Global Fermentation Enhancers Market Size, Share, And Enhanced Productivity By Product Type (Enzyme-based Enhancers, Yeast Nutrients, pH Adjusters, Microbial Growth Promoters, Oxygen Scavengers and Redox Agents, Prebiotics and Carbohydrate Sources, Antifoaming Agents), By Form (Powder, Liquid, Granules, Tablets), By Source (Synthetic, Natural/Biobased), By Functionality (Nutritional Supplementation, PH Regulation, Oxygen Reduction, Microbial Optimization, Biomass Enhancement, Product Yield Boosting, Others), By Application (Food and Beverage Fermentation, Industrial Fermentation, Pharmaceutical/Biotech, Animal Feed Fermentation, Agricultural Fermentation, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 172679

- Number of Pages: 237

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

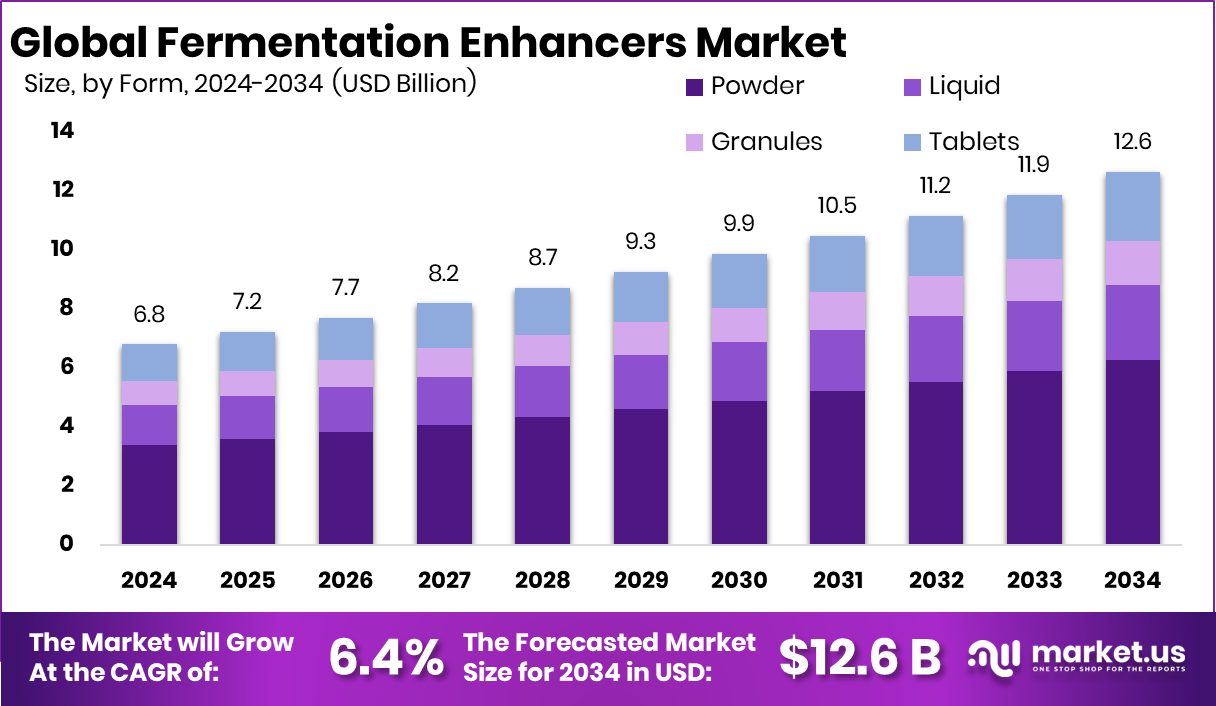

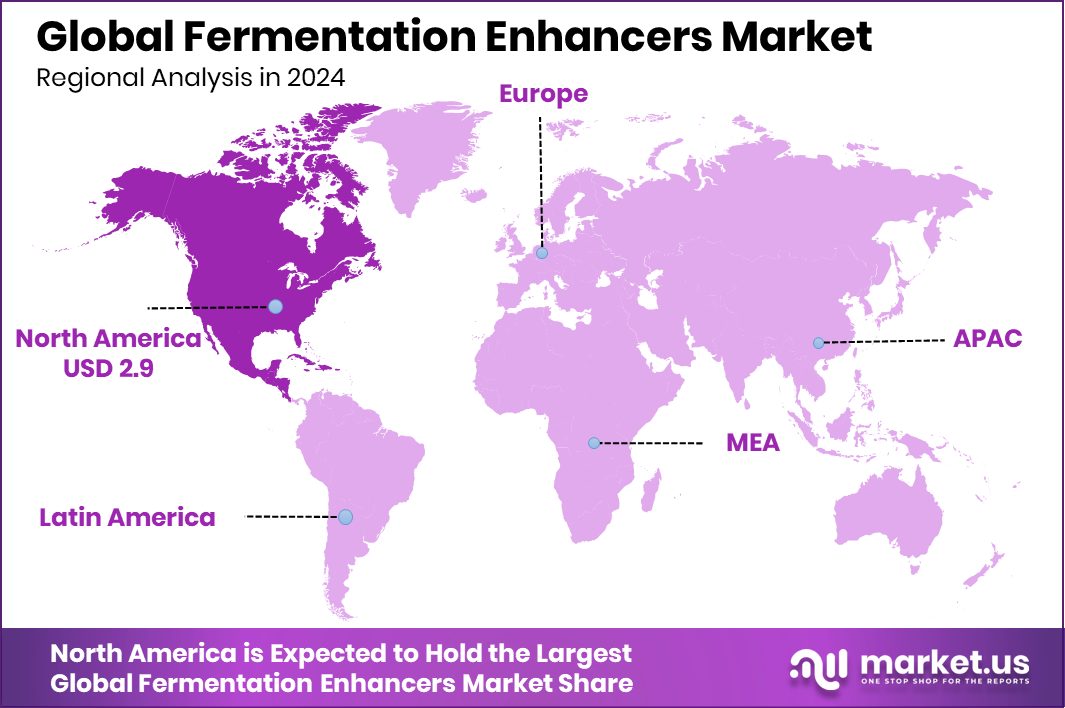

The Global Fermentation Enhancers Market is expected to be worth around USD 12.6 billion by 2034, up from USD 6.8 billion in 2024, and is projected to grow at a CAGR of 6.4% from 2025 to 2034. North America Fermentation Enhancers Market dominates with a 42.8% contribution to USD 2.9 Bn.

Fermentation enhancers are ingredients or processing aids added during fermentation to support microbial activity, stability, and efficiency. They help microorganisms perform better by improving nutrient availability, stress tolerance, and metabolic balance. As a result, fermentation becomes faster, more consistent, and more predictable. These enhancers are widely used in food, beverage, nutrition, agriculture, and industrial biotechnology, where controlled fermentation is essential for quality and yield.

