Global Construction Estimating Software Market By Deployment (Cloud, On-Premise), By Solution Type (Take-off and Estimating, Bid Management, Cost Databases and Analytics, Integrated Project Suites), By End-User (Architects & Builders, Construction Managers, Contractors, Others), By Enterprise Size (Large Enterprises, Small and Medium Enterprises), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Jan. 2026

- Report ID: 172258

- Number of Pages: 315

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Deployment Analysis

- Solution Type Analysis

- End-User Analysis

- Enterprise Size Analysis

- Key Features to Look For

- Key reasons for adoption

- Business benefits

- Usage

- Emerging Trends

- Growth Factors

- Key Market Segments

- Regional Analysis

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Competitive Analysis

- Future Outlook

- Recent Developments

- Report Scope

Report Overview

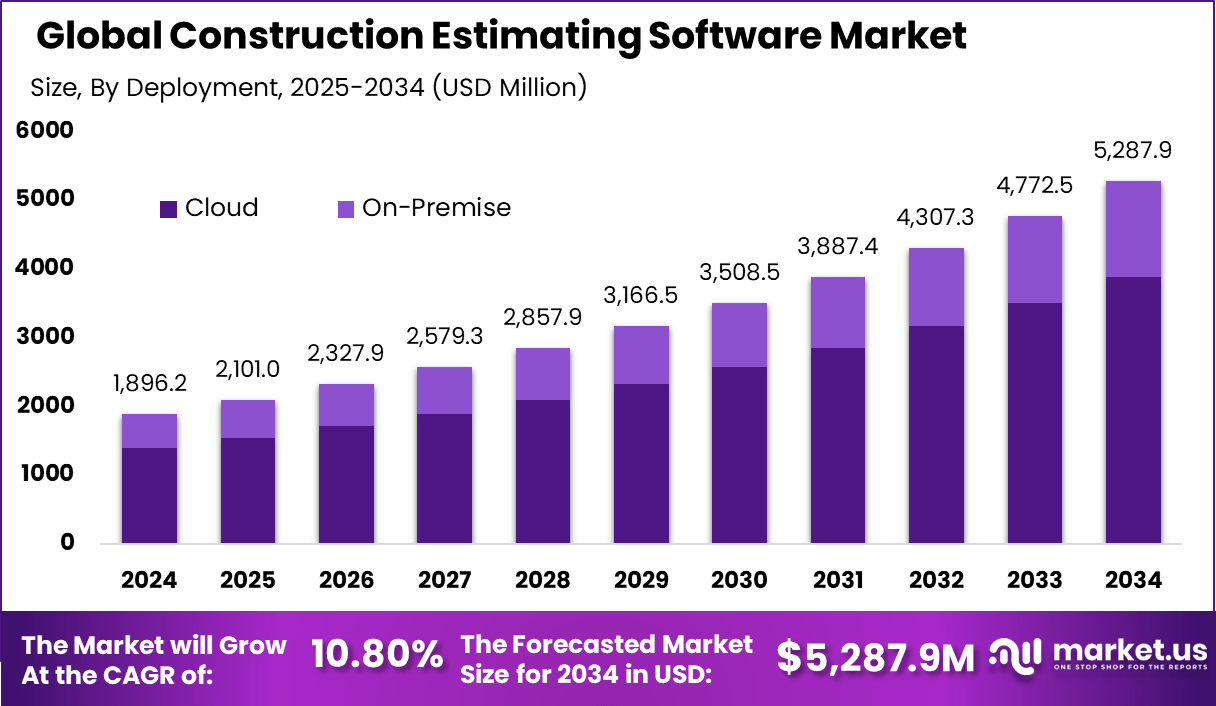

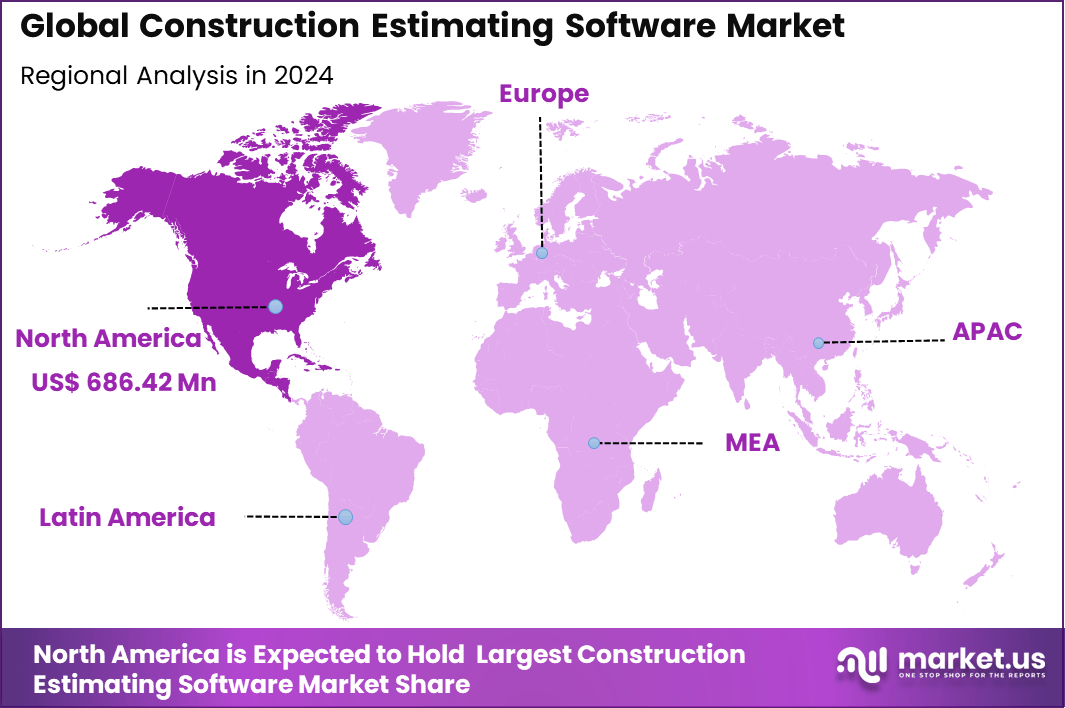

The Global Construction Estimating Software Market generated USD 1,896.2 million in 2024 and is predicted to register growth from USD 2,101 million in 2025 to about USD 5,287.9 million by 2034, recording a CAGR of 10.80% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 36.2% share, holding USD 686.42 Million revenue.

The construction estimating software market refers to digital tools used to calculate project costs, materials, labor, equipment, and timelines during construction planning. These solutions help contractors, engineers, and project managers prepare accurate cost estimates and bids. The software supports residential, commercial, and infrastructure construction projects. Adoption improves cost visibility and planning accuracy.

One major driving factor of the construction estimating software market is the need to control project costs and reduce overruns. Accurate estimates help prevent unexpected expenses during execution. Software-based estimation improves forecasting accuracy. This supports better financial planning. Another key driver is growing competition in the construction industry. Contractors must submit precise and competitive bids to win projects. Estimating software helps standardize pricing and reduce estimation errors.

Top Market Takeaways

- By deployment, cloud solutions took 73.5% of the construction estimating software market, as they offer easy access and real-time updates for teams.

- By solution type, integrated project suites held 28.3% share, combining estimating with project management tools.

- By end-user, contractors captured 44.1%, using software for accurate bids and cost tracking.

