Global Electrolytic Iron Market Size, Share, And Enhanced Productivity By Form (Powder, Granule, Paste), By Purity Level (High Purity, Medium Purity, Low Purity), By Application (Electrolytic Iron Powder, Magnetic Materials, Additives, Catalysts, Others), By End Use (Automotive, Construction, Electronics, Chemical, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 171007

- Number of Pages: 383

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

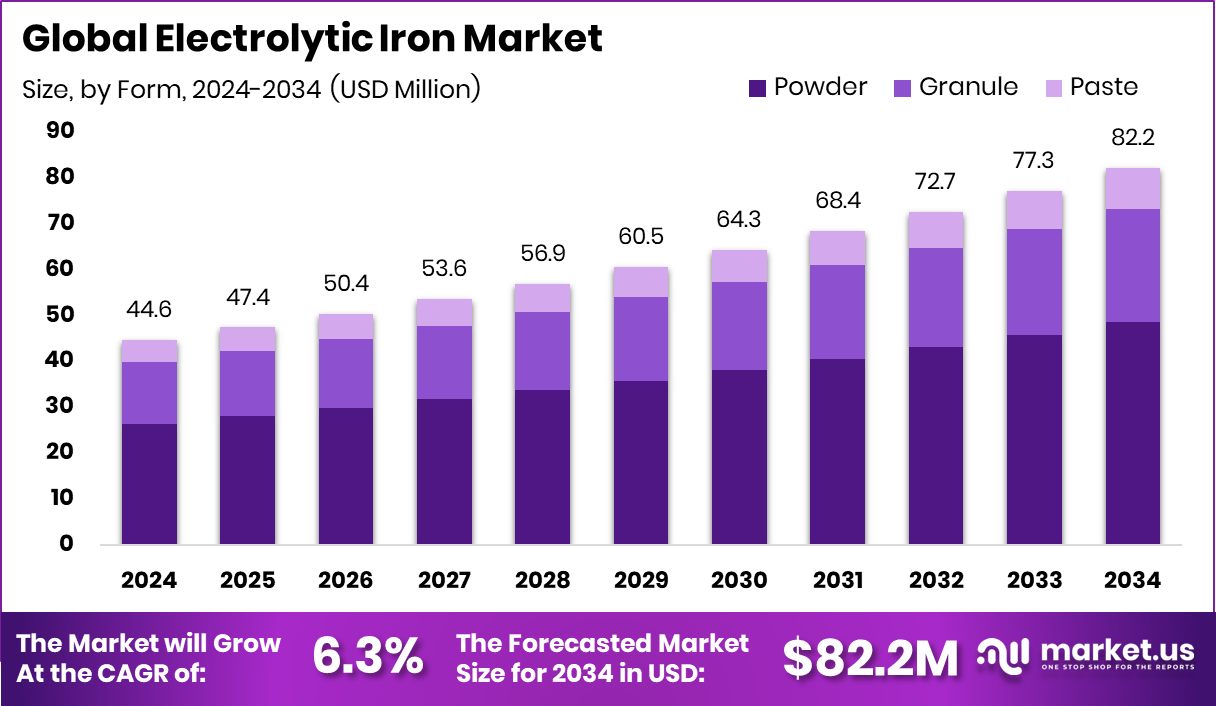

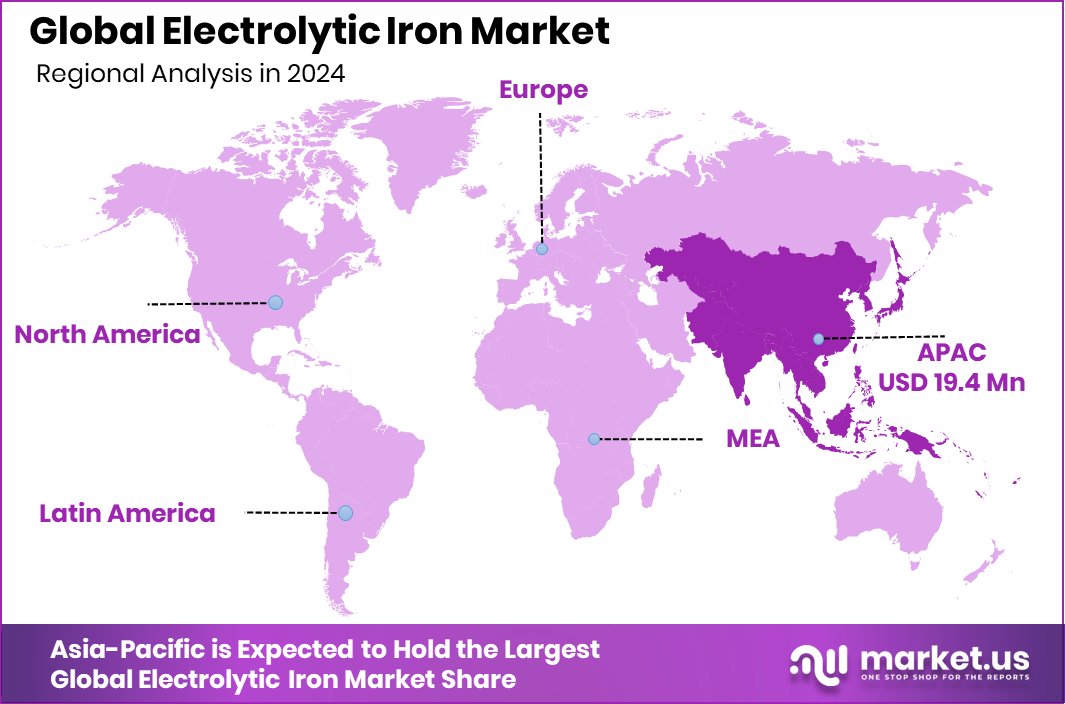

The Global Electrolytic Iron Market is expected to be worth around USD 82.2 million by 2034, up from USD 44.6 million in 2024, and is projected to grow at a CAGR of 6.3% from 2025 to 2034. Asia-Pacific Electrolytic Iron Market accounted for 43.70%, totaling USD 19.4 Mn overall regionally.

Electrolytic Iron is a high-purity form of iron produced through an electrochemical process where iron is deposited from a solution onto a cathode. This method delivers iron with very low impurity levels and consistent structure, making it suitable for applications where precision, cleanliness, and controlled material behavior matter. It is widely valued in advanced manufacturing, specialty materials, and emerging energy technologies.

The Electrolytic Iron Market refers to the commercial ecosystem covering production, processing, and use of electrolytic iron across multiple industries. Market activity is shaped by the need for reliable iron materials that perform predictably in demanding environments. Unlike conventional iron, electrolytic iron supports innovation-driven uses where quality stability is more important than bulk volume.

Growth factors are strongly linked to rising investments in next-generation energy storage and magnetic materials. For example, iron-air battery developer Form Energy raised $405M and announced collaboration with GE Vernova, alongside expanding its West Virginia facility and planning a 1.5 MW/150 MWh commercial pilot. These developments increase long-term demand for high-quality iron inputs.

Demand is further supported by funding for magnetic and ferrimagnetic research. Innovative ferrimagnetic material research received over $2.5M, while UTA secured a $1.3M grant to advance U.S. magnet manufacturing. At the industrial level, Niron Magnetics obtained $10M to build a 190,000-square-foot facility, strengthening domestic material supply chains.

- Noveon Magnetics raised $75M in Series B funding, highlighting strong confidence in iron-based magnetic solutions.

Additional momentum comes from multiple $65M raises by U.S. magnet startups aimed at scaling production and reducing global supply risks, creating long-term opportunity for electrolytic iron adoption.

Key Takeaways

- The Global Electrolytic Iron Market is expected to be worth around USD 82.2 million by 2034, up from USD 44.6 million in 2024, and is projected to grow at a CAGR of 6.3% from 2025 to 2034.

- In the Electrolytic Iron Market, powder form dominates demand, holding 59.2% share due to versatility.

