Global Digital Inspection Market Size, Share, Statistics Analysis Report By Offering (Hardware, Software, Services), By Technology (Machine Vision, Metrology, NDT), By Dimension (2D, 3D), By Vertical (Manufacturing, Electronics and Semiconductor, Oil & Gas, Aerospace & Defense, Automotive, Energy and Power, Public Infrastructure, Food and Pharmaceuticals, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: May 2025

- Report ID: 147706

- Number of Pages: 310

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Analyst’s Viewpoint

- Business Benefits

- U.S. Digital Inspection Market

- Offering Analysis

- Technology Analysis

- Dimension Analysis

- Vertical Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Emerging Trends

- Key Player Analysis

- Top Opportunities for Players

- Recent Developments

- Report Scope

Report Overview

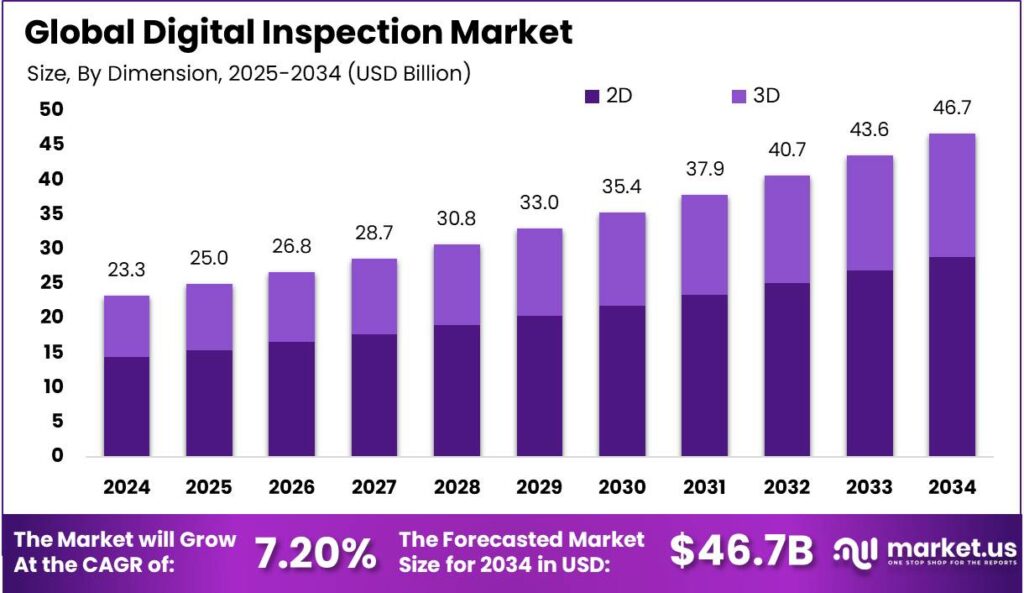

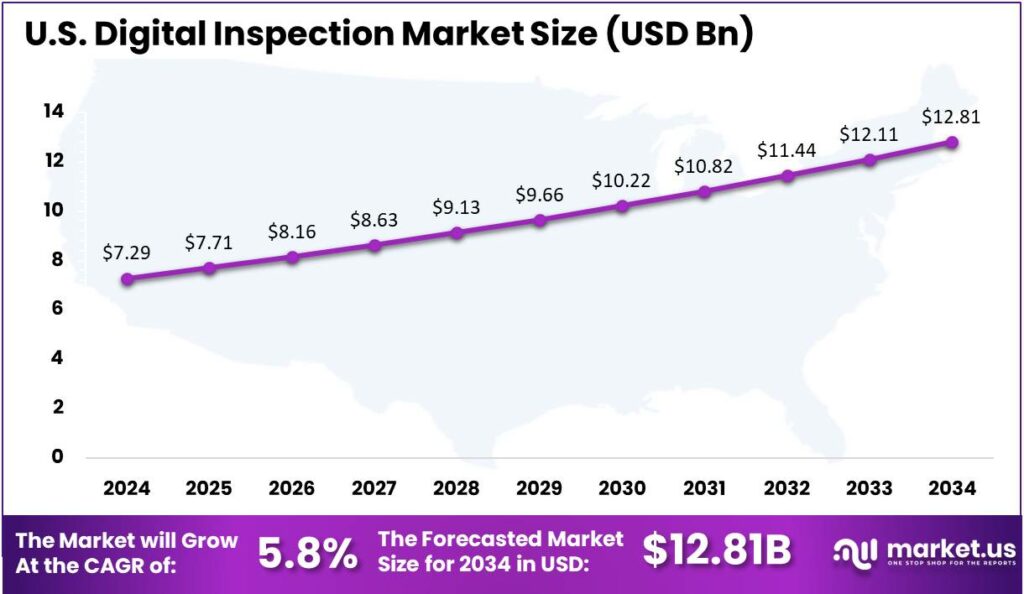

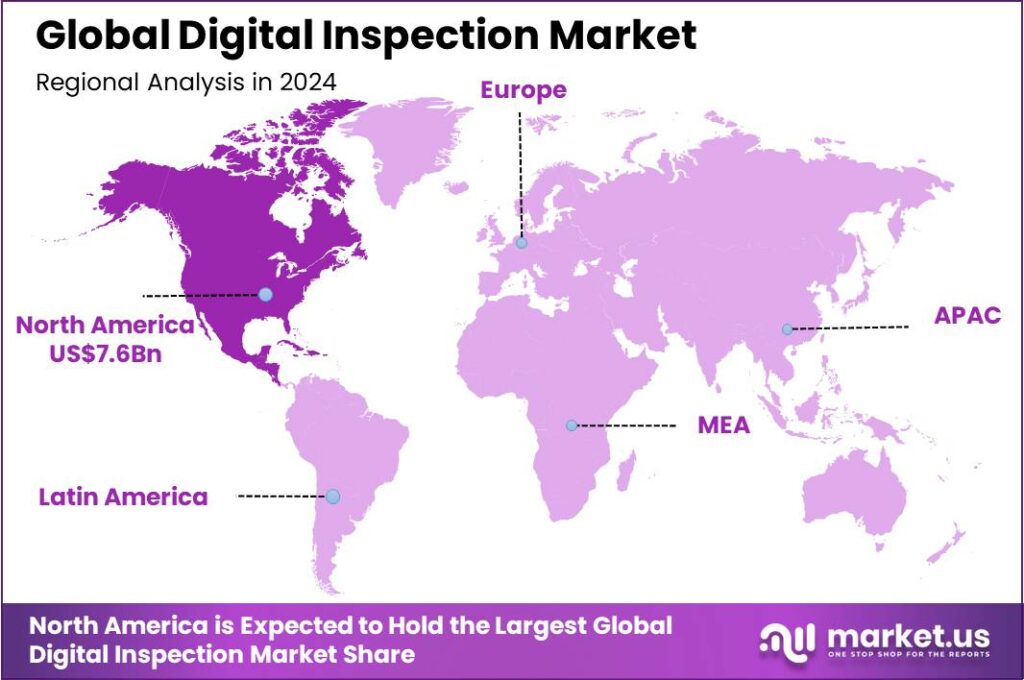

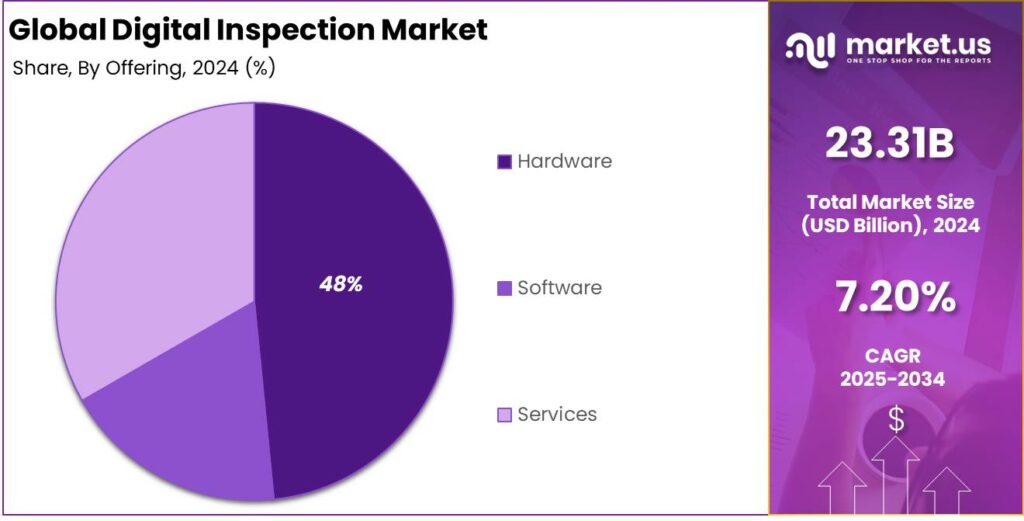

The Digital Inspection Market size is expected to be worth around USD 46.7 Bn By 2034, from USD 23.31 Bn in 2024, growing at a CAGR of 7.20% during the forecast period from 2025 to 2034. In 2024, North America led the global digital inspection market, contributing over 33% and generating around USD 7.6 billion. The U.S. alone accounted for USD 7.29 bn, with a projected CAGR of 5.8%, driven by rising demand for advanced quality and compliance solutions.

Digital inspection refers to the process of evaluating and analyzing products, components, or systems using advanced digital technologies. This approach replaces traditional manual inspection methods with tools such as machine vision, 3D metrology, and non-destructive testing (NDT) techniques. By leveraging digital inspection, industries can achieve higher accuracy, consistency, and efficiency in quality control processes.

