ensuring efficacy in weight management, skin health, and cardiovascular support. Alchem’s commitment to quality is reflected in their state-of-the-art manufacturing facilities and adherence to international standards.

Nutra Green Biotechnology is a prominent supplier of plant-based extracts, including forskolin derived from Coleus forskohlii. They provide forskolin extract with a 10% concentration, focusing on applications in dietary supplements and functional foods. The company emphasizes sustainability and eco-friendly practices in sourcing and production, aligning with the growing consumer demand for natural and responsibly sourced ingredients.

Glentham Life Sciences is a UK-based supplier of fine chemicals and biochemicals, offering forskolin (CAS 66575-29-9) with a purity of 98% by HPLC. Their product is utilized in research and development, particularly in studies related to cyclic AMP pathways and cellular signaling. Glentham’s commitment to quality is evident in their rigorous testing and adherence to safety standards, making them a trusted partner for scientific communities.

Top Key Players Outlook

- Alchem International Ltd.

- Nutra Green Biotechnology

- Glentham Life Sciences

- Flavour Trove

- Alpspure Lifesciences Pvt. Ltd.

- Bioprex Labs

- Natrol

- Sabinsa Corporation

- Jarrow Formulas

Recent Industry Developments

By 2024, Alchem’s revenue in related sectors, including textiles, is expected to reach USD 180 million, with a noticeable increase in demand for sustainable yarn alternatives.

As of 2024, Glentham Life Sciences is expected to generate an estimated USD 25 million in revenue, largely driven by their expertise in herbal and plant-based formulations.

Report Scope

Report Features Description Market Value (2024) USD 492.4 Mn Forecast Revenue (2034) USD 1165.7 Mn CAGR (2025-2034) 9.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Purity (Low, Medium, High), By Product Type (Root Extract, Leaf Extract, Seed Extract), By Form (Capsules, Tablets, Powder, Liquid Extract), By Application (Allergy Treatment, Weight Management, Respiratory Problems, Cardiovascular Disorders, Glaucoma, Hypothyroidism, Psoriasis, Others), By End-use (Dietary Supplements, Food And Beverages, Cosmetics, Pharmaceuticals, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Alchem International Ltd, Nutra Green Biotechnology, Glentham Life Sciences, Flavour Trove, Alpspure Lifesciences Pvt. Ltd., Bioprex Labs, Natrol, Sabinsa Corporation, Jarrow Formulas Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Alchem International Ltd.

- Nutra Green Biotechnology

- Glentham Life Sciences

- Flavour Trove

- Alpspure Lifesciences Pvt. Ltd.

- Bioprex Labs

- Natrol

- Sabinsa Corporation

- Jarrow Formulas