Global Ferrovanadium Market Size, Share, And Enhanced Productivity By Commercial Grade (FeV 80, FeV 60, FeV 50, FeV 40), By Production Process (Aluminothermic Reduction, Silicon Reduction, Others), By End Use (Construction and Rebar Steel, Energy and Pipelines, Automotive and Transportation Steels, Tools, Machinery and Engineering Steels, Aerospace and Defense Alloys, Other), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 173302

- Number of Pages: 386

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

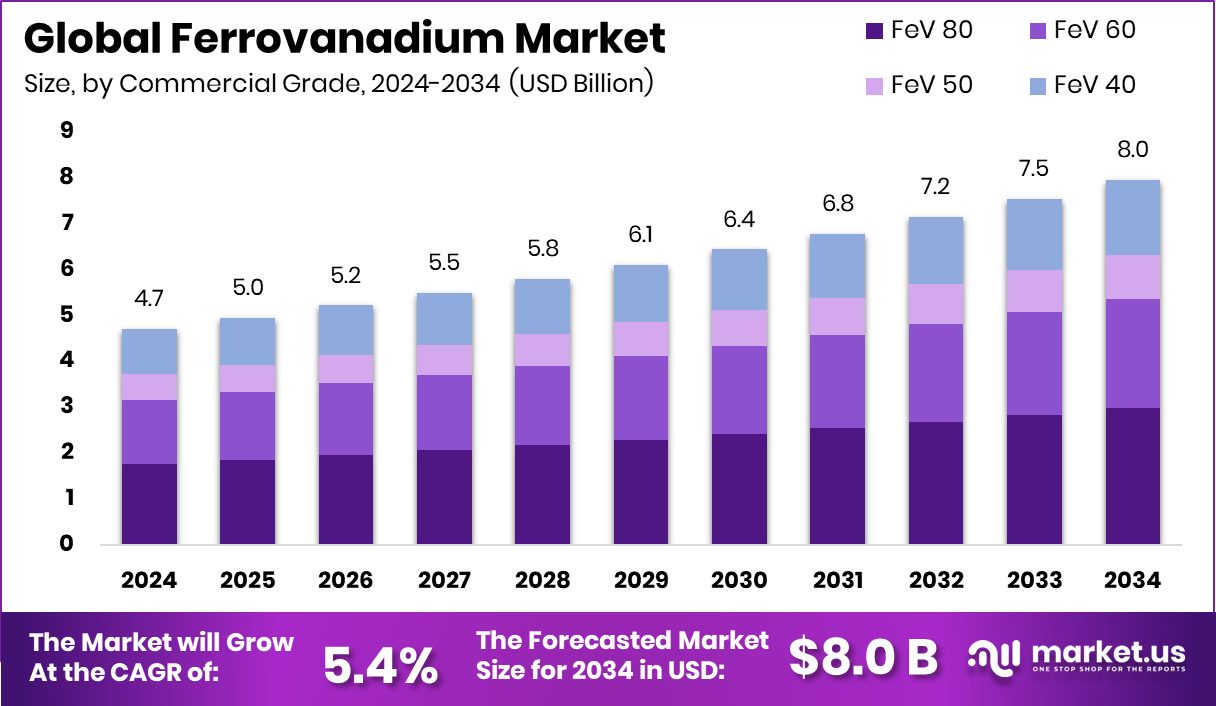

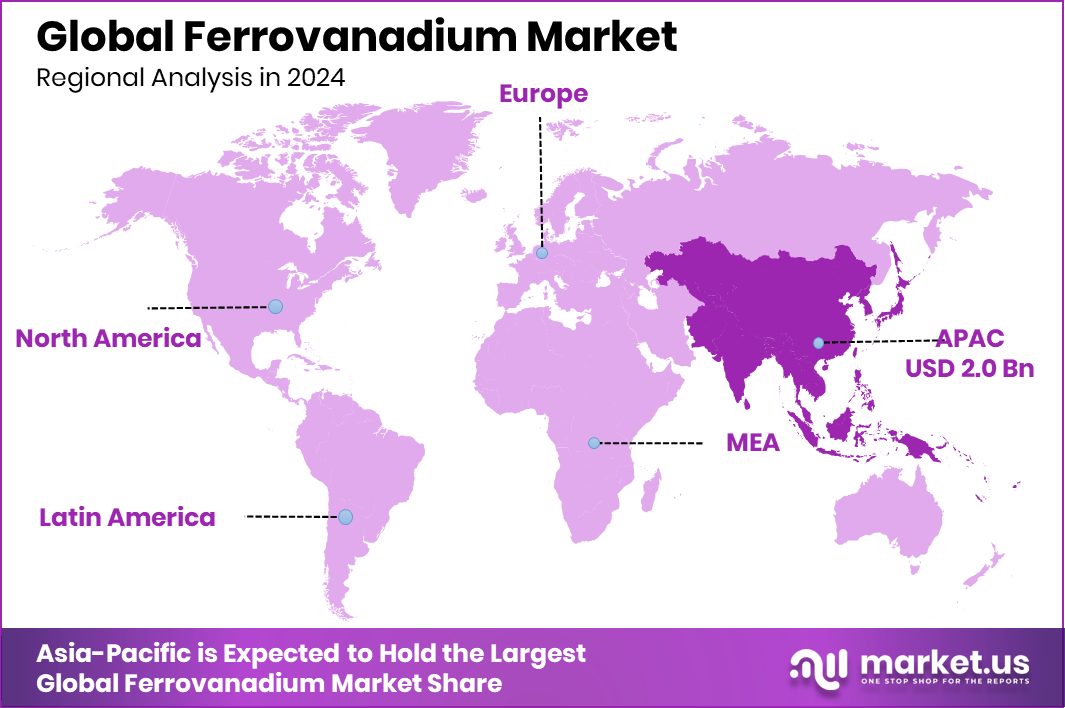

The Global Ferrovanadium Market is expected to be worth around USD 8.0 billion by 2034, up from USD 4.7 billion in 2024, and is projected to grow at a CAGR of 5.4% from 2025 to 2034. The Asia Pacific Ferrovanadium Market holds 43.20%, reaching USD 2.0 Bn in value.

Ferrovanadium is a special alloy made by combining iron with vanadium. Vanadium, a strong yet light metal, helps steel become tougher, more flexible, and resistant to wear. When added in small amounts to steel, ferrovanadium makes rebar, structural beams, and automotive parts stronger without adding much weight. It’s widely used in construction and heavy industry where durability matters. The production of ferrovanadium involves extracting vanadium from raw materials and alloying it with iron under controlled conditions so that steelmakers can easily use it in their furnaces.

