Global Earphones and Headphones Market Size, Share, Growth Analysis By Product (Earphones, Headphones), By Technology (Wired (ANC, Others), Wireless (ANC, Bluetooth, NFMI, Smart headphones, Others)), By Form Factor (In-Ear/Canal, Over-Ear, On-Ear, Open-Ear/Bone-Conduction), By Noise-Control Technology (Passive Noise-Isolation, Active Noise-Cancelling (ANC), Open-Transparency/Ambient Mode), By Application (Music & Entertainment, Fitness, Gaming, Virtual Reality, Others), By Distribution (Online, Offline) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Jan 2026

- Report ID: 174183

- Number of Pages: 373

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Product Analysis

- Technology Analysis

- Form Factor Analysis

- Noise-Control Technology Analysis

- Application Analysis

- Distribution Analysis

- Key Market Segments

- Drivers

- Restraints

- Growth Factors

- Emerging Trends

- Regional Analysis

- Key Earphones and Headphones Company Insights

- Key Players

- Recent Developments

- Report Scope

Report Overview

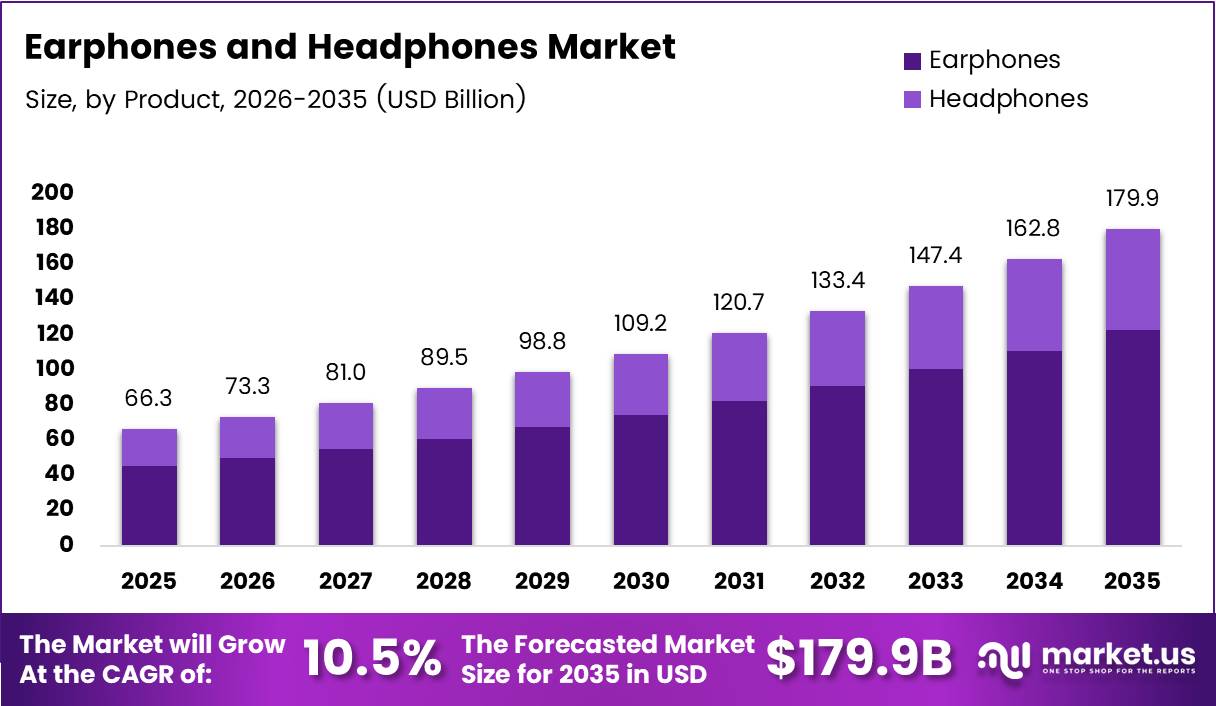

The global Earphones and Headphones Market is projected to grow from USD 66.3 billion in 2025 to USD 179.9 billion by 2035, expanding at a CAGR of 10.5% during the forecast period. This robust growth reflects accelerating consumer adoption of wireless audio devices and premium sound technologies. Moreover, the market benefits from continuous innovation in active noise cancellation and spatial audio capabilities.