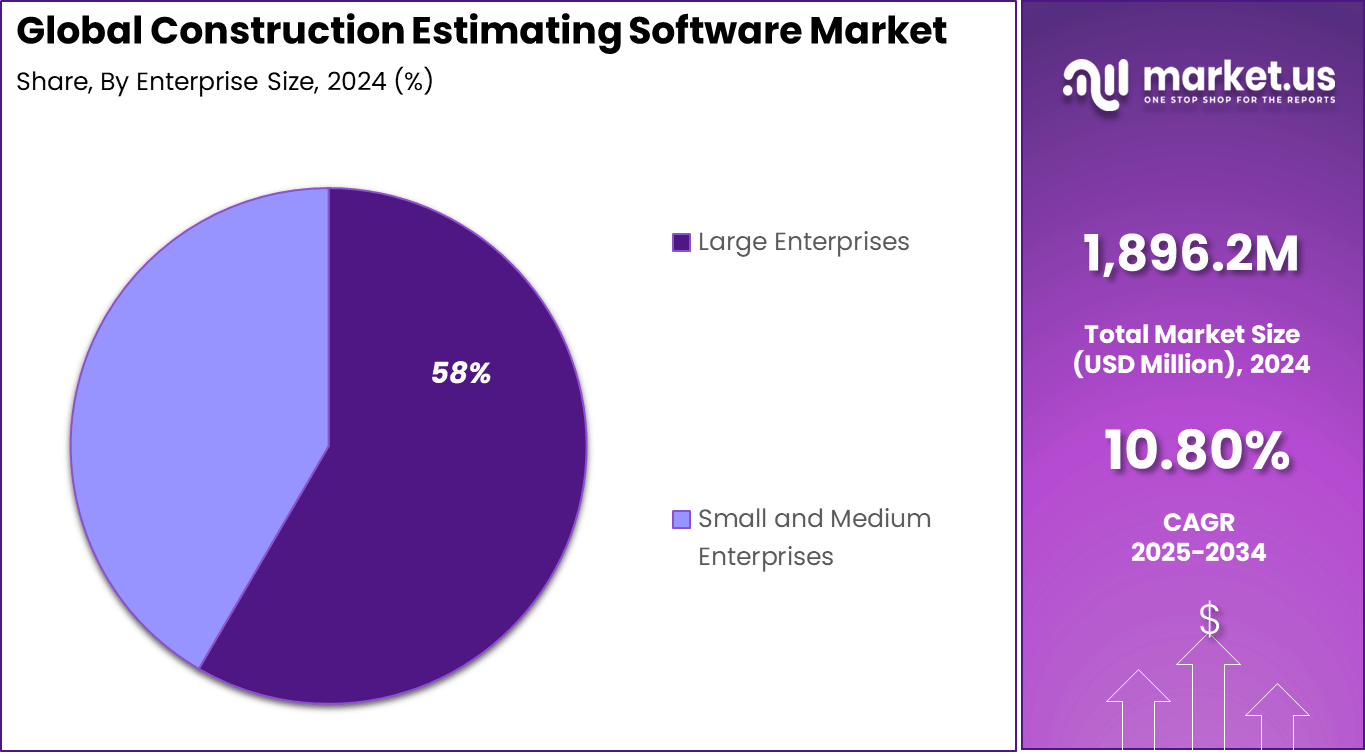

- By enterprise size, large enterprises accounted for 58.4%, handling big projects with advanced features.

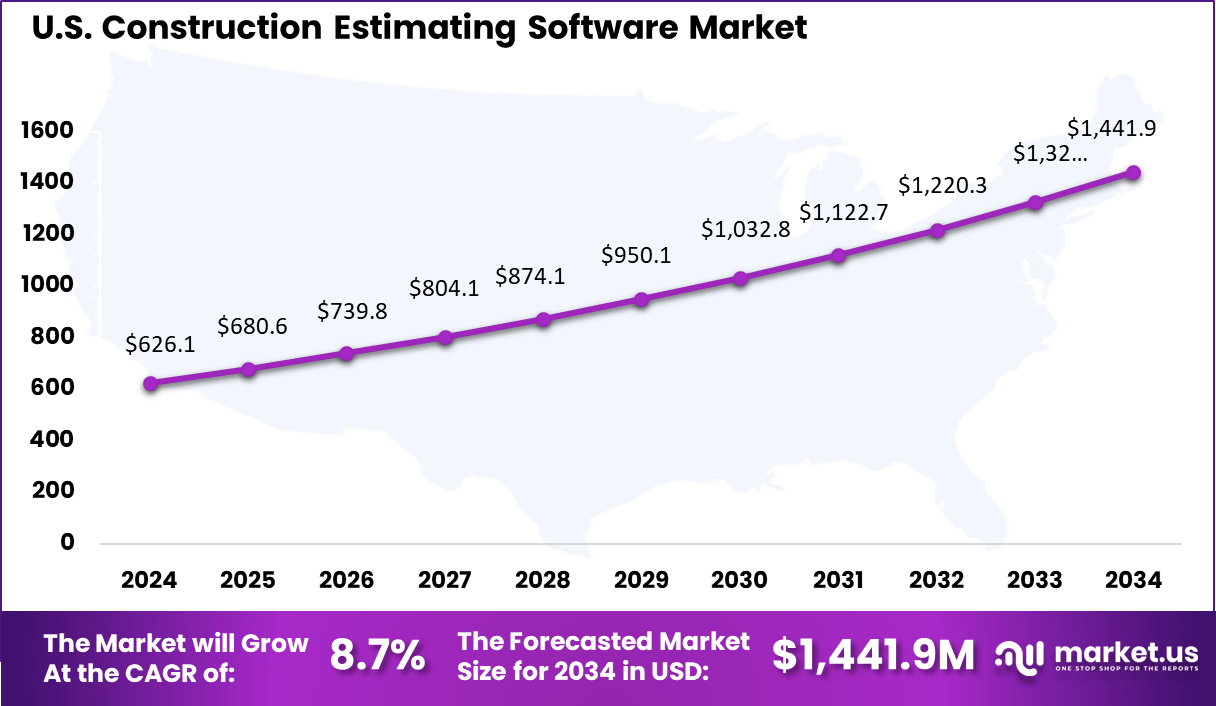

- North America had 36.2% of the global market, with the U.S. at USD 626.1 million in 2025 and growing at a CAGR of 8.7%.

