Global Culinary Sauces Market Size, Share, And Business Benefits By Product (Wet, Dry), By Product Type (Hot Sauces, Soy Sauces, Barbecue Sauces, Oyster Sauces, Pasta Sauces, Tomato Sauces, Others), By End Use (Households, Restaurants, Food Service Chains, Others), By Distribution Channel (Supermarket/Hypermarket, Convenience Store, Online, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 150892

- Number of Pages: 377

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

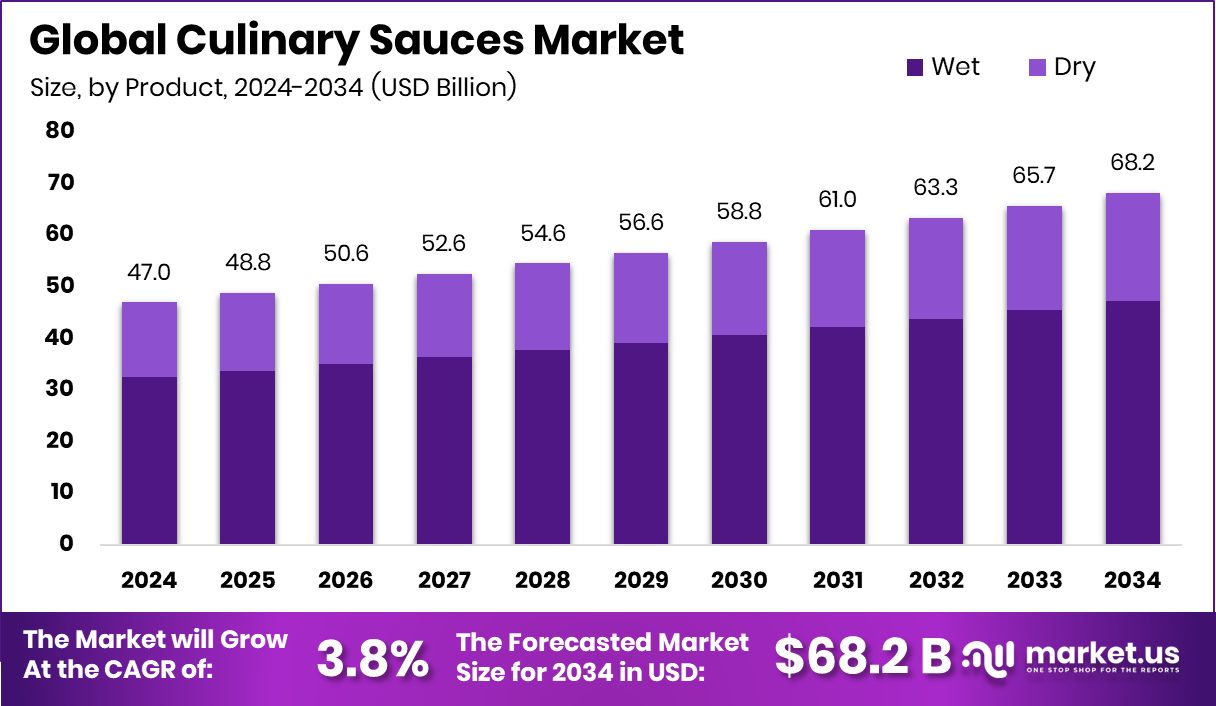

Global Culinary Sauces Market is expected to be worth around USD 68.2 billion by 2034, up from USD 47.0 billion in 2024, and grow at a CAGR of 3.8% from 2025 to 2034. Strong demand for convenience foods drives North America’s USD 18.5 billion sauces market.

Culinary sauces are flavorful liquid or semi-liquid preparations used to enhance the taste, texture, and appearance of food. They are essential in cooking across cultures, often forming the backbone of a dish’s identity, ranging from creamy and spicy to tangy and sweet. These sauces can be made from a wide range of ingredients, including vegetables, fruits, herbs, spices, dairy, and oils.

The culinary sauces market refers to the global trade and consumption of these sauces, encompassing everything from traditional homemade varieties to mass-produced bottled versions. This market includes a wide spectrum of products catering to different cuisines and dietary preferences, such as plant-based, gluten-free, and organic options. With increasing interest in global flavors and convenience-driven cooking, the market continues to diversify and expand. According to an industry report, Rao’s Tomato Sauce grew from a local NYC favorite to a $2.7 billion brand.

