Global Contraceptive Devices Market By Product Type (Male Contraceptive Devices and Female Contraceptive Devices (Vaginal Rings, Sub-dermal Implants, Intrauterine Devices (IUDs), Female Condoms, Diaphragms & Sponges, and Others)), By Technology (Hormonal Contraceptives and Barrier Contraceptives), By Distribution Channel (Hospital Pharmacy, Retail Pharmacy, Public Channels & NGOs, Online Channels, Clinics, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 154403

- Number of Pages: 335

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

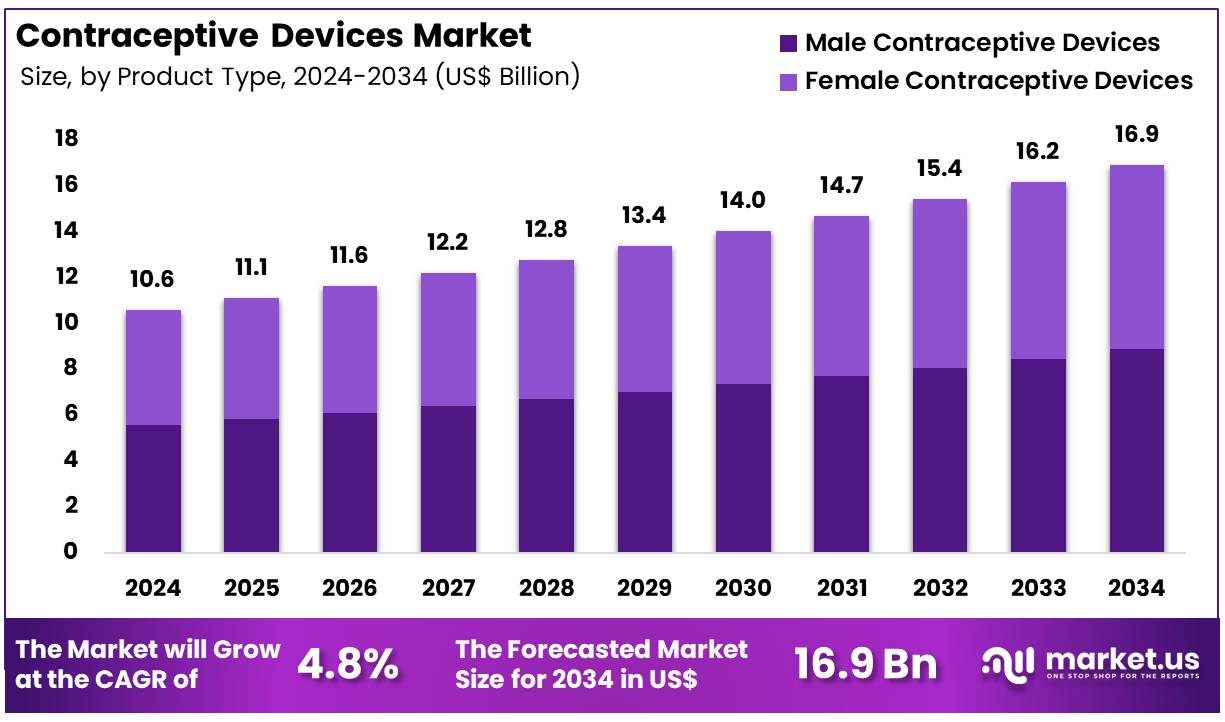

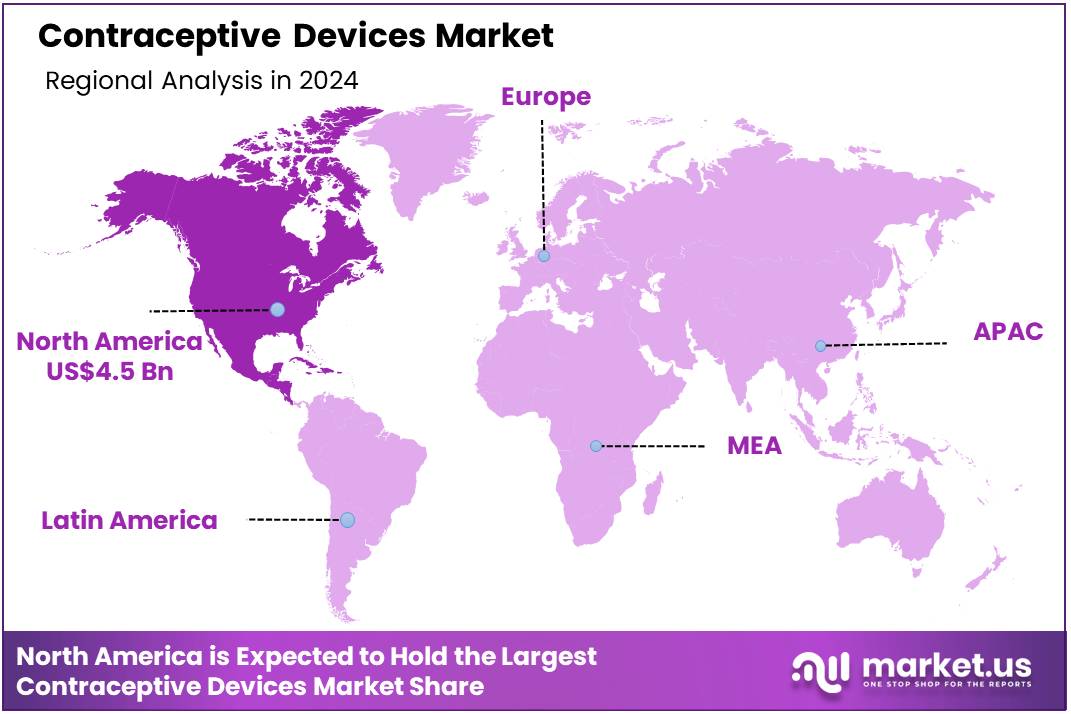

Global Contraceptive Devices Market size is expected to be worth around US$ 16.9 Billion by 2034 from US$ 10.6 Billion in 2024, growing at a CAGR of 4.8% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 42.3% share with a revenue of US$ 4.5 Billion.

Increasing awareness of reproductive health and the growing demand for family planning solutions are driving the growth of the contraceptive devices market. Contraceptive devices, such as intrauterine devices (IUDs), implants, condoms, and diaphragms, are essential tools for preventing unintended pregnancies and managing family planning choices. The market is seeing strong demand due to a growing focus on women’s health, autonomy, and access to safe and effective contraception.

Rising awareness about sexual and reproductive health, coupled with the global push for better healthcare access, has increased the adoption of various contraceptive methods. In particular, long-acting reversible contraceptives (LARCs) like IUDs and implants have gained popularity due to their convenience, effectiveness, and extended use period.

In November 2024, the US Department of Health & Human Services finalized updates to the HIPAA Privacy Rule, introducing stronger safeguards for reproductive health data and enhancing privacy protections for individuals seeking care. This move reflects a significant trend toward ensuring patient confidentiality and building trust in healthcare systems, which is vital for the adoption of contraceptive devices. The market also benefits from the growing trend of personalized healthcare, where women are increasingly able to choose contraceptive methods tailored to their specific needs.

Additionally, the rise in non-invasive contraceptive options and innovations in product design, such as female condoms and non-hormonal methods, presents new opportunities for market expansion. As societal attitudes toward contraception continue to evolve, the market is poised for further growth, driven by technological advancements, improved access to family planning services, and a growing focus on reproductive rights.

Key Takeaways

- In 2024, the market for contraceptive devices generated a revenue of US$ 10.6 billion, with a CAGR of 4.8%, and is expected to reach US$ 16.9 billion by the year 2034.

- The product type segment is divided into male contraceptive devices and female contraceptive devices, with male contraceptive devices taking the lead in 2023 with a market share of 52.4%.

