Global Digestive Enzyme Supplements Market Size, Share, And Business Benefits By Nature (Conventional, Organic), By Enzyme Type(Protease, Amylase, Lipase, Lactase, Others), By Form Type (Tablets / Capsules, Powders, Liquids, Chewables, Others), By Origin (Animal, Plant, Microbial, Others), By Application (Additional Supplements, Medical and Infant Nutrition, Sports Nutrition, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: August 2025

- Report ID: 155677

- Number of Pages: 246

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

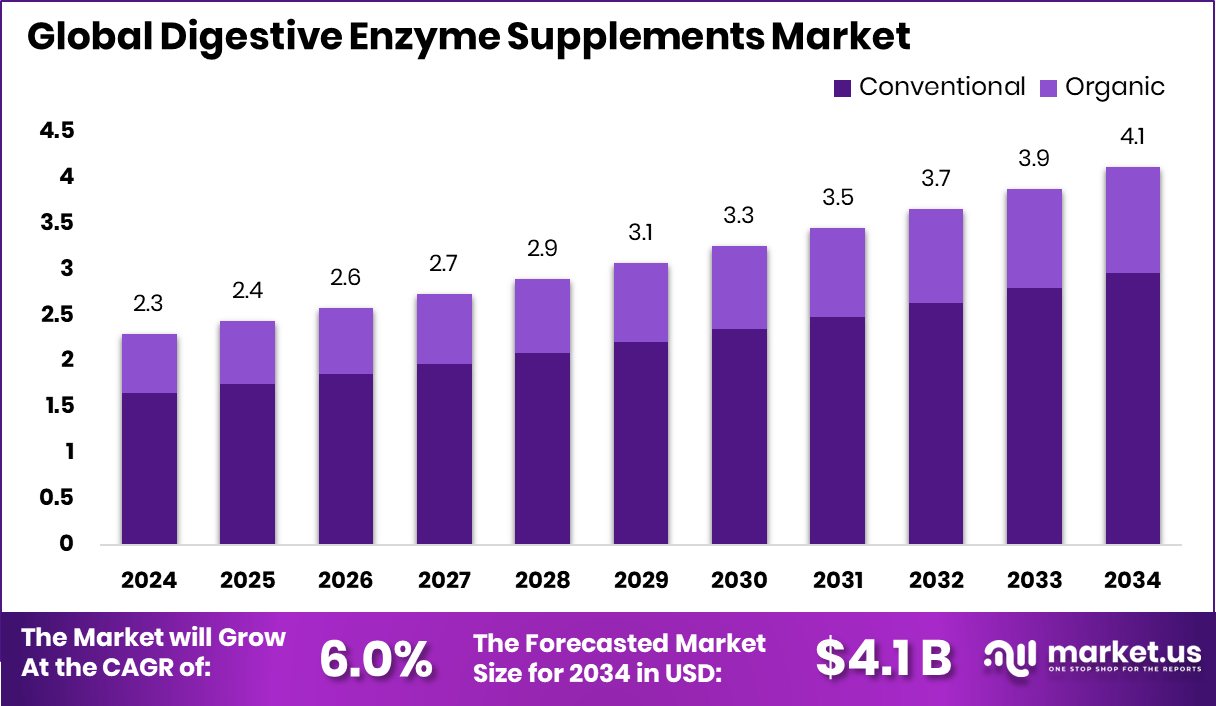

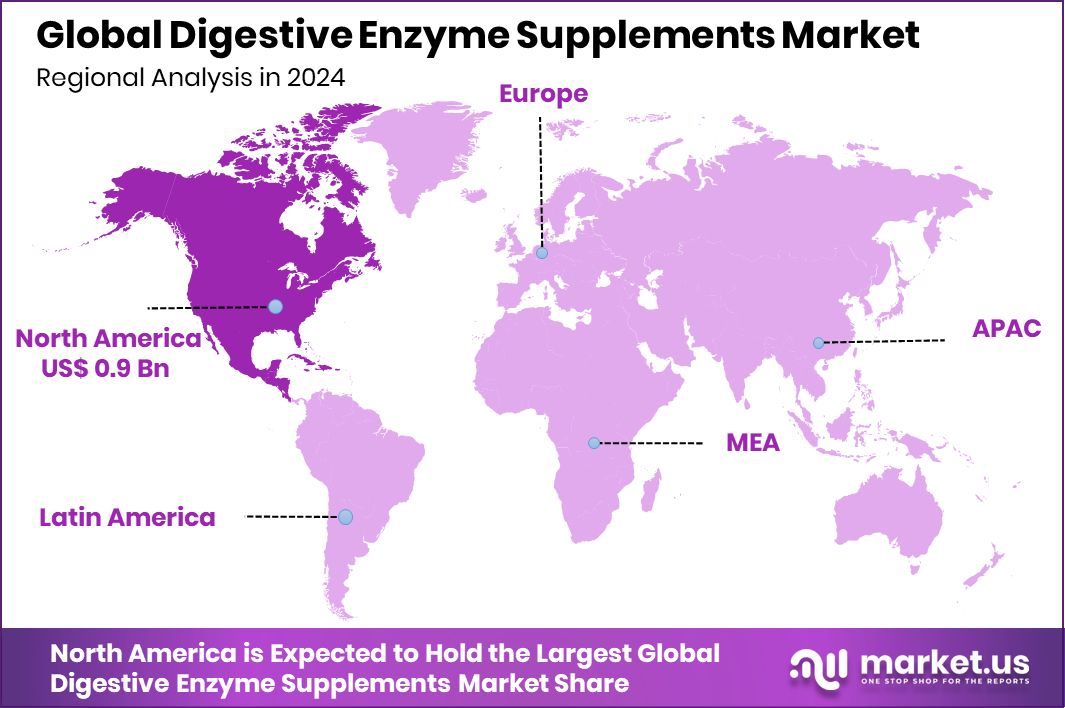

The Global Digestive Enzyme Supplements Market is expected to be worth around USD 4.1 billion by 2034, up from USD 2.3 billion in 2024, and is projected to grow at a CAGR of 6.0% from 2025 to 2034. With a 41.70% share, North America reached USD 0.9591 billion in digestive enzyme supplements.

Digestive enzyme supplements are products that help the body break down food into smaller, absorbable nutrients. These supplements usually contain enzymes like amylase, protease, and lipase, which support the digestion of carbohydrates, proteins, and fats. They are commonly used by people who experience bloating, indigestion, or nutrient absorption issues due to low natural enzyme production.

By aiding the digestive process, they promote better gut health, nutrient uptake, and overall well-being. In line with nutrition-focused innovation, D2C sports nutrition brand Nutrabay secures $5 million funding from RPSG Capital Ventures, while India’s HealthKart reaches a $500M valuation following fresh investment.