The Fermentation Enhancers Market represents the supply ecosystem around these solutions, covering products used to optimize yeast, bacteria, and other microbes at scale. The market supports industries moving toward precision fermentation, sustainable ingredients, and bio-based production. Its relevance continues to grow as fermentation shifts from traditional food processing into advanced nutrition, cosmetics, and functional biomaterials.

Growth factors are closely linked to innovation funding in fermentation-driven ingredients. Revyve raising $28m Series B for yeast-based egg replacers highlights how fermentation enhancers enable cost-competitive alternatives. Similarly, Portugal’s PFx Biotech is raising €5M, and Australia’s Eclipse Ingredients is securing $4.6M show growing investment in precision-fermented proteins, where enhancer performance directly affects scalability and product consistency.

Demand is rising as fermentation moves into cosmetics, nutrition, and clean-label formulations. The Estonian government’s $1.1M support and ÄIO’s €1 million funding to scale yeast-based palm oil alternatives reflect demand for sustainable fermentation outputs. In parallel, Phytolon’s $14.5M funding for biotech food colorants demonstrates how enhancers help stabilize color, yield, and batch quality.

Opportunities are expanding through functional nutrition and gut health applications. SuperYou’s ₹63 Cr Series B supports fermentation-backed nutrition products requiring optimized microbial performance. Additionally, €250,000 nutrition research grants awarded by DSM-Firmenich in APAC underline a growing scientific focus on fermentation efficiency, opening long-term opportunities for advanced fermentation enhancer solutions.

Key Takeaways

- The Global Fermentation Enhancers Market is expected to be worth around USD 12.6 billion by 2034, up from USD 6.8 billion in 2024, and is projected to grow at a CAGR of 6.4% from 2025 to 2034.