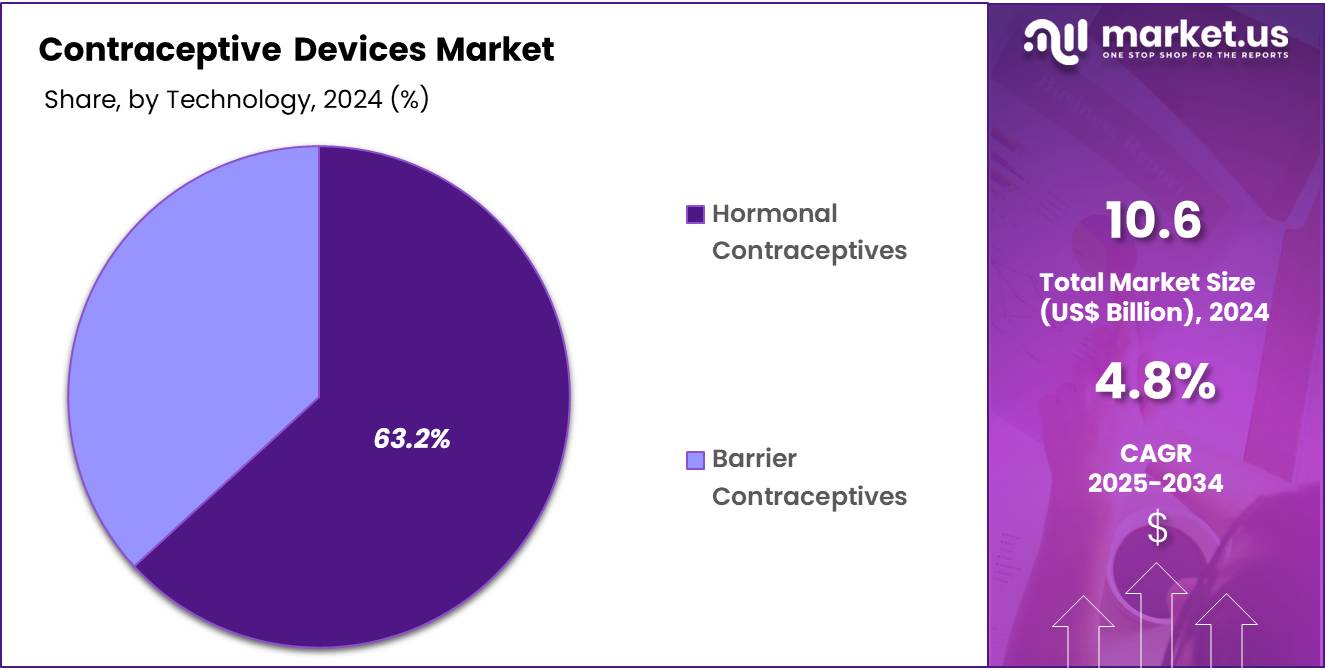

- Considering technology, the market is divided into hormonal contraceptives and barrier contraceptives. Among these, hormonal contraceptives held a significant share of 63.2%.

- Furthermore, concerning the distribution channel segment, the market is segregated into hospital pharmacy, retail pharmacy, public channels & NGOs, online channels, clinics, and others. The retail pharmacy sector stands out as the dominant player, holding the largest revenue share of 41.5% in the contraceptive devices market.

- North America led the market by securing a market share of 42.3% in 2023.

Product Type Analysis

Male contraceptive devices dominate the product type segment, holding 52.4% of the market share. This growth is expected to continue as male contraceptive methods gain increasing attention in the global effort to balance reproductive responsibility between genders. The rising awareness of male contraception options, such as condoms, vasectomy, and more recently, new hormonal and non-hormonal methods, is projected to drive demand in this segment.

