Global Enterprise Content Management Market Size, Share and Analysis Report By Component (Software/Solutions, Services), By Deployment Mode (On-premises, Cloud-based), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises), By End-User Industry (Banking, Financial Services, and Insurance, Government, Healthcare, Retail & E-commerce, IT & Telecommunications, Others), By Business Function (Human Resources, Legal & Compliance, Marketing & Sales, Operations, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Jan. 2026

- Report ID: 173779

- Number of Pages: 273

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Key Insight Summary

- Drivers Impact Analysis

- Risk Impact Analysis

- Restraint Impact Analysis

- By Component

- By Deployment Mode

- By Organization Size

- By End-User Industry

- By Business Function

- By Region

- Emerging Trends

- Growth Factors

- Opportunity

- Challenge

- Investor Type Impact Matrix

- Key Market Segments

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

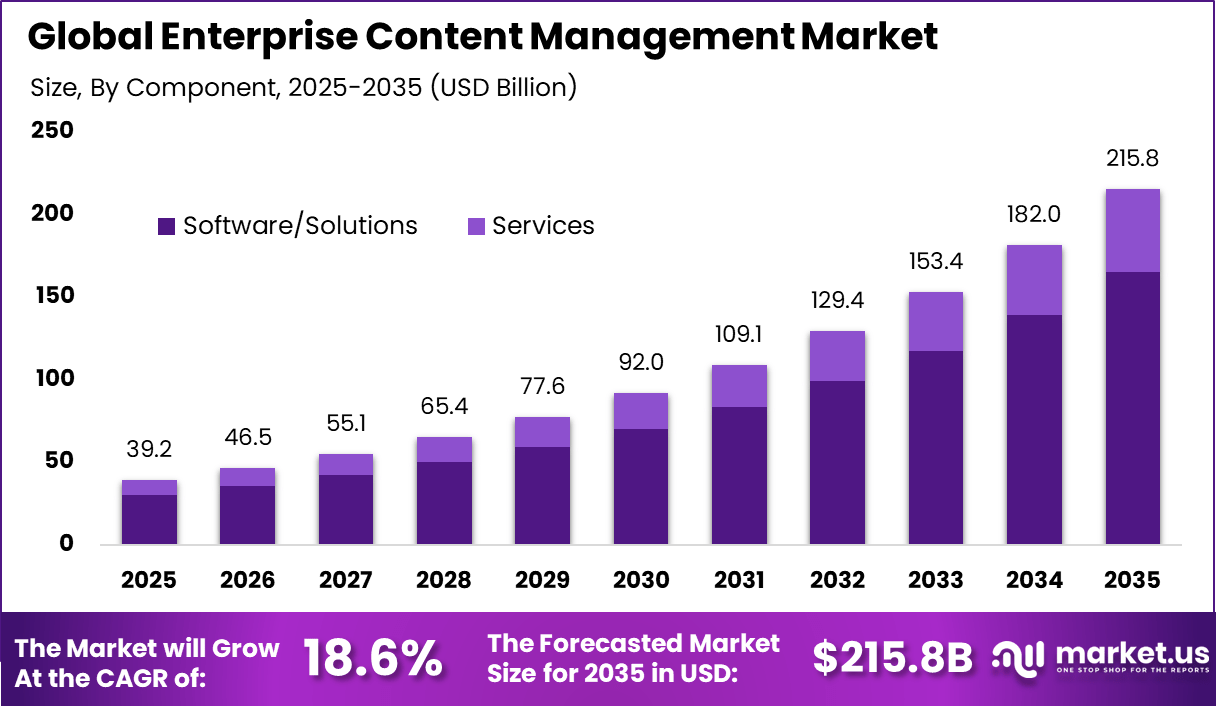

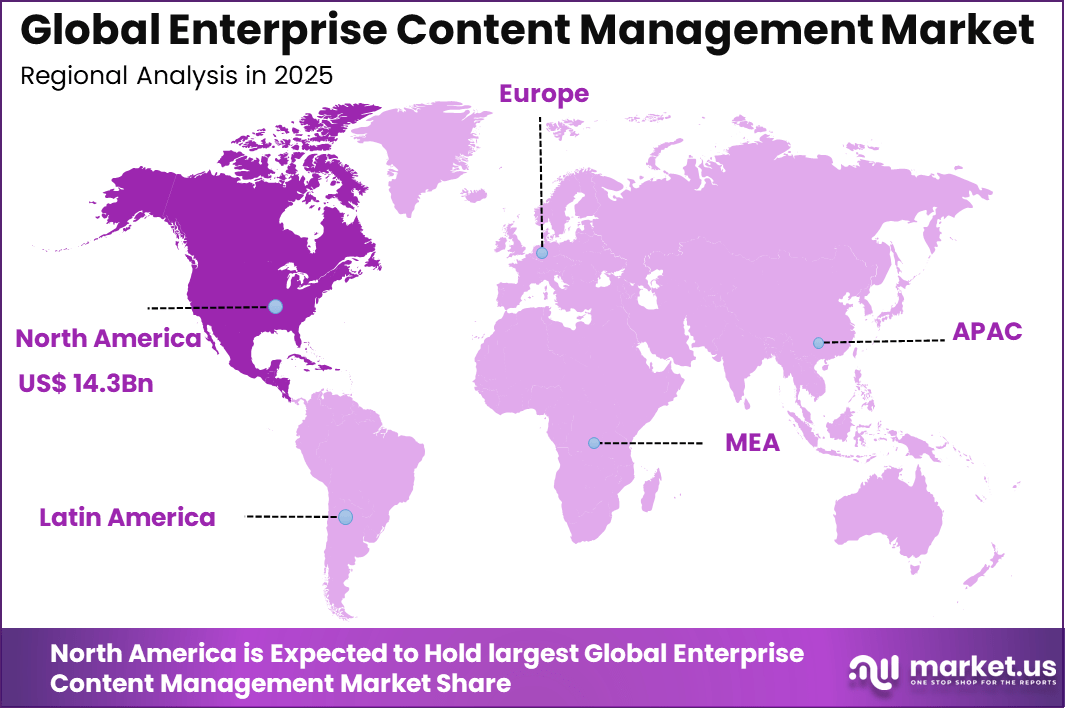

The Global Enterprise Content Management Market size is expected to be worth around USD 215.8 Billion By 2035, from USD 39.2 billion in 2025, growing at a CAGR of 18.6% during the forecast period from 2026 to 2035. North America held a dominan Market position, capturing more than a 36.5% share, holding USD 14.3 Billion revenue.

The enterprise content management market refers to software and services that enable organizations to capture, store, manage, and distribute business content and documents throughout their lifecycle. These solutions include document management, records management, workflow automation, collaboration tools, and content governance capabilities. Enterprise content management (ECM) platforms support structured and unstructured information across departments such as legal, HR, finance, and operations.

Adoption helps organizations reduce manual processes, improve compliance, and enhance information accessibility. The market growth has been influenced by the exponential increase in digital content and the need for structured information governance. Traditional file storage methods and disparate content silos often result in inefficiencies, duplication, and compliance risks. ECM solutions centralize content, streamline business processes, and provide auditable control over critical information.

One major driving factor of the enterprise content management market is the need for improved compliance and risk management. Many industries face stringent legal and regulatory requirements for data retention, privacy, and records traceability. ECM platforms provide retention policies, audit trails, and secure access controls that support compliance. These governance capabilities reduce legal exposure and support institutional accountability.

Demand for enterprise content management solutions is influenced by digital transformation initiatives that prioritize structured data use and seamless collaboration. Organizations are shifting toward paperless environments and digital processes to support remote work and distributed teams. ECM systems provide centralized repositories that enable users to access content securely across locations and devices.

