Global Feed Palatability Enhancers And Modifiers Market Size, Share Analysis Report By Source (Natural, Synthetic), By Product (Flavors, Sweeteners, Texturants, Aroma Enhancers, Others), By Livestock (Poultry, Ruminant, Swine, Aquaculture, Pet, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 155187

- Number of Pages: 309

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

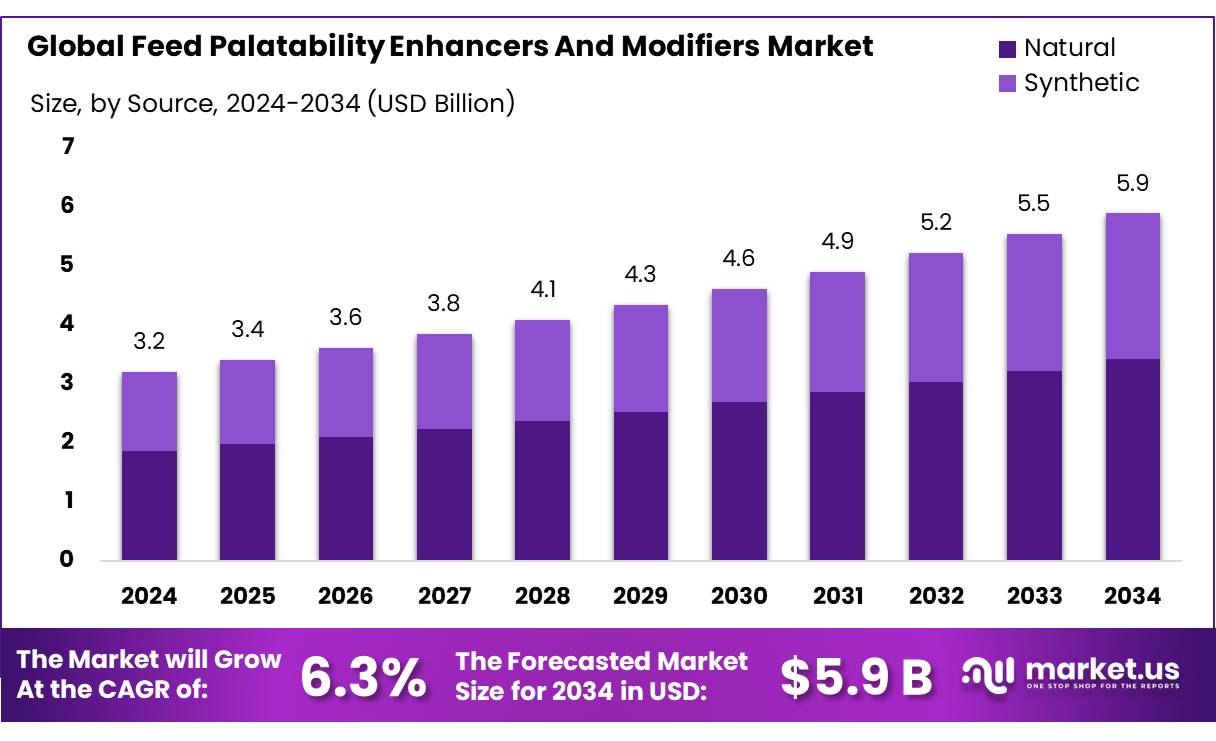

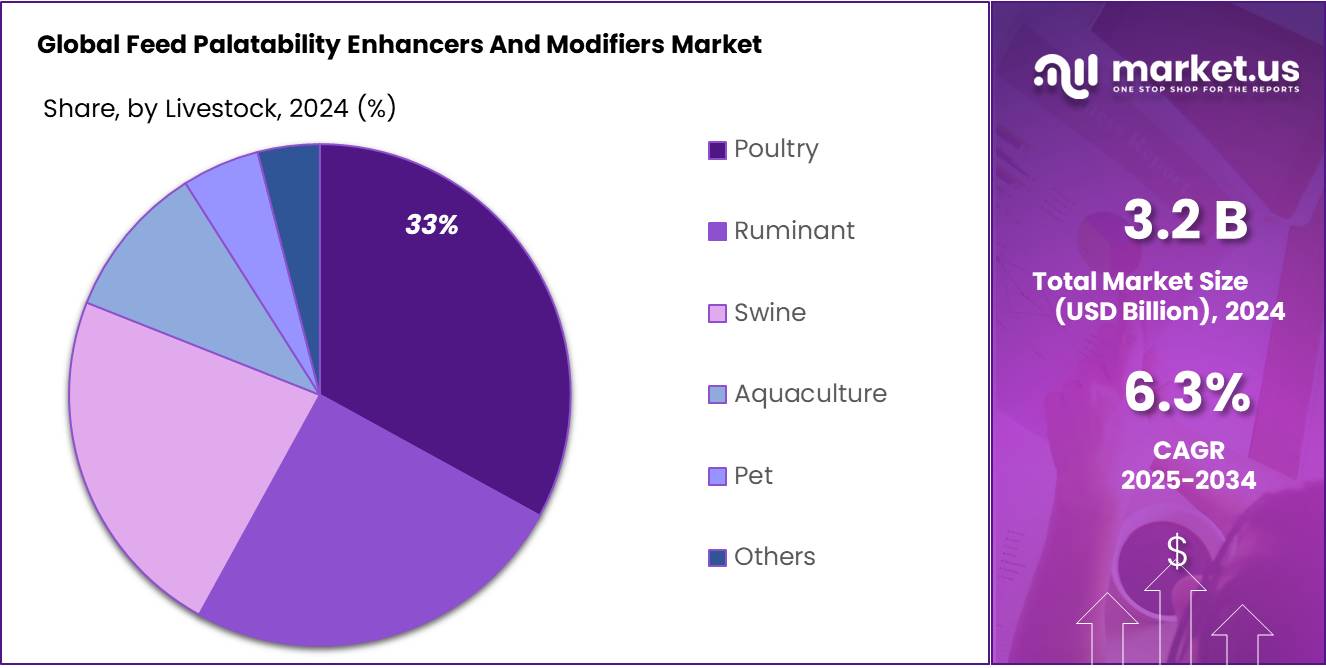

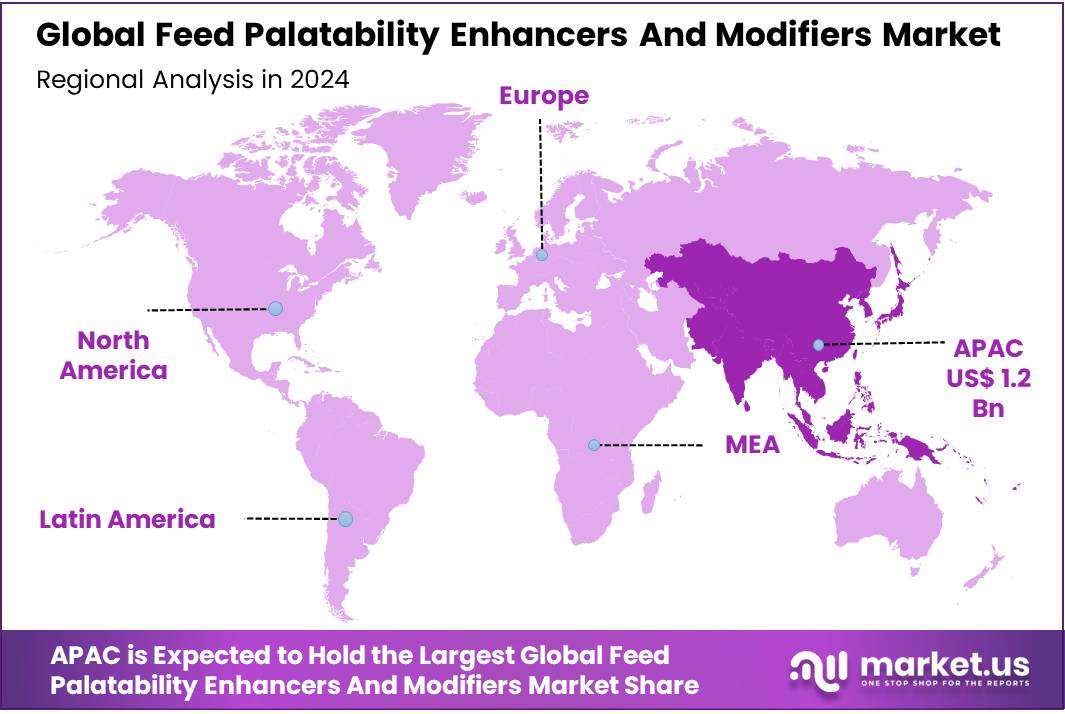

The Global Feed Palatability Enhancers And Modifiers Market size is expected to be worth around USD 5.9 Bn by 2034, from USD 3.2 Bn in 2024, growing at a CAGR of 6.3% during the forecast period from 2025 to 2034. In 2024, Asia-Pacific held a dominant market position, capturing more than a 38.3% share, holding USD 1.2 Billion revenue.

The Feed Palatability Enhancers and Modifiers (FPEMs) market in India is experiencing significant growth, driven by the increasing demand for high-quality animal products and advancements in animal nutrition. FPEMs, which include flavors, sweeteners, aroma enhancers, and texturants, are essential in improving the taste and smell of animal feed, thereby enhancing feed intake and overall livestock performance.

