Global Foam Insulation Market Size, Share, And Business Benefits By Form (Spray, Flexible, Rigid), By Product (Polyurethane Foam, Polystyrene Foam, Polyolefin Foam, Phenolic Foam, Elastomeric Foam, Others), By End Use (Building and Construction, Automotive and Transportation, Electricals and Electronics, Packaging, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: September 2025

- Report ID: 160100

- Number of Pages: 369

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

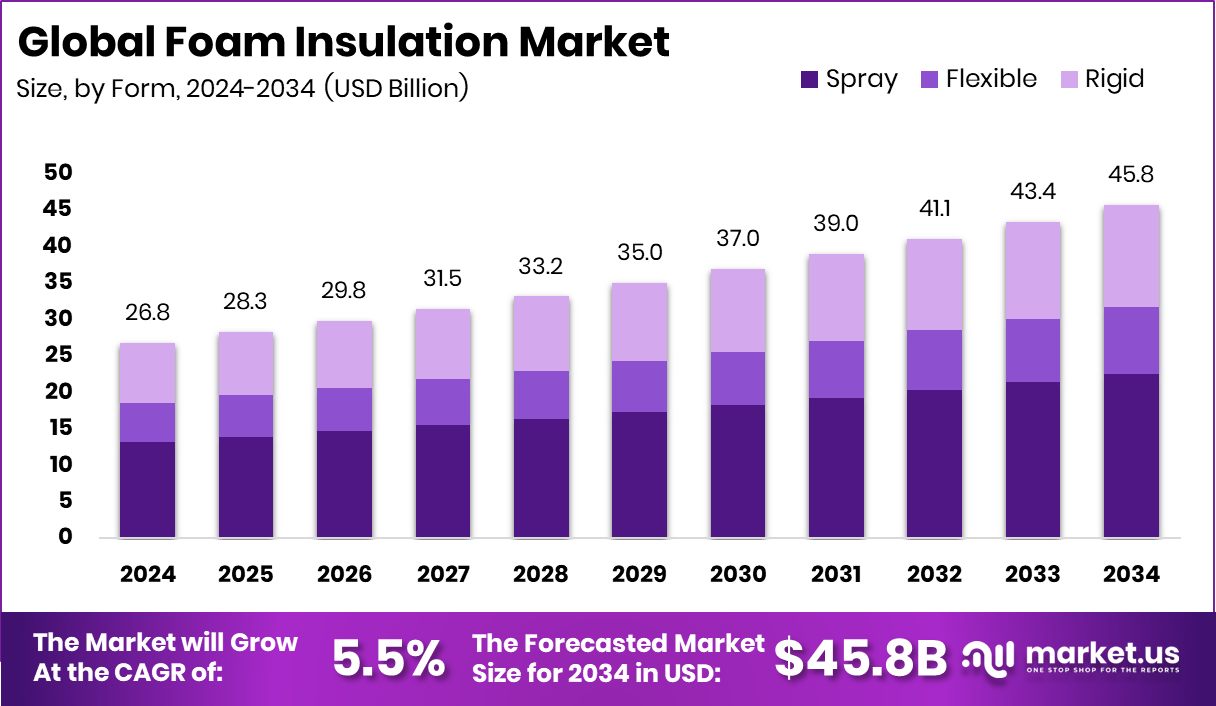

The Global Foam Insulation Market is expected to be worth around USD 45.8 billion by 2034, up from USD 26.8 billion in 2024, and is projected to grow at a CAGR of 5.5% from 2025 to 2034. The Foam Insulation Market value reached USD 12.2 Bn, highlighting strong dominance.

Foam insulation is a material used to reduce heat transfer and improve energy efficiency in buildings. It is commonly applied in walls, roofs, and floors to prevent air leakage and maintain indoor comfort. Unlike traditional insulation, foam expands to fill gaps and crevices, creating an effective barrier against heat, cold, and noise. Its versatility and durability have made it a popular choice in both residential and commercial construction.

The foam insulation market is gaining momentum as energy conservation becomes a global priority. Rising awareness of sustainable living and stricter building codes are pushing the demand for high-performance insulation materials. Bio-based polyurethane company secures $5 million in funding, highlighting investor confidence in eco-friendly alternatives, which further strengthens the market outlook.

Increasing urbanization, higher energy bills, and government policies promoting energy efficiency are strong growth drivers. People are more inclined toward solutions that reduce long-term energy costs, and foam insulation offers significant savings over time.

Growing construction activity, particularly in developing regions, is fueling demand. Renovation projects are also on the rise, with homeowners seeking better insulation for comfort and cost efficiency. Sheela Foam raises ₹1,200 cr via QIP; stock jumps 4%, reflecting how the sector continues to attract capital amid strong consumer interest.

