Global Diisononyl Phthalate Market Size, Share, Growth Analysis By Type (PVC, Acrylics, Polyurethanes, and Others), By Application (Flooring And Wall Covering, Wires And Cables, Films And Sheets, Coated Fabrics, Consumer Goods, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 167318

- Number of Pages: 370

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

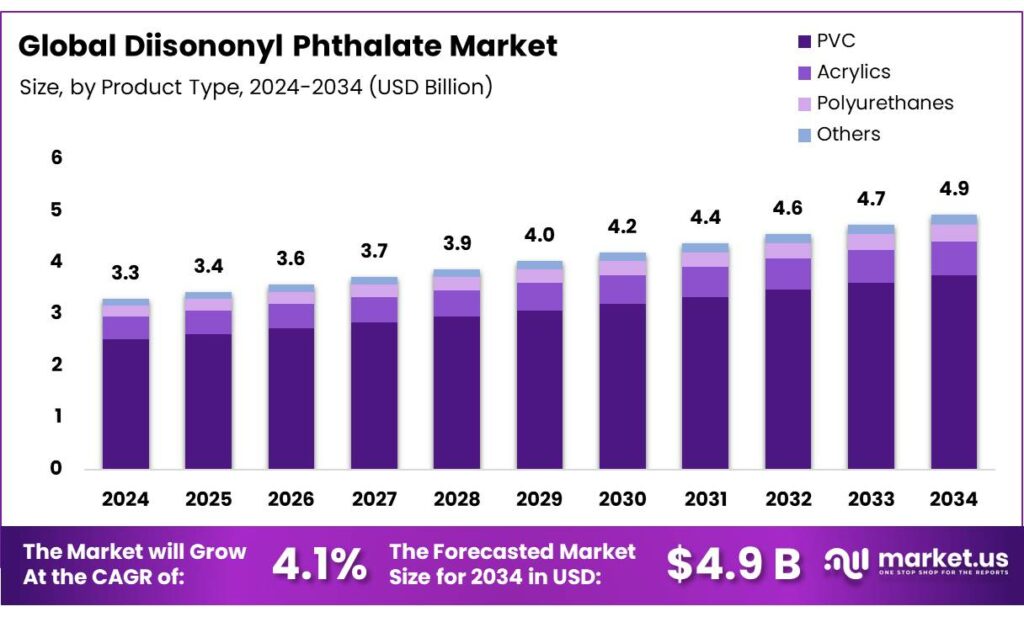

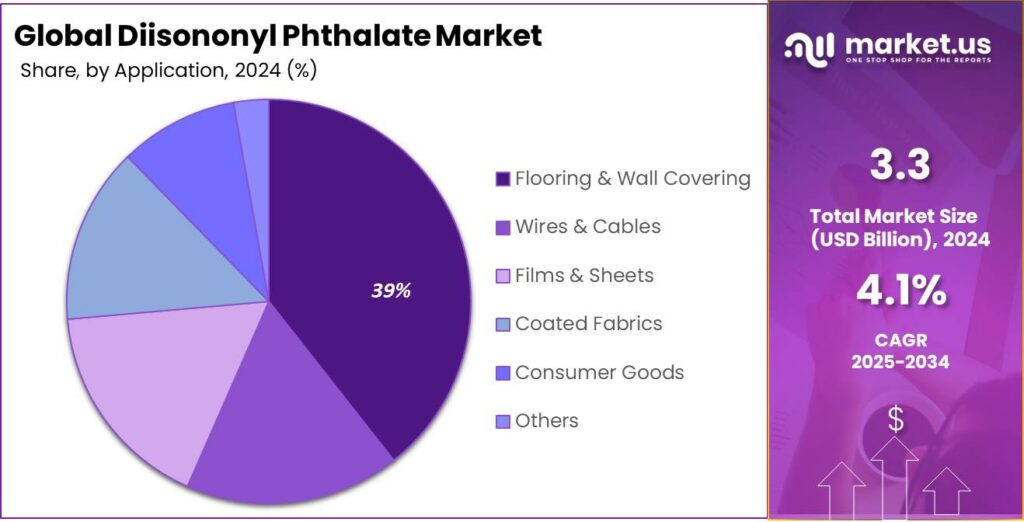

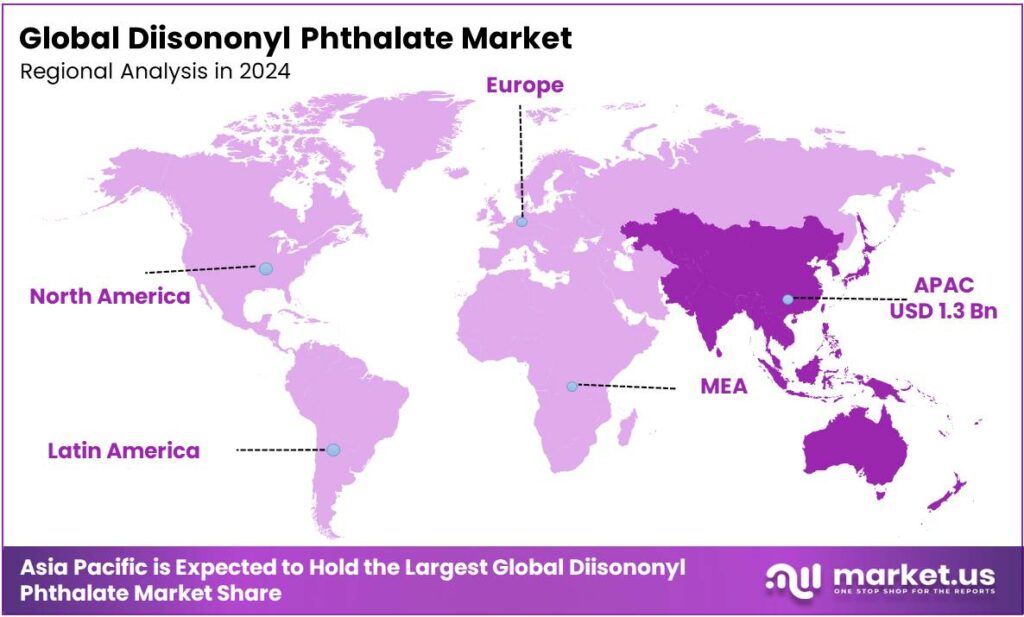

The Global Diisononyl Phthalate Market size is expected to be worth around USD 4.9 Billion by 2034, from USD 3.3 Billion in 2024, growing at a CAGR of 4.1% during the forecast period from 2025 to 2034. In 2024, Asia Pacific held a dominan market position, capturing more than a 38.9% share, holding USD 1.3 Billion revenue.

Diisononyl phthalate (DINP) is a high-molecular-weight phthalate ester, a chemical used to increase the flexibility and longevity of plastics, particularly PVC. Its primary function is to act as a plasticizer, a substance added to a material to make it softer and more pliable. At room temperature, it is a clear, transparent, oily liquid with a faint odor. It is found in a wide range of consumer products such as flooring, auto parts, and wire insulation.

The major driver of the DINP market is its application in PVC processing as a plasticizer. According to Plastics Europe AISBL, in 2023, the PVC production reached around 53 million tons, a 6% increase from 50 million tons in 2020. As PVC production increases, there is consistent demand for diisononyl phthalate. While it’s used in many applications, its use in children’s toys and childcare articles that can be mouthed is restricted in such as regions due to health concerns by regulatory authorities.

These regulatory frameworks work mainly against phthalates and pose a significant challenge to the industry. However, as the laws regarding phthalates grow stringent, there is a focus on the production of DINCH plasticizer, which is safer and eco-friendly than DINP, and is produced from the hydrogenation of DINP.

- Within the European Economic Area alone, in 2022, according to the European Chemicals Agency (ECHA), DINP production was registered, including importing and manufacturing, as being between 100,000 and 1,000,000 tons per year.

Key Takeaways

- The global diisononyl phthalate market was valued at USD 3.3 billion in 2024.

