Global Facade Market Size, Share, Growth Analysis By Type (Ventilated, Non-Ventilated, Others), By Façade Type (Curtain Wall, Cladding, Others), By Material Type (Glass, Metal, Plastic & Fibres, Wood, Others), By Installation Type (New Construction, Renovation / Retrofitting), By End User (Commercial, Residential, Institutional, Industrial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Jan 2026

- Report ID: 176161

- Number of Pages: 242

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

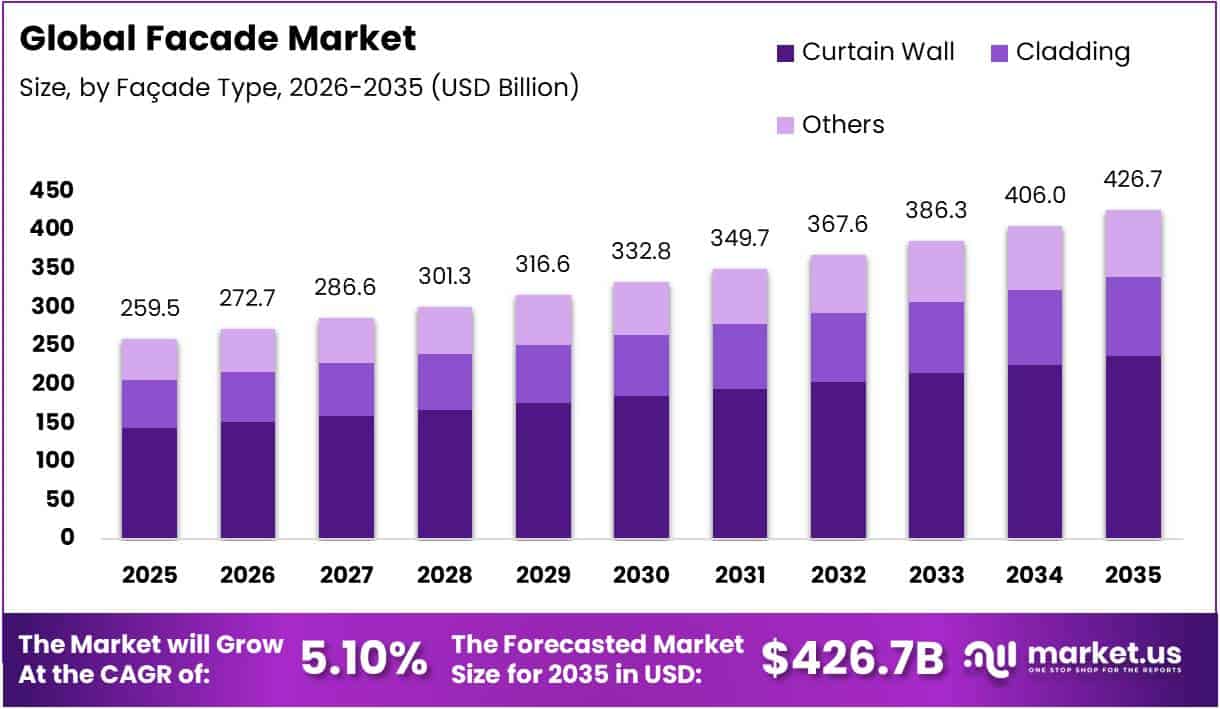

The Global Facade Market size is expected to be worth around USD 426.7 Billion by 2035, from USD 259.5 Billion in 2025, growing at a CAGR of 5.10% during the forecast period from 2026 to 2035.

Facades represent the exterior building envelope systems integrating architectural aesthetics with functional performance elements. These systems encompass curtain walls, cladding materials, glazing solutions, and ventilation components. Modern facades serve dual purposes by enhancing visual appeal while optimizing thermal regulation, energy efficiency, and occupant comfort across commercial and residential structures.

The facade market demonstrates robust expansion driven by urbanization and sustainable construction imperatives. Developers increasingly prioritize energy-efficient building solutions, consequently elevating demand for advanced facade technologies. This growth trajectory reflects heightened environmental consciousness and stricter building performance standards. Market players innovate continuously, introducing smart materials and integrated systems that address evolving architectural requirements.

Significant opportunities emerge from retrofitting existing infrastructure with high-performance facade systems. Aging commercial buildings require modernization to meet contemporary energy benchmarks and occupant expectations. Additionally, smart city initiatives create substantial demand for intelligent facade solutions incorporating sensors and automated climate control. These applications position facades as critical components in next-generation urban development strategies.