Top Market Takeaways

- Software and solutions led adoption with a 76.5% share, indicating strong preference for integrated platforms that manage documents, workflows, and governance in a single environment.

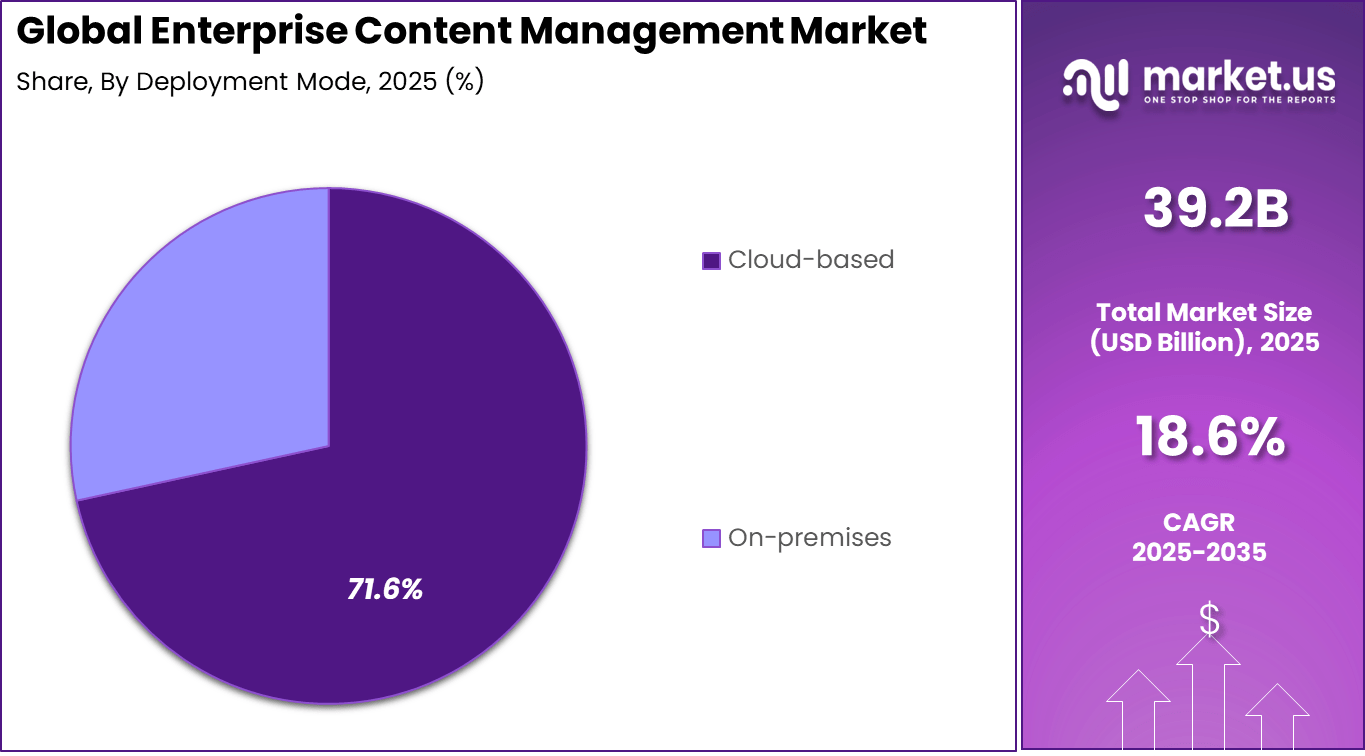

- Cloud based deployment accounted for 71.6%, reflecting demand for scalable access, remote collaboration, and reduced infrastructure overhead.

- Large enterprises represented 68.9% of usage, driven by high content volumes, complex approval processes, and strict regulatory needs.

- The banking, financial services, and insurance sector held a 32.7% share, supported by compliance heavy operations, audit readiness, and secure information handling.

- Legal and compliance functions captured 28.4%, highlighting reliance on ECM for contract lifecycle management, records retention, and regulatory reporting.