- The global diisononyl phthalate market is projected to grow at a CAGR of 4.1% and is estimated to reach USD 4.9 billion by 2034.

- Based on the type of diisononyl phthalate, the PVC phthalate dominated the market, with around 76.3% of the total global market.

- Among the applications of diisononyl phthalate, the flooring & wall covering industry emerged as a major segment in the market, with 39.4% of the market share.

- In 2024, the Asia Pacific was the most dominant region in the diisononyl phthalate market, accounting for around 38.9% of the total global consumption.

Type Analysis

The PVC Sector Held a Major Share of the Diisononyl Phthalate Market in 2024.

The diisononyl phthalate market is segmented based on the type into PVC, acrylics, polyurethanes, and others. Diisononyl phthalate is primarily used for polyvinyl chloride (PVC) rather than acrylics or polyurethanes, as its molecular structure is highly compatible with PVC’s polymer matrix, allowing it to act as an efficient internal plasticizer. DINP effectively reduces PVC’s glass transition temperature, enhancing flexibility, durability, and resistance to heat and UV degradation, which are critical properties for applications such as cables, flooring, and automotive interiors.

In contrast, acrylics and polyurethanes have different polarities and chemical backbones that limit DINP’s miscibility and performance benefits. These polymers often require specialized plasticizers or additives tailored to their specific molecular interactions. Approximately 76.3% of global DINP consumption is concentrated in flexible PVC formulations, where it delivers optimal processing efficiency and long-term stability.

Application Analysis

The Flooring & Wall Covering Sector Emerged as a Leading Segment in the Diisononyl Phthalate Market.

On the basis of applications of diisononyl phthalate, the market is segmented into flooring & wall covering, wires & cables, films & sheets, coated fabrics, consumer goods, and others. Approximately 39.4% of the revenue in the diisononyl phthalate market is generated by the flooring & wall covering industry, due to its excellent balance of flexibility, low volatility, and long-term durability, which are essential for these large-surface PVC products.

DINP provides superior resistance to wear, staining, and UV degradation, ensuring flooring materials maintain performance over years of foot traffic and exposure to sunlight. In addition, its relatively high molecular weight minimizes plasticizer migration, an important factor for maintaining dimensional stability in vinyl tiles and wall coverings. In contrast, applications such as wires and cables or films and sheets often demand plasticizers with lower viscosity or higher electrical resistance. Consequently, DINP’s physical and chemical profile aligns with the mechanical and aesthetic requirements of flooring and wall coverings.

Key Market Segments

By Type

- PVC

- Acrylics

- Polyurethanes

- Others

By Application

- Flooring & Wall Covering

- Wires & Cables

- Films & Sheets

- Coated Fabrics

- Consumer Goods

- Others

Drivers

Demand for Flexible PVC Drives the Diisononyl Phthalate Market.

The demand for flexible PVC is a major factor driving the use of diisononyl phthalate, a key plasticizer that enhances flexibility, durability, and resistance to wear. Flexible PVC is widely used in applications such as cables, flooring, automotive interiors, and medical devices, where performance and longevity are essential. For instance, PVC cables containing DINP are preferred in construction and electronics due to their excellent insulation properties and resistance to temperature fluctuations.

PVC makes up approximately 30% to 40% of a wire’s weight, as it is the primary material for insulation and sheathing, and plasticizers make up approximately 20% to 40% weight of the PVC. Similarly, in the automotive sector, DINP-based PVC components such as dashboards and door panels contribute to both comfort and design flexibility. According to industry data, over 76% of DINP consumption globally is linked to PVC applications, emphasizing its crucial role in maintaining the material’s versatility. As industries increasingly adopt lightweight and durable materials, particularly in construction and transport, the reliance on DINP as a cost-effective and efficient plasticizer continues to strengthen.

Restraints

Regulatory Pressure Remains a Significant Challenge in the Diisononyl Phthalate Market.

Regulatory pressure poses a significant challenge in the diisononyl phthalate market, as global authorities tighten restrictions on phthalate use due to environmental and health concerns. DINP, though considered less toxic than earlier phthalates such as DEHP and DBP, faces increasing scrutiny under regulations such as the European Union’s REACH framework and the U.S. Consumer Product Safety Improvement Act (CPSIA). For instance, the EU has restricted DINP in toys and childcare articles that can be placed in children’s mouths.

