Global Disposable Camera Market Size, Share, Growth Analysis By Type (Color, Black and White, Underwater), By Application (Personal Use, Commercial Use, Educational Use), By Distribution Channel (Online Stores, Retail Stores, Tourist Locations), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 172278

- Number of Pages: 287

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

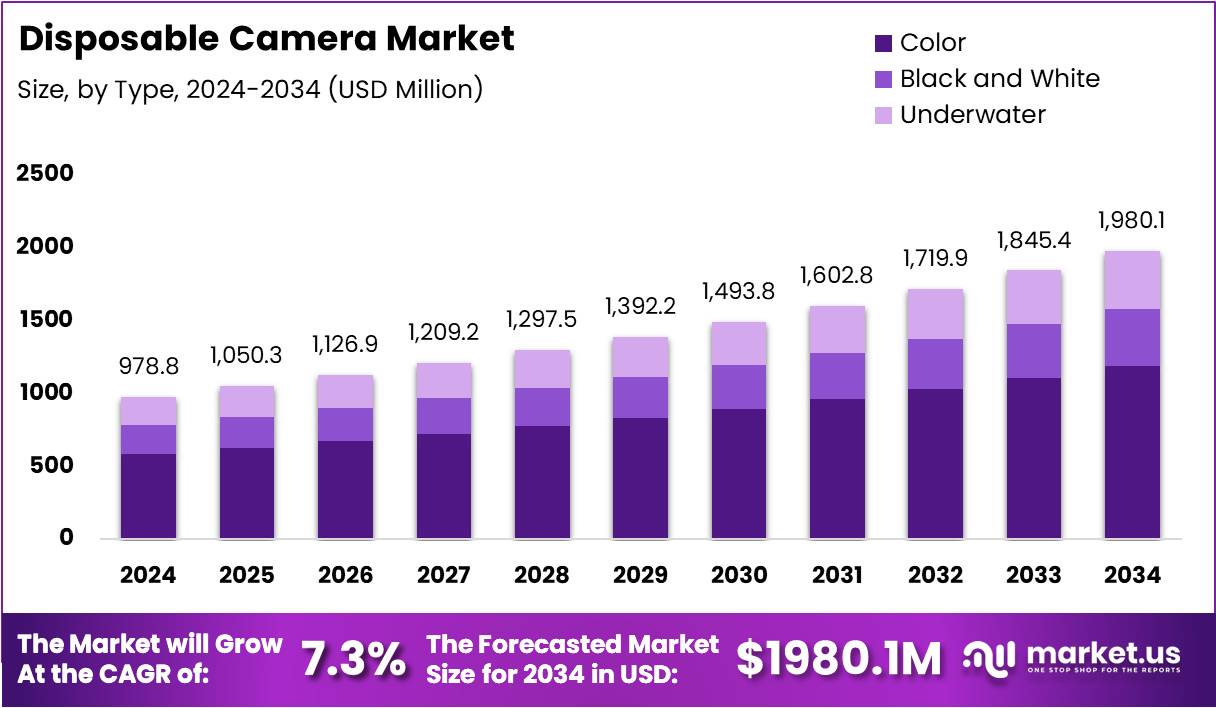

The Global Disposable Camera Market size is expected to be worth around USD 1980.1 Million by 2034, from USD 978.8 Million in 2024, growing at a CAGR of 7.3% during the forecast period from 2025 to 2034.

The disposable camera market represents a niche segment within imaging technology, primarily serving consumers seeking convenient, one-time-use photography solutions. These affordable devices eliminate concerns about equipment damage or loss during travel and special events. Furthermore, the market attracts photography enthusiasts valuing analog aesthetics and nostalgic experiences. The simplicity of point-and-shoot functionality continues driving demand among casual users worldwide.

Market growth demonstrates resilience despite digital photography dominance, particularly among younger demographics embracing retro trends. Notably, wedding photography, tourism activities, and festival attendees significantly contribute to sustained demand. Additionally, environmental concerns are prompting manufacturers to develop eco-friendly alternatives with recyclable components. This evolution positions the market for moderate expansion as brands balance sustainability with traditional manufacturing processes effectively.