The digestive enzyme supplements market represents the global trade, production, and consumption of these products across different regions. It is shaped by rising health awareness, an increase in digestive disorders, and a shift toward preventive healthcare. The market is expanding as consumers prefer natural solutions and dietary aids for better digestion, particularly in aging populations where enzyme production slows down. UConn Husky Nutrition & Sport awarded $4.9M in federal funding also reflects growing investment interest in nutrition and wellness.

A major growth factor is the rising prevalence of gastrointestinal issues such as lactose intolerance, acid reflux, and irritable bowel syndrome. With more people facing digestive discomfort, the demand for enzyme-based solutions has increased. Additionally, growing awareness of gut health and its link to immunity and overall wellness fuels market expansion. In this space, Nutrabay closes $5 million funding round led by RPSG Capital, while Hexis obtains $2 million in a pre-seed funding round, highlighting strong backing for nutrition-focused startups.

The demand is strongly driven by changing food habits and a growing reliance on processed and high-fat diets, which often strain digestion. Consumers are turning to enzyme supplements to counter these effects, improve nutrient absorption, and maintain digestive balance. The rise of self-care trends also plays a vital role in sustaining demand. Sweden’s Maurten raises €20 million to expand its sports fuel offerings globally, and Iris Ventures leads €20 million investment in Swedish sports nutrition company Maurten, underlining the broader growth of nutrition and digestive health markets.

Key Takeaways

- The Global Digestive Enzyme Supplements Market is expected to be worth around USD 4.1 billion by 2034, up from USD 2.3 billion in 2024, and is projected to grow at a CAGR of 6.0% from 2025 to 2034.

