Global Fluoropolymers Market Size, Share Analysis Report By Product (PTFE, PVDF, FEP, Fluoroelastomers, Others), By Form (Resins And Compounds, Films And Sheets, Coatings And Linings, Wire And Cable Insulation, Membranes), By Application (Industrial And Machinery, Automotive, Electric And Electronics, Construction, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 161709

- Number of Pages: 314

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

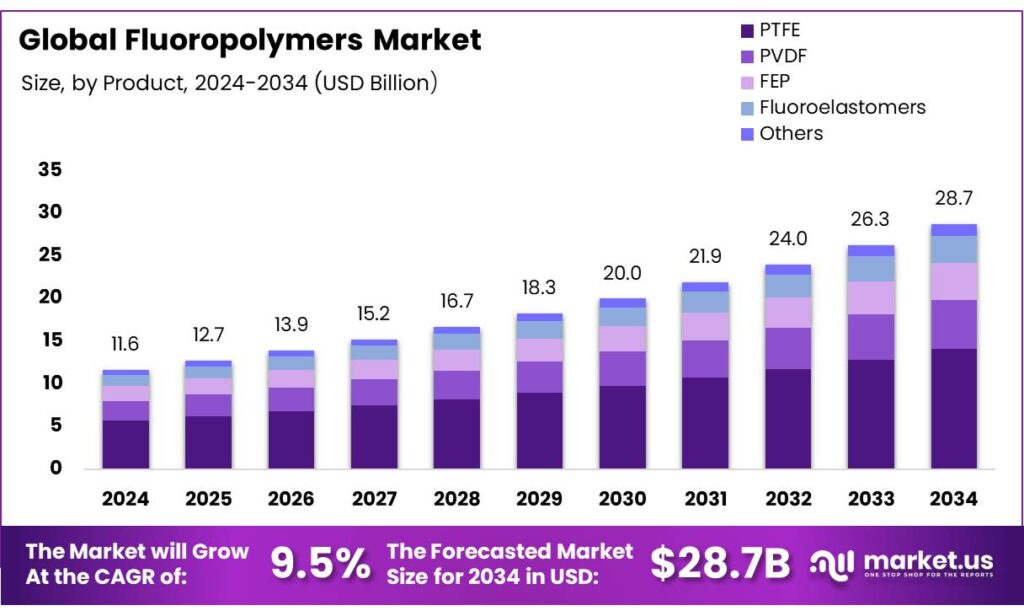

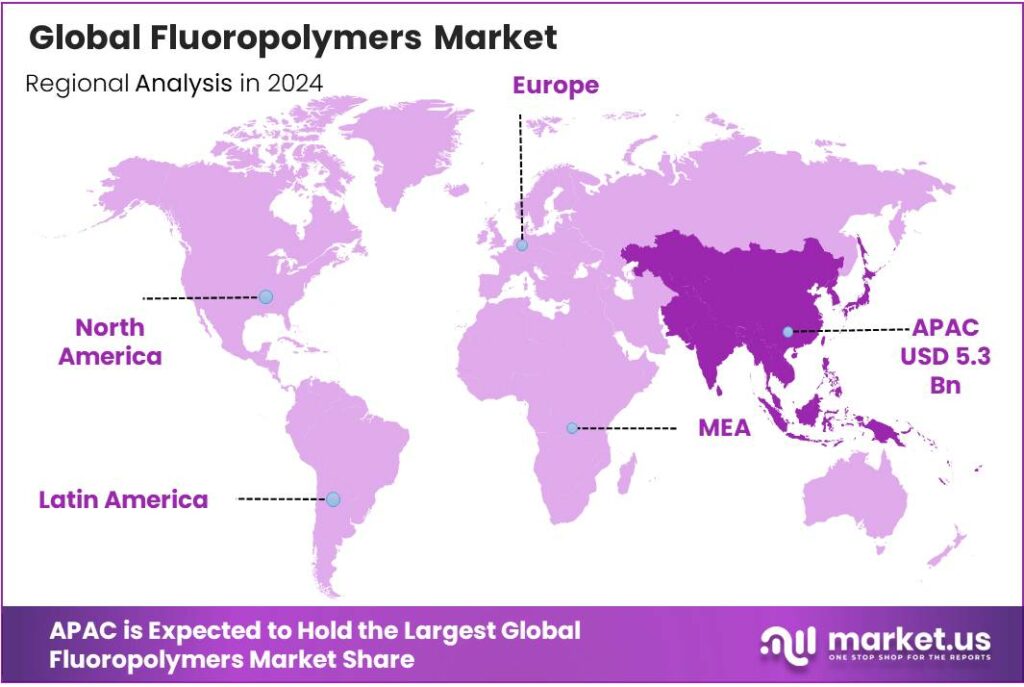

The Global Fluoropolymers Market size is expected to be worth around USD 28.7 Billion by 2034, from USD 11.6 Billion in 2024, growing at a CAGR of 9.5% during the forecast period from 2025 to 2034. In 2024 Asia Pacific held a dominant market position, capturing more than a 45.8% share, holding USD 5.3 Billion in revenue.

Fluoropolymers—such as PTFE, PVDF, FEP and ETFE—sit at the high-performance end of engineering plastics, where low surface energy, exceptional chemical resistance, and wide operating temperatures make them indispensable in corrosive processing, high-voltage insulation, and clean-energy systems. Their role is widening as electrification and hydrogen scale.

In 2024 the world added a record 582 GW of renewable power capacity, lifting cumulative installs to 4,443 GW; this expansion multiplies demand for fluoropolymer-insulated cables, backsheets/coatings, and chemical-resistant balance-of-plant components across solar and wind projects.

The industrial backdrop is being reshaped by three policy currents. First, the hydrogen build-out: the IEA reports installed water-electrolyser capacity rose from 1.4 GW (end-2023) and could reach ~5 GW by end-2024, with announced pipelines pointing to ~520 GW by 2030 (albeit only ~4% at FID/under construction today). Fluoropolymers are integral in PEM electrolyser membranes, seals, and piping that must withstand hot, acidic environments. Second, governments are underwriting hubs and equipment.

