Global Defoamer Market Size, Share, And Business Benefits By Product (Water-Based, Oil-Based, Silicone-Based, Others), By Medium of Dispersion (Aqueous Systems, Solvent based Systems), By Application (Coatings, Adhesives, Detergents, Wood Pulp, Food Processing, Wastewater Treatment, Others), By End Use (Paint and Coatings, Oil and Gas, Food and Beverages, Pharmaceuticals, Textile, Pulp and Paper, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: August 2025

- Report ID: 154509

- Number of Pages: 390

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

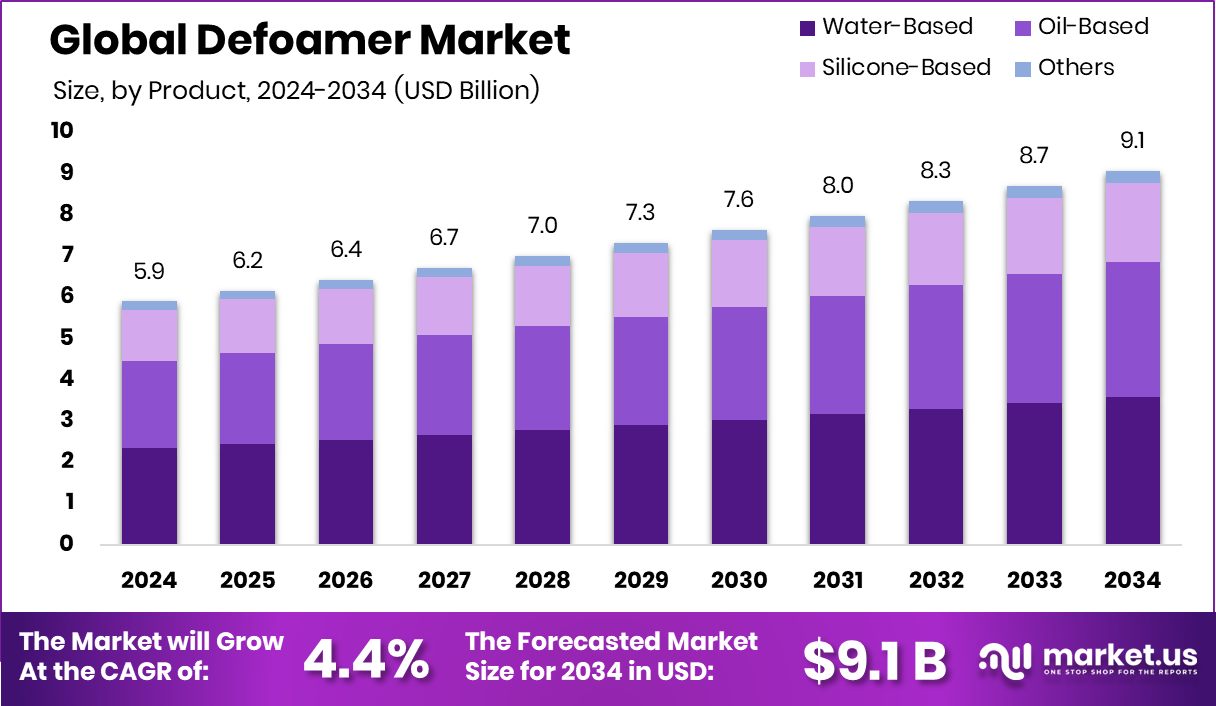

The Global Defoamer Market is expected to be worth around USD 9.1 billion by 2034, up from USD 5.9 billion in 2024, and is projected to grow at a CAGR of 4.4% from 2025 to 2034. Strong manufacturing growth in Asia-Pacific drives demand, supporting its 39.6% market dominance.

A defoamer is a chemical additive used to eliminate or reduce foam formation in industrial liquids. Foam can hinder processing efficiency and damage equipment, especially in systems involving agitation, aeration, or chemical reactions. Defoamers are typically added to prevent foam during production or to break existing foam. They are commonly formulated using oils, silicones, or other surfactants and are applied across various industries, including food processing, pulp and paper, paints and coatings, wastewater treatment, and pharmaceuticals.

