Global Ethnic Foods Market Size, Share, And Business Benefit By Type (Chinese, Japanese, Mexican, Italian, Others), By Food Type (Veg, Non- veg), By Distribution Channel (Hypermarkets and Supermarkets, Convenience Stores, Grocery Stores, Online, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: October 2025

- Report ID: 162375

- Number of Pages: 337

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

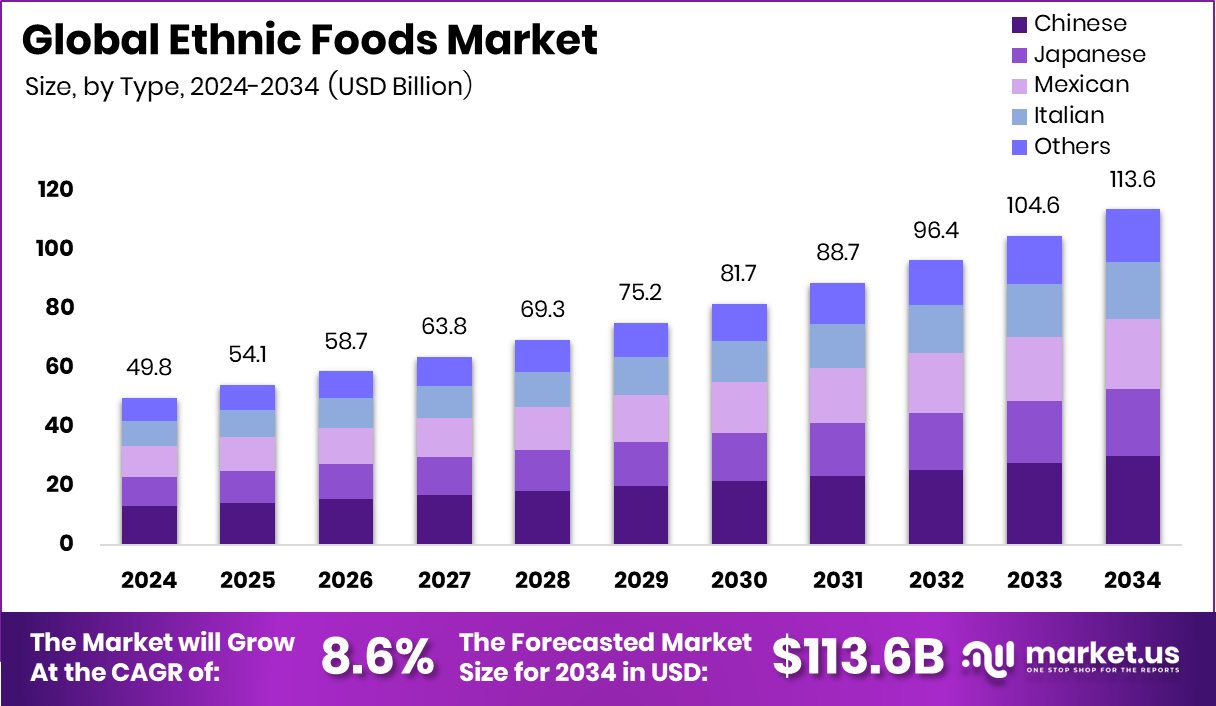

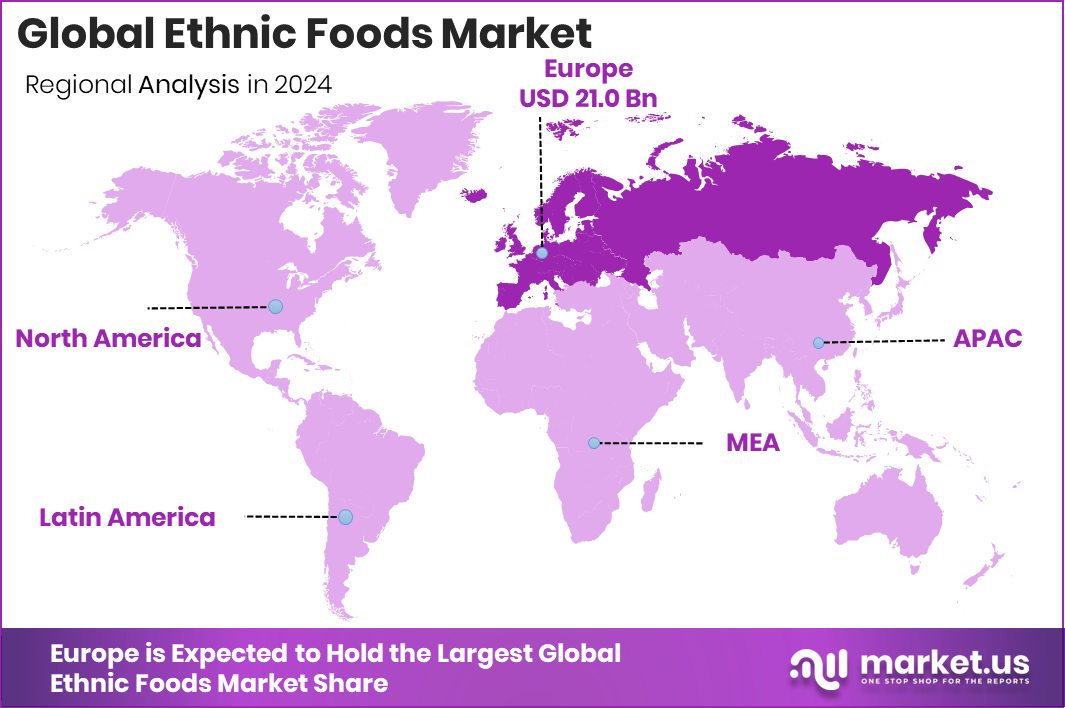

The Global Ethnic Foods Market is expected to be worth around USD 113.6 billion by 2034, up from USD 49.8 billion in 2024, and is projected to grow at a CAGR of 8.6% from 2025 to 2034. Growing multicultural populations and global cuisines drive Europe’s 42.30% share, USD 21.0 Bn.

Ethnic foods are cuisines, ingredients, and dishes that derive from the heritage, culture, and traditional practices of a specific ethnic or regional group. They often involve unique flavors, techniques, and ingredients that reflect a people’s cultural identity and migration story. These foods become “ethnic”, particularly when they are encountered outside of their originating culture and appreciated by a broader audience.

The ethnic foods market refers to the commercial ecosystem where such culturally rooted cuisines and products are produced, distributed, marketed, and consumed—either by communities of origin or a wider global audience. It encompasses packaged ethnic ingredients, ready-to-eat dishes, specialty retail channels, and online platforms that serve a demand for authenticity, cultural exploration, and variety. Within this market, funding and innovation are actively shaping how ethnic food reaches mainstream consumers.

