Global Electric Three Wheeler Market Size, Share, Growth Analysis By Payload Capacity (Upto 300Kgs, Above 300Kgs), By Vehicle (Passenger Carrier, Load Carrier), By Battery (Lithium-Ion, Lead Acid), By Power Capacity (Below 1,000W, 1,000W-1,500W, Above 1,500W), By Battery Capacity (Below 3kWh, 3-6kWh, Above 6kWh), By Speed (Low Speed 25 Km/H, High Speed 225 Km/H), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 169622

- Number of Pages: 269

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

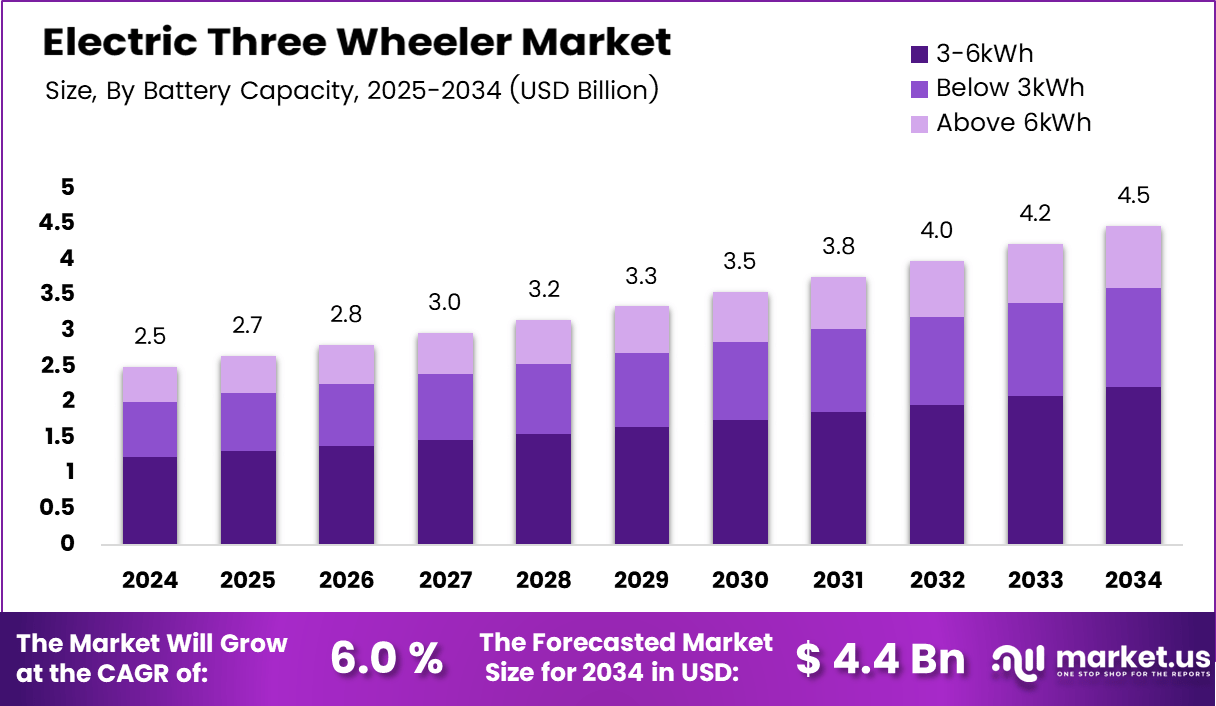

The Global Electric Three Wheeler Market size is expected to be worth around USD 4.5 billion by 2034, from USD 2.5 billion in 2024, growing at a CAGR of 6% during the forecast period from 2025 to 2034.

The electric three-wheeler market represents a rapidly expanding segment within urban mobility, driven by rising demand for cost-efficient last-mile transportation and supportive electrification policies. The market focuses on battery-powered passenger and load-carrier vehicles that replace traditional ICE three-wheelers through improved efficiency, lower operating expenses, and simplified mechanical systems supporting long-term fleet sustainability.

Growing adoption emerges as consumers and fleet operators recognize the economic advantages of electric mobility. Operators increasingly prefer electric three-wheelers for citywide shared mobility, micro-logistics, and IPT services, as these vehicles deliver predictable performance, compact design, and reduced dependency on fluctuating fuel prices. This shift continues strengthening as financing models and digital fleet platforms expand.