Audio consumption patterns are evolving rapidly across entertainment, professional, and fitness applications. Consequently, manufacturers are developing specialized products tailored to gaming, virtual reality, and sports activities. Additionally, the proliferation of smartphones and streaming platforms has created sustained demand for high-quality personal audio solutions. Therefore, both established brands and emerging players are investing heavily in research and development.

Wireless technology dominates current market dynamics, driven by smartphone compatibility and user convenience preferences. However, wired solutions maintain relevance in professional audio and gaming segments due to latency advantages. Furthermore, true wireless stereo earbuds have revolutionized portable audio by eliminating cables entirely. This segment continues capturing significant market share through improved battery life and connectivity features.

The online distribution channel has emerged as the preferred purchasing platform for audio devices globally. According to Ofcom, YouTube reaches 47% and Spotify reaches 37% of adults weekly in the UK for online audio services. Meanwhile, online music services reach 61% of UK adults weekly, nearly matching music radio at 62%. These statistics demonstrate the strong digital ecosystem supporting headphone adoption.

Government initiatives promoting digital infrastructure and smart device accessibility are indirectly supporting market expansion. Additionally, regulations around audio safety standards ensure product quality and consumer protection. Moreover, sustainability regulations are encouraging manufacturers to adopt eco-friendly materials and recyclable packaging solutions. Therefore, the earphones and headphones market stands positioned for sustained growth through technological advancement and expanding consumer applications.

Key Takeaways

- Global Earphones and Headphones Market projected to reach USD 179.9 billion by 2035 from USD 66.3 billion in 2025 at 10.5% CAGR

