Global Feeding Systems Market Size, Share, Growth Analysis By Product (Self-Propelled System, Rail Guided System, Conveyor Belt System), By Technology (Manual, Automated), By Application (Dairy Farm, Poultry Farm, Swine Farm, Equine Farm, Others) - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 157395

- Number of Pages: 348

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

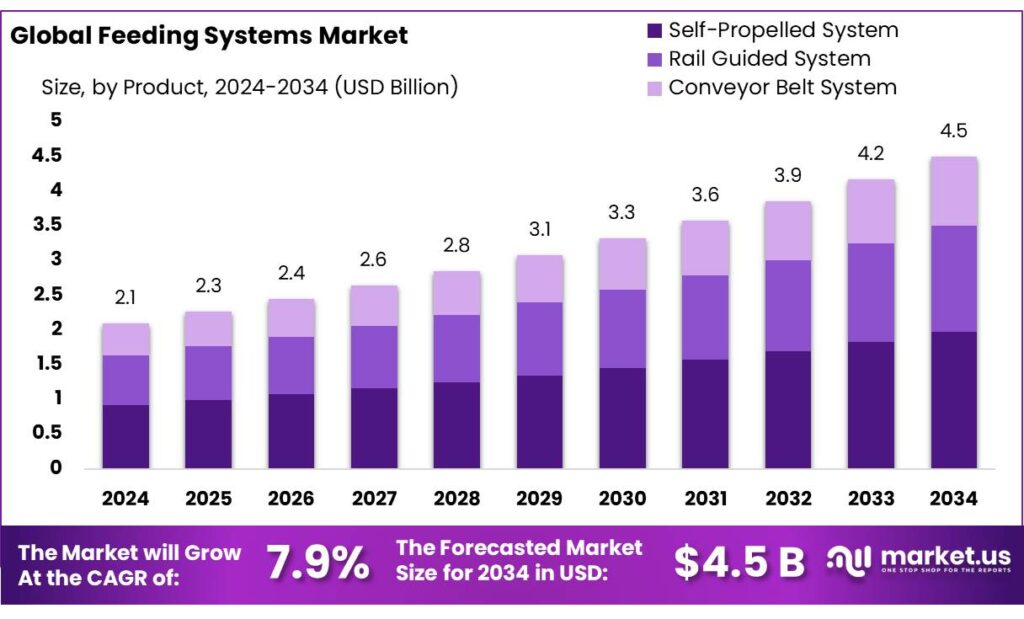

The Global Feeding Systems Market size is expected to be worth around USD 4.5 Billion by 2034, from USD 2.1 Billion in 2024, growing at a CAGR of 7.9% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 42.4% share, holding USD 0.8 Billion in revenue.

The animal feed industry in India plays a pivotal role in supporting the nation’s livestock sector, which is integral to its agricultural economy. As of 2023, India produced approximately 52.83 million metric tons of compound feed, positioning it as the fourth-largest producer globally. The primary components of this feed include broiler feed (19.72 million metric tons), layer feed (16.14 million metric tons), and dairy feed (13.94 million metric tons).

The government’s proactive initiatives have significantly bolstered the sector’s growth trajectory. Under the National Livestock Mission (NLM), the government provides a 50% capital subsidy (up to INR 50 lakh) for establishing feed and fodder value addition units, including facilities for hay/silage preparation and Total Mixed Ration production. Additionally, the Animal Husbandry Infrastructure Development Fund (AHIDF), with an allocation of INR 15,000 crore, offers financial assistance to private entities, Farmer Producer Organizations (FPOs), and entrepreneurs for setting up animal feed manufacturing units.

Technological advancements in feed formulation and production processes are also contributing to industry growth. Innovations such as precision feeding technologies, the use of alternative ingredients like Distillers Dried Grains with Solubles (DDGS), and sustainable practices are improving feed efficiency and reducing costs. For example, DDGS production in India has surged approximately 13-fold over the past two years, reaching an estimated 5.5 million tons by 2025.

