Global Crude Sulfate Turpentine Market Size, Share, And Enhanced Productivity By Product (Carene, Terpineol, Camphor, Pinane Hydro peroxide, Pure alpha-pinene, Beta-Pinene, Terpene Resins, Limonene), By Application (Additives, Adhesives, Solvents, Rubber Processing, Aroma Chemicals, Personal and Home Care Product, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 171713

- Number of Pages: 386

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

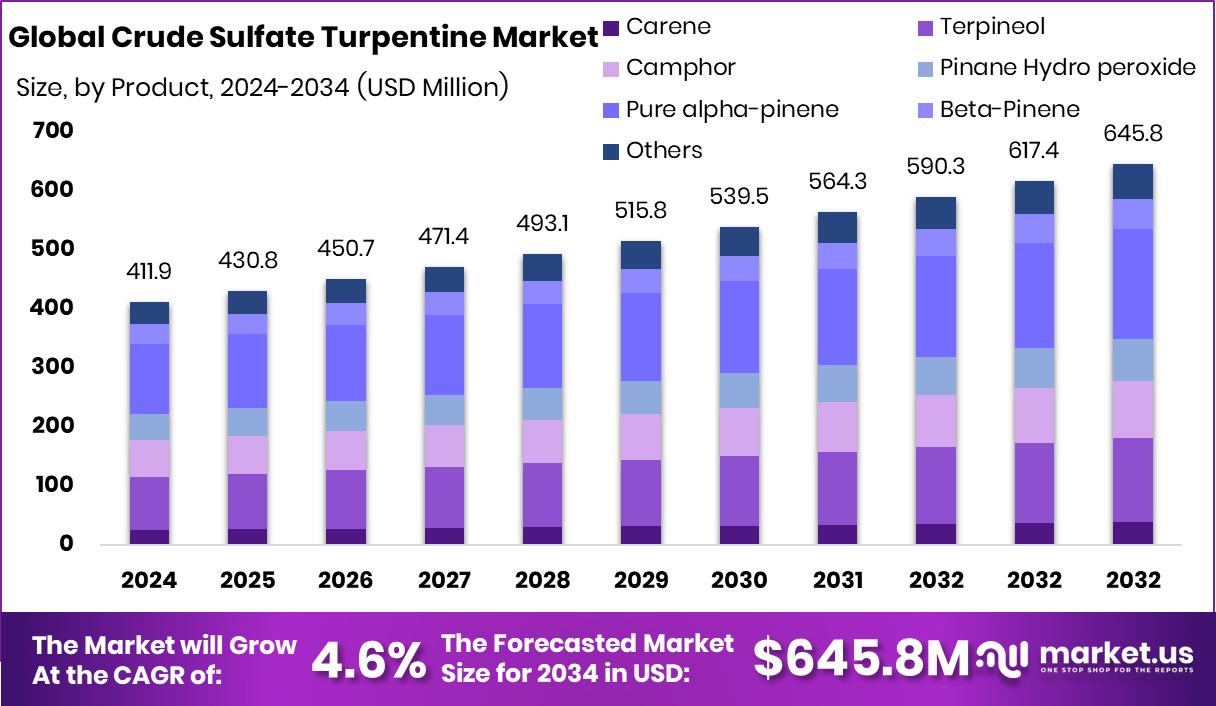

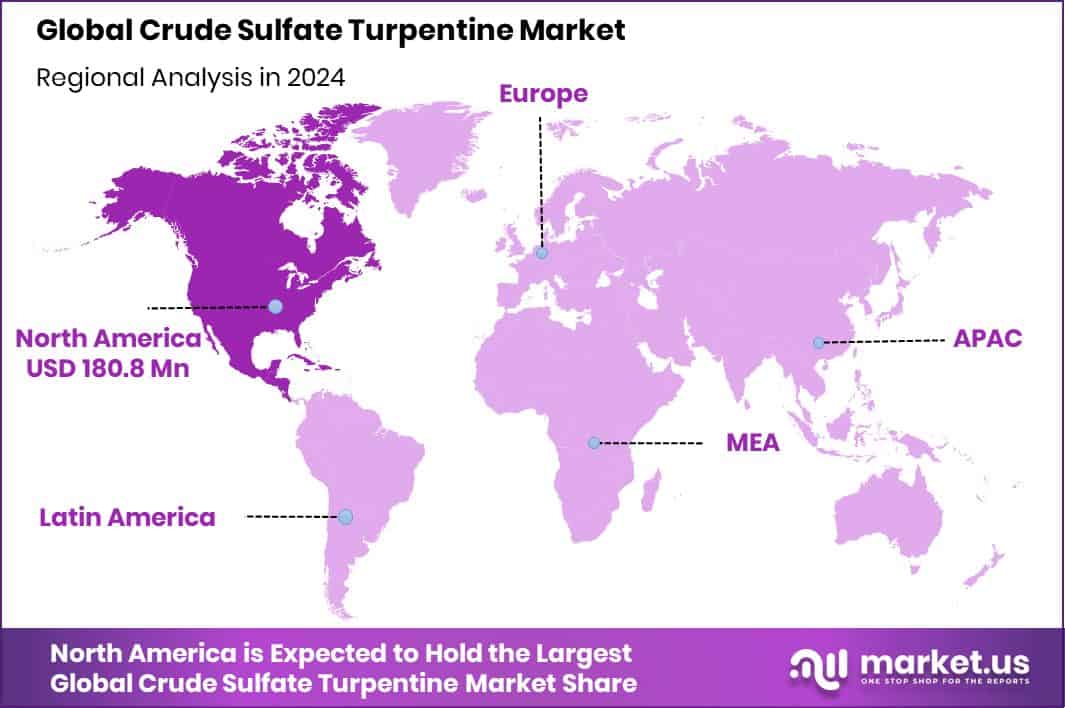

The Global Crude Sulfate Turpentine Market is expected to be worth around USD 645.8 million by 2034, up from USD 411.9 million in 2024, and is projected to grow at a CAGR of 4.6% from 2025 to 2034. The market in North America reached USD 180.8 Mn, representing a 43.90% share.

Crude Sulfate Turpentine (CST) is a natural, sulfur-bearing by-product collected during the kraft pulping of pine wood. It contains valuable terpenes such as alpha-pinene and beta-pinene, which serve as building blocks for fragrance ingredients, solvents, resins, and several chemical intermediates. Its value comes from being a renewable, biomass-based input rather than a petroleum-derived material, making it important in industries seeking natural feedstocks.

The Crude Sulfate Turpentine Market covers the production, recovery, purification, and commercial use of CST across chemical, industrial, and consumer-linked applications. It grows steadily because CST offers a sustainable raw material pathway for aroma chemicals, adhesives, coatings, and everyday formulated goods. As industries shift toward natural carbon-based inputs, CST remains a relevant feedstock with stable global demand.