Primary drivers of growth in the digital inspection market include the rise of industrial automation, the use of portable and handheld devices for flexible, efficient inspections, and the adoption of AI-powered predictive systems to reduce maintenance costs and improve asset reliability. These factors are expected to sustain long-term market growth.

The demand for digital inspection tools is driven by the manufacturing sector’s need for precision and efficiency. Industry 4.0 and smart factories are pushing investments in automated inspection, while safety regulations in sectors like aerospace and automotive are making digital inspections a standard. The need to monitor aging infrastructure without disrupting operations further fuels this shift.

Digital inspection provides real-time data, enabling quicker, informed decisions while reducing human intervention and labor costs. It minimizes inspection errors and fatigue, and offers traceable, auditable records for compliance. Integrated with predictive maintenance, it helps forecast failures, extend machinery lifespan, and reduce downtime, improving operational efficiency, product quality, and customer satisfaction.

Innovations in inspection are being fueled by AI, edge computing, and IoT. Companies are deploying drones with high-resolution imaging for structures like wind turbines and power lines. AI-driven handheld devices now detect cracks and defects in real time, while AR smart glasses let engineers visualize inspection data directly on physical assets.

Geographically, the digital inspection market is expanding rapidly, with North America leading due to high investments in infrastructure and smart manufacturing, while Asia-Pacific especially China, Japan, and South Korea sees swift growth in automation. The entry of small and mid-sized providers catering to niche industries like pharmaceuticals and food processing is further broadening the market scope.

Key Takeaways

- The Global Digital Inspection Market is projected to grow from USD 23.31 billion in 2024 to around USD 46.7 billion by 2034, registering a CAGR of 7.20% during the forecast period from 2025 to 2034.

- In 2024, the Hardware segment led the market, accounting for more than 48% share, mainly due to the increased adoption of high-performance inspection tools and devices in various industrial applications.

- The Machine Vision segment also held a dominant position in 2024, capturing over 47% market share, fueled by its extensive use in automated quality assurance processes in manufacturing industries.

- Within the technology spectrum, the 2D segment emerged as the leader in 2024, with more than 62% share of the global digital inspection market.

- The Manufacturing sector was the top industry vertical in 2024, holding over 27% share, underscoring the strong demand for digital inspection across production environments.

- North America dominated the global market in 2024, contributing more than 33% of the total market and generating approximately USD 7.6 billion in revenue.

- The U.S. Digital Inspection market alone was valued at about USD 7.29 billion in 2024 and is expected to expand at a CAGR of 5.8%, reflecting a growing emphasis on advanced quality and compliance solutions.