Government investments substantially influence market dynamics through green building incentives and infrastructure development programs. Regulatory frameworks worldwide mandate enhanced energy performance, compelling stakeholders to adopt advanced facade technologies. Building codes increasingly specify thermal transmittance limits and energy consumption targets. Such policies accelerate market adoption while fostering innovation in sustainable construction materials and methodologies.

Energy performance research validates the strategic importance of facade optimization in building sustainability. According to building performance simulations, envelope elements contribute approximately 50% to cooling demand, underscoring facades substantial impact on operational efficiency. Furthermore, integrated facade and envelope optimization achieves roughly 15.2% total annual energy savings compared with conventional designs, translating to approximately 4,627 kWh reduction in evaluation studies.

Innovative facade strategies deliver measurable performance improvements across diverse applications. Dynamic facade implementations using seasonal thresholds achieve 14.9% reductions in HVAC energy consumption versus traditional envelopes in office environments. Moreover, optimized opaque ventilated facades demonstrate approximately 32% reduction in annual heat flux compared with non-ventilated configurations when employing optimal design parameters in energy simulations. These quantifiable benefits reinforce facades’ essential role in sustainable architecture.

Key Takeaways

- The Global Facade Market is valued at USD 259.5 Billion in 2025 and is projected to reach USD 426.7 Billion by 2035, growing at a 5.10% CAGR.

- By type, Ventilated facades dominate the market with a share of 52.3% in 2025.

- By façade type, Curtain Wall systems lead with a market share of 55.6% in 2025.

- By material, Glass facades hold the largest share at 40.5% in 2025.

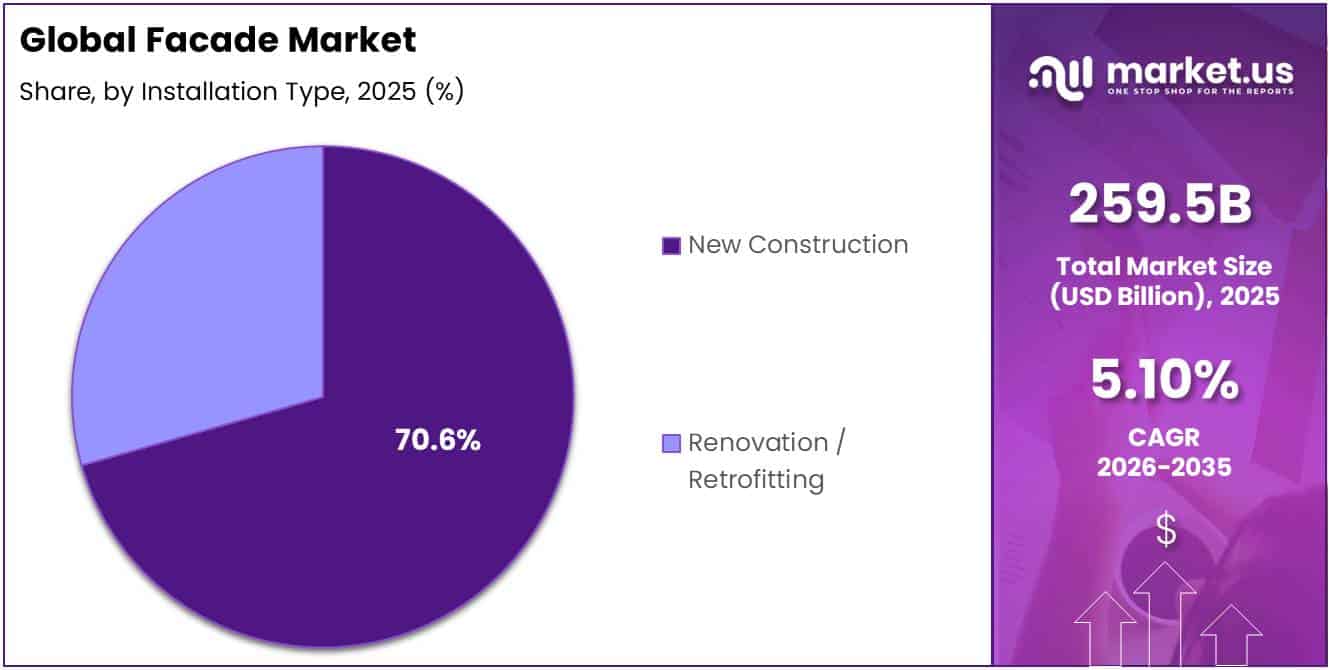

- By installation type, New Construction accounts for a dominant 70.6% market share in 2025.