A major opportunity lies in the development of bio-based and recyclable foam insulation products. With rising environmental concerns, companies investing in greener technologies stand to gain a competitive edge while meeting regulatory expectations and consumer demand for sustainable products.

Key Takeaways

- The Global Foam Insulation Market is expected to be worth around USD 45.8 billion by 2034, up from USD 26.8 billion in 2024, and is projected to grow at a CAGR of 5.5% from 2025 to 2034.

- By Form, spray foam dominates with 49.4%, offering excellent air sealing and energy efficiency.

- By Product, polyurethane foam leads with 38.3%, favored for durability, insulation strength, and versatile applications.

- By End Use, building and construction accounts for 45.8%, driven by rising housing and infrastructure projects.

- Asia Pacific’s growth reflects rising construction activity and demand for energy efficiency.

By Form Analysis

Spray foam holds a 49.4% share, showcasing its superior sealing ability.

In 2024, Spray held a dominant market position in the By Form segment of the Foam Insulation Market, with a 49.4% share. The strong adoption of spray foam insulation is driven by its ability to expand and seal even the smallest gaps, ensuring superior energy efficiency compared to many other forms.

Its ease of application in both new construction and renovation projects has further contributed to its leadership. The growing focus on reducing energy consumption in residential and commercial spaces has made spray foam the preferred choice among builders and homeowners. With its versatile usage and long-term cost benefits, spray foam continues to reinforce its leading role in the market’s growth trajectory.

By Product Analysis

Polyurethane foam dominates with 38.3%, valued for durability and energy savings.

In 2024, Polyurethane Foam held a dominant market position in the By Product segment of the Foam Insulation Market, with a 38.3% share. Its strong presence is linked to its excellent thermal resistance, lightweight nature, and ability to provide an airtight seal, which makes it highly effective in improving building energy efficiency.

Widely used in residential, commercial, and industrial applications, polyurethane foam has become a preferred choice where performance and durability are critical. Its adaptability to various construction needs has further strengthened its position. The continued focus on energy conservation and sustainable building practices has reinforced the demand for polyurethane foam, supporting its leading share in the product landscape of foam insulation.

By End Use Analysis

Building and construction lead with 45.8%, driven by efficiency-focused infrastructure projects.

In 2024, Building and Construction held a dominant market position in the By End Use segment of the Foam Insulation Market, with a 45.8% share. The sector’s leadership is supported by the rising demand for energy-efficient buildings and stricter building regulations aimed at reducing energy consumption.

Foam insulation is widely used in walls, roofs, and flooring within construction projects to improve thermal performance and lower utility costs. The growing pace of urbanization and infrastructure development has further boosted its adoption in both residential and commercial spaces. With builders and homeowners seeking long-term savings and comfort, foam insulation has firmly established itself as a key material in the building and construction landscape.

Key Market Segments

By Form

- Spray

- Flexible

- Rigid

By Product

- Polyurethane Foam

- Polystyrene Foam

- Polyolefin Foam

- Phenolic Foam

- Elastomeric Foam

- Others

By End Use

- Building and Construction

- Automotive and Transportation

- Electricals and Electronics

- Packaging

- Others

Driving Factors

Rising Energy Efficiency Needs Driving Market Growth

One of the biggest factors pushing the foam insulation market forward is the rising need for energy efficiency in homes, offices, and industries. As energy costs climb and people become more aware of climate change, there is a strong demand for materials that can cut energy use and lower bills. Foam insulation stands out because it seals gaps effectively, reduces heat loss, and keeps buildings comfortable all year round.

Governments are also promoting stricter building standards that encourage the use of advanced insulation materials. Alongside this, investments are flowing into sustainable solutions, creating new opportunities. Circular Plastics Netherlands invests €35.5 million to drive innovation in plastics recycling, showing how funding in eco-friendly projects supports long-term market growth.

Restraining Factors

High Installation Costs Limit Wider Market Adoption

A key restraining factor for the foam insulation market is its high installation cost compared to traditional insulation materials. While foam insulation offers strong benefits like better energy savings and durability, the upfront expense often discourages homeowners and small builders. The need for professional application and specialized equipment also adds to the overall cost, making it less affordable for budget-sensitive projects.

In developing regions, where price plays a major role in decision-making, this cost barrier slows down adoption despite the long-term savings it provides. Until installation becomes more affordable or subsidies are introduced, the higher cost will continue to limit the wider use of foam insulation in many markets.