Analyst’s Viewpoint

The digital inspection market presents numerous investment opportunities, particularly in the development of advanced inspection equipment and software solutions. Companies investing in research and development to innovate and improve inspection technologies are likely to gain a competitive edge.

Implementing digital inspection technologies offers several business advantages, including improved product quality, enhanced customer satisfaction, and reduced costs associated with rework and recalls. These technologies enable companies to maintain consistent quality standards, streamline production processes, and make informed decisions based on accurate data.

Regulatory bodies across various industries are imposing stringent quality and safety standards, necessitating the adoption of reliable inspection methods. Digital inspection technologies help companies comply with these regulations by providing precise and documented inspection results. Compliance with such standards is not only essential for legal and safety reasons but also enhances a company’s reputation and customer trust.

Business Benefits

Digital inspection enhances quality control by automating defect detection, enabling quick corrective actions. This streamlines the process, reducing manual effort, speeding up production, and cutting operational costs.

The Canalix customer survey report highlights key improvements driven by AI-enhanced inspection allocation software. Inspection scheduling is now up to 75% faster, efficiency has increased by as much as 40%, and the elimination of inspection allocation errors has become a reality.

Digital inspection systems provide real-time monitoring and standardized procedures, leading to more consistent and accurate quality assessments. By minimizing human error and variability, these systems ensure that products meet defined specifications consistently. This consistency enhances product reliability and customer satisfaction.

Digital inspection identifies defects early in production, preventing faulty products from advancing through the manufacturing line. This early detection reduces waste, rework, and recall costs, ultimately driving significant cost savings for manufacturers.

U.S. Digital Inspection Market

In 2024, the U.S. Digital Inspection market was valued at approximately USD 7.29 billion, underscoring the growing reliance of American industries on advanced inspection technologies to ensure quality control, regulatory compliance, and operational efficiency. This valuation underscores the U.S. market’s maturity, with digital inspection now integral to industries like automotive, aerospace, electronics, and energy.

The market is expected to grow at a 5.8% CAGR, fueled by automation, robotics, and rising demand for non-destructive testing (NDT). U.S. companies are heavily investing in digitizing production and maintenance, especially in defense, semiconductor, and medical device sectors. Stringent regulations from bodies like the FDA and OSHA are also driving the adoption of digital inspection tools for improved accuracy and traceability.

Technological advancements in 3D scanning, AR-enabled inspection systems, and cloud-based software are driving market growth. These tools enable real-time analysis, remote audits, and integration with ERP and MES systems. The U.S. digital inspection market benefits from strong infrastructure, R&D, and leading innovators, ensuring continued evolution, scalability, and innovation across industries.

In 2024, North America held a dominant market position in the global Digital Inspection market, capturing more than a 33% share and generating revenue of approximately USD 7.6 billion. This leadership can be attributed to the region’s rapid technological advancement, early adoption of Industry 4.0 practices, and robust presence of major industrial automation and inspection technology providers.

North America’s leading position is driven by strong regulatory compliance and safety standards, particularly in high-risk industries. Agencies like the FDA, OSHA, and FAA enforce strict quality control, prompting companies to invest in advanced inspection systems. Additionally, the rise of digital twin technology and AI-driven predictive maintenance has increased the demand for real-time digital inspection systems.

North America’s dominance is also fueled by a strong R&D ecosystem and government support for smart manufacturing, like the U.S. National Institute for Innovation in Manufacturing. This accelerates digital transformation, boosting the inspection technology market, with key players like Cognex, FARO Technologies, Hexagon AB, and Nikon Metrology driving innovation in advanced inspection systems.

Rising investments in automation, increasing industrial digitalization, and a highly skilled workforce will help North America maintain its leadership in the digital inspection market. The region’s advanced technological infrastructure and integration of cloud-based inspection platforms provide scalability and remote access, solidifying its position as a global hub for innovation in digital inspection.

Offering Analysis

In 2024, the Hardware segment held a dominant market position, capturing more than a 48% share in the Digital Inspection Market, primarily due to the widespread adoption of high-performance inspection tools and devices across industrial applications.

