Global Ethylene Vinyl Alcohol Market Size, Share, And Business Benefit By Grade (Standard EVOH, Speciality EVOH), By Downstream Form (Films and Sheets (Co-extruded, Laminated), Fuel Tanks and Containers, Pipes and Tubes, Bottles and Pouches, Others), By End Use (Packaging (Food and Beverages, Pharmaceuticals, Cosmetics, Others), Industrial (Gasoline Tanks, Protective Membranes, Piping Systems, Landfill Covers, Others)), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 165015

- Number of Pages: 263

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

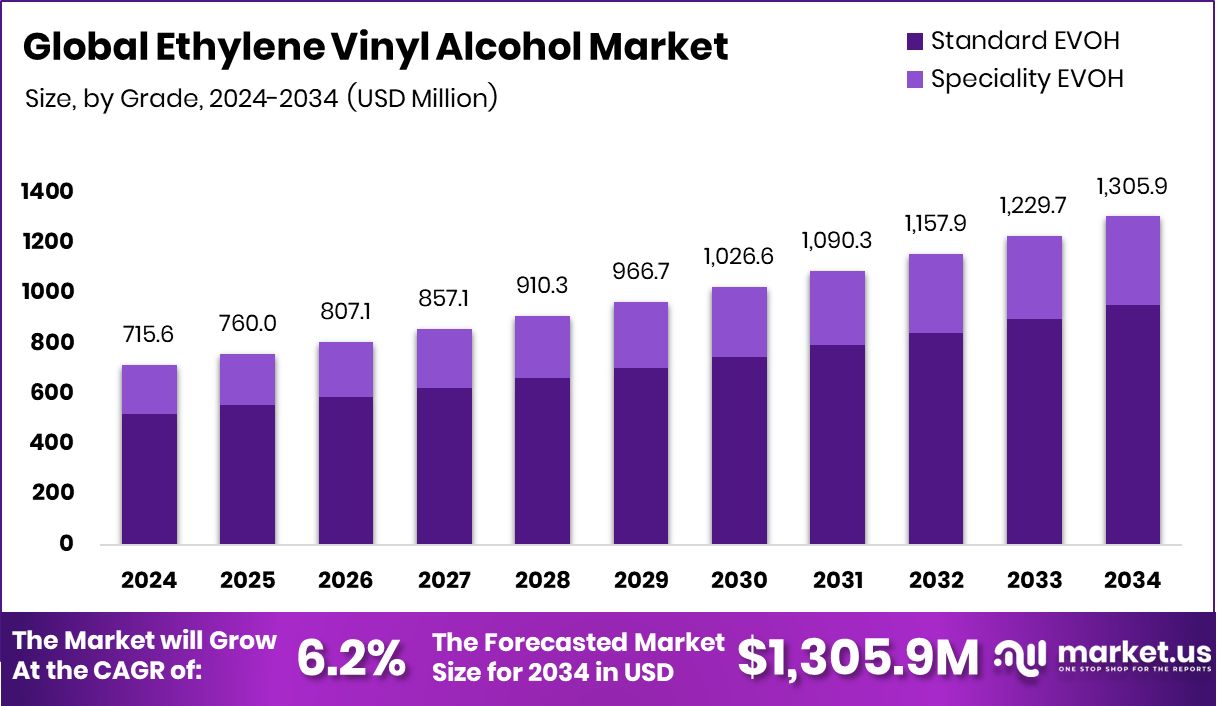

The Global Ethylene Vinyl Alcohol Market is expected to be worth around USD 1,305.9 million by 2034, up from USD 715.6 million in 2024, and is projected to grow at a CAGR of 6.2% from 2025 to 2034. Strong industrial growth and sustainable packaging trends further boosted Asia-Pacific’s 42.30% market presence.

Ethylene Vinyl Alcohol is a copolymer made from ethylene and vinyl alcohol, known for its exceptional gas barrier and chemical resistance. It’s widely used in multilayer packaging to preserve food freshness, protect pharmaceuticals, and maintain product quality. EVOH offers transparency, flexibility, and recyclability, making it an eco-friendly alternative for industries aiming to reduce plastic waste.

