Global Floating Production Market Size, Share, And Enhanced Productivity By Water Depth (Shallow Water, Deep Water, Ultra-Deep Water), By Build Segment (New Build, Conversion), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 168521

- Number of Pages: 288

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

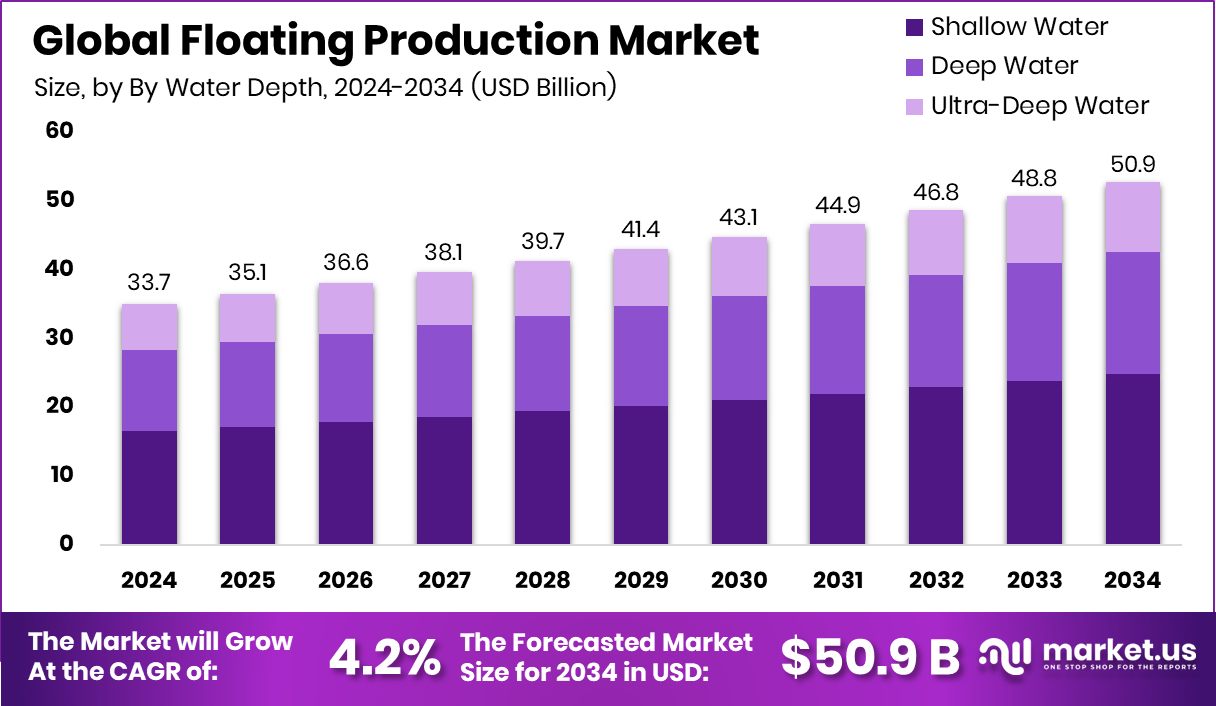

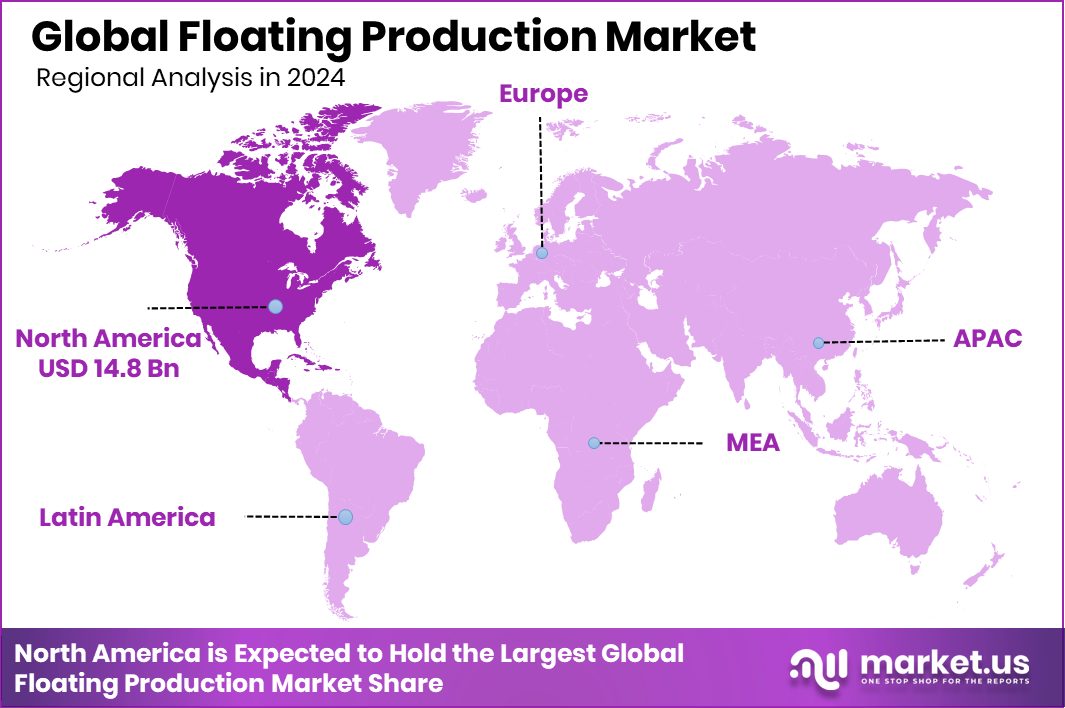

The Global Floating Production Market is expected to be worth around USD 50.9 billion by 2034, up from USD 33.7 billion in 2024, and is projected to grow at a CAGR of 4.2% from 2025 to 2034. North America represents 44.20% of Floating Production Market, reaching USD 14.8 Bn valuation region currently.

Floating Production refers to offshore systems that process oil and gas directly at sea using floating units. These facilities receive hydrocarbons from subsea wells, separate oil, gas, and water onboard, and store or offload output without relying on fixed platforms or onshore plants.

The Floating Production Market includes the development, deployment, and operation of floating units used in offshore fields. It supports deepwater and ultra-deepwater projects where seabed conditions, distances, or water depth make fixed infrastructure impractical or uneconomical.

Market growth is driven by rising offshore exploration and the need for flexible production assets. US$126 billion is expected to be invested in floating production units by 2030, highlighting long-term confidence. At the same time, the US decision to scrap a $13B green-energy funding pledge has redirected capital toward conventional offshore energy assets.

Demand continues to rise as producers seek faster field development and lower upfront risk. A $1B new investment for an FPSO company considering an initial public offering reflects investor appetite. SBM Offshore’s $400M FPSO deal has also encouraged more innovative financing approaches in offshore projects.

Strong capital flows are opening new opportunities for expansion and refinancing. Yinson Production closing a $1B investment to drive further growth signals confidence in floating production’s scalability, especially in frontier basins and long-life offshore developments worldwide.

Key Takeaways

- The Global Floating Production Market is expected to be worth around USD 50.9 billion by 2034, up from USD 33.7 billion in 2024, and is projected to grow at a CAGR of 4.2% from 2025 to 2034.

- Deep Water holds a 48.9% share in the Floating Production Market, driven by increasing ultra-deep offshore hydrocarbon developments.

