Global Dimethylacetamide Market Size, Share, And Business Benefit By Application (Synthetic Resins, Intermediates, Acrylic Fiber, Pesticides, Catalyst, Others), By End- Use (Pharmaceutical, Agrochemical, Personal Care, Textile, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: October 2025

- Report ID: 163207

- Number of Pages: 221

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

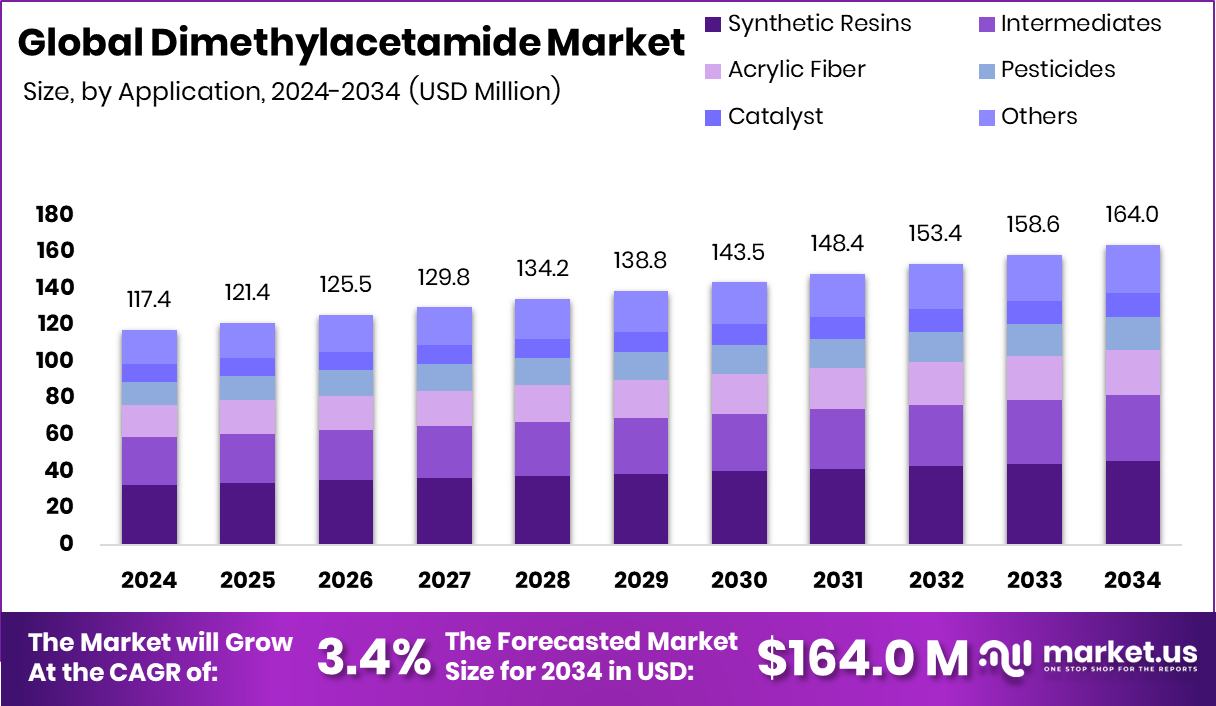

The Global Dimethylacetamide Market is expected to be worth around USD 164.0 million by 2034, up from USD 117.4 million in 2024, and is projected to grow at a CAGR of 3.4% from 2025 to 2034. Rising polymer and pharmaceutical production drove Asia-Pacific’s 43.90% share, valued at USD 51.5 million.

Dimethylacetamide (DMAc) is a high-boiling, polar organic solvent widely used in the chemical, textile, and pharmaceutical industries. It serves as an efficient medium for polymer spinning, coatings, and the synthesis of active pharmaceutical ingredients due to its strong solvency and thermal stability. Its excellent miscibility with water and most organic compounds makes it suitable for formulating agrochemicals, dyes, and specialty coatings. With growing emphasis on cleaner production and high-performance materials, DMAc continues to find applications in eco-friendly polymer synthesis and controlled drug delivery systems.

