Global Cylindrical Lithium Ion Battery Market Size, Share Analysis Report By Type (Lithium Iron Phosphate, Lithium Cobaltate, Lithium Manganate, Cobalt-Manganese, Others), By Capacity (Up to 500 mAh, 500-900 mAh, 900-1,200 mAh, More than 1,200 mAh), By End-Use (Consumer Electronics, Automotive, Telecommunication, Aerospace, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 168999

- Number of Pages: 312

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

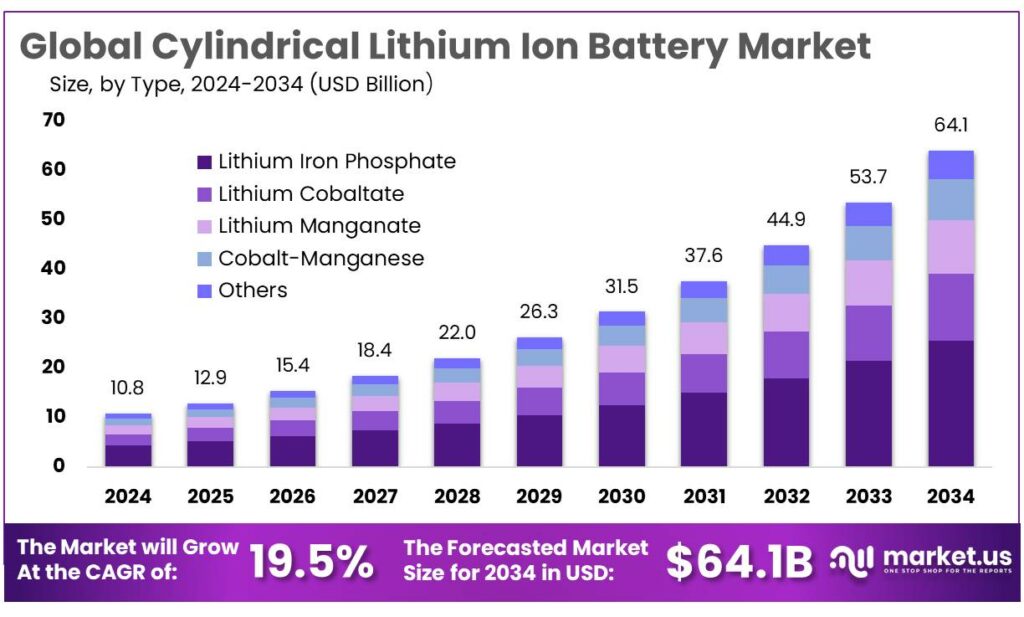

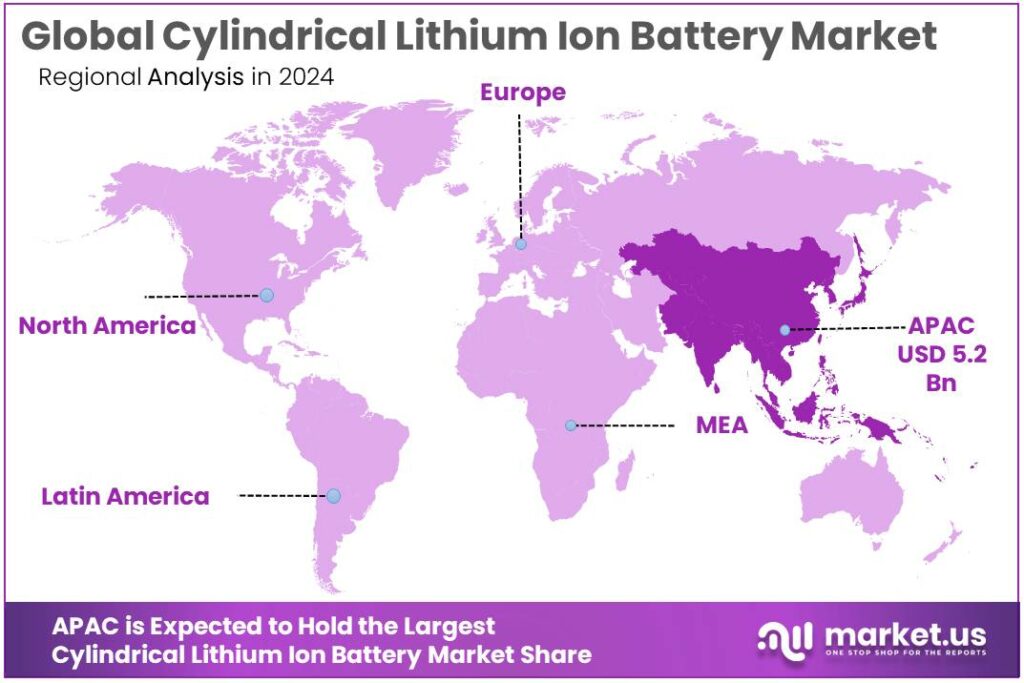

The Global Cylindrical Lithium Ion Battery Market size is expected to be worth around USD 64.1 Billion by 2034, from USD 10.8 Billion in 2024, growing at a CAGR of 19.5% during the forecast period from 2025 to 2034. In 2024, Asia Pacific held a dominant market position, capturing more than a 48.2% share, holding USD 5.2 Billion revenue.

Cylindrical lithium-ion batteries form one of the most mature and scalable cell formats in the global battery industry. Built around standardized can sizes such as 18650, 21700 and the newer large-format 4680 designs, these cells offer robust mechanical stability, high energy density and well-understood manufacturing processes, which makes them a preferred choice for power tools, two- and three-wheelers, stationary storage modules and some electric vehicles.

- The International Energy Agency (IEA) estimates that automotive lithium-ion battery demand rose from about 330 GWh in 2021 to 550 GWh in 2022, a jump of roughly 65%. By 2023, overall EV battery demand exceeded 750 GWh, up 40% year-on-year. Cylindrical formats, with their modularity and automated assembly, capture a meaningful share of this rising volume, especially in high-power and cost-sensitive applications.

The industrial landscape is undergoing a scale-up phase that directly supports cylindrical lithium-ion production. IEA commentary indicates global battery demand reached around 1 TWh in 2024, while manufacturing capacity climbed to about 3 TWh in the same year, with the potential to triple again within five years if all announced projects proceed. Such overcapacity risk at the pack level favors standardized cylindrical cells, which can be re-allocated quickly between end-markets such as consumer electronics, light EVs and stationary storage.

