Global De-Oiled Lecithin Market Size, Share Analysis Report By Source (Soybean, Sunflower, Rapeseed And Canola, Eggs, Others), By Nature (GMO, NON-GMO), By Form (Powder, Granules), By Method of Extractions (Acetone Extraction, Carbon Dioxide Extraction, Ultrafiltration Process), By Applications (Food And Beverages, Feed, Industrial, Health Care Products, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 168928

- Number of Pages: 274

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

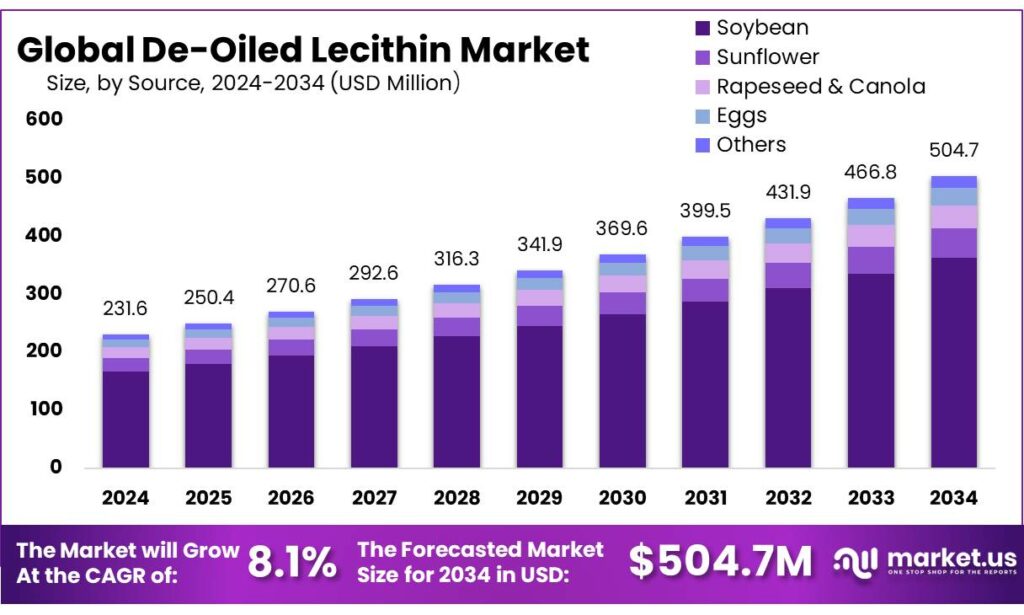

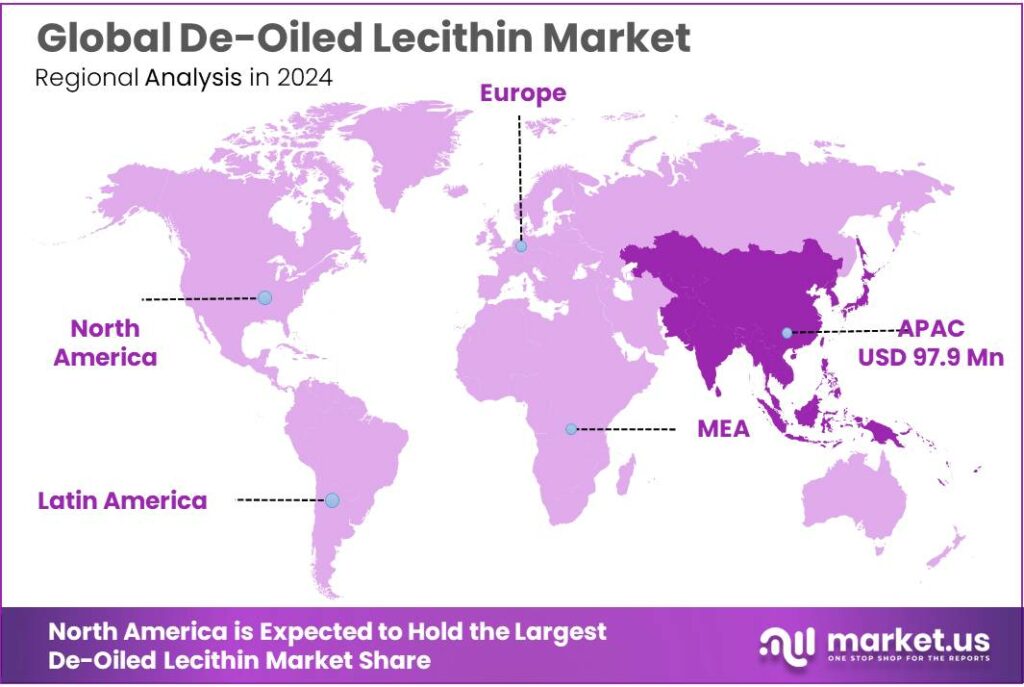

The Global De-Oiled Lecithin Market size is expected to be worth around USD 504.7 Million by 2034, from USD 231.6 Million in 2024, growing at a CAGR of 8.1% during the forecast period from 2025 to 2034. In 2024, Asia-Pacific (APAC) held a dominant market position, capturing more than a 42.3% share, holding USD 97.9 Million revenue.

De-oiled lecithin is a purified, virtually fat-free phospholipid fraction derived from crude lecithin obtained during the degumming of vegetable oils, mainly soybean, sunflower and rapeseed. The USDA Agricultural Marketing Service notes that lecithin already has “dozens of applications” across food, animal feed, pharmaceuticals, cosmetics and industrial products, highlighting its role as a multifunctional emulsifier and surface-active agent in global processing chains.

- Industrial supply is structurally tied to the vegetable-oil crushing sector. According to FAO statistics, global production of the main oil crops reached about 893 million tonnes in 2023, underlining the scale of the feedstock base for lecithin co-products. A separate 2024 analysis reports that the world soybean harvest alone was around 398.2 million tonnes in 2023, reaffirming soy’s position as the dominant commercial source of lecithin and de-oiled lecithin.