- In the Fermentation Enhancers Market, yeast nutrients lead product types with 29.3% share globally today.

- Powder form dominates the Fermentation Enhancers Market, accounting for 49.6% due to handling efficiency benefits.

- Synthetic sources hold prominence in the Fermentation Enhancers Market with 49.4% adoption worldwide across industries.

- Microbial optimization functionality leads the Fermentation Enhancers Market at 32.9%, improving process consistency and yields.

- Food and beverage fermentation applications dominate the Fermentation Enhancers Market with 36.2% share globally today.

- In North America, the fermentation enhancers market reached a 42.8% share, totaling USD 2.9 Bn.

By Product Type Analysis

The fermentation enhancers market shows the yeast nutrients product type with a 29.3% share.

In 2024, yeast nutrients held a 29.3% share in the Fermentation Enhancers Market, reflecting their critical role in improving fermentation efficiency and consistency. Yeast nutrients supply essential nitrogen sources, vitamins, and minerals that support healthy yeast metabolism during fermentation. Their widespread use across brewing, winemaking, bioethanol, and food fermentation processes has driven steady demand.

Manufacturers increasingly rely on yeast nutrients to reduce fermentation time, improve yield, and prevent process failures caused by nutrient deficiencies. The segment also benefits from growing interest in process optimization and cost control, especially in large-scale fermentation operations. As fermentation-based production expands across food and industrial biotechnology, yeast nutrients continue to remain a preferred product type for stable and predictable fermentation performance.

By Form Analysis

Fermentation Enhancers Market highlights powder form dominance, accounting for 49.6% overall.

In 2024, the powder form accounted for a dominant 49.6% share of the Fermentation Enhancers Market due to its ease of handling, longer shelf life, and formulation flexibility. Powdered fermentation enhancers are favored by manufacturers because they offer better stability during storage and transport compared to liquid forms. This format allows precise dosing and easy blending with other dry ingredients used in fermentation processes. Food and beverage producers, in particular, prefer powders for their compatibility with standardized production workflows.

Additionally, powdered products reduce logistics costs and minimize contamination risks. The strong adoption of powdered fermentation enhancers highlights industry preference for reliable, scalable, and cost-effective formats in both small-scale and industrial fermentation applications.

By Source Analysis

The Fermentation Enhancers Market indicates that synthetic sources lead the supply with 49.4% share.

In 2024, synthetic sources represented 49.4% of the Fermentation Enhancers Market, driven by their consistent quality, predictable composition, and high functional efficiency. Synthetic fermentation enhancers are widely used because they offer uniform nutrient profiles and controlled performance, which are essential for large-scale and high-precision fermentation processes. These products enable manufacturers to maintain consistent batch quality while reducing variability associated with natural raw materials.

The segment also benefits from easier regulatory compliance and cost efficiency in mass production. Synthetic sources are particularly popular in industrial fermentation, brewing, and bio-based manufacturing, where process stability is critical. Their strong market share reflects ongoing demand for standardized and performance-driven fermentation solutions.