The Dimethylacetamide market is expanding steadily, driven by its use in high-value industrial sectors such as pharmaceuticals, synthetic fibers, and agrochemicals. Its strong solvency helps improve processing efficiency in polyimide, polyurethane, and acrylic fiber production. Increasing agricultural modernization, coupled with supportive government subsidies, has also boosted DMAc demand in pesticide formulation and seed treatment. Tax incentives, rising industrialization, and innovations in sustainable solvents are further propelling global consumption growth.

The growing demand for high-purity solvents in pharmaceutical and polymer manufacturing is driving market expansion. The government’s agrochemical subsidies, such as India offering Rs 4,300 pesticides at just Rs 2,150, have increased agrochemical output and indirectly boosted DMAc demand as a formulation solvent. Additionally, expanding pesticide and seed treatment industries supported by Kotak’s Rs 375 crore investment in agrochemical ventures reflect stronger downstream utilization of DMAc. Rising R&D for specialty chemicals and cleaner solvent systems enhances long-term market potential.

The demand for Dimethylacetamide is increasing as countries intensify agricultural support and modernization programs. Investments such as BiocSol’s €5.2 million seed funding for microbial pesticides and Agrim’s $17.3 million initiative to enhance farmer access to crop inputs highlight robust chemical demand across rural economies. Furthermore, global pesticide usage supported by large-scale subsidies and exemptions—like Brazil’s US $2.2 billion annual tax relief—creates significant solvent demand for pesticide synthesis and coating applications.

Growing awareness about sustainable agriculture and safer solvents presents major opportunities for DMAc producers. Continuous reforms in pesticide regulation and funding redirection—such as the $15 million U.S. PFAS research withdrawal spurring greener chemical alternatives—will accelerate innovation in bio-based and low-toxicity solvent systems. Coupled with emerging markets’ focus on agrochemical self-reliance and polymer innovation, dimethylacetamide stands poised for diverse industrial expansion through 2034.

Key Takeaways

- The Global Dimethylacetamide Market is expected to be worth around USD 164.0 million by 2034, up from USD 117.4 million in 2024, and is projected to grow at a CAGR of 3.4% from 2025 to 2034.

- In 2024, the Dimethylacetamide Market saw synthetic resins application holding 27.8% due to polymer versatility.

