Global Ethylene Dichloride Market Size, Share, And Business Benefits By Production Process (Direct Chlorination, Oxy Chlorination), By Application (Vinyl Chloride Monomer, Ethylene Amines, Others), By End-Use (Construction, Automotive, Packaging, Furniture, Medical, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151870

- Number of Pages: 288

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

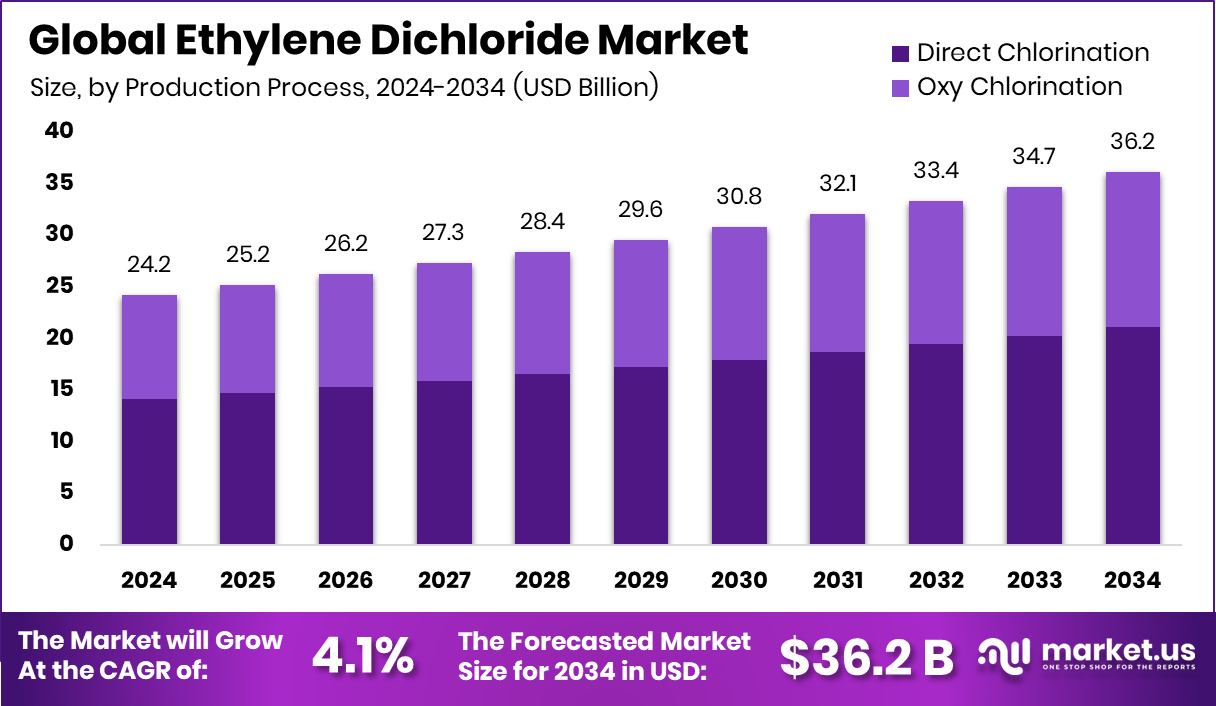

Global Ethylene Dichloride Market is expected to be worth around USD 36.2 billion by 2034, up from USD 24.2 billion in 2024, and grow at a CAGR of 4.1% from 2025 to 2034. North America’s strong industrial base supports a 39.10% share in global EDC demand.

Ethylene Dichloride (EDC), also known as 1,2-dichloroethane, is a chlorinated hydrocarbon commonly used as an intermediate in the production of vinyl chloride monomer (VCM), which is a key precursor in manufacturing polyvinyl chloride (PVC). It is a colorless liquid with a sweet odor and is also used in smaller amounts as a solvent and the manufacture of other chemicals.

The Ethylene Dichloride market refers to the global trade, production, and consumption of EDC, primarily driven by its demand in vinyl chloride production. The market is largely influenced by construction and infrastructure growth, where PVC is extensively used in pipes, fittings, and profiles. The EDC market is concentrated in regions with high industrial activity and established chemical manufacturing bases, including Asia-Pacific, North America, and Europe.

The growth of the Ethylene Dichloride market is supported by increasing demand for PVC across the construction, automotive, and consumer goods sectors. Rapid urbanization, especially in developing countries, is driving infrastructure development, thereby increasing the requirement for PVC-based materials.

