Global Diacetone Alcohol Market Size, Share, And Business Benefit By Function (Solvents, Chemical Intermediates, Additives), By End User (Paints Coating, Chemicals, Construction, Polymer Plastics, Textile, Leather, Agrochemicals, Automotive, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 164560

- Number of Pages: 386

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

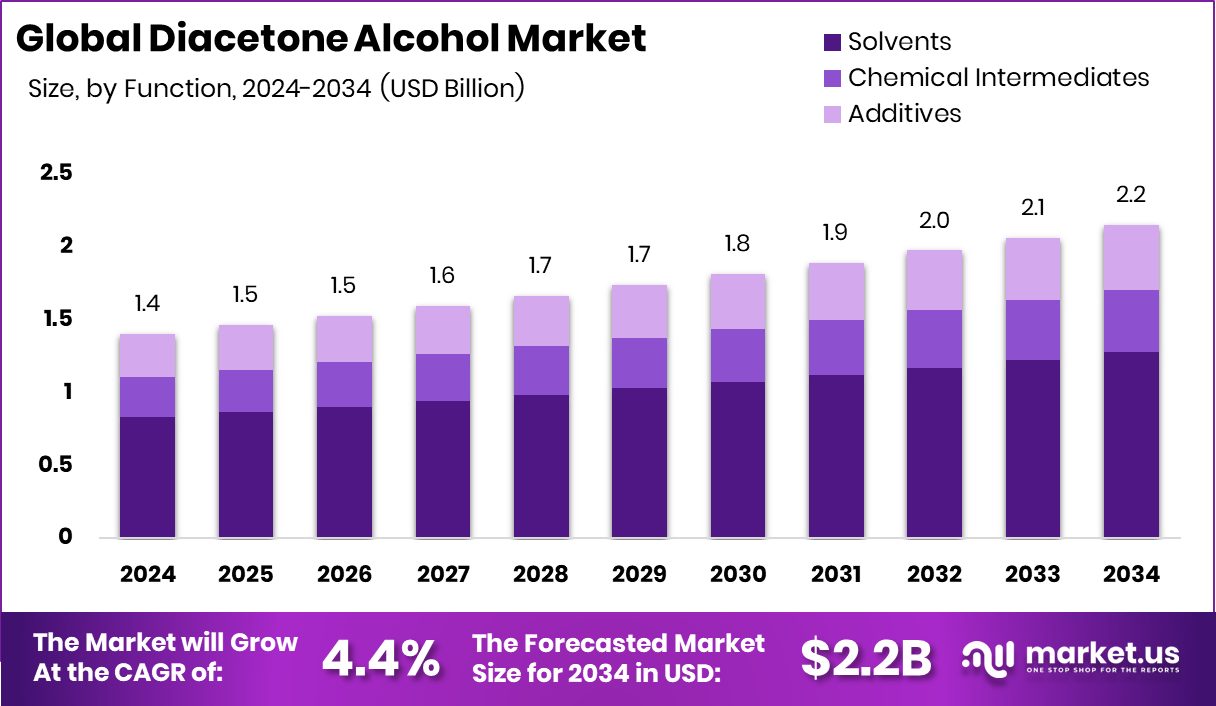

The Global Diacetone Alcohol Market is expected to be worth around USD 2.2 billion by 2034, up from USD 1.4 billion in 2024, and is projected to grow at a CAGR of 4.4% from 2025 to 2034. Growing adoption of sustainable solvents strengthened North America’s 47.30% share in global Diacetone Alcohol consumption.

Diacetone Alcohol is a clear, colorless liquid that serves as both a solvent and a chemical intermediate. It is known for its excellent solvency, low volatility, and miscibility with water and many organic compounds. Commonly used in coatings, adhesives, inks, and textile treatments, it provides stability, good drying properties, and reduced odor compared to traditional solvents. Its balanced chemical properties make it valuable in manufacturing paint additives, cleaning agents, and synthetic resins across various industrial sectors.

