Global Flexible Solar Cell Market Size, Share, And Enhanced Productivity By Type (Amorphous Silicon, Cadmium Telluride, Copper Indium Gallium Selenide, Others), By Technology (Monocrystalline Silicon, Polycrystalline Silicon, Thin Film), By Form Factor (Flat, Curved, Freeform), By Power Range (100 kW, 100-250 kW, 250-500 kW, Greater Than 500 kW), By Application (Residential, Industrial, Aerospace, Automobile, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 168487

- Number of Pages: 374

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

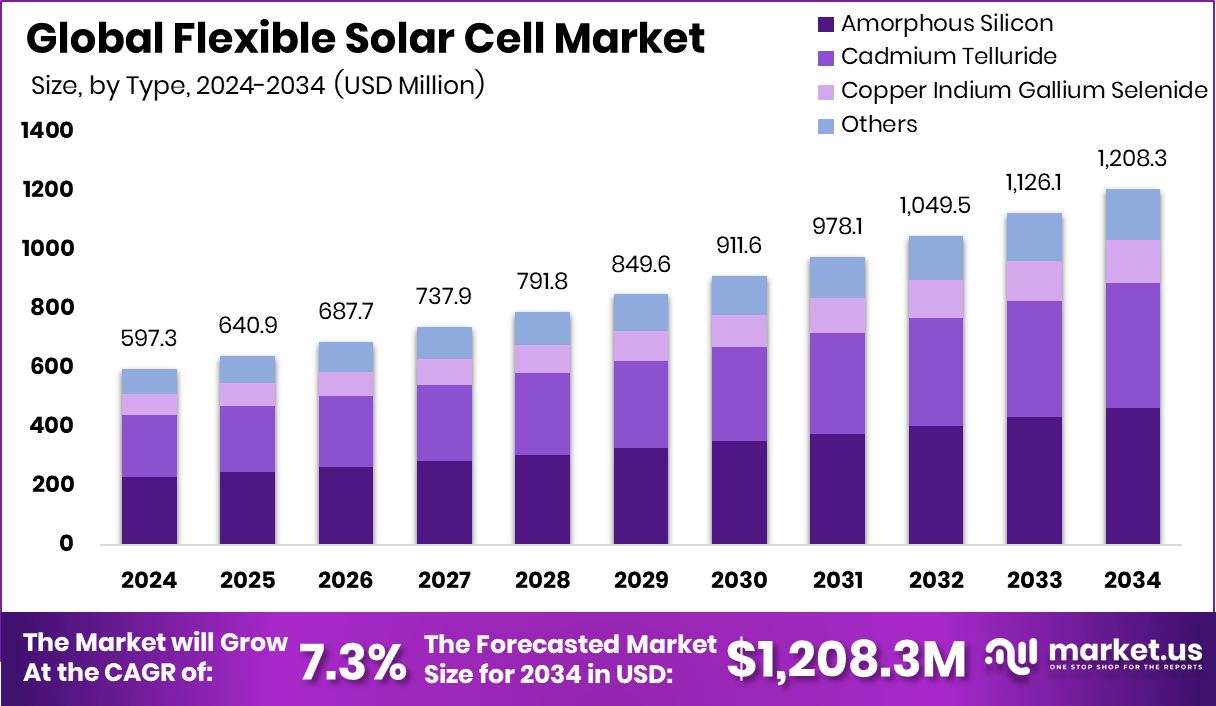

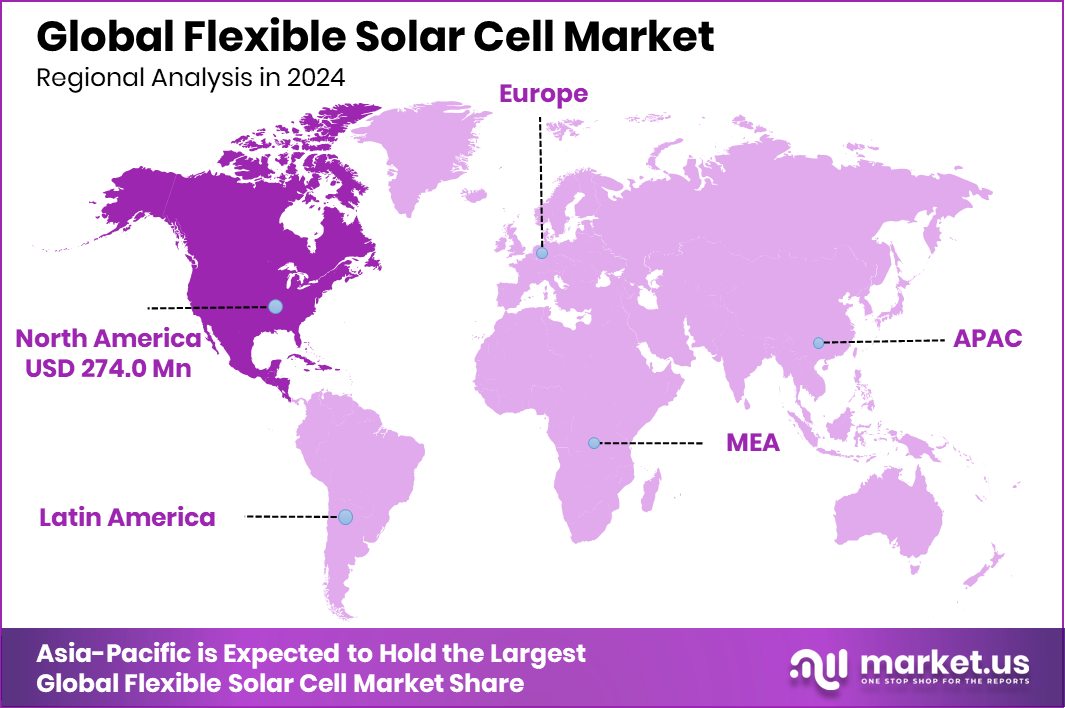

The Global Flexible Solar Cell Market is expected to be worth around USD 1,208.3 million by 2034, up from USD 597.3 million in 2024, and is projected to grow at a CAGR of 7.3% from 2025 to 2034. Asia-Pacific dominates Flexible Solar Cell Market at 45.90%, generating USD 274.0 Mn revenues.

Flexible solar cells are lightweight, bendable photovoltaic devices made on thin materials such as plastic, metal foil, or flexible glass. Unlike rigid solar panels, they can curve, fold, or conform to surfaces without breaking. This makes them suitable for portable electronics, building surfaces, vehicles, and wearable devices where weight, shape, and mobility matter more than traditional panel strength.

The Flexible Solar Cell Market refers to the commercial ecosystem that produces, integrates, and applies these bendable solar technologies across energy, construction, transport, and consumer electronics. The market focuses on thin-film and advanced cell designs that allow power generation on surfaces previously unsuitable for solar use, expanding where and how solar energy can be captured.

One major growth factor is strong public funding that supports efficiency and cost improvements. Art-PV received a $10 million grant for high-efficiency tandem solar cells, while thin-film solar development gained $2 million to advance flexible designs. These investments are accelerating lab-to-pilot transitions and improving commercial readiness.

Demand is rising as industries seek lightweight and portable power solutions. Public programs reinforce this demand, including $52 million from the DOE to support solar manufacturing, recycling, grid security, and community solar, helping flexible solar scale beyond niche uses.

A key opportunity lies in next-generation materials. The NREL awarded $1.8 million and an additional $2 million in separate contract rounds to develop cheaper and more efficient cadmium telluride solar cells, opening pathways for durable, high-output flexible solar products.

Key Takeaways

- The Global Flexible Solar Cell Market is expected to be worth around USD 1,208.3 million by 2034, up from USD 597.3 million in 2024, and is projected to grow at a CAGR of 7.3% from 2025 to 2034.