The Ethylene Vinyl Alcohol market focuses on the growing use of high-barrier packaging materials across food, healthcare, and industrial sectors. Its role in sustainable packaging, fuel tanks, and medical devices highlights its versatility. The market continues to expand as manufacturers shift toward environmentally responsible materials and advanced co-extrusion technologies.

Growth is driven by the global shift toward sustainable and safe packaging. Increasing awareness about food safety, shelf-life enhancement, and environmental compliance accelerates EVOH’s adoption. Governments promoting recyclable materials and companies investing in biodegradable solutions further support this expansion.

Rising consumption of packaged foods, pharmaceuticals, and cosmetics fuels EVOH demand. The rise of e-commerce and urban lifestyles has increased the need for durable, lightweight, and protective packaging materials that reduce spoilage and maintain product integrity.

Recent funding rounds in sustainable beauty and packaging—Renee Cosmetics ($30 Mn), Sugar Cosmetics ($4.5 Mn), Pilgrim (₹200 Cr), Greenitio ($1.5 Mn), and Mila Beauté ($2.16 Mn)—reflect a growing push toward eco-packaging innovation. This creates opportunities for EVOH producers to collaborate with these sectors and deliver barrier solutions aligned with clean-beauty and zero-plastic goals.

Key Takeaways

- The Global Ethylene Vinyl Alcohol Market is expected to be worth around USD 1,305.9 million by 2034, up from USD 715.6 million in 2024, and is projected to grow at a CAGR of 6.2% from 2025 to 2034.

- Standard Ethylene Vinyl Alcohol Market grade holds 72.9% share, driven by food safety and preservation needs.

- Films and sheets form 44.2% of the Ethylene Vinyl Alcohol Market, essential for flexible packaging.

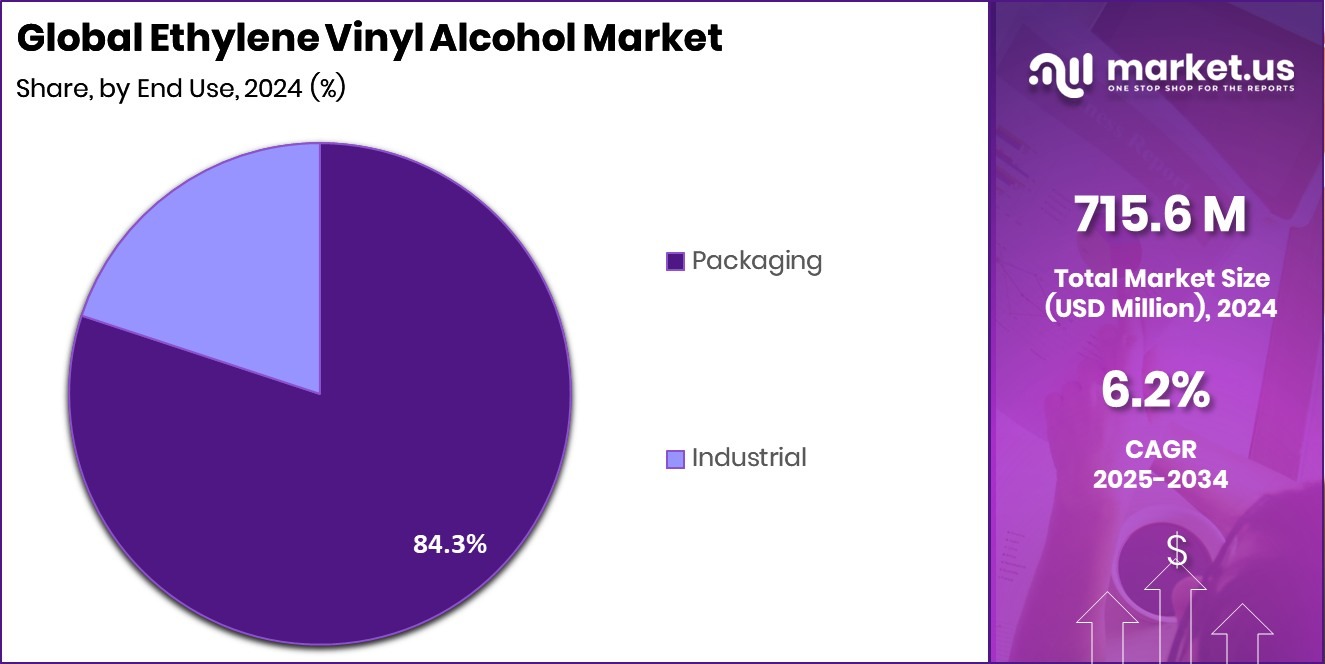

- Packaging dominates the Ethylene Vinyl Alcohol Market with an 84.3% share due to sustainability trends.