The growth of the diacetone alcohol market is strongly supported by the rising demand for sustainable and high-performance solvents in paints and coatings. It aligns with the global shift toward eco-friendly formulations, reducing volatile organic compound emissions. Growing infrastructure projects and industrial activity also boost demand for coatings, directly increasing consumption of diacetone alcohol. Funding activity, such as Ecoat securing €21 million to reinvent sustainable paint solutions, further reflects industry confidence. Similarly, Akzo Nobel’s ₹2,143 crore sale and BASF’s €7.7 billion coatings divestment highlight expansion and reinvestment in innovative chemistries that indirectly strengthen solvent markets.

Demand is rising across end-use sectors like coatings, adhesives, and industrial cleaners, where diacetone alcohol offers enhanced performance and low odor. Its versatility and safety make it a preferred choice for modern formulations. The growing popularity of water-based coatings and low-VOC systems has increased their usage worldwide. Additionally, financial activities such as Arbuda Agrochemicals’ ₹120 crore IPO, Distil’s $7.7 million Series A funding, and Kotak’s $45 million investment in an agrochemical firm emphasize growing capital flow into specialty chemical segments that rely on such intermediates.

The ongoing global focus on sustainable and bio-based solvents presents strong opportunities for Diacetone Alcohol producers. As coating and chemical firms pivot toward green innovation, products like Diacetone Alcohol can act as a bridge between performance and sustainability. New investments in specialty chemicals and coatings technologies indicate rising interest in efficient, environmentally responsible solvents.

Key Takeaways

- The Global Diacetone Alcohol Market is expected to be worth around USD 2.2 billion by 2034, up from USD 1.4 billion in 2024, and is projected to grow at a CAGR of 4.4% from 2025 to 2034.

- In 2024, the Diacetone Alcohol Market dominated by solvents, capturing 59.3% share due to rising coating applications.

