Global Connected Rail Market Size, Share, Growth Analysis By Service (Passenger Information System, Train Tracking and Monitoring, Automated Fare Collection System, Passenger Mobility, Predictive Maintenance), By Rolling Stock (Passenger Wagons, Diesel Locomotive, Electric Locomotive, Light Rail and Trams, Freight Wagons), By Safety And Signaling System (Communication-based Train Control, Positive Train Control, Automated Train Control), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 171339

- Number of Pages: 316

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

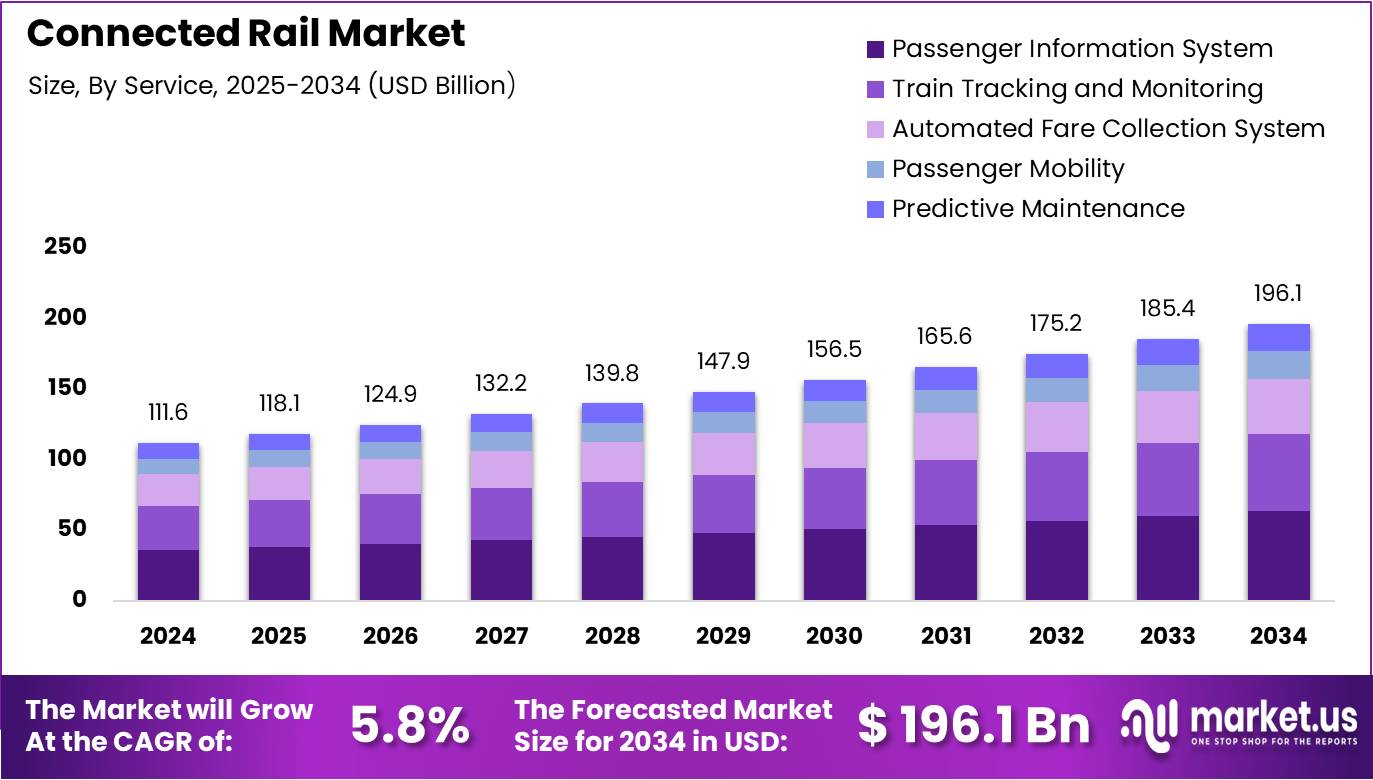

The Global Connected Rail Market size is expected to be worth around USD 196.1 Billion by 2034, from USD 111.6 Billion in 2024, growing at a CAGR of 5.8% during the forecast period from 2025 to 2034.