- In Flexible Solar Cell Market, Amorphous Silicon leads by type, holding 38.5% share globally.

- In Flexible Solar Cell Market, Thin Film dominates technology segment with 57.2% adoption globally.

- Flexible Solar Cell Market sees Flat form factor leading installations, capturing 66.6% share overall.

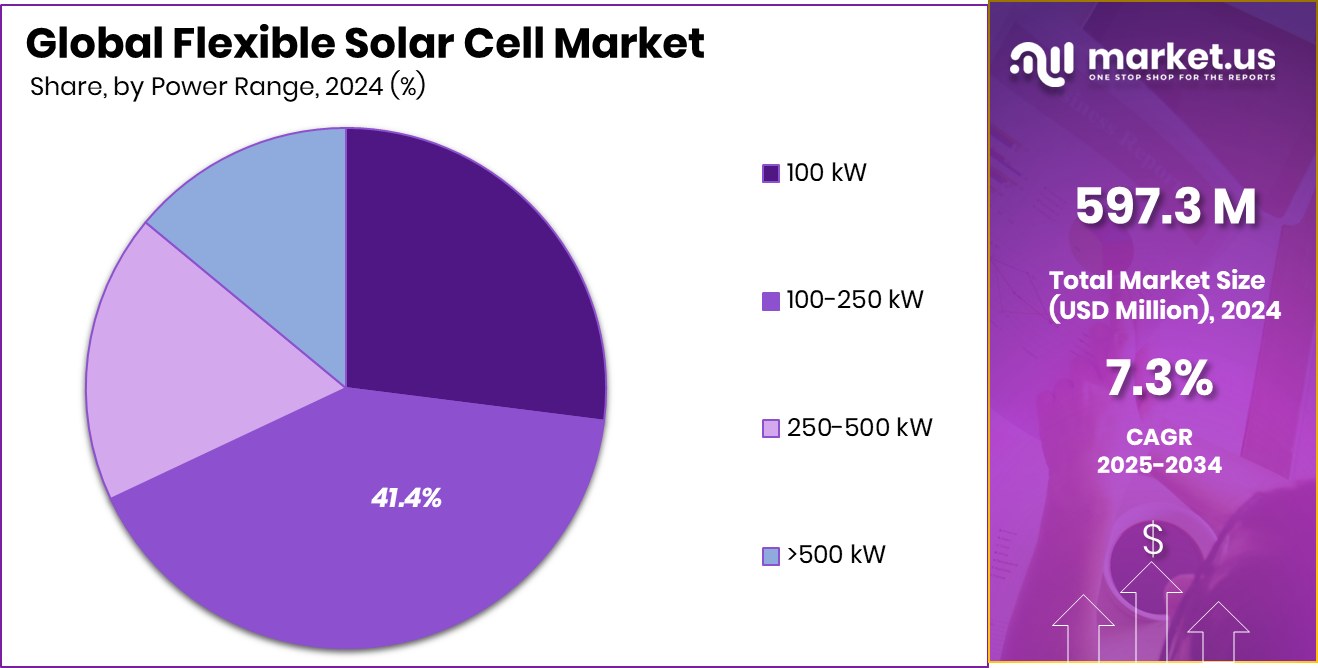

- In Flexible Solar Cell Market, 100-250 kW power range dominates deployments with 41.4% share.

- Flexible Solar Cell Market demand remains strongest in Industrial applications, accounting for 38.6% usage.

- Asia-Pacific region holds 45.90% of Flexible Solar Cell Market, reaching USD 274.0 Mn.

By Type Analysis

In Flexible Solar Cell Market, Amorphous Silicon dominates type with 38.5% share.

In 2024, Amorphous Silicon held a dominant market position in By Type segment of Flexible Solar Cell Market, with a 38.5% share. This leadership reflects its strong suitability for flexible formats, where lightweight structure and material stability are critical.

