Global Cricket Equipment Market Size, Share, Growth Analysis By Product Type (Bat, Ball, Protective Gear, Others), By End-user (Men, Women), By Distribution Channel (Offline, Online), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 176654

- Number of Pages: 311

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

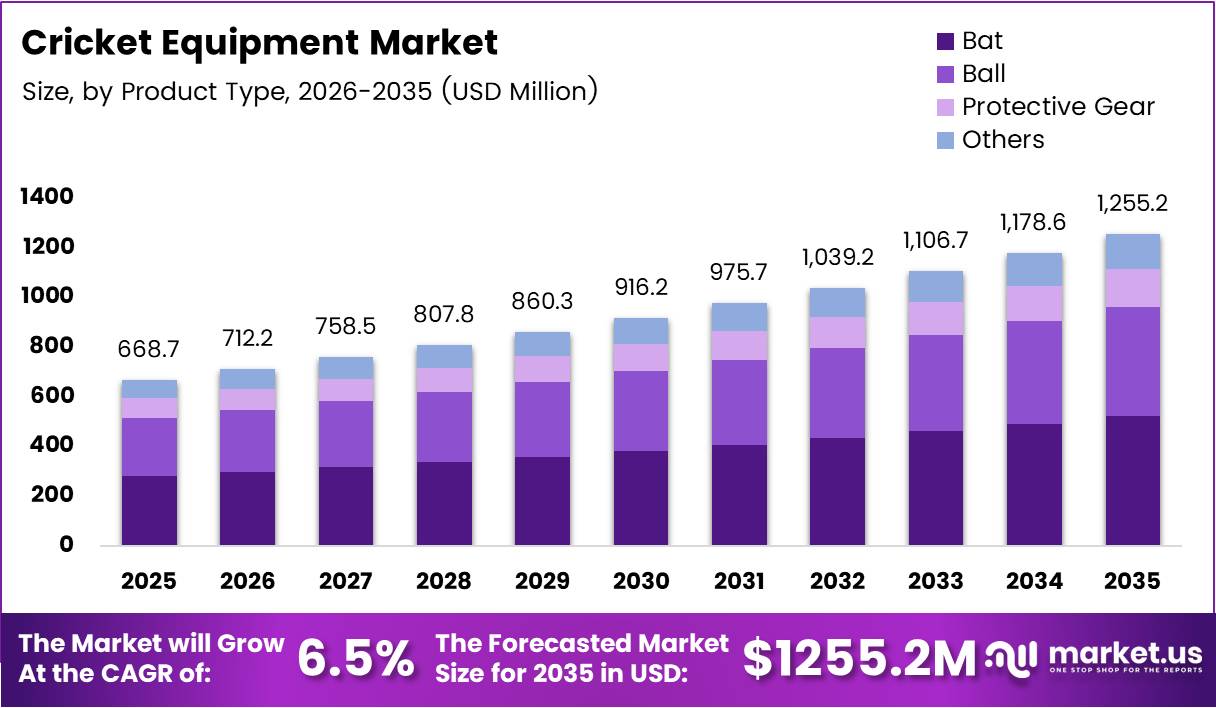

Global Cricket Equipment Market size is expected to be worth around USD 1255.2 Million by 2035 from USD 668.7 Million in 2025, growing at a CAGR of 6.5% during the forecast period 2026 to 2035.

Cricket equipment encompasses specialized sporting goods designed for professional and recreational play. This market includes bats, balls, protective gear, and accessories used by players worldwide. Manufacturers produce equipment meeting international standards while innovating with advanced materials and technologies.