The Connected Rail Market encompasses integrated digital technologies transforming railway infrastructure through IoT sensors, real-time data analytics, and advanced communication systems. This ecosystem enables seamless connectivity between trains, tracks, stations, and control centers. Rail operators leverage these solutions to optimize operations, enhance passenger experiences, and improve safety protocols. The market fundamentally reshapes traditional rail networks into intelligent, responsive transportation systems.

Connected rail solutions are experiencing robust growth driven by urbanization and smart city initiatives worldwide. Governments increasingly recognize rail modernization as essential infrastructure investment. Transit authorities prioritize digital transformation to address capacity constraints and operational inefficiencies. Furthermore, passenger expectations for seamless connectivity accelerate adoption of connected technologies. This convergence creates substantial opportunities for technology providers and rail operators alike.

Government investment plays a pivotal role in market expansion across developed and emerging economies. Regulatory frameworks increasingly mandate safety standards requiring real-time monitoring and predictive capabilities. Policymakers support public-private partnerships to accelerate network digitalization and interoperability standards. Additionally, sustainability regulations drive adoption of energy-efficient connected systems. These policy interventions establish favorable conditions for sustained market growth and technological innovation.

Passenger connectivity and operational efficiency demonstrate significant improvements through connected rail implementation. According to research, 72% of rail professionals express satisfaction with current Internet connectivity for passenger and operational applications. Mobile ticketing represents approximately 15% of transactions in automated fare collection systems, while contactless smart cards account for roughly 60%. Moreover, fare gates equipped with AFC technology reduce boarding time by approximately 35% and decrease fare evasion by around 40%.

Predictive maintenance capabilities deliver transformative operational benefits through connected rail infrastructure. Advanced analytics enable 35-45% lower train downtime compared to traditional maintenance approaches. Connected systems facilitate 70-75% reduction in unexpected breakdowns through early fault detection. Consequently, rail operators achieve 25-30% savings in overall maintenance costs. These performance improvements validate the business case for connected rail investments and accelerate market adoption trajectories.

Key Takeaways

- The Global Connected Rail Market is projected to grow from USD 111.6 Billion in 2024 to USD 196.1 Billion by 2034, expanding at a CAGR of 5.8%.

- By service segment, Passenger Information System led the market in 2024 with a dominant share of 31.8%.

- By rolling stock segment, Passenger Wagons accounted for the largest share of 34.2% in 2024.