- The Digestive Enzyme Supplements Market is largely conventional, accounting for 72.4% of total demand.

- Protease dominates the Digestive Enzyme Supplements Market by enzyme type, holding a 33.9% market share worldwide.

- Tablets and capsules lead the Digestive Enzyme Supplements Market by form type, representing 48.1% consumer preference.

- Animal-origin products account for 47.2% of the Digestive Enzyme Supplements Market, reflecting strong dominance.

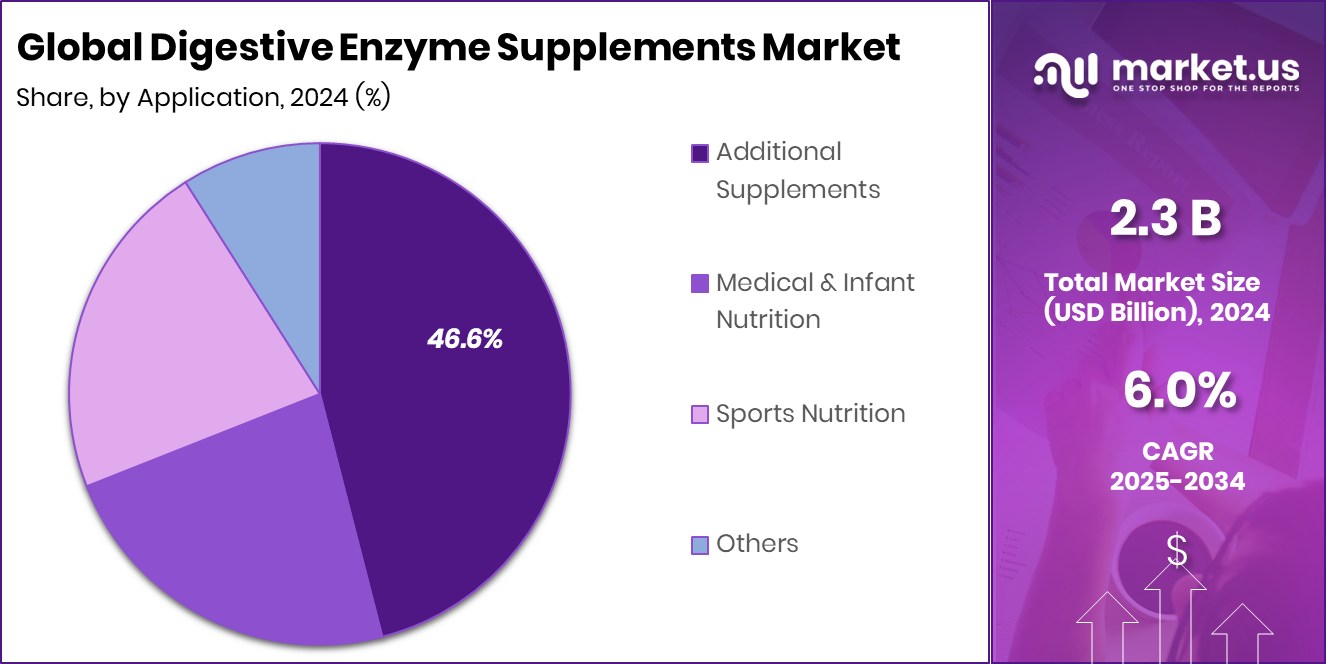

- Additional supplements hold a 46.6% share in the Digestive Enzyme Supplements Market, highlighting widespread consumer adoption.

- Strong consumer awareness in North America, holding a 41.70% share worth USD 0.9591 billion.

By Nature Analysis

Digestive Enzyme Supplements Market is dominated by conventional products, 72.4%.

In 2024, Conventional held a dominant market position in the By Nature segment of the Digestive Enzyme Supplements Market, with a 72.4% share. This leadership reflects the continued preference for traditional formulations among consumers who value affordability, easy availability, and established trust in conventional dietary products. Conventional enzyme supplements remain widely adopted due to their broad distribution across pharmacies, health stores, and online platforms, making them more accessible compared to specialized alternatives.