Growth in CST usage is supported by broader innovation activity, especially as industries working with materials, resins, and chemical building blocks attract strong investment. For example, Molekule raised $58 million in Series C funding, highlighting interest in material-linked innovation and testing capabilities such as those demonstrated by Berkeley Lab. These developments strengthen confidence in renewable, chemistry-based product ecosystems where CST fits naturally.

Demand is also uplifted by manufacturing and material-processing advancements. Multiple additive-manufacturing initiatives — such as RISE’s $1 million funding, America Makes’ $4.5 million award, Carbon’s $60M support, Alloyed’s £37M raise, and Australia’s $271m funding boost — show how industries continue expanding production technologies. As these sectors grow, so does the need for stable natural inputs, indirectly supporting CST-based chemical chains.

Opportunities are widening as consumer-facing industries expand. Product launches like Good Supply’s Monsters 1,000mg THC resin vapes signal rising interest in resin-rich formulations, where CST-derived intermediates often play supportive roles. Broader capital movement — such as €100 million raised by Carne, Rs 31 crore funding for SK Minerals, and $300,000 from Coppin State University’s gala — reflects healthy investment environments that reinforce growth pathways for CST-linked specialty materials.

Key Takeaways

- The Global Crude Sulfate Turpentine Market is expected to be worth around USD 645.8 million by 2034, up from USD 411.9 million in 2024, and is projected to grow at a CAGR of 4.6% from 2025 to 2034.

- Pure alpha-pinene holds a 28.9% share, driving strong demand in the Crude Sulfate Turpentine Market.