On the demand side, de-oiled lecithin powders are increasingly preferred in instant beverages, bakery premixes, chocolate, sports nutrition and feed formulations because they disperse easily, improve wettability and enable low-fat, label-friendly formulations. Growth in processed foods and high-performance animal feeds is reinforced by rising protein consumption; FAO reports that global production of chicken, pig and cattle meat reached about 321 million tonnes in 2023, sustaining a large feed industry that uses lecithin for fat metabolism and feed efficiency in poultry and aquaculture.

Regulation is broadly supportive, which is a key structural driver. In the European Union, lecithins are authorised as food additive E322 in most food categories under Regulation (EC) No 1333/2008. EFSA’s re-evaluation confirms their use even in sensitive segments such as infant formula and special medical foods, with lecithin permitted at levels up to 1,000 mg/L in certain infant categories, pushing demand for high-purity, carefully controlled de-oiled grades.

Government and regulatory endorsement also supports long-term demand, especially in animal nutrition. In the European Union, Commission Implementing Regulation (EU) 2017/2325 formally authorises lecithins, including de-oiled lecithins, as feed additives for all animal species, classified as technological additives in the functional group emulsifiers.

The European Food Safety Authority (EFSA) concluded that de-oiled lecithin does not pose adverse effects to animal or human health when used as proposed and is efficacious as an emulsifier, providing strong regulatory reassurance for feed manufacturers and integrated livestock producers.

Key Takeaways

- De-Oiled Lecithin Market size is expected to be worth around USD 504.7 Million by 2034, from USD 231.6 Million in 2024, growing at a CAGR of 8.1%.

- Soybean held a dominant market position, capturing more than a 72.4% share.

- NON-GMO held a dominant market position, capturing more than a 66.2% share.

- Powder held a dominant market position, capturing more than a 78.3% share.

- Acetone Extraction held a dominant market position, capturing more than a 59.7% share.