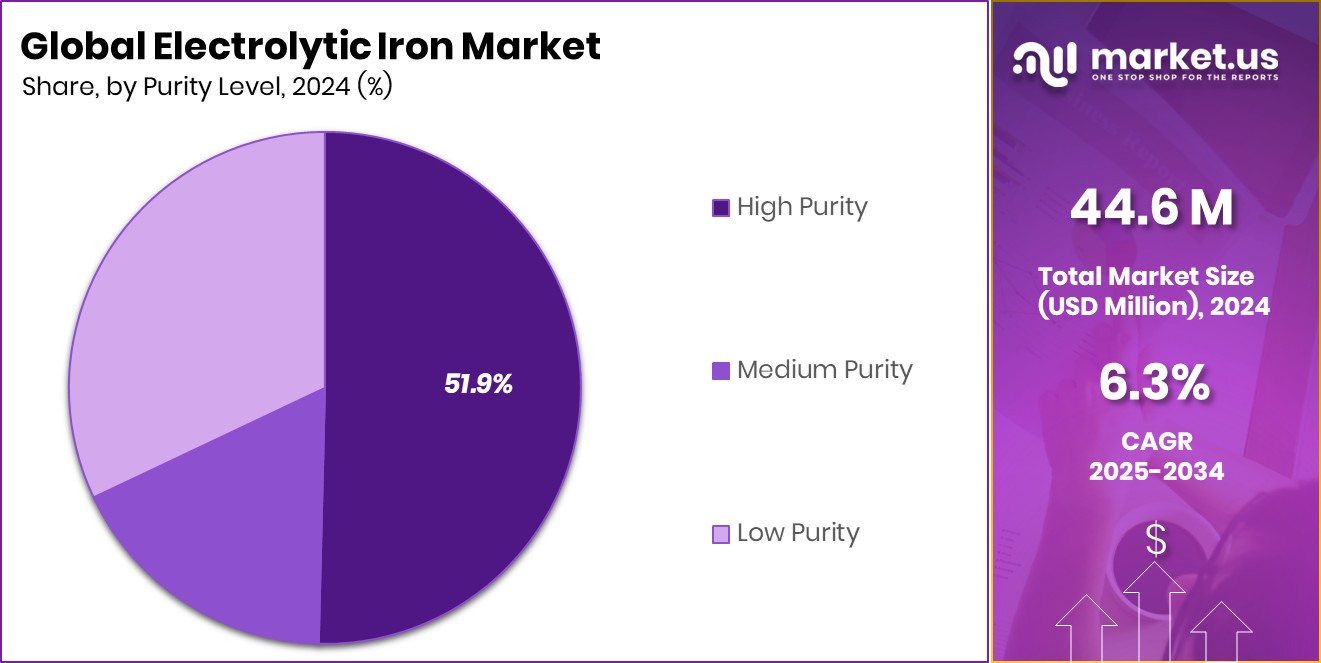

- High purity grades lead the Electrolytic Iron Market with 51.9% share, supporting performance-critical industrial applications.

- Electrolytic iron powder applications account for 38.3% share, driving growth across the Electrolytic Iron Market.

- Automotive end use contributes 34.6% share in the Electrolytic Iron Market, supported by metallurgical demand.

- Electrolytic Iron demand in Asia-Pacific reached 43.70%, representing a USD 19.4 Mn market size

By Form Analysis

Powder form leads the Electrolytic Iron Market with 59.2% share due versatility applications.

In 2024, Powder held a dominant market position in the By Form segment of the Electrolytic Iron Market, with a 59.2% share. This dominance reflects the strong preference for powder form across precision-driven manufacturing environments where consistency, flowability, and controlled particle behavior are critical. Powder-based electrolytic iron supports stable processing conditions, making it suitable for applications that demand predictable performance and uniform material characteristics.

The large 59.2% share also indicates widespread industrial acceptance of powder form due to its compatibility with modern fabrication and shaping techniques. Manufacturers favor powder as it allows better handling, easier storage, and efficient integration into downstream production workflows. As a result, powder continues to anchor the By Form segment, maintaining its leadership position through reliability and established industrial usage patterns.

By Purity Level Analysis

High purity dominates the Electrolytic Iron Market, holding 51.9%, driven by performance needs.

In 2024, High Purity held a dominant market position in the By Purity Level segment of the Electrolytic Iron Market, with a 51.9% share. This leadership highlights the growing importance of material quality, where strict chemical composition and minimal impurities are essential. High-purity electrolytic iron is preferred in applications that require consistent physical and chemical behavior to meet exact technical standards.

The 51.9% share underscores how end users increasingly prioritize performance stability and process control. High-purity material reduces variability during manufacturing and enhances end-product reliability. Its dominant position reflects steady demand from sectors that cannot compromise on quality thresholds, reinforcing high-purity electrolytic iron as the benchmark choice within the purity-based segmentation of the market.

By Application Analysis

Electrolytic iron powder application captures 38.3% of the Electrolytic Iron Market globally today.

In 2024, Electrolytic Iron Powder held a dominant market position in the By Purity Level segment of the Electrolytic Iron Market, with a 38.3% share. This position signals strong market confidence in electrolytic iron powder as a specialized material offering controlled composition and dependable structural properties. Its adoption is closely tied to applications that demand accuracy and repeatable performance outcomes.

With a 38.3% share, electrolytic iron powder demonstrates its relevance as a refined product form suited for precision manufacturing needs. The segment’s dominance reflects steady utilization, where material consistency supports operational efficiency. Its established role within the market highlights sustained demand patterns driven by quality-focused production environments rather than volume-based consumption alone.