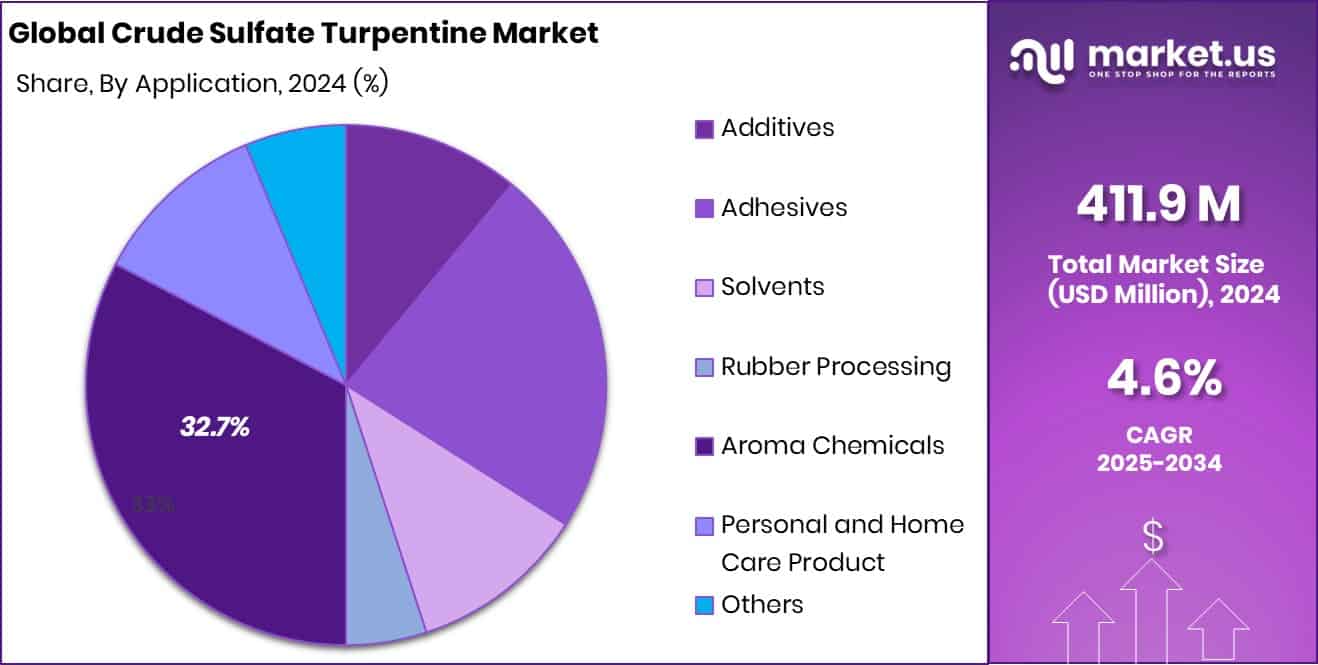

- Aroma chemicals dominate with a 32.7% share, shaping value creation in the crude sulfate turpentine market.

- In this period, North America maintained 43.90% dominance with a USD 180.8 Mn value

By Product Analysis

Pure alpha-pinene held 28.9%, strengthening the Crude Sulfate Turpentine Market outlook.

In 2024, Pure alpha-pinene held a dominant market position in the By Product segment of the Crude Sulfate Turpentine Market, with a 28.9% share. This leadership reflects its strong demand across industries that rely on CST-derived components for consistent quality and performance. Its wide usability keeps it at the front of product preferences, especially where purity and stability are essential for downstream processing.

Its dominance also indicates that manufacturers continue to value alpha-pinene for its dependable conversion efficiency in chemical formulation chains. With end-users steadily prioritizing reliable raw materials, this specific product category maintains its relevance and supports stable consumption patterns within the CST value ecosystem.

By Application Analysis

Aroma chemicals dominated with 32.7%, shaping the Crude Sulfate Turpentine Market expansion trends.

In 2024, Aroma Chemicals held a dominant market position in the By Application segment of the Crude Sulfate Turpentine Market, with a 32.7% share. This leading share highlights the strong reliance of the fragrance, flavor, and formulation industries on CST-based chemical intermediates. As aroma ingredients require consistent natural feedstock, CST-derived inputs continue to be favored for their ability to deliver stable aromatic profiles.

The dominance of this application also shows its central role in driving CST usage, as manufacturers prefer natural terpene routes for value-added aromatic compounds. With ongoing demand from perfumery and consumer product formulations, aroma chemicals remain the primary anchor segment within the CST application landscape.