- Stationary storage is becoming a second growth pillar for cylindrical lithium-ion batteries. REN21 reports that global grid-connected battery storage capacity grew 120% in 2023 to reach 55.7 GW, with China alone jumping to 27.1 GW from 7.8 GW the previous year. IRENA notes that annual capacity additions increased from just 0.1 GWh in 2010 to 95.9 GWh in 2023, while installed battery-storage project costs fell from about USD 2,511/kWh to roughly USD 273/kWh over the same period.

Policy support is also shaping the industrial trajectory. In the United States, the Inflation Reduction Act’s Section 45X advanced manufacturing production credit provides up to USD 35 per kWh for domestically produced battery cells, directly improving the economics of new cylindrical cell lines. In Europe, the Net-Zero Industry Act sets a benchmark of 550 GWh of EU battery manufacturing capacity by 2030 to meet at least 40% of annual deployment needs, signaling long-term policy backing for regional cylindrical cell investments.

Emerging markets are following a similar path. India’s Production Linked Incentive (PLI) scheme for Advanced Chemistry Cell (ACC) batteries targets 50 GWh of core ACC capacity plus an additional 5 GWh for niche technologies, supported by a budget of about INR 181 billion (≈ USD 2.16 billion) over five years. These programs explicitly encourage domestic manufacturing, localization of components and technology-agnostic chemistries, opening room for cylindrical formats optimized for local vehicle and storage platforms.

Key Takeaways

- Cylindrical Lithium Ion Battery Market size is expected to be worth around USD 64.1 Billion by 2034, from USD 10.8 Billion in 2024, growing at a CAGR of 19.5%.

- Lithium Iron Phosphate held a dominant market position, capturing more than a 39.7% share.

- 900–1,200 mAh held a dominant market position, capturing more than a 34.6% share.