The ferrovanadium market refers to the global trade and business of producing, selling, and buying ferrovanadium. This includes mining vanadium sources, making the alloy, and supplying it to steel mills and other industries that need strong, high-performance metals. Demand for ferrovanadium moves with construction activity, infrastructure projects, and manufacturing growth. Investors and companies watch this market closely because changes in steel demand or raw material supply can shift prices and production.

Growth is driven by rising construction and infrastructure work worldwide, which increases demand for stronger steel. Another factor is technological progress in steelmaking that uses vanadium more efficiently. Interest in advanced materials also attracts new capital to metallurgical innovation, similar to how Scintil Photonics welcomed $58M Series B funding to accelerate silicon photonics for data centers.

Demand rises as cities expand and industries seek lighter, stronger metals for machines and vehicles. Just as Seemplicity raised $50M to expand its AI-driven platform, investment flows into technologies that support industrial efficiency, indirectly boosting materials like ferrovanadium that enable better performance.

Opportunities lie in recycling wastes to recover vanadium and in regions building new infrastructure. Parallel to diverse investment trends, such as China polysilicon firms planning a $7 billion fund to restructure capacity and Journify raising $4 million to grow digital tools, ferrovanadium producers can tap smarter production and recycling to meet future needs.

Key Takeaways

- The Global Ferrovanadium Market is expected to be worth around USD 8.0 billion by 2034, up from USD 4.7 billion in 2024, and is projected to grow at a CAGR of 5.4% from 2025 to 2034.

- In the Ferrovanadium market, commercial grade FeV 80 dominates demand, holding a 37.4% share globally.