Companies in manufacturing, aerospace, energy, and automotive sectors are increasingly relying on hardware like cameras, sensors, ultrasonic testers, robotic arms, and drones to enhance accuracy, minimize human error, and accelerate inspection timelines. These tools form the physical backbone of the inspection process, without which software analytics or service integration cannot function effectively.

The hardware segment remains dominant due to rising investments in smart factories and industrial automation. Smart sensors enable real-time detection of issues, preventing equipment failures. Demand for rugged, portable inspection tools is also growing, driven by aging infrastructure and critical projects in sectors like oil & gas. As digital inspection becomes vital for quality assurance, hardware leads adoption where safety, scale, and precision are essential.

Another crucial factor in the hardware segment’s leadership is its role in enabling software and services. Accurate data from robust hardware is vital for AI and cloud-based inspections, keeping physical devices essential to bridging physical assets with digital intelligence.

Technology Analysis

In 2024, the Machine Vision segment held a dominant market position in the global Digital Inspection market, capturing more than a 47% share, driven by its widespread use in automated quality assurance processes across manufacturing industries.

Machine vision systems, which utilize high-resolution cameras, image sensors, and software algorithms, have become essential tools for detecting defects, verifying product assembly, and ensuring dimensional accuracy. Their ability to deliver real-time, high-speed, and non-contact inspection makes them highly suitable for high-volume production environments such as automotive, electronics, and packaging.

One of the primary reasons for the Machine Vision segment’s dominance is its integration with robotics and smart manufacturing systems, enabling fully automated inspection lines. These systems are capable of performing complex tasks like surface defect analysis, barcode verification, and component positioning with a high degree of precision.

Additionally, the segment has benefited significantly from advancements in artificial intelligence and deep learning, which allow machine vision systems to improve over time and adapt to varied inspection requirements. AI-enhanced machine vision can now identify anomalies that were previously undetectable using rule-based systems, enabling predictive maintenance and intelligent decision-making.

Dimension Analysis

In 2024, 2D segment held a dominant market position, capturing more than a 62% share in the global digital inspection market. This strong lead is largely due to the widespread adoption of 2D imaging solutions across industries such as electronics, automotive, and packaging.

2D inspection systems are known for their cost-effectiveness, simpler integration into production lines, and sufficient accuracy for detecting surface-level defects like scratches, misalignments, and cracks. These systems are particularly valued in high-volume manufacturing environments where speed and operational continuity are critical.

2D inspection technology remains popular among small to mid-sized manufacturers, especially in developing regions, due to its lower cost and compatibility with existing systems. Its maturity and upgraded software with features like real-time analytics, edge computing, and AI enhance both performance and usability.

Another reason for the dominance of the 2D segment is its adaptability in fast-paced automated environments such as semiconductor fabrication and consumer electronics assembly. In these industries, even minor surface defects can result in product rejection. 2D systems allow rapid, non-contact inspection and immediate quality assurance without slowing down production lines.

Vertical Analysis

In 2024, Manufacturing segment held a dominant market position, capturing more than a 27% share in the global digital inspection market. This leadership is driven by the growing reliance on automated quality control systems across various manufacturing lines, including metal fabrication, plastics, machinery, and assembly operations.

Manufacturers are increasingly turning to digital inspection technologies to reduce human error, minimize product defects, and ensure compliance with tightening global quality standards. The segment benefits from the widespread integration of machine vision, optical inspection, and non-destructive testing (NDT) solutions, all of which play a central role in improving product consistency and boosting throughput.

The rise of smart factories and Industry 4.0 is driving adoption of real-time digital inspection in manufacturing. Linked with IoT and cloud tools, these systems enable remote quality checks, predictive maintenance, and data-driven decision-making helping manufacturers scale efficiently while ensuring high accuracy..

Another factor contributing to the segment’s dominance is the increasing complexity of product designs and materials being used in modern manufacturing. From intricate electronic components to lightweight composite materials in machinery, quality control demands have grown more sophisticated. Digital inspection tools offer the precision and flexibility needed to inspect these diverse materials without interrupting the production flow.