- By end user, the Commercial segment leads with a share of 50.1% in 2025.

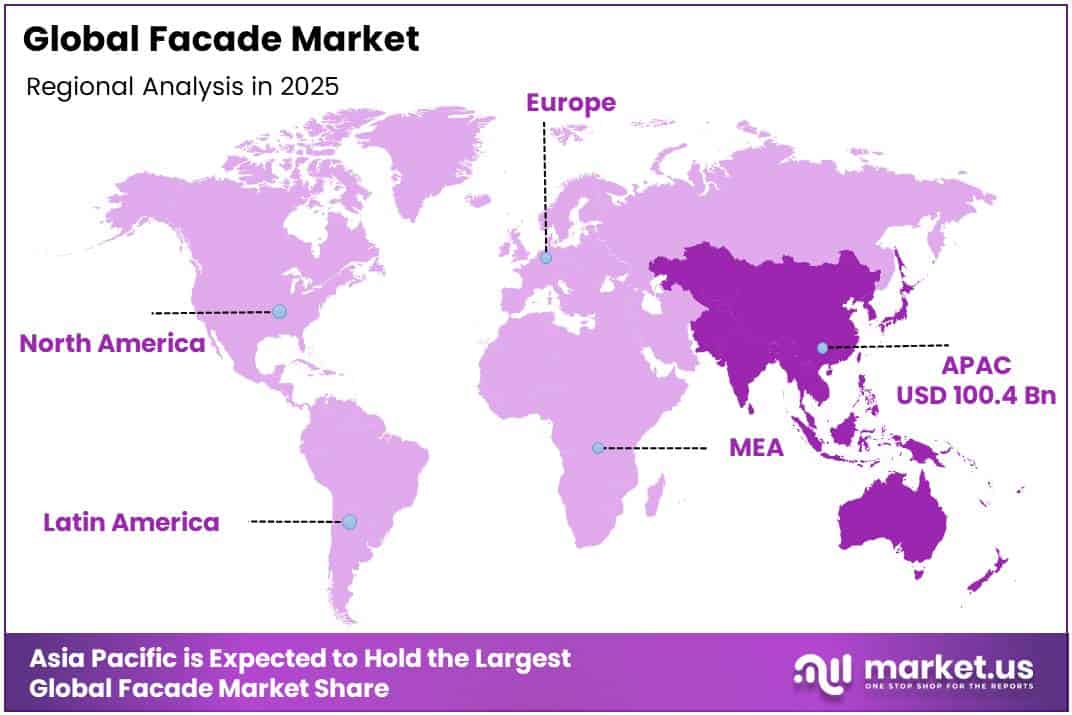

- Asia Pacific dominates the regional landscape with a market share of 38.7%, valued at USD 100.4 Billion.

Type Analysis

Ventilated held a dominant market position in the By Type Analysis segment of Facade Market, with a 52.3% share.

In 2025,Ventilated facades lead the market through superior thermal performance and energy efficiency. These systems create air cavities between building structures and external cladding, enabling natural ventilation and moisture control. Consequently, they reduce cooling costs while preventing condensation issues, aligning with environmental regulations and green building certifications.

Non-ventilated facades offer direct cladding attachment to building structures with simpler installation and lower initial costs. Despite lacking thermal regulation benefits, they remain popular where budget constraints dominate. Their straightforward design suits projects requiring quick deployment and minimal engineering complexity.

Others encompass specialized facade systems including hybrid solutions and innovative technologies. These alternatives address unique architectural requirements and specific climatic conditions. Furthermore, emerging technologies integrate smart materials and adaptive facades responding dynamically to environmental changes.

Façade Type Analysis

Curtain Wall held a dominant market position in the By Façade Type Analysis segment of Facade Market, with a 55.6% share.

In 2025, Curtain wall systems dominate through exceptional versatility and aesthetic appeal in contemporary architecture. These non-structural cladding systems hang from building frameworks, providing architects unprecedented design freedom. Additionally, curtain walls maximize natural light penetration while offering excellent weather protection, making them ideal for high-rise commercial buildings.

Cladding systems provide protective layers applied to building exteriors, offering durability and weather resistance. These solutions accommodate various materials and finishes, enabling diverse architectural expressions. Moreover, cladding enhances insulation properties and extends building lifespan through effective moisture and thermal management.

