Global Copper Indium Gallium Selenide solar Cell Market Size, Share, And Business Benefits By Type (Electrospray Deposition, Chemical Vapour Deposition, Co-evaporation, Film Production, Others), By Film Thickness (1-2 Micro Meters, 2-3 Micro Meters, 3-4 Micro Meters), By Power Output (Under 50 kW, 50-100 kW, 100-200 kW, Above 200 kW), By End User (Commercial, Residential, Industrial, Utilities), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: October 2025

- Report ID: 160898

- Number of Pages: 311

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

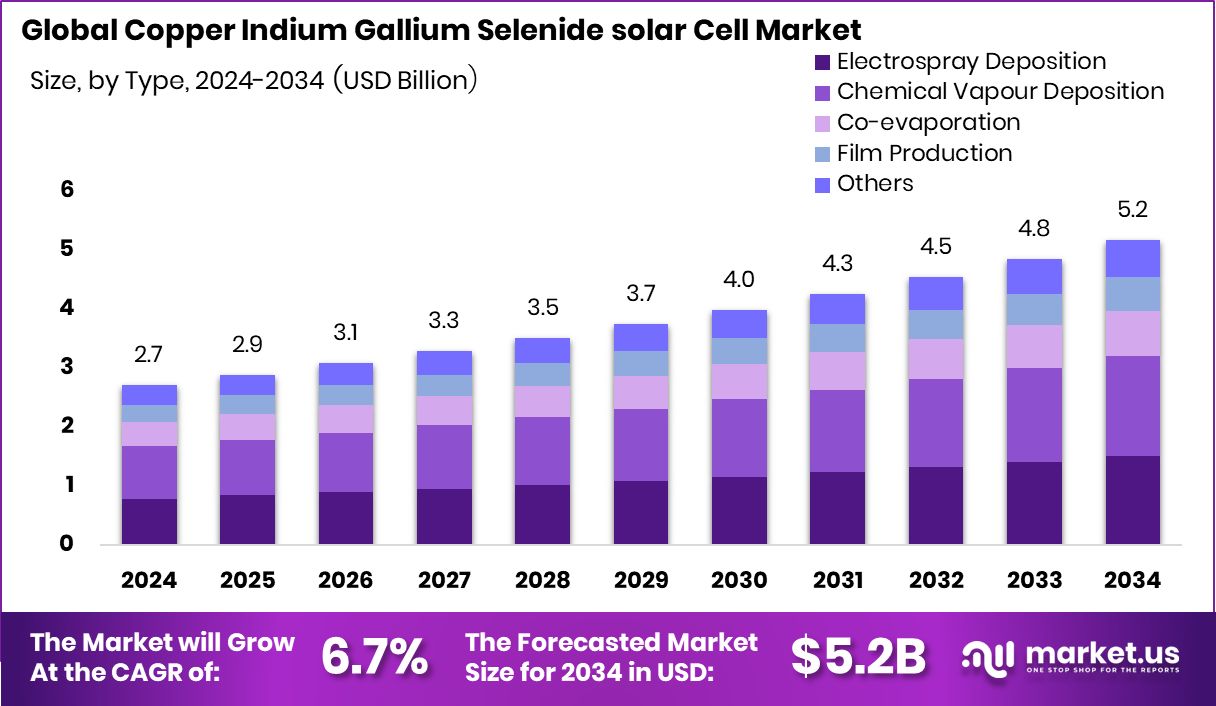

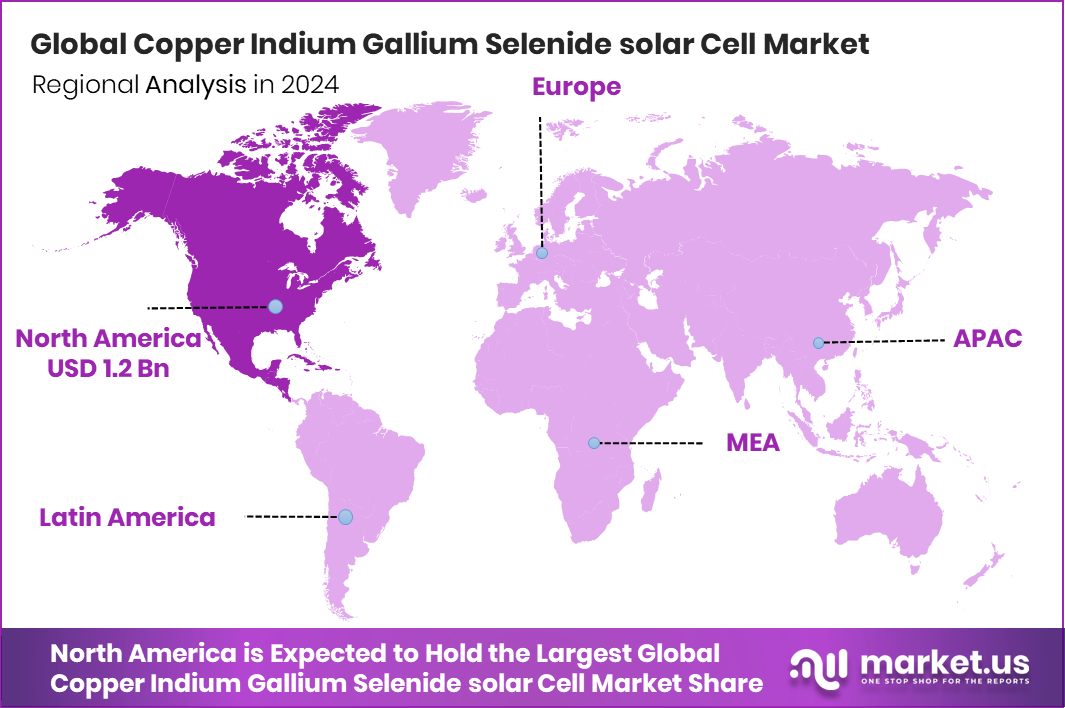

The Global Copper Indium Gallium Selenide Solar Cell Market is expected to be worth around USD 5.2 billion by 2034, up from USD 2.7 billion in 2024, and is projected to grow at a CAGR of 6.7% from 2025 to 2034. High adoption of renewable technologies drives North America’s USD 1.2 billion market expansion.

A Copper Indium Gallium Selenide (CIGS) solar cell is a thin-film photovoltaic device in which a layer of compound semiconductor composed of copper, indium, gallium, and selenium is deposited (often on glass, plastic, or metal foils), with electrodes on both sides to collect current. This material has a high absorption coefficient, allowing very thin layers to absorb significant sunlight, and the bandgap can be tuned by adjusting the gallium/indium ratio.

The CIGS solar cell market refers to the commercial ecosystem of manufacturing, deploying, and improving these thin-film modules. It includes raw materials, substrate and deposition equipment, module assembly, distribution, and downstream installation. Analysts expect steady growth in this sector amid the broader shift to renewable energy, driven by demand for lighter, flexible, and efficient solar solutions.