By End Use Analysis

Automotive end-use accounts for 34.6% demand in the Electrolytic Iron Market worldwide.

In 2024, Automotive held a dominant market position in the By End Use segment of the Electrolytic Iron Market, with a 34.6% share. This dominance points to the automotive sector’s consistent reliance on electrolytic iron for components that require durability, dimensional accuracy, and controlled material properties. The sector’s scale and structured supply chains support steady material consumption.

The 34.6% share reflects how automotive manufacturers continue to integrate electrolytic iron into production processes where reliability and repeatability are essential. Demand from this segment remains stable due to ongoing vehicle manufacturing and component standardization needs. As a result, automotive applications firmly anchor the end-use landscape of the electrolytic iron market.

Key Market Segments

By Form

- Powder

- Granule

- Paste

By Purity Level

- High Purity

- Medium Purity

- Low Purity

By Application

- Electrolytic Iron Powder

- Magnetic Materials

- Additives

- Catalysts

- Others

By End Use

- Automotive

- Construction

- Electronics

- Chemical

- Others

Driving Factors

Rising Magnet Innovation Demand Drives Electrolytic Iron Use

The Electrolytic Iron Market is strongly driven by growing innovation in advanced magnet technologies, where high-purity iron plays a critical role. As industries seek alternatives to rare-earth materials, iron-based magnetic solutions are gaining attention due to supply security and performance stability. This shift directly supports demand for electrolytic iron, which offers controlled purity and consistent structure needed for next-generation magnetic applications.

Investment activity clearly reflects this trend. Niron Magnetics secured $33 million to advance its permanent magnet platform, highlighting confidence in iron-based magnet systems. At the same time, research institutions are strengthening the innovation pipeline, with MagLab at Florida State receiving a $4.2 million grant to develop next-generation magnets, reinforcing long-term material demand.

- Noveon Magnetics raised $75 million to scale rare-earth magnet recycling, further accelerating interest in iron-centric magnet solutions and supporting steady growth for electrolytic iron.

Restraining Factors

Rare Earth Funding Shifts Limit Electrolytic Iron Adoption

A key restraining factor for the Electrolytic Iron Market is the strong financial and policy push toward rare earth–based materials, which can slow adoption of iron alternatives. Large-scale investments into rare earth mining and magnet supply chains reduce immediate urgency for industries to shift fully toward electrolytic iron, even when iron-based options offer long-term stability and supply security. When capital flows heavily into rare earth ecosystems, electrolytic iron often remains a secondary option rather than a primary material choice.

This imbalance is visible in recent funding moves. The Pentagon became the largest shareholder in MP Materials, triggering a 50% surge in shares and reinforcing confidence in rare earth supply. Similarly, a North Carolina rare earth magnet startup secured a $1 billion Pentagon investment, strengthening rare earth dominance.

- Cyclic Materials plans a $25 million rare earth recycling facility in Canada, further extending rare earth availability and competitive pressure on electrolytic iron solutions.

Growth Opportunity

Onshoring Magnet Supply Creates Iron Demand

A major growth opportunity for the Electrolytic Iron Market comes from the global push to onshore and localize magnet supply chains. As industries work to reduce reliance on imported materials, iron-based inputs are gaining attention for their availability and processing flexibility. Electrolytic iron fits well into this shift because it supports controlled manufacturing and can be sourced with fewer geopolitical risks. This trend opens new pathways for iron materials in advanced manufacturing and mobility-related applications.

Recent funding activity highlights this opportunity. Vulcan raised $65 million to onshore rare-earth magnet production, signaling broader investment in domestic magnet ecosystems that also need stable iron inputs. Jaguar Land Rover invested $2 million in rare earth magnet recycling, reinforcing circular material strategies.

- RarEarth closed a €2.6 million funding round, supporting innovation in magnet-related technologies and expanding future demand for electrolytic iron.

Latest Trends

Sustainable Magnet Investments Shape Electrolytic Iron Demand

A key latest trend in the Electrolytic Iron Market is the growing focus on building sustainable and secure magnet supply chains. Governments and industries are investing heavily in cleaner material systems, which indirectly increases interest in iron-based inputs that support stable and traceable production. Electrolytic iron benefits from this shift because it aligns with controlled manufacturing and reduced dependency risks. As magnet technologies evolve, material choices are being influenced by long-term sustainability goals rather than short-term cost advantages.