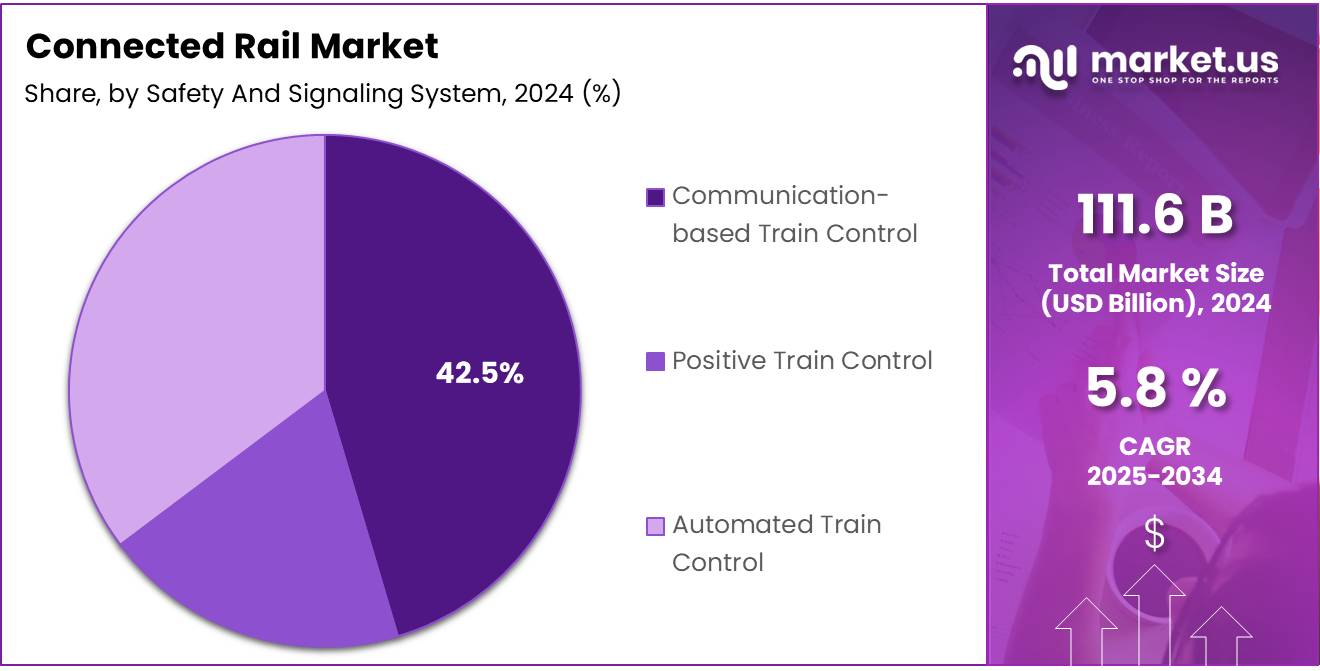

- By safety and signaling system, Communication-based Train Control held a leading market share of 42.5% in 2024.

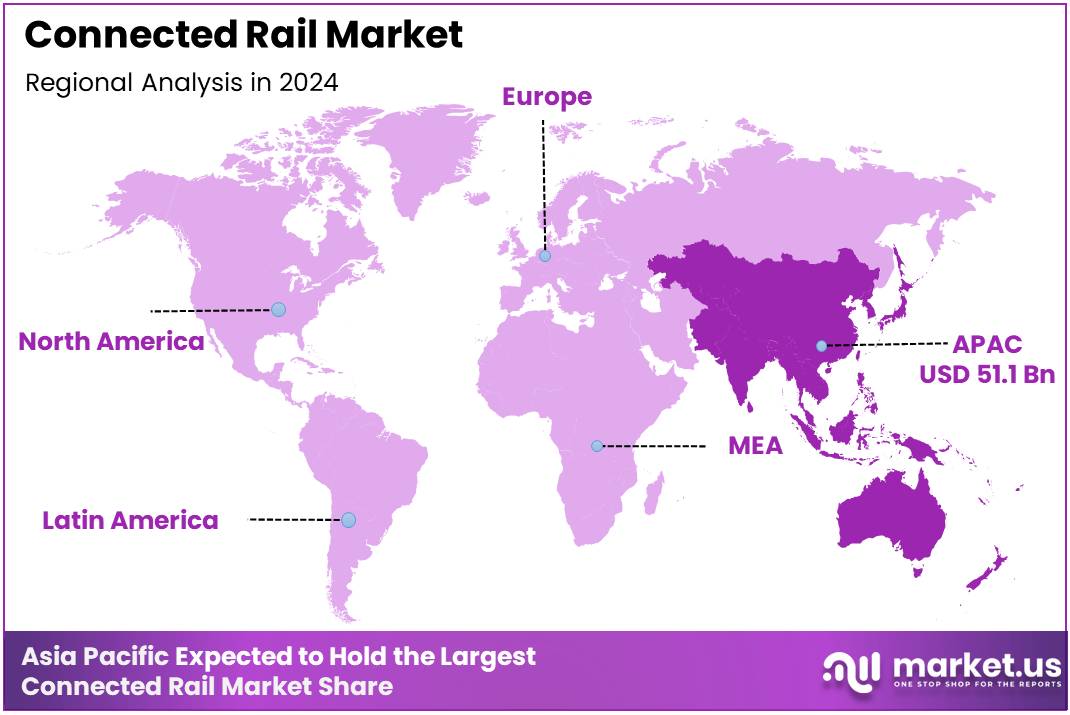

- Asia Pacific dominated the Connected Rail Market with a share of 45.8%, valued at USD 51.1 Billion.

By Service Analysis

In 2024, Passenger Information System held a dominant market position in the By Service Analysis segment of Connected Rail Market, with a 31.8% share.

