Global Food Cans Market Size, Share, And Business Benefits By Material (Steel, Aluminum, Tinplate, Plastics, Glass), By Can Type (Two-Piece, Three-Piece, Composite Cans), By Application (Fish and Seafood, Ready Meals, Powder Products, Fruits and Vegetables, Processed Food, Pet Food, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: August 2025

- Report ID: 155405

- Number of Pages: 282

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

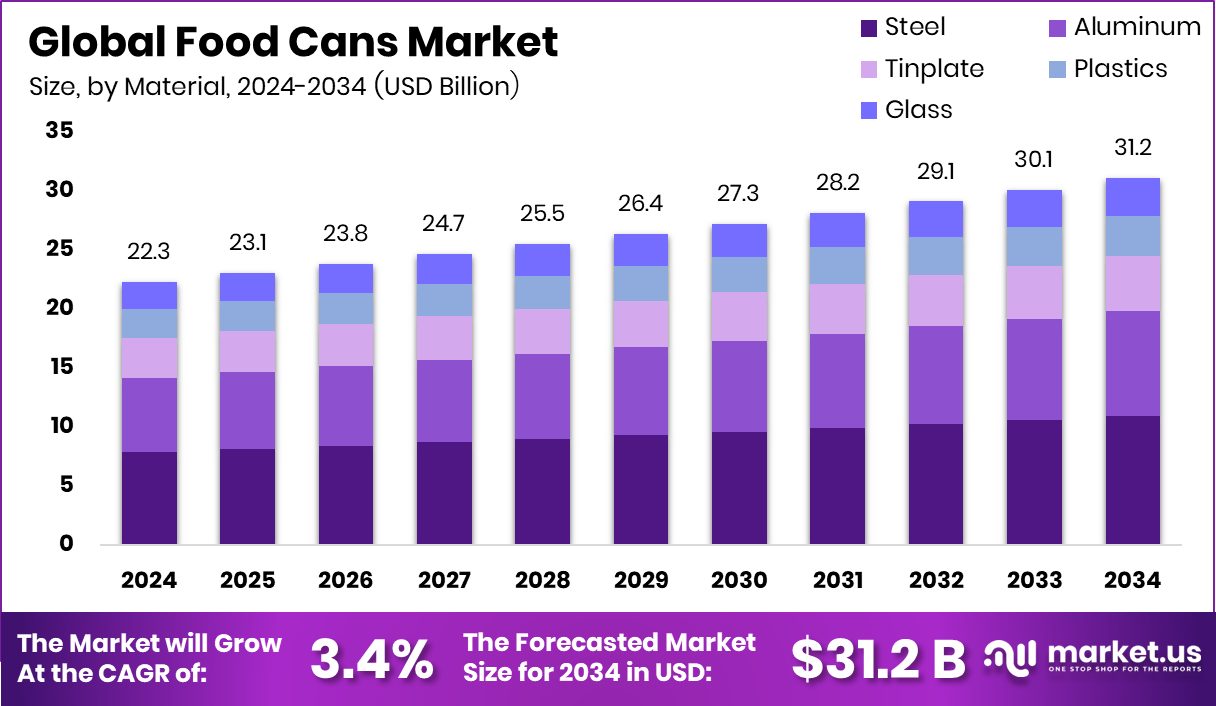

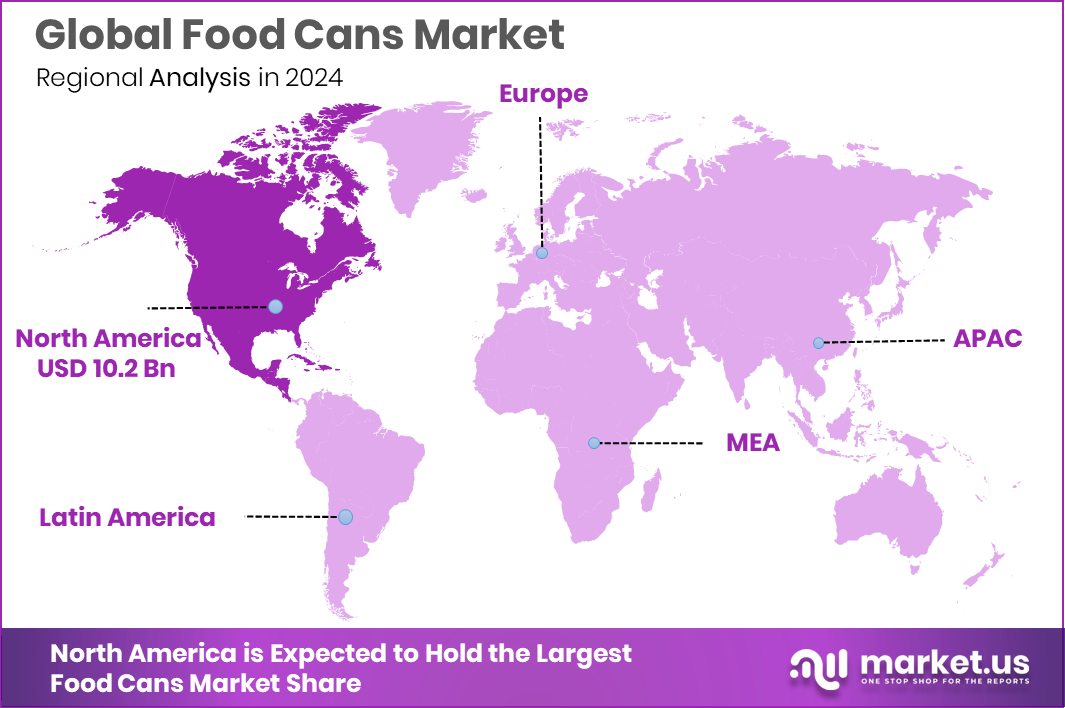

The Global Food Cans Market is expected to be worth around USD 31.2 billion by 2034, up from USD 22.3 billion in 2024, and is projected to grow at a CAGR of 3.4% from 2025 to 2034. Recycling initiatives supported North America’s 45.90%, USD 10.2 Bn market.

Food cans are sealed containers, typically made from tin-plated steel or aluminum, designed to preserve food by preventing contamination and extending shelf life. They are widely used for storing fruits, vegetables, meats, seafood, soups, and ready-to-eat meals. Their durability, ability to withstand transportation, and compatibility with high-heat sterilization make them a reliable packaging choice for both perishable and non-perishable food items.

The food cans market refers to the global trade, production, and consumption of canned food packaging across different segments such as beverages, meat products, fruits, vegetables, and pet food. It covers the supply chain from raw material sourcing to manufacturing, distribution, and retail, serving industries that require safe, long-lasting, and convenient food storage solutions.

The market is expanding due to rising urbanization, busy lifestyles, and the demand for convenient, ready-to-eat food products. Increased awareness about food safety and the recyclability of metal packaging also plays a key role in driving adoption. According to an industry report, Ready, Set, Food secured $3 million in funding, with the round led by the venture capital arm of Danone.

Higher consumption of processed and packaged food, especially in emerging economies, is boosting demand. Changing dietary habits and the growth of e-commerce grocery deliveries are further supporting market penetration. According to an industry report, Agricool obtained an additional $28 million to expand its container-based fruit cultivation operations.

Key Takeaways

- The Global Food Cans Market is expected to be worth around USD 31.2 billion by 2034, up from USD 22.3 billion in 2024, and is projected to grow at a CAGR of 3.4% from 2025 to 2034.

- Steel holds a 56.8% share in the Food Cans Market, driven by durability and effective preservation qualities.

- Two-piece cans dominate the Food Cans Market with a 67.3% share, offering superior strength and efficient manufacturing.