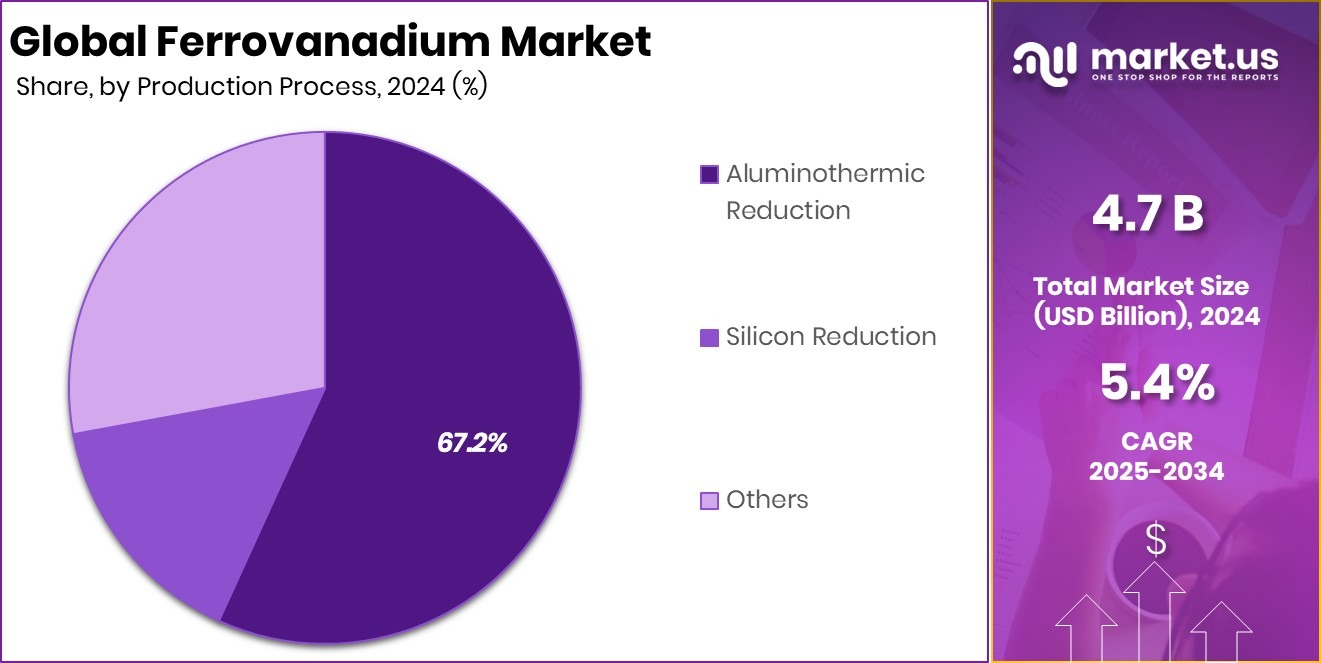

- Within the Ferrovanadium market, aluminothermic reduction leads production processes, accounting for a dominant 67.2% share.

- Construction and rebar steel are the leading end-use segments in the ferrovanadium market, capturing 34.60% share.

- Asia Pacific leads the Ferrovanadium Market at 43.20%, generating USD 2.0 Bn revenue.

By Commercial Grade Analysis

Within the Ferrovanadium Market, FeV 80 commercial grade held a 37.4% share.

In 2024, FeV 80 held a dominant position in the Ferrovanadium Market, accounting for 37.4% share due to its balanced vanadium content and wide usability in steelmaking. This grade is preferred by steel producers because it delivers consistent alloying performance while keeping production costs under control. FeV 80 is widely used in carbon steel, alloy steel, and microalloyed steel, where it improves strength, fatigue resistance, and wear performance.

Its stable chemistry helps manufacturers meet strict quality standards, especially for large-scale steel production. The grade also supports better yield control during melting, reducing wastage. As global infrastructure and industrial manufacturing activities continue, FeV 80 remains a practical and reliable choice, reinforcing its strong demand across both mature and emerging steel markets worldwide.

By Production Process Analysis

In the Ferrovanadium Market, aluminothermic reduction dominated production processes with 67.2% share.

In 2024, Aluminothermic Reduction dominated the Ferrovanadium Market by production process, capturing 67.2% share due to its efficiency and ability to produce high-purity ferrovanadium. This method is widely adopted because it allows better control over vanadium recovery and chemical composition, which is critical for steel applications.

Compared to other processes, aluminothermic reduction is suitable for smaller and medium-scale production setups and does not rely heavily on electricity, making it attractive in regions with high energy costs. The process also supports flexibility in raw material sourcing, including vanadium pentoxide. Its proven reliability, lower impurity levels, and consistent output quality make it the preferred production route, especially for manufacturers supplying alloying materials to construction, automotive, and industrial steel producers.

By End Use Analysis

For the Ferrovanadium Market, construction and rebar steel end use captured 34.60%.

In 2024, Construction and Rebar Steel emerged as the leading end-use segment in the Ferrovanadium Market, holding a 34.60% share as global infrastructure development remained strong. Ferrovanadium is essential in rebar steel because it significantly enhances tensile strength, load-bearing capacity, and durability without increasing steel weight. This makes it ideal for bridges, high-rise buildings, highways, and seismic-resistant structures.