Emerging opportunities exist within experiential marketing and branded promotional campaigns where companies distribute customized disposable cameras. Moreover, the rise of social media aesthetics celebrating vintage photography styles revitalizes consumer interest considerably. Educational institutions and art programs increasingly incorporate film photography, thereby creating consistent demand channels. Consequently, niche retailers and online platforms are expanding distribution networks to capture diverse consumer segments strategically.

Government regulations primarily focus on electronic waste management and plastic reduction initiatives affecting manufacturing standards. Compliance requirements encourage producers to adopt sustainable materials and establish recycling programs for used cameras. However, minimal direct investment exists in this mature market compared to emerging technologies. Regulatory frameworks generally emphasize environmental responsibility rather than industry-specific support mechanisms for traditional photography equipment manufacturers.

Technical specifications reveal that most disposable cameras accommodate approximately 27 photographic exposures, while premium variants offer 39 shots per unit. Industry standards indicate these cameras maintain optimal functionality for 2 to 3 years post-manufacturing, though proper storage extends usability to 5 or 6 years beyond expiration dates. These performance metrics underscore product reliability and value proposition for consumers prioritizing cost-effective photography solutions without sophisticated equipment investments or maintenance requirements.

Key Takeaways

- The global Disposable Camera Market is expected to reach USD 1980.1 Million by 2034 from USD 978.8 Million in 2024.

- The market is projected to grow at a CAGR of 7.3% between 2025 and 2034.

- Color disposable cameras dominate the market with a 67.3% share by type.