Key Market Segments

By Product

- Carene

- Terpineol

- Camphor

- Pinane Hydro peroxide

- Pure alpha-pinene

- Beta-Pinene

- Terpene Resins

- Limonene

By Application

- Additives

- Adhesives

- Solvents

- Rubber Processing

- Aroma Chemicals

- Personal and Home Care Product

- Others

Driving Factors

Growing Industrial Shift Toward Natural Terpene Feedstocks

The Crude Sulfate Turpentine (CST) market is being driven by a strong global shift toward natural, renewable terpene feedstocks that support cleaner industrial chemistry. Many sectors are searching for alternatives to petroleum-based solvents and aroma ingredients, and CST fits naturally into this movement because it comes from pine-based kraft pulping and carries a lower environmental footprint. This demand aligns with broader innovation in material production, where several funding developments highlight rising confidence in sustainable manufacturing.

For example, 6K Additive secured $27.4M in EXIM funds to expand powder processing, showing how industries continue to invest in material innovation. At the same time, ASTM received $2.1M in funding to improve sustainability in additive manufacturing, reinforcing the need for renewable chemical inputs like CST.

In agriculture and bio-based supply chains, interest in cleaner ingredients is also reflected in new funding activities. Danone’s $7M funding round for methane-reducing cattle feed additives signals a broader push for environmentally responsible production systems, which indirectly benefits CST adoption as industries seek greener raw materials. Further advancement in manufacturing methods, supported by Titomic Europe’s €800k funding for Cold Spray Additive Manufacturing, strengthens the overall ecosystem where CST-derived intermediates help support coatings, resins, and specialty chemical formulations.

Restraining Factors

Limited CST Supply Stability Restricts Market Growth

One major restraining factor for the Crude Sulfate Turpentine (CST) market is the limited stability of CST supply, which depends heavily on kraft pulp production rather than direct chemical manufacturing. When pulp mills reduce operating rates or shift toward alternative processing routes, CST output naturally declines. This creates uncertainty for downstream industries that rely on steady terpene availability for fragrances, resins, and solvents. The challenge becomes more visible as advanced manufacturing sectors continue expanding, highlighted by Immensa securing USD 20 million in funding, which shows how fast-growing industries demand predictable raw material flows.

This pressure increases further as automation and scaled material production gain funding momentum. Mosaic’s $28 million funding to boost the adoption of automated additive manufacturing reflects how technology-driven sectors need reliable ingredient inputs to keep expanding. When CST supply fluctuates, it becomes harder for manufacturers to plan long-term formulations or maintain consistent product performance. As innovation across materials, automation, and production accelerates, any disruption in CST availability can slow adoption in key applications, making supply stability a crucial limitation for the market.

Growth Opportunity

Rising Demand for Bio-Based Chemical Ingredients Globally

A major growth opportunity for the Crude Sulfate Turpentine (CST) market comes from the increasing global shift toward bio-based chemical ingredients, where industries are actively searching for natural terpene sources to replace petroleum-derived inputs. CST fits perfectly into this transition because it is extracted from renewable pine-based kraft pulping and serves as a clean, versatile feedstock for aromas, solvents, and specialty chemical intermediates. This opportunity becomes even stronger as new technologies receive fresh investment support

For instance, Enerzi secured $2M seed funding to scale its methane-to-hydrogen platform, showing how sustainability-driven solutions are gaining market acceptance and encouraging broader adoption of renewable chemical pathways.

The momentum continues with additional funding that strengthens innovation landscapes connected to clean materials. Capital A led INR 16.5 crore seed funding in Enerzi, and Enerzi’s Belagavi unit also raised INR 16.5 crore for its hydrogen and nanocarbon technology. These investments reflect a market environment that increasingly favors green chemistry, low-carbon inputs, and renewable feedstocks.

As industries adopt more environmentally conscious production models, CST stands to benefit greatly, offering manufacturers a dependable natural terpene source that supports long-term sustainability goals across fragrances, coatings, adhesives, and specialty chemical applications.

Latest Trends

Growing Interest in Natural Rubber–Linked Biochemical Pathways

A key trend shaping the Crude Sulfate Turpentine (CST) market today is the rising global interest in natural rubber–linked biochemical pathways, which indirectly strengthens demand for renewable terpene feedstocks. As industries look for cleaner, plant-based molecules, CST becomes an attractive option for producing aroma ingredients, resins, and specialized chemicals. This trend is reflected in multiple funding and support initiatives across the rubber and biomaterials ecosystem. For example, a Kerala Congress delegation sought a ₹1,000-crore package for rubber farmers, signaling stronger attention on natural, forest-derived value chains that align with CST-based chemistry.