Key Market Segments

By Offering

- Hardware

- Software

- Services

By Technology

- Machine Vision

- Metrology

- NDT

By Dimension

- 2D

- 3D

By Vertical

- Manufacturing

- Electronics and Semiconductor

- Oil & Gas

- Aerospace & Defense

- Automotive

- Energy and Power

- Public Infrastructure

- Food and Pharmaceuticals

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Integration of AI and Automation Enhancing Inspection Efficiency

The integration of AI and automation is transforming digital inspections, replacing traditional methods with real-time data analysis, predictive maintenance, and smarter decision-making.

AI-powered inspection systems quickly process large data, detecting defects with higher accuracy than manual inspections. In manufacturing, machine vision ensures quality control, reduces waste, and minimizes human errors through automation.

The adoption of these technologies leads to increased operational efficiency, cost savings, and improved product quality. Industries such as automotive, aerospace, and electronics are increasingly investing in AI-driven inspection solutions to meet stringent quality standards and regulatory compliances.

Restraint

High Implementation Costs and Integration Challenges

Despite the advantages, the adoption of digital inspection technologies is hindered by high initial implementation costs and integration challenges. Small and medium-sized enterprises (SMEs) often face financial constraints that make it difficult to invest in advanced inspection systems.

Furthermore, integrating digital inspection systems into existing workflows and legacy systems poses technical challenges. Compatibility issues may arise, requiring additional investments in system upgrades or custom interfaces.

These barriers can result in prolonged implementation timelines and increased operational disruptions, deterring organizations from transitioning to digital inspection methods. Collaboration between technology providers, industry stakeholders, and regulatory bodies is essential to address these challenges and facilitate broader adoption of digital inspection technologies.

Opportunity

Expansion into Emerging Markets and Diverse Industries

The digital inspection market is growing rapidly in emerging economies, driven by industrialization and infrastructure development in Asia, Africa, and Latin America. Sectors like construction, energy, and healthcare are increasingly adopting these technologies to improve efficiency and safety.

Digital inspection tools are versatile, extending beyond manufacturing to sectors like healthcare and agriculture. In healthcare, they aid in equipment maintenance and quality assurance, while in agriculture, they monitor crop health and detect pests. This broad adoption opens new opportunities for market expansion.

Government investments in digital infrastructure boost the growth of inspection technologies in emerging markets. Technology providers can leverage these opportunities through strategic partnerships, localized solutions, and targeted marketing to drive innovation and expand their customer base.

Challenge

Ensuring Data Security and Managing Cybersecurity Risks

As digital inspection systems become more interconnected and data-driven, ensuring data security and managing cybersecurity risks are critical challenges. These systems handle sensitive information like proprietary designs, operational data, and compliance records. A security breach can lead to financial losses, reputational damage, and legal consequences.

Integrating digital inspection tools with enterprise networks and cloud platforms exposes them to cyber threats like unauthorized access, data tampering, and malware. To protect data integrity, organizations must implement encryption, access controls, and conduct regular security audits. Continuous monitoring and updating of security frameworks are essential, along with investing in cybersecurity expertise to identify and address vulnerabilities.

Emerging Trends

Mobile-first solutions are improving efficiency by enabling field workers to perform on-site inspections and capture data in real time, reducing paperwork. Additionally, IoT devices and sensors enable continuous monitoring, providing real-time data for predictive maintenance, minimizing downtime, and extending equipment lifespan.

Artificial Intelligence (AI) and Machine Learning (ML) are also playing crucial roles. These technologies analyze vast amounts of inspection data to identify patterns, predict failures, and suggest improvements. By learning from historical data, AI and ML enhance the accuracy and reliability of inspections.

The use of drones and robotics in inspections is growing, enabling access to hazardous or hard-to-reach areas while capturing high-quality data safely. Cloud-based platforms are becoming the norm, offering centralized storage, easy access to inspection records, and seamless data sharing, enhancing collaboration and ensuring all parties have up-to-date information.

Key Player Analysis

Among the many players in Digital Inspection Market, a few key companies stand out for their innovation, global presence, and strong product offerings.