Government Initiatives: The Indian government has implemented various schemes to support the livestock sector. Under the National Livestock Mission Scheme, a 50% capital subsidy is provided for setting up feed/fodder value addition units, including those for Total Mixed Ration (TMR) preparation and fodder block making . Additionally, the Animal Husbandry Infrastructure Development Fund (AHIDF), with an allocation of INR 15,000 crore, aims to enhance private sector investment in animal husbandry infrastructure, including feed plants.

The surge in ethanol production, driven by the government’s 20% fuel blending policy, has led to an increase in the availability of Distillers Dried Grains with Solubles (DDGS), a cost-effective protein source for animal feed. However, this glut of DDGS has impacted the demand for traditional oilmeals, reflecting the dynamic nature of feed ingredient markets.

Key Takeaways

- Feed Palatability Enhancers And Modifiers Market size is expected to be worth around USD 5.9 Bn by 2034, from USD 3.2 Bn in 2024, growing at a CAGR of 6.3%.

- natural feed palatability enhancers and modifiers captured a dominant market position, holding more than a 58.2% share.

- flavors held a dominant position in the feed palatability enhancers and modifiers market, capturing more than a 39.3% share.

- poultry segment held a dominant position in the feed palatability enhancers and modifiers market, capturing more than a 33.9% share.

- Asia Pacific held a dominant position in feed palatability enhancers and modifiers, capturing 38.3% of global demand USD 1.2 Bn.

By Source Analysis

Natural Feed Palatability Enhancers Lead with 58.2% Market Share in 2024

In 2024, natural feed palatability enhancers and modifiers captured a dominant market position, holding more than a 58.2% share. This growth is attributed to the increasing consumer preference for natural and organic products, which has led to a surge in demand for natural additives in animal feed. Natural enhancers, derived from plant, animal, or microbial sources, are perceived as safer and more sustainable, aligning with the global trend towards clean-label products. The rise in organic farming practices and the growing awareness of the benefits of natural ingredients have further fueled this demand.

These synthetic additives are engineered to replicate or enhance natural flavors and aromas, offering cost-effective solutions for feed manufacturers. They provide consistency in quality and performance, which is crucial for large-scale animal farming operations. However, the increasing shift towards natural products and the rising concerns over the potential health impacts of synthetic additives have posed challenges to the growth of this segment.