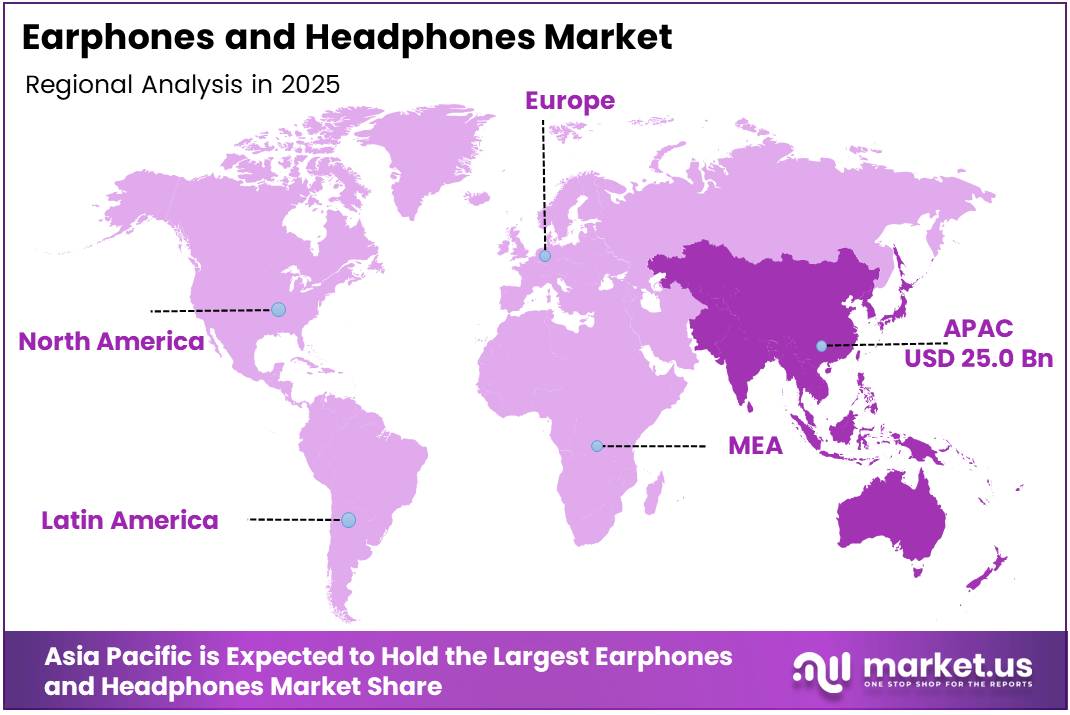

- Asia Pacific dominates with 37.8% market share, valued at USD 25.0 billion

- Earphones segment leads By Product category with 59.9% market share

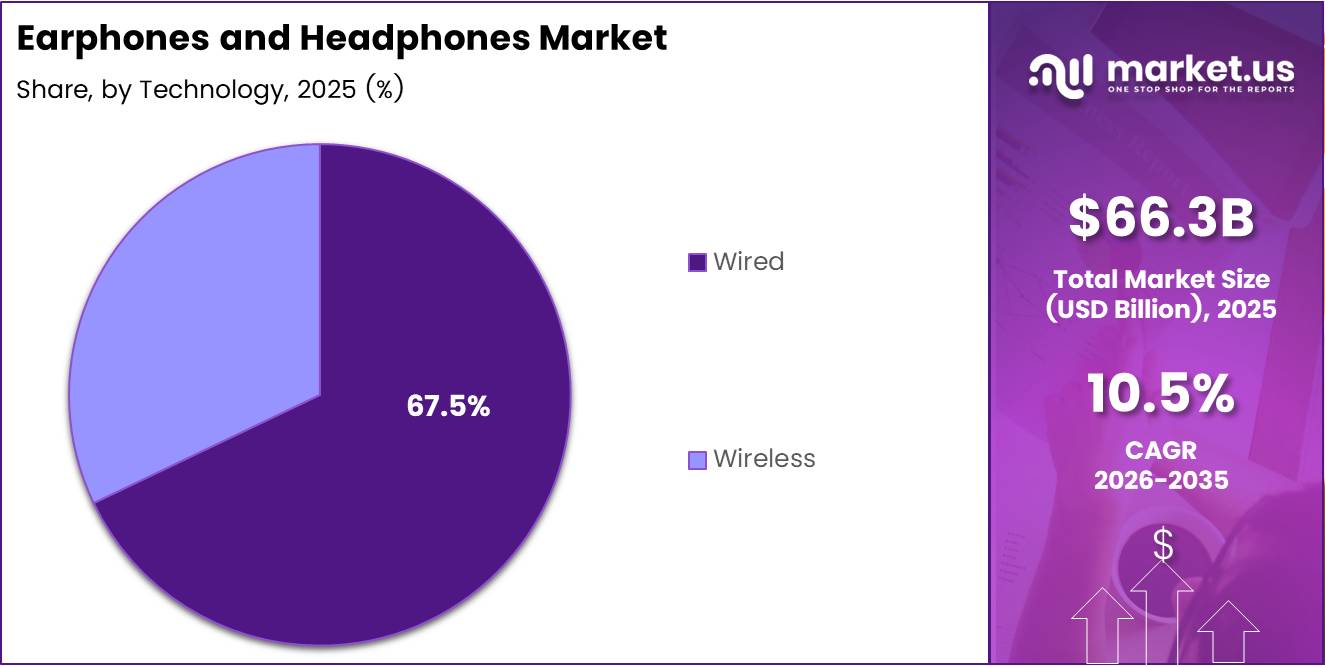

- Wired Technology holds 67.5% share in By Technology segment

- In-Ear/Canal form factor commands 41.1% of By Form Factor segment

- Passive Noise-Isolation captures 45.2% in Noise-Control Technology segment

- Music & Entertainment application represents 43.4% of total market

- Online distribution channel accounts for 59.7% of total sales

Product Analysis

Earphones dominate with 59.9% market share due to portability and widespread smartphone compatibility.