Despite these efforts, challenges persist, including a significant demand-supply gap in feed and fodder. The 19th Livestock Census indicates a shortfall of 64% in green fodder and 61.1% in dry fodder. To address this, states like West Bengal are expanding maize cultivation by 60,000 hectares over three years to meet rising feed demands.

Key Takeaways

- Feeding Systems Market size is expected to be worth around USD 4.5 Billion by 2034, from USD 2.1 Billion in 2024, growing at a CAGR of 7.9%.

- Self-Propelled System held a dominant market position, capturing more than a 43.9% share of the overall feeding systems industry.

- Automated held a dominant market position, capturing more than a 67.7% share in the feeding systems market.

- Dairy Farm held a dominant market position, capturing more than a 39.2% share of the overall feeding systems market.

- North America held a dominant position in the Feeding Systems market, capturing 42.4% of revenue—about USD 0.8 Bn.

By Product Analysis

Self-Propelled Feeding Systems dominate with 43.9% share in 2024

In 2024, Self-Propelled System held a dominant market position, capturing more than a 43.9% share of the overall feeding systems industry. This strong foothold reflects their ability to combine flexibility, efficiency, and labor savings in both large-scale dairy and cattle operations. Farmers increasingly prefer self-propelled units because they allow precise ration mixing, reduce dependency on multiple tractors, and streamline daily feed distribution tasks. These systems are especially valuable in regions where labor shortages and rising operational costs are pressing concerns.

By Technology Analysis

Automated Feeding Systems lead with 67.7% share in 2024

In 2024, Automated held a dominant market position, capturing more than a 67.7% share in the feeding systems market. This dominance reflects the growing preference of livestock producers for technology-driven solutions that save labor, reduce feed waste, and ensure consistent rations for animals. Automated systems are increasingly viewed as a necessity rather than a luxury, especially in large dairy farms and poultry operations where efficiency and precision directly affect profitability.

By Application Analysis

Dairy Farm Feeding Systems dominate with 39.2% share in 2024

In 2024, Dairy Farm held a dominant market position, capturing more than a 39.2% share of the overall feeding systems market. This leadership is largely driven by the continuous rise in global milk production and the growing demand for efficient feeding solutions that improve animal health and milk yields. Dairy farms, especially large-scale operations, rely heavily on consistent and precise feed management to maintain herd productivity, making feeding systems an essential investment.

Key Market Segments

By Product

- Self-Propelled System

- Rail Guided System

- Conveyor Belt System

By Technology

- Manual

- Automated

By Application

- Dairy Farm

- Poultry Farm

- Swine Farm

- Equine Farm

- Others

Emerging Trends

Government Support for Animal Feed Industry Growth

One of the significant initiatives is the Animal Husbandry Infrastructure Development Fund (AHIDF), which has an outlay of ₹29,110.25 crore. This fund encourages investments from individual entrepreneurs, private firms, MSMEs, Farmer Producer Organizations (FPOs), Section 8 entities, and dairy cooperatives to set up facilities such as animal feed manufacturing plants. The AHIDF aims to bolster the infrastructure necessary for efficient feed production and distribution, thereby supporting the growth of the animal feed industry.

Additionally, the National Livestock Mission (NLM) focuses on employment generation, entrepreneurship development, and enhancing per-animal productivity. The scheme targets increased production of meat, goat milk, eggs, and wool, with a particular emphasis on improving feed and fodder development. By addressing these areas, the NLM contributes to the overall growth and sustainability of the animal feed sector.

Drivers

Government Initiatives in India to Address Food Insecurity

In India, one of the major driving factors influencing the development and adoption of feeding systems is the government’s commitment to eradicating hunger and malnutrition. Despite being the world’s largest producer of several food items, India continues to face significant challenges related to food insecurity.

- According to the Food and Agriculture Organization (FAO), India is home to over 190 million undernourished people, accounting for a quarter of the world’s hungry population.