Growing urbanization and public infrastructure investments have increased the demand for high-strength, low-alloy steel, directly supporting ferrovanadium consumption. Rebar manufacturers favor vanadium-based alloys due to their cost-efficiency compared to alternative alloying elements. As construction standards become stricter worldwide, the need for stronger and longer-lasting steel continues to position this end-use segment as a key growth pillar for the ferrovanadium industry.

Key Market Segments

By Commercial Grade

- FeV 80

- FeV 60

- FeV 50

- FeV 40

By Production Process

- Aluminothermic Reduction

- Silicon Reduction

- Others

By End Use

- Construction and Rebar Steel

- Energy and Pipelines

- Automotive and Transportation Steels

- Tools, Machinery, and Engineering Steels

- Aerospace and Defense Alloys

- Other

Driving Factors

Growing Infrastructure and Steel Strength Demand Drives Market

The need for stronger steel in construction and heavy industry is the top driving factor for the Ferrovanadium Market. As cities grow and infrastructure projects expand globally, builders and engineers require materials that can withstand stress, weather, and heavy loads. Ferrovanadium makes steel tougher and more reliable, which is why demand rises whenever new highways, bridges, or buildings are planned. This trend follows broader interest in advanced materials, similar to how Spain’s Floatech secured €1M to supercharge silicon anode battery tech, showing investment in stronger, better materials is a global focus.

Similarly, innovations in vehicle and energy storage materials, such as Coreshell raising $24M for silicon EV batteries, reflect a push toward performance improvements across industries. These investments show that when funding supports better material solutions, demand for related alloy metals like ferrovanadium also grows. Overall, as construction and manufacturing push for durability and strength, ferrovanadium remains a key material supporting modern infrastructure needs.

Restraining Factors

Supply Chain Limitations and Price Volatility Challenge Growth

One major restraining factor for the Ferrovanadium Market is supply chain limitations and price volatility. Ferrovanadium depends on vanadium, a metal that can be hard to source consistently. When vanadium ore availability fluctuates or transportation issues arise, production slows, and cost goes up. This makes steelmakers hesitate to commit to large purchases or long-term contracts, especially when prices are unpredictable. Such uncertainty can slow market expansion even when demand from construction or manufacturing is strong.

Broader technology funding trends also highlight how investment focus can shift when companies aim to solve operational challenges. For example, Agentic AI startup Asepha bags $4M seed funding to automate pharmacy operations, showing money flowing into automation solutions for efficiency rather than raw materials. At the same time, Silicon Quantum Computing prepares for a $130 million (AUS) funding round, indicating capital seeking frontier technologies. When investment leans toward digital and quantum innovation, materials markets like ferrovanadium may face capital scarcity, adding pressure to navigate supply constraints and cost swings effectively.

Growth Opportunity

Recycling and Sustainable Vanadium Recovery Expand Market

A major growth opportunity in the Ferrovanadium Market is recycling and sustainable vanadium recovery. As vanadium demand rises, companies that can recover vanadium from spent catalysts, industrial waste, or recycled steel have a chance to lower costs and reduce reliance on raw mining. This not only helps keep supply steady but also appeals to industries focused on greener manufacturing. Doing more with recycled material means less pressure on traditional vanadium sources and higher value from existing metal flows.

This push toward smarter material use is similar to how investment trends support innovation. For example, Dutch-Swiss startup Cradle secures €69.5M to help scientists develop improved proteins using AI, showing that funding drives progress in high-value processes. Also, Protex AI raises $36m to continue US expansion, indicating strong investment interest in intelligent solutions that improve efficiency. In ferrovanadium production, such intelligent processes for recycling and recovery can unlock new supply streams and give producers a competitive edge. This makes sustainability not just an environmental goal but a real opportunity for market growth.

Latest Trends

Shift Toward Advanced Alloys and Value-Added Metals

A key latest trend in the Ferrovanadium Market is a shift toward advanced alloys and value-added metals. Steelmakers and material engineers are increasingly looking for ways to make metals that perform better in tough environments, such as buildings, bridges, and heavy machinery. Rather than traditional steel alone, companies want steels with precise alloy mixes that improve strength without adding much weight. This trend goes hand in hand with investments in metal innovation and development, as seen with Alloyed raising £37M in new funding for metal alloy development, which highlights how the industry is backing smarter material technologies.