The dominance of this segment is also tied to consumer familiarity, as many users rely on tried-and-tested solutions to address common digestive concerns such as bloating, indigestion, and nutrient malabsorption. The relatively lower cost of conventional products compared to newer or plant-based alternatives further supports their popularity, particularly in price-sensitive markets.

Moreover, the segment benefits from a wide variety of dosage forms such as capsules, tablets, and powders, allowing consumers to choose based on convenience and personal preference. With increasing digestive health awareness and an expanding customer base across both developed and emerging economies, the conventional segment is expected to maintain steady demand.

By Enzyme Type Analysis

Protease leads the enzyme type in the Digestive Enzyme Supplements Market, capturing 33.9%.

In 2024, Protease held a dominant market position in the By Enzyme Type segment of the Digestive Enzyme Supplements Market, with a 33.9% share. This strong position highlights the essential role of protease enzymes in breaking down proteins into smaller peptides and amino acids, which are vital for muscle repair, immune function, and overall metabolism. The growing demand for protein-rich diets, combined with rising cases of protein digestion issues, has boosted the adoption of protease-based supplements among consumers seeking improved nutrient absorption and digestive comfort.

Protease supplements are particularly valued by individuals with digestive challenges such as indigestion, bloating, or pancreatic insufficiency, as they help ease the digestion of protein-heavy meals. Their relevance extends to athletes and fitness-focused consumers, who require efficient protein utilization to support muscle growth and recovery. This broader appeal across health-conscious groups has reinforced the enzyme’s market dominance.

Additionally, the availability of protease supplements in multiple formats, including capsules, tablets, and blended formulations, ensures consumer convenience and widespread usage. With digestive health gaining prominence as part of preventive healthcare, the protease segment is positioned to retain its lead, making it a cornerstone in driving the overall growth of the digestive enzyme supplements market.

By Form Type Analysis

Tablets and capsules hold a 48.1% share in the digestive enzyme supplements market.

In 2024, Tablets / Capsules held a dominant market position in the By Form Type segment of the Digestive Enzyme Supplements Market, with a 48.1% share. This dominance reflects the strong consumer preference for convenient, portable, and accurately dosed supplement formats. Tablets and capsules are widely accepted due to their ease of consumption, longer shelf life, and the ability to deliver enzymes in a stable form without compromising effectiveness. Their familiarity with the supplement and pharmaceutical industries has also built consumer trust, encouraging repeat purchases and steady demand.

The segment’s growth is further supported by the broad availability of tablets and capsules across retail pharmacies, supermarkets, and e-commerce platforms, making them the most accessible format for a wide customer base. They also cater to a variety of consumer groups, from individuals managing digestive discomfort to health-conscious users seeking preventive care.

Additionally, advances in capsule technology, including delayed-release and enteric-coated options, have enhanced the effectiveness of enzyme delivery by ensuring they reach the intestines without being degraded by stomach acid. These innovations, combined with consumer comfort and affordability, strengthen the leadership of tablets and capsules.

By Origin Analysis

Animal-origin enzymes account for 47.2% of the digestive enzyme supplements market.

In 2024, Animal held a dominant market position in the By Origin segment of the Digestive Enzyme Supplements Market, with a 47.2% share. This leadership is largely driven by the proven effectiveness of animal-derived enzymes, such as pancreatin, which closely mimic the body’s natural enzyme activity. These supplements are widely used to support individuals with digestive disorders, including pancreatic insufficiency, lactose intolerance, and protein malabsorption, making them a trusted solution for clinical as well as general digestive health needs.

The dominance of animal-based enzymes is also linked to their strong track record in therapeutic applications, where consistency and efficacy are critical. Consumers and healthcare providers often prefer them due to their ability to deliver predictable and reliable results, particularly for those who require long-term supplementation.

In addition, animal-derived digestive enzyme products are available in diverse formats such as tablets, capsules, and powders, allowing broader usage across different consumer groups. Their established reputation, combined with widespread availability through pharmacies and online platforms, has reinforced their strong market standing. With rising awareness of digestive health and growing reliance on enzyme therapy for managing chronic conditions, the animal segment continues to hold a key role in driving market revenue and adoption.