Amorphous silicon performs reliably under low-light and diffused lighting conditions, making it practical for portable, indoor, and surface-integrated applications. Its relatively simple manufacturing process supports large-area deposition on flexible substrates, helping producers maintain consistent quality across varied designs.

The 38.5% share also highlights steady adoption in applications requiring durability and uniform energy output rather than peak efficiency. As flexibility, ease of integration, and operational stability remain key buying factors, amorphous silicon continued to secure a leading position within the flexible solar cell type landscape during 2024.

By Technology Analysis

Flexible Solar Cell Market sees Thin Film technology leading strongly at 57.2%.

In 2024, Thin Film held a dominant market position in By Technology segment of Flexible Solar Cell Market, with a 57.2% share. This dominance is closely linked to thin film’s natural compatibility with flexible substrates, enabling lightweight and bendable solar solutions without compromising functional stability.

The technology allows deposition on plastics, foils, and curved surfaces, which supports wide use across portable, building-integrated, and mobility-based applications. With a 57.2% share, thin film technology proved its ability to balance flexibility, coverage area, and consistent power output.

Its structural adaptability and ease of integration into non-flat surfaces continued to strengthen adoption, making thin film the preferred technology in flexible solar cell applications throughout 2024.

By Form Factor Analysis

In Flexible Solar Cell Market, Flat form factor holds leading 66.6% share.

In 2024, Flat held a dominant market position in By Form Factor segment of Flexible Solar Cell Market, with a 57.2% share. This strong position reflects the ease of integrating flat flexible solar cells onto broad and uniform surfaces while retaining bendability and lightweight benefits.

Flat formats support stable installation, simplified layering, and consistent exposure to light across the surface, which improves usability in many flexible applications. The 57.2% share also indicates preference for designs that balance flexibility with surface stability, allowing smoother handling, transport, and placement.

As practical deployment and form simplicity remained key considerations, flat form factor solutions continued to lead the flexible solar cell landscape during 2024.

By Power Range Analysis

Flexible Solar Cell Market favors 100-250 kW power range holding 41.4% share.

In 2024, 100–250 kW held a dominant market position in By Power Range segment of Flexible Solar Cell Market, with a 57.2% share. This leadership reflects strong adoption of flexible solar solutions designed to deliver balanced power output while retaining lightweight and adaptable form.

Systems within the 100–250 kW range fit well with applications that need meaningful energy generation but face space, weight, or surface constraints. The 57.2% share also shows preference for power capacities that enable dependable performance without requiring rigid structures or heavy mounting systems.

As users continued to prioritize efficiency, flexibility, and practical deployment, the 100–250 kW power range remained the leading choice within this segment during 2024.

By Application Analysis

In Flexible Solar Cell Market, Industrial applications account for a 38.6% share.

In 2024, Industrial held a dominant market position in By Power Range segment of Flexible Solar Cell Market, with a 38.6% share. This dominance highlights the growing use of flexible solar cells in industrial environments where weight reduction and surface adaptability are important.

Industrial users favor flexible formats that can be installed on large structures, curved surfaces, and space-limited areas without major structural changes. The 38.6% share reflects steady demand from industrial operations seeking dependable on-site energy generation along with easier installation and handling.

Flexible solar solutions also support operational continuity by fitting into existing layouts rather than requiring rigid mounting systems. As efficiency, easy integration, and surface versatility remained priorities, the industrial segment sustained its leading role within the flexible solar cell market in 2024.