Recognizing the urgency of this issue, the Indian government has implemented various initiatives aimed at improving food security and nutrition. One of the most notable programs is the Public Distribution System (PDS), which provides subsidized food grains to low-income households. Additionally, the National Food Security Act (NFSA) was enacted to ensure access to adequate quantities of quality food at affordable prices to people, thereby promoting nutritional security.

Furthermore, the government has launched several schemes focused on enhancing agricultural productivity and sustainability. Programs such as the Pradhan Mantri Krishi Sinchayee Yojana (PMKSY) aim to improve irrigation infrastructure, ensuring that farmers have reliable access to water for their crops. The Soil Health Management initiative seeks to promote the use of organic fertilizers and balanced nutrient management practices, enhancing soil fertility and crop yields.

These efforts are complemented by initiatives aimed at improving nutrition awareness and dietary habits among the population. The Poshan Abhiyaan (National Nutrition Mission) focuses on reducing malnutrition through community-based interventions, including promoting the consumption of diverse and nutritious foods. Additionally, the government collaborates with international organizations to implement programs that address food security challenges, such as the FAO’s support for improved monitoring of sustainable agriculture in India.

Restraints

Limited Access to Nutritious Food: A Barrier to Effective Feeding Systems

In India, a significant challenge to effective feeding systems is the limited access to nutritious food, particularly among vulnerable populations. Despite advancements in food production and distribution, many individuals, especially in rural and economically disadvantaged areas, struggle to obtain a balanced and healthy diet. This issue is compounded by factors such as poverty, lack of awareness, and inadequate infrastructure.

- The National Family Health Survey (NFHS) 2019-21 revealed concerning figures regarding malnutrition among children. It reported that 35.5% of children under five years of age were stunted, 19.3% were wasted, and 32.1% were underweight. These figures indicate a significant gap in the accessibility of nutritious food, which is essential for healthy growth and development .

Government initiatives such as the Public Distribution System (PDS) and the National Food Security Act (NFSA) aim to provide subsidized food grains to low-income households. However, these programs primarily focus on staple foods like rice and wheat, often neglecting the inclusion of diverse and nutrient-rich foods essential for a balanced diet. This limitation restricts the effectiveness of feeding systems in addressing the nutritional needs of the population.

In response to these challenges, the government has launched the Poshan Abhiyaan (National Nutrition Mission), which seeks to improve nutritional outcomes through a multi-sectoral approach. The mission emphasizes the importance of dietary diversity and aims to raise awareness about the consumption of a variety of foods. Additionally, the government collaborates with organizations like the FAO to promote sustainable agricultural practices that enhance the availability of diverse and nutritious foods

Opportunity

Growth Opportunity: Expansion of Maize Cultivation to Meet Rising Feed Demand

India’s animal feed industry is experiencing a significant growth opportunity driven by the increasing demand for livestock, poultry, and aquaculture products. To meet this demand, the state of West Bengal has announced plans to expand maize cultivation by 60,000 hectares over the next three years. This initiative aims to bolster the supply of maize, a crucial component in animal feed production, thereby supporting the state’s growing livestock and aquaculture industries.

The expansion of maize cultivation is a strategic response to the rising need for quality animal feed. Maize serves as a primary energy source in animal diets, and its increased availability will help stabilize feed prices and ensure a consistent supply for farmers. This move not only addresses the immediate needs of the animal husbandry sector but also contributes to the overall economic development of rural areas by providing employment opportunities and enhancing agricultural productivity.

Furthermore, this initiative aligns with broader national objectives to improve livestock productivity and support sustainable agricultural practices. By increasing maize production locally, the dependency on imported feed ingredients can be reduced, leading to cost savings and greater food security. The government’s support for such projects underscores the importance of strengthening the agricultural supply chain to meet the evolving demands of the animal feed industry.