Increasing discussions around gender equality and family planning are likely to make male contraceptives a more central part of the conversation. Additionally, the growing interest in long-term male contraceptive solutions, especially as societal norms evolve, will likely fuel the development and acceptance of newer methods. As healthcare systems and society at large shift towards more inclusive contraceptive options, the market for male contraceptive devices is anticipated to experience strong growth.

Technology Analysis

Hormonal contraceptives hold the largest share of 63.2% in the technology segment of the contraceptive devices market. This growth is expected to continue as hormonal methods, such as birth control pills, injections, implants, and hormonal intrauterine devices (IUDs), are widely recognized for their effectiveness and convenience. Hormonal contraceptives are projected to remain popular due to their long track record of providing reliable protection against unwanted pregnancies, particularly among women who seek a more hands-off approach to family planning.

The increasing availability of diverse hormonal contraceptive options, including those that address specific needs such as acne management or menstrual regulation, is likely to expand the market. Furthermore, the growing acceptance of hormonal contraceptives in both developed and developing regions is expected to drive further growth, as these methods become more accessible and tailored to individual needs. The continued focus on improving the safety, efficacy, and side-effect profile of hormonal contraceptives is anticipated to fuel ongoing demand.

Distribution Channel Analysis

Retail pharmacies represent the largest distribution channel in the contraceptive devices market, holding 41.5% of the share. This growth is expected to continue as retail pharmacies offer consumers an accessible, convenient, and confidential place to purchase contraceptives without requiring a prescription in many regions. Retail pharmacies are likely to benefit from the increasing demand for over-the-counter (OTC) contraceptive methods, such as condoms and emergency contraception, which have become more widely available and easier to obtain.

Additionally, the rising trend of self-care and autonomy in reproductive health is anticipated to drive the growth of OTC contraceptives sold in retail pharmacies. The increasing awareness about family planning and reproductive health is also projected to contribute to the demand for contraceptive devices at retail outlets. As retail pharmacies continue to expand their services, including online sales and delivery options, they will likely become even more important players in the distribution of contraceptive products, further solidifying their role in this segment.

Key Market Segments

By Product Type

- Male Contraceptive Devices

- Female Contraceptive Devices

- Vaginal Rings

- Sub-dermal Implants

- Intrauterine Devices (IUDs)

- Female Condoms

- Diaphragms & Sponges

- Others

By Technology

- Hormonal Contraceptives

- Barrier Contraceptives

By Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy

- Public Channels & NGOs

- Online Channels

- Clinics

- Others

Drivers

Increasing Focus on Family Planning and Unintended Pregnancy Prevention is Driving the Market

The rising global emphasis on family planning initiatives and the critical need to prevent unintended pregnancies are significant drivers propelling the contraceptive devices market. Governments, non-governmental organizations, and healthcare providers worldwide are actively promoting access to effective contraception as a fundamental aspect of reproductive health and women’s empowerment. This increased awareness about the societal and individual benefits of planned pregnancies, including improved maternal and child health outcomes, contributes to the growing demand for reliable birth control methods.

The United Nations Population Fund (UNFPA) reported in its 2022 State of World Population report, “Seeing the Unseen,” that nearly half of all pregnancies, totaling 121 million each year globally, are unintended. This staggering figure underscores the urgent and continuous need for effective contraception.

Furthermore, for the women and girls affected, the most life-altering reproductive choice whether or not to become pregnant is often not a choice at all, highlighting a human rights crisis. This global reality necessitates accessible and diverse contraceptive options, ensuring individuals can make informed decisions about their reproductive lives. The ongoing efforts to address this unmet need for family planning services globally will continue to drive the expansion and innovation within the market.

Restraints

Regulatory Hurdles and Accessibility Challenges are Restraining the Market

Stringent regulatory approval processes in various countries and persistent accessibility challenges, including high costs or limited availability in certain regions, represent a considerable restraint on the contraceptive devices market. Bringing new or improved methods to market requires extensive clinical trials, rigorous safety assessments, and lengthy review periods by regulatory bodies, increasing development costs and delaying broader adoption. Once approved, equitable access can be hindered by factors like device affordability, insurance coverage limitations, and distribution complexities, especially in underserved areas.