Growth in the culinary sauces market is primarily fueled by changing consumer lifestyles. Urbanization, busier routines, and a growing reliance on ready-to-cook meals have boosted the demand for easy-to-use sauces. Additionally, the rise in dual-income households has encouraged the use of time-saving cooking solutions, further driving market expansion. According to an industry report, Health-focused food startup Troovy secured ₹20 crore in investor funding.

Demand is also rising due to the growing food culture and experimentation among home cooks. With the influence of cooking shows and online recipes, more people are exploring new cuisines, increasing the demand for diverse sauces that replicate restaurant-like meals at home. This trend supports steady consumption and product innovation. According to an industry report, Bachan’s, known for Japanese-style BBQ sauces, raised $13 million in Series A funding.

Key Takeaways

- Global Culinary Sauces Market is expected to be worth around USD 68.2 billion by 2034, up from USD 47.0 billion in 2024, and grow at a CAGR of 3.8% from 2025 to 2034.

- Wet culinary sauces dominate the market, accounting for 69.2% due to versatility and convenience.

- Hot sauces hold a 19.9% share, reflecting growing consumer preference for bold and spicy flavors.

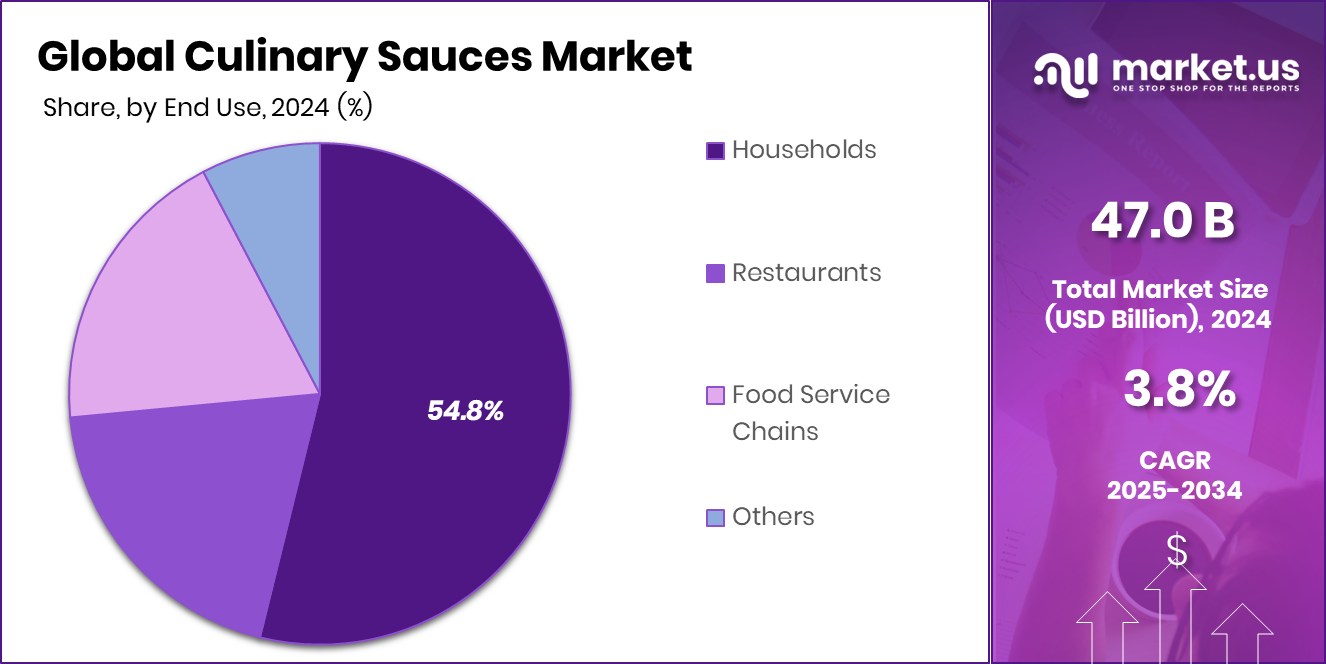

- Households represent 54.8% of the end-use segment, showing strong demand for home-cooked meals.

- Supermarkets and hypermarkets lead distribution with 44.7%, offering wide access and variety to consumers.