By Product Analysis

Flavors Dominate Feed Palatability Enhancers Market with 39.3% Share in 2024

In 2024, flavors held a dominant position in the feed palatability enhancers and modifiers market, capturing more than a 39.3% share. This significant market presence is attributed to the increasing demand for palatable and nutritious animal feed across various livestock sectors, including poultry, swine, and aquaculture. Flavors play a crucial role in enhancing the taste and aroma of feed, thereby improving feed intake and overall animal performance. The widespread adoption of flavored feed additives is driven by their effectiveness in stimulating appetite and promoting healthy growth in livestock.

The growth trajectory of the flavors segment is expected to continue in the coming years. Advancements in flavor technology and the development of new, more effective flavoring agents are anticipated to further bolster the segment’s market share. Additionally, the increasing awareness among livestock producers about the benefits of using palatable feed additives is likely to drive the demand for flavors in animal feed formulations. As the global demand for animal-based products rises, the role of flavors in enhancing feed palatability will become even more critical, positioning this segment for sustained growth and innovation.

By Livestock Analysis

Poultry Dominates Feed Palatability Enhancers Market with 33.9% Share in 2024

In 2024, the poultry segment held a dominant position in the feed palatability enhancers and modifiers market, capturing more than a 33.9% share. This significant market presence is attributed to the high-volume feed demand driven by the extensive commercial poultry farming operations across the globe. Poultry farming, particularly broiler production, benefits from the use of palatability enhancers to improve feed intake and overall animal performance. The adoption of these additives is crucial for enhancing feed efficiency, promoting healthy growth, and reducing mortality rates in poultry.

The poultry sector’s dominance is further reinforced by the increasing global demand for poultry meat and eggs, which are primary sources of protein in many diets. Feed palatability enhancers play a vital role in ensuring that poultry consume adequate amounts of feed, thereby supporting optimal growth rates and productivity. Moreover, the shorter production cycles in poultry farming necessitate the use of additives that can deliver rapid and noticeable results in terms of weight gain and feed conversion efficiency.

Key Market Segments

By Source

- Natural

- Synthetic

By Product

- Flavors

- Sweeteners

- Texturants

- Aroma Enhancers

- Others

By Livestock

- Poultry

- Ruminant

- Swine

- Aquaculture

- Pet

- Others

Emerging Trends

Sustainable Feed Additives: A Growing Trend in Animal Nutrition

In recent years, there has been a significant shift towards sustainable and natural feed additives in the animal nutrition industry. This trend is driven by increasing consumer demand for ethically produced animal products and a growing awareness of environmental impacts. Feed palatability enhancers and modifiers, which improve the taste and smell of animal feed, are at the forefront of this movement.

Traditionally, synthetic additives were commonly used to enhance feed palatability. However, there is a growing preference for natural ingredients such as herbs, spices, and plant-based compounds. These natural additives not only improve feed intake but also align with the increasing consumer demand for organic and clean-label products. For instance, the use of essential oils and plant extracts has been shown to enhance the flavor and aroma of feed, making it more appealing to livestock.

Governments worldwide are recognizing the importance of sustainable agricultural practices and are offering support to promote them. In India, the government has launched several initiatives to encourage the use of natural and sustainable feed additives. Programs under the National Livestock Mission aim to improve livestock productivity through the adoption of sustainable practices, including the use of natural feed enhancers. Additionally, the Animal Husbandry Infrastructure Development Fund provides financial assistance to establish modern feed processing units that can incorporate sustainable additives into animal feed.

The shift towards sustainable feed additives is not only a response to regulatory pressures but also a reflection of changing consumer preferences. Consumers are increasingly concerned about the environmental and ethical implications of their food choices, leading to a demand for products derived from animals raised on sustainably sourced feed. This has prompted producers to seek out feed additives that are both effective and environmentally friendly.

Drivers

Government Support and Policy Initiatives: Catalysts for Growth in Feed Palatability Enhancers

In India, the government’s strategic initiatives aimed at enhancing the livestock sector have significantly contributed to the growth of feed palatability enhancers and modifiers. These policy measures not only support the livestock industry but also foster innovation and investment in feed additive technologies.