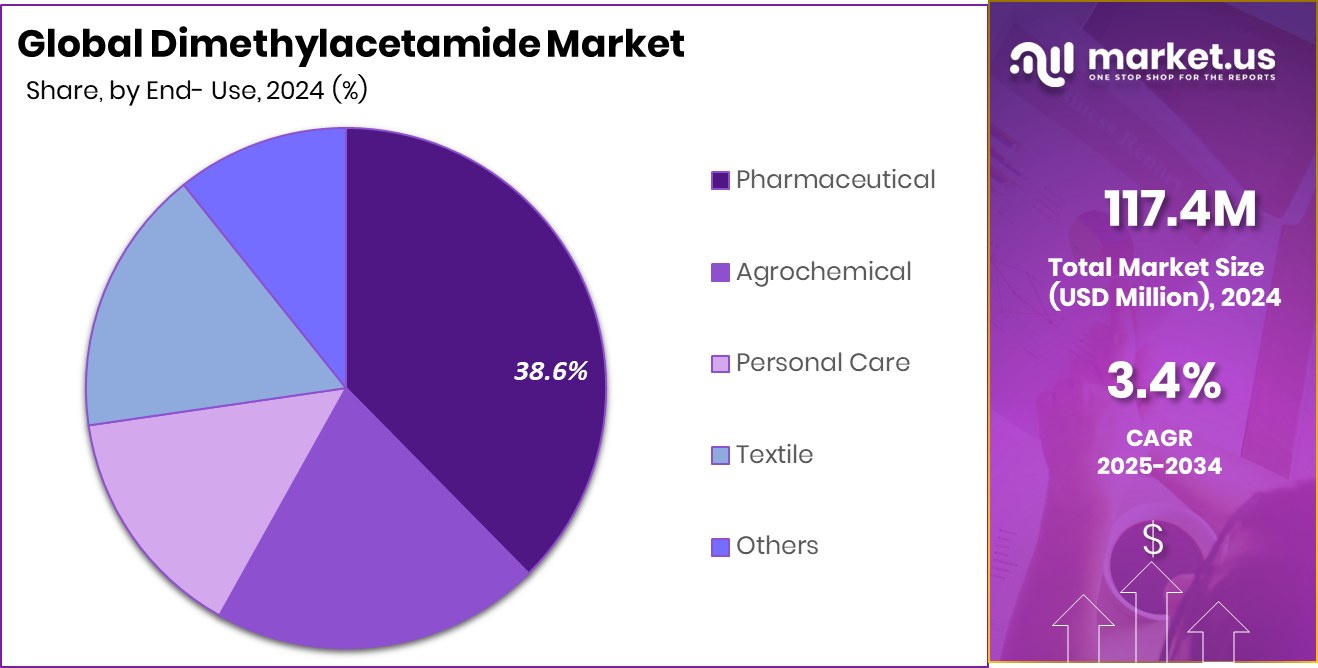

- The pharmaceutical sector dominated the Dimethylacetamide Market with a 38.6% share, driven by solvent-grade drug formulation.

- The Asia-Pacific region achieved a market value of USD 51.5 million during 2024’s industrial expansion.

By Application Analysis

In 2024, the Dimethylacetamide Market saw a 27.8% share from synthetic resin applications.

In 2024, Synthetic Resins held a dominant market position in the By Application segment of the Dimethylacetamide Market, with a 27.8% share. The segment’s strong presence is driven by its extensive use of Dimethylacetamide as a solvent in resin synthesis, particularly in high-performance coatings, adhesives, and polymer formulations. Its superior solubility and stability make it an ideal medium for achieving uniform polymerization and film formation.

The growing demand for advanced synthetic resins in automotive, construction, and industrial coatings further reinforces its market leadership. Continuous innovations in resin technology and increasing applications in specialty materials contribute to maintaining the segment’s significant share and consistent growth across key manufacturing regions.

By End-Use Analysis

The pharmaceutical sector dominated the Dimethylacetamide Market with a 38.6% share in 2024.

In 2024, Pharmaceutical held a dominant market position in the By End-Use segment of the Dimethylacetamide Market, with a 38.6% share. This dominance is attributed to the extensive use of Dimethylacetamide as a reaction and crystallization solvent in active pharmaceutical ingredient (API) production. Its high solvency power, purity, and stability support efficient drug formulation and controlled synthesis processes. The growing demand for high-quality solvents in advanced drug manufacturing and research has strengthened their usage across pharmaceutical facilities.

Additionally, regulatory emphasis on solvent quality and production efficiency continues to reinforce dimethylacetamide’s essential role in pharmaceutical applications, ensuring the segment’s strong contribution to overall market growth and global solvent consumption trends.

Key Market Segments

By Application

- Synthetic Resins

- Intermediates

- Acrylic Fiber

- Pesticides

- Catalyst

- Others

By End- Use

- Pharmaceutical

- Agrochemical

- Personal Care

- Textile

- Others

Driving Factors

Rising Polymer Production Strengthens Dimethylacetamide Demand

The major driving factor for the Dimethylacetamide market is the growing use of DMAc in polymer and resin manufacturing. It acts as a key solvent in producing synthetic resins, polyimides, and polyurethane coatings due to its strong dissolving ability and heat stability. The global rise in polymer production, especially in packaging and automotive applications, boosts solvent consumption significantly.

Moreover, sustainability initiatives such as plastic resin makers launching a $25 million recycling fund for PP and PE plastics are creating more demand for high-performance solvents like DMAc in advanced recycling and reprocessing systems. As industries focus on eco-efficient production and polymer recovery, Dimethylacetamide’s role as a versatile solvent continues to expand globally.

Restraining Factors

Health and Environmental Risks Limit Market Expansion

A key restraining factor for the Dimethylacetamide market is its potential health and environmental impact. Prolonged exposure to DMAc can cause skin irritation, respiratory issues, and liver damage, leading to strict regulatory monitoring in several regions.

Environmental agencies have classified it as a hazardous solvent, which limits its widespread use, especially in consumer-oriented products. Stringent safety norms in the pharmaceutical and chemical industries often require costly handling systems and worker protection measures, increasing operational expenses.

