Global Connected Street Lights Market Size, Share, Growth Analysis By Communication Technology (NB-IoT, Powerline Communication, Radio Frequency, Others), By Application (Smart Parking, Environmental Monitoring, Traffic Optimization, Others), By End-user (Industrial, Commercial, Residential), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 170463

- Number of Pages: 262

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

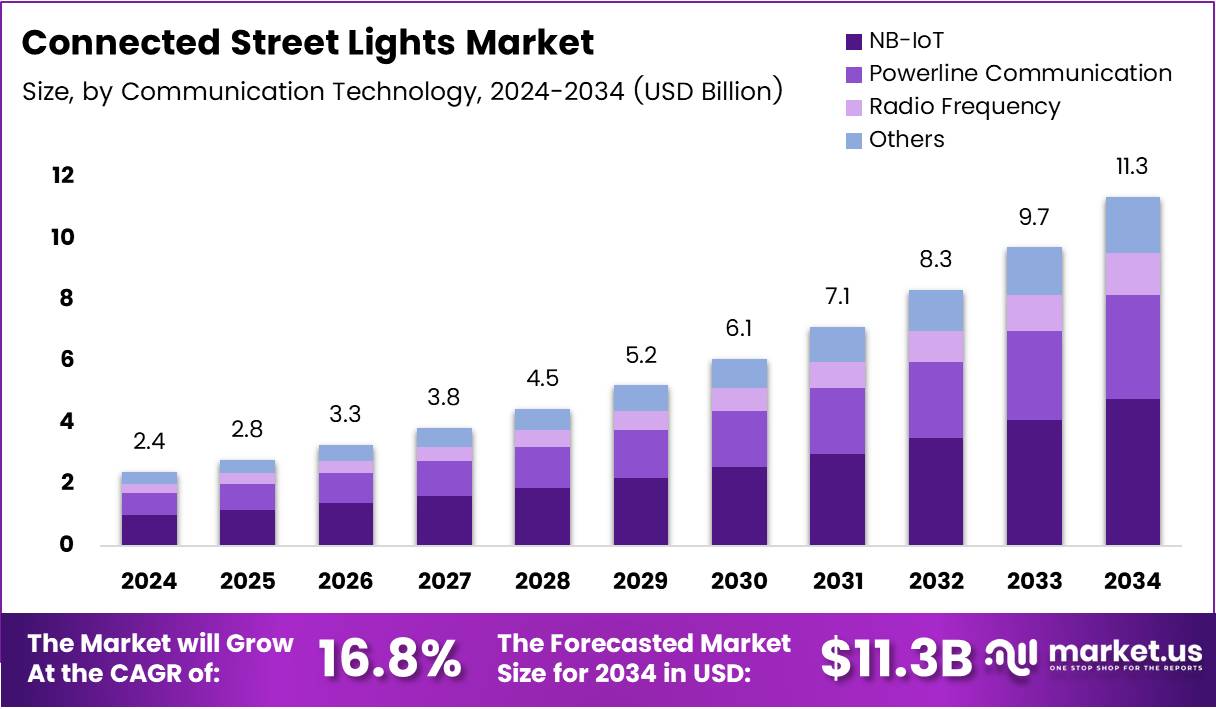

The global Connected Street Lights Market size is expected to reach approximately USD 11.3 Billion by 2034 from USD 2.4 Billion in 2024, expanding at a CAGR of 16.8% during the forecast period from 2025 to 2034. This remarkable growth reflects increasing urbanization and municipal commitments toward intelligent infrastructure development.

Connected street lights represent advanced lighting systems integrated with IoT sensors, wireless communication networks, and centralized management platforms. These smart solutions enable remote monitoring, adaptive brightness control, and real-time data collection for urban management. Municipalities worldwide are transitioning from conventional fixtures to intelligent lighting networks that optimize energy consumption while enhancing public safety.