- North America maintained leadership with a 36.5% share, supported by mature enterprise IT adoption and compliance focused digital transformation.

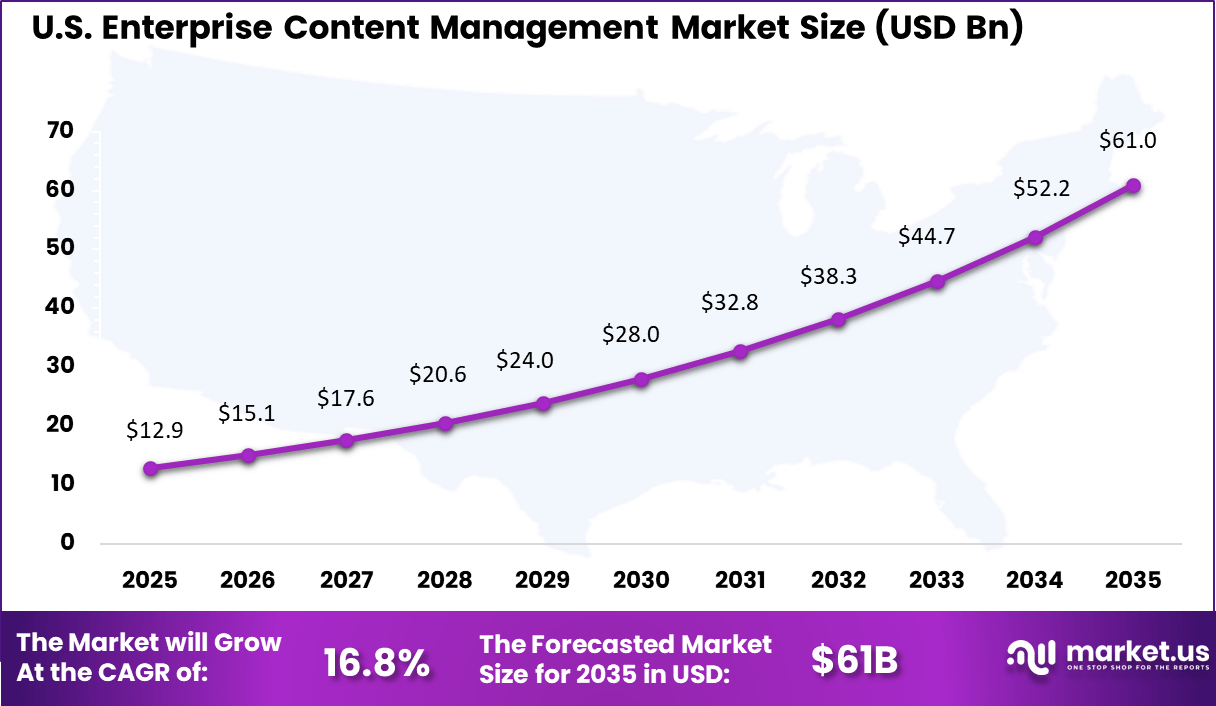

- The United States recorded USD 12.90 billion in market activity, expanding at a 16.84% growth rate, driven by cloud migration and rising governance requirements.

Key Insight Summary

Enterprise Content Management adoption is already well established across organizations of different sizes. According to marketingscoop, the top ECM vendors by market share include OpenText with 21%, followed by Hyland at 11%, IBM at 10%, Microsoft at 7%, and Box at 7%, based on G2 statistics. Other notable vendors such as Oracle hold 6%, while Newgen Software and M-Files each account for 5%.

Overall, 76% of businesses currently use some form of ECM, either through integrated enterprise platforms or standalone, siloed solutions. Adoption levels are particularly high among large enterprises. Only 24% of organizations with more than 5,000 employees operate without any ECM system, although many still face challenges related to consolidation and optimization.

ECM penetration shows that 45% of large companies use departmental ECM solutions, while 20% have implemented fully integrated enterprise wide systems. This indicates a gradual network toward broader integration rather than fragmented deployments. Investment priorities further highlight the importance of ECM.