One major growth factor is the rise of digital commerce and dedicated ethnic-food retail platforms: for example, one company bagged US$3.4 million to build an online supermarket specializing in ethnic products. Such funding enables sourcing, logistics, and curated experiences tailored to diverse culinary tastes. Alongside this, another player raised US$425 million in the latest funding round, demonstrating how investors see a scalable opportunity in serving diverse food communities through broader supply-chain reach.

Meanwhile, innovations in adjacent areas—such as a vegan dog food brand raising €9 million in Series A funding and an Indian startup securing US$570,000 to venture into plant-based meat & seafood—indicate that cultural food innovation is intersecting with health, ethics, and sustainability trends to boost growth in the ethnic foods market beyond traditional channels.

The opportunity in the ethnic foods market lies in bridging cultural authenticity with modern convenience and scale. With strong funding backing new business models—such as curated ethnic-supermarkets, online subscription delivery, and plant-based cultural food innovations—entrepreneurs have the chance to tap underserved food-heritage niches and adapt them for broader acceptance. There is space to innovate in packaging, supply-chain transparency, ingredient sourcing, and storytelling that resonates culturally while appealing to global tastes.

Key Takeaways

- The Global Ethnic Foods Market is expected to be worth around USD 113.6 billion by 2034, up from USD 49.8 billion in 2024, and is projected to grow at a CAGR of 8.6% from 2025 to 2034.