The market expansion is primarily driven by accelerating smart city initiatives across developed and emerging economies. Governments are investing heavily in modernizing urban infrastructure to reduce operational costs and carbon footprints. Furthermore, rising concerns about energy efficiency and sustainability are compelling cities to adopt LED-based connected lighting systems that deliver substantial long-term savings.

According to patentpc, connected streetlights can reduce energy consumption by up to 80% compared to traditional lighting systems. Additionally, maintenance costs drop by up to 50% via remote diagnostics, cutting truck rolls by 60%, with operational savings reaching $15-30 per light annually. Over 16 million connected streetlights have already been deployed across the globe, according to patentpc.

Real-world implementations demonstrate impressive results in major metropolitan areas globally. According to patentpc, Los Angeles reported 63% energy savings after deploying over 215,000 connected lights, while Amsterdam achieved 65% reductions with smart controls. Barcelona saves over $37 million yearly, Paris gained €9 million in annual savings, and San Diego rolled out more than 14,000 units for broader smart city data collection.

Environmental benefits further accelerate adoption as connected lights cut carbon emissions by over 1,200 lbs per unit yearly. Moreover, optimized lighting patterns contribute to reducing street crime by 10-15% through enhanced visibility and monitoring capabilities. With over 95% outage detection accuracy and payback periods averaging 4-7 years, municipalities view connected street lighting as financially viable. Notably, 70% of new installations are now connectivity-enabled, according to patentpc.com.

Key Takeaways

- Global Connected Street Lights Market projected to reach USD 11.3 Billion by 2034 from USD 2.4 Billion in 2024