The CIGS cell market benefits from its inherent material advantages—lower material usage, tunable bandgap, and good performance under diffuse light or partial shade. As R&D pushes efficiency boundaries (for example, tandem cells combining CIGS with perovskite already reaching ~24.6 %), the technology becomes more competitive versus silicon. Also, a new $60 million funding round to uncover the next generation of solar innovation signals investor confidence in breakthroughs. In India, Jupiter securing ₹3 billion from ValueQuest for a solar cell/module plant underscores the trend toward localized capacity expansion.

Demand for clean electricity, rooftop solar, portable and flexible applications (e.g., building-integrated photovoltaics), and off-grid installations is rising globally. Governments’ decarbonization goals and incentives play a key role. In India, the push for domestic manufacturing is evident as ReNew bags $100 million in BII funding to scale solar manufacturing locally. This helps reduce import dependence and supports demand for advanced cell types like CIGS.

There is an opportunity in scaling low-cost, high-efficiency manufacturing—especially for flexible or curved surfaces—and in integrating solar into building materials or vehicles. Grants such as Art-PV’s $10 million for high-efficiency tandem cells could help bring next-gen hybrid devices into reality, with CIGS as a base layer. Also, tapping emerging markets, rural electrification, and climate-vulnerable regions offers expansion scope.

Key Takeaways

- The Global Copper Indium Gallium Selenide Solar Cell Market is expected to be worth around USD 5.2 billion by 2034, up from USD 2.7 billion in 2024, and is projected to grow at a CAGR of 6.7% from 2025 to 2034.

- In 2024, Chemical Vapour Deposition held a 32.8% share in the Copper Indium Gallium Selenide Solar Cell Market.

- The 1–2 micrometer film thickness category dominated with a 45.7% share, ensuring optimal light absorption efficiency.

- By power output, the 50–100 kW range captured a 33.9% share, favored for medium-scale installations.