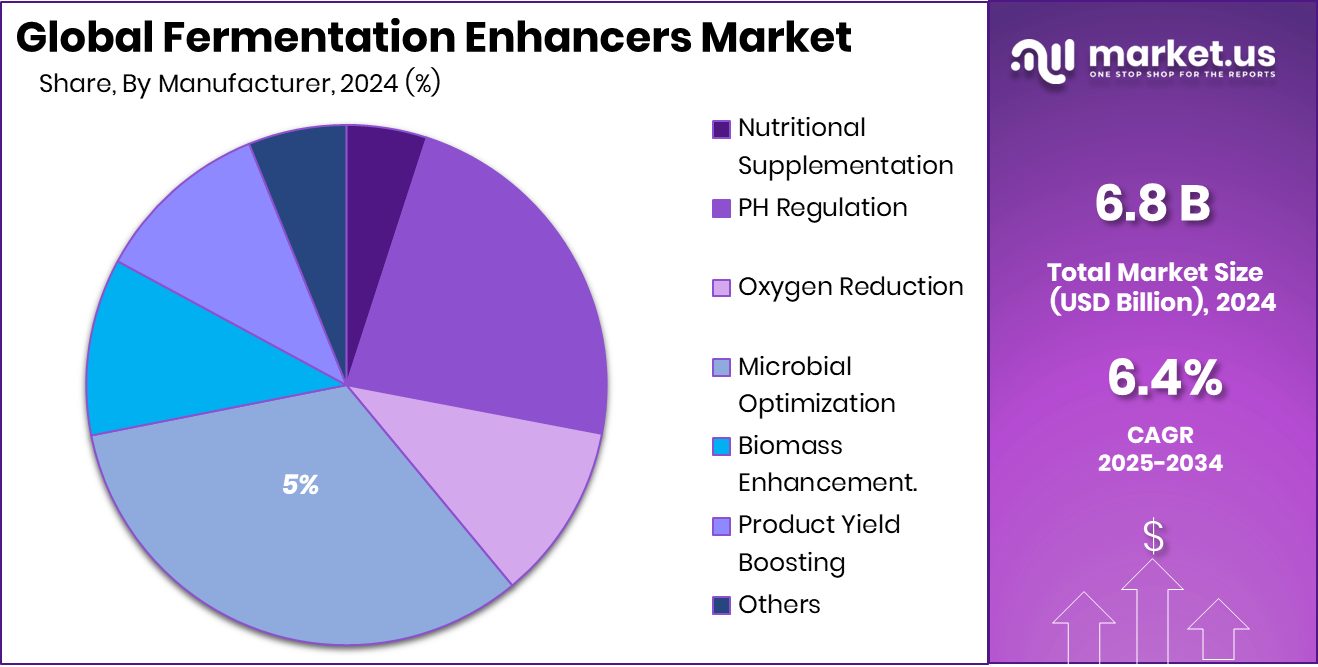

By Functionality Analysis

The fermentation enhancers market emphasizes microbial optimization functionality, capturing 32.9% adoption globally.

In 2024, microbial optimization emerged as the leading functionality segment, capturing a 32.9% share of the Fermentation Enhancers Market. This functionality focuses on improving microbial growth, activity, and resilience during fermentation. Products designed for microbial optimization help maintain ideal fermentation conditions by enhancing nutrient uptake and reducing stress on microorganisms.

As fermentation processes become more complex and yield-focused, manufacturers increasingly prioritize solutions that maximize microbial efficiency. This segment is especially important in applications requiring high productivity, such as enzymes, probiotics, and fermented foods. The growing emphasis on process efficiency, yield improvement, and reduced batch failures continues to drive demand for fermentation enhancers focused on microbial optimization.

By Application Analysis

The fermentation enhancers market is driven by food and beverage fermentation applications, holding 36.2%.

In 2024, food and beverage fermentation accounted for 36.2% of the Fermentation Enhancers Market, making it the largest application segment. The strong share is supported by the rising production of fermented foods and beverages such as beer, wine, dairy products, bakery items, and functional foods. Fermentation enhancers play a key role in improving flavor consistency, fermentation speed, and overall product quality in food and beverage manufacturing.

Growing consumer demand for fermented and functional foods has further strengthened this segment. Additionally, producers are adopting fermentation enhancers to scale up production while maintaining quality standards. This application remains central to market growth as fermentation continues to gain importance in modern food processing.

Key Market Segments

By Product Type

- Enzyme-based Enhancers

- Yeast Nutrients

- pH Adjusters

- Microbial Growth Promoters

- Oxygen Scavengers and Redox Agents

- Prebiotics and Carbohydrate Sources

- Antifoaming Agents

By Form

- Powder

- Liquid

- Granules

- Tablets

By Source

- Synthetic

- Natural/Biobased

By Functionality

- Nutritional Supplementation

- PH Regulation

- Oxygen Reduction

- Microbial Optimization

- Biomass Enhancement.

- Product Yield Boosting

- Others

By Application

- Food and Beverage Fermentation

- Industrial Fermentation

- Pharmaceutical/Biotech

- Animal Feed Fermentation

- Agricultural Fermentation

- Others

Driving Factors

Rising Precision Fermentation Investment Accelerates Enhancer Demand

The main driving factor for the Fermentation Enhancers Market is the rapid rise in precision-fermentation investment, which directly increases the need for reliable fermentation performance tools. When investors bet $9M on a Korean startup developing precision-fermented grape yeast proteins, it highlighted how fermentation success now depends on optimized microbial activity, stability, and yield. These advanced proteins require tightly controlled fermentation environments, where enhancers help microbes stay productive and reduce batch failures.