Regional Insights

In 2024, North America held a dominant position in the Feeding Systems market, capturing 42.4% of revenue—about USD 0.8 Bn. The region’s lead is anchored in its large, professionally managed dairy and beef operations, where feed efficiency, labor savings, and consistent ration delivery are business-critical. Producers continue to replace manual routines with automated bunk feeders, robotic mixers, and silo-to-trough metering lines that reduce wastage and improve herd performance. Adoption is also supported by widespread availability of dealer networks, rapid service response, and strong aftermarket parts, which lower downtime risk and sustain high utilization rates across diverse farm sizes.

Regulatory and buyer expectations around traceability and sustainability further encourage investment. Farms increasingly require systems that log feed composition, timing, and intake, and that integrate with herd management software for compliance and quality audits. Capital expenditure is being prioritized for scalable platforms—hardware paired with software modules—so producers can add capabilities like sensor-based monitoring, remote diagnostics, and data dashboards without a full equipment overhaul. This modular path supports clear payback through reduced feed losses, lower fuel usage, and more predictable labor planning.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Afimilk Ltd., based in Israel, is a pioneer in advanced dairy farm management technologies and feeding systems. The company is best known for its precision feeding solutions, herd management software, and real-time monitoring tools that improve animal health and productivity. Afimilk’s systems integrate with automated feeders to optimize rationing, reduce waste, and enhance milk yields. By serving farms across more than 50 countries, the company combines strong innovation with practical applications, making it a trusted partner in modern dairy operations.

CTB, Inc., headquartered in the United States, is a global leader in providing feeding, watering, and climate-control systems for the livestock sector. As part of Berkshire Hathaway, CTB leverages strong financial and technical resources to deliver high-quality automated feeding technologies for poultry, swine, and dairy farms. Its solutions focus on sustainability, labor efficiency, and scalability, serving both small and industrial-scale producers. With a wide distribution and support network, CTB has built a reputation for innovation, reliability, and global reach in modern animal agriculture.

DairyMaster, based in Ireland, is a key player in feeding and milking technology, widely respected for its innovative approach to dairy farm automation. The company provides advanced feeding systems, milk meters, and software solutions that optimize feed conversion and improve herd management. DairyMaster’s feeders are designed to deliver precise portions, support data-driven decisions, and enhance milk yields. With operations across multiple continents, the company continues to help farmers balance productivity, sustainability, and profitability, making it a leading brand in dairy farm technology.

Top Key Players Outlook

- Afimilk Ltd.

- Agrologic Ltd

- Cormall AS

- CTB, Inc.

- DairyMaster

- DeLaval

- GEA Group

- Aktiengesellschaft

- HETWIN Automation System GmbH

- Lely Holding S.A.R.L

- Pellon Group Oy

Recent Industry Developments

In 2024, CTB’s annual sales surpassed USD 1 billion, supported by a workforce of over 3,000 employees globally and a network of 46 manufacturing and warehouse facilities.

In 2024, DUNS 100 data lists the company’s 2024 income at NIS 210 million—that’s about USD 60 million, giving us a sense of its market weight and scale.

Report Scope

Report Features Description Market Value (2024) USD 2.1 Bn Forecast Revenue (2034) USD 4.5 Bn CAGR (2025-2034) 7.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Self-Propelled System, Rail Guided System, Conveyor Belt System), By Technology (Manual, Automated), By Application (Dairy Farm, Poultry Farm, Swine Farm, Equine Farm, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Afimilk Ltd., Agrologic Ltd, Cormall AS, CTB, Inc., DairyMaster, DeLaval, GEA Group, Aktiengesellschaft, HETWIN Automation System GmbH, Lely Holding S.A.R.L, Pellon Group Oy Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Afimilk Ltd.

- Agrologic Ltd

- Cormall AS

- CTB, Inc.

- DairyMaster

- DeLaval

- GEA Group

- Aktiengesellschaft

- HETWIN Automation System GmbH

- Lely Holding S.A.R.L

- Pellon Group Oy