Moreover, government incentives accelerate electrification by offering subsidies, road-tax exemptions, and charging-infrastructure programs that lower acquisition barriers. States adopting EV missions further create structured opportunities for fleet modernization, pushing operators toward lithium-ion platforms that support higher uptime. As urban congestion intensifies, policymakers emphasize low-emission mobility solutions, reinforcing long-term demand for electric three-wheelers across tier-1 to tier-3 cities.

However, the market experiences challenges linked to battery lifecycle, replacement cost, and charging accessibility. Lead-acid and entry-level lithium-ion batteries require periodic replacement, impacting operational economics for high-mileage users. Despite this, rising innovation in battery management and swappable battery networks gradually improves lifecycle value, strengthening the technology outlook.

Toward market performance, operational savings remain a critical adoption driver. According to industry observations, EV maintenance costs nearly Rs 3,000 yearly, while running expenses are about 80% lower than petrol or CNG vehicles, enhancing profitability for operators transitioning across IPT categories such as L5MICE, L5Melectric, Tempo, and e-rickshaw platforms. Seating configurations spanning Driver+3, Driver+6, and Driver+4 further support utilization flexibility.

Additionally, frequent battery replacement remains a noted issue, with typical replacement required after 300–350 charging cycles or roughly nine months, as indicated by field-usage statistics. Furthermore, other manufacturers recorded 36,622 unit sales, marking a 2.91% MoM rise and 16.01% YoY growth, underscoring expanding market confidence. As a result, the electric three-wheeler market continues transitioning into a mainstream mobility solution supported by strong economics and rising sustainability commitments.

Key Takeaways

- The Global Electric Three Wheeler Market reached USD 2.5 billion in 2024 and is projected to hit USD 4.5 billion by 2034.

- The market is forecast to grow at a steady 6% CAGR from 2025 to 2034.

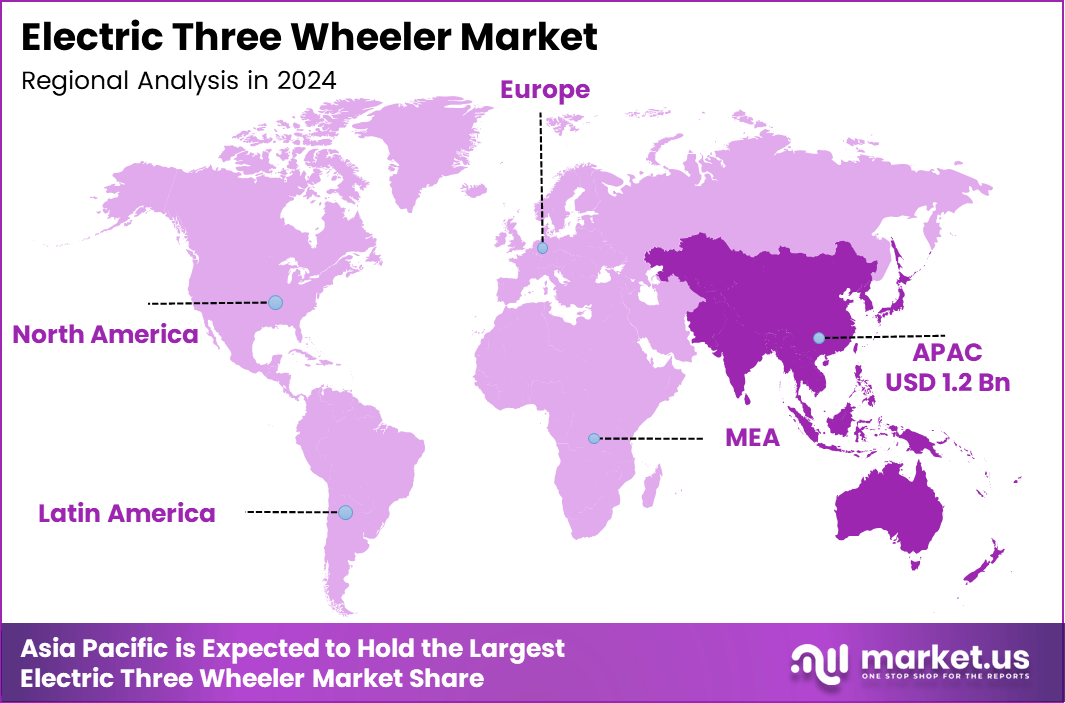

- Asia Pacific leads the industry with a dominant 49.8% share worth USD 1.2 billion.