- Market expanding at a CAGR of 16.8% during the forecast period 2025-2034

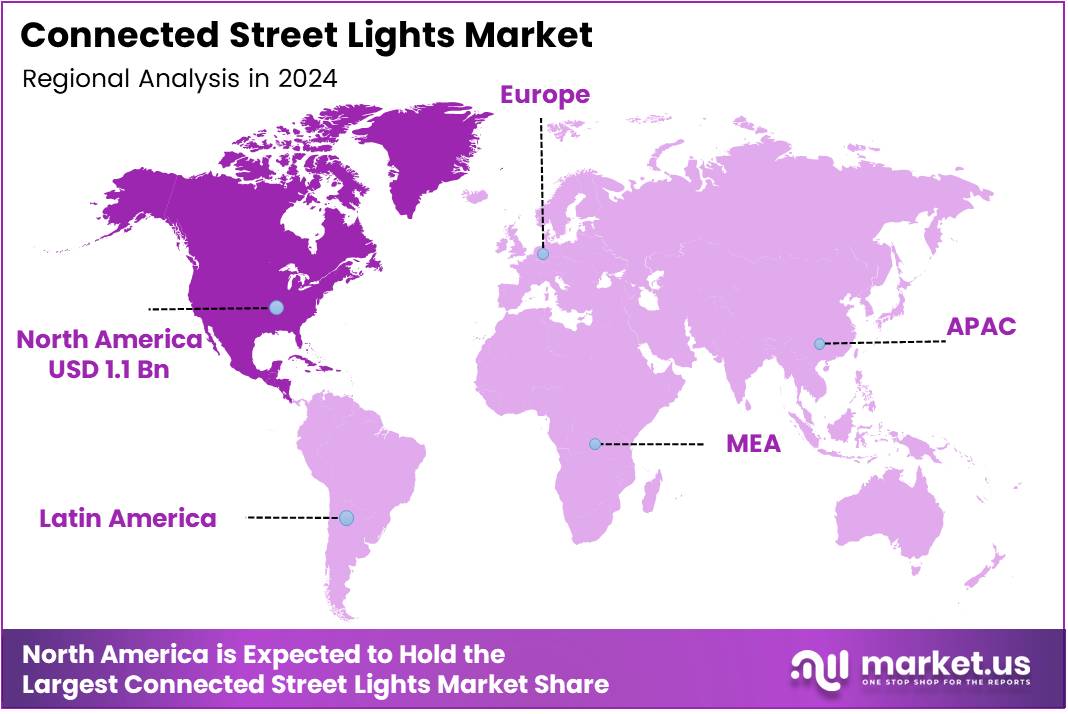

- North America dominates with 47.20% market share, valued at USD 1.1 Billion

- NB-IoT communication technology leads with 34.5% market share

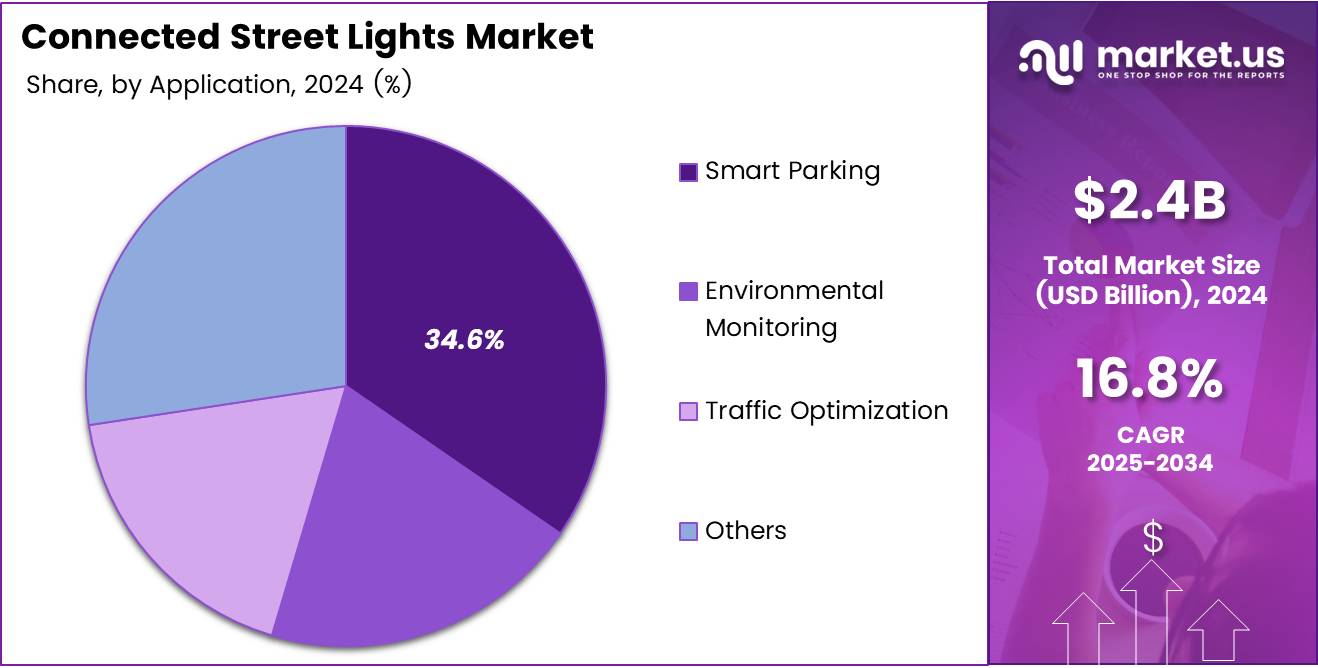

- Smart Parking application segment holds 34.6% market share

- Industrial end-user segment dominates with 45.2% market share

Communication Technology Analysis

NB-IoT dominates with 34.5% due to its low power consumption and wide coverage capabilities.

In 2024, NB-IoT held a dominant market position in the By Communication Technology segment of Connected Street Lights Market, with a 34.5% share. This technology offers exceptional power efficiency and deep penetration capabilities, making it ideal for outdoor urban deployments. Municipalities favor NB-IoT for its ability to connect thousands of lights with minimal infrastructure investment. The technology supports long battery life and reliable connectivity across extensive geographic areas.

Powerline Communication represents a cost-effective alternative leveraging existing electrical infrastructure for data transmission. This approach eliminates the need for separate communication networks, reducing initial deployment expenses significantly. Cities with established power grids find this solution particularly attractive for retrofitting legacy lighting systems with smart capabilities.