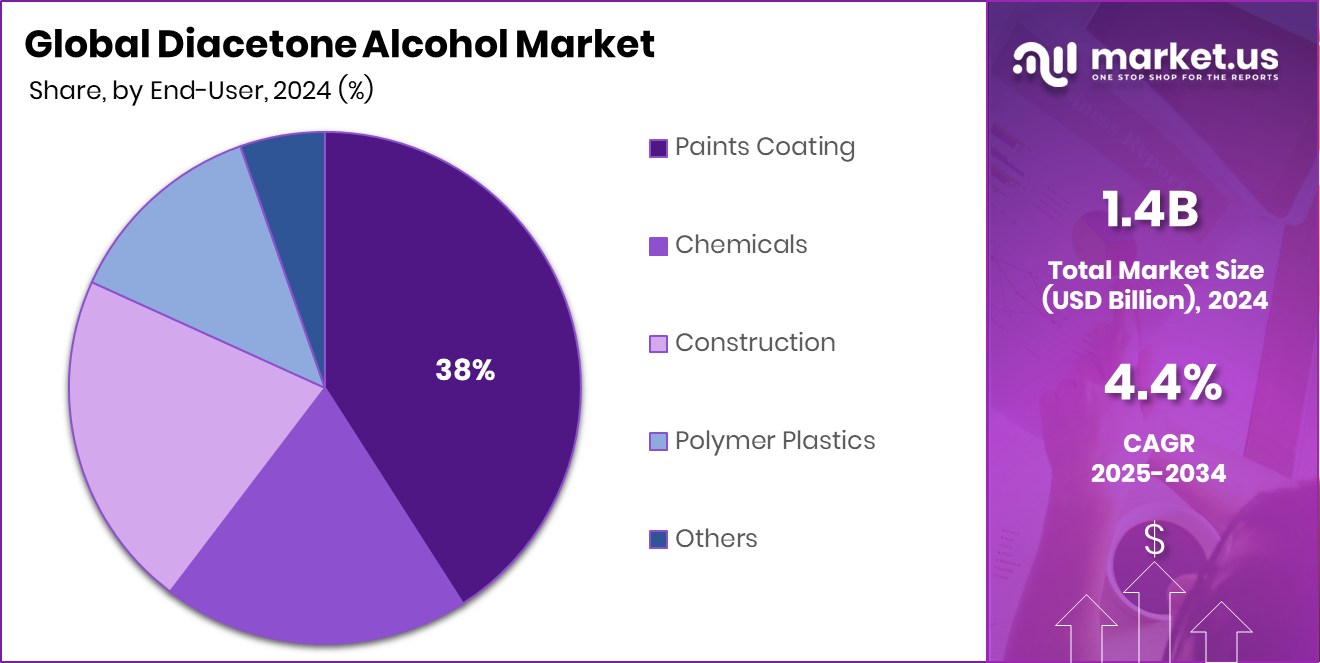

- The Diacetone Alcohol Market witnessed strong demand from paints and coatings, accounting for 38.2% share globally.

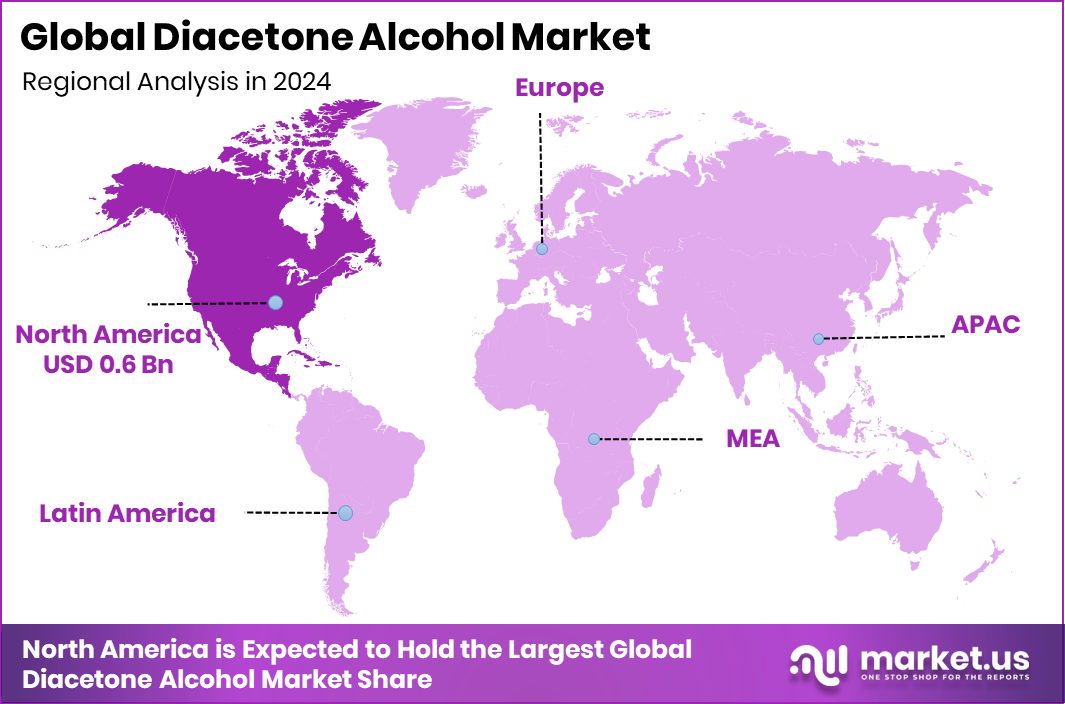

- North America’s strong industrial base and coating demand supported its USD 0.6 Bn market value.

By Function Analysis

In 2024, Diacetone Alcohol Market dominated the solvents segment, capturing 59.3% share globally.

In 2024, Solvents held a dominant market position in the By Function segment of the Diacetone Alcohol Market, capturing a 59.3% share. This dominance reflects its extensive use across coatings, adhesives, inks, and cleaning formulations, where it delivers excellent solvency, stability, and low volatility. The compound’s compatibility with water and organic materials makes it a preferred choice for industrial and decorative coating applications.

Its role in enhancing drying performance and minimizing odor further strengthens its adoption in environmentally friendly formulations. Supported by rising demand for sustainable solvent systems and continued investment in specialty chemical innovation, the solvent function of Diacetone Alcohol continues to anchor the market’s growth and industrial relevance across multiple end-use sectors.

