Global Cotton Yarn Market Size, Share Analysis Report By Type (Carded Yarn, Combed Yarn, Others), By Application (Apparel, Home Textiles, Industrial Textiles, Others), By Distribution Channel (Online, Offline) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 159039

- Number of Pages: 281

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

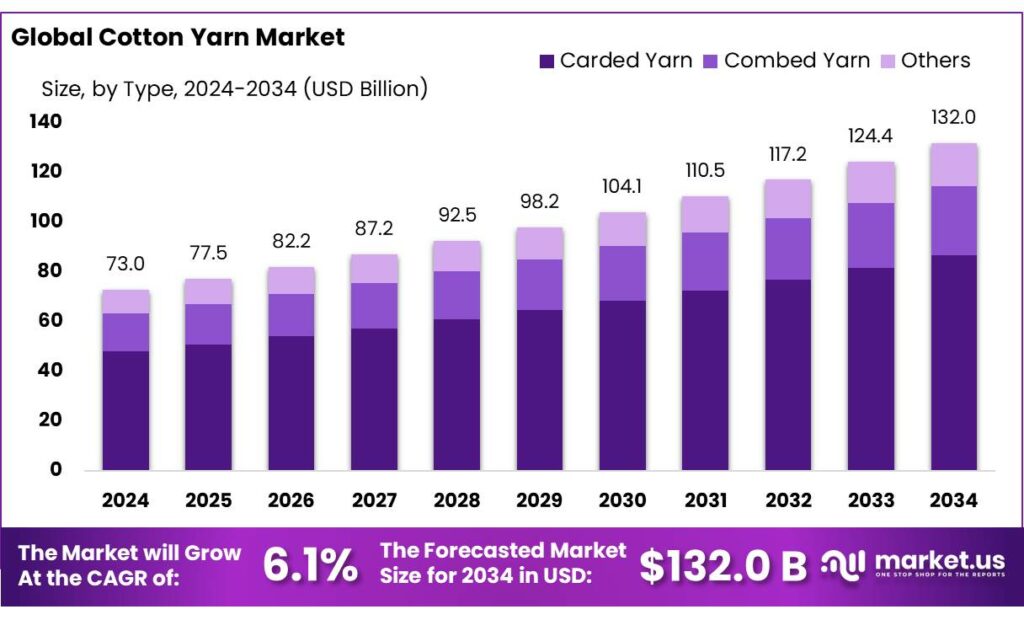

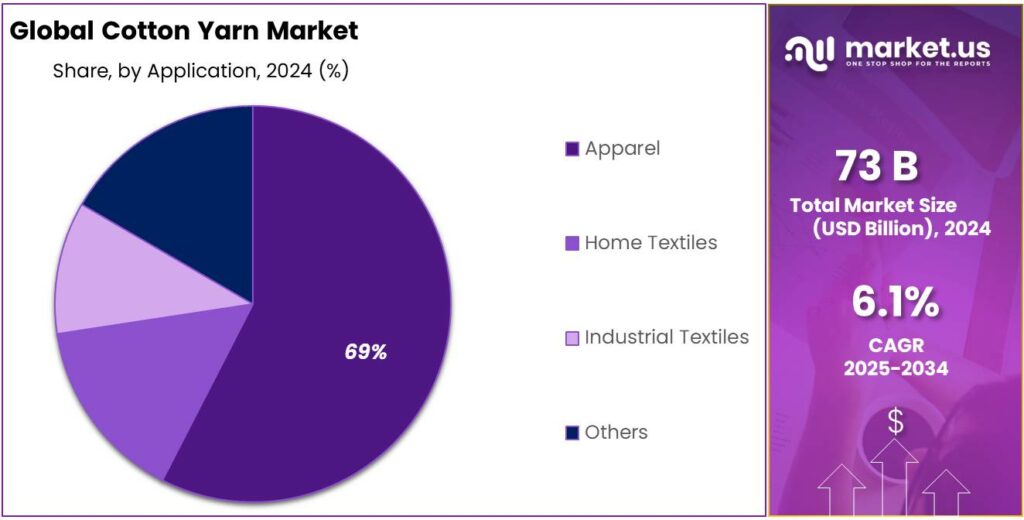

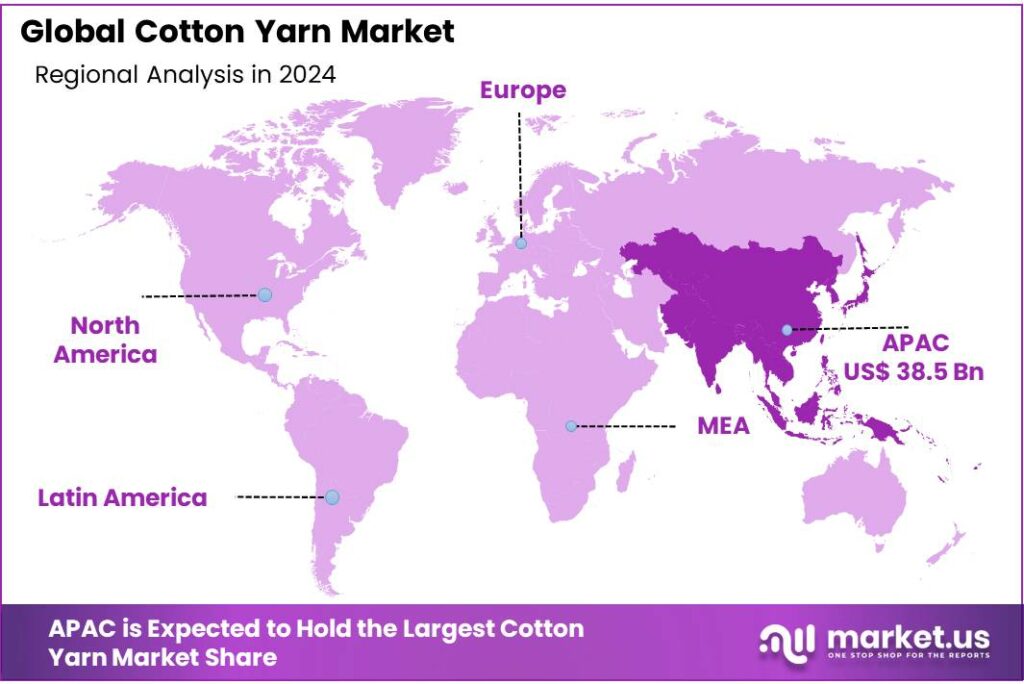

The Global Cotton Yarn Market size is expected to be worth around USD 132.0 Billion by 2034, from USD 73.0 Billion in 2024, growing at a CAGR of 6.1% during the forecast period from 2025 to 2034. In 2024 Asia-Pacific (APAC) held a dominant market position, capturing more than a 52.8% share, holding USD 38.5 Billion in revenue.

Cotton yarn is one of the most vital materials in the textile industry, playing a crucial role in manufacturing fabrics for apparel, home textiles, and industrial products. It is made by spinning cotton fibers into long, continuous strands of yarn. This process involves several stages, from ginning the cotton to spinning it into fine threads, which are then woven or knitted into fabrics. Cotton yarns are favored for their natural feel, breathability, and ability to absorb moisture, making them ideal for producing clothing, especially in hot and humid climates.

- For the Marketing Year (MY) 2025/26, domestic cotton production is forecast at 25 million 480‐lb bales, cultivated over about 11.4 million hectares, with average yield of 477 kg/ha.

Government policies have played a crucial role in shaping the industry landscape. The Pradhan Mantri Mega Integrated Textile Region and Apparel (PM MITRA) Parks Scheme aims to establish seven world-class textile parks with state-of-the-art infrastructure and integrated value chains. The first park in Madhya Pradesh has attracted investments totaling 20,746 crore INR (approximately 2.5 billion USD), positioning it as the nation’s largest textile hub.