Deployment Analysis

Cloud-based deployment accounts for 73.5% of the Construction Estimating Software market, showing strong preference for web-based estimating solutions. Cloud platforms allow estimators and project managers to access cost data, drawings, and estimates from any location. This is especially useful for construction teams working across multiple job sites and offices.

Cloud deployment also supports real-time updates, ensuring that cost changes and revisions are visible to all stakeholders. From an operational standpoint, cloud-based estimating software reduces dependency on local infrastructure and simplifies system maintenance.

Automatic updates and data backups help maintain accuracy and reliability. The strong share of cloud deployment reflects the construction industry’s growing focus on collaboration, mobility, and faster decision-making during the bidding and planning stages.

Solution Type Analysis

Integrated project suites hold 28.3% of the solution type segment, indicating rising demand for all-in-one estimating platforms. These suites combine estimating, budgeting, scheduling, and project tracking into a single system. Contractors and enterprises use integrated solutions to improve coordination between estimating and execution phases of construction projects.

By consolidating multiple functions, integrated project suites reduce data duplication and manual errors. They also provide better visibility into project costs and timelines. The adoption of this segment reflects growing preference for connected software environments that support end-to-end project management and cost control.

End-User Analysis

Contractors account for 44.1% of the market, making them the largest end-user group for construction estimating software. Contractors rely on accurate estimates to win bids, manage costs, and protect profit margins. Estimating software helps them calculate material, labor, and equipment costs more efficiently than manual methods.

For contractors, speed and accuracy in estimation are critical. Digital estimating tools allow quick adjustments and scenario comparisons. The strong share of this segment reflects contractors’ need for reliable estimating solutions to remain competitive in a cost-sensitive construction market.

Enterprise Size Analysis

Large enterprises represent 58% of the market, driven by their involvement in complex and large-scale construction projects. These organizations manage multiple projects simultaneously and require standardized estimating processes. Construction estimating software helps large enterprises maintain consistency and control across different teams and locations.

Large enterprises also benefit from advanced reporting and integration capabilities. Estimating tools support strategic planning and resource allocation. The strong presence of this segment highlights the importance of digital estimating solutions for managing risk and improving efficiency in large construction organizations.

Key Features to Look For

- Digital takeoff tools: Allow measurements to be taken directly from PDF, CAD, or BIM files, which removes the need for manual counting.

- Live cost databases: Connect with industry cost data or supplier price lists so estimates stay up to date with current market prices.

- Bid management: Help create trade packages, share them with subcontractors, and compare received bids in one place.

- Accounting integrations: Connect smoothly with accounting software such as QuickBooks or Xero to track estimated costs against actual spending.

Key reasons for adoption

- Faster and more consistent bid preparation across multiple projects and teams

- Better cost control through standardized templates, cost codes, and estimating rules

- Improved accuracy using updated material, labor, and equipment cost libraries

- Stronger collaboration between estimators, project managers, and procurement teams

- Higher win rates by responding quickly to tenders and reducing pricing mistakes

Business benefits

- Reduced estimate rework because scope, quantities, and assumptions are captured clearly

- More predictable margins through tighter tracking of direct costs, overheads, and risk allowances

- Better vendor comparison since quotes can be normalized and reviewed in one place

- Stronger audit readiness because estimate versions, approvals, and changes stay documented

- Improved cash planning as projected costs and timelines are clearer early in the project

Usage

- Tender and bid estimation for general contractors and subcontractors

- Quantity takeoff and cost build up from drawings, models, or item lists

- Change order estimation to price scope adjustments quickly and defensibly

- Budgeting and preconstruction planning to align scope with the target cost

- Cost database management to maintain pricing, productivity rates, and historical benchmarks