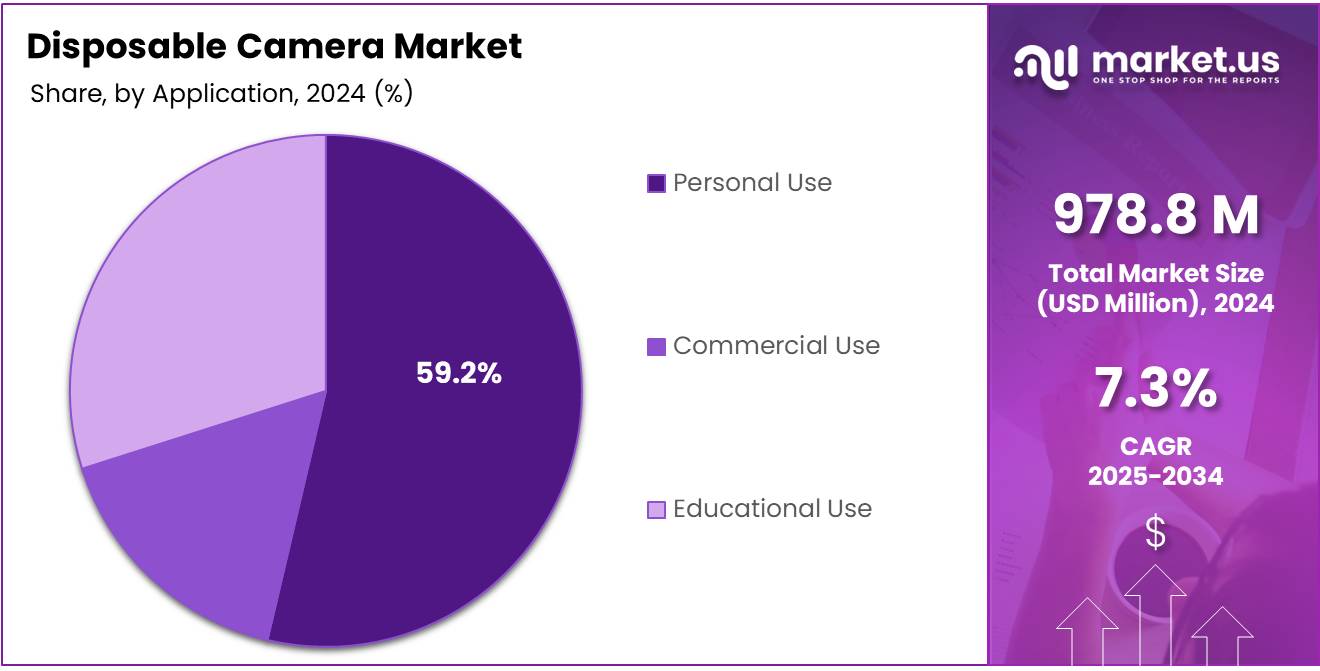

- Personal Use leads the application segment with a 59.2% share.

- Online Stores are the top distribution channel, holding a 49.5% market share.

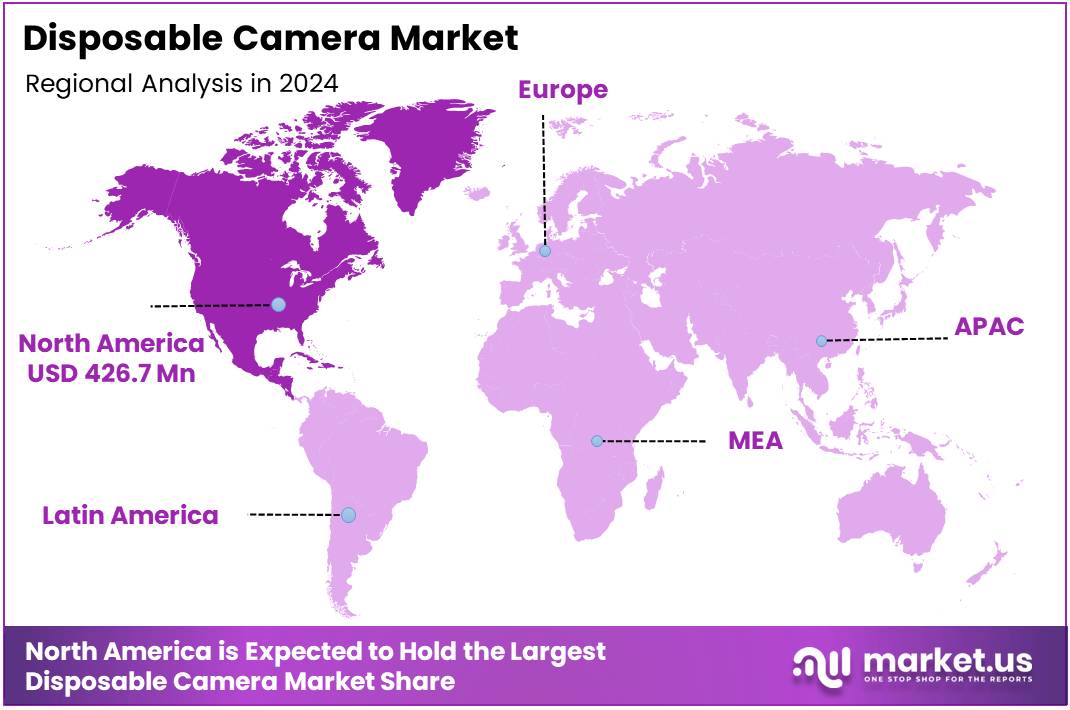

- North America dominates regionally with a market value of USD 426.7 Million and 43.6% share.

Type Analysis

Color disposable cameras dominate with 67.3% due to their vibrant output and widespread consumer preference.

In 2024, Color held a dominant market position in the By Type Analysis segment of Disposable Camera Market, with a 67.3% share. Color disposable cameras lead the market due to their ability to capture vivid, lifelike images. These cameras appeal to casual photographers, tourists, and event attendees who prioritize aesthetic quality. The widespread availability of color film processing services strengthens their position, making them the preferred choice across demographics.