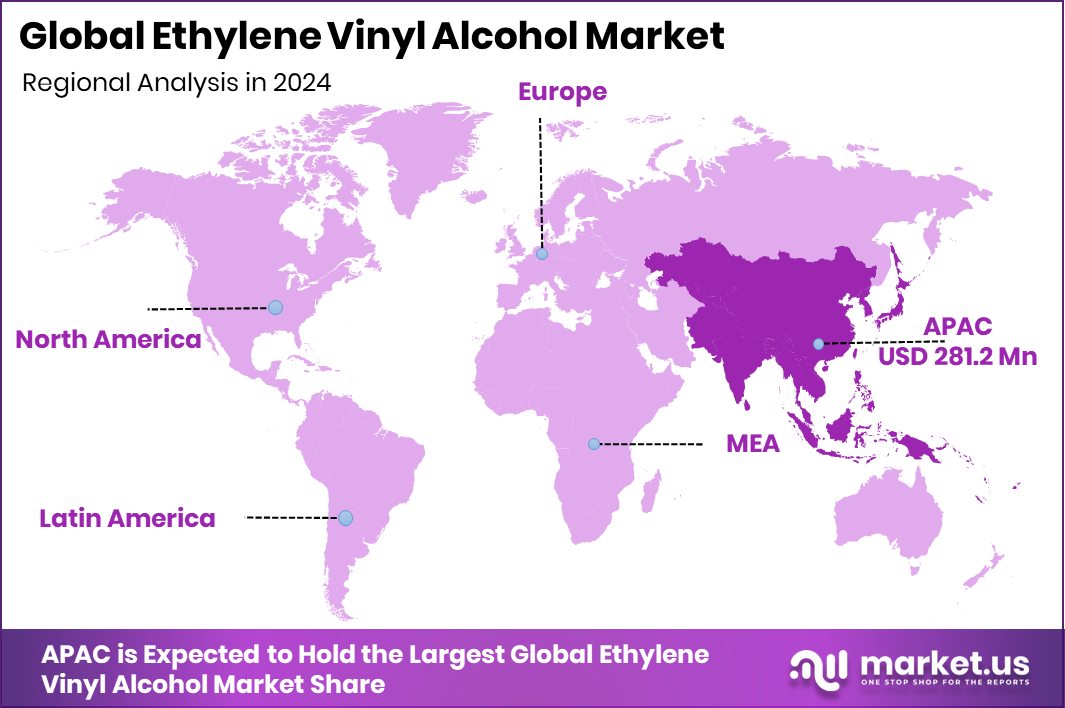

- The Asia-Pacific market value reached approximately USD 281.2 million, driven by rising packaging demand.

By Grade Analysis

In the Ethylene Vinyl Alcohol Market, Standard EVOH dominated with a 72.9% share.

In 2024, Standard EVOH held a dominant market position in the By Grade segment of the Ethylene Vinyl Alcohol Market, with a 72.9% share. This grade’s wide acceptance stems from its strong oxygen and gas barrier properties, making it ideal for food packaging, pharmaceutical containers, and industrial applications.

Standard EVOH delivers reliable performance, balancing durability and flexibility while maintaining product freshness and shelf life. Its cost-effectiveness and compatibility with various co-extrusion processes further strengthen its dominance.

The growing preference for sustainable packaging and enhanced product protection continues to support Standard EVOH’s leadership, as industries seek dependable materials that meet both functional and environmental requirements in evolving global supply chains.

By Downstream Form Analysis

Films and sheets led the ethylene vinyl alcohol market with a 44.2% share.

In 2024, Films and Sheets held a dominant market position in the By Downstream Form segment of the Ethylene Vinyl Alcohol Market, with a 44.2% share. This dominance is driven by their extensive use in food, medical, and industrial packaging, where high-barrier protection against oxygen and moisture is essential.