Radio Frequency technologies provide robust wireless connectivity for street lighting networks across diverse urban environments. These solutions offer flexibility in deployment and support real-time data exchange between lights and central management platforms. RF-based systems enable rapid installation without extensive infrastructure modifications or disruptions.

Other communication technologies include emerging protocols and hybrid solutions combining multiple connectivity options. These alternatives address specific municipal requirements such as enhanced security, redundancy, or integration with existing smart city infrastructure. Innovation continues to expand available communication pathways for connected lighting deployments.

Application Analysis

Smart Parking dominates with 34.6% due to increasing urban congestion and demand for intelligent parking solutions.

In 2024, Smart Parking held a dominant market position in the By Application segment of Connected Street Lights Market, with a 34.6% share. Integrated parking sensors within connected street lights provide real-time availability data to drivers through mobile applications. This multi-functional approach maximizes infrastructure investment by combining lighting and parking management capabilities. Cities reduce traffic congestion and emissions as drivers spend less time searching for available spaces.

Environmental Monitoring applications leverage connected street lights as sensor platforms for air quality and weather data collection. These systems continuously measure pollutants, temperature, humidity, and other environmental parameters across urban areas. Municipalities gain valuable insights for public health initiatives and climate action planning through distributed sensing networks.

Traffic Optimization utilizes connected lighting infrastructure to monitor vehicle flow and adjust signal timing dynamically. Real-time traffic data collected through street light sensors enables intelligent transportation management and congestion reduction. This application enhances road safety while improving overall traffic efficiency in metropolitan areas.

Other applications encompass public Wi-Fi hotspots, emergency broadcasting systems, and electric vehicle charging station integration. Connected street lights serve as versatile platforms supporting diverse smart city services beyond traditional illumination functions. These multi-purpose deployments deliver enhanced value propositions for municipal investments in intelligent infrastructure.

End-user Analysis

Industrial dominates with 45.2% due to extensive outdoor facility requirements and energy management priorities.

In 2024, Industrial held a dominant market position in the By End-user segment of Connected Street Lights Market, with a 45.2% share. Manufacturing facilities, warehouses, and logistics centers require extensive outdoor lighting for operations and security purposes. Connected systems enable precise control over large-scale lighting networks, reducing energy consumption during off-peak hours. Industrial operators prioritize technologies that deliver measurable operational savings and enhanced safety across expansive premises.

Commercial end-users including retail centers, business parks, and hospitality properties adopt connected street lights for enhanced customer experiences. These establishments leverage smart lighting to create welcoming environments while optimizing energy costs across parking areas and pedestrian pathways. Integration with building management systems enables centralized control and analytics for improved operational efficiency.

Residential applications focus on community safety, aesthetics, and sustainability within housing developments and neighborhoods. Homeowners associations and property managers implement connected street lighting to reduce electricity expenses while maintaining well-lit common areas. Smart controls allow customized lighting schedules that balance security needs with energy conservation goals for residential communities.

Key Market Segments

By Communication Technology

- NB-IoT

- Powerline Communication

- Radio Frequency

- Others

By Application

- Smart Parking

- Environmental Monitoring

- Traffic Optimization

- Others

By End-user

- Industrial

- Commercial

- Residential

Drivers

Rapid Smart City Infrastructure Investments Integrating IoT-Enabled Urban Lighting Drive Market Growth

Governments worldwide are allocating substantial budgets toward smart city transformation initiatives that prioritize connected infrastructure. Urban planners recognize intelligent street lighting as foundational components of comprehensive smart city ecosystems. These investments create immediate demand for IoT-enabled lighting solutions that integrate seamlessly with broader municipal technology platforms.

Municipal authorities increasingly view connected street lights as multi-functional assets beyond simple illumination. The ability to leverage lighting infrastructure for data collection, public safety monitoring, and environmental sensing justifies higher upfront investments. Cities implementing smart initiatives require scalable lighting networks that support future technology integrations and expanding service capabilities.