The Passenger Information System segment leads with 31.8% market share, driven by increasing demand for real-time updates and enhanced travel experiences. Modern rail operators prioritize digital displays, mobile applications, and announcement systems that keep passengers informed about schedules, delays, and platform changes. This technology significantly improves customer satisfaction and operational transparency, making it essential for competitive rail networks seeking to attract and retain ridership in an increasingly digital age.

The Train Tracking and Monitoring segment continues gaining traction as operators seek comprehensive visibility into fleet operations. Advanced GPS and IoT sensors enable real-time location tracking, performance monitoring, and route optimization. These systems enhance operational efficiency by identifying potential bottlenecks, reducing delays, and enabling proactive decision-making. Rail companies leverage this data to improve punctuality rates and resource allocation across their networks.

The Automated Fare Collection System segment transforms ticketing infrastructure through contactless payments and smart card technology. These solutions eliminate manual processes, reduce boarding times, and minimize revenue leakage. Integration with mobile wallets and digital payment platforms creates seamless travel experiences while generating valuable passenger data for service optimization and demand forecasting.

The Passenger Mobility segment focuses on multimodal integration and last-mile connectivity solutions. This includes bike-sharing programs, shuttle services, and integrated booking platforms that connect rail services with other transportation modes. Enhanced mobility options increase rail accessibility and appeal to environmentally conscious travelers.

The Predictive Maintenance segment employs artificial intelligence and machine learning to anticipate equipment failures before they occur. Sensors continuously monitor critical components, analyzing vibration patterns, temperature fluctuations, and performance metrics. This proactive approach reduces unplanned downtime, extends asset lifespan, and optimizes maintenance schedules, resulting in substantial cost savings and improved service reliability.

By Rolling Stock Analysis

In 2024, Passenger Wagons held a dominant market position in the By Rolling Stock Analysis segment of Connected Rail Market, with a 34.2% share.

The Passenger Wagons segment commands 34.2% market share, reflecting the massive global investment in passenger rail infrastructure and modernization initiatives. Connected technologies in passenger wagons include Wi-Fi connectivity, entertainment systems, climate control automation, and security cameras. Operators worldwide are retrofitting existing fleets and purchasing new rolling stock equipped with advanced connectivity features to meet rising passenger expectations for comfort and digital services during transit.

The Diesel Locomotive segment maintains relevance in non-electrified routes and remote regions where electrification remains economically unfeasible. Connected diesel locomotives feature fuel efficiency monitoring, emissions tracking, and performance optimization systems. These technologies help operators comply with environmental regulations while maximizing operational efficiency. Telematics solutions provide real-time engine diagnostics and maintenance alerts for improved reliability.

The Electric Locomotive segment represents the future of sustainable rail transport, with connectivity enabling sophisticated energy management systems. Smart electric locomotives optimize power consumption, regenerative braking, and grid integration. Real-time monitoring ensures efficient pantograph operation and electrical system health. The growing electrification of rail networks globally drives adoption of connected technologies in this segment.

The Light Rail and Trams segment serves urban transit needs with connected systems enhancing traffic signal prioritization and passenger flow management. These vehicles integrate seamlessly with city infrastructure through vehicle-to-infrastructure communication protocols. Real-time occupancy monitoring and dynamic routing capabilities improve service frequency and passenger distribution during peak hours.

The Freight Wagons segment benefits from connectivity through cargo tracking, temperature monitoring for sensitive goods, and security systems preventing theft or tampering. IoT sensors provide supply chain visibility, enabling logistics companies to optimize delivery schedules and provide accurate shipment updates to customers, enhancing overall freight rail competitiveness.

By Safety And Signaling System Analysis

In 2024, Communication-based Train Control held a dominant market position in the By Safety And Signaling System Analysis segment of Connected Rail Market, with a 42.5% share.

The Communication-based Train Control (CBTC) segment dominates with 42.5% market share, representing the most advanced signaling technology available today. CBTC systems utilize continuous wireless communication between trains and trackside equipment, enabling precise train positioning and automatic speed regulation. This technology dramatically increases line capacity by reducing headways between trains while maintaining superior safety standards. Metro systems and urban rail networks globally are transitioning to CBTC for its efficiency gains and operational flexibility.