Others include specialized facade types such as double-skin facades and structural glazing systems. These innovative solutions cater to niche applications requiring enhanced performance characteristics. Furthermore, they incorporate advanced technologies addressing specific environmental and aesthetic demands in unique construction projects.

Material Type Analysis

Glass held a dominant market position in the By Material Type Analysis segment of Facade Market, with a 40.5% share.

In 2025, Glass facades dominate due to their ability to maximize natural lighting while creating visually striking architectural statements. Modern glass technologies incorporate thermal insulation, UV protection, and energy efficiency features. Consequently, glass remains the preferred material for commercial buildings prioritizing transparency, aesthetics, and occupant comfort.

Metal facades offer exceptional durability, structural strength, and low maintenance requirements. Materials like aluminum, steel, and copper provide design flexibility with various finishes and profiles. Additionally, metal systems ensure long-term performance in challenging climatic conditions while supporting sustainable construction through recyclability.

Plastic and fibres deliver lightweight, cost-effective facade solutions with excellent moldability and design versatility. These materials enable innovative shapes and textures while providing adequate weather resistance. Furthermore, advanced composites within this category offer improved durability and sustainability credentials for modern construction applications.

Wood facades provide natural aesthetics and environmental sustainability, appealing to eco-conscious projects. Timber systems offer excellent insulation properties and carbon sequestration benefits. Moreover, modern treatments enhance wood’s durability and weather resistance, expanding its application in contemporary facade design.

Others include emerging materials such as terracotta, stone, and advanced composites. These alternatives address specific aesthetic preferences and performance requirements. Additionally, they enable unique architectural expressions while meeting diverse functional and environmental demands.

Installation Type Analysis

New Construction held a dominant market position in the By Installation Type Analysis segment of Facade Market, with a 70.6% share.

In 2025, New construction dominates the facade market driven by rapid urbanization and infrastructure development globally. Fresh building projects allow comprehensive facade planning, optimal material selection, and advanced system integration from inception. Consequently, new construction enables architects to implement cutting-edge facade technologies maximizing energy efficiency and aesthetic impact.

Renovation and retrofitting addresses existing building upgrades, enhancing energy performance and modernizing aesthetics. This segment grows as building owners seek to extend asset lifespans and meet updated regulatory standards. Furthermore, retrofitting projects increasingly incorporate sustainable facade solutions, reducing operational costs while improving occupant comfort and building valuations.

End User Analysis

Commercial held a dominant market position in the By End User Analysis segment of Facade Market, with a 50.1% share.

In 2025, Commercial buildings lead facade demand through extensive office towers, retail complexes, and hospitality developments. These projects prioritize premium aesthetics, branding visibility, and energy efficiency to attract tenants and customers. Consequently, commercial facades incorporate advanced glazing systems and innovative materials creating distinctive architectural identities.

Residential facades focus on balancing cost-effectiveness with aesthetic appeal and functional performance. Housing developments increasingly adopt modern facade systems enhancing thermal comfort and reducing energy consumption. Moreover, residential projects emphasize durability and low maintenance, ensuring long-term value for homeowners and developers.

Institutional facades serve educational, healthcare, and government facilities requiring durability and functionality. These buildings prioritize safety, accessibility, and environmental sustainability in facade design. Additionally, institutional projects often incorporate specialized features addressing unique operational requirements and regulatory compliance standards.

Industrial facades emphasize functionality, weather protection, and cost efficiency over aesthetic considerations. Warehouses, manufacturing facilities, and logistics centers require robust cladding systems withstanding harsh operational environments. Furthermore, industrial facades increasingly integrate insulation and ventilation features improving worker comfort and operational efficiency.

Key Market Segments

By Type

- Ventilated

- Non-Ventilated

- Others

By Façade Type

- Curtain Wall

- Cladding

- Others

By Material Type

- Glass

- Metal

- Plastic & Fibres

- Wood

- Others

By Installation Type

- New Construction

- Renovation / Retrofitting

By End User

- Commercial

- Residential

- Institutional

- Industrial

Drivers

Rising Demand for Energy-Efficient and Sustainable Building Envelopes Drives Market Growth

The facade market is experiencing significant momentum driven by the growing need for energy-efficient building solutions. As global energy costs continue to rise, building owners and developers are increasingly investing in advanced facade systems that reduce heating and cooling expenses. Modern facades incorporate insulation technologies and reflective materials that minimize thermal transfer, leading to substantial energy savings over time.