Additionally, the temporary removal of the 11% import duty on cotton from August 19 to September 30, 2025, is a strategic move to support the garment industry facing challenges such as increased export tariffs to the United States.

Key Takeaways

- Cotton Yarn Market size is expected to be worth around USD 132.0 Billion by 2034, from USD 73.0 Billion in 2024, growing at a CAGR of 6.1%.

- Carded Yarn held a dominant market position, capturing more than 65.8% of the cotton yarn market.

- Apparel held a dominant market position, capturing more than a 69.3% share of the cotton yarn market.

- Online held a dominant market position, capturing more than 87.4% of the cotton yarn market.

- Asia-Pacific (APAC) region holds a dominant share of 52.8% in the global cotton yarn market, valued at approximately USD 38.5 billion.

By Type Analysis

Carded Yarn Dominates Cotton Yarn Market with 65.8% Share in 2024

In 2024, Carded Yarn held a dominant market position, capturing more than 65.8% of the cotton yarn market. This segment continues to lead due to the cost-effectiveness and versatility of carded yarn, which makes it a popular choice for a wide range of textile products. Carded yarn is known for its relatively rougher texture, which makes it ideal for fabrics that require strength and durability.

The strong demand for carded yarn can be attributed to its widespread use in industries such as apparel manufacturing, home textiles, and industrial fabrics. Its affordability compared to other types of yarn, along with its ability to be easily processed into various fabric types, ensures its continued market dominance. As demand for durable and cost-effective textiles grows, carded yarn is expected to maintain its leadership position through 2025, further strengthening its share of the cotton yarn market.

By Application Analysis

Apparel Leads Cotton Yarn Market with 69.3% Share in 2024

In 2024, Apparel held a dominant market position, capturing more than a 69.3% share of the cotton yarn market. This segment continues to lead as cotton remains a preferred material for clothing due to its softness, breathability, and versatility. Cotton yarn is widely used in the production of a variety of apparel, including casual wear, activewear, and even formal clothing.

The demand for cotton yarn in the apparel sector is driven by the growing consumer preference for natural fabrics, as well as the rise in sustainable fashion. Cotton’s ability to be blended with other fibers also adds to its appeal, making it a versatile choice for a wide range of garments. As the global apparel industry continues to expand, particularly in emerging markets, the cotton yarn used for apparel is expected to maintain a dominant share, further increasing its market presence through 2025.

By Distribution Channel Analysis

Online Dominates Cotton Yarn Market with 87.4% Share in 2024

In 2024, Online held a dominant market position, capturing more than 87.4% of the cotton yarn market. The growth of e-commerce platforms has significantly transformed the way cotton yarn is distributed, making it easier for both manufacturers and consumers to access a wide range of products. Online channels provide convenience, a broader selection of brands, and competitive pricing, all of which contribute to the segment’s strong position.

The popularity of online shopping has been particularly strong in regions where internet penetration and digital payment systems are rapidly expanding. Consumers and businesses alike are increasingly turning to online platforms for sourcing cotton yarn due to the ease of comparison shopping, fast delivery, and bulk purchase options. As digital platforms continue to grow, the online distribution channel is expected to further solidify its dominance in the cotton yarn market through 2025, with more companies investing in e-commerce to meet the rising demand.

Key Market Segments

By Type

- Carded Yarn

- Combed Yarn

- Others

By Application

- Apparel

- Home Textiles

- Industrial Textiles

- Others

By Distribution Channel

- Online

- Offline

Emerging Trends

Surge in Exports and Strategic Government Support

India’s cotton yarn industry is experiencing a significant resurgence, driven by a combination of robust export growth and strategic government initiatives. In the fiscal year 2023–2024, cotton yarn exports from India reached approximately $11.7 billion, marking a 6.71% increase from the previous year. This growth is particularly notable in markets such as China, where exports surged by 1,324% during the same period, and Turkey, which saw an increase of 188%.