The Kaiser Family Foundation (KFF) reported that as of October 2024, while the Affordable Care Act (ACA) generally requires most private health plans to cover a wide range of preventive services, including contraceptive methods, without cost-sharing, coverage nuances and state-level policies can still create barriers. For example, the KFF noted that some states have policies specifically addressing over-the-counter contraception coverage, but this varies.

Additionally, for publicly funded programs, the Title X Family Planning Program, which aims to provide low-cost reproductive health services, served approximately 2.8 million people in 2023 according to Planned Parenthood. While this program is vital, the sheer volume of individuals needing care demonstrates the ongoing challenge of ensuring universal access, especially when facing funding constraints or geographical limitations. These multifaceted hurdles continue to impede the full potential of market expansion globally.

Opportunities

Development of Next-Generation Long-Acting Reversible Contraceptives (LARCs) is Creating Growth Opportunities

The continuous development and introduction of next-generation long-acting reversible contraceptives (LARCs), including improved intrauterine devices (IUDs) and subdermal implants, are creating significant growth opportunities in the market. These innovations focus on enhancing patient comfort, reducing side effects, extending duration of effectiveness, and improving ease of insertion or removal, making them more appealing to a broader user base. LARCs offer highly effective, convenient, and cost-effective pregnancy prevention for extended periods, reducing the need for daily adherence.

The US Food and Drug Administration (FDA) plays a crucial role in approving these advancements. For example, in July 2023, the FDA approved Opill, the first daily oral contraceptive pill to become available over-the-counter (OTC) without a prescription, demonstrating a move towards broader access to effective methods. While Opill is not a LARC, this approval reflects the regulatory environment’s receptiveness to expanding contraceptive options.

Furthermore, leading companies consistently invest in R&D to refine existing LARC technologies and explore novel delivery systems. The Centers for Disease Control and Prevention (CDC) continuously updates its US Selected Practice Recommendations for Contraceptive Use (US SPR), with the latest version in 2024 supporting a wide range of methods. The ongoing innovation in LARCs provides more choices for individuals seeking highly effective and user-friendly contraception, contributing substantially to market growth.

Impact of Macroeconomic / Geopolitical Factors

Global macroeconomic conditions, including inflation and the prioritization of public health investment, significantly influence the contraceptive devices market by affecting government funding for family planning programs and individual affordability of devices. Inflation can increase the costs for manufacturing, distributing, and delivering contraceptive devices, potentially leading to higher prices for consumers or increased budgetary strain on public health initiatives. This can particularly impact accessibility in lower-income settings or for vulnerable populations.

However, governments and international organizations globally increasingly recognize family planning as a cost-effective intervention with far-reaching benefits for public health, gender equality, and economic development. The World Health Organization (WHO) reported in May 2025 that global expenditure on health continued to rise, with many high-income countries allocating over 10% of their GDP to health in 2023.

For example, Canada’s health expenditure was 12.23% of GDP in 2022, and Australia’s was 10.37% in 2022, showcasing robust national commitments that support investments in essential health services, including contraception. Geopolitical stability also plays a role in ensuring consistent supply chains for raw materials and finished products. Despite economic pressures, the fundamental importance of reproductive health in achieving broader development goals ensures a sustained focus on and investment in contraceptive methods, fostering resilience and continued growth for the market.

Evolving US trade policies, including the imposition of tariffs on imported medical device components, specialty plastics, and electronic micro-components, are shaping the contraceptive devices market by directly influencing manufacturing costs and recalibrating supply chain strategies for major players. Manufacturers of contraceptive devices, particularly those for implants and IUDs, often rely on intricate global supply chains for specialized materials and precision-engineered parts, many of which are sourced from international suppliers.