In 2025, Earphones held a dominant market position in the By Product segment of Earphones and Headphones Market, with a 59.9% share. This segment leads due to compact design and seamless integration with mobile devices across consumer demographics. Moreover, true wireless stereo models have eliminated cable inconvenience while maintaining audio quality. Additionally, affordable pricing tiers make earphones accessible to mass-market consumers globally.

Headphones maintain significant market presence through superior sound quality and professional applications. This segment appeals to audiophiles, content creators, and gamers requiring extended wearing comfort. Furthermore, over-ear designs provide better noise isolation for immersive listening experiences. Consequently, premium headphone models command higher price points and profit margins for manufacturers.

Technology Analysis

Wired technology dominates with 67.5% market share due to reliability and zero-latency audio transmission.

In 2025, Wired held a dominant market position in the By Technology segment of Earphones and Headphones Market, with a 67.5% share. This technology persists in professional audio production, gaming, and audiophile markets where connection stability matters. Moreover, wired solutions eliminate battery anxiety and charging requirements completely. Additionally, latency-free performance remains essential for competitive gaming and studio monitoring applications.

Within wired technology, ANC-equipped models enhance listening experiences by blocking external noise effectively. These products serve travelers and office workers seeking focus in noisy environments. Furthermore, standard wired headphones without ANC continue serving budget-conscious consumers and institutional buyers. Therefore, manufacturers maintain diverse wired product portfolios addressing multiple price points.

Wireless technology is rapidly gaining market share through Bluetooth advancements and improved battery efficiency. This segment includes ANC-enabled wireless models delivering premium noise cancellation without cables. Moreover, Bluetooth connectivity dominates wireless earphones by offering universal device compatibility and ease of use. Additionally, NFMI technology provides stable connection for true wireless earbuds requiring synchronization between left and right units.

Smart headphones represent the emerging frontier with voice assistant integration and adaptive audio features. These devices adjust sound profiles automatically based on ambient noise and user preferences. Furthermore, wireless technology enables firmware updates that add features post-purchase. Consequently, innovation cycles accelerate as manufacturers differentiate through software capabilities alongside hardware improvements.

Form Factor Analysis

In-Ear/Canal form factor dominates with 41.1% market share due to portability and effective noise isolation.

In 2025, In-Ear/Canal held a dominant market position in the By Form Factor segment of Earphones and Headphones Market, with a 41.1% share. This design creates effective seals within ear canals, blocking external noise naturally. Moreover, compact dimensions enable truly portable carrying cases that fit in pockets conveniently. Additionally, silicone and foam tips accommodate different ear shapes while maintaining secure fit during physical activities.

Over-Ear headphones attract consumers prioritizing maximum comfort during extended listening sessions and superior sound reproduction. This form factor distributes weight across the head, reducing ear pressure compared to other designs. Furthermore, large drivers deliver powerful bass response and detailed soundstages preferred by audiophiles. Consequently, over-ear models dominate professional monitoring and home entertainment applications successfully.

On-Ear headphones balance portability with audio quality, appealing to commuters and casual listeners. This design rests against ear surfaces without fully enclosing them like over-ear alternatives. Moreover, foldable mechanisms enable compact storage while traveling. Additionally, on-ear models typically cost less than over-ear equivalents, attracting price-sensitive consumers.

Open-Ear/Bone-Conduction technology serves niche safety-conscious users requiring environmental awareness during use. This innovative form factor transmits sound through cheekbones, leaving ear canals completely open. Furthermore, runners and cyclists choose bone-conduction models to hear traffic warnings while enjoying audio content. Therefore, this segment experiences steady growth within fitness and outdoor activity markets.

Noise-Control Technology Analysis

Passive Noise-Isolation dominates with 45.2% market share due to cost-effectiveness and battery-free operation.