The defoamer market refers to the global trade and application of defoaming agents across multiple industries that depend on foam-free processes. These products play a vital role in maintaining operational efficiency and product quality. The market encompasses various types of defoamers, including oil-based, silicone-based, water-based, and powder forms, each tailored to specific industrial needs. The rising demand for cleaner production and sustainable chemical processes is influencing the growth and innovation in this market.

One key growth factor is the rapid expansion of the wastewater treatment industry. As governments enforce stricter environmental norms and industries adopt closed-loop water systems, the use of defoamers has grown significantly to control foam in aeration tanks and clarifiers. Additionally, the demand for bio-based defoamers is increasing due to rising sustainability goals in manufacturing.

Defoamers are in high demand in sectors such as pulp and paper, paints and coatings, and food and beverages. In paper manufacturing, for instance, foam can interrupt sheet formation and reduce paper quality, which drives consistent usage of defoamers. The paint industry uses them to ensure smooth application and surface finish without air bubbles.

Key Takeaways

- The Global Defoamer Market is expected to be worth around USD 9.1 billion by 2034, up from USD 5.9 billion in 2024, and is projected to grow at a CAGR of 4.4% from 2025 to 2034.

- In 2024, water-based products led the Defoamer Market, capturing 39.6% due to eco-friendly demand.

- Aqueous systems dominated by medium of dispersion, accounting for 59.4% in Defoamer Market applications requiring water compatibility.

- Coatings held the highest application share in 2024, with 27.8%, driven by rising industrial surface treatments.