The Indian government’s commitment to the development of the animal husbandry sector is evident through various schemes and funding mechanisms. For instance, the Animal Husbandry Infrastructure Development Fund (AHIDF) was established to encourage private investment in the construction and modernization of slaughterhouses, meat processing units, and animal feed plants. This initiative aims to improve the quality and availability of animal products, thereby increasing the demand for high-quality feed additives.

Additionally, the government’s focus on promoting sustainable and efficient farming practices has led to the introduction of policies that encourage the use of alternative feed ingredients. The promotion of Distillers Dried Grains with Solubles (DDGS), a byproduct of ethanol production, has been one such measure. While DDGS serves as a cost-effective protein source in animal feed, it has also spurred the development of palatability enhancers to improve its acceptability among livestock. The production of DDGS in India has increased significantly, reaching an estimated 5.5 million tons by 2025, according to industry officials.

These government initiatives have created a conducive environment for the growth of the feed additives market. By providing financial support and promoting the use of alternative feed ingredients, the government has stimulated innovation in feed formulation. This has led to the development of advanced palatability enhancers and modifiers that not only improve feed intake but also enhance the overall health and productivity of livestock.

Restraints

Regulatory Challenges in Feed Palatability Enhancers and Modifiers

One of the significant challenges facing the feed palatability enhancers and modifiers market in India is the evolving and sometimes ambiguous regulatory landscape. While the Food Safety and Standards Authority of India (FSSAI) has made strides in establishing standards for food products, the regulation of feed additives remains a complex issue. As of now, feed additives are not comprehensively regulated by FSSAI, though discussions are ongoing to include them within its scope.

This regulatory uncertainty poses several challenges for manufacturers and stakeholders in the feed industry. Without clear and consistent guidelines, companies may find it difficult to ensure compliance, leading to potential legal and operational risks. Moreover, the lack of standardized regulations can result in discrepancies in product quality and safety, which could undermine consumer trust and acceptance of feed additives.

Additionally, the absence of stringent regulations can lead to the unregulated use of harmful substances in feed products, posing health risks to animals and, by extension, to humans consuming animal-derived products. This situation necessitates urgent attention from regulatory bodies to establish and enforce comprehensive standards for feed additives, ensuring the safety and efficacy of these products in the market.

In response to these challenges, the Indian government has initiated several measures to strengthen the regulatory framework for animal feed. For instance, the FSSAI has reinstituted the Food Safety and Standards Amendment Regulation, 2020, concerning commercial feeds intended for meat and milk-producing animals. This regulation aims to align feed standards with those established by the Bureau of Indian Standards (BIS) and the Department of Animal Husbandry and Dairying (DAHD), addressing food safety and public health concerns associated with commodities like milk.

Opportunity

Government Initiatives Boosting Feed Palatability Enhancers in India

The Indian government’s proactive approach to enhancing livestock productivity and promoting sustainable agriculture has created a fertile ground for the growth of feed palatability enhancers and modifiers. These initiatives not only aim to improve animal health and feed efficiency but also align with global trends towards natural and sustainable feed solutions.

Launched during the 12th Five-Year Plan (2014–15), the National Livestock Mission focuses on holistic development of the livestock sector, including improvements in feed and fodder. One of its key components is the Sub-Mission on Feed and Fodder Development, which aims to increase the availability of quality feed and fodder to livestock. By enhancing the nutritional value of animal feed, this initiative directly supports the adoption of feed palatability enhancers, ensuring better feed intake and overall animal health.

In 2020, the Indian government established the Animal Husbandry Infrastructure Development Fund with an allocation of ₹15,000 crore to boost private sector investment in developing animal husbandry infrastructure. This fund supports the establishment of dairy plants, meat processing units, and animal feed plants. By facilitating the development of modern feed manufacturing facilities, the AHIDF encourages the production and incorporation of advanced feed additives, including palatability enhancers, to improve livestock productivity.

These government initiatives align with global trends in the feed industry, where there is a growing preference for natural and sustainable feed additives. The use of natural feed enhancers, such as phytogenics and prebiotics, is gaining popularity due to their benefits in improving feed intake and animal health. India’s focus on improving feed quality through these initiatives positions the country to meet both domestic and international demands for high-quality livestock products.