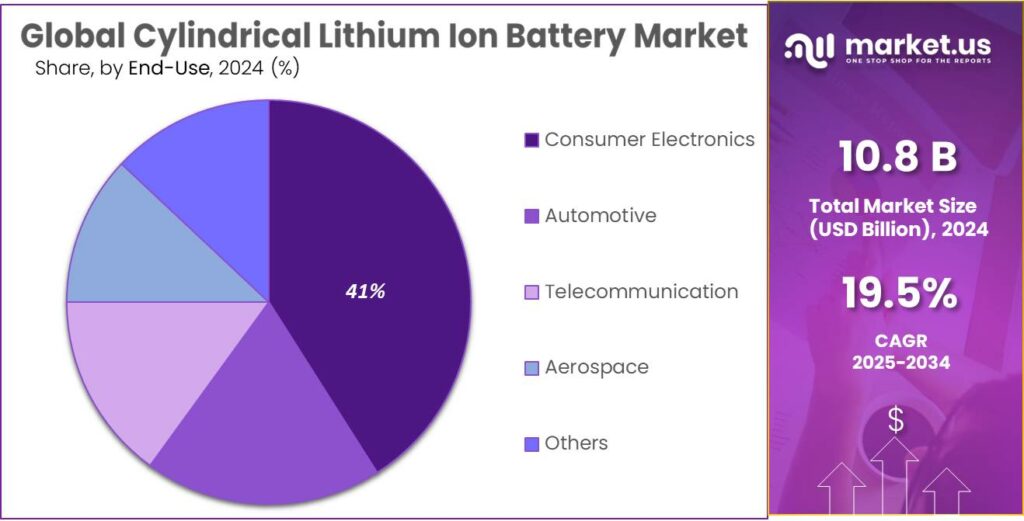

- Consumer Electronics held a dominant market position, capturing more than a 41.4 share.

- Asia-Pacific region accounted for a commanding 48.20% of the global cylindrical lithium-ion battery market, equivalent to approximately USD 5.2 billion.

By Type Analysis

Lithium Iron Phosphate leads with 39.7% — chosen for safety, long life and cost stability.

In 2024, Lithium Iron Phosphate held a dominant market position, capturing more than a 39.7% share. This outcome can be attributed to the chemistry’s inherent thermal stability, long cycle life and lower raw-material cost compared with nickel-rich alternatives, which made it the preferred choice for applications prioritizing safety and total cost of ownership. Manufacturers and OEMs favoured LFP cylindrical cells for electric two-wheelers, entry-level EVs, energy-storage systems and power tools where predictable performance and long calendar life are valued over maximum energy density.

Production investment was directed toward scaling cell manufacturing and improving volumetric energy through cell-engineering and pack-level optimisation, while suppliers focused on reliable supply chains for iron and phosphate feedstocks. Into 2025, the market trend was expected to remain supportive for LFP as cost and safety considerations continued to influence buyer decisions, sustaining its leading position in the cylindrical lithium-ion segment.

By Capacity Analysis

900–1,200 mAh leads with 34.6% — preferred for its balance of capacity, size and cost.

In 2024, 900–1,200 mAh held a dominant market position, capturing more than a 34.6% share; this range was favored because it delivers a practical balance between energy storage and compact form factor, making it suitable for power tools, mid-range portable electronics, and certain e-mobility applications where moderate runtime and easy thermal management are required. Producers prioritized this capacity band in 2024 as it allowed standardized cell formats, predictable manufacturing yields and competitive cost per watt-hour, which in turn lowered pack engineering complexity and reduced time to market for OEMs.

Across 2024–2025, incremental improvements in electrode loading and manufacturing precision were pursued to raise energy density within the same form factor, while quality control and cycle-life testing were emphasized to meet reliability expectations. As a result, the 900–1,200 mAh segment remained the pragmatic choice for many device designers who required a reliable, cost-effective cylindrical cell without the trade-offs of very high-energy or very low-capacity formats.

By End-Use Analysis

Consumer Electronics leads with 41.4% — driven by broad device penetration and demand for compact power.

In 2024, Consumer Electronics held a dominant market position, capturing more than a 41.4 share. This outcome was driven by widespread adoption of portable devices—smartphones, tablets, wearables, cameras and handheld gadgets—that require compact, reliable cylindrical lithium-ion cells. Device makers favoured standardized cylindrical formats because they simplify thermal management, assembly and supply-chain logistics, which in turn reduced unit cost and shortened time-to-market.