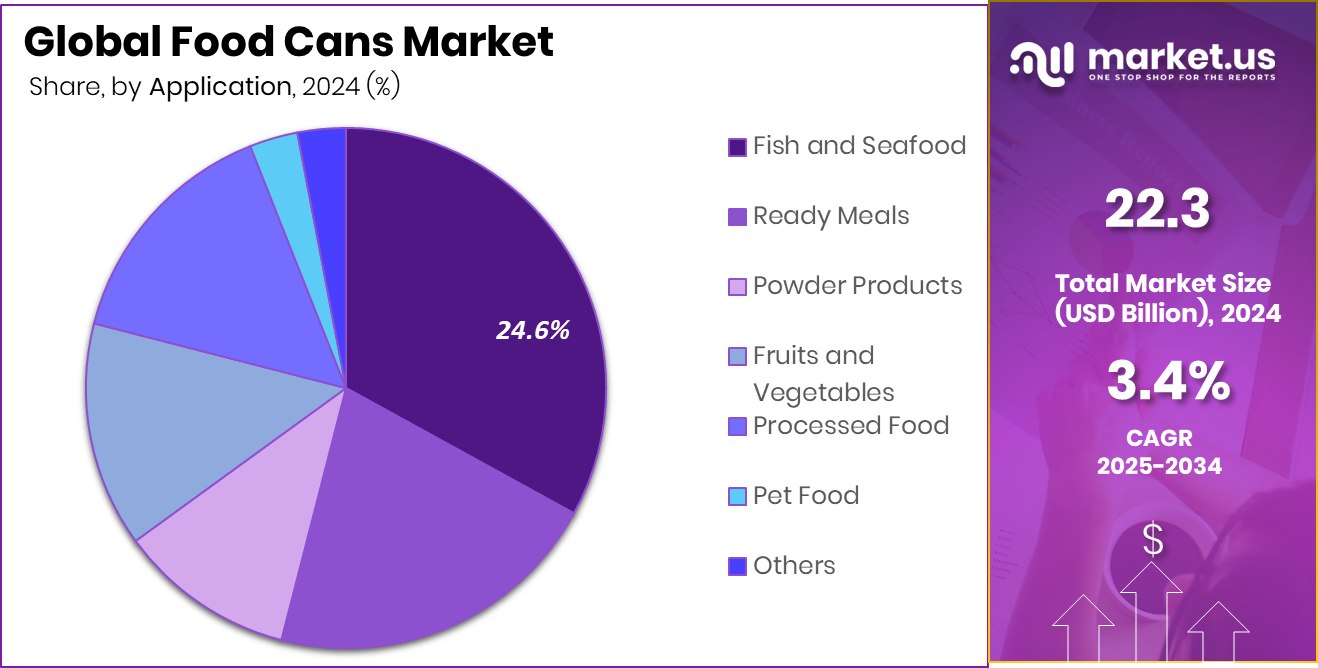

- Fish and seafood lead the Food Cans Market applications, capturing 24.6% share due to extended freshness benefits.

- Strong demand for packaged meals boosted North America by 45.90%, USD 10.2 Bn.

By Material Analysis

Steel holds a 56.8% share in the global food can market.

In 2024, Steel held a dominant market position in the By Material segment of the Food Cans Market, with a 56.8% share. This leadership is largely due to steel’s exceptional strength, barrier protection, and cost-effectiveness in preserving a wide range of food products. Its robust structure provides high resistance to external impacts during transportation and storage, making it a preferred choice for packaging fruits, vegetables, soups, and pet food. The material’s ability to withstand high-temperature sterilization processes ensures food safety and long shelf life without compromising nutritional value.

The recyclability of steel is another critical factor driving its adoption, aligning with growing environmental regulations and consumer preference for sustainable packaging. Unlike some alternative materials, steel can be infinitely recycled without loss of quality, reducing dependence on virgin raw materials. In regions with strong recycling infrastructure, such as North America and Europe, this eco-friendly attribute significantly boosts its market presence.

Additionally, technological improvements in can manufacturing have led to lighter yet stronger steel cans, lowering production and transportation costs. With rising demand for shelf-stable food products in both developed and emerging economies, steel’s durability, safety, and sustainability are expected to maintain its competitive edge in the food cans market over the coming years.

By Can Type Analysis

Two-piece cans dominate with a 67.3% share in the food can market.

In 2024, Two-Piece held a dominant market position in the By Can Type segment of the Food Cans Market, with a 56.8% share. This strong market lead is attributed to the manufacturing efficiency, seamless design, and superior sealing integrity of two-piece cans.

Produced from a single sheet of metal through a drawing and ironing process, these cans eliminate the need for side seams, reducing leakage risks and enhancing food safety. Their structure offers high durability and resistance to dents, making them ideal for packaging ready-to-eat meals, soups, vegetables, and pet food that require long shelf life and protection from contamination.

The two-piece design also supports advanced printing and labeling options, allowing for high-quality graphics that improve shelf appeal in competitive retail environments. Lightweight construction reduces material usage and transportation costs, while maintaining strength and product integrity. Additionally, two-piece cans are well-suited for high-speed automated filling lines, enabling large-scale food processors to improve operational efficiency.