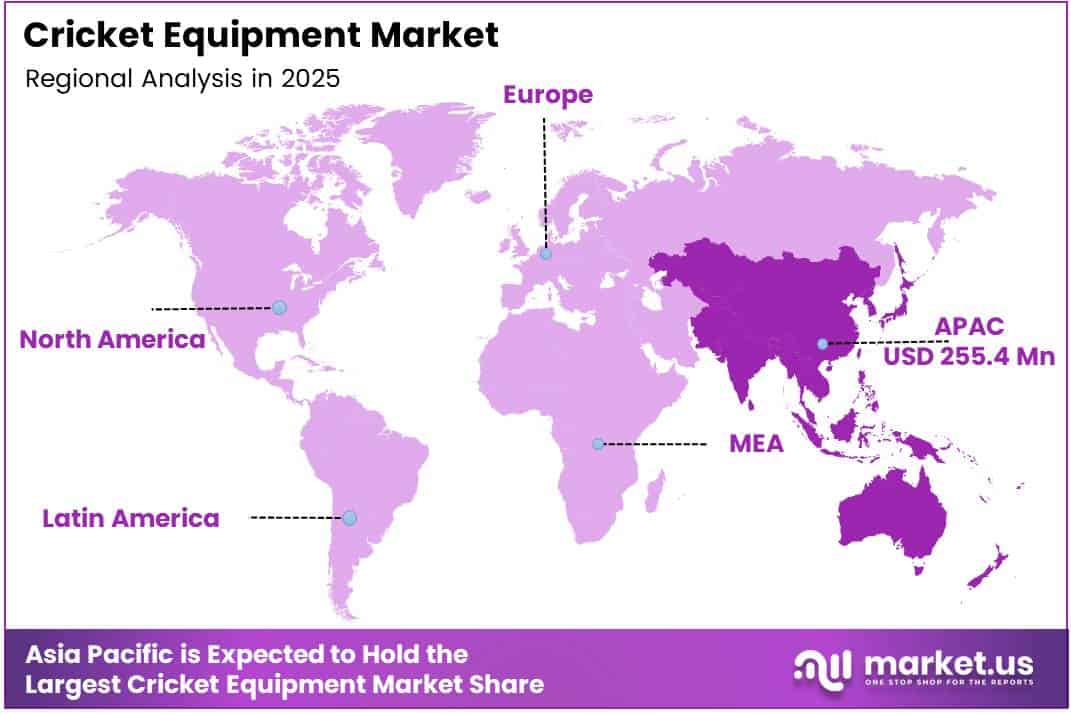

The market experiences steady growth driven by expanding cricket leagues and grassroots development programs. Asia Pacific dominates global demand due to cricket’s cultural significance in countries like India, Pakistan, and Australia. Professional tournaments create aspirational value that influences consumer purchasing decisions at all skill levels.

Equipment manufacturers invest heavily in research to enhance player safety and performance. Lightweight composite materials replace traditional willow and leather in many product categories. However, premium equipment maintains higher price points that challenge market penetration in developing regions.

Government initiatives promote cricket infrastructure development across emerging economies. Sports academies partner with brands to standardize training equipment and certifications. Moreover, digital platforms expand distribution reach beyond traditional retail networks. Consequently, accessibility improves for consumers in tier-two and tier-three cities.

In December 2025, Agilitas Sports acquired the One8 brand and Virat Kohli invested ₹40 crore into the company, embedding himself as an investor in the sportswear and equipment segment. This development signals growing celebrity involvement in market expansion strategies. Additionally, technological integration creates differentiation opportunities for established players.

Regulatory frameworks ensure product safety standards align with international cricket councils. Environmental concerns push brands toward sustainable manufacturing processes and recyclable materials. Therefore, eco-friendly innovations gain traction among environmentally conscious consumers seeking responsible purchasing options.

Market consolidation continues as major sporting goods conglomerates acquire specialist cricket brands. E-commerce channels transform distribution economics by reducing intermediary costs and enabling direct consumer relationships. Furthermore, customization services attract premium segment buyers seeking personalized equipment specifications.