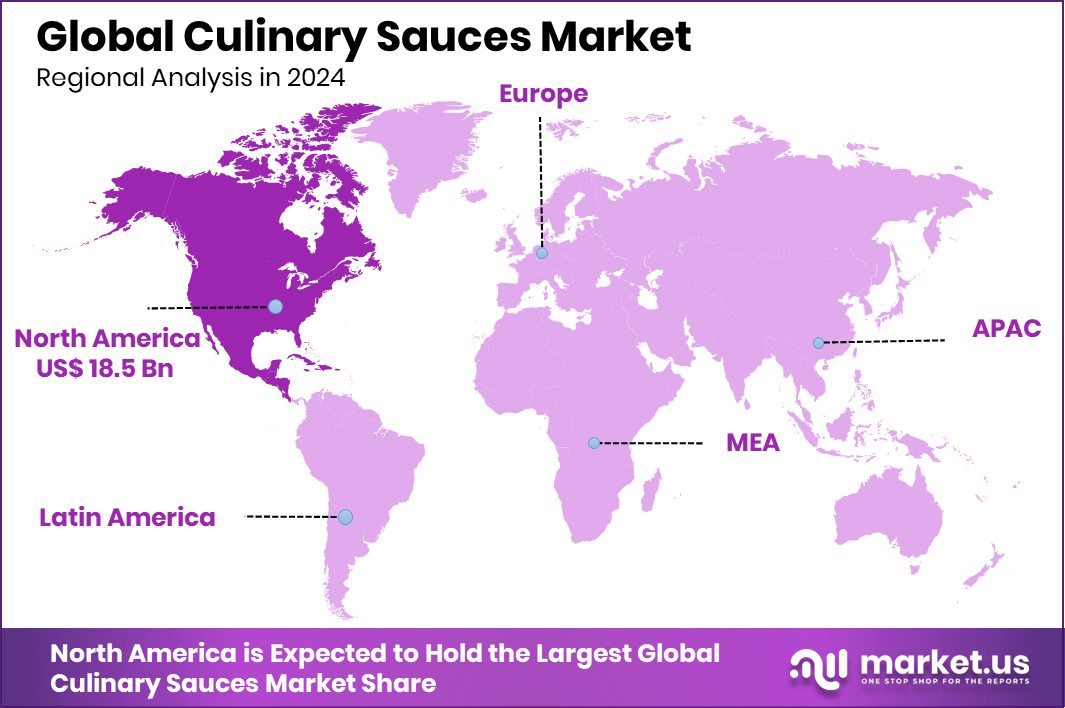

- North America held a dominant 39.4% share in the global sauces market.

By Product Analysis

Wet sauces dominate the culinary sauces market, accounting for a 69.2% share.

In 2024, Wet held a dominant market position in the By Product segment of the Culinary Sauces Market, with a 69.2% share. This significant share reflects the widespread consumer preference for ready-to-use sauces that enhance convenience and speed in meal preparation.

Wet sauces, including options like gravies, marinades, and cooking bases, are widely used across both home kitchens and foodservice establishments due to their ease of application and ability to quickly impart flavor and moisture to dishes.

The high market share of wet sauces can also be attributed to their versatility and compatibility with a broad range of global cuisines. As more consumers explore diverse culinary experiences, wet sauces offer an accessible way to replicate authentic tastes without complex preparation steps.

Their strong presence on retail shelves and in food delivery channels further strengthens their market foothold. Additionally, the rise of busy urban lifestyles has led to increased dependence on time-saving cooking solutions, with wet sauces emerging as a practical choice for enhancing meals with minimal effort.

By Product Type Analysis

Hot sauces hold 19.9% of the culinary sauces market by product type.

In 2024, Hot Sauces held a dominant market position in the By Product Type segment of the Culinary Sauces Market, with a 19.9% share. This notable share underscores the growing consumer inclination toward bold, spicy flavors that enhance taste profiles across a variety of cuisines. Hot sauces have become a staple in both home and commercial kitchens, valued for their ability to add heat, depth, and character to dishes with just a small amount.

The strong performance of hot sauces is also linked to shifting taste preferences, particularly among younger consumers who increasingly seek adventurous and intense flavor experiences. Their popularity is further fueled by their role in fast food, grilled items, and fusion dishes, making them a frequent addition to everyday meals.

Shelf visibility, portability, and long shelf life contribute to their consumer appeal. With a 19.9% share, hot sauces continue to hold a strong position in the culinary market, supported by their versatility and consistent demand across different meal occasions.

By End Use Analysis

Households drive 54.8% of the culinary sauces market’s end-use segment.

In 2024, Households held a dominant market position in the By End Use segment of the Culinary Sauces Market, with a 54.8% share. This strong market presence highlights the increasing reliance on culinary sauces in everyday home cooking. As cooking at home continues to be a regular activity for many families, sauces have become essential pantry staples, offering convenience, flavor enhancement, and variety in daily meals.