- Upto 300Kgs segment dominates payload capacity with a strong 67.8% market share.

- The passenger Carrier segment holds the highest vehicle share at 61.9% globally.

- Lithium-ion batteries lead the battery category with a 59.6% share.

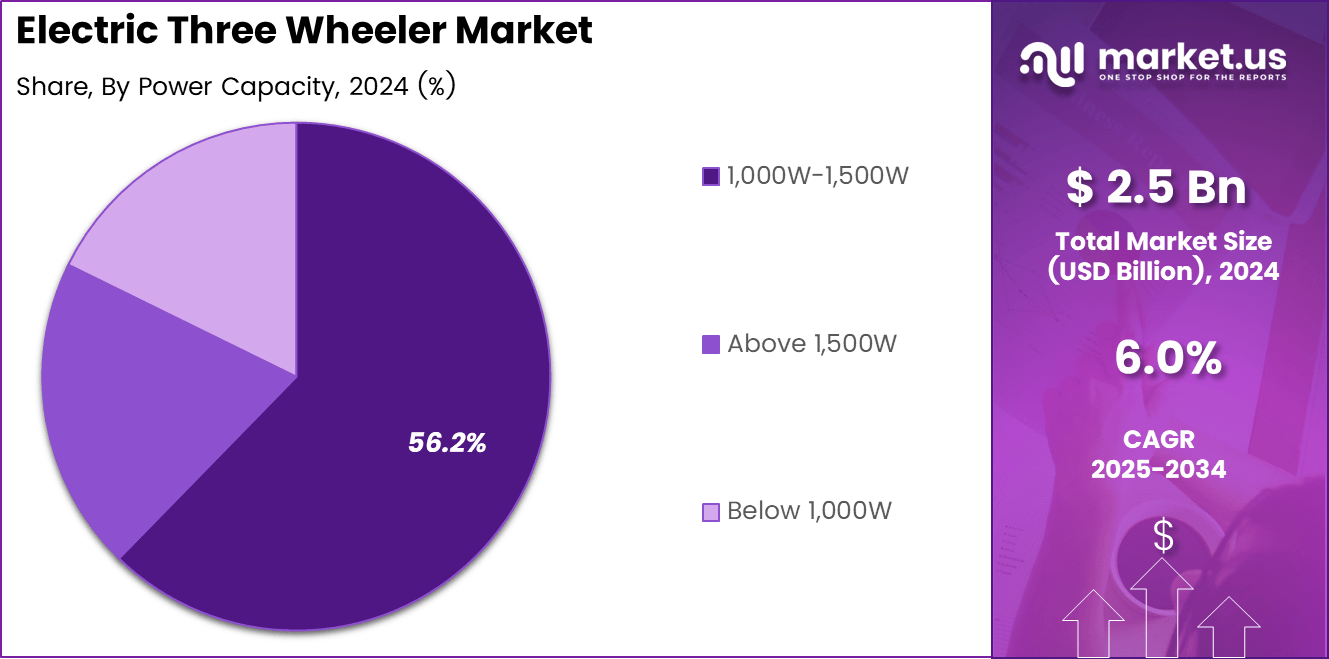

- The 1,000W–1,500W power capacity range dominates with a 56.2% market share.

- The 3–6kWh category leads battery capacity segmentation at 49.4%.

- Low-speed (25 Km/H) vehicles account for a major 73.7% of total speed-based sales.

- Asia Pacific remains the fastest-growing region, driven by strong EV adoption and government incentives.

Electric Three Wheeler Market Segmentation Analysis

By Payload Capacity

Up to 300Kgs dominates with 67.8% due to strong adoption in cost-driven short-distance transport applications.

In 2024, Upto 300Kgs held a dominant market position in the By Payload Capacity Analysis segment of the Electric Three Wheeler Market, with a 67.8% share. This category gains strong traction as operators prioritize lower acquisition costs and higher maneuverability. Additionally, increasing intra-city movement continues to support lightweight EV adoption across India’s expanding shared mobility ecosystem.

Above 300Kgs observed rising demand as logistics operators gradually shift toward higher-capacity EVs. This segment benefits from improving battery efficiency and growing commercial adoption for mid-range goods transport. Furthermore, favorable urban freight regulations continue encouraging the deployment of heavier electric three-wheelers.

By Vehicle

Passenger Carrier dominates with 61.9% due to expanding last-mile mobility demand.