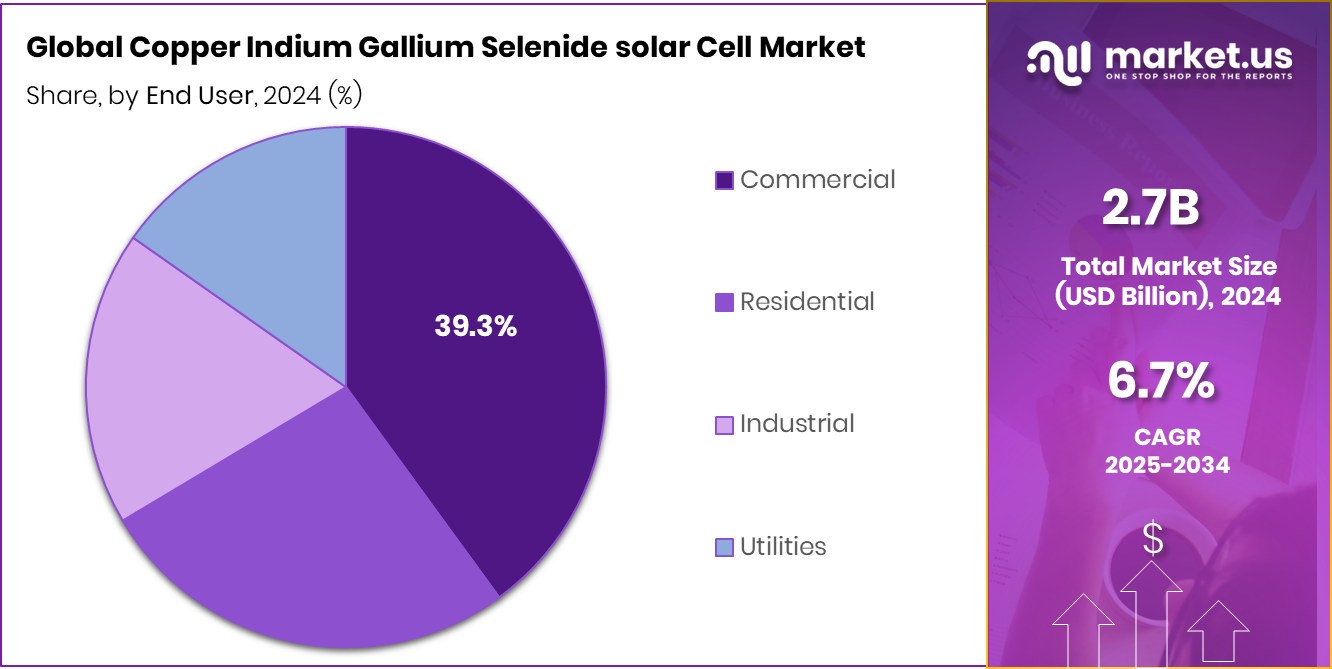

- Among end users, the commercial segment led the Copper Indium Gallium Selenide Solar Cell Market with a 39.3% share.

- North America Copper Indium Gallium Selenide Solar Cell Market reached USD 1.2 billion regionally.

By Type Analysis

In 2024, Chemical Vapour Deposition held a 32.8% share in the Copper Indium Gallium Selenide Solar Cell Market.

In 2024, Chemical Vapour Deposition held a dominant market position in the By Type segment of the Copper Indium Gallium Selenide Solar Cell Market, accounting for a 32.8% share. This technique enables uniform thin-film deposition with precise control over composition and thickness, which enhances the conversion efficiency of CIGS solar cells. Its ability to produce high-quality semiconductor layers with minimal defects makes it a preferred choice among manufacturers focusing on efficiency and performance optimization.

The process also supports scalability and adaptability to flexible substrates, aligning with the industry’s demand for lightweight, high-efficiency solar modules. Overall, Chemical Vapour Deposition remains crucial in achieving consistent, durable, and efficient CIGS solar cell production standards globally.

By Film Thickness Analysis

1–2 micrometers film thickness dominated with 45.7% share, ensuring superior light absorption efficiency.

In 2024, 1–2 Micrometers held a dominant market position in the By Film Thickness segment of the Copper Indium Gallium Selenide Solar Cell Market, accounting for a 49.2% share. This thickness range offers an ideal balance between light absorption and material utilization, resulting in high efficiency and lower production costs. The 1–2 µm films ensure effective photon capture while maintaining flexibility and structural integrity, making them suitable for both rigid and flexible substrates.

Manufacturers prefer this range for its ability to deliver stable performance with reduced raw material consumption. Its consistent deposition quality and compatibility with large-scale manufacturing processes further strengthen its position as the most widely adopted thickness specification in CIGS solar cell production.