Similarly, Melt&Marble raising $8.5M to launch animal-free fats for food and personal care shows how fermentation is moving beyond traditional uses. Producing structured fats without animals demands high efficiency and consistency, which increases reliance on fermentation enhancers. As more capital flows into precision-fermented ingredients, companies prioritize tools that improve fermentation speed, output, and quality, making enhancers a critical enabler rather than an optional input.

Restraining Factors

High Development Costs Limit Wider Fermentation Enhancer Adoption

A key restraining factor in the Fermentation Enhancers Market is the high cost and complexity of scaling fermentation-based products, which can slow adoption among smaller producers. When a startup partnered with a South Korean dairy giant to launch vegan casein products ahead of $12M in seed funding, it showed that significant capital is often required before fermentation systems become commercially viable. Developing stable, repeatable fermentation processes demands advanced inputs, including enhancers, which add to early-stage costs.

Similarly, Helaina raising $45M to launch Effera human lactoferrin highlights how expensive precision fermentation can be, even with strong backing from strategic partners. These high entry barriers make fermentation enhancers less accessible for cost-sensitive manufacturers. As a result, adoption may remain concentrated among well-funded companies until production costs decline and fermentation systems become easier to scale efficiently.

Growth Opportunity

Nutrition Safety Push Expands Fermentation Enhancer Market

A major growth opportunity for the Fermentation Enhancers Market is the rising focus on nutrition safety, clinical validation, and regulated food production. When the FDA sought USD 7.2 billion to strengthen food safety, nutrition, and medical product oversight, it signaled tighter quality expectations for fermented and bio-based ingredients. This creates demand for fermentation enhancers that improve process control, consistency, and microbial safety.

At the same time, Zooki securing £1.8 million in funding reflects growing investment in advanced nutritional products that rely on stable fermentation for bioavailability and shelf life.

Similarly, Pregnancy nutrition startup Needed is raising USD 5.8 million to launch new products and support clinical research highlights how fermentation-backed nutrition must meet higher scientific and regulatory standards. Together, these developments open strong opportunities for fermentation enhancers that help manufacturers deliver safe, reliable, and clinically supported nutrition products at scale.

Latest Trends

Institutional Investment Drives Advanced Fermentation Process Innovation

A key latest trend in the Fermentation Enhancers Market is the growing role of institutional funding and leadership-driven scale-up in fermentation technologies. When Raven SR secured USD 15 M in investment while strengthening its leadership team, it reflected a broader shift toward professionalized, large-scale fermentation and conversion platforms. Such developments increase demand for fermentation enhancers that improve microbial efficiency, stability, and throughput in complex systems.

At the same time, the USD 82M investment by NSF and international partners into six Global Centers in 2024 signals a strong public-sector commitment to advancing biotechnology, microbial science, and fermentation research. These centers are expected to accelerate innovation, pilot testing, and commercialization pathways. Together, private investment and public research funding are pushing fermentation toward higher performance standards, making advanced fermentation enhancers a critical component of next-generation bio-based production systems.

Regional Analysis

North America leads the fermentation enhancers market with 42.8% share at USD 2.9 Bn.

North America remains the dominating region in the Fermentation Enhancers Market, holding a 42.8% share valued at USD 2.9 Bn, supported by its mature food and beverage fermentation ecosystem and strong industrial biotechnology adoption. The region benefits from established brewing, dairy, and processed food sectors where fermentation enhancers are routinely used to improve yield consistency and process efficiency.

Europe follows as a structurally strong market, driven by long-standing fermentation traditions across bakery, dairy, and alcoholic beverages, alongside stringent quality standards that favor controlled fermentation inputs. Asia Pacific shows steady expansion, supported by rising consumption of fermented foods and beverages and growing industrial fermentation activity linked to population growth and urban food demand.

The Middle East & Africa market develops gradually, with fermentation enhancers gaining traction in food processing as manufacturers focus on shelf stability and localized production. Latin America continues to progress at a measured pace, supported by expanding beverage production and increased use of fermentation-based processes in food manufacturing.