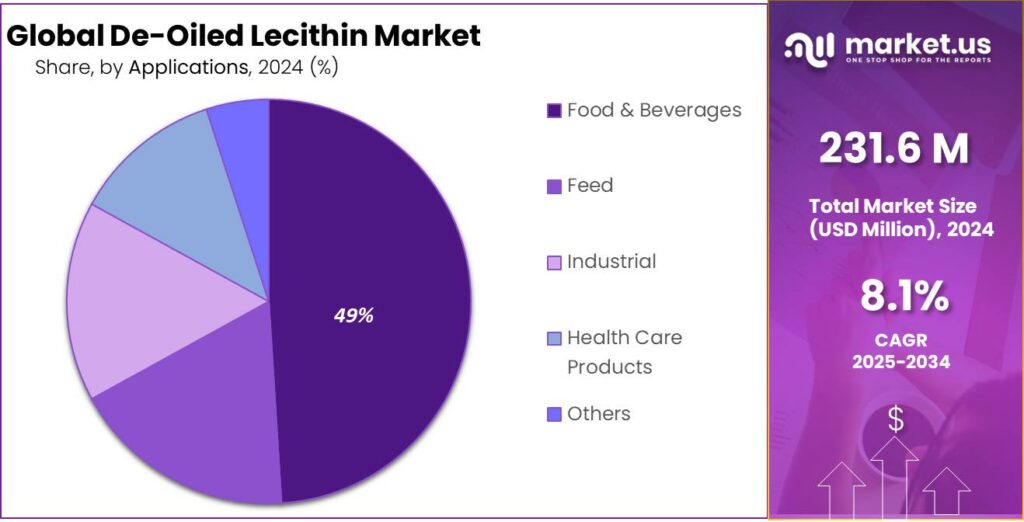

- Food & Beverages held a dominant market position, capturing more than a 49.1% share.

- Asia-Pacific (APAC) region held a dominant position in the global de-oiled lecithin market, capturing more than a 42.3% share, with a market value of approximately USD 97.9 million.

By Source Analysis

Soybean leads with 72.4% — chosen for its wide availability and consistent lecithin yield.

In 2024, Soybean held a dominant market position, capturing more than a 72.4% share; this outcome can be attributed to the crop’s widespread cultivation, established crushing infrastructure and high phospholipid yield that make soybean the most economical and reliable source of de-oiled lecithin for food, feed and industrial uses.

Supply chains and processing capacity for soybean lecithin were favoured because they reduce raw-material volatility and allow consistent quality and volume for downstream formulators. During 2024–2025, demand patterns were influenced by stable soybean supply and steady end-use uptake in bakery, confectionery and infant-nutrition formulations, while manufacturers emphasised supply-chain traceability and solvent-free processing to meet regulatory and clean-label requirements.

By Nature Analysis

NON-GMO De-Oiled Lecithin leads the market with a strong 66.2% share driven by clean-label demand.

In 2024, NON-GMO held a dominant market position, capturing more than a 66.2% share. The growth of this segment was supported by the rising demand for clean-label, traceable, and safer ingredients across food, nutrition, and infant formula applications. Strong preference for natural sourcing encouraged manufacturers to expand NON-GMO lecithin production capacities during 2024, and steady momentum is expected to continue through 2025 as regulatory focus on ingredient transparency becomes stricter in both developed and emerging markets. Increasing adoption in bakery, confectionery, and dietary supplements further strengthened its share, as brands aligned their product portfolios with consumer health awareness and non-GMO certification standards.

By Form Analysis

Powder form leads the market with a strong 78.3% share due to its high stability and wider usage.

In 2024, Powder held a dominant market position, capturing more than a 78.3% share. The increasing preference for powdered de-oiled lecithin was driven by its better shelf stability, ease of handling, and improved dispersibility across food, feed, and pharmaceutical applications. In 2024, strong uptake was recorded in bakery, instant mixes, nutraceuticals, and animal nutrition, as manufacturers preferred powder for its uniform performance and cost efficiency. This momentum is expected to continue in 2025, supported by rising demand for functional ingredients and the growing use of powder formulations in clean-label and high-protein food products.