Additionally, growing awareness toward green chemistry and safer solvent alternatives has prompted manufacturers to explore substitutes. These health and regulatory challenges collectively restrict the pace of market expansion, particularly in regions with tight environmental compliance standards.

Growth Opportunity

Expanding Coatings Sector Creates New Growth Prospects

A major growth opportunity for the Dimethylacetamide market lies in the expanding global coatings and resin industry. DMAc is widely used as a solvent in high-performance coatings, enabling better film formation and surface durability. Growing construction, automotive, and industrial applications continue to boost demand for advanced coating solutions.

The market is further strengthened by strategic industry investments, such as Nippon Paint’s plan to buy coatings and resins maker AOC for US$2.3 billion, which highlights rising production and innovation in the coatings value chain. As large-scale acquisitions enhance manufacturing capacity and product diversification, the need for reliable solvents like Dimethylacetamide is expected to grow significantly across both developed and emerging industrial markets.

Latest Trends

Advancements in Resin Production Shape Market Trends

One of the latest trends in the Dimethylacetamide market is the growing investment in advanced resin manufacturing and related chemical infrastructure. Dimethylacetamide is increasingly used as a solvent in producing specialty resins, coatings, and films that demand high precision and stability. The trend is strongly supported by major industry expansions, such as petrochemicals firm Sabic opening a $220 million resin manufacturing plant in Singapore and planning to expand hiring.

This reflects rising global demand for high-performance resins across electronics, automotive, and packaging sectors. As new resin facilities emphasize efficiency, sustainability, and material innovation, the use of Dimethylacetamide in polymer processing and resin formulation continues to grow steadily across international markets.

Regional Analysis

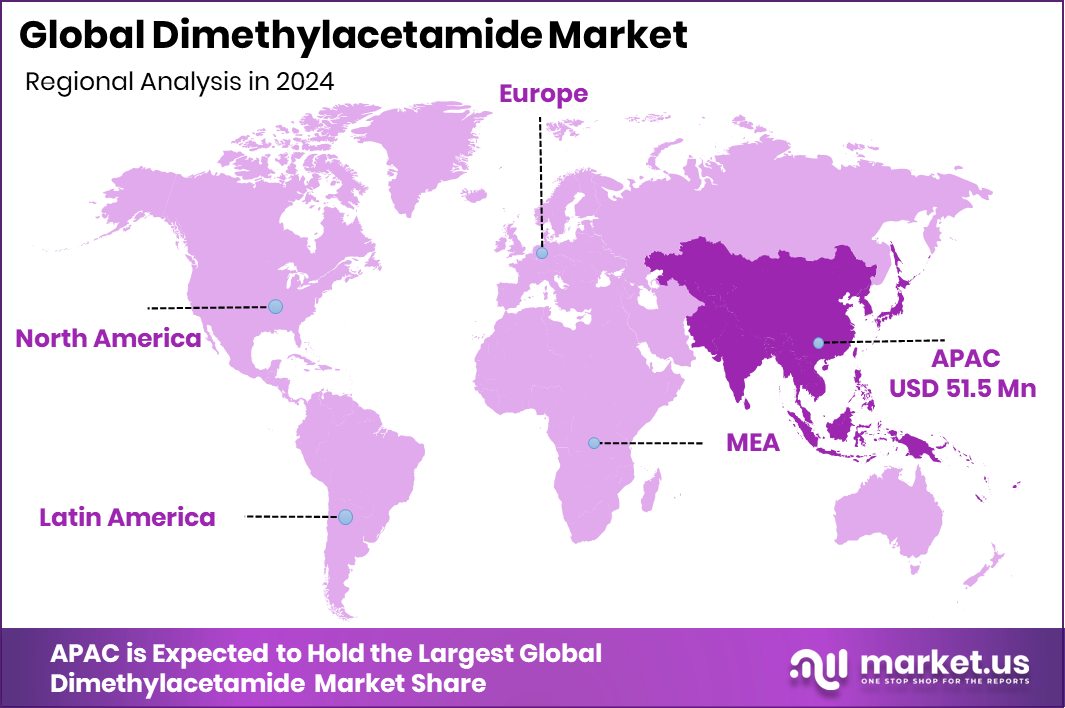

In 2024, Asia-Pacific dominated the Dimethylacetamide Market with a 43.90% share, showing strong regional growth.