Urbanization is reshaping skylines worldwide, particularly in developing regions where commercial infrastructure is expanding rapidly. Cities are witnessing unprecedented construction of office towers, shopping centers, and mixed-use developments, all requiring sophisticated facade systems. This urban growth creates consistent demand for innovative building envelope solutions that meet modern aesthetic and functional requirements.

Technological innovation is reshaping the facade industry through advanced materials and modern installation techniques. Lightweight composites, self-cleaning glass, and weather-resistant coatings are improving durability and performance. At the same time, digitally printed facades and dynamic shading systems enable greater design flexibility and customization to suit varied climates and client needs.

Restraints

Stringent Building Codes and Regulatory Compliance Challenges Restrain Market Expansion

The facade market faces notable constraints from increasingly complex building regulations and compliance requirements. Governments worldwide are implementing stricter fire safety standards, wind load specifications, and thermal performance mandates for building exteriors. These regulations vary significantly across regions, forcing manufacturers and contractors to navigate a complicated approval process.

Compliance documentation and testing procedures add substantial expenses to facade projects. Each material and system component must undergo rigorous certification to demonstrate safety and performance standards. This regulatory burden particularly affects smaller contractors who lack dedicated compliance teams, limiting their ability to compete for larger commercial projects.

The shortage of skilled labor presents another significant challenge for the facade industry. Installing modern facade systems requires specialized training in handling complex materials, operating advanced equipment, and understanding intricate engineering specifications. As experienced technicians retire, the industry struggles to replace them with adequately trained professionals. This skills gap leads to project delays, quality inconsistencies, and increased labor costs.

Growth Factors

Expansion in Retrofitting and Renovation of Aging Structures Creates Growth Opportunities

The facade market is poised for substantial growth through the retrofitting and renovation segment. Millions of aging buildings worldwide require exterior upgrades to meet contemporary energy standards and aesthetic expectations. Property owners recognize that modernizing facades can significantly increase building value, reduce operational costs, and attract premium tenants.

Smart and responsive facade technologies represent another promising growth avenue. Building automation systems now integrate with dynamic facades that automatically adjust to environmental conditions. These intelligent systems use sensors to control shading elements, ventilation openings, and light transmission based on temperature, sunlight intensity, and occupancy patterns.

Emerging markets in Asia-Pacific and the Middle East present strong growth opportunities for facade manufacturers and installers. Rapid development in countries such as India, Vietnam, and Saudi Arabia is driving infrastructure spending and new residential, hospitality, and commercial projects. Rising urbanization and expanding middle-class populations are expected to support steady, long-term demand, attracting international players seeking geographic diversification.

Emerging Trends

Integration of Biophilic and Green Facade Design Concepts Shapes Market Trends

The facade industry is witnessing a significant shift toward biophilic design principles that connect buildings with nature. Architects increasingly incorporate living walls, vertical gardens, and natural materials into building exteriors to enhance occupant wellbeing and environmental performance. These green facades provide multiple benefits including improved air quality, urban biodiversity, and thermal insulation.

Digital transformation is revolutionizing facade planning and execution through Building Information Modeling and digital twin technologies. These tools enable precise visualization of facade performance before construction begins, reducing costly errors and design conflicts. Contractors use BIM platforms to coordinate complex installations, manage material logistics, and simulate maintenance requirements throughout the building lifecycle.

Prefabricated and modular facade systems are gaining preference due to their installation efficiency and quality consistency. Off-site manufacturing allows precise fabrication in controlled environments, minimizing weather-related delays and on-site waste. These modular panels arrive ready for quick assembly, significantly reducing construction timelines compared to traditional methods.

Regional Analysis

Asia Pacific Dominates the Facade Market with a Market Share of 38.7%, Valued at USD 100.4 Billion

Asia Pacific leads the global facade market with a commanding share of 38.7%, valued at USD 100.4 billion. The region’s dominance is driven by rapid urbanization, extensive infrastructure development, and substantial construction investments across China, India, and Southeast Asian nations. Growing adoption of green building certifications and stringent energy efficiency regulations are accelerating demand for advanced facade solutions including curtain walls and energy-efficient glazing systems.

North America Facade Market Trends

North America represents a mature market characterized by strong emphasis on energy efficiency and sustainable building practices. The region’s growth is propelled by renovation activities in aging infrastructure and new commercial projects, with increasing integration of smart building technologies and prefabricated facade components enhancing construction efficiency across the United States and Canada.

Europe Facade Market Trends

Europe maintains a significant market position, distinguished by stringent energy performance regulations and the EU’s ambitious climate goals. The region leads in adopting innovative facade technologies including double-skin facades and photovoltaic-integrated systems, with strong emphasis on circular economy principles and sustainable material sourcing across Germany, the UK, France, and Nordic countries.