By Method of Extractions Analysis

Acetone Extraction dominates with 59.7% as producers rely on its high efficiency and purity output.

In 2024, Acetone Extraction held a dominant market position, capturing more than a 59.7% share. The strong preference for this method was driven by its ability to deliver higher purity de-oiled lecithin and its suitability for large-scale commercial processing. In 2024, steady demand came from food, feed, and industrial users who required consistent quality and stable performance. This method continued to gain traction in 2025 as manufacturers focused on improved efficiency, reliable yield, and cost-effective refining processes to meet the growing need for clean and functional lecithin ingredients.

By Applications Analysis

Food & Beverages leads with 49.1% due to rising demand for functional and clean-label ingredients.

In 2024, Food & Beverages held a dominant market position, capturing more than a 49.1% share. The growth of this segment was driven by the increasing use of de-oiled lecithin as an emulsifier, stabilizer, and texture enhancer in bakery, confectionery, dairy, and beverage products. Manufacturers preferred lecithin to improve product consistency, extend shelf life, and meet consumer demand for natural and clean-label ingredients. In 2025, the segment is expected to maintain its leadership, supported by expanding processed food production, growing health-conscious consumption trends, and the rising popularity of plant-based and functional foods globally.

Key Market Segments

By Source

- Soybean

- Sunflower

- Rapeseed & Canola

- Eggs

- Others

By Nature

- GMO

- NON-GMO

By Form

- Powder

- Granules

By Method of Extractions

- Acetone Extraction

- Carbon Dioxide Extraction

- Ultrafiltration Process

By Applications

- Food & Beverages

- Feed

- Industrial

- Health Care Products

- Others

Emerging Trends

Traceable, sustainable lecithin becomes the new normal

A clear new trend around de-oiled lecithin is the move toward sustainable, traceable and non-GMO supply chains, especially for soy and sunflower sources. Food brands no longer want lecithin to be a “black box” by-product of crushing. They want to know where the beans were grown, whether forests were cleared, and how farmers are treated. De-oiled lecithin, used in very visible categories like chocolate, bakery, infant formula and plant-based drinks, is right at the centre of this shift.

This trend is happening while oilseed supply keeps growing. The FAO’s 2025 Food Outlook says global oilseed production could reach a record 695.9 million tonnes, driven mainly by higher soybean output. The OECD-FAO Agricultural Outlook also expects food use of vegetable oils to make up 57% of total vegetable oil consumption by 2032, as lower- and middle-income countries use more oil in everyday diets. This means more crushing, more crude lecithin — and more pressure from buyers to make that lecithin clearly “responsible”.

- Certification is becoming a practical way to prove that story. The Round Table on Responsible Soy (RTRS) reports that 7.5 million tonnes of RTRS-certified soybeans were produced in 2023, a 6.4% increase versus 2022. The certified area reached about 2.2 million hectares, up 10.5% year-on-year, and involves over 77,000 certified producers worldwide.

Policy in major markets is pushing the same way. The European Union’s Regulation (EU) 2023/1115 on deforestation-free products requires companies placing soy and several other commodities on the EU market to prove that they are “deforestation-free” and comply with local laws, backed by geolocation and due-diligence statements.

Drivers

Rising clean-label, plant-based demand boosts de-oiled lecithin

A major driving force behind de-oiled lecithin demand is the steady rise of clean-label and plant-based foods, backed by a very strong oilseed and soybean base. De-oiled lecithin is a low-fat, highly concentrated phospholipid powder that works as a natural emulsifier in bakery, chocolate, instant drinks, infant formula and feed. Because it is plant-derived and label-friendly, it fits perfectly into reformulation projects where brands want to remove synthetic emulsifiers but keep the same texture and shelf life.

- FAO’s 2024 Food Outlook expects total oilseed production in 2023/24 to hit a record 667.6 million tonnes, with another potential record of 695.9 million tonnes forecast for 2024/25 as soybean output increases again. This expanding raw-material base keeps de-oiled lecithin supply relatively stable and supports long-term contracts for food and feed manufacturers.