In 2024, the Asia-Pacific region dominated the Dimethylacetamide Market, holding a 43.90% share valued at USD 51.5 million. The region’s leadership stems from strong industrial growth in pharmaceuticals, polymers, and coatings, supported by rising manufacturing activity in China, India, and Japan. The region’s expanding chemical production capacity and government incentives toward sustainable material development have further enhanced Dimethylacetamide consumption.

North America followed, driven by advancements in high-purity solvents used in pharmaceuticals and resins. Europe maintained steady demand due to its strict quality standards and focus on specialty chemical applications. Meanwhile, the Middle East & Africa region showed moderate progress, backed by growing industrial diversification and investment in coatings.

Latin America exhibited gradual growth, with Brazil and Mexico supporting agrochemical production that utilizes Dimethylacetamide as a solvent. Overall, Asia-Pacific continues to lead the global market, reflecting its strong industrial base and chemical innovation.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

AK-Kim Kimya, a major chemical producer, continued to strengthen its solvent portfolio by expanding its organic and performance chemicals production capacities. Its focus on supplying high-purity Dimethylacetamide for polymer and pharmaceutical industries positioned it as a key regional supplier, particularly across Europe and Asia. The company’s investment in environmentally responsible manufacturing further aligns with global sustainability trends in solvent usage.

BASF SE, with its advanced chemical integration model, maintained a strong footprint in the Dimethylacetamide space through its high-value solvent technologies. The company leveraged its extensive R&D network to develop cleaner and more efficient solvent solutions supporting polymer processing, coatings, and pharmaceutical intermediates. BASF’s innovation-driven approach helped reinforce its reliability as a consistent supplier to global industries demanding superior purity and safety compliance.

DuPont, known for its specialty materials and advanced chemistry expertise, utilized Dimethylacetamide in several precision polymer and coating applications. In 2024, DuPont’s emphasis on high-performance and sustainable manufacturing helped enhance solvent application efficiency across multiple sectors.

Top Key Players in the Market

- AK-Kim Kimya

- BASF SE

- Dupont

- Eastman Chemical Company

- Holy Stone Enterprise Co., Ltd

- Mitsubishi Gas Chemical Company

- Samsung Fine Chemicals Co., Ltd

- Others

Recent Developments

- In May 2025, BASF signed an agreement with DOMO Chemicals, giving BASF the right to acquire DOMO’s 49 % stake in the joint venture Alsachimie, where BASF already held 51 %. This move is part of BASF’s plan to become the sole owner of the business.

- In July 2024, DuPont completed the acquisition of Donatelle Plastics Incorporated, a U.S.-based medical-device contract manufacturer specializing in advanced injection-molding, liquid silicone rubber processing, precision machining, and assembly. The move strengthens DuPont’s Industrial Solutions business within its Electronics & Industrial segment by adding Donatelle’s specialised manufacturing capabilities.

Report Scope

Report Features Description Market Value (2024) USD 117.4 Million Forecast Revenue (2034) USD 164.0 Million CAGR (2025-2034) 3.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Application (Synthetic Resins, Intermediates, Acrylic Fiber, Pesticides, Catalyst, Others), By End- Use (Pharmaceutical, Agrochemical, Personal Care, Textile, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape AK-Kim Kimya, BASF SE, Dupont, Eastman Chemical Company, Holy Stone Enterprise Co., Ltd, Mitsubishi Gas Chemical Company, Samsung Fine Chemicals Co., Ltd, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Dimethylacetamide MarketPublished date: October 2025add_shopping_cartBuy Now get_appDownload Sample

Dimethylacetamide MarketPublished date: October 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- AK-Kim Kimya

- BASF SE

- Dupont

- Eastman Chemical Company

- Holy Stone Enterprise Co., Ltd

- Mitsubishi Gas Chemical Company

- Samsung Fine Chemicals Co., Ltd

- Others