In the United States, DOE’s program provides up to $1 billion in demand-side support for Regional Clean Hydrogen Hubs, while initial tranches include $22 million for the Gulf Coast hub and $30 million for the Appalachian ARCH2 hub—funding that flows into fluoropolymer-rich electrolyser, storage, and transport hardware.

Demand catalysts are visible across electrified transport and grids. The IEA’s Global EV Outlook notes >17 million electric cars sold in 2024, surpassing a 20% global sales share—each vehicle embedding PVDF binders and fluoropolymer gaskets, films, and high-voltage harness insulation. As EV fleets expand, chemical resistance to electrolytes and thermal stability at pack level keep fluoropolymers on spec sheets despite cost pressure.

Policy is reinforcing commercialization and domesticating supply chains that rely on fluoropolymer performance. DOE’s Hydrogen Program Plan (2024) projects U.S. hydrogen feedstocks could represent an $80–$150 billion domestic market by 2050, and reports >1 GW in annual fuel-cell shipments—applications where chemically inert fluoropolymers enable membranes, gaskets, and thermal-management components.

Key Takeaways

- Fluoropolymers Market size is expected to be worth around USD 28.7 Billion by 2034, from USD 11.6 Billion in 2024, growing at a CAGR of 9.5%.

- PTFE held a dominant market position, capturing more than a 38.4% share of the global fluoropolymers market.

- Resins & Compounds held a dominant market position, capturing more than a 43.6% share of the global fluoropolymers market.