In 2024, Passenger Carrier held a dominant market position in the By Vehicle Analysis segment of the Electric Three Wheeler Market, with a 61.9% share. Urban commuters increasingly choose electric auto-rickshaws for affordability and improved ride economics. Besides this, government-led electrification programs continue accelerating deployment across major metropolitan regions.

Load Carrier shows steady expansion as e-commerce and hyperlocal delivery networks adopt electric cargo three-wheelers. Additionally, companies focus on reducing fuel expenses and meeting emission compliance, which strengthens adoption in structured delivery fleets. Improving chassis durability also supports market penetration.

By Battery

Lithium-Ion dominates with 59.6% due to superior lifecycle and efficiency benefits.

In 2024, Lithium-Ion held a dominant market position in the Battery Analysis segment of the Electric Three Wheeler Market, with a 59.6% share. Faster charging, longer battery life, and declining cell prices strengthen this segment. Moreover, fleet operators prefer lithium-ion batteries due to reduced downtime and improved cost-per-kilometer performance.

Lead Acid retains presence in price-sensitive regions where low upfront cost remains a primary consideration. The segment continues to serve small-scale operators, although gradually transitioning toward lithium-ion alternatives as regulatory guidelines promote cleaner energy adoption.

By Power Capacity

1,000W–1,500W dominates with 56.2% due to balanced performance and affordability.

In 2024, 1,000W–1,500W held a dominant market position in the By Power Capacity Analysis segment of the Electric Three Wheeler Market, with a 56.2% share. This range offers optimal power output for daily passenger and cargo operations. Additionally, favorable performance under varying load conditions supports widespread market preference.

Below 1,000W caters to low-speed and short-distance use cases, primarily in rural and semi-urban environments. Operators adopt these models for cost-efficient transport, supported by reduced maintenance needs and simple mechanical design.

Above 1,500W expands gradually as high-performance EVs gain traction for heavier payloads. Commercial users prefer this category for better torque, improved gradient performance, and enhanced operational reliability in demanding delivery routes.

By Battery Capacity

3–6kWh dominates with 49.4% due to optimal range and cost suitability.

In 2024, 3–6kWh held a dominant market position in the By Battery Capacity Analysis segment of the Electric Three Wheeler Market, with a 49.4% share. This capacity enables a sufficient daily operating range with manageable charging cycles. Furthermore, fleet owners adopt it widely to optimize the total cost of ownership.

Below 3kWh remains suitable for lightweight mobility applications with limited daily travel. Operators in rural areas often choose this option for affordability. Additionally, low charging requirements make it feasible where grid access is inconsistent.

Above 6kWh sees increasing preference among commercial logistics operators requiring extended range. This segment gains momentum as delivery fleets expand and smart-charging infrastructure becomes more accessible across urban corridors.

By Speed

Low Speed (25 Km/H) dominates with 73.7% due to regulatory alignment and urban mobility suitability.

In 2024, Low Speed (25 Km/H) held a dominant market position in the By Speed Analysis segment of the Electric Three Wheeler Market, with a 73.7% share. This category aligns well with local transport regulations while offering high operational efficiency. Moreover, its compatibility with congested city routes supports sustained adoption.

High Speed (225 Km/H) remains a niche category with limited adoption due to regulatory restrictions and safety concerns. However, technological improvements and evolving standards may gradually enhance acceptance in advanced mobility environments.

Key Market Segments

By Payload Capacity

- Upto 300Kgs

- Above 300Kgs

By Vehicle

- Passenger Carrier

- Load Carrier

By Battery

- Lithium-Ion

- Lead Acid

By Power Capacity

- Below 1,000W

- 1,000W-1,500W

- Above 1,500W

By Battery Capacity

- Below 3kWh

- 3-6kWh

- Above 6kWh

By Speed

- Low Speed (25 Km/H)

- High Speed (225 Km/H)

Drivers

Government Incentives Accelerating EV Adoption Across Urban and Semi-Urban Mobility Networks

Government incentives accelerating EV adoption strengthen the Electric Three Wheeler Market by reducing upfront purchase costs and improving user affordability. These schemes make electric three-wheelers more attractive for drivers and fleet operators shifting from conventional fuel-based models. Favorable taxation and subsidy programs continue encouraging faster migration toward clean mobility.