Key Takeaways

- Global Cricket Equipment Market valued at USD 668.7 Million in 2025, projected to reach USD 1255.2 Million by 2035 at 6.5% CAGR

- Bat segment dominates product type category with 44.2% market share in 2025

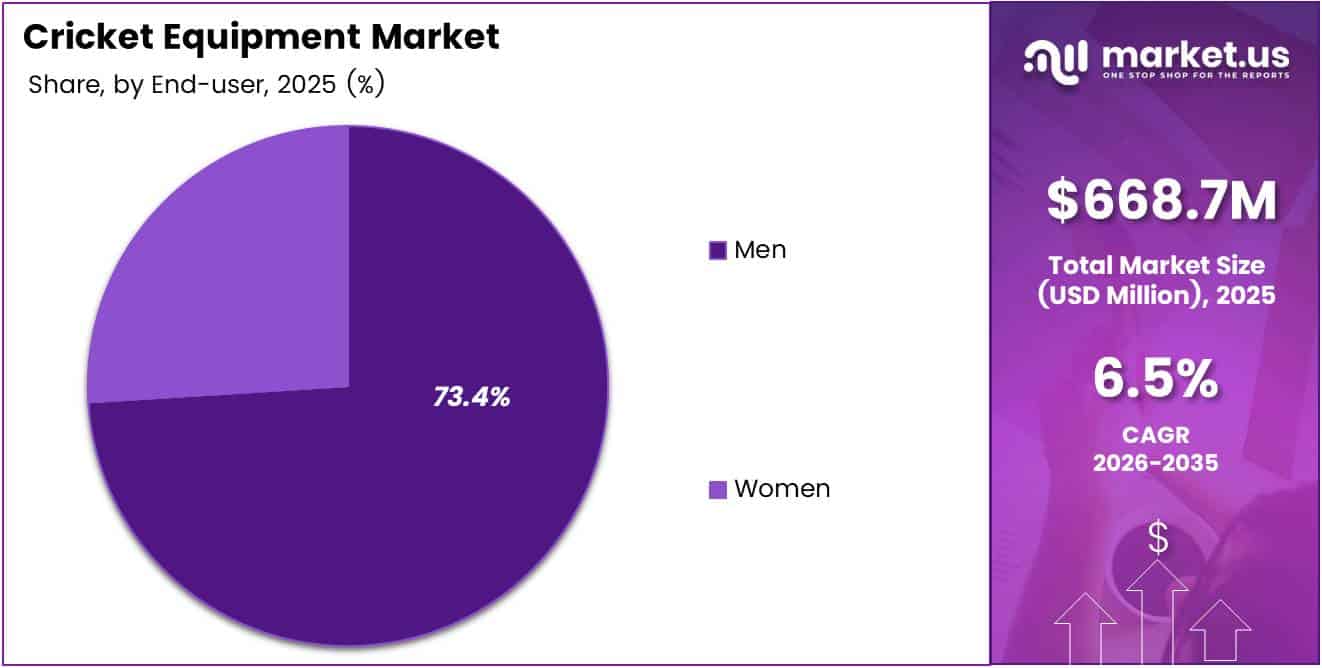

- Men end-users hold 73.4% market share, reflecting gender participation patterns

- Offline distribution channels account for 66.7% of total sales volume

- Asia Pacific leads regional markets with 38.20% share, valued at USD 255.4 Million

Product Type Analysis

Bat dominates with 44.2% due to replacement frequency and premium pricing strategies.

In 2025, Bat held a dominant market position in the By Product Type segment of Cricket Equipment Market, with a 44.2% share. Bats require regular replacement as willow deteriorates with usage and impact damage. Players invest in multiple bats for different match formats and pitch conditions. Premium Kashmir willow and English willow models command higher margins for manufacturers.

Ball represents essential consumables purchased in bulk by cricket academies and recreational clubs. Match-quality leather balls degrade rapidly during intensive play, creating recurring demand cycles. Moreover, different ball specifications exist for Test cricket, limited-overs formats, and practice sessions. Consequently, manufacturers maintain diverse product portfolios across price segments.