The US Department of Agriculture (USDA) projected that the global soybean harvest for 2023/24 would reach a record 410.6 million tonnes, up 11% or 40.2 million tonnes from the previous season. A separate USDA-linked forecast lifted expected US soybean production for 2024/25 to 124.9 million tonnes, reflecting higher harvested area and better yields. An IISD global soybean report notes that soybean output rose from 231 million tonnes in 2008 to 353 million tonnes in 2020, while supporting around 280,000 farmers in the United States and some 240,000 soybean farms in Brazil.

- Policy and regulation also reinforce this driver, particularly in animal nutrition. The European Union’s Commission Implementing Regulation (EU) 2017/2325 formally authorises preparations of lecithins, including de-oiled lecithins, as feed additives for all animal species in the technological additive category “emulsifiers.” EFSA’s scientific opinion concluded that lecithins are safe for all target species and that setting a maximum content is not necessary, while confirming their efficacy as emulsifiers.

Restraints

Allergen and GMO concerns slow de-oiled lecithin adoption

A key restraint for de-oiled lecithin – especially soy-based grades – is the mix of allergy worries and GMO labelling rules. On paper, lecithin is a safe, well-known emulsifier. In practice, many food and nutrition brands hesitate to rely on soy-derived de-oiled lecithin because it sits in the middle of two sensitive topics: food allergies and genetically modified crops.

- GMO labelling rules add another layer of complexity. In the European Union, Regulations (EC) 1829/2003 and 1830/2003 require that food and feed containing authorised GM material above 0.9% per ingredient must be labelled as genetically modified. Industry guidance notes explain that even if companies try to avoid GMOs, small amounts can appear through “adventitious or technically unavoidable” contamination along the chain.

Similar labelling thresholds exist globally. One comparative study notes that GM food must be labelled above 0.9% in the EU, 3% in Korea and 5% in Japan, underlining how exporters of soy lecithin must juggle different national rules. In the United States, mandatory bioengineered food disclosure took effect in 2022, with a 5% threshold for inadvertent GM presence in each ingredient.

On top of the regulatory and allergen pressures, upstream vegetable oil markets remain volatile, which feeds into lecithin pricing. FAO reported that its Vegetable Oil Price Index reached 166.8 points in July 2025, up 7.1% in a single month and the highest level in three years, driven by stronger demand and tighter supplies of palm, soy and sunflower oils. Reuters likewise highlighted that vegetable oil prices in the FAO basket rose 7.1% month-on-month to 166.8 points, contributing to the global Food Price Index climbing to 130.1 points in July 2025.

Opportunity

Expanding role in plant-based and instant nutrition

One of the biggest growth openings for de-oiled lecithin lies in plant-based and instant nutrition products – from oat and soy drinks to protein shakes, meal-replacement powders and fortified kids’ beverages. In all these formats, formulators want a clean-label emulsifier that keeps powders free-flowing, disperses instantly in water and still fits vegan or vegetarian positioning. De-oiled lecithin, especially in powder form, ticks all three boxes.

The demand backdrop is strong. An industry analysis based on data from The Good Food Institute shows that global retail sales of plant-based meat, seafood, milk, yogurt, ice cream and cheese reached about USD 28.6 billion in 2024, with the United States alone accounting for USD 8.1 billion. These figures are not just about burgers; they include exactly the kinds of beverages and frozen desserts where de-oiled lecithin helps blend fats, proteins and flavours into a stable system.

Long-term expectations are also encouraging. A synthesis of Bloomberg Intelligence data, reported by several food-industry outlets, suggests that plant-based foods could reach around USD 162 billion by 2030, up from USD 29.4 billion in 2020, potentially representing 7.7% of the global protein market. Even if reality lands below this ambitious curve, the direction is clear: more plant-based launches, more complex recipes, and more need for robust, label-friendly emulsifiers like de-oiled lecithin.

Regional Insights

Asia-Pacific leads with 42.3%, valued at USD 97.9 million, driven by growing food processing and feed industries.