During 2024–2025, engineering effort was concentrated on improving energy density and cycle life within existing form factors while maintaining safety and manufacturability; as a result, manufacturers achieved incremental gains in run-time without materially changing battery size. The segment’s dominance was further supported by large OEM agreements and stable production capacity at established cell plants, ensuring steady component availability for consumer electronics supply chains and reinforcing the category’s lead in the cylindrical cell market.

Key Market Segments

By Type

- Lithium Iron Phosphate

- Lithium Cobaltate

- Lithium Manganate

- Cobalt-Manganese

- Others

By Capacity

- Up to 500 mAh

- 500-900 mAh

- 900-1,200 mAh

- More than 1,200 mAh

By End-Use

- Consumer Electronics

- Automotive

- Telecommunication

- Aerospace

- Others

Emerging Trends

Larger Cylindrical Cells Powering EVs and Cleaner Food Cold Chains

Battery makers are already shifting in this direction. Samsung SDI started production of 46-series cylindrical cells in March 2025, initially for micro-mobility in the U.S. market, with a clear plan to expand into electric vehicles. The company notes that these 46 mm cells can deliver up to around six times the capacity of older 2170 cylindrical batteries, thanks to their larger volume and better space use. In parallel, Tesla began producing its 4680 cylindrical cells in California and Texas in 2022, aiming to cut costs and improve structural efficiency in vehicles like the Model Y and Cybertruck.

- The International Energy Agency reports that battery demand in the energy sector passed 1 TWh in 2024, with EV batteries alone exceeding 950 GWh, about 25% higher than in 2023 and more than 85% of total demand. To meet this scale, manufacturers want cell formats that are easy to mass-produce, stack efficiently in packs, and deliver more range or runtime without making systems heavier. Larger cylindrical cells hit this sweet spot, so they are becoming a central part of new gigafactory roadmaps.

Food and agriculture organizations add another layer to this trend. The Food and Agriculture Organization (FAO) estimates that 13.2% of food is lost between harvest and retail, while UNEP data shows a further 19% is wasted at retail, food service, and household level. FAO also reports that lack of effective refrigeration alone causes the loss of 526 million tons of food, about 12% of global production. At the same time, the food cold chain itself is responsible for around 4% of total global greenhouse gas emissions when you include both cooling equipment and food loss due to missing refrigeration.

- Governments are reinforcing this direction through funding. In the United States, the Department of Energy has announced more than USD 3 billion in grants to strengthen domestic battery manufacturing and supply chains, including cell and module plants that can build advanced cylindrical formats. In parallel, the World Bank has mobilized about USD 157 million from the Green Climate Fund to support clean cooling projects that reduce emissions from refrigeration, a key part of food cold chains.

Drivers

Rising Electric Vehicle Production Fuels Cylindrical Lithium-Ion Battery Demand

The biggest push behind cylindrical lithium-ion batteries today is the fast rise of electric vehicles. According to the International Energy Agency, electric car sales neared 14 million in 2023, and almost one in five cars sold worldwide was electric. Most of these vehicles rely on lithium-ion packs, and many leading carmakers still choose cylindrical cells because they are robust, easy to cool, and well suited for high-volume production lines.

- The IEA notes that batteries used in the energy sector reached more than 2,400 GWh in 2023, a fourfold jump from 2020, with EVs accounting for over 90% of this demand and more than 750 GWh in 2023 alone. Automakers and cell makers know that to meet such huge volumes, they need cell formats that are proven, automatable, and relatively low-cost. Cylindrical formats like 18650, 2170, and the newer 4680 fit this requirement and can be produced on highly standardized lines, which keeps both cost and quality under control.

Government policy is another strong tailwind. In the United States, the Department of Energy has launched multi-billion-dollar grant programs to build out the full battery supply chain. One initiative provides US$3 billion in grants for battery materials processing to expand domestic manufacturing capacity. Another DOE program has already awarded about US$1.82 billion to 14 projects for battery materials processing and manufacturing, directly supporting new plants for lithium, graphite, and component production that often target cylindrical cell lines.

These policies are not just numbers on a page. They influence how companies design their factories and which formats they back. When a government funds large-scale EV and battery manufacturing, producers tend to choose the safest bet: a cell design that can be ramped up fast and integrated into vehicles today. Cylindrical cells benefit directly from this cautious optimism because they already have a long safety record and a huge base of suppliers for cans, winding equipment, and formation systems.