Around 61% of IT leaders state that improving document management and collaboration is a top organizational priority. Companies plan to increase their ECM investments by an average of 23% over the next two years, reflecting continued focus on efficiency, compliance, and information governance. These trends suggest sustained demand for ECM modernization and platform consolidation.

Drivers Impact Analysis

Driver Category Key Driver Description Estimated Impact on CAGR (%) Geographic Relevance Impact Timeline Regulatory compliance pressure Document retention and audit requirements ~4.9% North America, Europe Short Term Cloud adoption across enterprises Scalable and remote content access ~4.3% Global Short Term Digital transformation initiatives Replacement of paper based workflows ~3.8% Global Mid Term Growth of unstructured data Emails, documents, and media files ~3.2% Global Mid Term Integration with business systems ERP and CRM driven content workflows ~2.4% Global Long Term Risk Impact Analysis

Risk Category Risk Description Estimated Negative Impact on CAGR (%) Geographic Exposure Risk Timeline Data security breaches Exposure of sensitive enterprise content ~4.6% Global Short Term Migration complexity Challenges moving legacy repositories ~3.9% Global Mid Term User adoption resistance Change management barriers ~3.2% Global Mid Term Compliance misconfiguration Incorrect policy enforcement ~2.6% North America, Europe Long Term Vendor lock in Dependence on proprietary platforms ~2.1% Global Long Term Restraint Impact Analysis

Restraint Factor Restraint Description Impact on Market Expansion (%) Most Affected Regions Duration of Impact High implementation cost Large scale enterprise deployments ~4.8% Emerging Markets Short to Mid Term Legacy system dependence Older content architectures ~3.9% Global Mid Term Customization complexity Extensive configuration needs ~3.1% Global Mid Term Data governance challenges Policy harmonization across regions ~2.5% Europe Long Term Limited SME penetration Cost and complexity barriers ~2.0% Emerging Markets Long Term By Component

Software and solutions account for 76.5%, highlighting their central role in enterprise content management. These platforms manage document creation, storage, and retrieval across organizations. Centralized systems improve control over enterprise information. Software solutions support version management and access control. They also help reduce manual document handling.

The dominance of software and solutions is driven by the need for structured content governance. Enterprises manage large volumes of digital documents daily. Software platforms enable automation of content workflows. Integration with business applications improves efficiency. This sustains strong demand for solution-based components.

By Deployment Mode

Cloud-based deployment holds 71.6%, reflecting preference for flexible content access. Cloud platforms allow employees to access documents from multiple locations. Centralized cloud storage supports collaboration across teams. Organizations reduce dependency on local infrastructure. Scalability remains a key benefit.

Adoption of cloud-based deployment is driven by remote and hybrid work models. Enterprises seek secure access to content anytime. Cloud platforms simplify updates and maintenance. Data backup and recovery improve reliability. This keeps cloud deployment widely adopted.

By Organization Size

Large enterprises represent 68.9%, making them the primary adopters of content management systems. These organizations generate high volumes of documents and records. Managing content across departments requires advanced systems. Large enterprises prioritize structured governance. Reliability and scalability remain essential.

Adoption among large enterprises is driven by regulatory and operational needs. Content systems support internal audits and reporting. Centralized platforms improve visibility across business units. Automation reduces administrative burden. This sustains strong enterprise-level adoption.

By End-User Industry

The banking, financial services, and insurance sector accounts for 32.7%, making it a key end-user industry. This sector manages sensitive documents such as contracts and records. Content management systems support secure storage and retrieval. Regulatory compliance remains a top priority. Accuracy and traceability are essential.

Growth in this segment is driven by strict compliance requirements. Financial institutions rely on structured document workflows. Content systems support audit readiness. Secure access controls protect sensitive information. This sustains steady adoption in the BFSI sector.