Furthermore, public sector mandates for energy efficiency and carbon reduction compel municipalities to modernize aging lighting infrastructure. Connected LED systems deliver quantifiable energy savings while providing enhanced operational visibility and control. The convergence of environmental goals and smart city objectives accelerates adoption rates across metropolitan areas globally.

Restraints

High Initial Deployment and Network Integration Costs Restrain Market Expansion

Significant upfront capital requirements for connected street lighting systems pose substantial barriers for budget-constrained municipalities. Comprehensive deployments involve expenses for LED fixtures, communication infrastructure, control platforms, and installation labor. Smaller cities and developing regions often struggle to justify these investments despite long-term operational savings potential.

Technical complexities associated with integrating connected lighting into existing urban infrastructure create additional cost pressures. Legacy electrical systems may require upgrades to support smart lighting networks, while ensuring interoperability with other municipal systems demands specialized expertise. These integration challenges extend project timelines and increase total implementation expenses beyond initial estimates.

Moreover, cybersecurity and data privacy concerns add layers of complexity to connected lighting deployments. Municipalities must invest in robust security measures to protect networked infrastructure from potential threats and vulnerabilities. The need for ongoing security updates and monitoring creates perpetual operational costs that impact overall return on investment calculations.

Growth Factors

Expansion of Smart Street Lighting Projects Across Emerging Urban Areas Creates Growth Opportunities

Rapid urbanization in developing economies presents vast opportunities for connected street lighting adoption in newly constructed districts. Greenfield developments allow municipalities to implement intelligent lighting infrastructure from inception without retrofitting constraints. These markets demonstrate strong growth potential as cities prioritize modern infrastructure to support expanding populations.

Integration of connected street lights with electric vehicle charging stations, environmental sensors, and traffic management systems expands value propositions significantly. Multi-functional infrastructure deployments optimize municipal investments while addressing diverse urban challenges through consolidated platforms. This convergence approach appeals to cities seeking maximum returns from limited infrastructure budgets.

Additionally, public-private partnerships are emerging as effective models for accelerating city-wide intelligent lighting rollouts. Private sector expertise and financing combined with public sector planning enable larger-scale implementations than municipalities could achieve independently. These collaborative frameworks reduce financial burdens while delivering advanced technological solutions to urban areas worldwide.

Emerging Trends

AI-Driven Adaptive Lighting Based on Real-Time Data Emerges as Leading Trend

Artificial intelligence integration enables street lighting systems to adjust brightness dynamically based on traffic patterns and pedestrian movement. These adaptive systems optimize energy consumption while maintaining appropriate illumination levels for safety and visibility requirements. AI-powered analytics provide municipalities with actionable insights for urban planning and resource allocation decisions.

The adoption of 5G and LPWAN technologies facilitates real-time connectivity for street light networks with minimal latency. Enhanced communication capabilities support advanced applications including video surveillance, environmental monitoring, and emergency response systems. These next-generation networks enable more sophisticated smart city services through existing lighting infrastructure.

Furthermore, solar-powered connected street lights are gaining traction as cities pursue energy-independent infrastructure solutions. Off-grid lighting systems reduce operational costs while supporting sustainability objectives in areas lacking reliable electrical infrastructure. The combination of renewable energy and smart connectivity addresses both environmental and technological advancement goals simultaneously.

Regional Analysis

North America Dominates the Connected Street Lights Market with a Market Share of 47.20%, Valued at USD 1.1 Billion

North America leads the global connected street lights market, holding a 47.20% share valued at USD 1.1 Billion. The region benefits from substantial smart city investments and advanced technological infrastructure supporting large-scale deployments. Major metropolitan areas across the United States and Canada have implemented extensive connected lighting networks. Strong government support for energy efficiency and sustainability initiatives accelerates adoption rates throughout North American municipalities.