- In 2024, Chinese cuisine dominated the Ethnic Foods Market with a 26.4% share, driven by global fusion demand.

- Non-veg options captured a 62.3% share in the ethnic foods market due to protein-rich preferences.

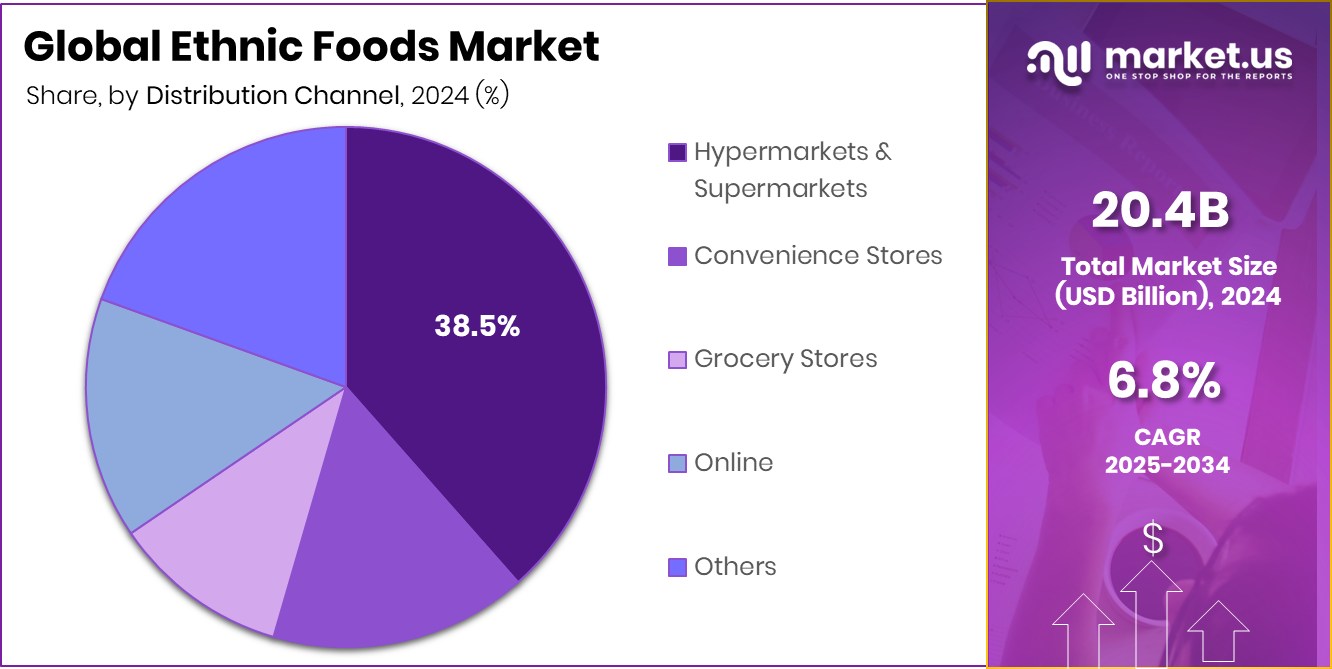

- Hypermarkets and supermarkets led the ethnic foods market with a 38.5% share, ensuring product visibility.

- Europe recorded a strong market value of USD 21.0 billion.

By Type Analysis

Chinese segment holds 26.4%, driven by rapid urbanization and taste diversity.

In 2024, Chinese held a dominant market position in the By Type segment of the Ethnic Foods Market, with a 26.4% share. The popularity of Chinese cuisine remains strong due to its diverse flavors, convenience, and global familiarity. Widespread acceptance in both household and foodservice sectors has supported its dominance.

Consumers are increasingly drawn to ready-to-eat Chinese meals and sauces that reflect authentic regional taste profiles. The adaptability of Chinese dishes to local preferences also sustains their broad appeal across international markets.

Furthermore, rising demand in supermarkets and online platforms enhances accessibility, making Chinese cuisine a central pillar of the ethnic foods category and a consistent growth driver within global culinary preferences.

By Food Type Analysis

Non-veg options dominate the Ethnic Foods Market with 62.3% global share.