Emerging Trends

Key Trend Description AI and Automation AI streamlines takeoffs, error checks, and predictive analytics, reducing manual work and improving estimation accuracy. Cloud Based Solutions Cloud platforms support real time collaboration, scalability, and remote access, accounting for more than half of market adoption. BIM Integration Building Information Modeling connects 3D models with cost data for more accurate and consistent project estimates. Mobile and Remote Collaboration Mobile first tools enable on site access, client interaction, and smooth coordination across multiple locations. Advanced Integrations Integration with project management, ERP, and cost databases improves workflow efficiency and data sharing. Growth Factors

Key Factors Impact Rising Construction Activities Growth in infrastructure and commercial projects worldwide increases demand for accurate cost estimation. Digital Transformation Adoption of AI, machine learning, and cloud tools reduces errors and supports complex project management. Need for Cost Accuracy Pressure to reduce cost overruns and delays drives adoption of flexible estimation software. Urbanization and Infrastructure Spend Government investment in emerging markets accelerates demand for advanced construction software. Regulatory and Project Complexity Stricter regulations and complex designs require advanced tools for compliance and efficiency. Key Market Segments

By Deployment

- Cloud

- On-Premise

By Solution Type

- Take-off and Estimating

- Bid Management

- Cost Databases and Analytics

- Integrated Project Suites

By End-User

- Architects & Builders

- Construction Managers

- Contractors

- Others

By Enterprise Size

- Large Enterprises

- Small and Medium Enterprises

Regional Analysis

North America accounted for 36.2% share, supported by strong adoption of digital construction management tools across residential, commercial, and infrastructure projects. Contractors and builders in the region have increasingly relied on construction estimating software to improve cost accuracy, manage material pricing volatility, and reduce bid preparation time.

Demand has been driven by rising project complexity and the need to control margins in a highly competitive construction environment. Integration with project management and accounting systems has further improved adoption across the region.

The U.S. market reached USD 626.1 Mn and is projected to grow at an 8.7% CAGR, reflecting steady demand from contractors, architects, and construction managers. Adoption has been particularly strong among mid sized and large firms that manage multiple projects simultaneously. Construction estimating software has helped U.S. companies improve bid accuracy, manage change orders, and maintain profitability under fluctuating material and labor costs.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

The construction estimating software market is being driven by the rising demand for digital tools that improve accuracy and efficiency in cost planning and bid preparation. Traditional manual approaches to cost estimation are prone to errors, delays, and oversights, which can lead to budget overruns and project inefficiencies.

Adoption of specialised software solutions helps organisations automate quantity take-offs, manage material and labour cost databases, and reduce miscalculations through advanced analytics. The integration of technologies such as cloud computing and artificial intelligence improves data accessibility and accuracy, enabling distributed teams to collaborate in real time and adapt quickly to market trends and changing project requirements.

Restraint Analysis

A significant restraint for the construction estimating software market relates to the complexity of deployment and integration with existing enterprise systems. Many construction firms continue to rely on legacy processes and on-premise tools, which can complicate the transition to digital estimating platforms.

Achieving seamless integration with project management systems, accounting tools, and design software often requires specialised technical planning and skilled resources, which can increase setup costs and extend implementation timelines. Furthermore, concerns about digital security, especially for cloud-based solutions, add to resistance among stakeholders who prioritise data protection and regulatory compliance.

Opportunity Analysis

Emerging opportunities in the construction estimating software market are associated with the expansion of digital transformation initiatives across the global construction industry. There is increasing interest in integrating advanced technologies such as Building Information Modeling (BIM) and 3D modelling with cost estimation workflows, which enhances the precision of estimates and supports seamless information flow across project teams.

The move toward cloud deployment and the subscription licence model broadens access for small and medium enterprises, enabling these firms to adopt enterprise-grade analytics without prohibitive upfront investments. Additionally, expanding infrastructure projects in emerging economies present untapped markets where construction estimating tools can support improved project planning and cost control.

Challenge Analysis

One of the central challenges confronting the market is balancing technological innovation with user adaptability and training needs. Construction estimating solutions often introduce advanced features, including automated cost libraries, AI-enhanced forecasting, and collaborative data platforms, which require users to develop new skill sets.

Resistance to change within organisations, limited training infrastructure, and scarcity of personnel experienced with digital estimating platforms can slow adoption rates. Ensuring that implementation is accompanied by effective training and change-management practices is critical to realise the full benefits of sophisticated estimating tools without disrupting established workflows.

Competitive Analysis

The competitive landscape of the construction estimating software market is shaped by a mix of large construction technology vendors and specialized estimating solution providers. Autodesk Inc., Oracle Corporation, Trimble Inc., Bentley Systems, RIB Software, and Bluebeam under Nemetschek hold strong positions due to their deep integration with design, project management, and cost control workflows.