In 2025, Passive Noise-Isolation held a dominant market position in the By Noise-Control Technology segment of Earphones and Headphones Market, with a 45.2% share. This technology relies on physical design elements blocking external sounds without electronic components. Moreover, ear cushions and tip materials create seals preventing ambient noise penetration effectively. Additionally, passive isolation works continuously without battery consumption, ensuring uninterrupted operation.

Active Noise-Cancelling (ANC) technology attracts premium buyers seeking maximum environmental noise reduction through electronic processing. This segment uses microphones detecting external sounds and generates inverse waves neutralizing them. Furthermore, ANC proves especially valuable during air travel and noisy commutes where passive isolation alone proves insufficient. Consequently, manufacturers position ANC as a premium feature commanding higher price points across product lines.

Open-Transparency/Ambient Mode enables users to hear surroundings while listening, enhancing safety and situational awareness. This technology selectively amplifies external sounds through microphones integrated into earphone housings. Moreover, office workers appreciate ambient mode for maintaining awareness of colleagues without removing earphones. Therefore, this feature has become standard in mid-range and premium wireless models increasingly.

Application Analysis

Music & Entertainment dominates with 43.4% market share due to widespread streaming service adoption and content consumption.

In 2025, Music & Entertainment held a dominant market position in the By Application segment of Earphones and Headphones Market, with a 43.4% share. This segment benefits from global streaming platform proliferation and podcast popularity growth. Moreover, commuters and leisure users consume audio content throughout daily routines consistently. Additionally, high-fidelity streaming services drive demand for quality headphones capable of reproducing detailed recordings.

Fitness applications drive earphone sales among health-conscious consumers requiring sweat-resistant and secure-fitting designs. This segment emphasizes durability, water resistance, and stability during vigorous physical activities. Furthermore, integrated heart rate monitors and coaching features add value beyond basic audio playback. Consequently, sports earphones command premium pricing through specialized functionality.

Gaming applications require low-latency audio transmission and spatial sound capabilities for competitive advantage and immersion. This segment includes dedicated gaming headsets with microphones for team communication during multiplayer sessions. Moreover, virtual surround sound technologies enhance positional awareness in first-person shooter and battle royale games. Therefore, gaming headphones incorporate RGB lighting and aesthetic designs appealing to younger demographics.

Virtual Reality applications demand lightweight headphones with precise spatial audio for convincing immersive experiences. This emerging segment grows alongside VR headset adoption in gaming and professional training applications. Furthermore, integrated audio solutions reduce cable clutter in mixed reality environments. Additionally, other applications include aviation, call centers, and language learning, expanding total addressable market continuously.

Distribution Analysis

Online distribution dominates with 59.7% market share due to convenience, variety, and competitive pricing.

In 2025, Online held a dominant market position in the By Distribution segment of Earphones and Headphones Market, with a 59.7% share. This channel offers extensive product selection with detailed specifications and customer reviews guiding purchase decisions. Moreover, direct-to-consumer brands leverage online platforms exclusively, reducing retail overhead costs significantly. Additionally, flash sales and promotional campaigns drive traffic to e-commerce platforms regularly.

Offline distribution maintains relevance through experiential retail where customers physically test products before purchasing decisions. This channel includes electronics specialty stores, department stores, and brand-exclusive outlets providing personalized assistance. Furthermore, immediate product availability appeals to consumers requiring urgent replacements or gift purchases. Consequently, premium brands maintain flagship retail locations demonstrating product quality and brand heritage effectively.

Key Market Segments

By Product

- Earphones

- Headphones

By Technology

- Wired

- ANC

- Others

- Wireless

- ANC

- Bluetooth

- NFMI

- Smart headphones

- Others

By Form Factor

- In-Ear/Canal

- Over-Ear

- On-Ear

- Open-Ear/Bone-Conduction

By Noise-Control Technology

- Passive Noise-Isolation

- Active Noise-Cancelling (ANC)

- Open-Transparency/Ambient Mode

By Application

- Music & Entertainment

- Fitness

- Gaming

- Virtual Reality

- Others

By Distribution

- Online

- Offline

Drivers

Surge in Wireless Audio Adoption Accelerates Market Expansion

Wireless audio adoption continues accelerating across smartphones, laptops, and smart TVs, eliminating cable clutter completely. Consequently, consumers increasingly prefer Bluetooth-enabled earphones for seamless multi-device connectivity throughout daily routines. Moreover, removal of headphone jacks from flagship smartphones has forced widespread wireless transition. Additionally, improved codec support ensures high-quality audio transmission approaching wired performance levels. Therefore, manufacturers prioritize wireless portfolios while maintaining legacy wired options.