Similarly, California’s Proposition 65 lists it as a chemical known to cause reproductive toxicity. The manufacturers are required to comply with stricter labeling, testing, and safety certifications. This has led several producers to invest in reformulating products or shifting toward non-phthalate plasticizers.

- According to the Chemical Data Reporting rule, DINP production ranged from 100 to 250 million pounds in 2015, decreasing to 50 to 100 million pounds by 2019. The evolving regulations continue to create compliance costs and technical challenges, influencing the competitiveness and innovation strategies within the global plasticizer industry.

Opportunity

DINP’s Advantages in Automotive Applications Create Opportunities in the Market.

Diisononyl phthalate offers significant advantages in automotive applications, creating strong opportunities for its continued use. Its excellent flexibility, low volatility, and resistance to heat and UV radiation make it ideal for manufacturing durable interior and exterior PVC components. DINP-plasticized materials are used in dashboards, door trims, underbody coatings, and wire insulation, helping vehicles maintain performance under varying temperature and stress conditions. In addition, lightweight DINP-based PVC components contribute to fuel efficiency by reducing overall vehicle weight without compromising safety or comfort.

- According to the International Organization of Motor Vehicle Manufacturers (OICA), approximately 93 million vehicles were produced globally in 2024, a significant increase from 77.7 million units in 2020.

Similarly, in 2024, approximately 67.7 million passenger vehicles were produced, and in the same year, about 10 million commercial vehicles were produced. Furthermore, its compatibility with recycling processes aligns with the automotive industry’s push toward sustainability. As demand for the vehicles increases, and automotive manufacturers continue to innovate toward more durable, cost-effective, and environmentally conscious materials, DINP’s versatility positions it as a preferred plasticizer in next-generation vehicle design.

Trends

Application of Diisononyl Phthalate in the Manufacturing of DINCH.

The application of diisononyl phthalate in the production of diisononyl cyclohexane-1,2-dicarboxylate (DINCH) has become increasingly important as industries seek safer alternatives to traditional plasticizers. DINP serves as a key precursor or benchmark compound in developing DINCH, a non-phthalate plasticizer known for its low volatility and reduced migration in flexible PVC products. DINCH is an environmentally friendly plasticizer that is mainly produced by hydrogenation of DINP, in which the benzene ring of DINP is hydrogenated.

The benzene-free structure of DINCH provides better safety. For instance, the European Food Safety Authority approved DINCH for various food contact applications. Similarly, the Scientific Committee on Emerging and Newly-Identified Health Risks (SCENIHR) evaluated the safety of PVC medical devices containing DEHP plasticizer or other plasticizers in newborns and other populations, and reported that DINCH can be used for European CE-certified medical devices, such as respiratory masks.

The demand for DINCH has risen notably in sensitive applications such as medical devices, food contact materials, and children’s toys, where regulatory restrictions on phthalates are strict. Consequently, DINP continues to play a crucial transitional role in the chemical synthesis and performance benchmarking of next-generation, non-phthalate plasticizers such as DINCH.

Geopolitical Impact Analysis

Geopolitical Tensions Are Impacting the Global Trade Dynamics of the Diisononyl Phthalate Market.

The geopolitical tensions have had a notable impact on the diisononyl phthalate market, influencing raw material availability, production costs, and global trade dynamics. Conflicts such as the Russia-Ukraine war and trade frictions between the U.S. and China have disrupted the supply of key feedstocks such as n-butene and isononanol, both essential for DINP synthesis.

Europe, which relies heavily on imported petrochemical intermediates, has experienced supply chain constraints and rising energy costs, leading to reduced operating rates in several plasticizer manufacturing plants. For instance, energy-intensive producers in Germany and the Netherlands reported lower output following spikes in natural gas prices during 2022-2023.