Regional Insights

Asia Pacific leads with 38.3% share and USD 1.2 Bn in 2024In 2024, Asia Pacific held a dominant position in feed palatability enhancers and modifiers, capturing 38.3% of global demand (USD 1.2 Bn). The region’s scale in feed manufacturing and its protein mix—poultry, swine, and especially aquaculture—underpin this lead. Asia-Pacific produced about 533.1 million metric tons of compound feed in 2024, remaining the world’s largest producer; even with a slight 0.8% dip, this base sustains steady pull for flavors, sweeteners, attractants, and masking agents that lift feed intake.Aquaculture is a structural driver: global farmed output set records and, for the first time, farmed aquatic animals surpassed wild catch, with Asia responsible for over 90% of aquaculture volumes—strengthening demand for palatability systems in shrimp and finfish diets. Poultry remains a volume backbone; USDA data show Asia contains multiple top chicken-meat producers, anchoring high-throughput broiler and layer feed where appetite stimulation and off-note masking directly improve feed conversion.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Adisseo is a major feed‐additives player linking core nutrition (methionine, vitamins, enzymes) with palatability science. Its portfolio spans natural extracts, sweeteners, taste maskers, and aquaculture attractants designed to lift feed intake in starter, grower, and medicated diets. The company leverages sensory testing, species-specific formulations, and coating technologies to keep flavor/aroma stable through pelleting and extrusion. Strong Asia exposure and technical service teams help translate intake gains into better FCR and livability, while integrated supply and QA systems support consistent, large-scale deployments.

Through AB Agri and AB Vista, ABF blends fermentation know-how with practical feed solutions. Enzymes, yeasts, and yeast extracts support both nutrient availability and palatability, especially in young-animal diets where acceptance is critical. Application labs tailor flavor/aroma systems to local raw materials, while digital nutrition services benchmark intake and performance. A broad manufacturing footprint and secure sourcing reduce variability across poultry, swine, and ruminant feeds. Sustainability programs and traceable supply chains resonate with producers seeking clean-label flavor solutions without compromising process stability.

Kerry applies its Taste & Nutrition expertise to animal feeds, supplying clean-label flavors, yeast extracts, and masking technologies that improve acceptance of high-protein or medicated formulations. Fermentation and biotech platforms create heat-stable, species-targeted profiles suited to pelleting and extrusion. Regional application centers in growth markets help localize palatability solutions to native grains and oils. Kerry’s cross-category R&D—spanning food, beverages, and pet—accelerates rapid prototyping, while sustainability commitments and secure sourcing appeal to integrators seeking dependable, scalable flavor systems for poultry and aquaculture.

Top Key Players Outlook

- Adisseo

- Associated British Foods plc (ABF)

- Kemin Industries, Inc.

- Kerry Group Plc

- Symrise AG

- Elanco Animal Health

Recent Industry Developments

Adisseo, a global leader in animal nutrition, has made significant strides in the feed palatability enhancers and modifiers sector in 2024. The company achieved a remarkable 18% year-over-year revenue growth, reaching CNY 15.53 billion, with a 67% increase in gross profit to CNY 4.69 billion.

Kerry Group divested its dairy operations for €500 million to focus more on its core competencies in taste and nutrition, including feed additives.

Report Scope

Report Features Description Market Value (2024) USD 3.2 Bn Forecast Revenue (2034) USD 5.9 Bn CAGR (2025-2034) 6.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Natural, Synthetic), By Product (Flavors, Sweeteners, Texturants, Aroma Enhancers, Others), By Livestock (Poultry, Ruminant, Swine, Aquaculture, Pet, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Adisseo, Associated British Foods plc (ABF), Kemin Industries, Inc., Kerry Group Plc, Symrise AG, Elanco Animal Health Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Feed Palatability Enhancers And Modifiers MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample

Feed Palatability Enhancers And Modifiers MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Adisseo

- Associated British Foods plc (ABF)

- Kemin Industries, Inc.

- Kerry Group Plc

- Symrise AG

- Elanco Animal Health