Collectively, these regions reflect a market shaped by industrial maturity in North America, regulatory discipline in Europe, volume-driven demand in the Asia Pacific, and emerging adoption trends across the Middle East & Africa and Latin America, with North America clearly leading at 42.8% and USD 2.9 Bn.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

AB Biotek continues to hold a strong strategic position in the Fermentation Enhancers Market due to its deep technical expertise in yeast and microbial solutions. The company’s strength lies in tailoring fermentation enhancers that improve microbial performance, consistency, and yield across food, beverage, and industrial fermentation processes. Its focus on application-specific solutions allows producers to optimize fermentation outcomes without altering core production systems. This capability supports long-term partnerships with manufacturers seeking reliability and process stability, reinforcing AB Biotek’s value as a technology-driven supplier rather than a commodity-focused player.

In 2024, Aemetis stands out for integrating fermentation enhancers within its broader bio-based and industrial fermentation operations. The company leverages fermentation optimization to improve efficiency, throughput, and resource utilization in large-scale production environments. Its operational experience provides practical insight into enhancer performance under real industrial conditions, strengthening internal process control. Aemetis’ approach highlights how fermentation enhancers can directly influence cost efficiency and scalability, positioning the company as both a user and improver of fermentation technologies within integrated value chains.

BASF maintains a robust presence in the Fermentation Enhancers Market by applying its extensive chemical and biological formulation expertise. The company focuses on consistency, quality, and performance reliability, which are critical for industrial and food-grade fermentation systems. BASF’s ability to integrate fermentation enhancers into broader ingredient and process portfolios gives customers operational flexibility. Its scale, technical depth, and focus on performance-driven solutions continue to support its competitive positioning in global fermentation-related applications.

Top Key Players in the Market

- AB Biotek

- Aemetis

- BASF

- Corteva

- Darling Ingredients

- DSM-Firmenich

- Evonik Industries

- Fermentalg

- Genomatica

- Ginkgo BioWorks

Recent Developments

- In October 2025, Genomatica announced that the world’s largest Geno™ Bio-BDO (1,4-butanediol) manufacturing plant started operating in Eddyville, Iowa. The company’s proprietary fermentation technology uses plant-based sugars to produce renewable BDO, which replaces fossil-based inputs. This plant reflects Genomatica’s work in industrial biotechnology, helping produce sustainable chemical building blocks used in textiles, plastics, and other everyday products.

- In August 2024, AB Mauri North America, which includes AB Biotek’s specialty yeast division, completed the acquisition of Omega Yeast Labs LLC. Omega Yeast is well-known for its craft brewing liquid yeast strains and advanced fermentation solutions in the U.S. This move helps AB Biotek expand its fermentation technology portfolio, particularly for craft beer and beverage applications, by adding new yeast strains and R&D capabilities.

- In May 2024, Ginkgo Bioworks announced several acquisitions, including Patch Biosciences, Proof Diagnostics, and key assets of Reverie Labs. These acquisitions strengthen Ginkgo’s capabilities in cell engineering and biological innovation, helping enhance its platform that supports fermentation and synthetic biology services. The added technologies improve how Ginkgo designs biological systems and supports industrial fermentation processes.

Report Scope

Report Features Description Market Value (2024) USD 6.8 Billion Forecast Revenue (2034) USD 12.6 Billion CAGR (2025-2034) 6.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Enzyme-based Enhancers, Yeast Nutrients, pH Adjusters, Microbial Growth Promoters, Oxygen Scavengers and Redox Agents, Prebiotics and Carbohydrate Sources, Antifoaming Agents), By Form (Powder, Liquid, Granules, Tablets), By Source (Synthetic, Natural/Biobased), By Functionality (Nutritional Supplementation, PH Regulation, Oxygen Reduction, Microbial Optimization, Biomass Enhancement, Product Yield Boosting, Others), By Application (Food and Beverage Fermentation, Industrial Fermentation, Pharmaceutical/Biotech, Animal Feed Fermentation, Agricultural Fermentation, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape AB Biotek, Aemetis, BASF, Corteva, Darling Ingredients, DSM-Firmenich, Evonik Industries, Fermentalg, Genomatica, Ginkgo BioWorks Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Fermentation Enhancers MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample

Fermentation Enhancers MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- AB Biotek

- Aemetis

- BASF

- Corteva

- Darling Ingredients

- DSM-Firmenich

- Evonik Industries

- Fermentalg

- Genomatica

- Ginkgo BioWorks