By Business Function

Legal and compliance functions represent 28.4%, highlighting their reliance on content management. These functions manage policies, contracts, and regulatory documents. Content systems support version control and approval workflows. Accurate documentation reduces legal risks. Access tracking improves accountability.

Adoption in legal and compliance functions is driven by regulatory pressure. Organizations must retain and manage records properly. Content platforms support document retention policies. Automation improves review processes. This keeps legal and compliance as a key functional area.

By Region

North America accounts for 36.5%, supported by advanced enterprise IT adoption. Organizations in the region prioritize digital document management. Regulatory environments encourage structured content handling. Cloud adoption supports market growth. The region remains influential.

Region Primary Growth Driver Regional Share (%) Regional Value (USD Bn) Adoption Maturity North America Regulatory compliance and cloud maturity 36.5% USD 14.33 Bn Advanced Europe Data protection and governance initiatives 28.1% USD 11.03 Bn Advanced Asia Pacific Enterprise digitization and cloud shift 25.4% USD 9.97 Bn Developing to Advanced Latin America Business process modernization 5.6% USD 2.20 Bn Developing Middle East and Africa Government and enterprise IT programs 4.4% USD 1.73 Bn Early

The United States reached USD 12.90 Billion with a CAGR of 16.84%, reflecting strong expansion. Growth is driven by digital transformation initiatives. Enterprises invest in content automation. Compliance requirements increase adoption. Market momentum remains strong.

Emerging Trends

In the enterprise content management market, one trend is the increased integration of artificial intelligence to support content classification, indexing, and search. Organisations are using intelligent automation to identify document types, extract key information, and improve retrieval accuracy across large repositories. This trend improves accessibility of stored content and reduces manual tagging efforts.

Another trend is the unification of content workflows across platforms. Enterprises are moving toward systems that bring together email, files, shared drives, and collaboration tools into a single management framework. Unified content systems help organisations maintain consistency, reduce duplication, and deliver a more seamless experience for users working with sensitive or mission-critical information.

Growth Factors

A key growth factor in the enterprise content management market is the rising volume and complexity of digital information. Organisations across industries generate and receive large quantities of documents, multimedia, forms, and correspondence. Systems that can organise, secure, and make this content usable help enterprises maintain efficiency and reduce the risk of lost or disorganised information.

Another factor supporting growth is the heightened focus on compliance and information governance. Many sectors face regulations that require careful document retention, audit trails, and controlled access to records. Enterprise content management solutions provide controls and reporting that help organisations demonstrate compliance and respond to legal or regulatory inquiries.

Opportunity

An opportunity exists in the enhancement of analytics and insight features that help organisations understand how content is used, accessed, and valued over time. Tools that surface usage patterns, identify outdated or high-risk content, and suggest retention actions can support better decision making and more efficient governance.

Another opportunity lies in expanding mobile and integrated user experiences. Employees increasingly need to interact with content from mobile devices and within familiar productivity tools. Systems that embed content management features into email, collaboration platforms, and mobile apps can increase adoption and reduce friction.

Challenge

One challenge for the enterprise content management market is ensuring data security and privacy in distributed environments. Systems that span cloud, on-premises, and hybrid architectures must maintain strong controls to protect sensitive information. Balancing accessibility with strict access management and monitoring remains an ongoing operational requirement.

Another challenge involves measuring return on investment and demonstrating business value. Content management projects often require initial investment in technology and process redesign. Organisations must define clear success metrics and monitor improvements in efficiency, compliance, and risk reduction to justify continued investment.