The rising use of lightweight and cost-effective materials in plumbing, wiring, and packaging is boosting the demand for PVC, which in turn propels the need for EDC. Additionally, expansion of the manufacturing sector in emerging markets and efforts to replace metal pipes with plastic alternatives in water management systems are further accelerating market demand.

Key Takeaways

- Global Ethylene Dichloride Market is expected to be worth around USD 36.2 billion by 2034, up from USD 24.2 billion in 2024, and grow at a CAGR of 4.1% from 2025 to 2034.

- The Ethylene Dichloride market is largely driven by direct chlorination, accounting for 58.3% share.

- Vinyl chloride monomer production remains the leading application in the Ethylene Dichloride market at 82.4%.

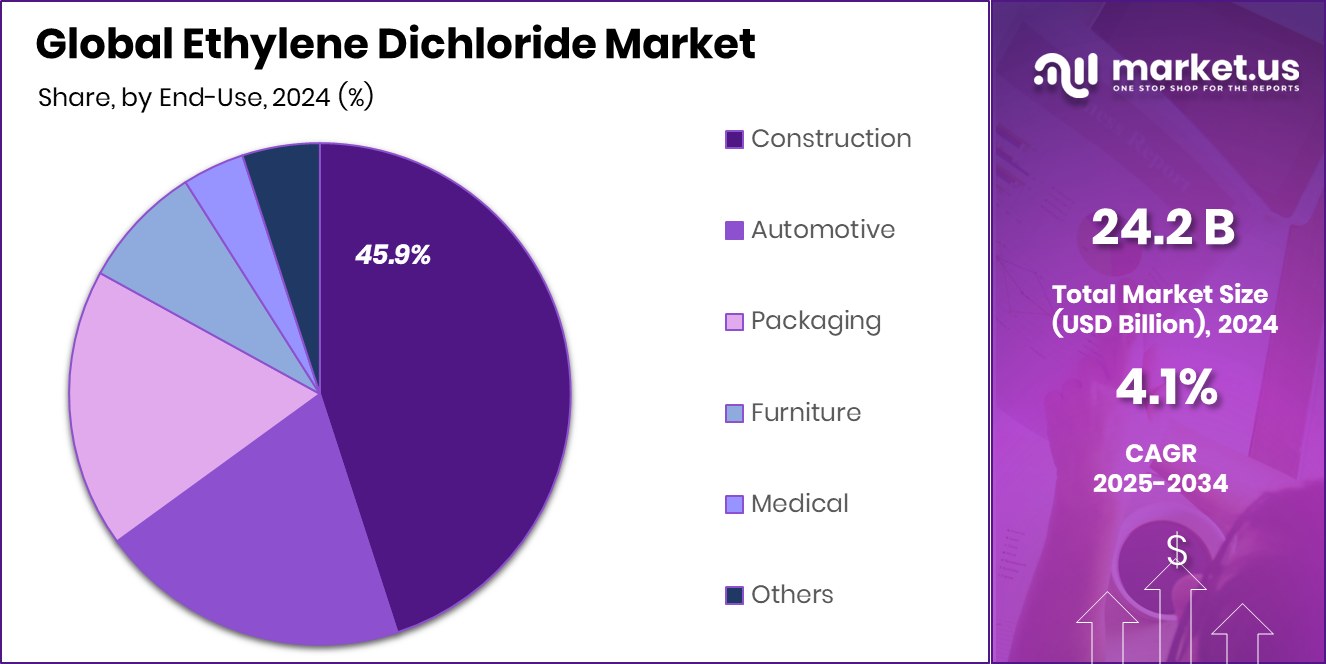

- Construction leads as the largest end-use sector in the Ethylene Dichloride market, holding 45.9% share.

- Ethylene Dichloride market in North America reached a value of USD 9.4 billion.

By Production Process Analysis

Direct chlorination dominates the Ethylene Dichloride market with a 58.3% share.

In 2024, Direct Chlorination held a dominant market position in the By Production Process segment of the Ethylene Dichloride Market, with a 58.3% share. This process remains the preferred method due to its operational simplicity, lower capital investment, and high conversion efficiency when compared to alternative methods.

Direct chlorination involves the reaction of ethylene with chlorine, producing EDC as the primary product. The widespread adoption of this route is mainly driven by its cost-effectiveness and compatibility with integrated PVC manufacturing facilities.