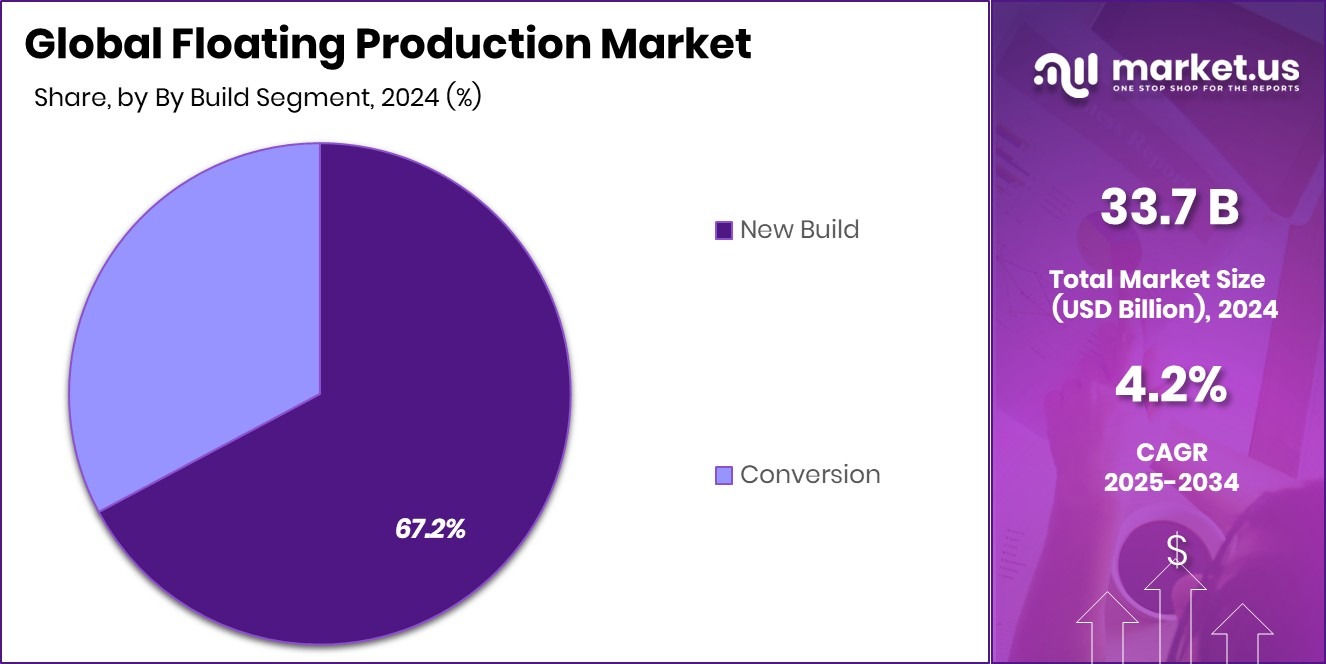

- Conversion dominates the Floating Production Market with a 67.2% share, supported by faster deployment and lower capital requirements.

- In North America, Floating Production Market holds 44.20% share, worth USD14.8Bn regionally today.

By Water Depth Analysis

Deep water dominates Floating Production Market due to investments holding 48.9% share.

In 2024, Deep Water held a dominant market position in the By Water Depth segment of the Floating Production Market, with a 48.9% share, reflecting its critical role in offshore energy development. Deepwater projects continue to attract strong interest due to their ability to unlock large hydrocarbon reserves that are not accessible through shallow-water operations.

Floating production systems are particularly suitable for deepwater conditions, where fixed infrastructure is technically complex and cost-intensive. The dominance of deep water is also supported by long field lifecycles, stable production profiles, and higher recovery potential, which improve project economics over time.

Operators favor deepwater floating production as it allows flexibility in field layout and supports subsea tie-backs, enhancing asset utilization. As offshore activities progress into deeper basins, the deepwater segment remains central to sustaining global offshore production capacity.

By Build Segment Analysis

Conversion leads Floating Production Market builds by reusing assets with 67.2% share.

In 2024, Conversion held a dominant market position in the By Build Segment segment of the Floating Production Market, with a 67.2% share, highlighting its strong preference across offshore developments.