Growth Opportunity

Expanding Demand for Eco-Friendly Insulation Solutions

A major growth opportunity for the foam insulation market lies in the rising demand for eco-friendly and sustainable materials. As consumers and industries focus on reducing carbon footprints, there is a strong interest in insulation made from renewable or recyclable sources. Foam insulation manufacturers are increasingly exploring bio-based and recyclable options that meet both performance and environmental standards.

This shift aligns with global policies encouraging green building practices and sustainable construction. The move toward circular economies also creates fresh prospects for innovation in foam products. Recently, plastic recycling innovation received $3m funding boost, highlighting how investments in sustainable technologies can accelerate the development of greener insulation materials and open new growth avenues for the market.

Latest Trends

Growing Focus on Recycling and Sustainable Materials

One of the latest trends in the foam insulation market is the strong focus on recycling and using sustainable materials. With increasing environmental concerns, companies are working on developing insulation products that not only save energy but are also easier to recycle or made from recycled plastics. This trend is gaining support as governments and industries encourage greener construction practices.

Innovations in material science are helping foam insulation become both high-performing and environmentally friendly. A recent example is that the UH research team was awarded $4M to convert plastic waste into useful materials, showing how research funding is pushing the industry toward more sustainable solutions and shaping the future of foam insulation products.

Regional Analysis

In 2024, the Asia Pacific held a 45.80% share of the Foam Insulation Market.

The Foam Insulation Market shows a diverse regional distribution, with Asia Pacific emerging as the dominant region in 2024. Holding a significant 45.80% share and valued at USD 12.2 Bn, Asia Pacific leads the market, supported by rapid urbanization, rising infrastructure projects, and growing demand for energy-efficient building materials. This dominance reflects the region’s strong construction sector and increasing focus on sustainable housing.

North America continues to remain an important market due to the widespread adoption of advanced insulation technologies and energy conservation practices across residential and commercial spaces.

Europe follows with steady demand, driven by strict regulatory standards on energy efficiency and sustainability goals across the construction industry. The Middle East & Africa region demonstrates gradual adoption, largely driven by infrastructure investments and the need to manage extreme climatic conditions.

Latin America also contributes steadily, with expanding construction activity and a growing awareness of long-term energy savings. Among all, Asia Pacific stands out as the clear leader, both in market share and value, showcasing its central role in shaping future trends of the Foam Insulation Market and setting benchmarks for other regions to follow.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The Air Barrier Association of America has been instrumental in promoting building practices that focus on air tightness and energy efficiency. By advocating for the use of foam insulation in achieving effective air barriers, the association strengthens market confidence and drives adoption across construction projects, particularly where energy conservation is prioritized.

Armacell International, a recognized innovator in flexible foam products, continues to expand the use of foam insulation in both building and industrial applications. Its solutions focus on thermal efficiency, lightweight materials, and adaptability to diverse climates, making foam insulation more practical and appealing across multiple regions. The company’s expertise in technical foams and insulation systems adds considerable value to the market by bridging performance and sustainability.

Meanwhile, BASF plays a critical role through its advancements in chemical solutions, particularly in polyurethane foams. The company’s focus on developing high-performance, durable, and energy-saving foam insulation materials contributes significantly to the industry’s growth. With an emphasis on sustainable chemistry, BASF reinforces the long-term relevance of foam insulation in global construction.

Top Key Players in the Market

- Air Barrier Association of America

- Armacell International

- BASF

- Carlisle Companies

- Covestro

- Dow Chemical

- Huntsman Building Materials

- Johns Manville

- Kingspan Group

Recent Developments

- In September 2024, Armacell also launched ArmaFlex ECO550 adhesives, meant to improve bonding for ArmaFlex insulation; the new adhesives require only one-third the quantity compared to conventional ones and are more user-friendly and eco-friendly.

- In January 2024, BASF entered a collaboration with Carlisle Construction Materials to explore InsulBase/VersiCore polyisocyanurate insulation boards using Lupranate ZERO, a zero-carbon footprint isocyanate (MDI) variant.

Report Scope

Report Features Description Market Value (2024) USD 26.8 Billion Forecast Revenue (2034) USD 45.8 Billion CAGR (2025-2034) 5.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Spray, Flexible, Rigid), By Product (Polyurethane Foam, Polystyrene Foam, Polyolefin Foam, Phenolic Foam, Elastomeric Foam, Others), By End Use (Building and Construction, Automotive and Transportation, Electricals and Electronics, Packaging, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Air Barrier Association of America, Armacell International, BASF, Carlisle Companies, Covestro, Dow Chemical, Huntsman Building Materials, Johns Manville, Kingspan Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Foam Insulation MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample

Foam Insulation MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Air Barrier Association of America

- Armacell International

- BASF

- Carlisle Companies

- Covestro

- Dow Chemical

- Huntsman Building Materials

- Johns Manville

- Kingspan Group