The 54.8% share reflects the growing demand from households for ready-to-use and easy-to-prepare ingredients that simplify meal preparation without compromising taste. Consumers are increasingly turning to sauces to recreate restaurant-style dishes at home, influenced by cooking shows, online recipes, and a broader interest in diverse cuisines. The appeal of culinary sauces in households also stems from their ability to save time, reduce cooking steps, and add consistency to meals.

This is particularly important in busy households where quick and flavorful cooking solutions are in high demand. The segment’s leading share demonstrates the integral role that sauces now play in home kitchens, supporting the continued growth and stability of the culinary sauces market through widespread and frequent household usage.

By Distribution Channel Analysis

Supermarkets lead distribution in the culinary sauces market with a 44.7% share.

In 2024, Supermarket/Hypermarket held a dominant market position in the By Distribution Channel segment of the Culinary Sauces Market, with a 44.7% share. This leading position reflects consumer preference for one-stop retail destinations that offer a wide product variety, competitive pricing, and immediate availability.

Supermarkets and hypermarkets continue to be the go-to shopping venues for culinary sauces, allowing customers to physically inspect a range of products, compare options, and make informed purchase decisions.

The 44.7% market share also highlights the strong shelf presence and visibility that sauces enjoy in these large-format retail spaces. Organized aisles, promotional displays, and regular in-store offers make supermarkets/hypermarkets an effective channel for driving both planned and impulse purchases.

These stores cater to a diverse customer base and serve as a primary channel for household grocery needs, which aligns with the routine purchasing habits of consumers when it comes to sauces. The accessibility and convenience of picking up preferred brands or exploring new varieties during regular grocery trips further support the channel’s dominance.

Key Market Segments

By Product

- Wet

- Dry

By Product Type

- Hot Sauces

- Soy Sauces

- Barbecue Sauces

- Oyster Sauces

- Pasta Sauces

- Tomato Sauces

- Others

By End Use

- Households

- Restaurants

- Food Service Chains

- Others

By Distribution Channel

- Supermarket/Hypermarket

- Convenience Store

- Online

- Others

Driving Factors

Growing Demand for Quick and Easy Cooking

One of the top driving factors of the Culinary Sauces Market is the rising demand for quick and easy cooking at home. As more people lead busy lives, they look for ways to prepare meals faster without sacrificing taste. Culinary sauces offer a simple solution—just a spoonful can add flavor, richness, and variety to everyday dishes.

Whether it’s a pasta sauce, curry base, or stir-fry blend, these sauces save time and effort in the kitchen. They also help people try new cuisines without needing many ingredients or advanced cooking skills. This growing need for convenience is encouraging more consumers to keep a variety of sauces in their kitchens, pushing the market forward with steady demand.

Restraining Factors

Health Concerns Over Preservatives and Additives

A major factor holding back the growth of the Culinary Sauces Market is growing health concerns related to preservatives, artificial colors, and high levels of salt or sugar often found in sauces. Many consumers are now more careful about what they eat and prefer cleaner, more natural ingredients. This shift in mindset makes some people avoid packaged sauces, especially those with long ingredient lists or unfamiliar additives.

As awareness of lifestyle diseases like obesity, diabetes, and high blood pressure rises, buyers are becoming cautious about processed foods. This concern limits the appeal of many mass-produced sauces and creates challenges for brands that rely on extended shelf life and strong flavors through additives, affecting overall market expansion.

Growth Opportunity

Rising Demand for Healthy and Natural Sauces

A key growth opportunity in the Culinary Sauces Market lies in the increasing demand for healthy and natural sauces. More people are now choosing food products that are free from artificial ingredients, low in sugar and salt, and made with organic or plant-based components. This shift is creating a strong space for brands to offer clean-label sauces that meet these expectations.

Consumers are reading labels more carefully and prefer products with simple, recognizable ingredients. There’s also a growing interest in sauces that cater to specific dietary needs, like vegan, gluten-free, or low-calorie options. Companies that focus on health-focused product development can connect better with modern consumers and grow their market presence by offering sauces that are both tasty and wholesome.

Latest Trends

Global Flavors and Fusion Sauces Gain Popularity

A leading trend in the Culinary Sauces Market today is the increasing popularity of sauces inspired by global flavors and fusion cooking styles. Home cooks and food enthusiasts are eager to explore tastes from around the world—such as Korean gochujang, Mexican adobo, Indian tikka masala, and Japanese teriyaki—but with creative twists.