These platforms benefit from strong adoption among large contractors and infrastructure firms, as they connect estimating with BIM, scheduling, and enterprise systems. Procore Technologies, InEight, Sage Group through Sage Estimating, and HCSS further strengthen competition by offering estimating tools closely linked with construction management, financial tracking, and field operations.

At the same time, focused estimating specialists such as STACK Construction Technologies, Buildxact Software, Buildsoft, PlanSwift Software, RedTeam Software, Contractor Foreman, Beck Technology, CoConstruct by Buildertrend, Causeway Technologies, and ConWize compete by emphasizing ease of use, faster takeoffs, and affordability for small and mid sized contractors.

Competitive differentiation increasingly depends on accuracy of takeoffs, speed of bid preparation, cloud collaboration, and integration with accounting and project delivery systems. The “Others” segment reflects regional vendors and niche developers offering tailored or cost effective solutions, which increases choice for users and pushes established players to improve flexibility and user experience.

Top Key Players in the Market

- Autodesk Inc.

- Procore Technologies Inc.

- Oracle Corporation

- Trimble Inc.

- RIB Software

- Bluebeam Inc. (Nemetschek)

- Bentley Systems Incorporated

- STACK Construction Technologies Inc.

- Buildxact Software Ltd.

- Buildsoft Pty Ltd.

- RedTeam Software LLC

- Contractor Foreman Inc.

- PlanSwift Software LLC

- InEight Inc.

- Sage Group plc (Sage Estimating)

- HCSS (Heavy Construction Systems Specialists Inc.)

- Beck Technology Ltd.

- CoConstruct by Buildertrend

- Causeway Technologies Ltd.

- ConWize Ltd.

- Others

Future Outlook

The future outlook for the Construction Estimating Software market is expected to remain positive as construction companies aim to improve cost control and project planning. These tools are being used to create accurate estimates, manage materials, and reduce budget overruns in complex projects.

Growing adoption of digital construction workflows and tighter profit margins are supporting steady demand. In the coming years, better integration with project management, BIM, and real time cost data is likely to improve estimate accuracy and support faster decision making.

Recent Developments

- Trimble shared its 2026 Industry Outlook, stressing AI’s role in workflows and better data interoperability for estimating across mixed fleets and infrastructure bids.

- November, 2025, Autodesk rolled out Autodesk Estimate, a cloud tool linking 2D/3D takeoffs to costs in Autodesk Construction Cloud, cutting errors and bid times for contractors.

Report Scope

Report Features Description Market Value (2024) USD 1,896.2 Mn Forecast Revenue (2034) USD 5,287.9 Mn CAGR(2025-2034) 10.80% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Deployment (Cloud, On-Premise), By Solution Type (Take-off and Estimating, Bid Management, Cost Databases and Analytics, Integrated Project Suites), By End-User (Architects & Builders, Construction Managers, Contractors, Others), By Enterprise Size (Large Enterprises, Small and Medium Enterprises) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Autodesk Inc., Procore Technologies Inc., Oracle Corporation, Trimble Inc., RIB Software, Bluebeam Inc. (Nemetschek), Bentley Systems Incorporated, STACK Construction Technologies Inc., Buildxact Software Ltd., Buildsoft Pty Ltd., RedTeam Software LLC, Contractor Foreman Inc., PlanSwift Software LLC, InEight Inc., Sage Group plc (Sage Estimating), HCSS (Heavy Construction Systems Specialists Inc.), Beck Technology Ltd., CoConstruct by Buildertrend, Causeway Technologies Ltd., ConWize Ltd., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Construction Estimating Software MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample

Construction Estimating Software MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Autodesk Inc.

- Procore Technologies Inc.

- Oracle Corporation

- Trimble Inc.

- RIB Software

- Bluebeam Inc. (Nemetschek)

- Bentley Systems Incorporated

- STACK Construction Technologies Inc.

- Buildxact Software Ltd.

- Buildsoft Pty Ltd.

- RedTeam Software LLC

- Contractor Foreman Inc.

- PlanSwift Software LLC

- InEight Inc.

- Sage Group plc (Sage Estimating)

- HCSS (Heavy Construction Systems Specialists Inc.)

- Beck Technology Ltd.

- CoConstruct by Buildertrend

- Causeway Technologies Ltd.

- ConWize Ltd.

- Others