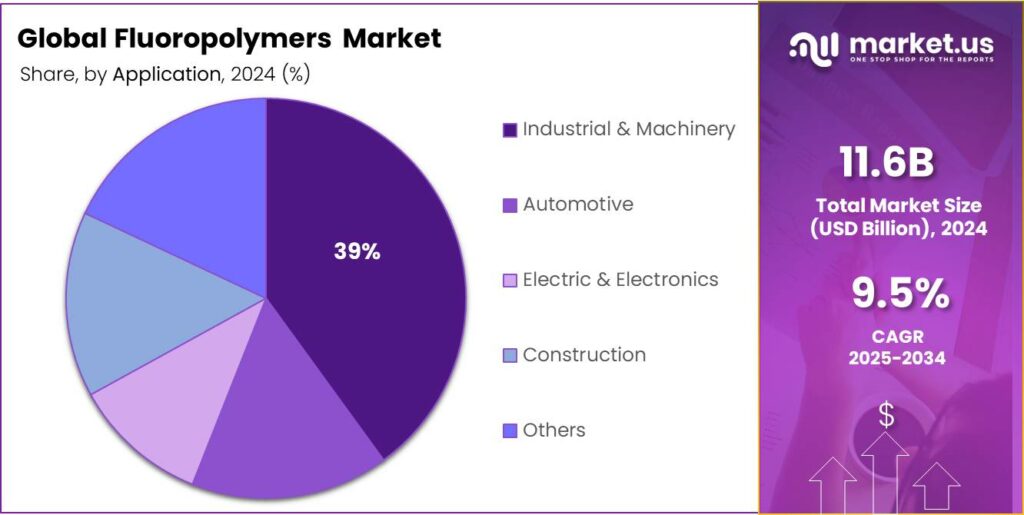

- Industrial & Machinery held a dominant market position, capturing more than a 39.5% share of the global fluoropolymers market.

- Asia Pacific (APAC) region emerged as the dominant market for fluoropolymers, capturing a substantial 45.8% share of the global market, valued at approximately USD 5.3 billion.

By Product Analysis

PTFE dominates Fluoropolymers Market with 38.4% share in 2024

In 2024, PTFE held a dominant market position, capturing more than a 38.4% share of the global fluoropolymers market. The material’s exceptional chemical resistance, high thermal stability, and low friction properties have made it a preferred choice across multiple industries. PTFE finds extensive application in the automotive sector for seals, gaskets, and fuel system components, where high performance under extreme conditions is required.

In the electronics and semiconductor industries, PTFE is valued for its insulating properties and ability to withstand aggressive chemical environments, supporting critical manufacturing processes. Over the year, the demand for PTFE grew steadily, driven by the rising adoption of electric vehicles and increased industrial use in Asia Pacific and North America. Its combination of durability, chemical inertness, and versatility continues to reinforce its leadership in the fluoropolymers market.

By Form Analysis

Resins & Compounds lead Fluoropolymers Market with 43.6% share in 2024

In 2024, Resins & Compounds held a dominant market position, capturing more than a 43.6% share of the global fluoropolymers market. Their widespread use is attributed to excellent processability, high chemical resistance, and thermal stability, making them suitable for a variety of industrial applications. In the automotive sector, these forms are extensively used for molded parts, gaskets, and coatings that must withstand harsh environments.

In electronics and electrical industries, resins and compounds provide reliable insulation and durability for critical components. Over 2024, the demand for Resins & Compounds increased steadily, particularly in Asia Pacific and North America, as industries sought materials that combine performance with adaptability in manufacturing. Their versatile nature continues to make Resins & Compounds a central driver of growth within the fluoropolymers segment.

By Application Analysis

Industrial & Machinery lead Fluoropolymers Market with 39.5% share in 2024

In 2024, Industrial & Machinery held a dominant market position, capturing more than a 39.5% share of the global fluoropolymers market. The segment’s growth is driven by the high demand for materials that offer exceptional chemical resistance, thermal stability, and durability under extreme operating conditions. Fluoropolymers are widely used in industrial equipment, pumps, valves, and machinery components, where reliability and long service life are critical.

In manufacturing plants, these materials help reduce maintenance costs and enhance operational efficiency by providing resistance to corrosion and wear. Over 2024, Industrial & Machinery applications continued to expand steadily, especially in regions with strong industrial growth such as Asia Pacific and North America, reinforcing their position as the leading application segment in the fluoropolymers market.

Key Market Segments

By Product

- PTFE

- PVDF

- FEP

- Fluoroelastomers

- Others

By Form

- Resins & Compounds

- Films & Sheets

- Coatings & Linings

- Wire & Cable Insulation

- Membranes

By Application

- Industrial & Machinery

- Automotive

- Electric & Electronics

- Construction

- Others

Emerging Trends

Hygienic, high-purity food lines are pulling fluoropolymers into the mainstream

Food and beverage producers are rebuilding lines around hygiene, faster changeovers, and fewer contamination risks. That is driving a quiet but strong shift toward fluoropolymers—PTFE, FEP, PFA, PVDF—in components that touch product or cleaning chemistry. The scale of the opportunity is visible in U.S. expenditure alone: total food spending reached $2.58 trillion in 2024, with $1.52 trillion at food-service outlets, expanding the installed base of equipment that must meet stricter sanitation and uptime demands.