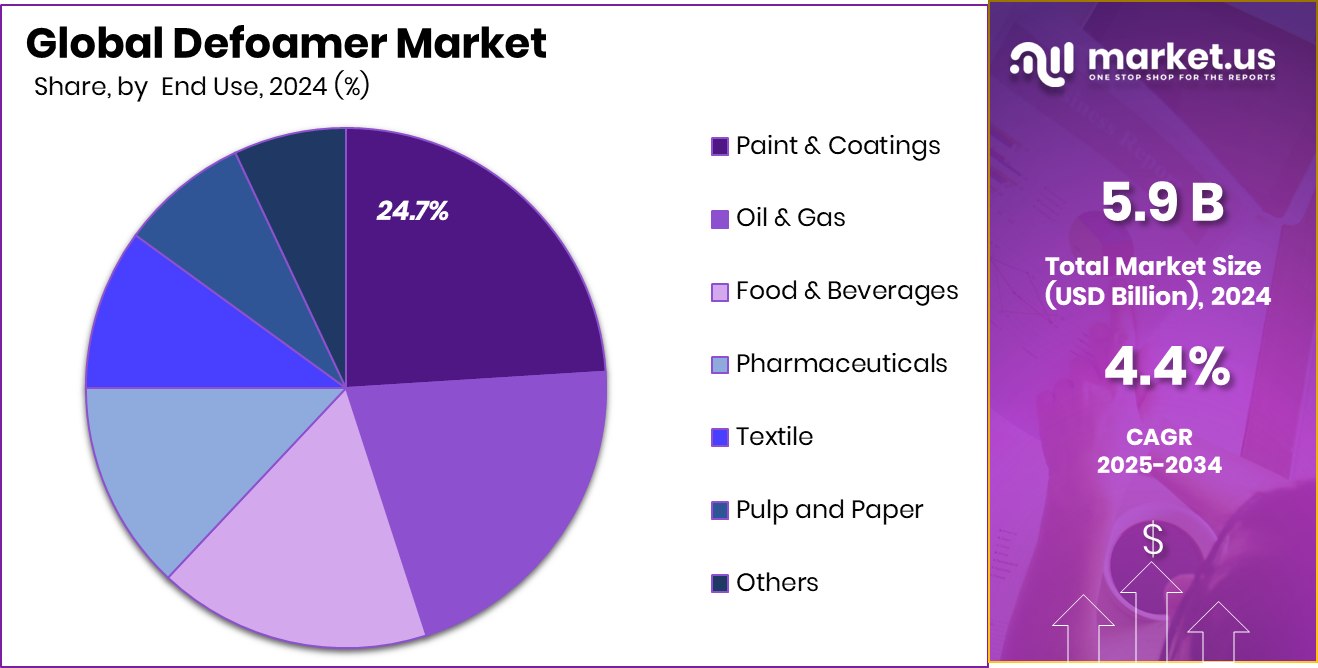

- The paint and coatings sector led end-use demand in the Defoamer Market, securing a 24.7% market share.

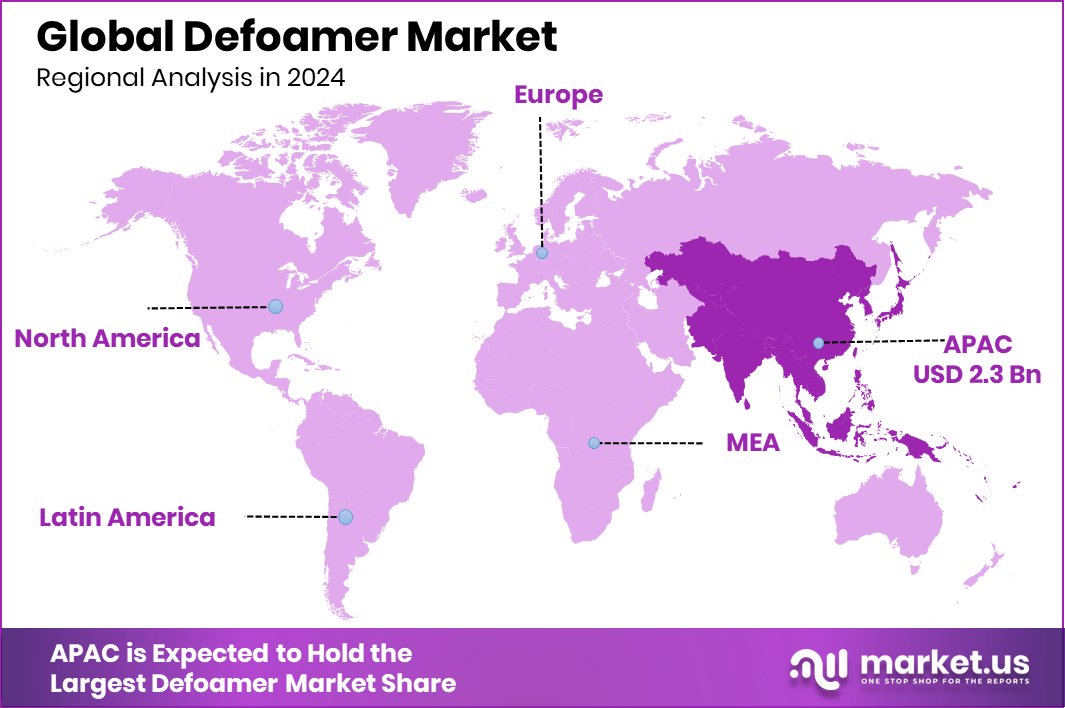

- Asia-Pacific defoamer industry reached a total value of USD 2.3 billion in 2024.

By Product Analysis

In 2024, water-based defoamers led the Defoamer Market with a 39.6% share.

In 2024, Water-Based held a dominant market position in By Product segment of Defoamer Market, with a 39.6% share. This leadership is primarily driven by the increasing shift toward environmentally friendly and low-VOC formulations across industries such as wastewater treatment, food processing, and pharmaceuticals. Water-based defoamers are widely preferred due to their compatibility with aqueous systems and ease of application, especially in operations requiring non-toxic and biodegradable ingredients.

Their use is also favored in settings where regulatory compliance with environmental standards is essential, contributing to their steady demand. Furthermore, these defoamers offer effective foam control with minimal residue, making them suitable for systems with sensitive surfaces or high-purity requirements. In addition, the demand from manufacturing units adopting sustainable practices has reinforced the growth of this segment.