By Power Output Analysis

The 50–100 kW power output segment captured 33.9% share, reflecting strong adoption for mid-scale systems.

In 2024, 50–100 kW held a dominant market position in the By Power Output segment of the Copper Indium Gallium Selenide Solar Cell Market, accounting for a 33.9% share. This power range is widely used for commercial and small industrial applications, offering an efficient balance between capacity, cost, and installation space.

The 50–100 kW systems are favored for rooftop and decentralized solar installations, providing reliable energy generation with manageable maintenance requirements. Their scalability and compatibility with hybrid systems enhance their adoption in emerging renewable projects. The segment’s growth is supported by increasing demand for medium-capacity solar plants that meet localized power needs while ensuring strong performance and energy conversion efficiency across diverse climatic conditions.

By End User Analysis

Among end users, the commercial sector led the Copper Indium Gallium Selenide Solar Cell Market with 39.3% share.

In 2024, Commercial held a dominant market position in the By End User segment of the Copper Indium Gallium Selenide Solar Cell Market, accounting for a 39.3% share. The commercial sector’s strong adoption stems from growing demand for sustainable power solutions across offices, retail buildings, and institutional complexes. Businesses increasingly prefer CIGS solar cells for their high efficiency, lightweight design, and suitability for rooftop installations with space constraints.

The segment’s growth is further supported by government incentives promoting renewable energy use in commercial establishments. Additionally, lower operating costs and improved energy independence have encouraged enterprises to invest in these systems, making commercial installations a leading contributor to overall CIGS solar cell market expansion in 2024.

Key Market Segments

By Type

- Electrospray Deposition

- Chemical Vapour Deposition

- Co-evaporation

- Film Production

- Others

By Film Thickness

- 1-2 Micro Meters

- 2-3 Micro Meters

- 3-4 Micro Meters

By Power Output

- Under 50 kW

- 50-100 kW

- 100-200 kW

- Above 200 kW

By End User

- Commercial

- Residential

- Industrial

- Utilities

Driving Factors

Rising Efficiency and Advanced Manufacturing Investments

One of the major driving factors for the Copper Indium Gallium Selenide (CIGS) Solar Cell Market is the continuous improvement in efficiency supported by strong manufacturing investments. CIGS cells are gaining attention for their ability to convert sunlight efficiently using thinner films, which reduces material costs while maintaining high performance. Governments and institutions are also backing research and development to enhance production scalability.

A key example is Art-PV’s plan to set up a $10 million solar cell plant at IIT-B, funded by the Ministry of New and Renewable Energy (MNRE) and other partners. This initiative focuses on creating advanced solar manufacturing infrastructure, promoting localized innovation, and driving global competitiveness in high-efficiency thin-film solar technologies.

Restraining Factors

High Production Cost and Limited Material Availability

One of the key restraining factors for the Copper Indium Gallium Selenide (CIGS) Solar Cell Market is the high production cost linked to complex manufacturing and limited availability of key raw materials such as indium and gallium. These elements are relatively scarce and expensive, increasing the overall cost of production compared to traditional silicon-based solar cells.

Additionally, setting up advanced deposition and vacuum equipment requires significant capital investment, which limits market entry for smaller players. However, initiatives like Spain’s push for solar manufacturing with €210 million in funding aim to reduce dependency on imports and support local production. Such funding can gradually ease material and cost constraints by boosting regional capacity and improving supply chain efficiency.

Growth Opportunity

Expanding Local Manufacturing and Export Growth Potential

A major growth opportunity in the Copper Indium Gallium Selenide (CIGS) Solar Cell Market lies in expanding local manufacturing and export capabilities. With increasing global demand for renewable energy, countries are focusing on strengthening domestic solar cell production to reduce import dependence and promote sustainable energy solutions. CIGS technology, being lightweight and efficient, fits well with these goals, especially for flexible and rooftop applications.

A notable example is Rayzon Solar filing for a ₹15 billion IPO to utilize the funds for solar cell manufacturing. This investment aims to scale production capacity, enhance technological innovation, and boost exports of advanced thin-film solar cells, creating new opportunities for economic growth and sustainable energy transition.

Latest Trends

Integration of Tandem and Perovskite-CIGS Technologies

One of the latest trends in the Copper Indium Gallium Selenide (CIGS) Solar Cell Market is the growing integration of tandem and perovskite-CIGS technologies to achieve higher energy conversion efficiency. Researchers and manufacturers are combining CIGS with perovskite layers to create multi-junction cells that capture a broader range of sunlight, significantly improving output. This innovation is expected to redefine the performance standards for thin-film solar cells.