Europe Connected Street Lights Market Trends

Europe demonstrates strong market growth driven by stringent environmental regulations and carbon reduction commitments. European cities prioritize intelligent lighting as key components of comprehensive sustainability strategies. The region benefits from established smart city frameworks and collaborative municipal networks sharing best practices. Government incentives and funding programs support widespread connected street lighting implementations across urban and suburban areas.

Asia Pacific Connected Street Lights Market Trends

Asia Pacific represents the fastest-growing regional market fueled by rapid urbanization and infrastructure modernization initiatives. Emerging economies invest heavily in smart city developments that incorporate connected lighting from the planning stages. China, India, and Southeast Asian nations lead regional adoption through large-scale municipal projects. The region’s manufacturing capabilities and technology innovation create favorable conditions for market expansion.

Middle East and Africa Connected Street Lights Market Trends

Middle East and Africa show increasing interest in connected street lighting as part of broader smart city ambitions. Gulf nations invest significantly in advanced urban infrastructure leveraging latest technologies for sustainable development. African cities adopt connected lighting to address infrastructure gaps while improving public safety and energy efficiency. Regional growth remains influenced by government initiatives and international partnerships supporting technology transfers.

Latin America Connected Street Lights Market Trends

Latin America experiences steady market growth as cities seek cost-effective solutions for aging infrastructure challenges. Brazil, Mexico, and Argentina lead regional adoption through pilot projects demonstrating energy savings and operational benefits. Economic constraints encourage municipalities to prioritize solutions offering rapid payback periods and measurable returns. Public-private partnerships facilitate deployments that might otherwise exceed municipal budget capabilities.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Connected Street Lights Company Insights

Signify Holding maintains its position as a global leader in connected lighting solutions through continuous innovation and strategic partnerships. The company leverages extensive experience in LED technology and IoT integration to deliver comprehensive smart city lighting platforms. Their solutions address diverse municipal requirements from basic connectivity to advanced multi-functional infrastructure deployments.

Telensa Limited specializes in wireless street lighting control systems serving municipalities across multiple continents with proven energy management solutions. Their platforms enable centralized monitoring and control of extensive lighting networks through user-friendly interfaces. The company focuses on delivering measurable operational savings and reliability for cities transitioning to intelligent lighting infrastructure.

Itron Inc brings decades of utility management expertise to the connected street lighting market through integrated infrastructure solutions. Their offerings combine lighting control with broader smart city applications including metering and network management capabilities. The company serves municipalities seeking comprehensive technology partners for multi-domain urban infrastructure modernization initiatives.

Rongwen provides cost-effective connected lighting solutions targeting emerging markets with affordable yet reliable smart infrastructure technologies. Their products address specific needs of developing regions balancing performance requirements with budget constraints. The company focuses on scalable platforms that enable phased implementations aligned with municipal financial capabilities and growth trajectories.

Key Companies

- Signify Holding

- Telensa Limited

- Itron Inc

- Rongwen

- DimOnOff

- Current Powered by GE

- gridComm

- FLASHNET SA

- Ubicquia, Inc.

Recent Developments

- In April 2025, Signify and Cornerstone partnered to deploy a city-wide multi-operator wireless network through street lighting to enhance urban connectivity and digital infrastructure.

- In September 2025, Signify launched modular, connected solar street lighting products including the Signify SunStay Pro gen2 and SunStay Pro gen2 mini.

Report Scope

Report Features Description Market Value (2024) USD 2.4 Billion Forecast Revenue (2034) USD 11.3 Billion CAGR (2025-2034) 16.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Communication Technology (NB-IoT, Powerline Communication, Radio Frequency, Others), By Application (Smart Parking, Environmental Monitoring, Traffic Optimization, Others), By End-user (Industrial, Commercial, Residential) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Signify Holding, Telensa Limited, Itron Inc, Rongwen, DimOnOff, Current Powered by GE, gridComm, FLASHNET SA, Ubicquia, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Connected Street Lights MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Connected Street Lights MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Signify Holding

- Telensa Limited

- Itron Inc

- Rongwen

- DimOnOff

- Current Powered by GE

- gridComm

- FLASHNET SA

- Ubicquia, Inc.