Key Market Segments

By Type

- Amorphous Silicon

- Cadmium Telluride

- Copper Indium Gallium Selenide

- Others

By Technology

- Monocrystalline Silicon

- Polycrystalline Silicon

- Thin Film

By Form Factor

- Flat

- Curved

- Freeform

By Power Range

- 100 kW

- 100-250 kW

- 250-500 kW

- >500 kW

By Application

- Residential

- Industrial

- Aerospace

- Automobile

- Others

Driving Factors

Government Funding Accelerates Flexible Solar Manufacturing Growth

One major driving factor of the Flexible Solar Cell Market is strong government investment aimed at strengthening domestic solar manufacturing and advanced cell production. When public funding supports manufacturing scale-up, it reduces cost barriers and speeds up commercial adoption of flexible solar technologies.

The U.S. government invested $71 million to boost domestic solar manufacturing, directly supporting production capacity, workforce development, and supply-chain resilience. In parallel, the U.S. Department of Energy invested another US$71 million specifically into thin-film and silicon solar manufacturing projects. These investments encourage innovation in lightweight, flexible designs while improving efficiency and durability.

Such funding helps bridge the gap between research and large-scale manufacturing, giving industries more confidence to adopt flexible solar solutions. As funding strengthens production ecosystems, flexible solar cells gain faster acceptance across multiple applications.

Restraining Factors

High Production Costs Slow Flexible Solar Adoption

One major restraining factor in the Flexible Solar Cell Market is the high cost of production and early-stage manufacturing complexity. Flexible solar cells rely on advanced materials and precise fabrication processes, which increase costs compared to conventional rigid panels.

Even though Toledo-area solar companies received $16.1 million in federal funding, such support is often aimed at pilot-scale improvements rather than full cost reduction. This means many producers still face challenges in achieving low-cost, mass production. Higher costs can slow purchasing decisions, especially in price-sensitive applications, and limit wider deployment.

While funding helps improve technology and local manufacturing readiness, scaling flexible solar solutions remains expensive. Until production processes become simpler and more standardized, high costs will continue to restrain faster market expansion.

Growth Opportunity

Advanced Electronics Integration Creates New Solar Opportunities

A major growth opportunity in the Flexible Solar Cell Market lies in integration with advanced electronics and next-generation devices. Flexible solar cells are increasingly suitable for systems that require lightweight, adaptive, and reliable power sources.

A $4.4 million grant to build a prototype of next-generation night vision technology highlights how defense and sensing applications need compact, flexible energy solutions that can operate in dynamic conditions. At the same time, US$850 million in 45X manufacturing credits generated through First Solar sales strengthens domestic production ecosystems and improves material availability for advanced solar technologies.

Together, these developments open new pathways for flexible solar use in electronics, security equipment, and specialized devices. As high-value applications expand, flexible solar cells gain new commercial space beyond traditional energy installations.

Latest Trends

Recycling And Investment Reshape Flexible Solar Industry

One major latest trend in the Flexible Solar Cell Market is the growing focus on recycling, circular manufacturing, and large-scale capital investment. The U.S. recently supported 19 solar recycling and manufacturing projects with $82 million in funding, highlighting a shift toward sustainable production and end-of-life management of solar materials.

This trend directly supports flexible solar cells, which rely on thin materials that benefit from efficient recycling systems. At the same time, $600 million in new equity investments brought in by Silicon Ranch reflect strong investor confidence in long-term solar infrastructure and manufacturing growth.

Together, these developments signal a market trend where sustainability and capital strength move hand in hand. Recycling readiness and financial backing are becoming key factors shaping the future of flexible solar adoption.

Regional Analysis

Asia-Pacific Flexible Solar Cell Market leads with 45.90% share valued USD 274.0 Mn.

Asia-Pacific dominates the Flexible Solar Cell Market, holding a commanding 45.90% share valued at USD 274.0 Mn. This leadership is supported by strong manufacturing ecosystems, expanding renewable energy adoption, and widespread use of lightweight power solutions across industrial, consumer, and infrastructure applications. The region benefits from large-scale production capabilities and increasing integration of flexible solar technologies in buildings, transport, and portable systems, allowing Asia-Pacific to maintain its leading position with USD 274.0 Mn in market value.