Conversion projects benefit from shorter execution timelines, as existing vessels are repurposed into floating production units, allowing faster deployment compared to new construction. This approach supports cost optimization by utilizing proven hulls and established designs, reducing technical uncertainty and project risk.

Conversion also offers flexibility in adapting vessels to different field requirements, making it suitable for varied offshore conditions. Its dominance reflects industry focus on efficient asset reuse and controlled capital expenditure while maintaining reliable production performance. As offshore operators prioritize schedule certainty and operational efficiency, the conversion segment continues to play a central role in floating production strategies.

Key Market Segments

By Water Depth

- Shallow Water

- Deep Water

- Ultra-Deep Water

By Build Segment

- New Build

- Conversion

Driving Factors

Rising Offshore Energy Security and Resilience

One major driving factor of the Floating Production Market is the growing need for reliable offshore energy supply amid changing global funding priorities. With energy security becoming critical, offshore oil and gas projects supported by floating production systems offer stable, long-term output close to demand centers. These systems allow production directly at sea, reducing dependence on onshore infrastructure and improving resilience against land-based disruptions.

At the same time, environmental and coastal protection funding is shaping offshore development practices. The announcement by LDCF and partners of $16.5 million for Pacific Ocean and coastal health highlights a parallel focus on responsible ocean use.

Floating production increasingly aligns with this direction by enabling controlled operations, reduced seabed impact, and better monitoring. Together, energy security needs and sustainability-linked ocean funding are reinforcing demand for floating production solutions.

Restraining Factors

High Environmental Compliance and Resource Pressure Costs

A key restraining factor for the Floating Production Market is the rising pressure to meet strict environmental and resource-use regulations. Offshore projects increasingly face higher compliance costs related to water management, emissions control, and ecosystem protection. This challenge is reinforced by public funding priorities that favor land-based conservation over offshore development.

For example, $1.2 million was awarded to replace water-intensive grass and leaky sprinklers in Colorado, reflecting stronger attention toward water efficiency and local sustainability. Such initiatives signal broader regulatory expectations that also influence offshore operations.

Floating production operators must invest more in monitoring, mitigation, and cleaner operating practices, which can slow project approvals and increase operating expenses. As regulation tightens, balancing offshore production with environmental responsibility remains a significant constraint.

Growth Opportunity

Offshore Development Aligned With Coastal Resilience Programs

A major growth opportunity for the Floating Production Market lies in aligning offshore energy development with coastal resilience and environmental protection programs. Governments are increasing funding to protect shorelines and marine ecosystems, creating space for offshore projects that demonstrate responsible ocean use.

Ottawa providing $117M for drought resilience on British Columbia’s Sunshine Coast shows rising commitment to long-term water and coastal security. Similarly, NOAA Fisheries announcing a final USD 100 million grant opportunity for coastal habitat projects reinforces the push for healthier marine environments.

Floating production systems can support this direction by operating offshore, reducing pressure on coastal land and infrastructure while enabling energy supply continuity. This balance between offshore production and coastal protection creates new approval pathways and long-term growth potential.

Latest Trends

Water-Efficient Offshore Design and Sustainable Operations

A clear latest trend in the floating production market is the growing focus on water-efficient design and sustainable offshore operations. Operators are increasingly reducing freshwater use, improving reinjection systems, and adopting smarter fluid management onboard floating units. This shift mirrors wider public funding priorities aimed at saving water and improving resource efficiency.

For instance, Arizona granting $214 million to promote water savings reflects a broader push toward responsible water use across industries. In offshore environments, floating production systems are adapting by minimizing discharge, optimizing cooling processes, and lowering overall water dependency.

These improvements help projects meet stricter expectations while maintaining operational efficiency. As sustainability becomes a design requirement rather than an option, water-focused operational practices are shaping modern floating production development.

Regional Analysis

North America leads Floating Production Market with 44.20% share, valued USD14.8Bn region today.