The Positive Train Control (PTC) segment enhances safety through automatic train stopping capabilities when operators fail to respond to signals or speed restrictions. Mandatory in many jurisdictions, PTC systems prevent train-to-train collisions, derailments caused by excessive speed, and unauthorized train movements in work zones. GPS-based positioning combined with digital communications creates comprehensive safety networks across freight and passenger operations.

The Automated Train Control (ATC) segment provides foundational safety functions including automatic train protection and supervision. While less sophisticated than CBTC, ATC systems offer reliable speed enforcement and signal compliance at lower implementation costs. Many legacy rail networks utilize ATC as an intermediate solution before full CBTC deployment, balancing safety improvements with infrastructure investment constraints.

Key Market Segments

By Service

- Passenger Information System

- Train Tracking and Monitoring

- Automated Fare Collection System

- Passenger Mobility

- Predictive Maintenance

By Rolling Stock

- Passenger Wagons

- Diesel Locomotive

- Electric Locomotive

- Light Rail and Trams

- Freight Wagons

By Safety And Signaling System

- Communication-based Train Control

- Positive Train Control

- Automated Train Control

Drivers

Growing Need for Operational Efficiency and Cost Optimization Drives Connected Rail Market

Rail operators worldwide are increasingly focusing on improving operational efficiency to reduce costs and enhance service delivery. Connected rail systems enable real-time data collection and analysis, helping operators optimize train schedules, reduce fuel consumption, and minimize downtime. These digital solutions allow railways to monitor asset performance continuously, leading to better resource allocation and improved profitability.

Government investments in smart rail infrastructure are accelerating market growth significantly. Countries are modernizing their aging rail networks by adopting connected technologies to meet growing transportation demands. Public-private partnerships and funding programs are supporting the deployment of intelligent rail systems, particularly in developing regions where urbanization is driving the need for efficient public transport solutions.

Safety concerns are pushing rail authorities to implement real-time monitoring systems across their networks. Connected rail technologies provide instant alerts about track conditions, equipment malfunctions, and potential hazards, reducing accident risks. Passenger safety solutions, including surveillance systems and emergency communication tools, are becoming standard requirements. These technologies also enable predictive analytics to identify issues before they escalate, ensuring safer and more reliable rail operations for millions of daily commuters.

Restraints

High Complexity of Integrating Legacy Infrastructure Restrains Connected Rail Market Growth

Integrating modern connected systems with existing legacy rail infrastructure presents significant technical challenges for the industry. Most railway networks operate on decades-old systems that were not designed for digital connectivity. Upgrading these systems requires substantial engineering efforts, compatibility testing, and often complete overhauls of communication protocols. Rail operators face difficulties in ensuring seamless interoperability between old and new technologies without disrupting ongoing operations.

The financial burden of retrofitting existing infrastructure is considerable, particularly for operators with limited budgets. Many railways must maintain legacy systems while gradually implementing connected solutions, creating dual maintenance costs. This phased approach extends implementation timelines and increases overall project complexity, discouraging some operators from adopting connected rail technologies.

Cybersecurity regulations are becoming increasingly stringent as rail networks become more digitally connected. Railway systems now handle sensitive operational data and passenger information, making them attractive targets for cyber threats. Compliance with data privacy laws and security standards requires significant investment in protective measures. Rail operators must implement robust encryption, authentication protocols, and continuous monitoring systems, adding complexity and cost to connected rail deployments and slowing market adoption rates.

Growth Factors

Expansion of Predictive Maintenance Solutions Creates Growth Opportunities in Connected Rail Market

Predictive maintenance is emerging as a transformative opportunity for the connected rail industry. IoT sensors installed on trains and tracks collect real-time data about component conditions, enabling operators to predict failures before they occur. This approach significantly reduces unplanned downtime and extends asset lifespan. Rail companies can schedule maintenance during off-peak hours, minimizing service disruptions while cutting maintenance costs by up to thirty percent compared to traditional methods.