In 2024, Non-veg held a dominant market position in the By Food Type segment of the Ethnic Foods Market, with a 62.3% share. The demand for non-vegetarian ethnic cuisines continues to grow due to rising global meat consumption and cultural preference for protein-rich meals.

Traditional dishes featuring poultry, seafood, and meat-based ingredients remain integral to authentic ethnic menus worldwide. Consumers increasingly seek flavorful and diverse non-veg recipes that reflect cultural authenticity and premium taste experiences.

Expanding restaurant chains and easy availability of frozen or ready-to-cook non-veg ethnic meals are further driving segment growth. The strong consumer inclination toward rich, savory, and region-specific non-veg dishes ensures its sustained leadership in the global ethnic foods category.

By Distribution Channel Analysis

Hypermarkets and supermarkets account for 38.5% of the Ethnic Foods Market distribution.

In 2024, Hypermarkets and Supermarkets held a dominant market position in the By Distribution Channel segment of the Ethnic Foods Market, with a 38.5% share. These retail formats continue to lead due to their wide product assortment, easy accessibility, and strong consumer trust in quality assurance.

Shoppers prefer hypermarkets and supermarkets for their ability to offer authentic ethnic food products under one roof. The organized layout, attractive promotions, and availability of both fresh and packaged ethnic food options have strengthened their dominance.

Additionally, growing urbanization and consumer inclination toward convenient shopping experiences have further boosted sales through this channel, making hypermarkets and supermarkets the preferred choice for ethnic food purchases worldwide.

Key Market Segments

By Type

- Chinese

- Japanese

- Mexican

- Italian

- Others

By Food Type

- Veg

- Non- veg

By Distribution Channel

- Hypermarkets and Supermarkets

- Convenience Stores

- Grocery Stores

- Online

- Others

Driving Factors

Growing Globalization and Cultural Exchange Boosting Ethnic Foods

The Ethnic Foods Market is strongly driven by globalization and increasing cultural exchange across countries. As people travel, migrate, and connect globally, their exposure to diverse cuisines rises, creating higher demand for authentic international flavors. Consumers are now eager to explore unique dishes beyond their native cuisine, fueling the popularity of ethnic food products in supermarkets and restaurants.

Governments and investors are also recognizing this growth potential. Recently, the Chancellor marked £600 million of secure growth for the UK economy in Beijing, supporting cross-border trade and cultural collaboration. Such international initiatives promote food innovation and expand the supply chain for ethnic products, helping traditional flavors reach global markets more effectively and sustainably.

Restraining Factors

High Production Costs and Supply Chain Challenges

One key restraining factor for the Ethnic Foods Market is the high production and distribution cost of authentic ingredients. Maintaining traditional taste and quality often requires importing rare spices, sauces, or grains from specific regions, which increases expenses.

Logistics and storage challenges further add to the cost, especially for perishable ethnic food items that need cold chain management. Small and medium producers struggle to compete with large-scale operations due to limited access to resources.

Recently, Zomato led a $5 million funding round in Mukunda Foods, aiming to improve food automation and reduce operational costs. Such efforts highlight the industry’s push to overcome high production barriers and enhance efficiency across the ethnic food supply network.

Growth Opportunity

Rising Digital Food Platforms Creating Global Opportunities

A major growth opportunity for the Ethnic Foods Market lies in the rapid expansion of digital food delivery and e-commerce platforms. These platforms make authentic ethnic cuisines easily accessible to global consumers, connecting diaspora communities with traditional flavors. The increasing popularity of online ordering and ethnic meal delivery apps enables small and regional food brands to reach wider audiences.

Recently, HungryPanda, a food-ordering app for the Asian diaspora, raised $55 million at a valuation of around $500 million, showcasing strong investor confidence in the ethnic food delivery space.

Such funding reflects the growing demand for convenience and authenticity, allowing the ethnic foods sector to expand its digital footprint and explore untapped international markets effectively.

Latest Trends

Digital Delivery Growth Extending Ethnic Foods Reach

A key trend shaping the ethnic foods market is the accelerating expansion of online delivery platforms and apps that enable consumers to access authentic global cuisines with ease. For instance, the delivery-service platform Fantuan raised US $40 million in a Series C funding round to expand its offering of genuine Asian food to customers’ doorsteps.