Black and White disposable cameras cater to photography enthusiasts and artists seeking classic aesthetics. These cameras attract consumers interested in vintage photography styles and creative expression. Despite smaller market share, they maintain steady demand among professional photographers, art students, and hobbyists who appreciate the distinctive monochrome finish and artistic depth.

Underwater disposable cameras serve specialized use cases among beachgoers, snorkelers, and vacation travelers. These waterproof variants enable consumers to capture unique aquatic moments without risking expensive equipment. Their targeted functionality appeals to adventure seekers and families visiting coastal destinations, maintaining consistent demand within specific recreational contexts despite representing a smaller segment.

Application Analysis

Personal Use dominates with 59.2% due to growing nostalgia trends and social media influence.

In 2024, Personal Use held a dominant market position in the By Application Analysis segment of Disposable Camera Market, with a 59.2% share. Personal use applications drive majority purchases, fueled by nostalgia trends and desire for authentic photography experiences. Consumers embrace disposable cameras for weddings, parties, vacations, and everyday moments, valuing the spontaneous nature of film photography.

Commercial Use encompasses professional applications including event photography, promotional campaigns, and hospitality services. Businesses utilize disposable cameras as guest engagement tools at weddings, corporate events, and entertainment venues. This segment benefits from unique perspectives guests provide when documenting events, creating authentic content that complements professional photography while offering memorable interactive experiences.

Educational Use represents applications where disposable cameras serve as teaching tools in photography courses, art programs, and workshops. Educational institutions appreciate their affordability and simplicity for teaching fundamental photography principles. These cameras enable hands-on learning experiences, teaching composition, lighting, and creative thinking while introducing students to analog photography techniques and film development.

Distribution Channel Analysis

Online Stores dominate with 49.5% due to convenience and competitive pricing advantages.

In 2024, Online Stores held a dominant market position in the By Distribution Channel Analysis segment of Disposable Camera Market, with a 49.5% share. Online platforms lead as the primary distribution channel, offering consumers unmatched convenience, extensive product variety, and competitive pricing. E-commerce websites and specialty photography retailers provide detailed product information and bulk purchasing options that attract budget-conscious consumers.

Retail Stores maintain significant presence through drugstores, photography shops, and general merchandise outlets. These traditional channels offer immediate product availability and tactile shopping experiences appealing to consumers preferring in-person purchases. Retail stores benefit from impulse buying behavior and provide convenient last-minute solutions for customers needing cameras quickly for events or vacations.

Tourist Locations serve as strategic distribution points capturing spontaneous purchase decisions at airports, theme parks, beaches, and popular attractions. These high-traffic venues capitalize on immediate customer needs when travelers forget cameras or seek waterproof options. Tourist location sales thrive on convenience premium pricing, offering readily accessible solutions for visitors documenting experiences.

Key Market Segments

By Type

- Color

- Black and White

- Underwater

By Application

- Personal Use

- Commercial Use

- Educational Use

By Distribution Channel

- Online Stores

- Retail Stores

- Tourist Locations

Drivers

Affordable Entry-Level Photography Option for Casual Users Drives Market Growth

Disposable cameras continue to attract consumers who want an easy and budget-friendly way to capture memories without investing in expensive digital equipment. These cameras require no technical knowledge or setup, making them perfect for casual photographers, tourists, and first-time users. The low price point removes barriers to entry, allowing people from various income levels to enjoy analog photography.

The growing nostalgia for physical photographs has created renewed interest in disposable cameras, especially as digital images often remain unseen in phone galleries. Consumers increasingly value tangible prints they can hold, display, and share with loved ones. This shift reflects a broader desire to disconnect from screens and create lasting physical mementos.

Camera manufacturers and retailers are actively targeting younger demographics through creative marketing campaigns that emphasize authenticity and artistic expression. Social media influencers and content creators showcase disposable camera results, highlighting their unique aesthetic qualities. These promotional efforts position disposable cameras as trendy accessories rather than outdated technology, successfully attracting youth and creative enthusiasts who appreciate the unpredictable, authentic feel of film photography.