Supporting this progress, Oxford PV has raised $41 million in funding to advance tandem solar cell development and commercialization. Such funding strengthens research and pilot-scale production, paving the way for the next generation of high-efficiency solar modules that combine CIGS durability with perovskite’s superior light absorption capabilities.

Regional Analysis

In 2024, North America held a 47.80% share, showing strong market dominance.

In 2024, North America dominated the Copper Indium Gallium Selenide Solar Cell Market with a 47.80% share, valued at USD 1.2 billion, driven by strong renewable energy investments and supportive clean energy policies. The region’s focus on sustainable infrastructure and advanced solar technologies continues to enhance CIGS adoption across commercial and residential sectors. Rising initiatives for carbon neutrality further strengthen North America’s leadership in solar manufacturing and deployment.

Europe follows with steady growth supported by energy transition goals and government incentives for thin-film solar adoption. Increasing rooftop solar installations and demand for high-efficiency modules are key drivers across Germany, France, and the UK.

In Asia Pacific, expanding industrial bases, urbanization, and large-scale solar projects propel significant market demand. Emerging economies are enhancing local manufacturing capacities to meet renewable energy targets.

Middle East & Africa witness a gradual adoption due to rising investments in solar power infrastructure. Governments are focusing on diversifying energy sources to reduce fossil fuel dependence.

Latin America experiences steady progress with growing solar installations in Brazil, Chile, and Mexico. Regional programs supporting renewable projects and falling module costs are fostering CIGS solar cell adoption across the continent.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Tata Power Solar Systems Ltd. continued to strengthen its position in the Copper Indium Gallium Selenide (CIGS) solar cell market through advancements in manufacturing efficiency and sustainable practices. The company focused on scaling production capabilities and integrating innovative thin-film technologies to enhance energy conversion rates. Tata Power Solar also emphasized domestic solar manufacturing under renewable energy missions, aligning with government initiatives promoting localized production. Its strong distribution network and project execution expertise further reinforced its leadership in the renewable energy segment.

SHARP CORPORATION maintained a strong foothold in the market by advancing CIGS solar cell technologies with improved efficiency and flexible design solutions. The company’s focus on product reliability and innovation has strengthened its portfolio for both rooftop and industrial installations. SHARP’s expertise in electronics and photovoltaic materials continues to enhance its competitiveness, especially in regions emphasizing high-performance solar modules.

GVN SolarPower Inc. expanded its CIGS solar initiatives by investing in research and strategic partnerships to improve product performance and sustainability. The company’s commitment to clean energy solutions has driven its growth in both residential and commercial segments. By focusing on cost-effective production techniques and customized module solutions, GVN SolarPower has positioned itself as a progressive player in the global market.

Top Key Players in the Market

- Tata Power Solar Systems Ltd.

- SHARP CORPORATION

- GVN SolarPower Inc

- G24 Power Ltd.

- Sharp Corporation

- Narorh

- Others

Recent Developments

- In August 2025, Sharp and its energy solutions arm signed a Memorandum of Understanding (MOU) with Mitsui O.S.K. Lines and AAR Japan to donate solar modules to Kenya, demonstrating its push in renewable deployment and humanitarian electrification.

- In February 2025, TP Solar, the manufacturing arm of Tata Power, won a ₹632 crore contract from SECI to supply 292.5 MWp of domestic-content solar modules under the DCR scheme, reinforcing local manufacturing strength and scale capabilities.

Report Scope

Report Features Description Market Value (2024) USD 2.7 Billion Forecast Revenue (2034) USD 5.2 Billion CAGR (2025-2034) 6.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Electrospray Deposition, Chemical Vapour Deposition, Co-evaporation, Film Production, Others), By Film Thickness (1-2 Micro Meters, 2-3 Micro Meters, 3-4 Micro Meters), By Power Output (Under 50 kW, 50-100 kW, 100-200 kW, Above 200 kW), By End User (Commercial, Residential, Industrial, Utilities) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Tata Power Solar Systems Ltd., SHARP CORPORATION, GVN SolarPower Inc, G24 Power Ltd., Sharp Corporation, Narorh, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Copper Indium Gallium Selenide solar Cell MarketPublished date: October 2025add_shopping_cartBuy Now get_appDownload Sample

Copper Indium Gallium Selenide solar Cell MarketPublished date: October 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Tata Power Solar Systems Ltd.

- SHARP CORPORATION

- GVN SolarPower Inc

- G24 Power Ltd.

- Sharp Corporation

- Narorh

- Others