Protective Gear encompasses helmets, pads, gloves, and body protection equipment mandated by safety regulations. Rising awareness about head injuries drives helmet technology investments and replacement patterns. Additionally, professional endorsements influence consumer preferences toward certified protection standards. Therefore, safety equipment demonstrates consistent growth across all market segments.

Others category includes stumps, bails, kit bags, and training accessories supporting cricket activities. These complementary products enhance player convenience and equipment organization needs. Furthermore, innovation in training tools creates new revenue opportunities for specialized manufacturers.

End-user Analysis

Men dominates with 73.4% due to higher participation rates and professional cricket infrastructure.

In 2025, Men held a dominant market position in the By End-user segment of Cricket Equipment Market, with a 73.4% share. Male cricket participation significantly exceeds female involvement across most cricket-playing nations. Professional leagues and international tournaments generate aspirational demand for equipment endorsed by male cricketers. Moreover, established distribution networks prioritize men’s product lines with broader size ranges and specifications.

Women segment demonstrates accelerating growth as cricket boards invest in women’s cricket development programs. International tournaments gain media visibility, inspiring grassroots participation among young female athletes. Additionally, brands introduce specialized equipment designed for biomechanical differences in female players. Therefore, this segment presents significant expansion opportunities despite current market share limitations.

Distribution Channel Analysis

Offline dominates with 66.7% due to consumer preference for physical product evaluation before purchase.

In 2025, Offline held a dominant market position in the By Distribution Channel segment of Cricket Equipment Market, with a 66.7% share. Specialty sports retailers provide expert consultation and equipment testing facilities unavailable through digital channels. Consumers prefer evaluating bat weight, grip comfort, and protective gear fit before committing to purchases. Moreover, established retail networks maintain strong relationships with local cricket communities and academies.

Online channels experience rapid growth as e-commerce platforms offer competitive pricing and extensive product catalogs. Digital marketplaces provide access to international brands unavailable in local retail outlets. Additionally, user reviews and detailed product specifications help consumers make informed purchasing decisions remotely. Therefore, online distribution gains market share particularly among younger, tech-savvy cricket enthusiasts.

Key Market Segments

By Product Type

- Bat

- Ball

- Protective Gear

- Others

By End-user

- Men

- Women

By Distribution Channel

- Offline

- Online

Drivers

Rising Popularity of T20 Leagues Fueling Demand for Professional Cricket Gear

T20 cricket leagues proliferate globally, creating aspirational demand for professional-grade equipment among recreational players. Franchise tournaments showcase cutting-edge gear worn by international cricketers, influencing consumer purchasing patterns. Moreover, league partnerships with equipment brands generate visibility and credibility for specific product lines. Consequently, T20 format expansion directly correlates with equipment sales growth across multiple market segments.

Youth participation increases across emerging cricket economies as governments invest in sports infrastructure development. School and academy programs introduce cricket to millions of young athletes annually. Additionally, affordable entry-level equipment enables broader demographic access to the sport. Therefore, grassroots development initiatives create sustainable long-term demand pipelines for manufacturers targeting youth segments.

Manufacturers develop lightweight composite materials that enhance player performance without compromising durability standards. Carbon fiber reinforcements and polymer coatings extend product lifespan while reducing equipment weight. Furthermore, ergonomic designs optimize energy transfer and reduce injury risk during play. These technological improvements justify premium pricing while expanding addressable market opportunities.

Restraints

High Cost of Advanced Cricket Equipment Limiting Consumer Adoption

Premium cricket equipment carries price points that restrict accessibility in developing markets with lower disposable incomes. Professional-grade bats manufactured from English willow cost significantly more than entry-level alternatives. Moreover, complete protective gear sets represent substantial financial commitments for recreational players and parents. Consequently, price sensitivity constrains market penetration across large population segments in cricket-playing nations.

Seasonal demand patterns create revenue volatility for manufacturers and retailers operating in temperate climate regions. Cricket activity concentrates in warmer months, reducing equipment purchases during off-season periods. Additionally, tournament schedules influence buying cycles as players upgrade equipment before competitive seasons. Therefore, manufacturers face inventory management challenges and cash flow fluctuations throughout annual cycles.