With their balance of performance, safety, and environmental compliance, water-based defoamers have become the first choice in many processing applications. As industries continue to prioritize green chemistry and resource-efficient production, the water-based product category is expected to maintain its strong market hold.

By Medium of Dispersion Analysis

Aqueous systems dominated by medium of dispersion, capturing 59.4% of the defoamer market share.

In 2024, Aqueous Systems held a dominant market position in the By Medium of Dispersion segment of the Defoamer Market, with a 59.4% share. This substantial market share reflects the high compatibility of aqueous dispersion systems with a broad range of water-based industrial processes. Industries such as wastewater treatment, pulp and paper, and food processing increasingly prefer aqueous systems for their ease of integration, low environmental impact, and effective foam control properties.

These systems are particularly suited for operations where water is the primary medium, enabling consistent dispersion of defoaming agents without disrupting the process chemistry. Their dominance is also reinforced by regulatory trends that favor water-based over solvent-based formulations due to lower emissions and safer handling. Moreover, aqueous systems offer excellent stability and minimal contamination risk, supporting their adoption in high-purity and hygiene-sensitive applications.

The 59.4% share in 2024 highlights the industrial shift toward safer and more sustainable defoaming solutions. As manufacturers continue to prioritize cleaner operations and align with environmental standards, the preference for aqueous systems in the medium of dispersion segment is expected to remain strong, anchoring their leading position in the global defoamer market.

By Application Analysis

Coatings application held a major position, accounting for 27.8% of the total market.

In 2024, Coatings held a dominant market position in the By Application segment of the Defoamer Market, with a 27.8% share. This significant share is attributed to the critical role defoamers play in enhancing the performance and appearance of coatings by preventing foam formation during production and application. Foam can negatively affect surface smoothness, gloss level, and film integrity, making defoamers essential in achieving consistent quality.

The demand for defoamers in the coatings industry is further supported by the widespread use of water-based formulations, where foam control is more challenging. Defoamers are added during both the manufacturing and application stages to reduce surface defects, improve leveling, and ensure efficient processing. The 27.8% share demonstrates the coatings sector’s reliance on defoaming technologies to meet quality standards and customer expectations across decorative, industrial, and protective coatings.

In addition, the rising global demand for coatings across construction, automotive, and general manufacturing sectors has reinforced the need for effective defoamer solutions. The consistent use of defoamers in coatings ensures production efficiency and superior end-product finish, securing their leading position in this application segment within the global defoamer market in 2024.

By End Use Analysis

Paint and coatings end-use contributed 24.7% to the overall defoamer market value.

In 2024, Paint and Coatings held a dominant market position in the By End Use segment of Defoamer Market, with a 24.7% share. This leadership is primarily driven by the growing reliance on defoamers to maintain the quality, consistency, and finish of paint and coating products. Foam formation during manufacturing or application can cause surface defects such as craters, pinholes, or uneven textures, which directly impact visual appeal and protective performance.

To address this, defoamers are incorporated at various stages of production to ensure smooth processing and optimal end-product quality. In water-based paints especially where foam is more prevalent, defoamers help to minimize air entrapment and maintain uniform film formation. The 24.7% share indicates the high usage of defoamers within this sector, reflecting both the volume of coatings produced globally and the necessity for precise application standards.

As decorative and industrial coatings continue to serve expanding construction and infrastructure needs, the demand for effective foam control remains essential. The Paint and Coatings segment’s strong position in 2024 underscores its critical role in driving defoamer consumption and highlights the importance of performance-enhancing additives in maintaining product quality and market competitiveness.