Restraints

Volatile Lithium and Raw Material Supply Limits Cylindrical Lithium-Ion Battery Expansion

One of the strongest restraining factors for cylindrical lithium-ion batteries is the unstable supply and pricing of lithium and other critical raw materials. These batteries depend heavily on lithium, nickel, cobalt, and graphite, and even small disruptions in supply can delay production or raise costs.

- According to the United States Geological Survey (USGS), global lithium mine production reached about 180,000 metric tons in 2023, but demand from batteries already consumed the majority of this supply.

Price instability is a major concern for battery makers using cylindrical cell designs, which require large volumes of uniform raw materials to maintain consistency. The International Energy Agency (IEA) reported that lithium prices rose by more than 400% between 2020 and 2022 before correcting in late 2023. Despite recent price drops, the IEA warns that volatility will remain high as electric vehicle and energy storage demand continues to rise.

Cylindrical batteries are especially sensitive to material quality because they use tightly wound electrode structures. Any inconsistency in lithium purity or cathode materials can impact safety and cycle life. This creates pressure on manufacturers, especially smaller players, who struggle to secure long-term supply contracts. The World Economic Forum highlights that battery-grade lithium refining is concentrated in a small number of countries, making supply chains vulnerable to geopolitical tension and export controls.

Government data also shows that mining expansion is not keeping pace with policy ambitions. While countries are pushing for electric mobility, permitting and environmental concerns slow new mining projects. The IEA estimates that bringing a new lithium mine into production can take over 16 years on average, from discovery to operation. This delay directly limits how fast cylindrical battery capacity can scale, regardless of demand growth.

Opportunity

Battery Recycling and Circular Supply Chains Create Strong Growth Opportunities

One of the clearest growth opportunities for cylindrical lithium-ion batteries lies in battery recycling and circular raw-material supply. As electric vehicles, power tools, and consumer electronics age, millions of cylindrical cells are reaching end-of-life. Instead of treating these batteries as waste, governments and industries are now turning them into a secondary source of lithium, nickel, cobalt, and graphite. This shift reduces dependence on mining and lowers long-term production costs.

- According to the International Energy Agency (IEA), the volume of end-of-life batteries available for recycling could provide up to 10% of global lithium demand and nearly 20% of nickel demand by 2030 if recycling systems scale properly. This is especially important for cylindrical batteries because their standardized shape makes automated dismantling and material recovery easier than many custom pouch formats.

Government initiatives strongly support this opportunity. The U.S. Department of Energy (DOE) has committed more than USD 3.5 billion through its Battery Materials Processing and Recycling programs to build domestic recycling capacity. Many funded projects are designed specifically to recover materials from cylindrical lithium-ion batteries used in EVs and industrial equipment. This support lowers entry barriers for battery manufacturers and helps secure recycled feedstock at predictable prices.

Food and agriculture organizations also play a role by highlighting the sustainability benefits of recycling. The Food and Agriculture Organization (FAO) has emphasized that mining expansion for battery minerals often competes with agriculture for land and water. By recovering materials from used batteries, pressure on freshwater resources and farmland can be reduced. FAO data shows that recycling one ton of lithium-ion batteries can save up to 70% of the water required compared with extracting the same materials from virgin ores.

Regional Insights

APAC leads with 48.2% share, valued at USD 5.2 billion — supported by manufacturing scale and strong end-market demand.

In 2024, the Asia-Pacific region accounted for a commanding 48.20% of the global cylindrical lithium-ion battery market, equivalent to approximately USD 5.2 billion, reflecting a concentration of cell manufacturing, active supply chains, and robust downstream demand across consumer electronics, e-mobility and stationary storage. Production capacity and upstream component supply are concentrated in China, South Korea and Japan, while Southeast Asian countries have been used for additional cell assembly and pack integration to serve global OEMs; this concentration has reduced lead times and enabled cost efficiencies through localized procurement of electrode materials and cell components.

The regional market in 2024 was supported by high domestic consumption of smartphones, power tools and two-wheel electric vehicles, together with accelerating electrification of light vehicles and investment in utility-scale storage that expanded demand for standardized cylindrical formats. Policy measures and industrial incentives in several APAC economies encouraged factory expansions and cell-gigafactory announcements, which in turn attracted capital for equipment suppliers and materials processors.