Tariffs on these specific imports directly increase the input costs for companies that either manufacture within the US or import finished components for assembly, potentially leading to higher prices for the final contraceptive devices sold in the US The US Customs and Border Protection (CBP) collected approximately US$92.3 billion in duties, taxes, and other fees in fiscal year 2023, encompassing a wide array of imported goods. This figure includes duties collected on various manufactured goods and electronics that can be components for medical devices.

The CBP further reported collecting more than US$38 billion in Section 301 duties from China in FY 2023, tariffs that specifically target various manufacturing sectors, including those that produce materials and electronic components integral to medical devices. These policies, while sometimes aimed at bolstering domestic manufacturing capabilities, primarily create a more expensive and intricate operational environment for companies. The essential nature of family planning products, however, motivates manufacturers to strategically manage their supply chains and absorb some costs, ensuring continued access to effective contraceptive options for the US population.

Latest Trends

Rising Adoption of Telehealth for Contraceptive Counseling and Prescription is a Recent Trend

A prominent recent trend shaping the contraceptive devices market in 2024 and continuing into 2025 is the increasing adoption of telehealth platforms for contraceptive counseling, prescription renewals, and follow-up care. This trend significantly enhances accessibility to reproductive health services, particularly for individuals in rural areas, those with transportation barriers, or those seeking greater privacy and convenience. Telehealth consultations allow individuals to discuss contraceptive options with healthcare providers remotely, receive electronic prescriptions for devices like the contraceptive patch or ring, and manage follow-up appointments without requiring in-person visits.

The US Health Resources and Services Administration (HRSA), through its Uniform Data System (UDS) reporting, indicated that health centers significantly expanded telehealth services. For instance, the HRSA’s UDS data for 2023 showed that health centers provided over 28.3 million telehealth visits across all service types, a substantial increase in accessibility compared to pre-pandemic levels.

While this figure encompasses all telehealth, it reflects the infrastructure and increased comfort level with virtual care that benefits reproductive health services. This shift to virtual care streamlines the process of accessing contraception, reduces logistical burdens, and integrates reproductive health services more seamlessly into patients’ lives. The ongoing expansion of telehealth infrastructure and favorable reimbursement policies further support the integration of these virtual services into routine contraceptive care.

Regional Analysis

North America is leading the Contraceptive Devices Market

The contraceptive devices market in North America, representing a significant 38.8% share, experienced substantial growth in 2024. This expansion was primarily driven by increasing awareness regarding family planning, a rising preference for long-acting reversible contraceptives (LARCs), and supportive government initiatives promoting reproductive health access.

The National Center for Health Statistics (NCHS) reported in December 2024 that during 2022–2023, 35.7% of females aged 15–49 in the United States received a family planning service in the preceding 12 months, with 23.5% receiving a birth control method or prescription, indicating consistent utilization of these services. Furthermore, advancements in device technology, offering improved efficacy, safety, and user convenience, have contributed to their wider acceptance. Major pharmaceutical and medical device companies have seen sustained demand for their offerings in the region.

CooperCompanies, through its CooperSurgical segment, which includes contraceptive devices, reported a fiscal year 2024 revenue of US$1,286.0 million, an increase of 10% from fiscal year 2023, reflecting robust sales in its office and surgical products. Bayer also continues to be a prominent player, with its Pharmaceuticals division contributing to overall group sales, driven by ongoing demand for its women’s healthcare portfolio.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The contraceptive devices market in Asia Pacific is expected to grow considerably during the forecast period. This anticipated expansion is fueled by large and growing populations, increasing government focus on family planning programs, and improving access to healthcare services across the region. The United Nations Population Fund (UNFPA) reported in its 2022-2023 report that the number of women using modern contraception globally has doubled since 1994, with significant efforts in Asia and the Pacific to prevent unintended pregnancies and enhance access to sexual and reproductive health services.

Governments in countries like India and China are actively implementing policies and programs to promote family planning and reduce unmet needs for contraception. For instance, the UNFPA Asia and the Pacific Regional Office provides strategic guidance and support to 36 country offices, aiming for zero unmet need for family planning by 2030. Major international and local companies are strategically expanding their distribution networks and introducing diverse product portfolios to cater to the varied needs of the Asian population.