Restraints

Environmental Regulations and Waste Management Concerns Limit Market Expansion

The disposable camera market faces challenges from increasing environmental awareness and stricter regulations on single-use products. These cameras generate plastic waste and contain materials requiring proper disposal, raising sustainability concerns. Governments worldwide implement policies to reduce single-use items, directly impacting sales and distribution.

Declining film processing facilities present another obstacle, particularly in developing regions and urban centers. Many traditional photo labs have closed due to reduced demand, leaving consumers with fewer convenient processing options. This infrastructure gap frustrates users who struggle to find accessible, affordable services for developing their film.

The combination of environmental pressures and limited processing networks creates challenges for market growth. Manufacturers must address sustainability through recycling programs and eco-friendly designs while maintaining processing infrastructure. Without solutions to these issues, the market may struggle to attract new customers despite renewed interest.

Growth Factors

Expansion in Niche Photography Markets Like Retro and Vintage Photography Creates New Opportunities

The disposable camera market finds growth potential in specialized photography segments where consumers seek authentic, nostalgic experiences. Retro photography enthusiasts value the unique grain, color saturation, and imperfections these cameras produce. This aesthetic cannot be replicated digitally, creating a dedicated customer base embracing analog photography.

Strategic partnerships with event planners and tourism operators represent significant expansion opportunities. Wedding coordinators place cameras on guest tables for candid shots, while travel companies include them in vacation packages. These collaborations create consistent demand while introducing products to consumers who might not otherwise purchase disposable cameras.

Educational institutions and DIY photography workshops increasingly incorporate disposable cameras into their programs. Photography instructors use these cameras to teach fundamental concepts without digital complexity. Community workshops embrace them as affordable creative tools. This educational adoption builds market awareness while cultivating future enthusiasts who appreciate analog photography’s unique characteristics.

Emerging Trends

Surge in Social Media Content Creation Driving Retro Photography Interest Shapes Market Trends

Social media growth has increased interest in disposable cameras as users seek distinctive content that stands out from smartphone photography. Content creators value the authentic, unfiltered aesthetic these cameras provide, which feels more genuine than edited digital images. This trend transforms disposable cameras into desirable tools for unique social media posts.

Millennials and Generation Z drive renewed popularity of instant photography aesthetics, viewing film photography as both novel and nostalgic. These demographics appreciate the surprise element of delayed results and organic imperfections. The deliberate nature of film photography, where each shot counts, appeals to generations raised on unlimited digital photos.

Disposable cameras have become integral to themed parties, weddings, and travel experiences where hosts capture authentic moments. Event organizers distribute cameras to guests, creating interactive activities while generating candid documentation. Travel enthusiasts embrace the unpredictability and adventure of film photography, positioning disposable cameras as lifestyle accessories rather than simple photography tools.

Regional Analysis

North America Dominates the Disposable Camera Market with 43.6% Share, Valued at USD 426.7 Million

North America leads the global disposable camera market with 43.6% share and USD 426.7 million valuation. Nostalgia and the resurgence of analog photography among millennials and Gen Z drive demand. Festivals, weddings, and social gatherings boost usage, with cameras serving as memorable keepsakes and creative alternatives to digital photography. The region’s mature retail networks and strong brand presence further support market stability.

Europe Disposable Camera Market Trends

Europe maintains significant demand, fueled by appreciation for traditional photography and artistic expression. Younger demographics view disposable cameras as fashionable and creative accessories. Tourism hotspots, cultural events, and vintage stores support steady market growth and new distribution channels. Collectors and hobbyists also contribute to niche demand for limited-edition and themed cameras.

Asia Pacific Disposable Camera Market Trends

Asia Pacific shows strong growth due to rising incomes, tourism, and Japanese and South Korean pop culture influence. Countries like Japan, South Korea, and Australia see interest among young adults for travel documentation and authentic social media content. Growing populations and middle-class segments offer expansion opportunities. Increasing marketing campaigns targeting youth and travelers are further driving adoption.