Growing demand for convenient, packaged food in both developed and emerging markets further supports their dominance. With the combination of cost efficiency, sustainability through recyclability, and strong consumer trust in canned food safety, the two-piece format is expected to retain its leadership in the food cans market in the coming years.

By Application Analysis

Fish and seafood lead applications with 24.6% of the food cans market.

In 2024, Fish and Seafood held a dominant market position in the By Application segment of the Food Cans Market, with a 24.6% share. This strong position is driven by the high global demand for preserved marine products, which offer convenience, long shelf life, and year-round availability regardless of fishing seasons.

Canned fish and seafood, including tuna, sardines, salmon, and shellfish, remain staple protein sources in many diets, particularly in regions where fresh seafood is less accessible or more expensive. The canning process effectively locks in nutrients, flavor, and freshness while ensuring safety through high-heat sterilization, making it a trusted option among consumers.

Rising health awareness and the recognition of fish as a rich source of omega-3 fatty acids have further boosted consumption. Additionally, the portability and easy storage of canned seafood make it a preferred choice for quick meals, emergency food reserves, and on-the-go consumption. The segment also benefits from the growing popularity of ready-to-eat seafood-based meals and snack packs.

With advancements in can design, lightweight packaging, and attractive labeling, coupled with expanding distribution through supermarkets and e-commerce, the fish and seafood application is expected to maintain its strong market presence, catering to both developed and emerging economies in the coming years.

Key Market Segments

By Material

- Steel

- Aluminum

- Tinplate

- Plastics

- Glass

By Can Type

- Two-Piece

- Three-Piece

- Composite Cans

By Application

- Fish and Seafood

- Ready Meals

- Powder Products

- Fruits and Vegetables

- Processed Food

- Pet Food

- Others

Driving Factors

Rising Demand for Convenient and Long-Lasting Food

One of the biggest driving factors for the food cans market is the growing demand for convenient and long-lasting food options. Busy lifestyles, urbanization, and the need for quick meal solutions are pushing more consumers toward packaged and ready-to-eat food. Food cans offer a long shelf life without the need for refrigeration, making them ideal for storage and transportation.

They protect food from contamination, preserve nutritional value, and maintain taste for months or even years. This reliability appeals to both households and institutions such as schools, hospitals, and the military. As global food consumption shifts toward packaged formats, the ability of cans to deliver safety, convenience, and durability continues to fuel steady market growth across various regions.

Restraining Factors

High Production Costs Compared to Alternative Packaging

A key restraining factor for the food cans market is the relatively high production cost when compared to certain alternative packaging materials like flexible pouches or plastic containers. Manufacturing food cans requires high-quality metals such as steel or aluminum, along with energy-intensive processes like molding, sterilization, and printing. Fluctuations in raw material prices, especially in the metals market, can significantly impact production expenses.

Additionally, the transportation of metal cans is costlier due to their weight compared to lighter packaging options. For price-sensitive markets and low-margin food products, this cost difference can make alternatives more attractive. As competition from cost-efficient packaging grows, manufacturers in the food cans sector face pressure to improve efficiency and reduce production costs to maintain competitiveness.

Growth Opportunity

Expanding Demand for Sustainable and Recyclable Packaging

A major growth opportunity for the food cans market lies in the rising global shift toward sustainable and eco-friendly packaging solutions. Governments, retailers, and consumers are increasingly prioritizing packaging that reduces environmental impact, and metal cans fit this need perfectly as they are 100% recyclable without losing quality. With growing restrictions on single-use plastics and heightened awareness of waste management, food cans are gaining more acceptance as a greener choice.

This opens the door for market expansion, especially in regions investing in advanced recycling infrastructure. By promoting the environmental benefits of metal cans and adopting lightweight, resource-efficient designs, manufacturers can tap into a large segment of eco-conscious consumers, driving future growth and strengthening market presence worldwide.

Latest Trends

Lightweight Can Designs for Cost and Efficiency

One of the latest trends shaping the food cans market is the shift toward lightweight can designs. Manufacturers are focusing on reducing the amount of metal used without compromising strength or durability. This not only lowers raw material costs but also reduces transportation weight, helping to cut shipping expenses and lower carbon emissions.