A pivotal factor contributing to this export boom is the establishment of the PM Mega Integrated Textile and Apparel (MITRA) Park in Dhar, Madhya Pradesh. This initiative has attracted over ₹23,000 crore in investments from 114 textile and apparel manufacturers across various states, including Tamil Nadu, Gujarat, and Rajasthan. The park, spanning over 2,158 acres, is designed to foster integrated supply chains, reduce logistics costs, and streamline production, positioning India as a global textile powerhouse.

In addition to infrastructure investments, the Indian government has implemented supportive policies to bolster the cotton yarn sector. The extension of the 11% cotton import duty exemption until December 31, 2025, aims to alleviate raw material shortages and support the highly capital-intensive cotton value chain, which employs approximately 35 million people. These measures are expected to enhance the competitiveness of Indian cotton yarn in both domestic and international markets.

The industry is projected to achieve a revenue growth of 7–9% in the current fiscal year, a significant improvement from the 2–4% growth recorded in the previous year. This uptick is driven by higher volumes, aided by a modest rise in yarn prices and strong domestic demand. Operating margins are also expected to improve by another 50–100 basis points, supported by stable cotton yarn spreads and improved cotton availability through procurement by the Cotton Corporation of India

Drivers

Government Support and Strategic Investments

The Indian cotton yarn industry is experiencing a resurgence, driven by a combination of strategic investments and government initiatives aimed at revitalizing the sector. One of the most significant developments is the establishment of the PM Mega Integrated Textile and Apparel (MITRA) Park in Dhar, Madhya Pradesh.

This initiative has already attracted over ₹23,000 crore in investments from around 114 textile and apparel manufacturers across various states, including Tamil Nadu, Gujarat, and Rajasthan. The park is designed to foster integrated supply chains, reduce logistics costs, and streamline production, positioning India as a global textile powerhouse.

These concerted efforts are expected to bolster the cotton yarn industry, enhancing its competitiveness in both domestic and international markets. The combination of strategic infrastructure development and supportive policies underscores the government’s commitment to revitalizing the cotton yarn sector and ensuring its sustainable growth.

Restraints

Global Trade Barriers and Export Challenges

The Indian cotton yarn industry is grappling with significant export challenges, primarily due to escalating global trade barriers. A notable development is the imposition of a 50% tariff by the United States on Indian textile imports, including cotton yarn. This tariff comprises a 25% existing duty and an additional 25% penalty, effective from August 2025, in response to India’s purchases of Russian oil. This steep tariff has made Indian cotton yarn less competitive compared to other countries like Bangladesh and Vietnam, which face lower duties of 20% each.

Consequently, Indian cotton yarn purchases have declined by 50%, as reported by the Cotton Association of India (CAI). The U.S. market, being India’s largest textile export destination, is particularly affected. The CAI notes that shifting to alternative markets is challenging due to the unique size and standards of the U.S. market.

- In response to these challenges, the Indian government has temporarily exempted import duties on cotton from August 19 to September 30, 2025. This move aims to support the garment industry, which is facing increased challenges due to the U.S. tariff hike. The exemption reduces the prior 11% duty, providing some relief to the sector

These developments underscore the vulnerability of the Indian cotton yarn industry to global trade dynamics and the need for strategic measures to enhance competitiveness in the international market.

Opportunity

Government Support and Strategic Investments

The Indian cotton yarn industry is experiencing a resurgence, driven by a combination of strategic investments and government initiatives aimed at revitalizing the sector. One of the most significant developments is the establishment of the PM Mega Integrated Textile and Apparel (MITRA) Park in Dhar, Madhya Pradesh.