By Application Analysis

Additional supplement applications dominate the digestive enzyme supplements market with 46.6%.

In 2024, Additional Supplements held a dominant market position in the By Application segment of the Digestive Enzyme Supplements Market, with a 46.6% share. This dominance highlights the growing use of digestive enzymes not only for addressing specific medical conditions but also as part of broader nutritional and wellness routines.

Consumers are increasingly integrating enzyme-based supplements into their daily diets to enhance nutrient absorption, reduce digestive discomfort from heavy meals, and maintain long-term gastrointestinal health. This preventive approach has expanded the application of digestive enzymes beyond therapeutic use, driving stronger adoption under the additional supplements category.

The popularity of additional supplements is also supported by rising consumer interest in proactive health management. With lifestyles increasingly shaped by irregular eating habits and processed food consumption, enzyme supplements offer a convenient way to counter digestive strain. Their inclusion in daily supplementation regimes makes them more appealing to health-conscious individuals who see them as a natural extension of multivitamins and probiotics.

Key Market Segments

By Nature

- Conventional

- Organic

By Enzyme Type

- Protease

- Amylase

- Lipase

- Lactase

- Others

By Form Type

- Tablets / Capsules

- Powders

- Liquids

- Chewables

- Others

By Origin

- Animal

- Plant

- Microbial

- Others

By Application

- Additional Supplements

- Medical and Infant Nutrition

- Sports Nutrition

- Others

Driving Factors

Rising Digestive Disorders Fueling Enzyme Supplement Demand

One of the strongest driving factors for the Digestive Enzyme Supplements Market is the rising number of people suffering from digestive disorders. Conditions like bloating, indigestion, acid reflux, and lactose intolerance are becoming more common because of changing food habits, busy lifestyles, and higher consumption of processed foods. This has created a large need for products that can improve digestion and support nutrient absorption.

Digestive enzyme supplements provide a convenient and effective solution for people facing these issues. With more individuals focusing on gut health as an important part of overall wellness, the use of enzyme supplements is steadily increasing. This trend is expected to keep supporting the strong growth of the market in the coming years.

Restraining Factors

High Product Cost Limiting Wider Consumer Adoption

A key restraining factor for the Digestive Enzyme Supplements Market is the high cost of these products compared to regular dietary supplements. Since many enzyme supplements are made using advanced extraction and formulation techniques, their prices are often higher, making them less affordable for a large group of consumers, especially in price-sensitive regions. For individuals who need long-term usage, the ongoing expense becomes a financial burden.

This limits consistent adoption and discourages repeat purchases, even among those who benefit from these products. Additionally, limited awareness about the differences between enzyme supplements and other common digestive aids sometimes makes people hesitant to invest. These cost-related barriers slow down the pace of market expansion despite growing health needs.

Growth Opportunity

Growing Demand for Plant-Based Enzyme Supplement Options

A major growth opportunity in the Digestive Enzyme Supplements Market comes from the rising demand for plant-based formulations. With more consumers shifting toward vegan, vegetarian, and clean-label lifestyles, there is a clear preference for products sourced from plants like papaya (papain) and pineapple (bromelain). These plant-based enzymes appeal to health-conscious buyers who want natural, sustainable, and allergen-free solutions for digestive health.

They also meet the needs of consumers who avoid animal-derived ingredients for ethical or religious reasons. As awareness of gut health expands, companies offering plant-based alternatives have the chance to attract a wider audience. This trend opens doors for innovation, customized blends, and functional foods enriched with plant enzymes, boosting future market expansion globally.

Latest Trends

Personalized Digestive Enzyme Supplements Gaining Strong Popularity

One of the latest trends in the Digestive Enzyme Supplements Market is the rise of personalized formulations tailored to individual health needs. Consumers are becoming more aware that digestive issues can vary widely, from lactose intolerance to protein or fat malabsorption. As a result, there is growing interest in supplements designed to target specific concerns rather than relying on one-size-fits-all solutions.

Advances in health testing and digital wellness platforms are making it easier to match people with the right enzyme blends. This trend aligns with the broader movement toward personalized nutrition, where consumers seek products that fit their lifestyle, diet, and health goals. It is reshaping the market and driving innovation in product development.