Public funding highlights this trend clearly. The UK Government announced £11 million in funding to strengthen a sustainable rare earth magnet supply chain, reinforcing regional material independence. At the technology level, a $2 million grant was awarded to support the development of a “magnetic camera,” showing expanding innovation in magnet-based applications.

- A strategic $1.4 billion rare earth magnet partnership is reshaping U.S. supply chains, indirectly boosting demand for high-purity electrolytic iron inputs.

Regional Analysis

Asia-Pacific dominates the Electrolytic Iron Market with 43.70% share valued at USD 19.4 Mn

Asia-Pacific emerged as the dominating region in the Electrolytic Iron Market, accounting for 43.70% share and valued at USD 19.4 Mn, reflecting its strong industrial base and consistent material consumption across manufacturing-driven economies. The region’s dominance highlights its established production capabilities and steady downstream demand, positioning Asia-Pacific as the primary contributor to overall market activity.

In comparison, North America represents a mature regional landscape where electrolytic iron demand is shaped by stable industrial usage patterns and quality-focused applications, supporting balanced market participation without aggressive volume shifts. Europe follows a similar trajectory, with demand linked to structured manufacturing ecosystems and regulated production environments that emphasize material consistency.

The Middle East & Africa region shows gradual market participation, supported by developing industrial activities and increasing awareness of specialized iron materials, though its contribution remains comparatively moderate. Latin America maintains a steady presence, driven by selective industrial adoption and localized production requirements rather than large-scale expansion.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Blyth Metals Ltd. plays a focused and technically grounded role in the global Electrolytic Iron Market in 2024. The company is known for its specialization in iron and related metal products, with an emphasis on controlled quality and consistent output. Blyth Metals’ strength lies in its ability to serve niche industrial requirements where material reliability is critical. Its operational approach reflects long-term relationships with end users that value precision, making the company a steady participant rather than a volume-driven supplier.

Dr. Fritsch is viewed as a technology-oriented player with deep expertise in material processing and powder-related solutions. In the electrolytic iron space, the company benefits from its strong engineering background and process know-how. Dr. Fritsch’s position is supported by its capability to align material characteristics with specific application needs. This technical alignment allows the company to remain relevant in quality-sensitive segments, reinforcing its credibility among industrial customers seeking performance consistency.

Hoganas High Alloys LLC holds a strategically important position due to its strong metallurgical foundation and application-driven product development. The company’s involvement in high-performance alloy and iron solutions reflects a clear focus on demanding industrial uses. Its analytical strength lies in combining material science expertise with customer-specific requirements, enabling Hoganas High Alloys to maintain a resilient and application-focused presence in the Electrolytic Iron Market during 2024.

Top Key Players in the Market

- Blyth Metals Ltd.

- Dr. Fritsch

- Hoganas High Alloys LLC

- Industrial Metal Powders Pvt. Ltd.

- JFE Steel Corporation

- NetShape Nutrition Pvt. Ltd.

- Shanghai Zhiye Industry Co., Ltd.

- Toho Zinc Co., Ltd.

Recent Developments

- In May 2025, Toho Zinc outlined progress in reorganizing its unprofitable operations and strengthening core and growth areas such as smelting, recycling, and electronic materials, which include electrolytic iron products. The company emphasized improving profitability and expanding recycling capabilities, positioning its advanced materials segment for future growth.

- In April 2025, JFE Steel announced plans to install a large, high-efficiency electric arc furnace at its Kurashiki Works in Japan. This new furnace aims to improve energy use and reduce carbon footprint as part of future steel production technologies.

Report Scope

Report Features Description Market Value (2024) USD 44.6 Million Forecast Revenue (2034) USD 82.2 Million CAGR (2025-2034) 6.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Powder, Granule, Paste), By Purity Level (High Purity, Medium Purity, Low Purity), By Application (Electrolytic Iron Powder, Magnetic Materials, Additives, Catalysts, Others), By End Use (Automotive, Construction, Electronics, Chemical, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Blyth Metals Ltd., Dr. Fritsch, Hoganas High Alloys LLC, Industrial Metal Powders Pvt. Ltd., JFE Steel Corporation, NetShape Nutrition Pvt. Ltd., Shanghai Zhiye Industry Co., Ltd., Toho Zinc Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Electrolytic Iron MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample

Electrolytic Iron MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Blyth Metals Ltd.

- Dr. Fritsch

- Hoganas High Alloys LLC

- Industrial Metal Powders Pvt. Ltd.

- JFE Steel Corporation

- NetShape Nutrition Pvt. Ltd.

- Shanghai Zhiye Industry Co., Ltd.

- Toho Zinc Co., Ltd.