CooperSurgical’s Asia Pacific revenue for its CooperVision segment, which includes some women’s health products, showed a 7% increase in the fourth quarter of fiscal year 2024 compared to the previous year, indicating a positive trend in the broader medical device market. These collective efforts are likely to drive the significant growth of the market for these devices across Asia Pacific.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the contraceptive devices market employ several strategies to drive growth. These include investing in research and development to create innovative products, such as advanced intrauterine devices (IUDs) and non-hormonal implants, enhancing treatment efficacy. Strategic mergers and acquisitions enable companies to expand their product portfolios and enter new markets.

Collaborations with healthcare providers and research institutions facilitate the development of cutting-edge technologies and broaden market reach. Geographic expansion into emerging markets allows companies to tap into new customer bases and increase revenue streams. Adherence to regulatory standards ensures product safety and efficacy, building trust with healthcare professionals and patients. Additionally, companies focus on marketing and educational initiatives to raise awareness about the benefits of contraceptive devices, thereby driving demand.

Bayer AG, a leading company in this sector, specializes in providing medical devices for various procedures, including contraceptive devices. The company offers a comprehensive range of products designed to treat reproductive health concerns, such as hormonal and non-hormonal IUDs. With a strong focus on expanding its product portfolio and leveraging advanced technologies, Bayer aims to enhance patient outcomes and reduce healthcare costs. Through continuous innovation and strategic acquisitions, Bayer strengthens its position in the contraceptive devices market, meeting the growing demand for reliable and effective reproductive health solutions.

Top Key Players

- Veru Inc

- Teva Pharmaceutical Industries Ltd

- Reckitt Benckiser Group plc

- Pfizer Inc

- Merck & Co., Inc

- Medisafe Distribution Inc

- Janssen Global Services, LLC

- Dare Bioscience

- Church & Dwight Co., Inc

- Bayer AG

- Allergan

Recent Developments

- In April 2025, Bayer expanded its collaboration with UNFPA Egypt by securing an additional EUR 100,000 in funding. The initiative aims to deliver family planning services to 810,000 women and ensure that 540,000 women have access to modern contraceptive options by 2028.

- In February 2025, Dare Bioscience entered into a strategic partnership with Theramex, signing a co-development and licensing agreement for Casea S, a biodegradable contraceptive implant currently progressing through Phase 1 trials.

- In January 2025, Dare Bioscience revealed a breakthrough with its DARE-LARC1 platform, a wireless-controlled, long-acting contraceptive implant, marking a significant technological advancement in the field.

Report Scope

Report Features Description Market Value (2024) US$ 10.6 Billion Forecast Revenue (2034) US$ 16.9 Billion CAGR (2025-2034) 4.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Male Contraceptive Devices and Female Contraceptive Devices (Vaginal Rings, Sub-dermal Implants, Intrauterine Devices (IUDs), Female Condoms, Diaphragms & Sponges, and Others)), By Technology (Hormonal Contraceptives and Barrier Contraceptives), By Distribution Channel (Hospital Pharmacy, Retail Pharmacy, Public Channels & NGOs, Online Channels, Clinics, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Veru Inc, Teva Pharmaceutical Industries Ltd, Reckitt Benckiser Group plc, Pfizer Inc, Merck & Co., Inc, Medisafe Distribution Inc, Janssen Global Services, LLC, Dare Bioscience, Church & Dwight Co., Inc, Bayer AG, Allergan. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Contraceptive Devices MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample

Contraceptive Devices MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Veru Inc

- Teva Pharmaceutical Industries Ltd

- Reckitt Benckiser Group plc

- Pfizer Inc

- Merck & Co., Inc

- Medisafe Distribution Inc

- Janssen Global Services, LLC

- Dare Bioscience

- Church & Dwight Co., Inc

- Bayer AG

- Allergan