Key Market Segments

By Product

- Water-Based

- Oil-Based

- Silicone-Based

- Others

By Medium of Dispersion

- Aqueous Systems

- Solvent-based Systems

By Application

- Coatings

- Adhesives

- Detergents

- Wood Pulp

- Food Processing

- Wastewater Treatment

- Others

By End Use

- Paint and Coatings

- Oil and Gas

- Food and Beverages

- Pharmaceuticals

- Textile

- Pulp and Paper

- Others

Driving Factors

Eco-Friendly Demand Boosts Water-Based Defoamer Adoption

One of the top driving factors for the defoamer market is the growing demand for eco-friendly and safer chemicals, especially in industries like paints, coatings, food processing, and water treatment. Many companies are moving away from solvent-based chemicals and shifting toward water-based defoamers due to their lower toxicity, reduced environmental impact, and compliance with global safety regulations.

Water-based defoamers are not only effective but also meet the increasing need for sustainable production processes. With rising awareness of environmental safety and stricter pollution control rules, manufacturers are choosing greener options. This shift has significantly boosted the demand for water-based defoamers, making it a key growth driver in both developed and developing countries in 2024.

Restraining Factors

Performance Limitations in High-Temperature Industrial Processes

One of the main restraining factors in the defoamer market is the reduced performance of some defoamers under high-temperature or high-pressure industrial conditions. In industries such as metalworking, oil refining, or chemical manufacturing, where extreme heat is common, certain water-based or silicone-free defoamers may break down or lose effectiveness. This limits their usage and forces companies to rely on more expensive or less eco-friendly alternatives.

Additionally, inconsistent foam suppression in challenging environments can lead to production delays and quality issues. As a result, end-users may hesitate to switch to newer or greener defoamer options without proven long-term stability. These performance limitations continue to slow down broader adoption in specific high-intensity industrial sectors.

Growth Opportunity

Opportunity in Biodegradable and Low-VOC Defoamer Solutions

The greatest growth opportunity in the defoamer market lies in the development of biodegradable and low‑volatile organic compound (VOC) formulations. As industries increasingly adopt sustainable manufacturing practices and comply with tightening environmental regulations, there is a rising demand for defoamers that are eco‑friendly and safe for sensitive environments.

Biodegradable formulations reduce chemical residues and minimize environmental impact, while low‑VOC variants support air quality standards and worker safety. Such defoamers are especially valuable in sectors like food and beverage processing, pharmaceuticals, and water treatment, where product purity and minimal chemical residues are essential.

Companies that innovate in this area can gain a competitive edge by offering green defoamer options that perform effectively while meeting health and environmental requirements. This opportunity is expected to become a key driver of market expansion as sustainability remains a central concern in global industrial operations.

Latest Trends

Shift Toward Biobased Natural Defoamer Ingredients Development

One of the latest trends in the defoamer market is the growing adoption of biobased and naturally derived ingredients in product formulations. Plant-derived oils, natural fatty alcohols, and fermentation-based surfactants are being used to design defoamers with lower environmental impact and reduced chemical residues. Manufacturers are moving away from synthetic or petroleum‑based additives in favor of renewable and biodegradable feedstocks.

This trend aligns with broader sustainability goals in industries such as food processing, pharmaceuticals, and water treatment, where cleaner production processes are highly valued. Because these natural ingredient‑based defoamers often offer comparable foam control performance while improving regulatory acceptance, their popularity is rising.

The shift also appeals to end users concerned about chemical exposure, product purity, and green branding. As research continues to refine natural formulations for stability and efficiency, biobased defoamer solutions are becoming a compelling trend with strong potential for further adoption.

Regional Analysis

In 2024, Asia-Pacific led the defoamer market with 39.6% regional share.

In 2024, Asia-Pacific emerged as the leading region in the global defoamer market, capturing a dominant 39.6% share and generating approximately USD 2.3 billion in revenue. This strong regional performance is primarily driven by rapid industrial growth and expanding applications of defoamers across manufacturing hubs in China, India, Japan, and Southeast Asia. The presence of large-scale operations in paints and coatings, water treatment, pulp and paper, and food processing industries has significantly increased the consumption of defoamers in this region.