The steady demand for polyvinyl chloride, especially in construction and infrastructure sectors, has reinforced the importance of streamlined and economical production methods like direct chlorination. This segment’s strong market position reflects its ability to meet large-scale industrial requirements with consistent output and fewer environmental by-products when operated under controlled conditions.

Moreover, the availability of raw materials and mature technological frameworks has allowed producers to maintain stable production rates through direct chlorination. As a result, this segment continues to play a critical role in sustaining the global supply of EDC, particularly in regions with expanding PVC applications.

By Application Analysis

Vinyl Chloride Monomer leads the Ethylene Dichloride market with 82.4% usage.

In 2024, Vinyl Chloride Monomer held a dominant market position in the By Application segment of the Ethylene Dichloride Market, with an 82.4% share. This overwhelming share is a direct result of Ethylene Dichloride’s primary use as a key intermediate in the production of vinyl chloride monomer (VCM), which is further processed to manufacture polyvinyl chloride (PVC). The high consumption rate of EDC for this purpose underscores its critical role in the global plastics value chain.

The dominance of this segment can be attributed to the steady rise in global PVC demand, especially in applications such as construction materials, piping systems, cable insulation, and packaging. Vinyl chloride monomer production requires a substantial and consistent supply of EDC, reinforcing the segment’s central position in the overall market. Industrial facilities often integrate EDC and VCM units to optimize production efficiency, reduce operational costs, and ensure stable feedstock availability.

With VCM serving as the foundational compound for PVC, which is widely used across various industries, the continued growth in this segment is expected to sustain Ethylene Dichloride consumption at a significant level in the foreseeable future.

By End-Use Analysis

The construction sector holds 45.9% of the Ethylene Dichloride market share.

In 2024, Construction held a dominant market position in the By End-Use segment of the Ethylene Dichloride Market, with a 45.9% share. This strong market position reflects the significant dependence of the construction industry on polyvinyl chloride (PVC) materials, which are produced using Ethylene Dichloride as a key intermediate. PVC is widely used in construction applications such as pipes, window frames, siding, flooring, and roofing due to its durability, cost-efficiency, and resistance to environmental stress.

The rapid pace of urbanization and infrastructure development, especially in emerging economies, has contributed to increased demand for construction-grade PVC products. This trend has directly supported the high consumption of Ethylene Dichloride in the construction sector. Moreover, the need for sustainable, lightweight, and long-lasting materials in modern construction projects continues to drive the preference for PVC over traditional alternatives.

Ethylene Dichloride’s role in enabling large-scale VCM and subsequently PVC production makes it a critical input for construction-related manufacturing. The established supply chains, technological integration, and cost advantages linked with EDC usage in construction further strengthen this segment’s leading position.

Key Market Segments

By Production Process

- Direct Chlorination

- Oxy Chlorination

By Application

- Vinyl Chloride Monomer

- Ethylene Amines

- Others

By End-Use

- Construction

- Automotive

- Packaging

- Furniture

- Medical

- Others

Driving Factors

Strong Demand for PVC Drives EDC Market Growth

One of the biggest driving factors for the Ethylene Dichloride (EDC) market is the high demand for polyvinyl chloride (PVC). EDC is mainly used to make vinyl chloride monomer (VCM), which is the key ingredient for producing PVC. As PVC is widely used in construction materials such as pipes, window frames, and flooring, the rise in global construction activities—especially in growing economies—is boosting the need for EDC.

Additionally, the shift toward lightweight and durable plastic materials in automotive, electrical, and packaging sectors further increases PVC usage. Since most of the EDC produced goes directly into making PVC, this growing demand directly supports the expansion of the EDC market and secures its industrial importance.

Restraining Factors

Strict Environmental Rules Limit EDC Market Expansion

A major restraining factor for the Ethylene Dichloride (EDC) market is the presence of strict environmental and safety regulations. EDC is a toxic and flammable chemical, and its production, storage, and transportation require careful handling. Many countries have set tough rules to control emissions and exposure due to their harmful impact on health and the environment.

These regulations increase operational costs and sometimes limit plant expansions or new project approvals. Additionally, rising awareness about environmental safety is pressuring industries to reduce their use of hazardous chemicals like EDC. As a result, some manufacturers may look for safer or greener alternatives, which can slow down the growth of the EDC market despite its high demand in PVC production.