EVOH-based films and sheets ensure product freshness, extended shelf life, and safety while supporting the shift toward sustainable and recyclable packaging solutions. Their excellent transparency and compatibility with multilayer packaging structures make them highly preferred among converters and brand owners.

As global demand for safe, long-lasting packaged products rises, the Films and Sheets segment continues to strengthen its position in the EVOH market landscape.

By End Use Analysis

Packaging dominated the ethylene vinyl alcohol market, holding an 84.3% share.

In 2024, Packaging held a dominant market position in the By End Use segment of the Ethylene Vinyl Alcohol Market, with an 84.3% share. This leadership is attributed to EVOH’s strong gas and moisture barrier properties, which are vital in extending the shelf life of packaged goods.

The material’s compatibility with multilayer packaging structures makes it an ideal choice for food, pharmaceutical, and cosmetic applications where product integrity and freshness are crucial.

Growing consumer demand for safe, long-lasting, and eco-friendly packaging has reinforced EVOH’s importance in the packaging industry. Its recyclability and performance benefits ensure continued adoption across diverse product lines, strengthening its position as the preferred material in the packaging segment.

Key Market Segments

By Grade

- Standard EVOH

- Speciality EVOH

By Downstream Form

- Films and Sheets

- Co-extruded

- Laminated

- Fuel Tanks and Containers

- Pipes and Tubes

- Bottles and Pouches

- Others

By End Use

- Packaging

- Food and Beverages

- Pharmaceuticals

- Cosmetics

- Others

- Industrial

- Gasoline Tanks

- Protective Membranes

- Piping Systems

- Landfill Covers

- Others

Driving Factors

Superior Barrier Performance Drives Adoption Everywhere

One of the key driving forces behind the Ethylene Vinyl Alcohol (EVOH) market is its outstanding ability to block gases, moisture, solvents, and hydrocarbons. In applications from food packaging to fuel tanks, this exceptional performance helps maintain freshness, prevent contamination, and extend the shelf life of sensitive products.

On the fuel-storage side, investments such as the “$12 billion tab to remove leaky gasoline tanks” and the “$270 million US fuel storage facility on Darwin’s outskirts” show how barrier materials are critical in preventing leaks and protecting infrastructure—creating opportunities for EVOH in industrial containment and transport as well.

As end-users demand more reliability, safety, and sustainability, EVOH’s high-barrier credentials position it favorably for broader adoption across packaging, automotive, industrial, and energy sectors.

Restraining Factors

Cost Sensitivity Limits Broad Adoption

One of the main restraining factors for the ethylene vinyl alcohol market is its relatively high production cost, which places it at a disadvantage when compared to lower-cost barrier materials. The expensive raw inputs and complex processing steps make it less attractive for price-sensitive applications.

Added to this is the reality that many fuel tank and containment projects—such as the one where the “Denali Commission gets $100 million to rescue deteriorating rural fuel tank farms”—highlight investments in containment but also emphasize the cost pressures upstream.

As manufacturers evaluate material choices in such infrastructure projects, the elevated cost of EVOH may slow its uptake despite its superior barrier performance. Until cost parity improves or higher-value applications offset the price premium, this cost sensitivity will remain a key restraint.

Growth Opportunity

Expanding into Clean-Energy & Infrastructure Packaging

One major growth opportunity for the Ethylene Vinyl Alcohol (EVOH) market lies in its alignment with large-scale clean-energy and infrastructure projects, illustrated by the headline: DOE selects 7 hydrogen hubs for a $7B funding opportunity.

As hydrogen production, storage, and fuel cell systems require advanced barrier and containment materials to ensure safety and longevity, EVOH can position itself as a high-performance choice for flexible liners, protective films, and multilayer pipes or canisters within these hubs.

The massive injection of funding into hydrogen hubs creates a downstream demand pull—developers will seek materials that meet strict barrier, chemical-resistance, and durability requirements. By proactively tailoring EVOH grades for hydrogen-infrastructure packaging, storage, and transport, producers can tap into the growth wave emerging from clean-energy policy and infrastructure build-outs.