North America and Europe followed in market contribution, supported by steady demand from mature industrial sectors and a consistent focus on regulatory compliance and sustainable production practices. Meanwhile, the Middle East & Africa and Latin America accounted for comparatively smaller shares, though these regions are witnessing gradual adoption of defoamers in water-intensive industries and infrastructure development.

Across all regions, environmental regulations and the push for eco-friendly chemical formulations are influencing product demand, with Asia-Pacific maintaining a clear lead in both volume and value. The regional market dynamics indicate that Asia-Pacific’s dominant position is likely to persist, given the pace of industrialization and the growing preference for efficient, cost-effective foam control solutions in large-scale production environments.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Kemira Oyj, a Finland-based specialty chemicals company, continued its leadership through well-established water treatment and industrial chemical operations. The firm maintained robust supply chains and technical expertise in custom defoamer formulations, catering to pulp and paper, wastewater treatment, and coatings sectors. Its established production infrastructure and industry partnerships reinforced its market resilience and responsiveness to client-specific foam control needs.

Air Products and Chemicals, Inc., recognized for its industrial gas and performance chemicals, played a significant role in providing silicone and oil-based defoaming agents. Its access to broad industrial applications and capacity to produce consistent, high-volume chemical intermediates allowed supply reliability in sectors such as refining, mining, and plastics. The firm’s integration across various chemical streams enhanced its agility and scale in global distribution.

Ashland Inc. remained a key specialty chemical provider with a focused portfolio in performance additives. The company’s innovative formulations—including low‑VOC and high‑efficiency defoaming products—were widely adopted in coatings, adhesives, and personal care applications. Ashland’s emphasis on R&D investment and formulation expertise enabled tailored solutions to meet performance criteria, reinforcing demand in regulated and quality-sensitive end‑use segments.

Bluestar Silicones International, specializing in silicone-based additives, contributed advanced silicone defoamer systems engineered for precise foam control in coatings and lubricant industries. Its specialty silicone technologies offered thermal stability and compatibility across diverse chemical environments. Bluestar’s technical service support and formulation collaboration further strengthened its position in high-performance industrial applications.

Top Key Players in the Market

- Kemira Oyj

- Air Products and Chemicals, Inc.

- Ashland Inc.

- Bluestar Silicones International

- Dow Inc.

- Evonik Industries AG

- Wacker Chemie AG

- Shin-Etsu Chemical Co., Ltd.

- BASF SE

- Elementis PLC

Recent Developments

- In May 2024, Dow introduced DOWSIL™ ACP‑3089, a combined antifoam and defoamer solution specifically designed for the pulp industry. This all‑in‑one compound offers enhanced chemistry for better foam control performance and improved sustainability compared to prior products.

- In April 2024, Kemira Oyj signed an exclusive distribution agreement to supply pulp defoamer and drainage technology in Brazil. Under this arrangement, Kemira became the sole provider of BIM Kemi’s pulp defoamer products to the Brazilian pulp market. This step expanded Kemira’s presence in pulp-related defoamer solutions for tissue and packaging applications.

Report Scope

Report Features Description Market Value (2024) USD 5.9 Billion Forecast Revenue (2034) USD 9.1 Billion CAGR (2025-2034) 4.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Water-Based, Oil-Based, Silicone-Based, Others), By Medium of Dispersion (Aqueous Systems, Solvent based Systems), By Application (Coatings, Adhesives, Detergents, Wood Pulp, Food Processing, Wastewater Treatment, Others), By End Use (Paint and Coatings, Oil and Gas, Food and Beverages, Pharmaceuticals, Textile, Pulp and Paper, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Kemira Oyj, Air Products and Chemicals, Inc., Ashland Inc., Bluestar Silicones International, Dow Inc., Evonik Industries AG, Wacker Chemie AG, Shin-Etsu Chemical Co., Ltd., BASF SE, Elementis PLC Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Kemira Oyj

- Air Products and Chemicals, Inc.

- Ashland Inc.

- Bluestar Silicones International

- Dow Inc.

- Evonik Industries AG

- Wacker Chemie AG

- Shin-Etsu Chemical Co., Ltd.

- BASF SE

- Elementis PLC