Growth Opportunity

Emerging Economies Create New EDC Market Opportunities

A key growth opportunity for the Ethylene Dichloride (EDC) market lies in the rising industrial and construction activities in emerging economies. Countries in Asia, the Middle East, and Latin America are investing heavily in infrastructure projects such as housing, roads, water systems, and commercial buildings. These developments are increasing the demand for PVC, which relies on EDC as a raw material.

Additionally, many of these regions are expanding their chemical production capacity, including new plants for vinyl chloride monomer (VCM) and PVC. This industrial growth offers long-term potential for EDC manufacturers to expand their supply networks and partnerships.

Latest Trends

Shift Toward Energy‑Efficient EDC Production Technologies

An important trend in the Ethylene Dichloride (EDC) market involves a growing focus on energy-efficient production methods. Manufacturers are increasingly adopting advanced process designs—such as waste heat recovery, optimized reactor operations, and combined heat and power systems—to reduce energy consumption and emissions. These improvements not only lower operational costs but also help companies meet stricter environmental standards.

As a result, energy-efficient EDC production supports more sustainable business models and strengthens the overall market position. This trend reflects broader industry efforts to improve process efficiency and environmental performance while maintaining a reliable supply for downstream PVC production.

Regional Analysis

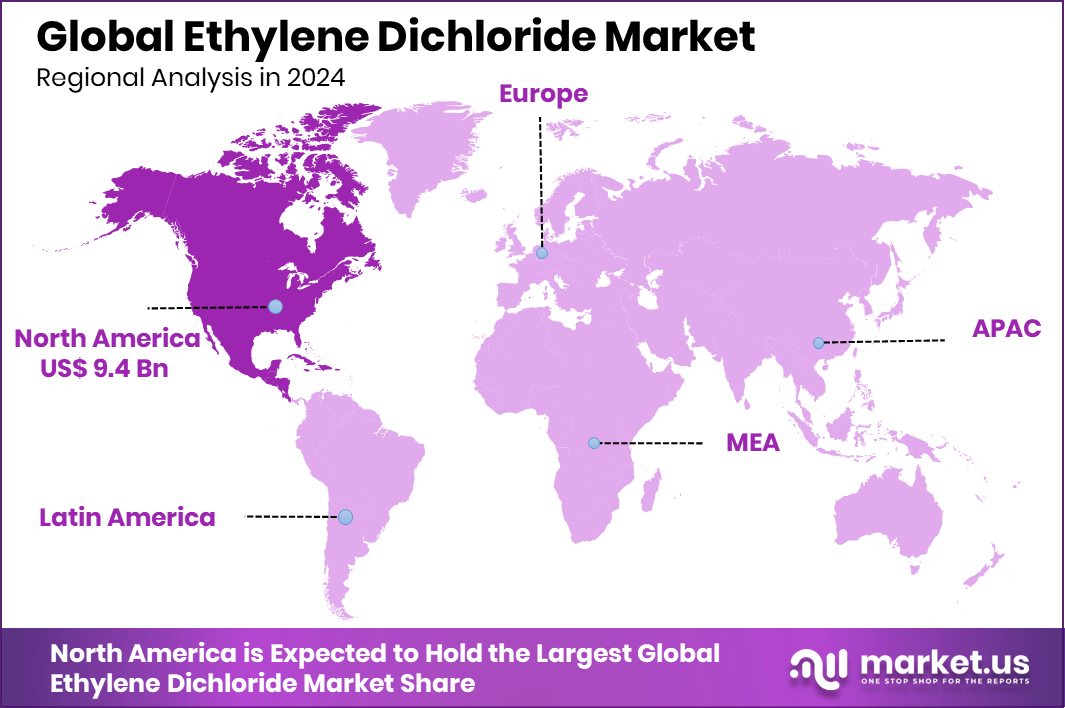

In 2024, North America held 39.10% market share in Ethylene Dichloride production.

In 2024, North America emerged as the leading region in the Ethylene Dichloride market, capturing a dominant 39.10% share and reaching a market value of USD 9.4 billion. This strong position is supported by the region’s well-established chemical manufacturing infrastructure and consistent demand from the downstream vinyl chloride monomer and PVC industries.

The presence of integrated production facilities and access to raw materials such as ethylene and chlorine have further enhanced North America’s capacity to meet both domestic and international demand for Ethylene Dichloride.