Artificial intelligence is revolutionizing traffic management in urban rail networks, creating substantial growth potential. AI-enabled systems analyze passenger flow patterns, weather conditions, and historical data to optimize train frequencies and routes dynamically. These intelligent platforms reduce congestion, improve on-time performance, and enhance overall network capacity without requiring additional physical infrastructure investments.

IoT-based passenger experience services represent another significant opportunity for market expansion. Connected rail systems now offer personalized travel information, mobile ticketing, onboard entertainment, and real-time journey updates directly to passengers’ smartphones. These services improve customer satisfaction and loyalty while generating additional revenue streams through data-driven insights. Railway operators can better understand passenger preferences and behaviors, enabling them to tailor services and create more attractive travel experiences.

Emerging Trends

Increasing Deployment of 5G Networks Shapes Connected Rail Market Trends

The rollout of 5G technology is revolutionizing rail communication capabilities across global networks. Fifth-generation networks provide ultra-low latency and high-speed connectivity essential for real-time rail operations. This advanced infrastructure enables instant data transmission between trains, control centers, and trackside equipment, supporting critical safety applications and autonomous train operations. Rail operators are increasingly partnering with telecom providers to establish dedicated 5G corridors along railway lines.

Cloud-based platforms are transforming how rail operations are managed and monitored. Railways are migrating their operational systems to cloud infrastructure, enabling centralized control, scalability, and cost efficiency. Cloud solutions facilitate data sharing across multiple stakeholders, improving coordination between different rail operators and infrastructure managers. These platforms support remote diagnostics, centralized analytics, and seamless software updates across entire rail networks.

Digital twin technology is gaining rapid adoption for rail infrastructure management and planning. This innovative approach creates virtual replicas of physical rail assets, allowing operators to simulate scenarios, test modifications, and optimize performance without physical risks. Digital twins integrate data from multiple sources to provide comprehensive asset visibility. Rail authorities use these virtual models for infrastructure planning, maintenance scheduling, and training purposes, significantly improving decision-making capabilities and operational outcomes.

Regional Analysis

Asia Pacific Dominates the Connected Rail Market with a Market Share of 45.8%, Valued at USD 51.1 Billion

Asia Pacific commands the connected rail market with a substantial market share of 45.8%, valued at USD 51.1 billion, driven by rapid urbanization, massive infrastructure investments, and government initiatives promoting smart transportation systems. The region’s dominance stems from extensive deployment of IoT-enabled rail solutions, predictive maintenance systems, and passenger information platforms across countries like China, India, and Japan. Growing focus on high-speed rail networks, metro expansion projects, and integration of AI and big data analytics in rail operations solidify the region’s leading position in connected rail technology adoption.

North America Connected Rail Market Trends

North America represents a significant market for connected rail solutions, characterized by advanced technological infrastructure and substantial investments in rail digitalization. The region’s mature railway networks are increasingly adopting predictive maintenance systems, real-time monitoring technologies, and automated train control systems to improve safety and operational efficiency. The presence of major technology providers, stringent safety regulations, and government mandates for railway modernization drive the integration of IoT sensors, cloud computing, and cybersecurity solutions across rail operations.

Europe Connected Rail Market Trends

Europe holds a prominent position in the connected rail market, supported by extensive railway networks and ambitious digital transformation agendas across multiple countries. The region’s railway operators are actively implementing European Train Control System (ETCS) standards, communication-based train control systems, and integrated passenger information platforms to ensure interoperability. The European Union’s commitment to sustainable mobility, combined with substantial funding programs for railway digitalization, accelerates connected rail technology adoption and positions Europe as a key innovation hub in the sector.

Middle East and Africa Connected Rail Market Trends

The Middle East and Africa region is experiencing gradual growth in the connected rail market, driven by infrastructure development initiatives and urban transit expansion projects. Countries in the Gulf Cooperation Council are leading adoption through metro projects, high-speed rail developments, and integration of digital ticketing systems. The region’s focus on enhancing public transportation networks and ensuring passenger safety creates opportunities for IoT-enabled rail solutions, though infrastructure readiness and funding constraints may moderate the pace of technology adoption.