Additionally, the rapid expansion of charging and battery-swapping infrastructure enhances operational uptime for commercial vehicles. These developments help reduce range anxiety and enable uninterrupted last-mile delivery operations. The growing presence of charging points in cities and semi-urban regions supports wider EV penetration across logistics and passenger transport sectors.

Rising demand for low-cost last-mile logistics solutions also pushes market growth, especially within e-commerce and hyperlocal delivery ecosystems. Electric three-wheelers offer lower running costs and better profitability than petrol or CNG alternatives. Their compact size and economical operation make them suitable for dense urban routes.

A wider shift toward cleaner transportation due to strict urban emission-control regulations further boosts adoption. Authorities are encouraging zero-emission vehicles to address pollution and congestion. This regulatory push motivates businesses and public mobility providers to transition toward electric three-wheelers for sustainable transportation models.

Restraints

Limited Availability of High-Capacity Batteries Restricts Load Range and Daily Operational Cycles

Limited availability of high-capacity batteries affects the Electric Three Wheeler Market by restricting payload capability and achievable daily kilometers. Operators require longer ranges for commercial usage, and insufficient battery performance directly impacts revenue potential. This creates hesitation among buyers seeking reliable long-distance operation.

A fragmented EV manufacturing ecosystem also restrains growth because product quality and reliability differ across regions and brands. Inconsistent standards create maintenance challenges and reduce consumer confidence. Fleet owners prefer dependable platforms, and variability slows overall adoption momentum in competitive markets.

Insufficient grid stability in many rural and semi-urban areas further limits reliable charging access. Frequent power fluctuations or a lack of robust electricity networks delay charging cycles and disrupt operations. These challenges reduce fleet productivity and make widespread rural deployment difficult.

Together, these restraints underline the need for stronger battery innovation, manufacturing standardization, and grid modernization to unlock full market potential.

Growth Factors

Integration of Telematics and IoT Platforms Enabling Real-Time Fleet Optimization and Diagnostics

Integration of telematics and IoT systems creates strong growth opportunities in the Electric Three Wheeler Market. Real-time tracking, performance insights, and predictive maintenance support higher fleet efficiency. Operators benefit from optimized routes and reduced downtime, making EV operations more profitable and data-driven.

Modular battery architecture introduces flexibility by allowing vehicle owners to customize range and payload needs. Commercial users can scale battery capacity depending on daily operations, reducing wasted energy and improving overall cost efficiency. This modularity increases adoption among logistics and passenger service providers.

Energy-as-a-service (EaaS) models represent another major opportunity by lowering ownership costs. Operators can access batteries on subscription or pay-per-use terms, reducing the burden of upfront investment. These models enhance affordability and encourage business owners to shift toward electric fleets.

Emerging Trends

Growing Shift Toward Lightweight Composite Chassis for Improved Efficiency and Extended Range

A growing shift toward lightweight composite chassis shapes key trends in the Electric Three Wheeler Market. These materials reduce overall vehicle weight, resulting in better energy efficiency and extended driving range. Manufacturers increasingly adopt composite structures to improve durability while supporting sustainable mobility goals.

Increasing preference for fast-charging lithium-ion batteries also emerges as a strong trend. These batteries offer shorter charging times, longer life cycles, and higher energy density compared to lead-acid options. Their adoption improves productivity for commercial operators requiring faster turnaround times.

Together, these trends reflect a dynamic transition toward technologically advanced, durable, and energy-efficient electric three-wheelers.

Regional Analysis

Asia Pacific Dominates the Electric Three Wheeler Market with a Market Share of 49.8%, Valued at USD 1.2 Billion

Asia Pacific remains the leading region in the Electric Three Wheeler Market, accounting for a dominant 49.8% share valued at approximately USD 1.2 billion. Strong regulatory support, rapid electrification of last-mile mobility, and expanding urban logistics networks accelerate adoption across India, China, and Southeast Asia. Government-backed subsidies and charging infrastructure expansion further strengthen regional growth momentum.

North America Electric Three-Wheeler Market Trends

North America shows steady adoption driven by commercial fleet electrification and growing interest in compact mobility for urban delivery. Supportive clean mobility policies and pilot programs focused on micro-transportation use cases encourage market expansion. The region increasingly integrates electric three-wheelers into sustainable logistics and municipal mobility planning.