Innovation in sustainable rubber development further pushes this trend. Pretred received an $11.2M multiyear grant, and UArizona engineers are leading a $70M project to convert desert shrubs into rubber alternatives, showing active investment in plant-based production routes. At the same time, UK Rubber secured £370,000 in funding, reinforcing the broader industry’s shift toward renewable materials. As these initiatives advance, they create more interest in natural terpene feedstocks like CST, which support greener formulations in fragrances, additives, and industrial chemicals.

Regional Analysis

North America held a 43.90% share, valuing the Crude Sulfate Turpentine Market at USD 180.8 Mn.

North America emerged as the leading region in the Crude Sulfate Turpentine Market, holding a commanding 43.90% share valued at USD 180.8 Mn, reflecting strong industrial usage and stable integration of CST in chemical processing. This leadership sets the benchmark for regional demand behavior across the global landscape.

Europe follows as a mature consumer base, supported by consistent usage within fragrance, adhesive, and resin-related applications that rely on CST as a natural input. Asia Pacific continues expanding its market presence, driven by steady industrialization and broader utilization of CST derivatives across manufacturing clusters.

The Middle East & Africa region shows a gradual uptake as regional industries increasingly explore CST-derived materials in local processing activities. Latin America maintains steady involvement in the CST ecosystem through established supply chains and ongoing demand for CST-linked intermediates in regional production environments. Together, all regions contribute to a balanced global outlook, with North America remaining the primary anchor due to its sizable share and strong CST-linked industrial applications.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

DSM-Firmenich benefits from its long-standing presence in aroma and ingredient development, where CST-based terpene streams remain important inputs for fragrance and flavor innovations. The company’s strong integration between natural material sourcing and formulation expertise reinforces its ability to capture higher-value opportunities within CST-linked segments.

Ingevity remains a key player due to its deep specialization in pine chemicals and CST utilization. Its focus on performance chemicals and consistent optimization of CST processing technologies supports stable downstream conversion, enabling the company to deliver reliable terpene-based intermediates to industrial and specialty-chemical customers. Ingevity’s operational experience positions it favorably as demand for CST-derived additives and modifiers maintains steady traction.

Kraton Corporation continues leveraging CST derivatives in its broader portfolio of specialty polymers and chemical ingredients. Its capabilities in resin solutions and engineered materials allow CST-based components to integrate into multiple end-use applications, offering flexibility across industries that rely on natural terpene chemistry. Together, these companies strengthen the global CST ecosystem by maintaining a steady supply, technical expertise, and diversified application reach.

Top Key Players in the Market

- dsm-firmenich

- Ingevity

- Kraton Corporation

- ORGKHIM Biochemical Holding

- Pine Chemical Group

- International Flavors & Fragrances, Inc. (IFF)

- Symrise

- Stora Enso

Recent Developments

- In September 2025, Stora Enso introduced a new premium uncoated paperboard called Ensovelvet. This product is designed for luxury packaging applications such as cosmetics and perfumes, expanding the company’s packaging material offerings.

- In January 2025, Symrise completed its recommended takeover offer to Probi shareholders, extending the offer period and moving toward ownership consolidation. This follows its November 2024 acquisition move and represents Symrise’s continued commitment to integrating Probi within its growth strategy.

Report Scope

Report Features Description Market Value (2024) USD 411.9 Million Forecast Revenue (2034) USD 645.8 Million CAGR (2025-2034) 4.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Carene, Terpineol, Camphor, Pinane Hydro peroxide, Pure alpha-pinene, Beta-Pinene, Terpene Resins, Limonene), By Application (Additives, Adhesives, Solvents, Rubber Processing, Aroma Chemicals, Personal and Home Care Products, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape dsm-firmenich, Ingevity, Kraton Corporation, ORGKHIM Biochemical Holding, Pine Chemical Group, International Flavors & Fragrances, Inc. (IFF), Symrise, Stora Enso Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Crude Sulfate Turpentine MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample

Crude Sulfate Turpentine MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- dsm-firmenich

- Ingevity

- Kraton Corporation

- ORGKHIM Biochemical Holding

- Pine Chemical Group

- International Flavors & Fragrances, Inc. (IFF)

- Symrise

- Stora Enso