Fusion sauces blend elements from different cuisines, for instance, combining spicy Sichuan peppers with creamy European-style bases, or pairing Mediterranean herbs with tropical fruits. This trend meets consumers’ desire for exciting, restaurant-quality flavor at home, without needing advanced cooking skills or rare spices. It also fits well into ready-to-use sauce formats, making it easy for people to try new dishes.

Regional Analysis

In North America, the Culinary Sauces Market reached USD 18.5 billion in 2024.

In 2024, North America dominated the global Culinary Sauces Market with a significant 39.4% share, valued at USD 18.5 billion. This leadership is driven by high consumption of ready-to-eat and processed food, alongside strong demand for diverse and premium sauce varieties in both household and foodservice settings.

Consumers in this region increasingly seek flavorful and convenient meal options, further pushing the use of sauces in everyday cooking. Europe follows closely behind, with steady growth supported by a mature market and a well-established culture of using sauces in various traditional and modern dishes. In Asia Pacific, the market continues to expand, fueled by a growing population, increasing urbanization, and rising interest in Western and fusion cuisines.

Countries like China, India, and Japan contribute notably to the regional demand. The Middle East & Africa region is gradually picking up pace, supported by a growing young population and evolving culinary preferences. Latin America, with its rich native cuisine and strong local sauce traditions, maintains a stable market presence, especially in countries like Mexico and Brazil.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Conagra Brands, Del Monte Foods Inc., and General Mills Inc. held notable influence within the global Culinary Sauces Market, each bringing distinct strengths that contributed to market development and consumer engagement.

Conagra Brands continued to leverage its wide portfolio and deep retail presence to strengthen its position in the sauce segment. Known for its focus on convenience and flavor innovation, Conagra addressed evolving consumer preferences by offering sauces that cater to both traditional tastes and modern dietary needs. Its agility in product development and established distribution networks helped maintain steady visibility across grocery shelves.

Del Monte Foods Inc. sustained its relevance through a strong reputation for quality and freshness. In 2024, the company emphasized natural ingredients and clean-label offerings, resonating with health-conscious consumers. Its sauces, often built on recognizable ingredients like tomatoes and fruits, appealed to households seeking simpler, more wholesome culinary solutions. This positioning aligned well with the growing demand for transparent and nutritious food choices.

General Mills Inc. remained an influential player by integrating culinary sauces into its broader packaged food strategy. The company capitalized on its household brand recognition to promote sauces as essential complements to easy meals. Its ability to adapt to trends, such as global flavor exploration and meal kit integration, helped keep its sauce offerings relevant and competitive.

Top Key Players in the Market

- Conagra Brands

- Del Monte Foods Inc

- General Mills Inc.

- Hormel Foods Corporation

- Ken’s Foods

- Kikkoman Corporation

- Kraft Heinz Company

- McCormick & Company Incorporated

- McllhennyCompany

- Nestle

- The Kraft Heinz Company

- Unilever

- YAMASA Corporation

Recent Developments

- In May 2025, Conagra finalized an agreement to sell its Chef Boyardee shelf-stable pasta line (excluding frozen skillet meals) to Hometown Food Company for $600 million in cash. The brand had contributed about $450 million to Conagra’s 2024 net sales.

- In November 2024, Agro Tech Foods (later rebranded as Sundrop Brands) completed its acquisition of Del Monte Foods Private Limited in India. This deal included Del Monte’s sauces, spreads, and condiments, along with their R&D facility in Tamil Nadu.

Report Scope

Report Features Description Market Value (2024) USD 47.0 Billion Forecast Revenue (2034) USD 68.2 Billion CAGR (2025-2034) 3.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Wet, Dry), By Product Type (Hot Sauces, Soy Sauces, Barbecue Sauces, Oyster Sauces, Pasta Sauces, Tomato Sauces, Others), By End Use (Households, Restaurants, Food Service Chains, Others), By Distribution Channel (Supermarket/Hypermarket, Convenience Store, Online, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Conagra Brands, Del Monte Foods Inc, General Mills Inc., Hormel Foods Corporation, Ken’s Foods, Kikkoman Corporation, Kraft Heinz Company, McCormick & Company Incorporated, McllhennyCompany, Nestle, The Kraft Heinz Company, Unilever, YAMASA Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Conagra Brands

- Del Monte Foods Inc

- General Mills Inc.

- Hormel Foods Corporation

- Ken's Foods

- Kikkoman Corporation

- Kraft Heinz Company

- McCormick & Company Incorporated

- McllhennyCompany

- Nestle

- The Kraft Heinz Company

- Unilever

- YAMASA Corporation