Europe Electric Three-Wheeler Market Trends

Europe experiences rising deployment of electric three-wheelers as cities enforce stricter low-emission zones and promote alternative mobility formats. Various countries invest in greener last-mile distribution models, improving acceptance among logistics service providers. Demand continues to grow in metropolitan areas, prioritizing congestion reduction and sustainability goals.

Middle East and Africa Electric Three-Wheeler Market Trends

The Middle East and Africa region witnesses gradual adoption supported by expanding urban commercial activities and increasing interest in cost-efficient mobility. Government diversification strategies and pilot initiatives in emerging cities promote EV testing and localized use cases. Growth remains moderate but improving as infrastructure projects advance.

Latin America Electric Three-Wheeler Market Trends

Latin America shows growing potential as fleet operators shift toward electric mobility to reduce operational expenses. Urban delivery growth in countries such as Brazil and Mexico encourages demand for compact, low-maintenance vehicles. Policy improvements and rising fuel prices further create a favorable environment for market penetration.

US Electric Three-Wheeler Market Trends

The US market demonstrates early but steady interest, primarily within commercial logistics and campus-based mobility applications. Adoption is supported by clean-energy incentives and pilot deployments in select states focusing on sustainable last-mile transport. Growing attention toward operational efficiency and emission reduction enhances future market prospects.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Electric Three Wheeler Company Insights

The global Electric Three Wheeler Market in 2024 continues expanding as manufacturers strengthen product reliability, enhance battery technologies, and address last-mile mobility priorities across developing economies. Leading companies focus on operational efficiency, lower total cost of ownership, and improved payload capabilities, supporting wider fleet adoption in both passenger and cargo applications. Rising demand in urban and semi-urban transport corridors further accelerates competitive differentiation.

Bajaj Auto maintains a strong position due to its established distribution network and consistent focus on performance-driven electric three-wheelers. The company emphasizes durability, optimized driving range, and adaptable vehicle configurations, supporting adoption among commercial fleet operators transitioning from ICE to electric formats.

Mahindra Last Mile Mobility strengthens market penetration through purpose-built EV platforms tailored for varied Indian transport conditions. Its offerings benefit from high operational savings and improved power efficiency, positioning the company as a preferred choice for enterprises seeking dependable last-mile mobility solutions.

Mini Metro EV expands its presence by focusing on affordable electric three-wheelers with essential mobility features suitable for dense intra-city routes. Its strategy centers on providing cost-efficient vehicles that meet daily commercial usage demands while supporting low maintenance expectations.

Piaggio Vehicles enhances competitiveness through engineering upgrades and expanded EV variants designed for both passenger and load-carrier applications. Its focus on torque performance, productivity, and chassis stability enables the brand to retain strong acceptance in small businesses and logistics operations.

Top Key Players in the Market

- Bajaj Auto

- Mahindra Last Mile Mobility

- Mini Metro EV

- Piaggio Vehicles

- Saera Electric Auto

- YC Electric

Recent Developments

- In Sep 2024, Ola Electric announced plans to launch its electric three wheeler (e rickshaw), aiming to enter the fast growing urban mobility segment. The company is expected to adopt competitive pricing to challenge established market leaders such as Mahindra, Piaggio, and Bajaj in India’s E3W space.

- In Mar 2025, Hero MotoCorp announced a phased investment of around Rs 525 crore in Euler Motors as part of its long term strategy to strengthen its presence in India’s electric three wheeler (E3W) market. The investment highlights strong growth momentum in the E3W segment, driven by government support, rising fuel costs, and increasing environmental awareness.

Report Scope

Report Features Description Market Value (2024) USD 2.5 billion Forecast Revenue (2034) USD 4.5 billion CAGR (2025-2034) 6.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Payload Capacity (Up to 300Kgs, Above 300Kgs), By Vehicle (Passenger Carrier, Load Carrier), By Battery (Lithium-Ion, Lead Acid), By Power Capacity (Below 1,000W, 1,000W-1,500W, Above 1,500W), By Battery Capacity (Below 3kWh, 3-6kWh, Above 6kWh), By Speed (Low Speed 25 Km/H, High Speed 225 Km/H) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Bajaj Auto, Mahindra Last Mile Mobility, Mini Metro EV, Piaggio Vehicles, Saera Electric Auto, YC Electric Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Electric Three Wheeler MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Electric Three Wheeler MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Bajaj Auto

- Mahindra Last Mile Mobility

- Mini Metro EV

- Piaggio Vehicles

- Saera Electric Auto

- YC Electric