Latin America Connected Rail Market Trends

Latin America presents emerging opportunities in the connected rail market, with increasing investments in urban metro systems and freight rail modernization initiatives. The region’s railway operators are gradually adopting digital solutions such as real-time tracking systems, automated fare collection, and condition monitoring technologies to improve service quality. Government initiatives promoting public transportation infrastructure development support connected rail technology implementation, though economic volatility and limited technology infrastructure in certain areas may pose challenges to widespread adoption.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Connected Rail Company Insights

Trimble Inc. continues to leverage its strong positioning in advanced positioning and connectivity solutions, enabling real-time asset tracking and operational visibility across rail networks. Its focus on integrating IoT with rail infrastructure supports improved safety and efficiency, particularly for freight and track maintenance operations. Trimble’s modular platform approach fosters scalable deployments for operators seeking phased digital transformation.

Siemens Mobility remains a leading force in connected rail through its comprehensive portfolio spanning signaling, communications, and digital control systems. Its adoption of open architecture and data analytics enhances interoperability across diverse rail ecosystems, supporting both urban and intercity networks. Siemens is strategically positioned to benefit from increasing investments in smart rail upgrades globally.

Robert Bosch GmbH leverages its deep expertise in sensors and automation to deliver connected rail solutions focused on predictive maintenance and condition monitoring. By embedding robust sensor technologies and edge computing capabilities, Bosch enables operators to preempt failures and optimize lifecycle costs. Its emphasis on safety and reliability aligns well with stringent rail industry requirements.

Alstom SA is advancing connected rail through its suite of digital signaling and traffic management systems, enhancing network fluidity and operational responsiveness. Alstom’s strength lies in blending traditional rail engineering with cutting-edge digital services, helping operators reduce delays and increase capacity. Continued R&D investment underpins its competitive differentiation in high-growth markets.

Top Key Players in the Market

- Trimble Inc.

- Siemens Mobility

- Robert Bosch GmbH

- Alstom SA

- Nokia

- Hitachi Rail Limited

- Huawei Technologies Co., Ltd.

- International Business Machines Corporation

- Wabtec Corporation

- Cisco Systems, Inc.

Recent Developments

- In November 2025, Great Western Railway (GWR) launched a 2-month pilot of superfast onboard Wi-Fi across UK intercity routes.The solution combines 5G and low Earth orbit satellite switching to significantly enhance passenger connectivity, supported by government funding.

- In September 2025, Knorr-Bremse completed the acquisition of duagon for EUR 500 million to expand its railway electronics portfolio.This move strengthens its position in signalling and digital train communication systems across global rail networks.

- In January 2025, Hitachi Rail announced the acquisition of Omnicom to reinforce its digital asset management capabilities.The transaction supports enhanced lifecycle monitoring, analytics, and operational efficiency for connected rail infrastructure.

- In September 2024, Hitachi Rail introduced CBTC integration with 5G digital signalling to improve real-time train-to-ground communication.The capability supports advanced passenger information systems on New York’s Crosstown Line and Hong Kong’s airport rail network.

Report Scope

Report Features Description Market Value (2024) USD 111.6 Billion Forecast Revenue (2034) USD 196.1 Billion CAGR (2025-2034) 5.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Service (Passenger Information System, Train Tracking and Monitoring, Automated Fare Collection System, Passenger Mobility, Predictive Maintenance), By Rolling Stock (Passenger Wagons, Diesel Locomotive, Electric Locomotive, Light Rail and Trams, Freight Wagons), By Safety And Signaling System (Communication-based Train Control, Positive Train Control, Automated Train Control) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Trimble Inc., Siemens Mobility, Robert Bosch GmbH, Alstom SA, Nokia, Hitachi Rail Limited, Huawei Technologies Co., Ltd., International Business Machines Corporation, Wabtec Corporation, Cisco Systems, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Trimble Inc.

- Siemens Mobility

- Robert Bosch GmbH

- Alstom SA

- Nokia

- Hitachi Rail Limited

- Huawei Technologies Co., Ltd.

- International Business Machines Corporation

- Wabtec Corporation

- Cisco Systems, Inc.