Advanced manufacturing techniques and improved alloy compositions are making it possible to produce thinner yet stronger cans that still meet safety and shelf-life standards. Lightweight designs also align with sustainability goals, as they use fewer resources and are easier to recycle. This trend is expected to gain momentum as companies look for ways to improve efficiency, reduce costs, and meet environmental regulations.

Regional Analysis

In 2024, North America held 45.90%, USD 10.2 Bn.

In 2024, North America dominated the global Food Cans Market, capturing a 45.90% share valued at USD 10.2 billion. This leadership is driven by the region’s high consumption of packaged and processed foods, strong retail infrastructure, and widespread adoption of sustainable packaging solutions.

The demand is further supported by well-established recycling systems, with metal packaging achieving some of the highest recovery rates globally. Consumers in the U.S. and Canada show strong preference for canned goods due to their long shelf life, safety, and convenience, aligning with busy lifestyles and the growing popularity of ready-to-eat meals.

Europe follows closely, supported by strict food safety regulations, sustainability-focused policies, and high demand for eco-friendly packaging. Asia Pacific is emerging as a rapidly growing market, fueled by urbanization, rising disposable incomes, and expanding retail channels. The Middle East & Africa and Latin America are showing steady growth, driven by increasing adoption of packaged food in urban areas and improvements in supply chain infrastructure.

While these regions present strong potential, North America’s combination of advanced manufacturing, efficient distribution, and consumer trust in canned products positions it as the market leader, and it is expected to maintain a significant share over the forecast period.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Ardagh Group continued to strengthen its position with advanced manufacturing technologies and lightweight can designs, focusing on reducing material use while maintaining durability. Their emphasis on fully recyclable metal packaging aligned well with the growing demand for eco-friendly solutions.

Ball Corporation maintained its strong presence by expanding production capabilities and enhancing can designs to improve food safety, shelf life, and visual appeal. The company’s commitment to lowering carbon emissions in manufacturing further positioned it as a preferred supplier for environmentally conscious brands.

CAN-PACK S.A. capitalized on its global footprint and flexible production lines, offering customized can sizes and decorative finishes that appeal to diverse markets. Their investments in high-speed production technology enabled faster turnaround times, meeting the increasing needs of food processors worldwide.

Del Monte Foods, as a major food brand and canner, played a critical role in driving demand for food cans through its extensive product portfolio in fruits, vegetables, and ready-to-eat meals. By focusing on convenient, nutrient-rich, and long-shelf-life products, Del Monte reinforced the relevance of canned foods in modern diets.

Top Key Players in the Market

- Ardagh Group

- Ball Corporation

- CAN-PACK S.A.

- Dell Monte Foods

- Dole plc

- Kaira Cans

- Kian Joo Group

- Kraft Heinz

- Silgan Holdings

- Nampak

- Sonoco Products Company

- Trivium Packaging

Recent Developments

- In February 2025, Ball acquired Florida Can Manufacturing, a beverage-can producer based in Winter Haven, Florida, for about $160 million. Simultaneously, the company announced plans to build a new two-line can production plant in Oregon to meet growing regional demand.

- In April 2024, Ardagh Glass Packaging‑Europe (AGP‑Europe) agreed to acquire Svensk Glasåtervinning (SGÅ), Sweden’s leading glass recycling firm. This move ensures a dependable supply of high-quality recycled glass for their packaging operations, strengthening their sustainability efforts by keeping glass recycling within Sweden rather than exporting it.

Report Scope

Report Features Description Market Value (2024) USD 22.3 Billion Forecast Revenue (2034) USD 31.2 Billion CAGR (2025-2034) 3.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material (Steel, Aluminum, Tinplate, Plastics, Glass), By Can Type (Two-Piece, Three-Piece, Composite Cans), By Application (Fish and Seafood, Ready Meals, Powder Products, Fruits and Vegetables, Processed Food, Pet Food, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Ardagh Group, Ball Corporation, CAN-PACK S.A., Dell Monte Foods, Dole plc, Kaira Cans, Kian Joo Group, Kraft Heinz, Silgan Holdings, Nampak, Sonoco Products Company, Trivium Packaging Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Ardagh Group

- Ball Corporation

- CAN-PACK S.A.

- Dell Monte Foods

- Dole plc

- Kaira Cans

- Kian Joo Group

- Kraft Heinz

- Silgan Holdings

- Nampak

- Sonoco Products Company

- Trivium Packaging