The mobile gaming and e-sports industries drive high-fidelity headset demand through competitive gaming growth globally. Furthermore, professional gamers require low-latency audio and precise spatial positioning for competitive advantages during tournaments. Additionally, streaming platforms showcase gaming content, inspiring casual players to upgrade audio equipment. Consequently, gaming headphone sales surge alongside e-sports prize pools and viewership numbers steadily.

Remote work and virtual learning have normalized daily headphone usage for video conferencing and online education. Moreover, noise cancellation features enable productivity in home environments with household distractions present. Additionally, extended wearing comfort has become essential as work-from-home arrangements persist beyond pandemic periods. Therefore, consumer preferences shift toward lightweight designs with superior microphone quality for clear communication.

Restraints

Battery Degradation Challenges True Wireless Earbuds Market Growth

Battery degradation and limited lifespan of True Wireless Stereo (TWS) earbuds create consumer frustration and environmental concerns. Moreover, lithium-ion batteries typically degrade after 300-500 charge cycles, reducing playback time significantly. Additionally, non-replaceable batteries force complete product disposal when battery performance becomes inadequate for daily use. Consequently, sustainability-conscious consumers hesitate purchasing TWS models despite convenience advantages over wired alternatives.

Furthermore, battery replacement services remain expensive relative to new earbud prices, discouraging repair over replacement decisions. Therefore, electronic waste accumulation from discarded wireless earphones presents growing environmental challenges globally. Additionally, shorter product lifecycles compared to wired headphones increase total cost of ownership over time.

Increasing price sensitivity in mid-range and premium audio segments restrains market expansion during economic uncertainty periods. Moreover, consumers perceive diminishing returns as prices exceed certain thresholds without proportional quality improvements. Additionally, mature markets demonstrate saturation as replacement cycles extend beyond manufacturer expectations. Consequently, brands compete aggressively through promotional discounting, compressing profit margins across industry participants.

Growth Factors

Spatial Audio and Head-Tracking Technologies Create Premium Segment Opportunities

Penetration of spatial audio and head-tracking enabled smart headphones unlocks immersive listening experiences beyond traditional stereo. Moreover, integration with streaming platforms delivering Dolby Atmos and Sony 360 Reality Audio content drives adoption. Additionally, head-tracking sensors adjust soundstage dynamically as users move, enhancing realism in gaming and entertainment. Consequently, premium pricing for spatial audio capabilities expands market value despite unit volume constraints.

Expansion of AI-powered hearing enhancement and adaptive sound devices addresses aging populations and hearing accessibility needs. Furthermore, real-time audio adjustments compensate for individual hearing profiles without medical device classifications. Additionally, machine learning algorithms optimize frequency responses based on ambient noise environments automatically. Therefore, smart headphones transcend entertainment applications into health and wellness categories successfully.

Rising demand for fitness-oriented and sweat-resistant sports earphones reflects growing health consciousness and active lifestyle trends. Moreover, IP ratings certifying water and dust resistance have become standard expectations rather than premium features. Additionally, secure fit technologies prevent earphone displacement during intense physical activities and outdoor adventures. Consequently, sports audio segments command premium prices through specialized durability and performance attributes.

Growth of personalized audio tuning and app-based sound customization platforms empowers users optimizing sound signatures. Furthermore, companion applications enable equalizer adjustments, firmware updates, and feature customization from smartphones conveniently. Additionally, hearing tests within apps generate personalized sound profiles enhancing listening experiences individually. Therefore, software differentiation complements hardware innovation as key competitive advantage increasingly.