Other key regions in the global market include Europe, Asia Pacific, the Middle East & Africa, and Latin America. Each of these regions contributes to the overall market based on local demand dynamics and industrial activities. While Europe maintains steady growth due to environmental regulations and modernization of chemical plants, Asia Pacific is witnessing rising investments in infrastructure and PVC-related applications.

Meanwhile, the Middle East & Africa and Latin America are gradually expanding their market presence through industrial development and increased consumption of PVC-based products. However, North America continues to lead in terms of production volume, technological capabilities, and export potential, maintaining its status as the dominant region in the Ethylene Dichloride market landscape.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Axiall Corporation continued to consolidate its position by leveraging integrated production facilities that enable streamlined conversion of EDC to vinyl chloride monomer (VCM). Its focus on operational efficiency and high utilization rates contributed to stable EDC output across its U.S. chemical complexes. The company’s investments in equipment upgrades enhanced plant reliability and supported consistent supply for downstream PVC customers.

Formosa Plastics Corporation demonstrated strong market presence through vertically integrated operations in both Taiwan and the United States. By coordinating upstream EDC production with its VCM and PVC manufacturing units, the firm effectively managed feedstock flow, cost control, and output stability. Formosa’s robust logistics operations and long-term supply arrangements allowed it to navigate volatile regional demand, reinforcing its competitive edge.

Horizon Chemical Industry Co., Ltd pursued expansion across Asia through new or expanded production lines. By focusing on regional demand centers, the company achieved better cost efficiency and logistics advantages for regional customers. These efforts enabled Horizon to deepen its reach into emerging Asian PVC markets, offering localized supply options and responsive service models tailored to shorter lead times.

INEOS Group Holdings S.A., a major European-based entity, emphasized modernization and environmental performance within its EDC assets. Investment in energy-efficient technologies and closed-loop operations helped the company meet stricter European standards. INEOS’s capability to adapt its EDC production toward sustainable criteria allowed it to retain a strong market share even as competitors sought compliance upgrades.

Top Key Players in the Market

- Axiall Corporation

- Formosa Plastics Corporation

- Horizon Chemical Industry Co. Ltd

- INEOS Group Holdings S.A.

- LyondellBasell Industries N.V.

- Occidental Petroleum Corporation

- Olin Corporation

- PPG Industries

- PT Asahimas Chemical

- Punjab Chemicals & Crop Protection Limited

- Saudi Basic Industries Corporation

- Shin-Etsu Chemical Co., Ltd.

- The Dow Chemical Company

- Westlake Chemical Corporation

Recent Developments

- In March 2025, LyondellBasell announced an investment to expand propylene production at its Channelview Complex near Houston, targeting an additional 400,000 t/year capacity with construction starting in Q3 2025 and completion expected by late 2028.

- In May 2024, INEOS Oxide finalized its acquisition of LyondellBasell’s Ethylene Oxide and Derivatives (EO&D) business in Bayport, Texas, for approximately USD 700 million. The purchase included a 420 kt ethylene oxide plant, along with 375 kt ethylene glycols and 165 kt glycol ethers facilities.

Report Scope

Report Features Description Market Value (2024) USD 24.2 Billion Forecast Revenue (2034) USD 36.2 Billion CAGR (2025-2034) 4.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Production Process (Direct Chlorination, Oxy Chlorination), By Application (Vinyl Chloride Monomer, Ethylene Amines, Others), By End-Use (Construction, Automotive, Packaging, Furniture, Medical, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Axiall Corporation, Formosa Plastics Corporation, Horizon Chemical Industry Co. Ltd, INEOS Group Holdings S.A., LyondellBasell Industries N.V., Occidental Petroleum Corporation, Olin Corporation, PPG Industries, PT Asahimas Chemical, Punjab Chemicals & Crop Protection Limited, Saudi Basic Industries Corporation, Shin-Etsu Chemical Co., Ltd., The Dow Chemical Company, Westlake Chemical Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Ethylene Dichloride MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Ethylene Dichloride MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Axiall Corporation

- Formosa Plastics Corporation

- Horizon Chemical Industry Co. Ltd

- INEOS Group Holdings S.A.

- LyondellBasell Industries N.V.

- Occidental Petroleum Corporation

- Olin Corporation

- PPG Industries

- PT Asahimas Chemical

- Punjab Chemicals & Crop Protection Limited

- Saudi Basic Industries Corporation

- Shin-Etsu Chemical Co., Ltd.

- The Dow Chemical Company

- Westlake Chemical Corporation