In Asia, countries such as China and South Korea have maintained comparatively stable production, benefiting from domestic feedstock availability. However, the market faces uncertainties in exports as shipping costs fluctuate due to conflicts in the South China Sea.

The Middle East has emerged as a key supplier of petrochemical feedstocks in recent years, capitalizing on relatively stable energy markets. Additionally, currency fluctuations and sanctions have complicated global trade settlements, prompting some manufacturers to seek local sourcing strategies or diversify production bases. These geopolitical disruptions have collectively heightened price volatility, encouraged inventory stockpiling, and accelerated the shift toward regionalized supply chains within the global DINP industry, as companies aim to minimize exposure to external political and logistical risks.

Regional Analysis

Asia Pacific Held the Largest Share of the Global Diisononyl Phthalate Market.

In 2024, the Asia Pacific dominated the global diisononyl phthalate market, holding about 38.9% of the total global consumption. The region holds the largest share of the global diisononyl phthalate market, driven by rapid industrialization, expanding manufacturing capacity, and high demand for flexible PVC products. Countries such as China, India, South Korea, and Japan are major consumers due to their strong automotive, construction, and electronics industries. In 2023, the Asia Pacific accounted for almost 56% of the total plastic production of the world. Out of which, China alone accounted for 33.3% and Japan for 2.8%. Similarly, China accounts for a significant portion of global PVC production, exceeding 25 million tons annually.

The region’s booming infrastructure development, supported by urbanization projects and large-scale housing initiatives, further increases demand for DINP in cables, flooring, and wall coverings. Additionally, rising automobile production, with Asia accounting for over half of global vehicle output, contributes to higher consumption in automotive interiors and coatings. In 2022, China alone produced over 27 million vehicles, making it the world’s largest automobile producer. India followed with nearly 5.5 million units, while Japan produced around 7.8 million. Moreover, the presence of numerous local chemical producers supports a steady supply, making Asia Pacific the dominant hub in the global DINP value chain.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The major market players in the diisononyl phthalate market are BASF SE, ExxonMobil, Evonik Industries, LG Chem, & Mitsubishi Chemical Holdings Corporation. These players in the diisononyl phthalate market focus on strategic activities such as partnerships, investments, and expansion to strengthen their market presence. Several manufacturers put emphasis on improving product purity and performance, developing high-grade DINP with lower volatile organic compound (VOC) content to meet tightening environmental and safety regulations.

In addition, strategic collaborations with players from end-use industries help ensure consistent demand and long-term supply agreements. Furthermore, key players expand their global footprint by building production facilities in high-demand regions such as Asia-Pacific to reduce logistics costs and improve delivery times.

The major players in the industry

- BASF SE

- ExxonMobil

- Evonik Industries

- LG Chem

- Mitsubishi Chemical Holdings Corporation

- KLJ Group

- Azelis Group

- AEKYUNG

- Nan Ya Plastics

- UPC Technology Corporation

- Other Key Players

Key Development

- In June 2023, KLJ Group, a leading player in the chemical and plasticizers industry, invested INR 1,200 crore, US$145 million, and commissioned a plasticizers & phthalic anhydride production facility, BIS-certified, at the GIDC Jhagadia Industrial Estate, Bharuch, Gujarat.

Report Scope

Report Features Description Market Value (2024) US$3.3 Bn Forecast Revenue (2034) US$4.9 Bn CAGR (2025-2034) 4.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (PVC, Acrylics, Polyurethanes, and Others), By Application (Flooring & Wall Covering, Wires & Cables, Films & Sheets, Coated Fabrics, Consumer Goods, and Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape BASF SE, ExxonMobil, Evonik Industries, LG Chem, Mitsubishi Chemical Holdings Corporation, KLJ Group, Azelis Group, Aekyung, Nan Ya Plastics, UPC Technology Corporation, and Other Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Diisononyl Phthalate MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Diisononyl Phthalate MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- BASF SE

- ExxonMobil

- Evonik Industries

- LG Chem

- Mitsubishi Chemical Holdings Corporation

- KLJ Group

- Azelis Group

- AEKYUNG

- Nan Ya Plastics

- UPC Technology Corporation

- Other Key Players