Latest Trends

Lightweight Advanced Barrier Systems Emerging

A prominent trend in the Ethylene Vinyl Alcohol (EVOH) market is the move toward ultra-lightweight and high-performance barrier systems that serve both packaging and industrial containment purposes. Innovations are now focusing on reducing material weight while enhancing gas, fuel, and chemical barrier properties.

For instance, the fact that a rocket startup secured a $3 M grant to develop lighter fuel tanks underscores growing interest in advanced barrier resins and multilayer structures tailored for demanding applications like aerospace fuel storage. EVOH, with its excellent impermeability, is well-suited for such evolving uses.

As industries look to lighten structures and improve safety, EVOH formulations are being refined and integrated into next-generation barrier systems, opening new markets and applications beyond traditional packaging.

Regional Analysis

In 2024, the Asia-Pacific dominated the Ethylene Vinyl Alcohol Market with a 42.30% share.

In 2024, Asia-Pacific emerged as the dominant region in the Ethylene Vinyl Alcohol (EVOH) Market, holding a 42.30% share valued at USD 281.2 million. This leadership is supported by the region’s expanding packaging, food processing, and healthcare industries, particularly in countries like China, Japan, South Korea, and India. Rapid urbanization and growing demand for high-barrier, sustainable packaging materials have strengthened EVOH adoption in flexible and rigid packaging applications.

North America follows with strong growth driven by the use of EVOH in fuel tanks, medical packaging, and food safety standards. Europe remains steady due to stringent environmental regulations promoting recyclable barrier materials and advanced multilayer film technology. Meanwhile, Latin America shows increasing demand from the food packaging sector, supported by changing consumption habits.

The Middle East & Africa region, though smaller in scale, is gradually expanding with industrialization and growing consumer product manufacturing. Overall, Asia-Pacific continues to set the pace for EVOH innovation and consumption, supported by rising sustainability goals, expanding e-commerce packaging, and government initiatives encouraging environmentally friendly materials across industrial and consumer sectors.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Mitsubishi Chemical Corporation continued strengthening its polymer business by improving production efficiency and expanding its EVOH applications across packaging and fuel systems. The company’s strategic focus on circular materials and carbon-neutral solutions positioned it well in a market increasingly driven by sustainability and performance demands.

Kuraray, recognized as one of the leading EVOH producers, advanced the market through its continuous development of high-barrier materials and investments in packaging innovation. Its emphasis on enhancing recyclability and reducing environmental impact aligned with the global shift toward eco-friendly polymers.

Chang Chun Group contributed by optimizing its supply network and expanding its material offerings to meet rising regional demand, especially in the Asia-Pacific. The company’s integration across chemical intermediates and resins supported stable production and competitive pricing. Collectively, these companies enhanced product performance, supply reliability, and sustainable development in the EVOH landscape

Top Key Players in the Market

- Mitsubishi Chemical Corporation

- Kuraray

- Chang Chun Group

- SK Functional Polymers

- Smurfit Kappa Group

- Mondi plc

Recent Developments

- In May 2025, SoarnoL™ EVOH resins were recognised by the Association of Plastic Recyclers (APR) and pre-qualified by How2Recycle for store-drop-off recycling in multi-layer PE film structures (≤ 15 wt% % SoarnoL™). This helps brands use the resin label on their packaging as more recyclable and supports circular-economy positioning.

Report Scope

Report Features Description Market Value (2024) USD 715.6 Million Forecast Revenue (2034) USD 1,305.9 Million CAGR (2025-2034) 6.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Grade (Standard EVOH, Speciality EVOH), By Downstream Form (Films and Sheets (Co-extruded, Laminated), Fuel Tanks and Containers, Pipes and Tubes, Bottles and Pouches, Others), By End Use (Packaging (Food and Beverages, Pharmaceuticals, Cosmetics, Others), Industrial (Gasoline Tanks, Protective Membranes, Piping Systems, Landfill Covers, Others)) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Mitsubishi Chemical Corporation, Kuraray, Chang Chun Group, SK Functional Polymers, Smurfit Kappa Group, Mondi plc Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Ethylene Vinyl Alcohol MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample

Ethylene Vinyl Alcohol MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Mitsubishi Chemical Corporation

- Kuraray

- Chang Chun Group

- SK Functional Polymers

- Smurfit Kappa Group

- Mondi plc