Emerging Trends

Ultra-Compact Charging Cases and Fast-Charge Technology Enhance User Experience

The shift toward ultra-compact charging case designs and fast-charge earbuds addresses portability and convenience demands simultaneously. Moreover, manufacturers reduce case dimensions while maintaining multi-day battery capacity through efficient power management. Additionally, quick-charge technologies deliver hours of playback from minutes of charging, eliminating battery anxiety. Consequently, smaller pockets and bags accommodate modern earbud cases without compromising functionality or user experience.

Integration of voice assistants and touch-free control features enables hands-free operation during multitasking and driving scenarios. Furthermore, wake-word activation allows users accessing virtual assistants without physical button presses or screen interactions. Additionally, gesture controls enable volume adjustments, playback control, and call management through intuitive head movements. Therefore, touchless interfaces enhance safety and convenience across diverse usage contexts successfully.

Increasing popularity of open-ear and bone conduction headphones reflects safety priorities among runners, cyclists, and outdoor enthusiasts. Moreover, these designs maintain environmental awareness while delivering audio content, preventing accidents during activities. Additionally, bone conduction technology suits users with hearing impairments or ear canal sensitivities. Consequently, specialized form factors expand total addressable market beyond traditional in-ear and over-ear segments.

Adoption of eco-friendly materials and sustainable packaging in audio products responds to environmental consciousness among younger consumers. Furthermore, brands incorporate recycled plastics, biodegradable components, and minimal packaging reducing environmental footprints. Additionally, take-back programs and repair services extend product lifecycles, aligning with circular economy principles. Therefore, sustainability initiatives differentiate brands competing for environmentally conscious consumer segments increasingly.

Regional Analysis

Asia Pacific Dominates the Earphones and Headphones Market with 37.8% Market Share, Valued at USD 25.0 Billion

Asia Pacific commands the largest market share at 37.8%, valued at USD 25.0 billion, driven by massive consumer populations and electronics manufacturing capabilities. Moreover, China, India, and Southeast Asian nations demonstrate rapid smartphone adoption fueling wireless earbud demand. Additionally, domestic brands offer competitive pricing strategies capturing price-sensitive segments effectively. Furthermore, regional manufacturing clusters enable cost advantages and supply chain efficiencies.

North America Market Trends

North America represents a mature market characterized by premium product preferences and early technology adoption patterns. Moreover, high disposable incomes support purchases of flagship audio devices with advanced noise cancellation features. Additionally, strong e-commerce infrastructure facilitates direct-to-consumer brand growth. Furthermore, gaming and streaming culture drives specialized headphone segment expansion continuously.

Europe Market Trends

Europe demonstrates balanced growth across wireless and wired segments with strong sustainability preferences influencing purchasing decisions. Moreover, stringent electronic waste regulations encourage brands developing repairable and recyclable audio products. Additionally, audiophile culture supports premium headphone markets in Germany and Nordic countries. Furthermore, multilingual voice assistant support expands smart headphone adoption across diverse European markets.

Middle East and Africa Market Trends

Middle East and Africa exhibit emerging market characteristics with increasing smartphone penetration driving entry-level earbud adoption. Moreover, rising youth populations demonstrate strong preferences for branded audio products and fashion-forward designs. Additionally, expanding retail infrastructure in Gulf nations improves product accessibility. Furthermore, music streaming service availability correlates with headphone market growth trajectories.

Latin America Market Trends

Latin America shows steady growth despite economic volatility, with consumers prioritizing value-oriented audio solutions over premium alternatives. Moreover, localized distribution partnerships enable brands penetrating diverse national markets effectively. Additionally, rising middle-class populations increase disposable income allocated toward consumer electronics. Furthermore, mobile-first internet usage patterns support wireless earbud adoption across the region.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Earphones and Headphones Company Insights

Apple, Inc. maintains market leadership through ecosystem integration and brand loyalty driving AirPods dominance globally. The company revolutionized true wireless earbuds by combining seamless iOS connectivity with minimalist design aesthetics. Moreover, spatial audio and adaptive transparency features position AirPods Pro as premium offerings. Additionally, continuous software updates extend product lifecycles while adding functionality post-purchase. Furthermore, Apple’s retail presence and supply chain efficiency enable global market penetration across diverse demographics consistently.