Basler AG, a German company, is known for its high-quality industrial cameras and vision systems. Their products are widely used in automation, medical imaging, and logistics. Basler stands out for integrating artificial intelligence (AI) and deep learning into its vision systems, helping companies achieve smarter and faster inspections.

Carl Zeiss AG is a global leader in optics and optoelectronics, bringing unmatched precision to digital inspection. Known for its premium lenses and metrology tools, Zeiss provides solutions that can measure microscopic and nanoscopic features with high accuracy. This makes Zeiss a key player in sectors like semiconductor manufacturing and medical devices. Their strength lies in decades of research, innovation, and a commitment to quality.

FARO Technologies, Inc., based in the U.S., specializes in 3D measurement and imaging solutions. Their standout product range includes laser scanners and portable coordinate measuring machines (CMMs) that are widely used in construction, automotive, and aerospace. FARO’s edge lies in its user-friendly software and high-precision hardware, making complex inspections easier and more efficient.

Top Key Players in the Market

- Basler AG

- Carl Zeiss AG

- FARO Technologies, Inc.

- General Electric

- Hexagon AB

- MISTRAS Group, Inc.

- Nikon Metrology NV

- Omron Corporation

- Olympus Corporation

- Cognex

- Zetec

- Mitutoyo

- Others

Top Opportunities for Players

- AI-Driven Quality Control in Manufacturing: Manufacturers are increasingly adopting AI-powered visual inspection systems to enhance product quality. These systems utilize machine learning to detect defects with high accuracy, surpassing human capabilities. This shift not only reduces waste but also accelerates production timelines, meeting the growing demand for precision and efficiency in manufacturing processes.

- Remote and Autonomous Inspections in Hazardous Environments: Industries such as oil and gas, mining, and utilities are leveraging autonomous drones and robotic systems for inspections in challenging environments. These technologies minimize human exposure to hazardous conditions while providing comprehensive data through high-resolution imaging and sensors, leading to improved safety and operational efficiency.

- Integration of AI in Infrastructure Maintenance: The integration of AI in infrastructure inspections, including bridges and pipelines, enables early detection of structural issues. AI algorithms analyze data from various sources to identify potential faults, facilitating proactive maintenance and reducing the risk of catastrophic failures.

- Enhanced Inspection in the Automotive Sector: The automotive industry is adopting AI-based inspection systems to improve vehicle safety and quality. These systems perform thorough inspections of components and assemblies, ensuring compliance with safety standards and reducing the likelihood of recalls.

- Advancements in Non-Destructive Testing (NDT): Digital inspection technologies are revolutionizing non-destructive testing methods across various sectors. By employing advanced imaging and data analysis, these technologies provide detailed insights into material integrity without causing damage, thus ensuring reliability and extending the lifespan of critical assets.

Recent Developments

- In April 2025, MISTRAS Group has launched MISTRAS Data Solutions, unifying its data-driven services, inspection software, and management systems under one brand to deliver full lifecycle asset protection through integrated digital inspection and data management.

- In April 2024, Hexagon introduced the PRESTO System, a modular robotic inspection cell that halves inspection time and allows easy automation for quality control in automotive and aerospace manufacturing.

Report Scope

Report Features Description Market Value (2024) USD 23.31 Bn Forecast Revenue (2034) USD 46.7 Bn CAGR (2025-2034) 7.20% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Offering (Hardware, Software, Services), By Technology (Machine Vision, Metrology, NDT), By Dimension (2D, 3D), By Vertical (Manufacturing, Electronics and Semiconductor, Oil & Gas, Aerospace & Defense, Automotive, Energy and Power, Public Infrastructure, Food and Pharmaceuticals, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Basler AG, Carl Zeiss AG, FARO Technologies, Inc., General Electric, Hexagon AB, MISTRAS Group, Inc., Nikon Metrology NV, Omron Corporation, Olympus Corporation, Cognex, Zetec, Mitutoyo, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Basler AG

- Carl Zeiss AG

- FARO Technologies, Inc.

- General Electric

- Hexagon AB

- MISTRAS Group, Inc.

- Nikon Metrology NV

- Omron Corporation

- Olympus Corporation

- Cognex

- Zetec

- Mitutoyo

- Others