At the same time, broader metal resource support, like the US awarding NioCorp unit up to $10 million for a scandium project in Nebraska, shows how governments and investors are boosting supplies of specialty metals that help strengthen alloys. While scandium is a different metal, support for these materials reflects a wider industry focus on critical metals and alloying elements. For ferrovanadium, this trend means more attention on enhancing performance through precise chemistry and advanced material science, supporting longer-lasting, higher-strength steel products.

Regional Analysis

Asia Pacific dominates the Ferrovanadium Market with 43.20% share, valued at USD 2.0 Bn.

Asia Pacific remains the dominating region in the Ferrovanadium Market, accounting for 43.20% share and a market value of USD 2.0 Bn, supported by its large steel production base and strong consumption of rebar and alloy steels. Countries across the Asia Pacific continue to benefit from sustained infrastructure construction, urban expansion, and industrial manufacturing, which directly support ferrovanadium usage in strengthening steel.

In comparison, North America represents a stable market driven by replacement demand, strict steel quality standards, and consistent use of microalloyed steels in construction and engineering applications. Europe shows steady demand, supported by advanced steelmaking practices and a focus on high-performance structural steel, though growth remains moderate due to mature infrastructure.

The Middle East & Africa market is developing gradually, linked to ongoing construction projects and industrial capacity additions, while remaining smaller in scale. Latin America reflects emerging demand, supported by selective infrastructure and industrial steel usage. Overall, Asia Pacific’s strong industrial base and construction intensity firmly position it as the leading regional contributor to global ferrovanadium demand.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, AMG Vanadium stands out for its strong focus on vanadium recovery and recycling from industrial residues. The company’s operations are closely aligned with steelmakers seeking a reliable ferrovanadium supply with consistent quality. Its recycling-based model supports supply stability while addressing raw material constraints, making AMG a strategic partner for long-term steel alloy requirements. The company’s technical expertise in processing spent catalysts and residues gives it a competitive edge in producing high-grade ferrovanadium for demanding applications.

Treibacher Industrie AG plays a critical role through its deep metallurgical know-how and integrated production capabilities. The company is recognized for delivering precise alloy compositions that meet strict customer specifications, particularly for high-performance steel applications. Its strong process control and long-standing relationships with industrial customers reinforce its position as a dependable supplier. Treibacher’s emphasis on quality, consistency, and customized alloy solutions continues to support its relevance in specialized ferrovanadium applications.

Bear Metallurgical Company maintains a solid presence through its focus on niche ferroalloy production and customer-specific requirements. The company’s flexible manufacturing approach allows it to respond quickly to changing steel industry needs. Its experience in alloy production and commitment to product reliability make it a trusted supplier, particularly in markets valuing operational responsiveness and technical support.

Top Key Players in the Market

- AMG Vanadium

- Treibacher Industrie AG

- Bear Metallurgical Company

- Bushveld’s Vanchem

- JFE Materials

- Others

Recent Developments

- In March 2024, Treibacher Industrie AG celebrated a major milestone with a topping-out ceremony for a new recycling plant at its Althofen site. This plant focuses on recycling spent metal-containing catalysts, including vanadium-rich materials, and supports circular economy goals. The project, with nearly €120 million in investment, aims to use waste heat to produce electricity and recover valuable metals for ferrovanadium and other alloys. Commissioning was planned for summer 2024 with completion expected by early 2025.

- In February 2024, AMG Vanadium acquired a suite of processing technologies and intellectual property from Transformation Technologies Inc. (TTI). This development strengthens AMG’s ability to recycle spent oil refinery catalysts and other wastes into valuable metals, enhancing its recycling performance and expanding its global processing capabilities. This move also improves efficiency and lowers the carbon footprint of its operations in spent catalyst recycling.

Report Scope

Report Features Description Market Value (2024) USD 4.7 Billion Forecast Revenue (2034) USD 8.0 Billion CAGR (2025-2034) 5.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Commercial Grade (FeV 80, FeV 60, FeV 50, FeV 40), By Production Process (Aluminothermic Reduction, Silicon Reduction, Others), By End Use (Construction and Rebar Steel, Energy and Pipelines, Automotive and Transportation Steels, Tools, Machinery and Engineering Steels, Aerospace and Defense Alloys, Other) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape AMG Vanadium, Treibacher Industrie AG, Bear Metallurgical Company, Bushveld’s Vanchem, JFE Materials, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- AMG Vanadium

- Treibacher Industrie AG

- Bear Metallurgical Company

- Bushveld's Vanchem

- JFE Materials

- Others