By End User Analysis

The Diacetone Alcohol Market held a 38.2% share in paints and coatings applications.

In 2024, Paints & Coatings held a dominant market position in the By End User segment of the Diacetone Alcohol Market, capturing a 38.2% share. This leadership is driven by its extensive application as a solvent and coalescing agent in paints, varnishes, and industrial coatings. Diacetone Alcohol enhances gloss, flow, and film formation while maintaining low odor and controlled evaporation rates, making it ideal for both water-based and solvent-based systems.

The growing emphasis on sustainable coating technologies and increasing industrial and infrastructure projects further support its demand. Its compatibility with multiple resins and contribution to environmental compliance strengthen its position, ensuring that paints and coatings remain the key consumer of Diacetone Alcohol across industries.

Key Market Segments

By Function

- Solvents

- Chemical Intermediates

- Additives

By End User

- Paints Coating

- Chemicals

- Construction

- Polymer Plastics

- Textile

- Leather

- Agrochemicals

- Automotive

- Others

Driving Factors

Rising Demand for Sustainable and Efficient Solvents

One of the key driving factors for the Diacetone Alcohol Market is the growing demand for sustainable, high-performance solvents across coatings, adhesives, and industrial applications. Industries are moving toward low-VOC and environmentally safe formulations, and Diacetone Alcohol fits perfectly due to its low volatility, high solvency, and compatibility with eco-friendly systems.

It plays a vital role in modern water-based coatings and surface treatments where both performance and sustainability are essential. Growing infrastructure projects, along with the rise of advanced coatings in automotive and construction, are boosting usage. Additionally, new investments in green technologies, such as VitalFluid securing €5 million in funding to advance sustainable AgTech, highlight the global shift toward cleaner chemistry that indirectly supports Diacetone Alcohol’s market expansion.

Restraining Factors

Stringent Environmental Regulations and Safety Limitations Impact

A major restraining factor for the Diacetone Alcohol Market is the growing stringency of environmental and safety regulations on chemical manufacturing and solvent usage. Governments worldwide are enforcing tighter controls on volatile organic compounds (VOCs) and solvent emissions, which increases production costs and restricts usage in some industrial processes. Handling and storage also require strict safety measures due to their flammability and potential health risks, making compliance expensive for smaller producers.

Moreover, industries are gradually shifting toward bio-based alternatives, which can limit traditional solvent demand. However, new funding within the specialty chemical ecosystem, such as Scimplify raising $9.5 million from Omnivore and others, shows ongoing efforts to develop safer, sustainable chemical solutions that can help address these market restraints.

Growth Opportunity

Expanding Use in Eco-Friendly Coating Formulations

A major growth opportunity for the Diacetone Alcohol Market lies in its expanding use in eco-friendly coating and paint formulations. With industries shifting toward sustainable and low-VOC products, Diacetone Alcohol’s excellent solvency, stability, and compatibility with water-based systems make it an ideal choice for new-generation coatings. Its ability to improve gloss, flow, and durability while maintaining low odor supports its adoption in architectural, industrial, and automotive applications.

Growing demand from developing regions and the steady rise of green infrastructure projects further enhance market prospects. Additionally, strong funding activity, such as IFC investing Rs 300 crore in agrochemical firm Crystal Crop Protection, signals continued confidence in sustainable chemical solutions, indirectly creating new opportunities for diacetone alcohol applications.

Latest Trends

Growing Focus on Green and Bio-Based Solvents

One of the latest trends in the Diacetone Alcohol Market is the growing focus on developing green and bio-based solvents to meet global sustainability goals. Manufacturers are increasingly exploring renewable feedstocks and energy-efficient production methods to reduce carbon footprints and environmental impact. Diacetone Alcohol, with its balanced performance and low toxicity, fits perfectly into this trend as industries aim to replace traditional high-VOC solvents with safer alternatives.

This shift is further supported by strong financial momentum in the chemical sector, such as Kotak Mahindra investing Rs 375 crore in agrochemical company Cropnosys, reflecting increased investor confidence in sustainable chemical technologies. Such developments highlight how the market is steadily evolving toward greener, more responsible solvent innovation.