Counterfeit products flood markets in price-sensitive regions, undermining legitimate brand revenues and reputation. Unauthorized manufacturers replicate popular equipment designs without adhering to safety standards or quality controls. Furthermore, consumers struggle to differentiate authentic products from sophisticated imitations in unregulated retail environments. These dynamics pressure premium brands to invest heavily in anti-counterfeiting measures and consumer education.

Growth Factors

Development of Eco-Friendly and Sustainable Cricket Gear

Manufacturers introduce biodegradable materials and recycled components in equipment production to address environmental concerns. Sustainable willow cultivation practices ensure long-term raw material availability while reducing ecological footprints. Moreover, brands communicate environmental commitments to attract conscious consumers willing to pay premium prices. Consequently, eco-friendly product lines create differentiation opportunities in increasingly competitive markets.

Sports brands collaborate with cricket academies to secure product endorsements and establish credibility among aspiring players. Academy partnerships provide testing grounds for new equipment designs while generating grassroots brand awareness. Additionally, endorsed products gain validation from coaching professionals who influence student purchasing decisions. According to industry analysts, these collaborations strengthen market positioning particularly in youth and amateur segments.

Smart cricket equipment integrates sensors and connectivity features that provide real-time performance analytics and training insights. IoT-enabled bats and balls capture swing data, impact force, and technique metrics for player development. Furthermore, mobile applications analyze collected data to deliver personalized coaching recommendations and progress tracking. Therefore, technological innovation creates premium product categories commanding higher margins and attracting tech-savvy consumers.

Emerging Trends

Rising Influence of Celebrity Cricketers on Equipment Choices

Professional cricketers leverage social media platforms to showcase equipment preferences, directly influencing fan purchasing behaviors. Player endorsements create aspirational connections between consumers and premium product lines. Moreover, signature edition equipment featuring celebrity branding commands price premiums in collector and enthusiast segments. Consequently, brands invest substantially in athlete partnerships to capitalize on influencer marketing dynamics.

Urban consumers establish home cricket facilities and backyard practice areas to maintain fitness and recreational activities. Compact training equipment designed for residential use expands addressable market beyond traditional outdoor settings. Additionally, pandemic-driven lifestyle changes accelerate home sports equipment adoption trends. Therefore, manufacturers develop space-efficient products targeting apartment dwellers and urban households.

In January 2026, Cricket South Africa appointed SHREY as its official helmet and luggage partner in a five-year deal through 2030. This partnership demonstrates growing integration of artificial intelligence in training tools and performance analysis platforms. Data analytics software helps coaches optimize player development strategies through evidence-based insights. Furthermore, AI-powered video analysis systems identify technique improvements and injury risk factors.

Regional Analysis

Asia Pacific Dominates the Cricket Equipment Market with a Market Share of 38.20%, Valued at USD 255.4 Million

Asia Pacific commands market leadership with 38.20% share, valued at USD 255.4 Million, driven by cricket’s cultural dominance in India, Pakistan, Australia, and Bangladesh. Massive grassroots participation combined with professional league investments creates sustained equipment demand across all price segments. Moreover, regional manufacturing hubs enable competitive pricing while maintaining quality standards for domestic and export markets.

North America Cricket Equipment Market Trends

North America experiences growing cricket interest among immigrant communities and youth programs introducing the sport in schools. Equipment sales concentrate in metropolitan areas with established cricket leagues and expatriate populations. Additionally, Caribbean diaspora communities maintain strong cricket traditions, supporting specialty retail presence. Therefore, market growth potential exists despite cricket’s niche status compared to dominant American sports.

Europe Cricket Equipment Market Trends

Europe demonstrates steady demand led by England’s established cricket infrastructure and growing participation in Netherlands, Ireland, and Scotland. Professional county cricket and international competitions sustain premium equipment markets. Furthermore, immigrant communities from cricket-playing nations expand grassroots participation across major European cities. Consequently, specialized retailers serve diverse consumer segments with varying quality and price expectations.