Investor Type Impact Matrix

Investor Type Adoption Level Contribution to Market Growth (%) Key Motivation Investment Behavior Large enterprises Very High ~68.9% Compliance and operational efficiency Platform wide deployment BFSI institutions High ~32.7% Risk management and records control Long term investment Government agencies Moderate ~14% Transparency and governance Program based adoption Professional services firms Moderate ~10% Document intensive workflows Selective deployment SMEs Low to Moderate ~7% Basic document management Gradual adoption Key Market Segments

By Component

- Software/Solutions

- Document Management Systems

- Web Content Management

- Records Management

- Digital Asset Management

- Workflow & Business Process Management

- Others

- Services

- Professional Services

- Consulting & Implementation

- Support & Maintenance

- Managed Services

- Others

- Professional Services

By Deployment Mode

- On-premises

- Cloud-based

By Organization Size

- Large Enterprises

- Small and Medium-sized Enterprises

By End-User Industry

- Banking, Financial Services, and Insurance

- Government

- Healthcare

- Retail & E-commerce

- IT & Telecommunications

- Others

By Business Function

- Human Resources

- Legal & Compliance

- Marketing & Sales

- Operations

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Analysis

The Enterprise Content Management Market is dominated by large technology providers with broad enterprise software portfolios. Microsoft Corporation leverages its ecosystem to integrate content management with productivity and collaboration tools. IBM Corporation and Oracle Corporation focus on secure, scalable ECM platforms for regulated industries. Adobe Inc. emphasizes digital document workflows and content lifecycle management.

Specialized ECM vendors strengthen the market through focused innovation and flexibility. OpenText Corporation is recognized for end-to-end information management solutions. Hyland Software, Inc. supports content-intensive sectors such as healthcare and government. Box, Inc. delivers cloud-native content collaboration.

Alfresco Software, Inc. and Nuxeo focus on open and modular architectures. These vendors address customization and integration needs. Mid-sized and niche providers enhance adoption among small and mid-sized enterprises. Laserfiche and M-Files Corporation emphasize automation and metadata-driven management. DocuWare GmbH supports document digitization and workflow efficiency.

Top Key Players in the Market

- Microsoft Corporation

- OpenText Corporation

- Hyland Software, Inc.

- Box, Inc.

- IBM Corporation

- Oracle Corporation

- Adobe Inc.

- Alfresco Software, Inc.

- Laserfiche

- Nuxeo

- M-Files Corporation

- DocuWare GmbH

- Ascend Software

- Xerox Corporation

- Zoho Corporation Pvt. Ltd.

- Others

Recent Developments

- November, 2025: OpenText expanded its collaboration with SAP to deliver AI-ready cloud content management solutions at scale, helping businesses handle content more efficiently across platforms.

- December, 2025: Microsoft announced Partner Center updates, including new tools and kits for ECM-related launches extending into 2026, supporting partners in content services delivery.

- October, 2025: Box partnered with Tata Consultancy Services (TCS) to deliver AI-powered content management services across sectors like finance and healthcare. This collaboration combines Box’s platform with TCS’s expertise to speed up digital transformation for enterprises.

Report Scope

Report Features Description Market Value (2025) USD 39.2 Bn Forecast Revenue (2035) USD 215.8 Bn CAGR (2026-2035) 18.6% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Software/Solutions, Services), By Deployment Mode (On-premises, Cloud-based), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises), By End-User Industry (Banking, Financial Services, and Insurance, Government, Healthcare, Retail & E-commerce, IT & Telecommunications, Others), By Business Function (Human Resources, Legal & Compliance, Marketing & Sales, Operations, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Microsoft Corporation, OpenText Corporation, Hyland Software, Inc., Box, Inc., IBM Corporation, Oracle Corporation, Adobe Inc., Alfresco Software, Inc., Laserfiche, Nuxeo, M-Files Corporation, DocuWare GmbH, Ascend Software, Xerox Corporation, Zoho Corporation Pvt. Ltd., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Enterprise Content Management MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample

Enterprise Content Management MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Microsoft Corporation

- OpenText Corporation

- Hyland Software, Inc.

- Box, Inc.

- IBM Corporation

- Oracle Corporation

- Adobe Inc.

- Alfresco Software, Inc.

- Laserfiche

- Nuxeo

- M-Files Corporation

- DocuWare GmbH

- Ascend Software

- Xerox Corporation

- Zoho Corporation Pvt. Ltd.

- Others