Middle East and Africa Facade Market Trends

The Middle East and Africa region experiences notable growth driven by ambitious infrastructure projects and mega-city developments in GCC countries. Extreme climatic conditions necessitate specialized facade solutions offering superior thermal insulation and solar control, with significant investments in iconic architectural projects across the UAE, Saudi Arabia, and Qatar.

Latin America Facade Market Trends

Latin America represents an emerging market with growth stemming from increasing urbanization and infrastructure modernization across Brazil, Mexico, and Chile. Despite economic fluctuations, the region shows steady demand for diverse facade solutions driven by expanding commercial real estate and growing emphasis on sustainable urban development.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Facade Company Insights

The global facade market in 2025 is characterized by intense competition among established manufacturers who continue to drive innovation in building envelope solutions. These key players are leveraging advanced materials, sustainable technologies, and integrated design approaches to meet the evolving demands of modern architecture and stringent energy efficiency regulations.

ROCKWOOL Ltd. maintains a prominent position in the facade market through its comprehensive range of stone wool insulation solutions that offer superior fire resistance and thermal performance. The company’s focus on sustainable building materials and non-combustible facade systems has strengthened its market presence, particularly in regions with strict fire safety requirements.

Aluplex has established itself as a significant player in aluminum composite panel manufacturing, providing architects and builders with versatile facade cladding solutions. Their product portfolio emphasizes durability, aesthetic flexibility, and weather resistance, catering to both commercial and residential construction projects across diverse climate zones.

EOS Framing Limited specializes in engineered facade framing systems that support complex architectural designs while ensuring structural integrity. The company’s expertise in curtain wall solutions and unitized facade systems has positioned it as a preferred partner for high-rise and large-scale commercial developments.

AFS International brings extensive experience in aluminum facade systems, offering innovative solutions that combine functionality with architectural appeal. Their commitment to energy-efficient building envelopes and customizable facade designs has enabled them to serve demanding projects requiring both performance and aesthetic excellence.

These industry leaders, along with other established players like Kingspan Group, Lindner Group, and Saint-Gobain S.A., collectively shape the competitive landscape of the facade market, driving technological advancement and setting industry standards for quality and sustainability.

Top Key Players in the Market

- ROCKWOOL Ltd.

- Aluplex

- EOS Framing Limited

- AFS International

- Kingspan Group

- Lindner Group

- Fundermax

- Josef Gartner GmbH

- HansenGroup

- Saint-Gobain S.A.

- AGC Glass Europe

- Enclos Corp.

- Kawneer Company

- Other Key Players

Recent Developments

- In January 2026, RPM International Inc. confirmed that its Tremco Construction Products Group signed a definitive agreement to acquire Kalzip GmbH, strengthening its global presence in metal-based roofing and façade systems for advanced building envelopes.

- In September 2025, YKK AP Inc. completed the acquisition of Seufert-Niklaus GmbH, expanding its European footprint and enhancing capabilities in high-performance façade and entrance solutions.

- In January 2025, Lerch Bates announced the acquisition of Building Enclosure Consultants and Scientists (BECS), reinforcing its strength in building enclosure consulting and technical advisory services.

- In April 2025, Seele Holding acquired Abele Ingenieure through an asset deal, aimed at improving engineering depth and integrated façade project execution.

Report Scope

Report Features Description Market Value (2025) USD 259.5 Billion Forecast Revenue (2035) USD 426.7 Billion CAGR (2026-2035) 5.10% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Ventilated, Non-Ventilated, Others), By Façade Type (Curtain Wall, Cladding, Others), By Material Type (Glass, Metal, Plastic & Fibres, Wood, Others), By Installation Type (New Construction, Renovation / Retrofitting), By End User (Commercial, Residential, Institutional, Industrial) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape ROCKWOOL Ltd., Aluplex, EOS Framing Limited, AFS International, Kingspan Group, Lindner Group, Fundermax, Josef Gartner GmbH, HansenGroup, Saint-Gobain S.A., AGC Glass Europe, Enclos Corp., Kawneer Company, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- ROCKWOOL Ltd.

- Aluplex

- EOS Framing Limited

- AFS International

- Kingspan Group

- Lindner Group

- Fundermax

- Josef Gartner GmbH

- HansenGroup

- Saint-Gobain S.A.

- AGC Glass Europe

- Enclos Corp.

- Kawneer Company

- Other Key Players