Latin America Cricket Equipment Market Trends

Latin America represents an emerging market with cricket development concentrated in Argentina, Brazil, and Caribbean nations. Limited infrastructure constrains market size, but regional cricket federations invest in youth development programs. Moreover, international tournament hosting opportunities raise sport visibility and equipment awareness. Therefore, long-term growth depends on sustained grassroots investment and competitive success.

Middle East & Africa Cricket Equipment Market Trends

Middle East and Africa show expanding cricket participation driven by South Asian expatriate populations and indigenous cricket growth in South Africa, Zimbabwe, and Kenya. Gulf nations invest in sports infrastructure as part of economic diversification strategies. Additionally, international cricket council development programs target African markets for long-term expansion. Consequently, equipment demand grows steadily despite economic constraints in certain regions.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

Kookaburra Sport Pty Ltd maintains market leadership through comprehensive product portfolios spanning all cricket equipment categories and price segments. The Australian manufacturer supplies cricket balls to international cricket councils and professional leagues worldwide. Moreover, continuous innovation in bat technology and protective gear strengthens brand reputation among professional and amateur players. Consequently, Kookaburra commands premium positioning supported by extensive distribution networks across cricket-playing nations.

Grays International operates as a heritage brand with centuries of cricket equipment manufacturing expertise and craftsmanship recognition. The company specializes in handcrafted bats and premium protective gear favored by traditionalist cricketers. Additionally, Grays maintains strong presence in English county cricket and Commonwealth markets. Therefore, brand heritage creates competitive differentiation despite competition from mass-market manufacturers.

KIPPAX WILLOW LIMITED COMPANY focuses on premium bat manufacturing using English willow sourced from sustainable forestry operations. The company supplies professional cricketers and serious amateur players seeking tournament-grade equipment performance. Furthermore, custom bat-making services attract collectors and players with specific weight and balance preferences. These specialization strategies enable premium pricing and loyal customer relationships.

Adidas AG leverages global sports brand recognition to expand cricket equipment market presence through strategic partnerships and celebrity endorsements. The company applies athletic footwear and apparel expertise to cricket-specific product development. Moreover, integrated marketing campaigns across multiple sports create cross-selling opportunities with existing customer bases. Consequently, Adidas gains market share particularly among younger consumers valuing brand lifestyle associations.

Key Players

- Kookaburra Sport Pty Ltd

- Grays International

- KIPPAX WILLOW LIMITED COMPANY

- Bradbury

- Blue Tongue Sports

- Adidas AG

- Stag Cricket

- Blankbats

Recent Developments

- January 2026 – Cricket South Africa appointed SHREY as its official helmet and luggage partner in a five-year deal through 2030. This partnership strengthens SHREY’s international presence while providing Cricket South Africa with certified safety equipment for national teams and development programs across all competitive levels.

- 2025 – Kookaburra Sport’s sensor-embedded SmartBall technology was highlighted in industry coverage as a training innovation enabling real-time analytics. The technology captures bowling metrics including speed, spin rate, and trajectory data, providing coaches and players with actionable performance insights during practice sessions and skill development programs.

Report Scope

Report Features Description Market Value (2025) USD 668.7 Million Forecast Revenue (2035) USD 1255.2 Million CAGR (2026-2035) 6.5% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Bat, Ball, Protective Gear, Others), By End-user (Men, Women), By Distribution Channel (Offline, Online) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Kookaburra Sport Pty Ltd, Grays International, KIPPAX WILLOW LIMITED COMPANY, Bradbury, Blue Tongue Sports, Adidas AG, Stag Cricket, Blankbats Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Kookaburra Sport Pty Ltd

- Grays International

- KIPPAX WILLOW LIMITED COMPANY

- Bradbury

- Blue Tongue Sports

- Adidas AG

- Stag Cricket

- Blankbats