Regional Analysis

In 2024, North America held a 47.30% share, valued at USD 0.6 Bn.

In 2024, North America held a dominant position in the Diacetone Alcohol Market, capturing a 47.30% share valued at USD 0.6 billion. The region’s leadership is supported by its strong industrial base, extensive use of coatings and adhesives, and growing emphasis on low-VOC solvent technologies. The increasing adoption of sustainable manufacturing practices in the United States and Canada further strengthens market growth.

Europe follows with a well-established coatings and printing ink sector, focusing on environmental compliance and advanced formulations. Asia Pacific shows steady growth due to industrial expansion, particularly in paints, packaging, and agrochemicals, supported by rising infrastructure spending. Meanwhile, Latin America and the Middle East & Africa regions exhibit gradual development driven by growing construction and manufacturing activities.

However, North America remains the leading region, benefiting from high regulatory standards, innovation in specialty chemicals, and robust demand from downstream industries such as automotive and building materials. The combination of sustainable product adoption and advanced industrial operations continues to secure North America’s dominance and influence in the global Diacetone Alcohol Market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Arkema Group continues to strengthen its presence in the global Diacetone Alcohol market through its focus on high-performance and sustainable chemical solutions. The company’s diversified product portfolio and ongoing investments in environmentally friendly technologies support the growing demand for solvents and intermediates across coatings, adhesives, and industrial formulations. Arkema’s strategic direction toward reducing carbon intensity and improving production efficiency aligns well with market trends favoring low-VOC and bio-based solvents.

Prasol Chemical Pvt. Ltd has been expanding its specialty chemical capabilities, emphasizing the production of solvents and intermediates with improved purity and consistency. The company’s robust domestic presence and export-oriented approach allow it to serve both local and international coatings and adhesive manufacturers. Prasol’s emphasis on quality, innovation, and regulatory compliance strengthens its competitiveness in the Diacetone Alcohol segment.

Tianjin Daofu Chemical New Technology Development demonstrates a strong focus on research-driven manufacturing and process innovation. Its operations reflect China’s growing investment in high-value chemical intermediates and advanced solvent technologies. The company’s continuous improvements in production efficiency, safety, and environmental management contribute to its growing influence in the regional and global Diacetone Alcohol market, particularly in meeting the rising demand for sustainable and high-performance industrial chemicals.

Top Key Players in the Market

- Arkema Group

- Prasol Chemical Pvt. Ltd

- Tianjin Daofu Chemical New Technology Development

- Solventis Ltd.

- Monument Chemicals, Inc

- Solvay S.A

- Mitsubishi Chemical Corporation

Recent Developments

- In October 2025, Prasol filed a Draft Red Herring Prospectus (DRHP) with the capital markets regulator to raise up to ₹500 crore via an initial public offering (IPO). The fresh issue of shares worth ₹ 80 crore and an offer-for-sale worth ₹ 420 crore are planned to repay debt and fund capacity expansion at its units in Maharashtra.

- In October 2024, Arkema launched a bio-based version of its ethyl acrylate monomer, produced entirely from bioethanol at its Carling facility in France. The product achieves a ~40% bio-carbon content and reduces product carbon footprint by up to ~30%.

Report Scope

Report Features Description Market Value (2024) USD 1.4 Billion Forecast Revenue (2034) USD 2.2 Billion CAGR (2025-2034) 4.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Function (Solvents, Chemical Intermediates, Additives), By End User (Paints Coating, Chemicals, Construction, Polymer Plastics, Textile, Leather, Agrochemicals, Automotive, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Arkema Group, Prasol Chemical Pvt. Ltd, Tianjin Daofu Chemical New Technology Development, Solventis Ltd., Monument Chemicals, Inc, Solvay S.A, Mitsubishi Chemical Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Diacetone Alcohol MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample

Diacetone Alcohol MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Arkema Group

- Prasol Chemical Pvt. Ltd

- Tianjin Daofu Chemical New Technology Development

- Solventis Ltd.

- Monument Chemicals, Inc

- Solvay S.A

- Mitsubishi Chemical Corporation