Public-health pressure is reinforcing this material shift. The CDC estimates 48 million illnesses, 128,000 hospitalizations, and 3,000 deaths from foodborne disease each year in the United States. Those numbers keep plant managers laser-focused on non-stick, low-residue surfaces and seals that can endure aggressive washdowns without shedding or swelling—use cases where fluoropolymers excel. At the same time, regulators are expanding oversight: the FDA oversees more than $2.9 trillion in food, tobacco, and medical products, so FDA food-contact policies and device approvals increasingly shape material selection on the factory floor.

Dairy is a vivid example: world milk output reached ~930 million tonnes in 2022 (FAO) and ~965.7 million tonnes in 2023, sustaining a vast global network of pasteurizers, separators, membranes, and fillers where fouling control and caustic cleaning dominate operating costs. As processors add capacity and upgrade lines, they lean toward materials that cut residue, ease cleaning, and hold up to oxidizing agents—again favoring fluoropolymer contact parts.

Drivers

Demand for Food-Safe and Hygienic Processing in the Food & Beverage Sector

One of the major driving forces behind the expanding use of fluoropolymers is their critical role in enabling safe, hygienic, and long-lasting equipment in the food and beverage industry. As food producers, processors, and packagers push for higher throughput, stricter safety standards, and lower downtime, fluoropolymers like PTFE (polytetrafluoroethylene), FEP (fluorinated ethylene propylene), and PFA find increasing demand because of their chemical inertness, non-stick surfaces, wide temperature tolerance, and regulatory compliance.

Fluoropolymers help reduce residue build-up on surfaces in food lines, which lowers microbial risk and cleaning cycles. In beverage dispensing machines, for instance, PTFE and FEP tubes are used because they resist fouling and allow high hygiene even under repeated thermal cycling. According to industry sources, these materials are already FDA-, NSF-, and EU food-contact compliant, making them acceptable for critical food processing and contact environments.

Moreover, in food packaging and processing plants, fluoropolymer coatings or linings are applied to conveyor rollers, gaskets, valves, and sensor housings to reduce sticking, corrosion, and contamination risk. As one estimate notes, a leading coatings supplier says fluoropolymers are used from “cooking equipment to food coverings, conveyor belt rollers, UV lamp coatings, temperature sensor casings and non-stick surface covers.”

In Europe, the EU Regulation (EU) No 10/2011 sets strict rules on materials intended to come into contact with food, and many grades of fluoropolymers are certified under it. Because fluoropolymers meet these regulatory thresholds, they are often chosen in place of less durable or more contaminable alternatives. This regulatory tailwind is a structural advantage.

Restraints

Regulatory Pressure and Environmental Concerns Around PFAS / Fluorochemicals

One major restraining factor for the fluoropolymer industry is the tightening regulation and growing public concern over PFAS (per- and polyfluoroalkyl substances), under which many fluorochemicals are scrutinized. Though fluoropolymers (like PTFE, PVDF, etc.) are sometimes exempted, the broader regulatory climate creates uncertainty, increases compliance costs, and can slow R&D and adoption in sensitive sectors like food, packaging, and consumer goods.

Fluoropolymers are part of the broader PFAS family in chemical classification, which has triggered strong public and regulatory scrutiny due to persistence in the environment. Several U.S. states are enacting bans on “intentionally added PFAS” in food packaging, cookware, and other consumer products by 2027–2032. For example, New Mexico passed the PFAS Protection Act in April 2025, phasing out intentionally added PFAS in food packaging and cookware—but explicitly exempting fluoropolymers because of their essential roles and perceived safety.

These regulatory pressures are especially delicate in food-contact applications. The food and beverage sector is among the most sensitive to public demand, health standards, and liability. If some regulators were to narrow exemptions or require more demonstration of safety, companies might hesitate to use new grades of fluoropolymers in food processing, packaging, or contact equipment even if technically suitable.

Beyond regulation, environmental backlash is real. Fluoropolymers are extremely persistent, and at end-of-life or in waste streams, their disposal or degradation is problematic. Some studies note that while pure PTFE has established recycling paths, many PTFE compounds or pigmented blends must be landfilled or disposed of at high cost. The extreme persistence means they may be secondarily regarded as “forever chemicals” in public discourse, even if scientifically distinct from smaller PFAS molecules. Environmental organizations warn that restricting PFAS broadly could also ensnare fluoropolymers.