Bose Corporation leads premium noise cancellation segments through decades of acoustic engineering expertise and innovation legacy. The company’s QuietComfort series defines industry standards for active noise cancellation performance and wearing comfort. Moreover, Bose prioritizes audio quality over feature proliferation, appealing to discerning audiophiles and frequent travelers. Additionally, recent acquisition of McIntosh Group strengthens luxury audio positioning and brand portfolio breadth. Furthermore, direct-to-consumer sales channels complement retail partnerships, controlling customer experiences effectively.

Sony Corporation competes across multiple price tiers while maintaining technological leadership in wireless codecs and spatial audio. The company’s WH and WF series combine industry-leading noise cancellation with high-resolution audio support. Moreover, Sony’s entertainment content ecosystem enhances product value propositions through integrated services. Additionally, partnerships with PlayStation gaming platforms drive headset sales among console gamers globally. Furthermore, Sony’s sensor technologies enable innovative features like automatic playback pause when headphones are removed.

Sennheiser represents audiophile-grade quality through professional audio heritage and precision engineering standards. The company’s Momentum series balances premium materials with refined sound signatures satisfying critical listeners. Moreover, Sennheiser maintains strong presence in professional monitoring and broadcast markets beyond consumer segments. Additionally, German manufacturing reputation reinforces quality perceptions and premium pricing strategies. Furthermore, recent launches incorporating Snapdragon Sound technology demonstrate commitment to wireless audio advancement.

Key Players

- Alclair Audio, Inc.

- Apple, Inc.

- Bose Corporation

- Grado Labs

- JVC Kenwood Corporation

- Koninklijke Philips N.V.

- Logitech, Inc.

- Panasonic Corporation

- Pioneer Corporation

- Shure Incorporated

Recent Developments

- In March 2024, Sennheiser officially launched the MOMENTUM True Wireless 4 flagship earbuds globally after showcasing them at CES 2024, featuring Snapdragon Sound and Bluetooth 5.4 connectivity. This launch demonstrates continued innovation in wireless audio technology and codec support.

- In November 2024, Bose Corporation acquired McIntosh Group, strengthening its position in the luxury audio segment and expanding product portfolio capabilities. This strategic acquisition enhances Bose’s premium brand positioning and market reach significantly.

Report Scope

Report Features Description Market Value (2025) USD 66.3 Billion Forecast Revenue (2035) USD 179.9 Billion CAGR (2026-2035) 10.5% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Earphones, Headphones), By Technology (Wired (ANC, Others), Wireless (ANC, Bluetooth, NFMI, Smart headphones, Others)), By Form Factor (In-Ear/Canal, Over-Ear, On-Ear, Open-Ear/Bone-Conduction), By Noise-Control Technology (Passive Noise-Isolation, Active Noise-Cancelling (ANC), Open-Transparency/Ambient Mode), By Application (Music & Entertainment, Fitness, Gaming, Virtual Reality, Others), By Distribution (Online, Offline) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Alclair Audio, Inc., Apple, Inc., Bose Corporation, Grado Labs, JVC Kenwood Corporation, Koninklijke Philips N.V., Logitech, Inc., Panasonic Corporation, Pioneer Corporation, Shure Incorporated Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Earphones and Headphones MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Earphones and Headphones MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Alclair Audio, Inc.

- Apple, Inc.

- Bose Corporation

- Grado Labs

- JVC Kenwood Corporation

- Koninklijke Philips N.V.

- Logitech, Inc.

- Panasonic Corporation

- Pioneer Corporation

- Shure Incorporated