Latin America Disposable Camera Market Trends

Latin America exhibits moderate but steady demand, concentrated in urban centers and tourist spots in Brazil, Mexico, and Argentina. Festivals, beach tourism, and retro trends among urban youth boost disposable camera usage as cost-effective alternatives to digital equipment. Retail promotions and seasonal events also help increase consumer engagement in key cities.

Middle East and Africa Disposable Camera Market Trends

The Middle East and Africa is an emerging market, driven by tourism in the UAE, South Africa, and Egypt. Adventure tourism and outdoor activities increase demand for durable, waterproof disposable cameras, meeting needs in challenging environments. Expanding retail presence and online channels are expected to accelerate market penetration in the coming years.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Disposable Camera Company Insights

The global Disposable Camera Market in 2024 continues to be shaped by established photography companies that have adapted their strategies to meet evolving consumer preferences. Despite the dominance of digital photography, these key players maintain their presence by catering to niche markets, analog photography enthusiasts, and consumers seeking nostalgic experiences.

Fujifilm Holdings Corporation remains a dominant force in the disposable camera segment, leveraging its extensive experience in film manufacturing and distribution networks. The company’s QuickSnap series continues to be popular among tourists and casual photographers, offering reliable performance and widespread availability across global markets.

Eastman Kodak Company maintains its legacy position in the disposable camera market through its iconic brand recognition and affordable product offerings. Despite facing financial challenges in recent years, Kodak’s disposable cameras remain sought after by consumers who associate the brand with quality and nostalgia, particularly in specialty retail and tourist destinations.

Ilford Photo (Harman Technology) has carved out a unique position by focusing on black-and-white disposable cameras that appeal to artistic photographers and professionals seeking specific aesthetic outcomes. The company’s commitment to analog photography and quality film production has earned it a loyal customer base among enthusiasts and educators.

Agfa-Gevaert Group continues to serve the disposable camera market with products that emphasize reliability and consistent image quality. The company’s long-standing expertise in imaging technology and chemical manufacturing provides it with competitive advantages in producing cost-effective disposable camera solutions for various market segments.

These manufacturers collectively sustain the disposable camera market by addressing specific consumer needs, from casual vacation photography to artistic expression, ensuring the segment’s continued relevance in an increasingly digital world.

Top Key Players in the Market

- Fujifilm Holdings Corporation

- Eastman Kodak Company

- Ilford Photo (Harman Technology)

- Agfa-Gevaert Group

- Lomography

- The Imaging Warehouse

- Kenko Tokina Co. Ltd.

- Rollei

- Olympus Corporation

Recent Developments

- In August 2025, Fujifilm launched the QuickSnap disposable camera in Australia, featuring high-quality Fujicolor 400 film for vibrant and sharp images, catering to casual and travel photography enthusiasts.

- In November 2025, Reto Production Ltd. (a brand licensee of Eastman Kodak) unveiled the Kodak Snapic A1, a retro-styled 35mm film camera equipped with a dedicated double-exposure function, appealing to creative photographers seeking classic analog effects.

Report Scope

Report Features Description Market Value (2024) USD 978.8 Million Forecast Revenue (2034) USD 1980.1 Million CAGR (2025-2034) 7.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Color, Black and White, Underwater), By Application (Personal Use, Commercial Use, Educational Use), By Distribution Channel (Online Stores, Retail Stores, Tourist Locations) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Fujifilm Holdings Corporation, Eastman Kodak Company, Ilford Photo (Harman Technology), Agfa-Gevaert Group, Lomography, The Imaging Warehouse, Kenko Tokina Co. Ltd., Rollei, Olympus Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Fujifilm Holdings Corporation

- Eastman Kodak Company

- Ilford Photo (Harman Technology)

- Agfa-Gevaert Group

- Lomography

- The Imaging Warehouse

- Kenko Tokina Co. Ltd.

- Rollei

- Olympus Corporation