North America represents a mature and innovation-driven regional market, supported by technology development, advanced manufacturing capabilities, and growing demand for adaptive solar solutions. Flexible solar cells are increasingly used in specialized applications requiring lightweight and surface flexibility, strengthening regional adoption without reliance on high installation complexity.

Europe shows steady progress driven by sustainability priorities, clean energy integration, and architectural applications. Flexible solar cells align well with the region’s focus on design-conscious energy solutions and efficient use of space, supporting gradual market expansion across multiple use environments.

The Middle East & Africa market is developing as flexible solar gains relevance in regions with high solar exposure and infrastructure constraints. Lightweight formats support deployment where traditional systems are less practical.

Latin America continues to emerge as flexible solar adoption grows in off-grid, mobile, and distributed energy applications, enhancing regional market presence through adaptability and ease of deployment.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

ENECOM plays a focused role in the Flexible Solar Cell Market through its emphasis on lightweight and adaptable solar solutions. In 2024, its activities reflect a clear alignment with applications requiring mobility, surface flexibility, and ease of integration. ENECOM’s approach centers on practical deployment where conventional rigid panels are not suitable, supporting steady adoption in specialized energy uses. From an analyst perspective, the company’s strength lies in aligning product design with real-world flexibility needs rather than scale-driven volume, helping it remain relevant as demand grows for surface-conforming solar systems.

MiaSolé remains a technology-oriented participant known for advancing thin, flexible solar designs suited for curved and lightweight installations. In 2024, its position reflects continued attention on improving performance consistency while maintaining flexibility advantages. Analysts view MiaSolé’s steady presence as evidence of long-term confidence in thin-film flexible formats. Its focus on product reliability and form adaptability supports applications where design constraints and weight reduction directly influence purchasing decisions.

Global Solar Energy, Inc. contributes to the market through its experience in flexible solar products designed for durability and portability. In 2024, the company’s market role reflects sustained relevance in applications requiring dependable power on flexible substrates. From an analyst viewpoint, its continued participation signals stable demand for flexible solutions that balance usability with performance in evolving solar applications.

Top Key Players in the Market

- ENECOM

- MIASOLE

- GLOBAL SOLAR ENERGY, INC.

- POWERFILM SOLAR, INC.

- SOLOPOWER SYSTEM

- SOLBIAN

- SUNPOWER CORPORATION

- Others

Recent Developments

- In April 2024, MiaSolé announced the continuation of its global partnership with TRAILAR to provide flexible solar transportation solutions. The collaboration aims at delivering solar-powered transport systems, leveraging MiaSolé’s thin-film flexible modules suited for vehicles and mobile installations.

- In April 2024, PowerFilm introduced a new 60 W foldable solar panel that uses an overlaminate layer to boost moisture resistance and durability. The design targets small- to medium-power applications such as charging portable electronics, offering lightweight flexibility and improved robustness.

Report Scope

Report Features Description Market Value (2024) USD 597.3 Million Forecast Revenue (2034) USD 1,208.3 Million CAGR (2025-2034) 7.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Amorphous Silicon, Cadmium Telluride, Copper Indium Gallium Selenide, Others), By Technology (Monocrystalline Silicon, Polycrystalline Silicon, Thin Film), By Form Factor (Flat, Curved, Freeform), By Power Range (100 kW, 100-250 kW, 250-500 kW, >500 kW), By Application (Residential, Industrial, Aerospace, Automobile, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ENECOM, MIASOLE, GLOBAL SOLAR ENERGY, INC., POWERFILM SOLAR, INC., SOLOPOWER SYSTEM, SOLBIAN, SUNPOWER CORPORATION, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Flexible Solar Cell MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample

Flexible Solar Cell MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ENECOM

- MIASOLE

- GLOBAL SOLAR ENERGY, INC.

- POWERFILM SOLAR, INC.

- SOLOPOWER SYSTEM

- SOLBIAN

- SUNPOWER CORPORATION

- Others