This initiative has already attracted over ₹23,000 crore in investments from around 114 textile and apparel manufacturers across various states, including Tamil Nadu, Gujarat, and Rajasthan. The park is designed to foster integrated supply chains, reduce logistics costs, and streamline production, positioning India as a global textile powerhouse.

These concerted efforts are expected to bolster the cotton yarn industry, enhancing its competitiveness in both domestic and international markets. The combination of strategic infrastructure development and supportive policies underscores the government’s commitment to revitalizing the cotton yarn sector and ensuring its sustainable growth.

Regional Insights

APAC Dominates Cotton Yarn Market with 52.8% Share, Valued at USD 38.5 Billion in 2024

In 2024, the Asia-Pacific (APAC) region holds a dominant share of 52.8% in the global cotton yarn market, valued at approximately USD 38.5 billion. This region has established itself as the leading hub for cotton yarn production and consumption due to its robust textile industry, favorable economic conditions, and large-scale manufacturing capabilities. Countries like China, India, and Bangladesh are major contributors to this dominance, with India being the largest producer of cotton yarn globally, followed closely by China.

Furthermore, the APAC region is benefiting from rising consumer demand for cotton-based fabrics, driven by the growing middle class and changing lifestyle patterns. The shift towards sustainable and eco-friendly textiles also plays a role in the growing consumption of cotton yarn in the region. As the textile industry continues to expand, particularly in emerging markets, APAC is projected to maintain its dominant market position through 2025, with further growth expected in both production and consumption.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Texhong is a prominent Chinese textile manufacturer specializing in cotton yarn production. The company operates over 1.89 million spindles across multiple production bases in China, Vietnam, and Cambodia. In 2023, Texhong aimed to sell 750,000 tonnes of yarn and 110 million meters of woven garment fabrics. Despite challenges such as declining yarn prices and increased competition, Texhong continues to expand its global presence, particularly in Southeast Asia and Latin America.

Vardhman is India’s largest vertically integrated textile manufacturer. With over 1.23 million spindles, the company produces approximately 240,000 metric tonnes of yarn annually. In 2024, Vardhman unveiled a ₹2,000 crore investment plan to expand its yarn and fabric capacities. The company exports to over 75 countries, serving major global brands like H&M, Ralph Lauren, and Adidas.

Huafu, based in Zhejiang, China, specializes in color-spun yarns. The company operates 1.89 million spindles and produces approximately 200,000 tonnes of yarn annually. In 2023, Huafu invested $735 million to establish the world’s largest mélange spinning mill in Xinjiang, aiming to enhance its production capacity and technological capabilities.

Top Key Players Outlook

- Texhong

- Vardhman Group

- BROS

- Weiqiao Textile

- Lutai Textile

- Huafu

- Alok

- Huamao

- Nahar Spinning

- Nishat Mills

Recent Industry Developments

In 2024, Texhong is expected to produce approximately 1.8 million metric tons of cotton yarn, contributing significantly to the textile industry, particularly in China, where it has its largest manufacturing base.

In 2024, Huafu is expected to produce around 1.5 million tons of cotton yarn, positioning itself as a major player in both domestic and global markets. Known for its advanced spinning technology, the company offers a wide range of high-quality yarns, primarily for the apparel and home textile industries.

Report Scope

Report Features Description Market Value (2024) USD 73.0 Bn Forecast Revenue (2034) USD 132.0 Bn CAGR (2025-2034) 6.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Carded Yarn, Combed Yarn, Others), By Application (Apparel, Home Textiles, Industrial Textiles, Others), By Distribution Channel (Online, Offline) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Texhong, Vardhman Group, BROS, Weiqiao Textile, Lutai Textile, Huafu, Alok, Huamao, Nahar Spinning, Nishat Mills, Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Texhong

- Vardhman Group

- BROS

- Weiqiao Textile

- Lutai Textile

- Huafu

- Alok

- Huamao

- Nahar Spinning

- Nishat Mills