This investment reflects strong investor confidence in digitised ethnic food delivery. As more people adopt app-based ordering and seek diverse culinary experiences, ethnic food brands and platforms can leverage technology to scale rapidly and bring niche cuisines into mainstream adoption.

Regional Analysis

In Europe, the Ethnic Foods Market held a 42.30% share in 2024.

In 2024, Europe held a dominant position in the Ethnic Foods Market, accounting for a 42.30% share with a market value of USD 21.0 billion. The region’s strong dominance is driven by growing multiculturalism, migration, and increasing consumer openness to global cuisines. European consumers are actively embracing Asian, Middle Eastern, and African dishes, supported by expanding restaurant chains and retail shelves offering authentic ethnic products.

In North America, demand is supported by a large immigrant population and rising interest in Asian and Latin American cuisines, boosting both retail and foodservice sales. The Asia Pacific region shows steady growth owing to its vast cultural diversity and strong local demand for regional delicacies.

Meanwhile, the Middle East & Africa and Latin America are emerging markets, supported by urbanization and expanding food distribution networks. Europe’s leading share reflects its well-developed food infrastructure, retail penetration, and cultural acceptance of diverse ethnic flavors.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Associated British Foods PLC continues to strengthen its presence in the global Ethnic Foods Market through its wide portfolio of culturally inspired food brands. The company focuses on developing authentic flavors, emphasizing ingredients sourced from traditional regions, and expanding retail reach across Europe and North America. Its strong supply chain and innovation in ready-to-cook ethnic meals contribute significantly to consumer accessibility and trust.

General Mills, Inc. leverages its extensive global network to promote ethnic-inspired food products, catering to growing consumer curiosity for international cuisines. The company emphasizes product diversification and packaging innovation, introducing convenient meal options that blend authenticity with modern lifestyles. Its strategic marketing aligns with the rising demand for globally influenced comfort foods.

Ajinomoto Co. Inc. plays a major role by integrating culinary tradition with advanced food technology. It focuses on Asian cuisines, particularly flavor-enhancing products and seasonings that reflect authentic taste. The company’s expansion into Western markets through innovative sauces and ready-meal solutions showcases its adaptability. Ajinomoto’s commitment to sustainability and ingredient transparency further strengthens its brand reliability, making it a strong contributor to the ethnic food category’s evolving global landscape.

Top Key Players in the Market

- Associated British Foods PLC

- General Mills, Inc.

- Ajinomoto Co. Inc.

- McCormick & Company Inc.

- Orkla ASA

- Paulig Group

- The Spice Tailor

- Asli Fine Foods

- TRS Group

- Others

Recent Developments

- In January 2025, ABF released a trading update highlighting that its Grocery business saw a decline of 1.8 % at actual currency and grew only +0.8 % at constant currency for the period. The ingredients business also faced a decline of 1.6 % actuals but grew +3.5 % constant currency. The update stresses continued pressure on some food segments amid cost and demand challenges.

- In December 2024, General Mills launched Cheerios Protein, a new version of its iconic cereal delivering 8 grams of protein per serving, available in Cinnamon and Strawberry flavors.

Report Scope

Report Features Description Market Value (2024) USD 49.8 Billion Forecast Revenue (2034) USD 113.6 Billion CAGR (2025-2034) 8.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Chinese, Japanese, Mexican, Italian, Others), By Food Type (Veg, Non-veg), By Distribution Channel (Hypermarkets and Supermarkets, Convenience Stores, Grocery Stores, Online, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Associated British Foods PLC, General Mills, Inc., Ajinomoto Co. Inc., McCormick & Company Inc., Orkla ASA, Paulig Group, The Spice Tailor, Asli Fine Foods, TRS Group, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Associated British Foods PLC

- General Mills, Inc.

- Ajinomoto Co. Inc.

- McCormick & Company Inc.

- Orkla ASA

- Paulig Group

- The Spice Tailor

- Asli Fine Foods

- TRS Group

- Others