North America dominates the Floating Production Market, holding a 44.20% share and valued at USD 14.8 Bn, making it the leading regional contributor. This dominance reflects the region’s strong offshore production base, mature deepwater infrastructure, and consistent deployment of floating production systems. The market benefits from established offshore operating expertise and stable project pipelines, supporting long-term utilization of floating production assets across offshore basins.

Europe represents a well-developed regional market, supported by long-standing offshore operations and a focus on extending the life of existing offshore fields. Floating production units play a key role in maintaining output from mature assets, while supporting operational flexibility in challenging offshore environments.

Asia Pacific shows steady momentum in floating production adoption, driven by expanding offshore exploration activities and rising regional energy demand. The region increasingly relies on floating production systems to access deeper offshore resources and optimize field development timelines.

Middle East & Africa continues to utilize floating production as a strategic solution for offshore fields where fixed infrastructure is less feasible. Floating units support efficient production while enabling phased offshore development approaches.

Latin America remains an active offshore region, where floating production systems are critical for deepwater field development and sustaining offshore output over long project lifecycles.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Bumi Armada Berhad holds a focused position in the global Floating Production Market through its long-standing involvement in floating production system operations. From an analyst viewpoint, the company’s strength lies in its specialization in managing and operating floating assets across offshore environments. Its market relevance is supported by consistent operational engagement and experience in handling floating production units, making it a steady participant in offshore production activities where reliability and operational continuity are essential.

Hyundai Heavy Industries Co. Ltd plays a significant role in the Floating Production Market through its industrial capability and experience in building complex offshore structures. In 2024, the company is viewed as a critical contributor to floating production development due to its strong engineering depth and large-scale offshore construction background. Its participation supports the supply side of the market, particularly where advanced fabrication quality and delivery discipline are required.

Keppel Offshore & Marine Ltd remains an important name in the floating production landscape, supported by its offshore design, engineering, and integration expertise. In 2024, the company continues to influence the market through its involvement in offshore production solutions that emphasize efficiency and adaptability. From an analyst perspective, Keppel’s presence reflects ongoing demand for experienced offshore infrastructure developers within the global floating production ecosystem.

Top Key Players in the Market

- Bumi Armada Berhad

- Hyundai Heavy Industries Co. Ltd

- Keppel Offshore & Marine Ltd

- Malaysia Marine and Heavy Engineering Berhad

- Mitsubishi Heavy Industries Ltd

- SBM Offshore

- TechnipFMC Plc

- Others

Recent Developments

- In August 2025, HHI approved a merger with its affiliate HD Hyundai Mipo Dockyard (HMD), to form a consolidated company under the HHI name. The merger is set to complete by December 2025, aiming to strengthen its shipbuilding and offshore capabilities.

- In November 2024, Bumi Armada secured a two-year firm extension for the charter of its FPSO unit Armada TGT1 for the TGT (Te Giac Trang) field offshore Vietnam. The extension runs from 15 November 2024 to 7 December 2026, with a contract value of about US$74.4 million.

Report Scope

Report Features Description Market Value (2024) USD 33.7 Billion Forecast Revenue (2034) USD 50.9 Billion CAGR (2025-2034) 4.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Water Depth (Shallow Water, Deep Water, Ultra-Deep Water), By Build Segment (New Build, Conversion) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Bumi Armada Berhad, Hyundai Heavy Industries Co. Ltd, Keppel Offshore & Marine Ltd, Malaysia Marine and Heavy Engineering Berhad, Mitsubishi Heavy Industries Ltd, SBM Offshore, TechnipFMC Plc, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Floating Production MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample

Floating Production MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Bumi Armada Berhad

- Hyundai Heavy Industries Co. Ltd

- Keppel Offshore & Marine Ltd

- Malaysia Marine and Heavy Engineering Berhad

- Mitsubishi Heavy Industries Ltd

- SBM Offshore

- TechnipFMC Plc

- Others