Regional Analysis

In 2024, North America captured a 41.70% share, valued at USD 0.9591 billion.

The Digestive Enzyme Supplements Market shows varied regional dynamics, shaped by lifestyle patterns, dietary habits, and consumer awareness levels. In 2024, North America emerged as the dominating region, holding a 41.70% share valued at USD 0.9591 billion, supported by strong consumer awareness of digestive health and high spending on dietary supplements.

The region’s dominance is also linked to the rising prevalence of digestive disorders and the increasing adoption of preventive healthcare practices, making supplements a regular part of consumer wellness routines.

Europe follows closely, driven by growing demand for natural and plant-based supplements alongside supportive healthcare systems that emphasize gut health. Asia Pacific is witnessing rapid growth, fueled by urbanization, changing diets, and rising disposable incomes, which are increasing the acceptance of enzyme-based products.

Meanwhile, the Middle East & Africa and Latin America are gradually adopting digestive enzyme supplements, supported by improving healthcare infrastructure and expanding retail distribution channels.

While all regions contribute to overall market expansion, North America’s significant lead underlines its role as the most influential market, setting trends in product innovation and consumer preferences that are likely to guide global growth in the digestive enzyme supplements industry.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Amano Enzyme Inc. continues to strengthen its position through advanced enzyme solutions, leveraging decades of expertise in enzyme research. Its focus on precision formulations enhances digestion efficiency, positioning the brand as a reliable partner in both healthcare and wellness segments.

Enzymedica, recognized for its natural and plant-based formulations, has built strong consumer loyalty by promoting clean-label products. In 2024, the company’s focus on digestive health awareness campaigns and broader retail distribution has supported its market presence, especially among health-conscious consumers seeking sustainable solutions.

Advanced Enzyme Technologies has gained traction by combining biotechnology with targeted digestive care. The company’s strong R&D foundation helps create specialized enzyme blends tailored for varied digestive conditions, allowing it to cater to both therapeutic needs and preventive health markets. Its global outreach in 2024 highlights its role in expanding access to affordable enzyme supplements.

Metagenics is playing a pivotal role by integrating digestive enzyme supplements within broader nutrition and lifestyle programs. In 2024, the company’s emphasis on practitioner partnerships and clinical validation has enhanced credibility, particularly among consumers seeking science-backed digestive health solutions.

Top Key Players in the Market

- Amano Enzyme Inc.

- Enzymedica

- Advanced Enzyme Technologies

- Metagenics

- Danone

- Vox Nutrition

- Integrative Therapeutics

- Country Life

- NOW Foods

- Houston Enzymes

Recent Developments

- In May 2025, Advanced Enzyme Technologies further strengthened its product portfolio by actively working on new launches across enzymes and probiotics. These developments are part of a broader strategy to strengthen offerings in human nutrition, animal nutrition, and food processing sectors. The company reinforced its commitment to growing its consumer health segment while leveraging existing infrastructure and R&D for innovation.

- In October 2024, Enzymedica expanded its product range by unveiling a new line of SubCulture™ probiotics, specially formulated to address bloating, mood, and women’s wellness. These additions underscore the company’s commitment to holistic digestive health.

Report Scope

Report Features Description Market Value (2024) USD 2.3 Billion Forecast Revenue (2034) USD 4.1 Billion CAGR (2025-2034) 6.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Nature (Conventional, Organic), By Enzyme Type(Protease, Amylase, Lipase, Lactase, Others), By Form Type (Tablets / Capsules, Powders, Liquids, Chewables, Others), By Origin (Animal, Plant, Microbial, Others), By Application (Additional Supplements, Medical and Infant Nutrition, Sports Nutrition, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Amano Enzyme Inc., Enzymedica, Advanced Enzyme Technologies, Metagenics, Danone, Vox Nutrition, Integrative Therapeutics, Country Life, NOW Foods, Houston Enzymes Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Digestive Enzyme Supplements MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample

Digestive Enzyme Supplements MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Amano Enzyme Inc.

- Enzymedica

- Advanced Enzyme Technologies

- Metagenics

- Danone

- Vox Nutrition

- Integrative Therapeutics

- Country Life

- NOW Foods

- Houston Enzymes