In 2024, the Asia-Pacific (APAC) region held a dominant position in the global de-oiled lecithin market, capturing more than a 42.3% share, with a market value of approximately USD 97.9 million. The region’s leadership is supported by its large-scale soybean cultivation, established crushing infrastructure, and growing demand for functional ingredients in food, beverages, and animal feed. Countries such as China, India, Japan, and Thailand have witnessed rapid expansion in processed food production, confectionery, bakery, and dairy sectors, where lecithin is widely used as an emulsifier, stabilizer, and texture enhancer.

The feed industry in APAC also contributes significantly to demand, particularly in poultry, swine, and aquaculture nutrition, where de-oiled lecithin improves digestibility and nutrient absorption. In 2024, production capacities in the region were expanded to meet both domestic and export requirements, and manufacturers focused on improving extraction efficiencies and quality standards to align with global compliance.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Cargill is a leading supplier of de-oiled lecithin globally, offering non-GMO, organic, and specialty lecithin products for food, feed, and industrial applications. In 2024, Cargill maintained a strong market presence with over USD 210 million in lecithin-related revenues and a production capacity exceeding 120,000 metric tons per year. The company’s global supply chain and R&D capabilities support product innovation, quality consistency, and sustainable sourcing, making it a preferred partner for bakery, confectionery, dairy, and dietary supplement manufacturers.

ADM is a major producer of de-oiled lecithin derived primarily from soybeans and sunflower seeds. In 2024, ADM contributed to the market with a production capacity of ~95,000 metric tons and estimated revenues of USD 180 million in lecithin products. ADM’s extensive global distribution network and focus on clean-label, non-GMO, and organic lecithin solutions have reinforced its position across food, beverage, and feed industries, while innovation in functional lecithin blends continues to strengthen its market footprint.

Bunge is a global agribusiness and food ingredient supplier, producing soybean and sunflower-based de-oiled lecithin for food, feed, and industrial uses. In 2024, Bunge’s lecithin division generated approximately USD 120 million in revenue with a production capacity of ~75,000 metric tons. The company emphasizes high-quality, non-GMO, and clean-label products and maintains a strong global presence through extensive processing and distribution networks that support bakery, confectionery, dairy, and nutraceutical sectors.

Top Key Players Outlook

- Cargill Incorporated

- ADM

- Stern-Wywiol Gruppe

- Bunge

- American Lecithin Company

- AAK AB

- Cargill, Incorporated

- Louis Dreyfus Company

- The Scoular Company

- Croda International

Recent Industry Developments

In 2024, Archer Daniels Midland Company (ADM) continued to play a leading role in the global de-oiled lecithin segment, leveraging over 85 years of technical expertise in lecithin and emulsifier technologies.

In 2024, American Lecithin Company remains a well-established name in the de-oiled lecithin space, drawing on more than 90 years of experience since its founding in 1929 by Joseph Eichberg.

In 2024, Cargill Incorporated is a key global supplier of de-oiled lecithin, using more than 70 years of lecithin know-how to offer one of the most extensive portfolios in the market, with 4 main types: fluid, tailored fluid, standard de-oiled and tailored/fractionated de-oiled lecithins for food, feed and pharma customers.

Report Scope

Report Features Description Market Value (2024) USD 231.6 Mn Forecast Revenue (2034) USD 504.7 Mn CAGR (2025-2034) 8.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Soybean, Sunflower, Rapeseed And Canola, Eggs, Others), By Nature (GMO, NON-GMO), By Form (Powder, Granules), By Method of Extractions (Acetone Extraction, Carbon Dioxide Extraction, Ultrafiltration Process), By Applications (Food And Beverages, Feed, Industrial, Health Care Products, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Cargill Incorporated, ADM, Stern-Wywiol Gruppe, Bunge, American Lecithin Company, AAK AB, Cargill, Incorporated, Louis Dreyfus Company, The Scoular Company, Croda International Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Cargill Incorporated

- ADM

- Stern-Wywiol Gruppe

- Bunge

- American Lecithin Company

- AAK AB

- Cargill, Incorporated

- Louis Dreyfus Company

- The Scoular Company

- Croda International