Opportunity

Expansion of High-Purity Food Contact Applications

One of the most promising growth avenues for fluoropolymers lies in high-purity food contact and processing applications. In the food and beverage sector, equipment must meet very strict hygiene, chemical inertness, and migration standards. Fluoropolymers, because of their chemical stability, low extractables, and resistance to harsh cleaning regimens, are well suited for demanding food contact uses — in tubing, valves, seals, linings, coatings, and sensor housings. As regulatory requirements tighten and consumer expectations rise, this niche becomes more valuable.

To see how big the food industry is, consider foodservice alone in the U.S.: in 2024, food sales at foodservice outlets were USD 1.52 trillion. That’s just one slice of the whole food and beverage chain — equipment, packaging, processing all scale behind it. Because of this scale, even a small share of fluoropolymers used in food-grade equipment can translate to a substantial volume and revenue increase.

At the same time, recent regulatory trends are creating openings. For example, the European Union’s new Regulation (EU) 2025/351 imposes stricter purity and migration limits for plastic food contact materials, effective from 16 September 2026. Materials that cannot convincingly show low migration or contamination risk will be disfavored. Fluoropolymers with certified food-contact grades that can clearly meet these standards will gain competitive advantage. Food equipment manufacturers will prefer materials that reduce regulatory risk, and that need less testing or substitution later.

Regional Insights

APAC dominates Fluoropolymers Market with 45.8% share valued at USD 5.3 Billion in 2024

In 2024, the Asia Pacific (APAC) region emerged as the dominant market for fluoropolymers, capturing a substantial 45.8% share of the global market, valued at approximately USD 5.3 billion. This leadership is attributed to the region’s rapidly expanding industrial base, increasing adoption of advanced manufacturing technologies, and growing demand from end-use industries such as automotive, electronics, chemical processing, and construction.

Government initiatives promoting clean energy and advanced manufacturing have further accelerated fluoropolymer adoption. Investments in renewable energy projects, including solar and wind power installations, have boosted the demand for fluoropolymers in protective coatings, insulation, and corrosion-resistant applications. The region’s growth trajectory is expected to remain strong, supported by rising industrial output, expanding end-use sectors, and continued focus on sustainability.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Daikin Industries, headquartered in Osaka, Japan, is a prominent manufacturer of fluoropolymers, including PTFE, PFA, and FEP. Their products are renowned for their excellent chemical resistance, high thermal stability, and low friction properties, making them suitable for a wide range of applications in industries such as automotive, electronics, and chemical processing. Daikin’s commitment to innovation and quality positions them as a key player in the global fluoropolymer market.

Solvay is a global chemical company that provides a broad portfolio of fluoropolymer products, including PVDF (polyvinylidene fluoride) and FEP. These materials are widely used in industries such as automotive, electronics, and chemical processing due to their excellent chemical resistance, high thermal stability, and electrical insulating properties. Solvay’s commitment to sustainability and innovation drives its leadership in the fluoropolymer market.

Arkema is a French multinational chemical company that specializes in the production of high-performance materials, including fluoropolymers. Their Kynar® PVDF resins are widely used in applications requiring exceptional chemical resistance, high thermal stability, and mechanical strength. Arkema’s focus on innovation and sustainability positions them as a leading player in the global fluoropolymer market.

Top Key Players Outlook

- Chemours

- Daikin Industries

- 3M

- Solvay

- Arkema

- AGC Chemicals

- Dongyue Group

- Gujarat Fluorochemicals

- Halopolymer

- Kureha Corporation

Recent Industry Developments

In 2024, Arkema reported total group sales of €9,544 million, nearly steady compared with 2023, supported by growth in its Advanced Materials and Specialty segments.

In 2024, Solvay posted underlying net sales of about €4,686 million, with underlying EBITDA of €1,052 million, reflecting robust performance despite market headwinds.

Report Scope

Report Features Description Market Value (2024) USD 11.6 Bn Forecast Revenue (2034) USD 28.7 Bn CAGR (2025-2034) 9.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (PTFE, PVDF, FEP, Fluoroelastomers, Others), By Form (Resins And Compounds, Films And Sheets, Coatings And Linings, Wire And Cable Insulation, Membranes), By Application (Industrial And Machinery, Automotive, Electric And Electronics, Construction, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Chemours, Daikin Industries, 3M, Solvay, Arkema, AGC Chemicals, Dongyue Group, Gujarat Fluorochemicals, Halopolymer, Kureha Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Chemours

- Daikin Industries

- 3M

- Solvay

- Arkema

- AGC Chemicals

- Dongyue Group

- Gujarat Fluorochemicals

- Halopolymer

- Kureha Corporation