Technology improvement and process optimisation were pursued across the value chain to improve volumetric energy density, cycle life and safety, while manufacturers focused on LFP and NMC chemistries to match diverse application needs. Supply-chain resilience initiatives and sourcing diversification were implemented during 2024 to mitigate raw-material volatility and logistics disruption. Looking into 2025, the APAC region is expected to retain its leading position as capacity additions and rising regional consumption translate into larger production volumes and continued downward pressure on per-unit costs, reinforcing the region’s central role in the global cylindrical lithium-ion battery market.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Sony’s broad electronics and components footprint supports battery-related activities and downstream product demand. In fiscal 2024 the Sony Group reported consolidated sales ¥12.96 trillion, providing capital and market reach to pursue battery-adjacent R&D, sensor-battery integration and small-format cell applications for consumer devices. Sony’s 2024 strategy focused on leveraging sensor and device synergies while monitoring battery-technology advances relevant to portable electronics.

Hitachi’s diversified industrial portfolio supports battery and electrification activities across mobility, infrastructure and energy segments. For fiscal 2024, Hitachi reported consolidated revenue = ¥9,783.3 billion, enabling continued investment in electrification technologies, battery systems integration and grid-scale storage projects. In 2024 Hitachi’s approach combined systems engineering, component supply and digital asset management to deliver integrated battery solutions for industrial customers and utilities.

Panasonic Energy maintained a substantial presence in cylindrical cell supply chains for consumer electronics and mobility applications in 2024, backed by broader Panasonic group resources. The energy unit reported sales ¥873.2 billion (2024) and continued investments in cell manufacturing, materials R&D and safety improvements. In 2024 the company emphasised high-reliability cylindrical formats for industrial and automotive clients while progressing manufacturing optimisations and strategic partnerships for next-generation battery formats.

Top Key Players Outlook

- Tianneng rechargeable battery manufacturers

- Contemporary Amperex Technology Co., Limited.

- Panasonic Energy Co., Ltd.

- Hitachi, Ltd.

- Samsung SDI Co., Ltd.

- Sony Corporation

- LG Chem

- Murata Manufacturing Co., Ltd.

- Xiamen Tmax Battery Equipments Limited.

- EVE Energy Co., Ltd.

Recent Industry Developments

In 2024, Tianneng reported total revenue of over USD 11 billion, reflecting its broad battery business and global reach. The company states it now has more than 20 GWh of lithium-battery production capacity across its facilities.

In 2024, Panasonic Energy confirmed that it is ramping up production of the advanced 4680 cylindrical battery cells: the company issued a press release saying mass production of those high-capacity 4680 automotive lithium-ion batteries is ready at its factory in Wakayama, Japan.

In 2024, Hitachi reported consolidated revenues of ¥9,783.3 billion for the fiscal year ending March 31, 2025.

In 2024, Samsung SDI saw challenging times but also demonstrated clear commitment to new cylindrical battery formats. The company’s battery business reported revenue of KRW 3.56 trillion in the full-year 2024 period and posted an operating loss for that segment.

Report Scope

Report Features Description Market Value (2024) USD 10.8 Bn Forecast Revenue (2034) USD 64.1 Bn CAGR (2025-2034) 19.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Lithium Iron Phosphate, Lithium Cobaltate, Lithium Manganate, Cobalt-Manganese, Others), By Capacity (Up to 500 mAh, 500-900 mAh, 900-1,200 mAh, More than 1,200 mAh), By End-Use (Consumer Electronics, Automotive, Telecommunication, Aerospace, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Tianneng rechargeable battery manufacturers, Contemporary Amperex Technology Co., Limited., Panasonic Energy Co., Ltd., Hitachi, Ltd., Samsung SDI Co., Ltd., Sony Corporation, LG Chem, Murata Manufacturing Co., Ltd., Xiamen Tmax Battery Equipments Limited., EVE Energy Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Cylindrical Lithium Ion Battery MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Cylindrical Lithium Ion Battery MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Tianneng rechargeable battery manufacturers

- Contemporary Amperex Technology Co., Limited.

- Panasonic Energy Co., Ltd.

- Hitachi, Ltd.

- Samsung SDI Co., Ltd.

- Sony Corporation

- LG Chem

- Murata Manufacturing Co., Ltd.

- Xiamen Tmax Battery Equipments Limited.

- EVE Energy Co., Ltd.